Cloud Billing Market by Component (Solutions, Services), Billing Type (Subscription, Usage-Based, One-Time, Others), Deployment Type, Service Model (IaaS, PaaS, SaaS), Organization Size, Vertical, and Region - Global Forecast to 2025

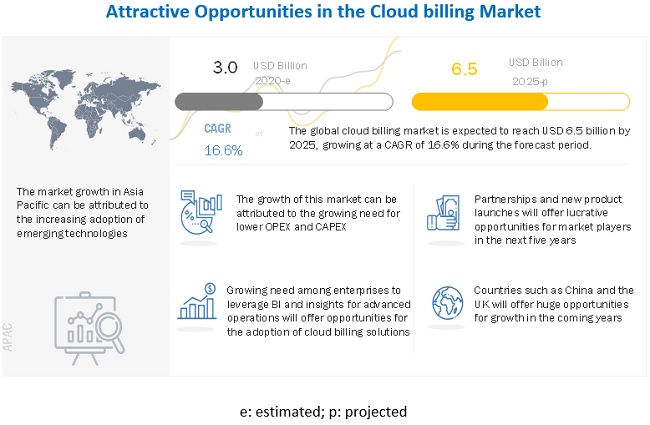

The global Cloud Billing Market is projected to grow significantly, with a valuation of USD 3.0 billion in 2020 and an expected reach of USD 6.5 billion by 2025, leading to a Compound Annual Growth Rate (CAGR) of 16.6% during the forecast period. The growing number of cloud billing enrollments has emerged as one of the strongest factors for cloud billing tools and services adoption across regions. Factors such as growing international student mobility and increasing government initiatives and funding are expected to create ample opportunities for cloud billing vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact analysis on the global cloud billing market

The impact of the COVID-19 pandemic on the market is covered throughout this report. The pandemic has had a positive impact on the cloud billing market. Due to the COVID-19 outbreak, cloud billing solutions have gained traction, especially usage-based billing, as organizations have changed their budgets and preferences to survive during this pandemic. Moreover, organizations across the world are investing more in cloud billing solutions to continue operations. Governments are announcing packages to help businesses during this pandemic, with a special focus on SMEs. The COVID-19 pandemic has also boosted cloud adoption across industry verticals as users move to leverage cloud benefits, such as scalability and cost. As per the Subscription Impact Report: COVID-19 Edition by Zuora, during the outbreak of COVID-19, four out of five subscription companies are still growing despite the economic slowdown, while 50% of subscription companies are growing at the same pace without any negative impact due to the COVID-19 pandemic.

Cloud Billing Market Dynamics

Driver: Need for lower OPEX and CAPEX

Companies constantly strive to lower their capital expenditure and operating costs. The existing competitive landscape and global economic situation have accelerated the adoption of cost-effective measures for restructuring existing business models. Emerging cloud technology has been gaining high market traction across the globe with its cost-saving and better business agility advantages for all organizational sizes. The cloud is allowing organizations to streamline their billing processes, thereby enhancing the overall customer experience. The deployment of cloud billing solutions brings fiscal benefits for any business, as it considerably reduces the IT resources and the infrastructure required through the minimal need for integration & expensive hardware, as well as reducing the risk of vendor lock-in for billing functions. These billing solutions result in low capital and operating expenditure as they replace manual processes.

Restraint: Increasing cyberattacks and data theft activities

Cybersecurity is one of the most important factors for smooth business operations. In recent times, there has been a huge rise in the number of data breaches and cyberattacks— instances of cyberattacks have increased over the years, and most enterprises are unaware of this issue and have unprotected data and poor cybersecurity practices in place, making them vulnerable to data loss. As per data from Cybint Solutions, a cyberattack takes place every 39 seconds, and, in the year 2018, 62% of businesses experienced phishing and social engineering attacks. As per a report by Norton, the US is expected to account for half of the data breach activities by 2023. Cloud billing solutions process crucial customer data, product information, and revenue details of an enterprise. This type of data is very important for every enterprise, and this data being compromised might mean an impact on brand image, market position, and business strategy. Hence, increasing cyberattacks and data thefts are expected to restrict the growth of the global cloud billing market.

Opportunity: Growing need among enterprises to leverage BI and insights for advanced operations

BI includes the collection, integration, analysis, and presentation of business information using various technologies and different practices. It provides businesses insights about customer behavior and products as well as assists in effective decision making. In the current scenario, the impact of BI on online shopping is increasing, whereas brick-and-mortar shops are striving to get in-depth information about their businesses.

Revenue is the most important part of a billing system. The data related to revenue can provide details about revenue leakages by showing discrepancies in sales figures and product consumption. Billing and revenue data can provide advantages such as rapid insights into the health of a digital transformation project and can also help in making immediate adjustments by analyzing the impact of system changes on Key Performance Indicators (KPIs). Integration of analytics in cloud billing can offer benefits such as analysis of purchasing behavior of customers, managing complex financial structures and parameters, and creation & application of new price models, among others. Hence, organizations are looking to generate more BI and insights.

Challenge: High initial costs of investment, installation, and maintenance

There are many advantages of cloud billing solutions; however, these come with costs and overheads associated with them. The licenses of these solutions are priced per user or number of customers, and in many cases, users order fewer licenses than required in order to control their costs. The billing system works best under strong IT infrastructure and stable connections; however, enterprises in developing countries face continuous issues with their connectivity and IT infrastructure. Furthermore, there is a necessity for regular maintenance of the system to ensure high reliability, as these solutions process crucial enterprise data. Hence, the high cost of installation, maintenance, and related activities is expected to act as a challenge for vendors operating in the global cloud billing market.

Solutions segment to hold a larger market size during the forecast period

Cloud billing solutions help capture the value of the cloud services portfolio with automated recurring billing for license- and usage-based accounts, resulting in increased operational efficiency. The major drawbacks of manual billing, such as time consumption and risk, are the major factors pushing organizations towards adopting cloud billing solutions, as these solutions provide detailed visibility and insights into cloud services. Cloud billing solutions help organizations to market faster and increase product line revenue.

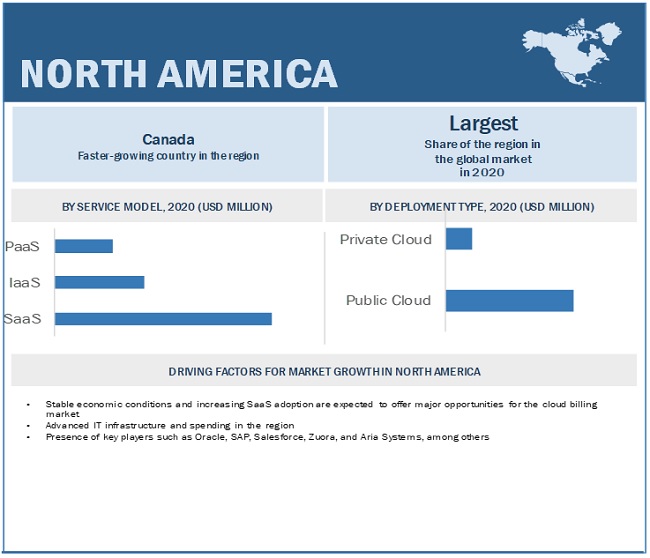

Public Cloud segment to hold a larger market size during the forecast period in the cloud billing market

In the public deployment model, various resources, such as applications, storage, virtual servers, and hardware, are available to client enterprises over the internet. The services offered through the public deployment model are either free or offered under a subscription model. It helps organizations meet their demands for scalability, provides a pay per usage pricing model, and ensures ease of deployment. Enterprises can utilize public clouds to make their operations significantly more efficient. Cloud customers generally waste an estimated 45% of their spend, and cloud billing solutions are expected to help reduce this wastage. Cloud billing solutions generate bills for public cloud service consumption and also provide daily, weekly, and monthly performance reports.

SaaS service model to hold a majority of the market share during the forecast period

SaaS refers to a cloud-based method of providing software to users. Users subscribe to an application rather than purchasing it once and installing it. Users can log into and use a SaaS application from any compatible device over the internet. The actual application runs in cloud servers, instead of each user having to install the software on their device. This model deploys, reduces the costs of, scales, and upgrades business applications more rapidly than maintaining on-premises systems and software. It can be used to offer enterprise applications, such as ERM, CRM, HCM, SCM, and collaboration. It is important for SaaS businesses to send professional invoices through predesigned templates, as this helps in building healthy customer relationships. Cloud billing solutions for SaaS service model process the core operation of the business as the product to generate the bills.

Telecommunications vertical to hold a majority of the market share during the forecast period

It is a challenge for telecommunications providers to manage this data and retain existing customers as well as enhance customer experience and gain new subscribers. In the telecommunications sector, the majority of companies are using outdated billing systems that cannot be integrated with newer technologies. On the other hand, these companies are focusing on streamlining revenue loss. Cloud billing solutions will help telecommunications companies integrate usage data with rating and invoicing.

To know about the assumptions considered for the study, download the pdf brochure

North America to account for the largest market size during the forecast period

The global cloud billing market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period. North America is expected to be the most promising region for major verticals, such as telecommunications, IT, BFSI, and telecommunications. North America is heavily impacted by COVID-19. According to the Bureau of Economic Analysis (which is maintained by the US Department of Commerce), 11.6% of the US economic output comes from the manufacturing vertical. Owing to the lockdown, various manufacturing firms have halted their operations and are hence using fewer cloud services. In this report, North America is further segmented into the US and Canada. The US is expected to be one of the major revenue contributors towards the growth of the cloud billing market in North America. Canada is also expected to present major growth opportunities for cloud billing solution & service providers.

Key Market Players

The cloud billing vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering cloud billing solutions and services globally are Oracle (US), SAP (Germany), Salesforce(US), Zuora(US), Aria System(US), OneBill (US), BillingPlatform(US), Recurly(US), Jamcracker(US), Cerillion(UK), CGI(Canada), ConnectWise(US), Zoho(India), AppDirect(US), CloudBilling(Netherlands), Chargebee(US), RecVue(US), Cloud Assert(US), CloudXchange.io(India), and Chargify(US).

The study includes an in-depth competitive analysis of key players in the cloud billing market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Cloud Billing Market Report Scope

|

Report Metric |

Details |

|

Market Value (2022) |

USD 3.0 billion |

|

Market Size (2025) |

USD 6.5 billion |

|

Market Growth Rate |

16.6% CAGR |

|

Market size available for years |

2015–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Billing Type, Deployment Type, Service Model, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

Oracle (US), SAP (Germany), Salesforce(US), Zuora(US), Aria System(US), OneBill (US),BillingPlatform(US), Recurly(US), Jamcracker(US), Cerillion(UK), CGI(Canada), ConnectWise(US), Zoho(India), AppDirect(US), CloudBilling(Netherlands), Chargebee(US), RecVue(US), Cloud Assert(US), CloudXchange.io(India), and Chargify(US) |

This research report categorizes the cloud billing market based on component, billing type, deployment type, service model, organization size, vertical, and region.

Based on the component:

- Solutions

- Services

Based on the billing type:

- Subscription

- Usage Based

- One-Time

- Others

Based on the deployment type:

- Private Cloud

- Public Cloud

Based on the service model:

- IaaS

- PaaS

- SaaS

Based on the organization size:

- Large Enterprises

- SMEs

Based on the vertical

- BFSI

- IT

- Telecommunications

- Education

- Consumer Goods & Retail

- Media & Entertainment

- Healthcare

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Rest of Europe

-

APAC

- China

- Rest of APAC

-

MEA

- KSA

- Rest of MEA

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In September 2020, SAP introduced enhancements in SAP Subscription Billing. The newly added features include sending notifications before and after an allowance expires, setting prices for allowances, completing pending subscriptions, and setting cancellation notice dates.

- In August 2020, Zuora, in partnership with GoCardless (UK), launched a joint solution for subscription payments. According to Zuora's Subscription Economy Index, over the past eight years, subscription revenue has grown eight times faster than sales revenue.

- In July 2020, Aria Systems launched Aria Marketplace Suite, it is an extension of the Aria billing and monetization platform, which enables B2B and B2C marketplace providers to streamline their operations. Aria Marketplace Suite offers product and revenue management tools for marketplace operators as well as a seamless billing and payments experience.

Frequently Asked Questions (FAQ):

How big is the Cloud Billing Market?

What is growth rate of the Cloud Billing Market?

What are the top trends in Cloud Billing Market?

Who are the key players in Cloud Billing Market?

Who will be the leading hub for Cloud Billing Market?

What are the top opportunities in Cloud Billing Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 6 CLOUD BILLING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary interviews

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 CLOUD BILLING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING CLOUD BILLING SOLUTION AND SERVICES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM BILLING TYPE

2.4 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 11 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.5 RESEARCH ASSUMPTIONS

TABLE 2 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 12 SOLUTIONS SEGMENT TO HOLD HIGHER MARKET SHARE IN 2020

FIGURE 13 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2020

FIGURE 14 PUBLIC CLOUD SEGMENT TO HOLD HIGHER MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CLOUD BILLING MARKET

FIGURE 15 GROWING USE OF CLOUD COMPUTING TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 MARKET, BY COMPONENT, 2020 VS. 2025

FIGURE 16 SOLUTIONS SEGMENT TO HOLD A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY SERVICE MODEL, 2020 VS. 2025

FIGURE 17 SOFTWARE AS A SERVICE SEGMENT TO HOLD THE HIGHEST MARKET SHARE UNTIL 2025

4.4 MARKET, BY VERTICAL, 2020 VS. 2025

FIGURE 18 TELECOMMUNICATIONS SEGMENT TO HOLD THE HIGHEST MARKET SHARE UNTIL 2025

4.5 MARKET INVESTMENT SCENARIO, 2020–2025

FIGURE 19 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 CLOUD BILLING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Need for lower OPEX and CAPEX

5.2.1.2 Increasing revenue leakages across industries

5.2.2 RESTRAINTS

5.2.2.1 Increasing cyberattacks and data theft activities

5.2.2.2 Varying structure of regulatory policies

5.2.3 OPPORTUNITIES

5.2.3.1 Growing need among enterprises to leverage BI and insights for advanced operations

5.2.3.2 Emergence of real-time billing

5.2.4 CHALLENGES

5.2.4.1 High initial costs of investment, installation, and maintenance

5.2.4.2 Privacy and security aspects

5.3 INDUSTRY TRENDS

5.3.1 CASE STUDY ANALYSIS

5.3.1.1 Use Case 1: Telecommunications

5.3.1.2 Use Case 2: Education

5.3.1.3 Use Case 3: Energy & Utility

5.4 PRICING ANALYSIS

FIGURE 21 PRICING ANALYSIS: CLOUD BILLING MARKET

5.5 VALUE CHAIN ANALYSIS

FIGURE 22 MARKET: VALUE CHAIN ANALYSIS

5.6 COVID-19 IMPACT: MARKET

5.6.1 ASSUMPTIONS: COVID-19 IMPACT ON MARKET

5.6.2 OPERATIONAL DRIVERS: MARKET

5.6.3 CUMULATIVE GROWTH ANALYSIS

TABLE 3 MARKET: CUMULATIVE GROWTH ANALYSIS

5.7 TECHNOLOGY ANALYSIS

5.7.1 CLOUD COMPUTING

5.7.2 ANALYTICS

5.8 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

5.8.1 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 9001 QUALITY MANAGEMENT

5.8.2 CLOUD SECURITY ALLIANCE CONTROLS

5.8.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.8.4 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

6 CLOUD BILLING MARKET, BY COMPONENT (Page No. - 58)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 23 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 4 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 5 MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

6.2 SOLUTIONS

TABLE 6 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 7 SOLUTIONS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3 SERVICES

TABLE 8 SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 SERVICES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 CLOUD BILLING MARKET, BY BILLING TYPE (Page No. - 62)

7.1 INTRODUCTION

7.1.1 BILLING TYPE: MARKET DRIVERS

7.1.2 BILLING TYPE: COVID-19 IMPACT

FIGURE 24 USAGE BASED BILLING TYPE TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY BILLING TYPE, 2016–2019 (USD MILLION)

TABLE 11 MARKET SIZE, BY BILLING TYPE, 2020–2025 (USD MILLION)

7.2 SUBSCRIPTION

TABLE 12 SUBSCRIPTION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 SUBSCRIPTION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.3 USAGE BASED

TABLE 14 USAGE BASED: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 USAGE BASED: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.4 ONE-TIME

TABLE 16 ONE-TIME: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 ONE-TIME: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.5 OTHER BILLING TYPES

TABLE 18 OTHER BILLING TYPES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 OTHER BILLING TYPES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 CLOUD BILLING MARKET, BY DEPLOYMENT TYPE (Page No. - 69)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

8.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

FIGURE 25 PRIVATE CLOUD DEPLOYMENT TYPE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 20 MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 21 MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

8.2 PUBLIC CLOUD

TABLE 22 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.3 PRIVATE CLOUD

TABLE 24 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9 CLOUD BILLING MARKET, BY SERVICE MODEL (Page No. - 74)

9.1 INTRODUCTION

9.1.1 SERVICE MODEL: MARKET DRIVERS

9.1.2 SERVICE MODEL: COVID-19 IMPACT

FIGURE 26 SOFTWARE AS A SERVICE SEGMENT TO HOLD THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 26 MARKET SIZE, BY SERVICE MODEL, 2016–2019 (USD MILLION)

TABLE 27 MARKET SIZE, BY SERVICE MODEL, 2020–2025 (USD MILLION)

9.2 INFRASTRUCTURE AS A SERVICE

TABLE 28 INFRASTRUCTURE AS A SERVICE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 INFRASTRUCTURE AS A SERVICE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.3 PLATFORM AS A SERVICE

TABLE 30 PLATFORM AS A SERVICE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 PLATFORM AS A SERVICE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.4 SOFTWARE AS A SERVICE

TABLE 32 SOFTWARE AS A SERVICE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 SOFTWARE AS A SERVICE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10 CLOUD BILLING MARKET, BY ORGANIZATION SIZE (Page No. - 80)

10.1 INTRODUCTION

10.1.1 ORGANIZATION SIZE: MARKET DRIVERS

10.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 27 LARGE ORGANIZATIONS SEGMENT TO HOLD A LARGER MARKET SHARE DURING THE FORECAST PERIOD

TABLE 34 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 35 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.2 LARGE ENTERPRISES

TABLE 36 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.3 SMALL AND MEDIUM ENTERPRISES

TABLE 38 SMALL AND MEDIUM ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 SMALL AND MEDIUM ENTERPRISES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11 CLOUD BILLING MARKET, BY VERTICAL (Page No. - 85)

11.1 INTRODUCTION

11.1.1 VERTICAL: MARKET DRIVERS

11.1.2 VERTICAL: COVID-19 IMPACT

FIGURE 28 CONSUMER GOODS & RETAIL VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 40 MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 41 MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 42 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11.3 INFORMATION TECHNOLOGY

TABLE 44 INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11.4 TELECOMMUNICATIONS

TABLE 46 TELECOMMUNICATIONS: CLOUD BILLING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11.5 CONSUMER GOODS & RETAIL

TABLE 48 CONSUMER GOODS & RETAIL: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11.6 MEDIA & ENTERTAINMENT

TABLE 50 MEDIA & ENTERTAINMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 MEDIA & ENTERTAINMENT: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11.7 EDUCATION

TABLE 52 EDUCATION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 EDUCATION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11.8 HEALTHCARE

TABLE 54 HEALTHCARE: CLOUD BILLING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 HEALTHCARE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11.9 OTHER VERTICALS

TABLE 56 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 OTHER VERTICALS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

12 CLOUD BILLING MARKET, BY REGION (Page No. - 96)

12.1 INTRODUCTION

FIGURE 29 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 58 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: COVID-19 IMPACT

12.2.2 NORTH AMERICA: MARKET DRIVERS

12.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

TABLE 60 NORTH AMERICA: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY BILLING TYPE, 2016–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY BILLING TYPE, 2020–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY SERVICE MODEL, 2016–2019 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY SERVICE MODEL, 2020–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.2.4 UNITED STATES

TABLE 74 UNITED STATES: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 75 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 76 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 77 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

12.2.5 CANADA

TABLE 78 CANADA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 81 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: COVID-19 IMPACT

12.3.2 EUROPE: CLOUD BILLING MARKET DRIVERS

12.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 82 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY BILLING TYPE, 2016–2019 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY BILLING TYPE, 2020–2025 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY SERVICE MODEL, 2016–2019 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY SERVICE MODEL, 2020–2025 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.4 UNITED KINGDOM

TABLE 96 UNITED KINGDOM: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 97 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 98 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 99 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

12.3.5 REST OF EUROPE

TABLE 100 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 102 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: COVID-19 IMPACT

12.4.2 ASIA PACIFIC: MARKET DRIVERS

12.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 104 ASIA PACIFIC: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY BILLING TYPE, 2016–2019 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY BILLING TYPE, 2020–2025 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY SERVICE MODEL, 2016–2019 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY SERVICE MODEL, 2020–2025 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.4.4 CHINA

TABLE 118 CHINA: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 119 CHINA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 120 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 121 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

12.4.5 REST OF ASIA PACIFIC

TABLE 122 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 124 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 125 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

12.5.1 MIDDLE EAST & AFRICA: COVID-19 IMPACT

12.5.2 MIDDLE EAST & AFRICA: MARKET DRIVERS

12.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

TABLE 126 MIDDLE EAST & AFRICA: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MARKET SIZE, BY BILLING TYPE, 2016–2019 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: MARKET SIZE, BY BILLING TYPE, 2020–2025 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE MODEL, 2016–2019 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE MODEL, 2020–2025 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: CLOUD BILLING MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.5.4 KINGDOM OF SAUDI ARABIA

TABLE 140 KINGDOM OF SAUDI ARABIA: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 141 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 142 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 143 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

12.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 144 REST OF MIDDLE EAST & AFRICA: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 145 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 146 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 147 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: COVID-19 IMPACT

12.6.2 LATIN AMERICA: MARKET DRIVERS

12.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 148 LATIN AMERICA: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET SIZE, BY BILLING TYPE, 2016–2019 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET SIZE, BY BILLING TYPE, 2020–2025 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET SIZE, BY SERVICE MODEL, 2016–2019 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET SIZE, BY SERVICE MODEL, 2020–2025 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 157 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 158 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.6.4 BRAZIL

TABLE 162 BRAZIL: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 163 BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 164 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 165 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

12.6.5 REST OF LATIN AMERICA

TABLE 166 REST OF LATIN AMERICA: CLOUD BILLING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 167 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 168 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 169 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 140)

13.1 MARKET EVALUATION FRAMEWORK

FIGURE 32 MARKET EVALUATION FRAMEWORK

13.2 MARKET SHARE ANALYSIS

FIGURE 33 MARKET SHARE ANALYSIS OF COMPANIES IN CLOUD BILLING MARKET

13.3 MARKET RANKING

FIGURE 34 MARKET RANKING IN 2019

13.4 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 35 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS IN MARKET, 2015-2019

13.5 KEY MARKET DEVELOPMENTS

FIGURE 36 KEY DEVELOPMENTS IN THE CLOUD BILLING MARKET FOR 2018–2020

13.5.1 NEW PRODUCT LAUNCHES

TABLE 170 NEW PRODUCT LAUNCHES

13.5.2 PRODUCT ENHANCEMENTS

TABLE 171 PRODUCT ENHANCEMENTS

13.5.3 BUSINESS EXPANSIONS

TABLE 172 BUSINESS EXPANSIONS

13.5.4 PARTNERSHIPS AND AGREEMENTS

TABLE 173 PARTNERSHIPS AND AGREEMENTS

13.6 COMPANY EVALUATION MATRIX

13.6.1 STAR

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE

13.6.4 PARTICIPANTS

FIGURE 37 GLOBAL CLOUD BILLING MARKET, COMPANY EVALUATION MATRIX

13.7 STARTUP/SME EVALUATION MATRIX, 2020

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

FIGURE 38 GLOBAL CLOUD BILLING MARKET, STARTUP/SME EVALUATION MATRIX, 2020

14 COMPANY PROFILES (Page No. - 151)

14.1 INTRODUCTION

(Business Overview, Products Offered, Recent Developments, MnM View, Key strengths, Strategic choices made, Weaknesses and competitive threats)*

14.2 ORACLE

FIGURE 39 ORACLE: COMPANY SNAPSHOT

14.3 SALESFORCE

FIGURE 40 SALESFORCE: COMPANY SNAPSHOT

14.4 SAP

FIGURE 41 SAP: COMPANY SNAPSHOT

14.5 ZUORA

FIGURE 42 ZUORA: COMPANY SNAPSHOT

14.6 ARIA SYSTEMS

14.7 BILLINGPLATFORM

14.8 RECURLY

14.9 ONEBILL

14.10 JAMCRACKER

14.11 CERILLION

14.12 CGI

14.13 CONNECTWISE

14.14 ZOHO

14.15 APPDIRECT

14.16 CHARGIFY

14.17 CLOUDBILLING

14.18 CHARGEBEE

14.19 RECVUE

14.20 CLOUD ASSERT

14.21 CLOUDXCHANGE.IO

*Business Overview, Products Offered, Recent Developments, MnM View, Key strengths, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 178)

15.1 INTRODUCTION

15.1.1 RELATED MARKETS

15.1.2 LIMITATIONS

15.2 TELECOM CLOUD BILLING MARKET

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

15.2.3 TELECOM MARKET ANALYSIS, BY TYPE OF BILLING

TABLE 174 TELECOM MARKET SIZE, BY TYPE OF BILLING, 2014–2021 (USD MILLION)

TABLE 175 CONVERGENT: TELECOM MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 176 PREPAID: TELECOM MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 177 POSTPAID: TELECOM MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 178 INTERCONNECT: TELECOM MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 179 ROAMING: TELECOM MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 180 OTHER BILLING TYPES: TELECOM MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

15.2.4 GEOGRAPHIC ANALYSIS

TABLE 181 TELECOM CLOUD BILLING MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

15.2.4.1 North America

TABLE 182 NORTH AMERICA: TELECOM MARKET SIZE, BY COUNTRY, 2014–2021 (USD MILLION)

TABLE 183 NORTH AMERICA: TELECOM MARKET SIZE, BY TYPE OF BILLING, 2014–2021 (USD MILLION)

TABLE 184 NORTH AMERICA: TELECOM MARKET SIZE, BY APPLICATION, 2014–2021 (USD MILLION)

TABLE 185 NORTH AMERICA: TELECOM MARKET SIZE, BY CLOUD PLATFORM, 2014–2021 (USD MILLION)

TABLE 186 NORTH AMERICA: TELECOM MARKET SIZE, BY DEPLOYMENT, 2014–2021 (USD MILLION)

TABLE 187 NORTH AMERICA: TELECOM MARKET SIZE, BY RATE OF CHARGING MODE, 2014–2021 (USD MILLION)

TABLE 188 NORTH AMERICA: TELECOM MARKET SIZE, BY SERVICE, 2014–2021 (USD MILLION)

TABLE 189 NORTH AMERICA: TELECOM CLOUD BILLING MARKET SIZE, BY END USER, 2014–2021 (USD MILLION)

15.3 CLOUD ANALYTICS MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.3.3 CLOUD ANALYTICS MARKET, BY SOLUTION

TABLE 190 CLOUD ANALYTICS MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 191 CLOUD ANALYTICS MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 192 CLOUD BI TOOLS: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 193 CLOUD BI TOOLS: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 194 HOSTED DATA WAREHOUSE SOLUTIONS: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 195 HOSTED DATA WAREHOUSE SOLUTIONS: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 196 COMPLEX EVENT PROCESSING: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 197 COMPLEX EVENT PROCESSING: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 198 ENTERPRISE INFORMATION MANAGEMENT: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 199 ENTERPRISE INFORMATION MANAGEMENT: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 200 ENTERPRISE PERFORMANCE MANAGEMENT: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 201 ENTERPRISE PERFORMANCE MANAGEMENT: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 202 GOVERNANCE, RISK, AND COMPLIANCE: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 203 GOVERNANCE, RISK, AND COMPLIANCE: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 204 ANALYTICS SOLUTIONS: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 205 ANALYTICS SOLUTIONS: CLOUD ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

16 APPENDIX (Page No. - 191)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

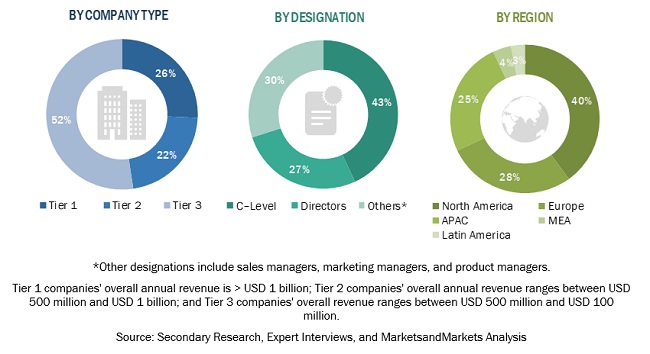

The study involved four major activities in estimating the current size of the global cloud billing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total cloud billing market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the cloud billing market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the cloud billing market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global cloud billing market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the cloud billing market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the cloud billing market based on component, billing type, deployment type, service model, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends in solution & services, category prospects, and contribution to the overall market

- To analyze the impact of COVID-19 on the market

- To forecast the market size of the five major regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the cloud billing market and comprehensively analyze their core competencies in each subsegment

- To track and analyze competitive developments, such as new product developments, product enhancements, and partnerships & agreements, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Growth opportunities and latent adjacency in Cloud Billing Market

US level market numbers

Interested in cloud billing structure

Intested in finding out top solutions/products in the cloud billing market

Competitive intelligence for vendors