Contact Center Software Market by Component (Solutions (Omnichannel Routing, Reporting & Analytics), Services), Organization Size, Deployment Mode, Vertical (BFSI, Telecommunications, & Retail & Consumer Goods) and Region - Global Forecast to 2028

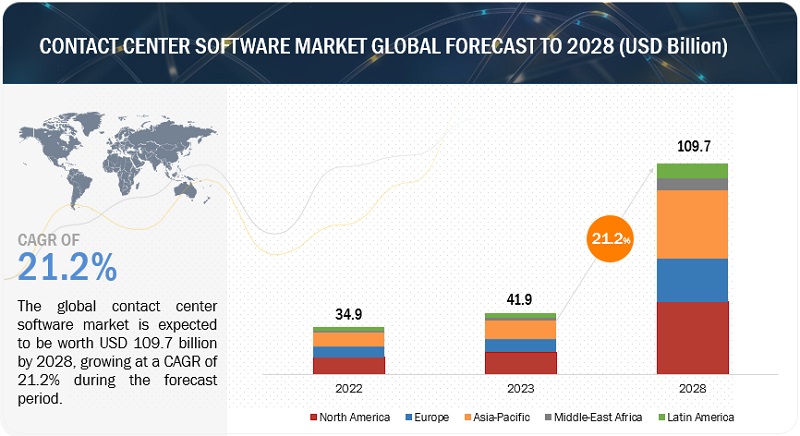

The global Contact Center Software Market size was valued at USD 41.9 billion in 2023 and is expected to grow at a CAGR of 21.2% from 2023 to 2028. The revenue forecast for 2028 is projected to reach $109.7 billion. Some important factors that boost the growth of the contact center software market include AI/ML integrated contact center solutions, integration with CRM and other business systems, and the role of social media in contact center operations. The increasing demand for AI and automation and dynamic customer demands for robust self-service interactions would create numerous opportunities for contact center software vendors in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Contact Center Software Market

The economic slowdown has impacted the contact center software market, resulting in reduced investments, delayed deployments, and canceled client projects. However, there has also been an increased demand for contact center software solutions and a focus on cost optimization, efficiency, and automation. There is an increased need for cloud services to accelerate digital transformation to stay competitive during the recession. In a downturn, customers become more demanding of the businesses they support; they might demand more value from a product or service to justify their pay. They are more likely to react if something doesn’t work as expected. The business could lose customers if the call center isn’t optimized to handle customers. Such instances also expose inefficiencies in a call center’s KPIs, such as customer satisfaction, first contact resolution, net promoter score, and agent utilization rates.

Qatar has become a regional cloud hub, with Google and Microsoft constructing significant regional data centers. Despite the many benefits of cloud computing, such as reduced costs, increased flexibility, and improved service quality, only 3% of Qatar’s private sector has adopted the cloud, with security being a significant barrier. However, public cloud service providers invest heavily in security, spending billions yearly to protect corporate and personal data. Overcoming this obstacle will require a cultural shift rather than just a new security infrastructure. CFOs, CTOs, and CEOs are now debating whether their cloud-deployment strategies are recession-proof or flexible enough to meet shifting marketing demands while reducing expenses without compromising revenue and growth.

The major cloud vendors globally are Google Cloud, Microsoft Azure, and Amazon Web Services. In 2020, AWS saw a 33% YoY growth and earned a record-breaking USD 10 billion in revenue. In the same year, Azure and Google Cloud expanded by 59% and 52%, respectively. IBM’s Cloud & Data Platforms division also experienced a 32% increase in revenue. Alibaba and Oracle also reported revenue growth. However, the current economic downturn caused by COVID-19 and the Russia-Ukraine war would affect all cloud service providers, including AWS, Google Cloud Platform, and Microsoft Azure, as their clients are scaling back due to reduced demand which has resulted in a slowdown in earnings in the first quarter of 2022 for cloud service providers. This trend would continue throughout the year.

Despite the challenges, the cloud industry is showing long-term growth because of its flexibility and scalability. During a recession, businesses prefer to scale back or delay unnecessary technology spending to save money. This trend affects cloud vendors because cloud spending has become a significant business expense. In 2008, during the last recession, cloud computing was a new technology, but now almost all businesses use it for some of their workloads. In Q1 2020, cloud spending increased by 37% to USD 29 billion due to the COVID-19 crisis, and this trend will continue as the world shifts to virtual work. The need for scalable, trustworthy, affordable, secure, and off-premises technology services has become urgent during COVID-19. Therefore, despite the expected decline in IT spending by 8%, cloud spending is expected to grow by 19% for the entire year, according to a survey.

Contact Center Software Market Dynamics

Driver: Role of social media in contact center operations

Modern contact center solution providers focus on providing organizations with social media capabilities to handle queries from social media to assess brand value and brand impact and reduce costs and complexities associated with abandoned client queries and customer turnovers. Social media plays a crucial role in identifying social media influencers, word of mouth, emotion, sentiments, and brand image to improve the overall efficiency of contact center agents and offered services or products. Also, customers have a favorable take on companies that respond to customer queries and comments on social media. Social media has transformed the way customers engage with businesses. Customers often turn to social media platforms like Facebook, Twitter, Instagram, LinkedIn, and others to seek support, ask questions, or voice their concerns. Contact centers must be present and responsive on social media to meet customers where they are. Contact center software enables businesses to monitor and manage social media interactions effectively, ensuring timely responses and excellent customer support. Social media is crucial in maintaining a brand’s reputation. Customer experiences and interactions shared on social media platforms significantly impact the perception of a brand. Contact center software helps organizations monitor social media conversations about their brand, products, or services.

Restraint: Implementation and integration challenges

Implementing and integrating contact center software can cause several challenges for businesses, possibly due to technical complexities, organizational factors, or the need for seamless integration with existing systems. Contact center software implementations are pretty complex, involving various components such as Automatic Call Distribution (ACD), Interactive Voice Response (IVR), Computer Telephony Integration (CTI), workforce management, and reporting/analytics modules. Integrating these components and ensuring they work harmoniously can be challenging, especially when dealing with legacy systems or multiple vendors. The system’s complexity may require dedicated IT resources and expertise for implementation and ongoing maintenance. Integrating contact center software with existing systems, such as Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), or ticketing systems, can be a significant challenge.

Opportunity: Dynamic customer demands robust self-service interactions

The growth in contact center turnover rate and waiting time in connecting to an agent might result in a negative customer experience. Improving customer satisfaction becomes vital to organizations as customer experience is essential in maintaining customer relationships and improving products and services based on customer feedback. Incorporating robust self-service bots and cutting-edge technologies such as AI, ML, and analytics enables organizations to connect with their customers to deliver enhanced customer experiences, especially after the influx in calls during and after the COVID-19 crisis. Customers today value convenience and autonomy in their interactions with businesses and want quick and easy access to information without relying on assistance from human agents. Self-service options empower customers to find answers to questions, troubleshoot issues, and complete tasks at their own pace and convenience. By offering robust self-service capabilities through contact center software, businesses can meet customer expectations, enhance customer satisfaction, and reduce the need for agent intervention. Self-service options provided by contact center software can be available around the clock, enabling customers to seek assistance and access information at any time, irrespective of business hours. This flexibility is precious for global businesses serving customers in different time zones. By offering self-service capabilities, companies can ensure that customers can access relevant resources and support whenever needed, enhancing customer experiences and loyalty. Contact center software often includes Interactive Voice Response (IVR) systems, allowing customers to navigate.

Challenge: Need for training and skill requirements

The restraint of training and skill requirements in the contact center software market refers to the challenges associated with training employees and developing the necessary skills to utilize the software effectively. Contact center software solutions have many features and functionalities to enhance customer interactions and streamline operations. However, these features can be complex and require proper training for agents and administrators to leverage their benefits entirely. Agents must understand how to navigate the software interface, utilize call management tools, handle multiple communication channels (phone calls, emails, live chat, and social media), and access customer information and history. Administrators must be skilled in configuring and customizing the software, creating call flows, setting up routing rules, and generating reports. The complexity of these features can pose a learning curve for employees, requiring dedicated training and support. Contact center software often requires a certain level of technical knowledge to install, configure, and maintain.

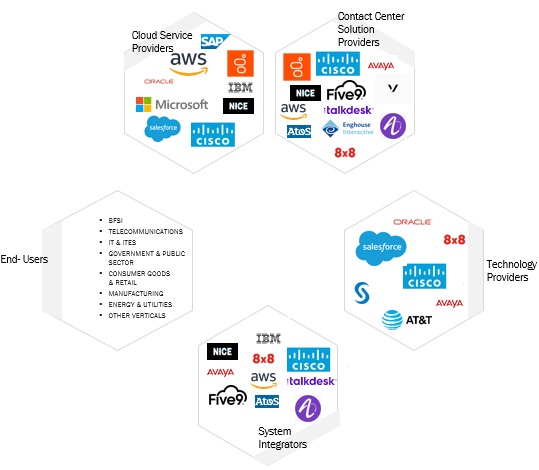

Contact Center Software Market Ecosystem

This section highlights the contact center software ecosystem comprising the technology providers, cloud service providers, solution providers, system integrators, and end users. The contact center software ecosystem varies based on the various vendors in the market.

The contact center software ecosystem defines various players that support and utilize multiple applications to develop contact center solutions. OEMs provide different infrastructure devices and equipment required to deploy contact center solutions, such as hardware, software, and communication systems. IT solution manufacturers bundle OEM parts, such as processors and software, to form a single solution. The technology providers offer various applications and software required to build the solution. Cloud-based contact center solutions reduce overall costs and provide highly scalable access to solutions hosted by the cloud service provider. Cloud service providers host all the services, such as networking, software, servers, and infrastructure, in public or private cloud environments and often offer on-demand cloud computing components.

The contact center vendors provide core contact center software platforms and industry-oriented solutions. These vendors have large-scale technical teams to develop and support the contact center platform. They leverage advanced technologies like cloud computing, analytics, and AI/ML to improve efficiency. Partnerships, collaborations, and agreements are the major strategies these players adopt to work with other players operating in the market.

The figure given below highlights the ecosystem of the contact center software market. The contact center software ecosystem represents a relationship between all the elements—vendors, solutions/services, and end users/verticals.

Based on solutions, the customer engagement management segment will witness the second-highest CAGR during the forecast period.

Customer engagement management builds and maintains customer relationships through various channels, including email, social media, live chat, and phone calls. Contact centers are physical or virtual locations where businesses interact with customers through these channels. The customer engagement management solution addresses critical business issues with unprecedented efficacy by combining data from multiple digital and non-digital sources, such as websites, mobile devices, CRM systems, social media, email, and various third-party websites. The solution enables companies to identify customer preferences based on interactions, transactions, and feedback and develop business plans accordingly.

Based on vertical, the telecommunications vertical holds the second-largest market size during the forecast period.

The telecommunications sector is one of the key verticals that can significantly benefit from implementing contact center software. Telecommunications companies require robust contact center software solutions for customer service and support operations. Telecommunications companies prioritize delivering exceptional customer service experiences to differentiate themselves in a competitive market. Contact center software enables them to provide efficient and personalized support across multiple channels, including voice, email, chat, and social media. The sector’s focus on customer service excellence drives the adoption of contact center software with advanced features and capabilities. Telecommunications companies typically face high call volumes and complex interactions due to billing inquiries, service activations, technical support, and more. Contact center software that can handle large call volumes, support intelligent call routing, and streamline workflows is critical for efficiently managing telecommunications customer interactions.

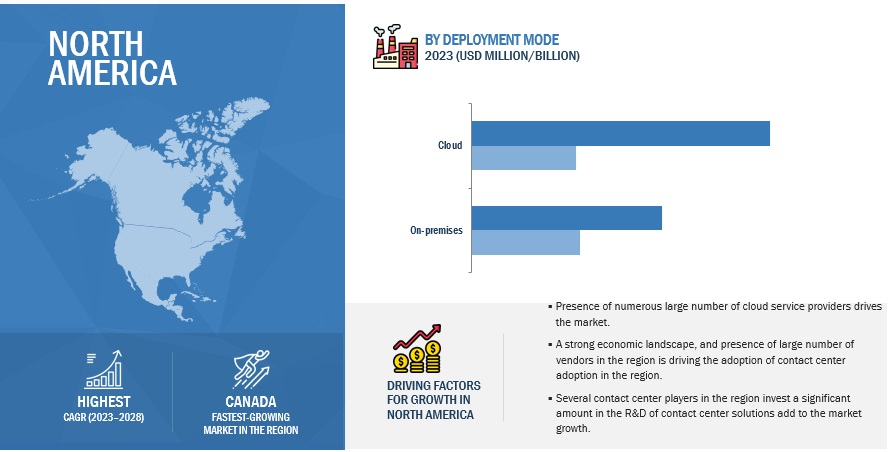

The US market contributes the largest share of North America’s contact center software market during the forecast period.

The US is estimated to account for North America’s most significant share of the contact center software market in 2023, and the trend will continue until 2028. Due to several factors, including advanced IT infrastructure, the existence of numerous businesses, and the availability of technical skills, it is the most developed market for adopting contact center software solutions. The US has a significant presence of global mega-vendors, high adoption of advanced technologies, such as AI, ML, and IoT, and the highest readiness for adopting the cloud; these factors would drive the adoption of contact center software. Many mergers, acquisitions, and VC/private equity deals are happening in the country, making it the largest market for investors and vendors worldwide.

Key Market Players

The contact center software market includes analysis of a few globally established players such as NICE (Israel), IBM (US), Genesys (US), AWS (US), Five9 (US), Twilio (US), Mitel (Canada), Cisco (US), BT (UK), Verizon (US), Avaya (US), Vonage (US), among others, are the key vendors that secured contact center software contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have local expertise. Most key players have adopted partnerships and product developments to cater to the demand for contact center software solutions and services.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Million/Billion (USD) |

|

Segments Covered |

Component (Solutions, Services), Organization Size, Deployment Mode, and Vertical |

|

Geographies Covered |

North America, Latin America, Europe, Middle East & Africa, and Asia Pacific |

|

Companies Covered |

Some of the key vendors offering contact center software across the globe include NICE (Israel), Genesys (US), AWS (US), IBM (US), Five9 (US), Twilio (US), Cisco (US), Mitel (Canada), BT (UK), Verizon (US), Vonage (US), Avaya (US), and more. |

This research report categorizes the contact center software market based on components (solutions, services), organization size, deployment mode, verticals, and regions.

Based on the Component:

-

Solution

- Omnichannel Routing

- Workforce Engagement Management

- Reporting and Analytics

- Customer Engagement Management

- Others (CTI, Messaging, Compliance, and Data Integration)

-

Services

- Consulting

- Integration and Implementation

- Training Support and Maintenance

Based on the Deployment Model:

- On-premises

- Cloud

Based on the Organization Size:

- Small and Medium-Sized Enterprises

- Large Enterprises

Based on the Vertical:

- BFSI

- Telecommunications

- IT and ITES

- Government & Public Sector

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Healthcare and Life Sciences

- Others (Media & Entertainment, Travel & Hospitality, Transportation & Logistics, and Education)

Based on Regions:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Belgium

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- United Arab Emirates

- Kingdom of Saudi Arabia

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2023, Genesys unveiled its new ai-powered employee experience solution, Genesys Cloud Ex. This solution helps businesses improve the employee experience in their contact centers by giving them the tools they need to be more productive, engaged, and satisfied.

- In June 2023, NICE announced that its CXone platform is now available as an EU sovereign cloud platform. CXone is an industry-leading cloud platform for customer experience (CX) that offers unmatched scalability, reliability, and a complete set of CX applications. With this announcement, organizations from any vertical across the EU can now choose CXone as their platform while meeting regulatory and compliance requirements.

- In June 2023, Amazon Connect Chat came with a new feature that offers more ways to customize the chat widget that comes with the service. It enables the user to add a logo and change the text in fields like “system message,” “bot,” “text input placeholder,” and “end chat.”

- In May 2023, BT and Five9 announced they are expanding their partnership to offer organizations global contact center services and solutions. As part of the expanded partnership, BT will now provide the Five9 Intelligent CX Platform as a managed service to new and existing customers. BT will install, configure, and maintain the Five9 platform, freeing customers to focus on their core business activities.

- In March 2023, Genesys and Acqueon partnered to help B2C organizations optimize proactive customer outreach. The partnership will combine Genesys’ ai-powered experience orchestration capabilities with Acqueon’s omnichannel workflows, predictive analytics, and ai to help organizations deliver personalized, compliant, and effective outbound customer interactions. Through the partnership, joint contact center customers can seamlessly leverage the Genesys Cloud CX platform’s artificial intelligence (AI)-based experience orchestration capabilities with the Acqueon omnichannel workflows, predictive analytics, AI, and built-in compliance suite.

- In March 2023, Five9 announced the general availability of Five9 Agent Assist 2.0 with AI Summary, powered by OpenAI. This new solution uses generative AI technology to summarize customer call transcripts in seconds, which can help businesses to reduce manual, after-call work and improve the efficiency of their contact centers.

- In January 2023, Mitel entered exclusive negotiations with Atos to acquire Unify. Unify provides Communication and Collaboration Services businesses (CCS) and Unified Communications and Collaboration (UCC). Mitel and Unify would serve a customer base of over 75 million users in nearly 100 countries and a channel community of more than 5,500 global partners. The proposed transaction would also notably expand Mitel’s reach and increase global revenues and profitability.

- In January 2023, Verizon Business introduced digital engagement capabilities to enhance the end-to-end digital customer journey for the Verizon Virtual Contact Center (VCC). The latest VCC digital solutions would help improve customer experiences.

- In July 2022, Amazon Connect launched Contact Lens integration with Contact Control Panel and Salesforce CTI Adapter.

- In June 2022, Avaya announced that it is reimagining digital campus learning with its Avaya OneCloud Experience Platform. The platform offers significant advantages for higher education institutions facing increased competition and slowing admission growth.

- In May 2022, Avaya and Microsoft expanded their strategic partnership by integrating Avaya’s OneCloud portfolio with Microsoft Azure to provide businesses with more options to enhance productivity, scalability, and customer engagement.

Frequently Asked Questions (FAQ):

What is contact center software?

Contact center software is a set of software applications designed to help organizations manage and streamline customer interactions across voice, video, web, chat, and social media. The contact center software helps organizations increase productivity by optimizing inbound and outbound operations. Contact center software includes a range of functionalities that facilitate efficient customer interactions and enhance overall customer experience. These functionalities include omnichannel routing, workforce engagement management, reporting and analytics, and customer engagement management.

Which country is an early adopter of contact center software?

The US is at the initial stage of adopting contact center software.

What are the driving factors in the contact center software market?

The need to streamline, enhance, and personalize the customer experience, growing advanced technology integration, and the rise in omnichannel communication drive the market growth.

Which are significant verticals adopting contact center software?

Key verticals adopting the contact center software market include: -

- BFSI

- Telecommunications

- IT & ITES

- Government & Public Sector

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Healthcare & Life Sciences

- Other Verticals

Which are the key vendors exploring Contact Center Software?

The key technology vendors in the market include NICE (Israel), IBM (US), Genesys (US), AWS (US), Five9 (US), Twilio (US), Mitel (Canada), Cisco (US), BT (UK), Verizon (US), Avaya (US), Vonage (US), 8x8 (US), Talkdesk (US), Alcatel Lucent Enterprise (France), Sinch (Sweden), Oracle (US), RingCentral (US), Lifesize (US), Content Guru (UK), Alvaria (US), Enghouse Interactive (US), 3CLogic (US), Ameyo (India), West (US), NEC (Japan), ZTE (China), Vocalcom (France), Evolve IP (US), UJET (US), Amtelco (US), AVOXI (US), VCC Live (Hungary), Glia (US), Bright Pattern (US), ComputerTalk (Canada), and C-Zentrix (India).

What is the total CAGR for the contact center software market from 2023-2028?

The contact center software market would record a CAGR of 21.2% during 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of advanced contact center technologies- Need to control contact center attrition and absenteeism- Impact of social media on contact center operations- Continuous transition to cloud-based contact centers- Integration with CRM and other business systems- Growing demand for personalized and streamlined interactionsRESTRAINTS- Inadequate network bandwidth to minimize adoption of VoIP and cloud-based telephony- High costs and long-term contracts associated with PRI phone services- Impact of IVR fraud and cyberattacks on business operationsOPPORTUNITIES- Growing demand for analyzing audio and video conversations- Growing demand for AI and automation- Dynamic customer demand for robust self-service interactionsCHALLENGES- Data privacy and security aspects- Barriers to moving contact centers to cloud environments- Lack of trained and skilled workforce- Implementation and integration challenges

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: ECSI IMPROVED TELEPHONIC INTERACTION SPEED AND REDUCED CHAT HANDLING TIME WITH NICE’S SOLUTIONCASE STUDY 2: 8X8 VIRTUAL CONTACT CENTER HELPED BAILEY INTERNATIONAL REDUCE CALL ANSWER TIMES AND ABANDONMENT RATESCASE STUDY 3: GENESYS HELPED TECHSTYLE FASHION GROUP ENHANCE VISIBILITY AND EXPERIENCECASE STUDY 4: FIVE9 HELPED TELADOC INCREASE UPTIME, IMPROVE CUSTOMER SATISFACTION, AND PREVENT OUTAGESCASE STUDY 5: KANTAR STREAMLINED GLOBAL MARKET RESEARCH CENTERS WITH SYTEL’S MULTI-TENANT CCAAS PLATFORMCASE STUDY 6: ORANGE OPTIMIZED MESSAGE HANDLING AND ENHANCED CUSTOMER RELATIONS WITH RINGCENTRAL’S SOLUTIONCASE STUDY 7: TALKDESK OFFERED REAL-TIME REPORTS AND INTEGRATIONS WITH BUSINESS TOOLS TO IMPROVE ACXIOM’S CUSTOMER EXPERIENCESCASE STUDY 8: ATOS HELPED MUNICIPALITY OF MAASTRICHT IMPROVE RESPONSIVENESS OF CALLSCASE STUDY 9: TWILIO’S SOLUTION HELPED HULU IMPROVE CUSTOMER EXPERIENCECASE STUDY 10: AVAYA CONTACT CENTER SELECT HELPED GTECH OFFER MINUTE STATISTICS

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 ECOSYSTEM/MARKET MAP

-

5.6 TECHNOLOGY ANALYSISADVANCED ANALYTICS- Data analytics- Speech analytics- Sentiment analyticsARTIFICIAL INTELLIGENCE- ML- NLP

- 5.7 PRICING ANALYSIS

-

5.8 PATENT ANALYSIS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 TARIFFS AND REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST AND SOUTH AFRICALATIN AMERICA

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS’ BUSINESSES

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.14 BUSINESS MODEL ANALYSISON-PREMISES BUSINESS MODELHOSTED BUSINESS MODELCLOUD-BASED BUSINESS MODEL

- 6.1 INTRODUCTION

-

6.2 SOLUTIONSGROWING DEMAND FOR OMNICHANNEL CUSTOMER SERVICE AND INCREASING REGULATORY REQUIREMENTS TO DRIVE MARKETSOLUTIONS: CONTACT CENTER SOFTWARE MARKET DRIVERSOMNICHANNEL ROUTING- Omnichannel routing to help calls and assign tasks to agents based on their expertise and experience- Digital channels- Intelligent routing- Interactive Voice Response (IVR)- Automatic Call Distributors (ACD)- Dialers- Virtual agentsWORKFORCE ENGAGEMENT MANAGEMENT- Workforce engagement to include faster resolution, improve agent productivity, and increase customer retention- Workforce optimization- Call recording and quality management- GamificationREPORTING AND ANALYTICS- Reporting and analytics to identify trends, model data, and predict outcomes related to KPIs and SLAs- Historical and customized reports- Speech and text analytics- Real-time analytics and dashboardCUSTOMER ENGAGEMENT MANAGEMENT- Customer engagement management to identify customer preferences and develop business strategies- IVR and advanced chat- Self-service automation- Customer surveysOTHER SOLUTIONS

-

6.3 SERVICESNEED TO IMPROVE OPERATIONAL EFFICIENCY AND INCREASE AGILITY OF CONTACT CENTER SOLUTIONS TO DRIVE MARKETSERVICES: CONTACT CENTER SOFTWARE MARKET DRIVERSCONSULTING- Consulting services to ensure smooth implementation and integration of solutionsIMPLEMENTATION & INTEGRATION- Implementation & integration services to provide hassle-free and accurate integration and deployment of solutionsTRAINING, SUPPORT & MAINTENANCE- Training, support & maintenance services to ensure smooth operation and identification of issues

-

7.1 INTRODUCTIONDEPLOYMENT MODES: MARKET DRIVERS

-

7.2 ON-PREMISESON-PREMISES DEPLOYMENT TO ENABLE ORGANIZATIONS TO CUSTOMIZE CONTACT CENTER SOLUTIONS TO THEIR SPECIFIC NEEDS

-

7.3 CLOUDCLOUD DEPLOYMENT TO OFFER COST EFFICIENCY, SCALABILITY, ACCESSIBILITY, AND REDUCED INFRASTRUCTURE MANAGEMENT

-

8.1 INTRODUCTIONORGANIZATION SIZES: MARKET DRIVERS

-

8.2 LARGE ENTERPRISESNEED FOR ADVANCED FEATURES, SCALABILITY, AND CUSTOMIZATION OPTIONS TO DRIVE DEMAND FOR CONTACT CENTER SOFTWARE

-

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)COST-EFFECTIVENESS AND AFFORDABILITY OF CLOUD-BASED CONTACT CENTER SOFTWARE TO DRIVE ITS DEMAND IN SMES

-

9.1 INTRODUCTIONVERTICALS: MARKET DRIVERS

-

9.2 BFSINEED TO ENGAGE WITH CUSTOMERS AND PROVIDE SEAMLESS EXPERIENCES TO DRIVE DEMAND FOR CONTACT CENTER SOFTWARE

-

9.3 TELECOMMUNICATIONSNEED FOR COMPREHENSIVE ANALYTICS AND REPORTING TOOLS TO BOOST DEMAND FOR CONTACT CENTER SOFTWARE

-

9.4 HEALTHCARE & LIFE SCIENCESNEED TO MANAGE APPOINTMENT SCHEDULING, ENSURE PATIENT ADHERENCE TO TREATMENT PLANS, AND STREAMLINE APPOINTMENT PROCESSES TO DRIVE MARKET

-

9.5 IT & ITESNEED FOR MULTICHANNEL CUSTOMER ENGAGEMENT, ACCESS CUSTOMER INFORMATION, TRACK INTERACTIONS, AND MANAGE TICKETS TO PROPEL MARKET

-

9.6 MANUFACTURINGNEED TO MANAGE ORDER INQUIRIES, TRACK SHIPMENTS, AND PROVIDE STATUS UPDATES TO FUEL DEMAND FOR CONTACT CENTER SOFTWARE

-

9.7 RETAIL & CONSUMER GOODSNEED FOR FASTER DECISION-MAKING, CUSTOMER-CENTRIC MARKET STRATEGIES, AND BUSINESS OPERATIONS TO DRIVE MARKET

-

9.8 GOVERNMENT & PUBLIC SECTORNEED FOR EFFECTIVE COMMUNICATION, PROGRESS TRACKING, AND TIMELY ISSUE RESOLUTION TO DRIVE MARKET

-

9.9 ENERGY & UTILITIESEFFICIENTLY HANDLING CUSTOMER INQUIRIES, SERVICE REQUESTS, BILLING INQUIRIES, AND OUTAGE REPORTS TO DRIVE MARKET

- 9.10 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPE- US Securities and Exchange Commission (SEC)- International Organization for Standardization (ISO) 27001- California Consumer Privacy Act (CCPA)- Health Insurance Portability and Accountability Act (HIPAA) of 1996- Sarbanes-Oxley (SOX) Act of 2002US- Advanced IT infrastructure, presence of numerous organizations, and availability of technical skills to drive marketCANADA- Presence of knowledgeable and skilled workforce, increased digitalization, and rise in workload to drive market

-

10.3 EUROPEEUROPE: CONTACT CENTER SOFTWARE MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPE- General Data Protection Regulation (GDPR)- European Cybersecurity ActUK- Increasing digitalization and rising demand for mobile devices and cloud services to boost demand for contact center softwareGERMANY- Government initiatives for technology adoption and growing popularity of WFO to drive marketFRANCE- Need for exceptional customer experiences, digital transformation, and leveraging data insights to propel marketBELGIUM- Need to break out of legacy infrastructure to develop agile approach and presence of robust contact center industry to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: CONTACT CENTER SOFTWARE MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPE- Personal Data Protection Act (PDPA)- Singapore Standard (SS) 564- Internet Data Center (IDC) in ChinaCHINA- Growing concern for data privacy and security and increasing focus on customer experience to propel marketJAPAN- Presence of major vendors, need to move to cloud-based B2B services, and business-friendly regulations to drive marketAUSTRALIA & NEW ZEALAND (ANZ)- Customer experience, strong service-oriented sectors, and high level of technology adoption to drive marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: CONTACT CENTER SOFTWARE MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPE- Personal Data Protection Law (PDPL)- Cloud Computing Regulatory FrameworkKSA- Initiatives such as Vision 2030 and the National Transformation Program to drive marketUAE- Rising need for omnichannel communication and workforce management to fuel demand for contact center softwareREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: CONTACT CENTER SOFTWARE MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPE- FEDERAL LAW ON PROTECTION OF PERSONAL DATA HELD BY INDIVIDUALSBRAZIL- Shift toward cloud-based contact center solutions for flexibility and cost-effectiveness to accelerate marketMEXICO- Government initiatives to attract foreign investment, digital advancement, and technical expertise to drive marketREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 HISTORICAL REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 MARKET RANKING OF KEY PLAYERS

- 11.6 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

11.7 COMPETITIVE BENCHMARKING FOR KEY PLAYERSEVALUATION CRITERIA FOR KEY COMPANIES

-

11.8 EVALUATION MATRIX FOR KEY PLAYERS, 2023DEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.9 EVALUATION MATRIX FOR STARTUPS/SMES, 2023DEFINITIONS AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.10 COMPETITIVE BENCHMARKING FOR STARTUPS/SMESEVALUATION CRITERIA FOR STARTUPS/SMES

- 11.11 VALUATION AND FINANCIAL METRICS OF CONTACT CENTER SOFTWARE VENDORS

-

11.12 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 12.1 INTRODUCTION

-

12.2 MAJOR PLAYERSGENESYS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNICE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFIVE9- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTWILIO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITEL- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO- Business overview- Products/Solutions/Services offered- Recent developmentsBT GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsVERIZON- Business overview- Products/Solutions/Services offered- Recent developmentsAVAYA- Business overview- Products/Solutions/Services offered- Recent developmentsVONAGE- Business overview- Products/Solutions/Services offered- Recent developments8X8- Business overview- Products/Solutions/Services offered- Recent developmentsTALKDESK- Business overview- Products/Solutions/Services offered- Recent developments

-

12.3 OTHER PLAYERSALCATEL-LUCENT ENTERPRISESINCHORACLERINGCENTRALLIFESIZECONTENT GURUALVARIAENGHOUSE INTERACTIVE3CLOGIC INCAMEYONEC CORPORATIONWEST TECHNOLOGY GROUPZTE CORPORATION

-

12.4 STARTUPS/SMESVOCALCOMEVOLVE IPUJETAMTELCOAVOXIVCC LIVEGLIA TECHNOLOGIESBRIGHT PATTERNCOMPUTERTALKC-ZENTRIX

-

13.1 INTRODUCTIONRELATED MARKETSLIMITATIONS

- 13.2 CLOUD-BASED CONTACT CENTER MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 CONTACT CENTER SOFTWARE MARKET: RECESSION IMPACT ANALYSIS

- TABLE 4 ASSUMPTIONS

- TABLE 5 MARKET SIZE AND GROWTH, 2017–2022 (USD MILLION, Y-O-Y)

- TABLE 6 MARKET SIZE AND GROWTH, 2023–2028 (USD MILLION, Y-O-Y)

- TABLE 7 MARKET: PRICING ANALYSIS

- TABLE 8 TOP TEN PATENT APPLICANTS (US)

- TABLE 9 CONTACT CENTER SOFTWARE MARKET: PATENT ANALYSIS

- TABLE 10 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 13 KEY BUYING CRITERIA FOR END USERS

- TABLE 14 CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 15 MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 16 MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 17 MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 18 SOLUTIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 19 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 OMNICHANNEL ROUTING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 21 OMNICHANNEL ROUTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 WORKFORCE ENGAGEMENT MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 23 WORKFORCE ENGAGEMENT MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 REPORTING AND ANALYTICS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 25 REPORTING AND ANALYTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 CUSTOMER ENGAGEMENT MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 27 CUSTOMER ENGAGEMENT MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 OTHER SOLUTIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 OTHER SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 CONTACT CENTER SOFTWARE MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 31 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 32 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 CONSULTING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 IMPLEMENTATION & INTEGRATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 IMPLEMENTATION & INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 TRAINING, SUPPORT & MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 TRAINING, SUPPORT & MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 41 MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 42 ON-PREMISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 CLOUD: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 CONTACT CENTER SOFTWARE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 47 CONTACT CENTER SOFTWARE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 48 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 SMES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 SMES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 53 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 54 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 TELECOMMUNICATIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 TELECOMMUNICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 IT & ITES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 61 IT & ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 65 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 67 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 ENERGY & UTILITIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 69 ENERGY & UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 71 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 CONTACT CENTER SOFTWARE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 73 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 US: CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 89 US: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 90 US: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 91 US: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 92 US: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 93 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 94 CANADA: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 95 CANADA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 96 CANADA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 97 CANADA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 98 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 99 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 108 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 109 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 UK: CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 115 UK: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 116 UK: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 117 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 118 GERMANY: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 119 GERMANY: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 120 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 121 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 122 FRANCE: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 123 FRANCE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 124 FRANCE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 125 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 126 BELGIUM: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 127 BELGIUM: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 128 BELGIUM: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 129 BELGIUM: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 130 REST OF EUROPE: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 131 REST OF EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 132 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 133 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 148 CHINA: CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 149 CHINA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 150 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 151 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 152 JAPAN: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 153 JAPAN: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 154 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 155 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 156 AUSTRALIA & NEW ZEALAND: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 157 AUSTRALIA & NEW ZEALAND: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 158 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 159 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 178 KSA: CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 179 KSA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 180 KSA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 181 KSA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 182 UAE: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 183 UAE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 184 UAE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 185 UAE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 190 LATIN AMERICA: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 192 LATIN AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 193 LATIN AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 194 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 195 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 196 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 197 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 198 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 199 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 201 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 203 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 204 BRAZIL: CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 205 BRAZIL: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 206 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 207 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 208 MEXICO: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 209 MEXICO: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 210 MEXICO: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 211 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 212 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 213 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 214 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 215 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 216 CONTACT CENTER SOFTWARE MARKET: DEGREE OF COMPETITION

- TABLE 217 COMPANY REGIONAL FOOTPRINT

- TABLE 218 COMPANY COMPONENT FOOTPRINT

- TABLE 219 COMPANY VERTICAL FOOTPRINT

- TABLE 220 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 221 COMPANY REGIONAL FOOTPRINT

- TABLE 222 COMPANY COMPONENT FOOTPRINT

- TABLE 223 COMPANY VERTICAL FOOTPRINT

- TABLE 224 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 225 MARKET: DEALS

- TABLE 226 GENESYS: COMPANY OVERVIEW

- TABLE 227 GENESYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 GENESYS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 229 GENESYS: DEALS

- TABLE 230 NICE: COMPANY OVERVIEW

- TABLE 231 NICE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 NICE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 233 NICE: DEALS

- TABLE 234 IBM: COMPANY OVERVIEW

- TABLE 235 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 AWS: COMPANY OVERVIEW

- TABLE 237 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 AWS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 239 AWS: DEALS

- TABLE 240 FIVE9: COMPANY OVERVIEW

- TABLE 241 FIVE9: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 FIVE9: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 243 FIVE9: DEALS

- TABLE 244 TWILIO: COMPANY OVERVIEW

- TABLE 245 TWILIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 TWILIO: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 247 TWILIO: DEALS

- TABLE 248 MITEL: COMPANY OVERVIEW

- TABLE 249 MITEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 MITEL: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 251 MITEL: DEALS

- TABLE 252 CISCO: COMPANY OVERVIEW

- TABLE 253 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 255 CISCO: DEALS

- TABLE 256 BT GROUP: COMPANY OVERVIEW

- TABLE 257 BT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 BT GROUP: DEALS

- TABLE 259 VERIZON: COMPANY OVERVIEW

- TABLE 260 VERIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 VERIZON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 262 AVAYA: COMPANY OVERVIEW

- TABLE 263 AVAYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 AVAYA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 265 AVAYA: DEALS

- TABLE 266 VONAGE: COMPANY OVERVIEW

- TABLE 267 VONAGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 VONAGE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 269 VONAGE: DEALS

- TABLE 270 8X8: COMPANY OVERVIEW

- TABLE 271 8X8: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 8X8: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 273 8X8: DEALS

- TABLE 274 TALKDESK: COMPANY OVERVIEW

- TABLE 275 TALKDESK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 TALKDESK: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 277 TALKDESK: DEALS

- TABLE 278 CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 279 CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 280 CLOUD-BASED CONTACT CENTER MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 281 CLOUD-BASED CONTACT CENTER MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 282 SOLUTIONS: CLOUD-BASED CONTACT CENTER MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 283 SOLUTIONS: CLOUD-BASED CONTACT CENTER MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 284 SERVICES: CLOUD-BASED CONTACT CENTER MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 285 SERVICES: CLOUD-BASED CONTACT CENTER MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 286 CLOUD-BASED CONTACT CENTER MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 287 CLOUD-BASED CONTACT CENTER MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 288 CLOUD-BASED CONTACT CENTER MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 289 CLOUD-BASED CONTACT CENTER MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 290 CLOUD-BASED CONTACT CENTER MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 291 CLOUD-BASED CONTACT CENTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET: DATA TRIANGULATION

- FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET: RESEARCH FLOW

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - SUPPLY SIDE: ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CONTACT CENTER SOFTWARE VENDORS

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY – DEMAND-SIDE APPROACH

- FIGURE 10 LIMITATIONS

- FIGURE 11 GLOBAL MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 FASTEST-GROWING SEGMENTS OF MARKET

- FIGURE 14 INCREASING INVESTMENTS IN CONTACT CENTER SOFTWARE TO ENHANCE CUSTOMER EXPERIENCES AND BOOST MARKET GROWTH

- FIGURE 15 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 OMNICHANNEL ROUTING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 CONSULTING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 22 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 NUMBER OF PEOPLE USING SOCIAL MEDIA FOR BUSINESS

- FIGURE 24 MEDIUM USED TO MAKE HIGH-STAKE PURCHASES

- FIGURE 25 CONTACT CENTERS TO FACE CHALLENGES IN REDUCING FINANCIAL COSTS AND HIRING QUALIFIED AGENTS

- FIGURE 26 USE OF CHATBOTS FOR COMMON QUESTIONS

- FIGURE 27 CONTACT CENTER SOFTWARE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 MARKET: ECOSYSTEM/MARKET MAP

- FIGURE 29 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 30 TOP FIVE PATENT OWNERS (GLOBAL)

- FIGURE 31 CONTACT CENTER SOFTWARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 32 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS’ BUSINESSES

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 34 KEY BUYING CRITERIA FOR END USERS

- FIGURE 35 CONTACT CENTER SOFTWARE MARKET: BUSINESS MODEL ANALYSIS

- FIGURE 36 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 37 CLOUD DEPLOYMENT MODE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 43 HISTORICAL FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY CONTACT CENTER SOFTWARE PROVIDERS

- FIGURE 44 MARKET SHARE ANALYSIS

- FIGURE 45 MARKET RANKING OF KEY CONTACT CENTER SOFTWARE PLAYERS, 2023

- FIGURE 46 CONTACT CENTER SOFTWARE MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2023

- FIGURE 47 EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 48 EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 49 EVALUATION MATRIX FOR SMES/STARTUPS: CRITERIA WEIGHTAGE

- FIGURE 50 EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 51 COMPANY FINANCIAL METRICS

- FIGURE 52 NICE: COMPANY SNAPSHOT

- FIGURE 53 IBM: COMPANY SNAPSHOT

- FIGURE 54 AWS: COMPANY SNAPSHOT

- FIGURE 55 FIVE9: COMPANY SNAPSHOT

- FIGURE 56 TWILIO: COMPANY SNAPSHOT

- FIGURE 57 CISCO: COMPANY SNAPSHOT

- FIGURE 58 BT GROUP: COMPANY SNAPSHOT

- FIGURE 59 VERIZON: COMPANY SNAPSHOT

- FIGURE 60 8X8: COMPANY SNAPSHOT

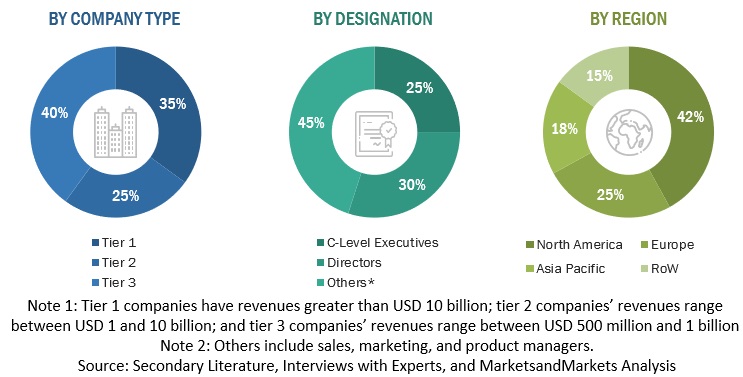

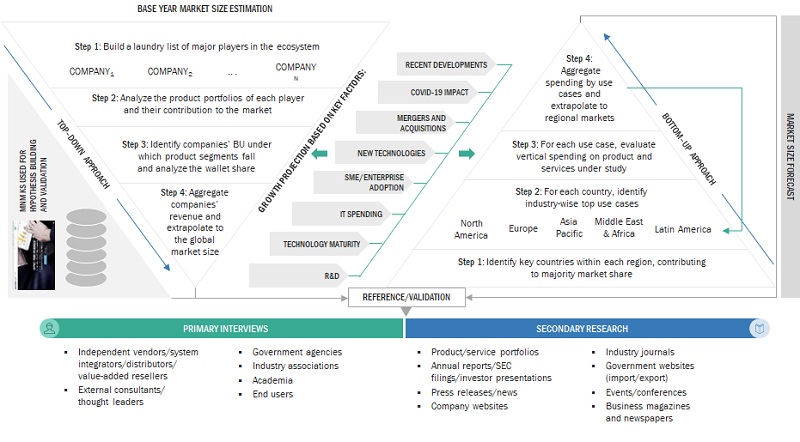

The study involved key activities in estimating the contact center software market’s size. We conducted exhaustive secondary research to collect information on the current, adjacent, and parent market reports. The next step was to validate these assumptions, findings, and sizing with subject matter experts via primary research. We used the bottom-up approach to estimate the total market size. After that, we employed the market breakup and data triangulation procedures to estimate and forecast the market size of the segments/sub-segments of the contact center software market.

Secondary Research

We analyzed the market size of companies offering contact center software solutions and services based on the secondary data available through reliable unpaid/paid sources. We then examined the product portfolios of major companies based on their product capabilities, strategic initiatives, and market shares.

We referred to various sources for identifying and collecting study information in the secondary research process. The secondary sources included press releases, investor presentations of companies, annual reports, SEC filings, product data sheets, white papers, journals, certified publications, articles, government websites, and credible databases.

We used secondary research to obtain critical information about the industry’s supply chain, the total list of key/ startup players, market segmentation based on industry trends to the bottom level, and key developments from both markets - and technology-based perspectives, all validated by primary sources.

Primary Research

In the primary research process, we interviewed experts from the demand and supply sides to obtain critical information for this report. Supply-side primary sources included industry experts - CEOs, VPs, technology leaders, marketing executives, and executives from companies operating in the contact center software market.

The research included conducting primary interviews to gather insights on market statistics, the latest trends, use cases, data on revenue collected from products and services, market bifurcation, market estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. We interviewed demand-side stakeholders, such as Chief Technology Officers (CTOs), Chief Information Officers (CIOs), and Chief Security Officers (CSOs), end users using contact center software solutions and services to understand the buyer’s perspective on the market trends/developments/growth, which would affect the overall contact center software market.

To know about the assumptions considered for the study, download the pdf brochure

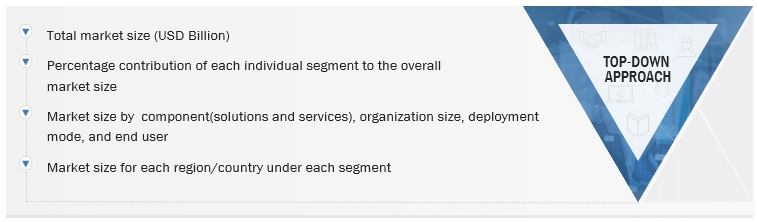

Market Size Estimation

We used the top-down and bottom-up approaches to calculate the contact center software market and its subsegments. We finalized the vendors in the market via secondary research and their segment shares in regions/ countries through extensive market research. This procedure included studying major market players’ annual reports and extensive interviews with industry leaders.

Top Down and Bottom Up Approach of Contact Center Software Market

To know about the assumptions considered for the study, Request for Free Sample Report

Top Down Approach of Contact Center Software Market

Data Triangulation

In the market estimation process, we split the market into segments and subsegments after arriving at the total market size. We followed data triangulation and market breakdown procedures to determine each market segment’s and subsegment’s size. The data was triangulated by studying factors and trends from the demand and supply in BFSI, consumer goods & retail, telecommunications, manufacturing, IT & ITeS, government & public sector, energy & utilities, healthcare & life sciences, and other verticals (media and entertainment, travel and hospitality, transportation and logistics, and education).

Market Definition

According to MarketsandMarkets, contact center software is a set of software applications designed to help organizations manage and streamline customer interactions across multiple communication channels, such as voice, video, web, chat, mobile applications, and social media. The contact center software helps organizations increase productivity by optimizing inbound and outbound operations. Contact center software includes a range of functionalities that facilitate efficient customer interactions and enhance overall customer experience. These functionalities include omnichannel routing, workforce engagement management, reporting and analytics, and customer engagement management.

Key Stakeholders

- Contact center software solution and service providers

- Professional service providers

- Cloud Service Providers (CSPs)

- Consulting service providers and consulting companies

- Government organizations, forums, alliances, and associations

- Technology providers

- System Integrators (SIs)

- Value-added Resellers (VARs) and distributors

- End users

Report Objectives

- To define, describe, and forecast the contact center software market by component (solution and service), organization size, deployment model, vertical, and region

- To provide detailed information about the factors (drivers, opportunities, restraints, and challenges) that impact the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments for five regions, including North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as new product launches; product enhancements; partnerships & collaborations; and acquisitions; in the contact center software market globally.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional contact center software market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Contact Center Software Market

Nice Information, Please share more information related to this. Thank you very much