This research study involved the extensive use of both primary and secondary sources. It involved the analysis of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study extensively utilized secondary sources, including directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, as well as white papers, annual reports, and companies' house documents. The aim of the secondary research was to gather and analyze information for a comprehensive and commercially focused study of the healthcare cloud computing market, encompassing technical aspects and market dynamics. It also facilitated the identification of key players, market classification, industry trends, geographical markets, and significant market-related developments. Additionally, a database of prominent industry leaders was compiled through secondary research.

Primary Research

In the primary research process, various supply-side and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the healthcare cloud computing market. Primary sources from the demand side included personnel from pharmaceutical & biotechnology companies, research institutes and hospitals (small, medium-sized, and large hospitals).

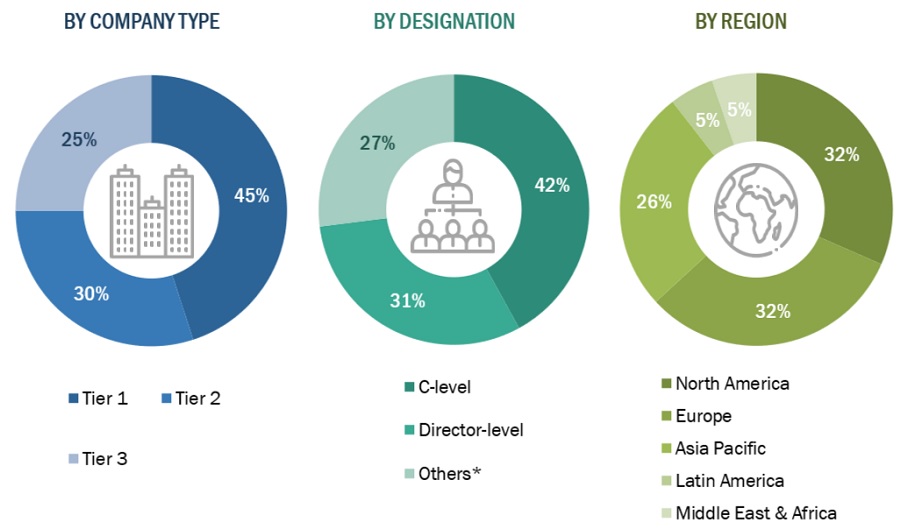

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the healthcare cloud computing market was determined after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

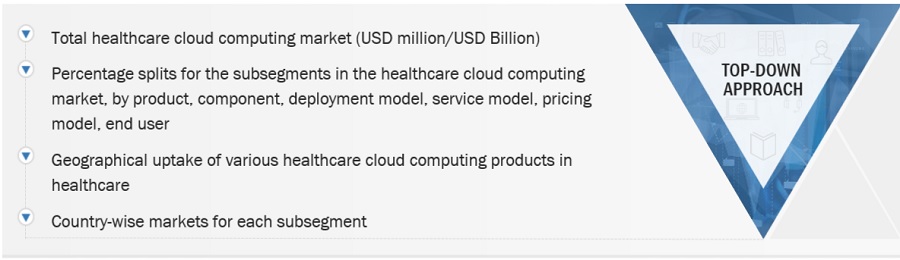

Global Healthcare Cloud Computing Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

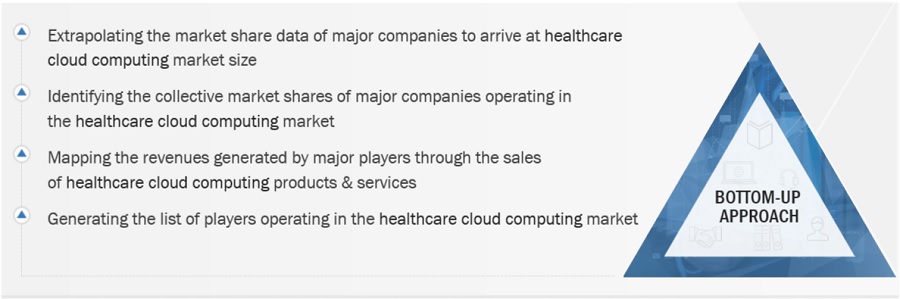

Global Healthcare Cloud Computing Market Size: Bottom-Up Approach

Data Triangulation

The size of the healthcare cloud computing market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

-

Revenues for individual companies were gathered from public sources and databases.

-

Shares of leading players in the healthcare cloud computing market were gathered from secondary sources to the extent available. In certain cases, shares of healthcare cloud computing businesses have been ascertained after a detailed analysis of various parameters including product portfolios, market positioning, selling price, and geographic reach & strength.

-

Individual shares or revenue estimates were validated through interviews with experts.

-

The total revenue in the healthcare cloud computing market was determined by extrapolating the market share data of major companies.

Market Definition

Cloud computing involves the storage, management, and processing of data from disparate locations and delivering that data to hosted services over the Internet. It provides on-demand access to software applications, resources, and services through the internet.

Cloud computing in healthcare describes the practice of implementing remote servers accessed via the internet to store, manage, and process healthcare-related data.

Key Stakeholders

-

Healthcare IT service providers

-

Healthcare insurance companies/payers

-

Healthcare institutions/providers (hospitals, medical groups, physician practices, diagnostic centers, and outpatient clinics)

-

Healthcare startups, consultants, and regulators

-

Research and development (R&D) companies

-

Business research and consulting service providers

-

Venture capitalists

-

Government agencies

-

Accountable care organizations

Objectives of the Study

-

To define, describe, and forecast the healthcare cloud computing market based on product, deployment model, service model, pricing model, component, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall healthcare cloud computing market

-

To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of the market segments with respect to five main regions, namely,

-

North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa.

-

To profile the key players and analyze their market shares and core competencies2

-

To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, and collaborations in the overall healthcare cloud computing market

-

To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

-

Further breakdown of the Rest of Asia Pacific healthcare cloud computing market into Australia, Taiwan, New Zealand, Thailand, Singapore, Malaysia, and other countries

-

Further breakdown of the Rest of Europe healthcare cloud computing market into Russia, Austria, Finland, Sweden, Turkey, Norway, Poland, Portugal, Romania, Denmark, and other countries

Cloud

Aug, 2020

This market study is a complete guide to the Cloud Computing Healthcare market..