Contraband Detector Market by Technology ( X-ray,Metal, Spectroscopy), Screening Type (People, Baggage & Cargo, Vehicle), Deployment Type (Fixed, Portable), Application and Region (2021-2026)

Updated on : October 23, 2024

The global contraband detector market is expected to grow from USD 3.9 billion in 2021 to USD 5.6 billion by 2026, growing at a CAGR of 7.5% during the forecast period from 2021 to 2026.

The contraband detector market is experiencing significant growth, driven by escalating concerns over security and safety in various sectors, including transportation, law enforcement, and border control. With the increasing sophistication of smuggling techniques, there is a rising demand for advanced detection technologies that can effectively identify illegal substances, weapons, and other prohibited items. Key trends shaping this market include the adoption of innovative technologies such as X-ray imaging, millimeter-wave scanners, and chemical detection systems, which provide enhanced accuracy and speed in detection processes. Additionally, the integration of artificial intelligence and machine learning into detection systems is improving threat assessment capabilities and reducing false positives. As regulatory requirements tighten and security concerns escalate globally, the contraband detectors market is poised for robust growth, with significant investments in research and development aimed at enhancing detection efficiency and reliability.

Increasing security concerns due rise in a terrorist attack is the primary factor driving the contraband detectors market growth. Moreover, growing adoption of contraband detection technology in transportation and retail applications will drive the demand for this technology in the near future.

To know about the assumptions considered for the study, Request for Free Sample Report

Contraband detector Market Dynamics

Driver: Growing security concerns due to rapid urbanization

The growing concerns in security essentials due to rising terrorist activities and rapid urbanization is one of the major factors increasing the demand for contraband detector. With the rise in terrorist incidents, governments worldwide are forced to use advanced contraband detector systems, which is boosting the contraband detector market growth. Similarly, the demand for contraband detector systems is increasing worldwide due to the growing concerns for security and safety because of illegal immigration.

Restraint: Huge initial investment and higher operational and maintenance costs associated with security systems

Contraband detector systems are widely used to ensure security and safety at transit facilities, public places, hospitals, government organizations, banks, commercial buildings, educational institutions, critical infrastructure, etc.; however, they have a high cost of ownership. Many of the aforementioned places require costly explosive detectors for which the operational cost is equally high. For instance, full-body X-ray scanners require a huge initial investment. Also, the maintenance cost of several explosive detectors is comparatively high. All these factors may result in a reluctance to deploy security measures at facilities.

Opportunity: Digital transformation through the inclusion of AI technology in security applications

Increasing threats at critical places such as airports, borders, and government facilities have led to the high adoption of security measures. Over the past couple of decades, the number of passengers at airports is increasing. Due to the ease in trading policies, transportation and cargo services across the world are increasingly being adopted, thereby fostering the use of screening technologies at critical places.

Challenge: Medical threats posed by full-body scanners

Full-body scanners are used to ensure the complete safety of travelers at airports by generating a computerized stripped image of the passengers boarding flights. This guarantees that none of the passengers are carrying any dangerous materials to avoid the act of terrorism. Exposure to high levels of X-rays can increase the risk of cancer and cardiovascular diseases. European countries have banned X-ray scanners at airports since a few cancer cases have resulted from scanning hundreds of millions of passengers a year. The impact of this factor is high and an alternate solution must be made to maintain security at airports.

X-ray imaging technology is expected to witness the highest market share during the forecast period

The contraband detector industry for x-ray imaging technology is expected to witness the highest market share during the forecast period. X-ray screening technologies such as backscatter and computed tomography (CT) are largely used at various critical places worldwide. With technological advancements various technologies of x-ray imaging including backscatter technology, energy transmission and computed tomography (CT) its adoption in transportation, retail and government applications is increased. This has led the x-ray imaging technology market to have significantly the highest contraband detectors market share during the forecast period.

Transportation application is expected to have the largest market share during the forecast period

The contraband detectors market for transportation application is expected to have significantly the largest market share during the forecast period. This can be attributed to the consistent demand for contraband detector systems in transit locations such as airports, seaports, railway stations and others. These locations have a major threat of illicit material transit. This has led to increased demand for contraband detectors in transportation application. Also, there has been an increasing adoption of temperature sensing and touchless contraband detectors in such transit locations due Covid pandemic. Touchless technological innovations are seen to be adopted more due to hygiene essentials. Such developments are expected to drive the contraband detectors market for transportation application during the forecast period.

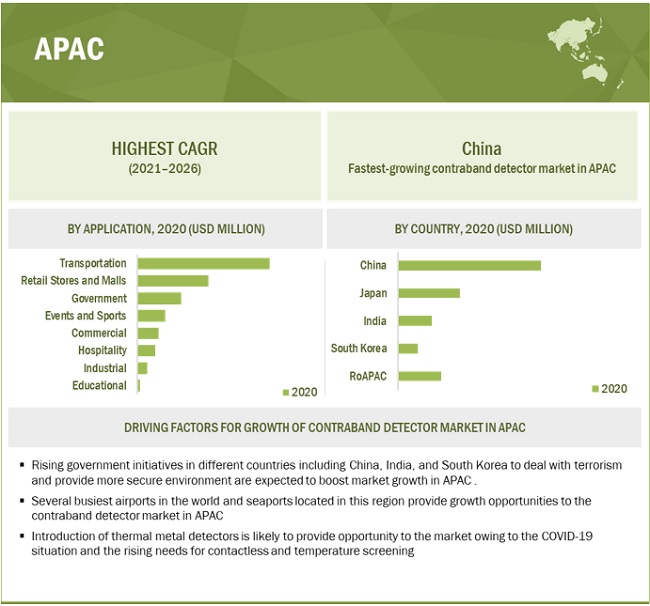

Asia Pacific is the leading contraband detector market in terms of CAGR, globally, by value, in 2020

APAC is projected to lead the contraband detector market from 2021 to 2026 with the highest CAGR. Rising needs for security due to various infrastructural developments is one of the major driving factors for market growth. The rising trend of adoption of advanced technologies with inclusion of AI and touchless-enabled technologies is expected to create growth opportunities for the market in APAC. Rising government initiatives in different countries including China, India, and South Korea to deal with terrorism and provide more secure environment are expected to boost market growth in APAC.

To know about the assumptions considered for the study, download the pdf brochure

Contraband Detector Market Key Players

The contraband detector companies is dominated by players such as Smiths Group(UK), OSI Systems (US), Leidos(US), Nuctech(China) and Metrasens(UK).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million), |

|

Segments covered |

By Technology, By Screening type, By Deployment Type, By Application |

|

Geographies covered |

North America, Europe, APAC, Rest of the World |

|

Companies covered |

Leidos ( US), OSI Systems, Inc. (US), Smiths Group (UK), Nuctech Company Limited (China), Metrasens( UK), ADANI (US), Costruzioni Elettroniche Industriali Automatismi C.E.I.A. Spa (Italy), Berkeley Varitronics Systems, Inc. (US), Godrej Security Solutions (India), Campbell/Harris Security Equipment Company (US), Garrett Metal Detectors. (US), PKI Electronic Intelligence Gmbh (Germany), Vidisco Ltd. (Israel), Global Security Solutions, Inc. (Canada), Astrophysics, Inc. (US), Autoclear LLC (US), Gilardoni S.P.A. (Italy), Aventura Technologies, Inc. (US), and Ranger Security Detectors (US) are the key players in the contraband detector market. (Total 25 companies) |

The study categorizes the contraband detector market based on value, by technology, by screening type, by deployment type and application at the regional and global levels.

By Technology

- X-ray Imaging

- Metal Detection

- Spectroscopy/Spectrometry

- Others

By Screening Type

- People Screening

- Baggage and Cargo Screening

- Vehicle Screening

By Deployment Type

- Fixed

- Portable

By Application

- Government

- Transportation

- Retail

- Hospitality

- Commercial

- Industrial

- Education

- Events and Sports

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World

- Middle East & Africa

- South America

Recent Developments

- In April 2021, Smiths Detection, a division of Smiths Group PLC, announced the launch of a new lithium battery algorithm for the HI-SCAN 10080 EDX-2is, a dual-view air cargo, and checked-baggage screening system. The algorithm will provide automatic detection of lithium batteries in all freight and baggage screened for explosives by the HI-SCAN 10080 EDX-2is, reducing the burden on image analysts with very low false alarm rates.

- In March 2021, OSI Systems signed a contract worth USD 15 million to upgrade a prime international airport by providing RTT®110 hold baggage screening systems along with a range of checkpoint security systems – Rapiscan 920CT and Orion® baggage scanners, Itemiser® 5x trace detection units and Metor® walk-through metal detectors.

- In May 2020, Leidos acquired L3Harris Technology’s Security Detection and Automation Segment. The acquired segment is categorized under the Civil Operating segment of Leidos and will provide various security detection products such as trace detectors and others for airports and critical infrastructure screening.

Frequently Asked Questions (FAQ):

What is the current size of the global contraband detector market?

The global contraband detector market is estimated to be USD 3.9 billion in 2021 and is projected to reach USD 5.6 billion by 2026, at a CAGR of 7.5%.

What are the major driving factors and opportunities in the contraband detector market?

Increasing security concerns due to rapid urbanization, growing adoption of contraband detectors in the transportation and retail industry, and growing adoption of new technological innovations in aviation industry are the key drivers for the market.

Who are the star players in the global contraband detector market?

Companies such Smiths Group(UK), OSI Systems (US), Leidos(US), Nuctech(China) and Metrasens(UK) fall under the star category. These companies cater to the requirements of their customers by providing customized products. Moreover, these companies have effective supply chain strategies. Such advantages give these companies an edge over other companies in the market.

What are the major strategies adopted by the key players?

Product launches and deals such as acquisitions, partnerships, agreements and sales contracts are the major strategies adopted by the key players of contraband detector market.

Which region contributes to the largest market share in contraband detector market during the forecast period?

North America contributes the largest market share in contraband detector market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 SEGMENTATION OF CONTRABAND DETECTOR MARKET

FIGURE 2 GEOGRAPHIC SCOPE OF MARKET

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 RESEARCH FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis (demand side)

FIGURE 5 CONTRABAND DETECTOR MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 6 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 SUPPLY SIDE

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 SUPPLY SIDE

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 10 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 11 X-RAY IMAGING TECHNOLOGY TO CAPTURE LARGEST SIZE OF CONTRABAND DETECTOR MARKET BY 2026

FIGURE 12 PORTABLE CONTRABAND DETECTORS TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 13 RETAIL APPLICATION TO REGISTER HIGHEST CAGR FOR MARKET DURING 2021–2026

FIGURE 14 MARKET IN APAC TO GROW AT FASTEST RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 15 GROWING SECURITY CONCERNS IN TRANSPORTATION AND RETAIL APPLICATIONS DRIVE MARKET GROWTH

4.2 MARKET, BY SCREENING TYPE

FIGURE 16 MARKET FOR PEOPLE SCREENING IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

FIGURE 17 TRANSPORTATION APPLICATION AND US EXPECTED TO CAPTURE LARGEST SHARES OF MARKET, IN TERMS OF VALUE, BY 2026

4.4 COUNTRY-WISE CONTRABAND DETECTOR MARKET GROWTH RATE

FIGURE 18 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 CONTRABAND DETECTORS MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 IMPACT OF DRIVERS AND OPPORTUNITIES ON MARKET

FIGURE 20 IMPACT OF RESTRAINTS AND CHALLENGES ON MARKET

FIGURE 21 INCREASING SECURITY CONCERNS DUE TO RAPID URBANIZATION DRIVE MARKET GROWTH

5.2.1 DRIVERS

5.2.1.1 Growing security concerns due to rapid urbanization

5.2.1.2 Rising government investments for improvement of existing transit facilities and construction of new transit locations, especially airports

5.2.1.3 Ongoing technological advancements in security screening systems and revised European Union Threat Detection Standards

5.2.2 RESTRAINTS

5.2.2.1 Huge initial investment and higher operational and maintenance costs associated with security systems

5.2.3 OPPORTUNITIES

5.2.3.1 Digital transformation through inclusion of AI technology in security applications

5.2.3.2 High importance of security measures in aviation and retail applications

5.2.4 CHALLENGES

5.2.4.1 Medical threats posed by full-body scanners

6 CONTRABAND DETECTOR MARKET, BY TECHNOLOGY (Page No. - 54)

6.1 INTRODUCTION

FIGURE 22 X-RAY IMAGING TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 1 MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 2 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

6.2 X-RAY IMAGING

6.2.1 X-RAY IMAGING EXPECTED TO LEAD MARKET DUE TO ITS WIDE UTILIZATION FOR SCREENING LUGGAGE AT AIRPORTS

FIGURE 23 ENERGY TRANSMISSION AND BACKSCATTER TECHNOLOGIES TO LEAD X-RAY MARKET DURING FORECAST PERIOD

TABLE 3 MARKET, BY X-RAY IMAGING TECHNOLOGY TYPE, 2017–2020 (USD MILLION)

TABLE 4 MARKET, BY X-RAY IMAGING TECHNOLOGY TYPE, 2021–2026 (USD MILLION)

TABLE 5 MARKET FOR X-RAY IMAGING TECHNOLOGY, BY SCREENING TYPE, 2017–2020 (USD MILLION)

TABLE 6 MARKET FOR X-RAY IMAGING TECHNOLOGY, BY SCREENING TYPE, 2021–2026 (USD MILLION)

TABLE 7 MARKET FOR ENERGY TRANSMISSION AND BACKSCATTER X-RAY IMAGING TECHNOLOGIES, BY SCREENING TYPE, 2017–2020 (USD MILLION)

TABLE 8 MARKET FOR ENERGY TRANSMISSION AND BACKSCATTER X-RAY IMAGING TECHNOLOGIES, BY SCREENING TYPE, 2021–2026 (USD MILLION)

TABLE 9 CONTRABAND DETECTORS MARKET FOR X-RAY IMAGING TECHNOLOGY, BY DEPLOYMENT TYPE, 2017–2020 (USD MILLION)

TABLE 10 MARKET FOR X-RAY IMAGING TECHNOLOGY, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

FIGURE 24 TRANSPORTATION APPLICATION TO HOLD LARGEST SIZE OF MARKET FOR X-RAY IMAGING TECHNOLOGY DURING FORECAST PERIOD

TABLE 11 MARKET FOR X-RAY IMAGING TECHNOLOGY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 12 MARKET FOR X-RAY IMAGING TECHNOLOGY, BY APPLICATION, 2021–2026 (USD MILLION)

6.3 METAL DETECTION

6.3.1 MARKET FOR METAL DETECTORS EXPECTED TO GROW AT FASTEST RATE DUE TO THEIR INCREASING USE FOR PEOPLE SCREENING

FIGURE 25 CONTINUOUS-WAVE AND MAGNETOMETER METAL DETECTION TECHNOLOGY TO COMMAND CONTRABAND DETECTOR MARKET DURING 2021–2026

TABLE 13 CONTRABAND DETECTORS MARKET, BY METAL DETECTION TECHNOLOGY TYPE, 2017–2020 (USD MILLION)

TABLE 14 CONTRABAND DETECTORS MARKET, BY METAL DETECTION TECHNOLOGY TYPE, 2021–2026 (USD MILLION)

TABLE 15 MARKET FOR METAL DETECTION TECHNOLOGY, BY SCREENING TYPE, 2017–2020 (USD MILLION)

TABLE 16 MARKET FOR METAL DETECTION TECHNOLOGY, BY SCREENING TYPE, 2021–2026 (USD MILLION)

TABLE 17 MARKET FOR PULSED FILED METAL DETECTION TECHNOLOGY, BY SCREENING TYPE, 2017–2020 (USD MILLION)

TABLE 18 CONTRABAND DETECTORS MARKET FOR PULSED FIELD METAL DETECTION TECHNOLOGY, BY SCREENING TYPE, 2021–2026 (USD MILLION)

TABLE 19 MARKET FOR CONTINUOUS WAVE AND MAGNETOMETER METAL DETECTION TECHNOLOGY, BY SCREENING TYPE, 2017–2020 (USD MILLION)

TABLE 20 CONTRABAND DETECTORS MARKET FOR CONTINUOUS WAVE AND MAGNETOMETER METAL DETECTION TECHNOLOGY, BY SCREENING TYPE, 2021–2026 (USD MILLION)

TABLE 21 MARKET FOR METAL DETECTION TECHNOLOGY, BY DEPLOYMENT TYPE, 2017–2020 (USD MILLION)

TABLE 22 CONTRABAND DETECTORS MARKET FOR METAL DETECTION TECHNOLOGY, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

FIGURE 26 RETAIL APPLICATION TO DOMINATE MARKET FOR METAL DETECTION TECHNOLOGY DURING 2021–2026

TABLE 23 MARKET FOR METAL DETECTION TECHNOLOGY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 24 MARKET FOR METAL DETECTION TECHNOLOGY, BY APPLICATION, 2021–2026 (USD MILLION)

6.4 SPECTROMETRY AND SPECTROSCOPY

6.4.1 SPECTROMETRY AND SPECTROSCOPY TECHNOLOGIES ARE MAINLY USED IN TRANSPORTATION APPLICATIONS

FIGURE 27 WORKING OF IMS DETECTOR

FIGURE 28 PEOPLE SCREENING TO ACCOUNT FOR LARGEST SIZE OF MARKET FOR SPECTROMETRY AND SPECTROSCOPY TECHNOLOGIES DURING FORECAST PERIOD

TABLE 25 CONTRABAND DETECTORS MARKET FOR SPECTROMETRY AND SPECTROSCOPY TECHNOLOGIES, BY SCREENING TYPE, 2017–2020 (USD MILLION)

TABLE 26 MARKET FOR SPECTROMETRY AND SPECTROSCOPY TECHNOLOGIES, BY SCREENING TYPE, 2021–2026 (USD MILLION)

FIGURE 29 TRANSPORTATION APPLICATION TO CAPTURE LARGEST SIZE OF MARKET FOR SPECTROMETRY AND SPECTROSCOPY TECHNOLOGIES DURING FORECAST PERIOD

TABLE 27 MARKET FOR SPECTROMETRY AND SPECTROSCOPY TECHNOLOGIES, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 28 CONTRABAND DETECTORS MARKET FOR SPECTROMETRY AND SPECTROSCOPY TECHNOLOGIES, BY APPLICATION, 2021–2026 (USD MILLION)

6.5 OTHERS

FIGURE 30 PEOPLE SCREENING TO DOMINATE CONTRABAND DETECTOR MARKET FOR OTHER TECHNOLOGIES DURING 2021–2026

TABLE 29 CONTRABAND DETECTORS MARKET FOR OTHER TECHNOLOGIES, BY SCREENING TYPE, 2017–2020 (USD MILLION)

TABLE 30 MARKET FOR OTHER TECHNOLOGIES, BY SCREENING TYPE, 2021–2026 (USD MILLION)

TABLE 31 MARKET FOR OTHER TECHNOLOGIES, BY DEPLOYMENT TYPE, 2017–2020 (USD MILLION)

TABLE 32 MARKET FOR OTHER TECHNOLOGIES, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

FIGURE 31 TRANSPORTATION APPLICATION TO LEAD MARKET FOR OTHER TECHNOLOGIES DURING FORECAST PERIOD

TABLE 33 MARKET FOR OTHER TECHNOLOGIES, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 34 MARKET FOR OTHER TECHNOLOGIES, BY APPLICATION, 2021–2026 (USD MILLION)

6.6 IMPACT OF COVID -19 ON DIFFERENT TECHNOLOGIES OF CONTRABAND DETECTORS

7 CONTRABAND DETECTOR MARKET, BY SCREENING TYPE (Page No. - 75)

7.1 INTRODUCTION

FIGURE 32 BAGGAGE AND CARGO SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 35 MARKET, BY SCREENING TYPE, 2017–2020 (USD MILLION)

TABLE 36 MARKET, BY SCREENING TYPE, 2021–2026 (USD MILLION)

7.2 PEOPLE SCREENING

7.2.1 PEOPLE SCREENING WOULD BE FASTEST-GROWING SEGMENT DUE TO INCREASING THREATS OF CONTRABAND ITEMS

FIGURE 33 METAL DETECTION TECHNOLOGY TO LEAD MARKET FOR PEOPLE SCREENING DURING FORECAST PERIOD

TABLE 37 CONTRABAND DETECTORS MARKET FOR PEOPLE SCREENING, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR PEOPLE SCREENING, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 39 MARKET FOR PEOPLE SCREENING, BY METAL DETECTION TECHNOLOGY TYPE, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR PEOPLE SCREENING, BY METAL DETECTION TECHNOLOGY TYPE, 2021–2026 (USD MILLION)

7.3 BAGGAGE AND CARGO SCREENING

7.3.1 BAGGAGE & CARGO SCREENING TO HOLD LARGEST SHARE OF MARKET DUE TO STRICT GOVERNMENT REGULATIONS FOR INSTALLATION OF CONTRABAND DETECTORS AT TRANSIT LOCATIONS

TABLE 41 MARKET FOR BAGGAGE AND CARGO SCREENING, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 42 MARKET FOR BAGGAGE AND CARGO SCREENING, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 43 MARKET FOR BAGGAGE AND CARGO SCREENING, BY X-RAY IMAGING TECHNOLOGY TYPE, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR BAGGAGE AND CARGO SCREENING, BY X-RAY IMAGING TECHNOLOGY TYPE, 2021–2026 (USD MILLION)

TABLE 45 MARKET FOR BAGGAGE AND CARGO SCREENING, BY METAL DETECTION TECHNOLOGY TYPE, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR BAGGAGE AND CARGO SCREENING, BY METAL DETECTION TECHNOLOGY TYPE, 2021–2026 (USD MILLION)

7.4 VEHICLE SCREENING

7.4.1 MARKET FOR VEHICLE SCREENING IS DRIVEN BY RISING INCIDENTS OF SMUGGLING CONTRABAND ITEMS THROUGH VEHICLES AT BORDER CROSSINGS

FIGURE 34 X-RAY IMAGING TECHNOLOGY TO LEAD MARKET FOR VEHICLE SCREENING DURING FORECAST PERIOD

TABLE 47 CONTRABAND DETECTORS MARKET FOR VEHICLE SCREENING, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR VEHICLE SCREENING, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 49 MARKET FOR VEHICLE SCREENING, BY X-RAY IMAGING TECHNOLOGY TYPE, 2017–2020 (USD MILLION)

TABLE 50 CONTRABAND DETECTORS MARKET FOR VEHICLE SCREENING, BY X-RAY IMAGING TECHNOLOGY TYPE, 2021–2026 (USD MILLION)

8 CONTRABAND DETECTOR MARKET, BY DEPLOYMENT TYPE (Page No. - 84)

8.1 INTRODUCTION

FIGURE 35 MARKET FOR PORTABLE CONTRABAND DETECTORS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 51 MARKET, BY DEPLOYMENT TYPE, 2017–2020 (USD MILLION)

TABLE 52 MARKET, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

8.2 FIXED

8.2.1 MARKET FOR FIXED CONTRABAND DETECTOR SYSTEMS IS MAINLY DRIVEN BY INCREASING USE OF X-RAY SYSTEMS FOR BAGGAGE SCREENING

FIGURE 36 METAL DETECTION TECHNOLOGY-BASED FIXED CONTRABAND DETECTORS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 53 MARKET FOR FIXED DEPLOYMENT, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 54 MARKET FOR FIXED DEPLOYMENT, BY TECHNOLOGY, 2021–2026 (USD MILLION)

8.3 PORTABLE

8.3.1 PORTABLE CONTRABAND DETECTORS ARE EXPECTED TO WITNESS HIGHER GROWTH IN COMING YEARS

TABLE 55 MARKET FOR PORTABLE DEPLOYMENT, BY TECHNOLOGY, 2017–2020 (USD MILLION

TABLE 56 MARKET FOR PORTABLE DEPLOYMENT, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9 CONTRABAND DETECTOR MARKET, BY APPLICATION (Page No. - 89)

9.1 INTRODUCTION

FIGURE 37 RETAIL TO EXHIBIT HIGHEST CAGR IN MARKET, BY APPLICATION, DURING FORECAST PERIOD

TABLE 57 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 58 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 TRANSPORTATION

9.2.1 TRANSPORTATION APPLICATION TO HOLD LARGEST MARKET SHARE AS CONTRABAND DETECTORS ARE WIDELY USED AT AIRPORTS AND SEAPORTS

FIGURE 38 X-RAY IMAGING TECHNOLOGY-BASED CONTRABAND DETECTORS TO ACCOUNT FOR LARGEST MARKET SIZE FOR TRANSPORTATION APPLICATION DURING FORECAST PERIOD

TABLE 59 CONTRABAND DETECTORS MARKET FOR TRANSPORTATION APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 60 MARKET FOR TRANSPORTATION APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 39 APAC TO WITNESS HIGHEST CAGR IN MARKET FOR TRANSPORTATION APPLICATION DURING FORECAST PERIOD

TABLE 61 MARKET FOR TRANSPORTATION APPLICATION, BY REGION, 2017–2026 (USD MILLION)

TABLE 62 MARKET FOR TRANSPORTATION APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.3 GOVERNMENT

9.3.1 GOVERNMENT APPLICATIONS TO CONTRIBUTE SIGNIFICANTLY DUE TO RISING USE OF CONTRABAND DETECTORS AT CUSTOMS, BORDERS, AND CORRECTIONAL FACILITIES

TABLE 63 MARKET FOR GOVERNMENT APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR GOVERNMENT APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 40 NORTH AMERICA TO CAPTURE LARGEST SIZE OF MARKET FOR GOVERNMENT APPLICATION BY 2026

TABLE 65 MARKET FOR GOVERNMENT APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 MARKET FOR GOVERNMENT APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.4 RETAIL

9.4.1 CONTRABAND DETECTOR MARKET FOR RETAIL TO GROW AT FASTEST RATE OWING TO RISING SECURITY CONCERNS IN STORES AND MALLS

TABLE 67 MARKET FOR RETAIL APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 68 MARKET FOR RETAIL APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 41 APAC TO REGISTER HIGHEST CAGR IN MARKET FOR RETAIL APPLICATION DURING 2021–2026

TABLE 69 MARKET FOR RETAIL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR RETAIL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.5 HOSPITALITY

9.5.1 HOSPITALITY SECTOR IS PRONE TO RISK OF CRIMINAL ACTIVITIES AT RESTAURANTS, HOTELS, CLUBS, AND CASINOS

TABLE 71 MARKET FOR HOSPITALITY APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 72 MARKET FOR HOSPITALITY APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 42 APAC TO COMMAND MARKET FOR HOSPITALITY APPLICATION DURING FORECAST PERIOD

TABLE 73 MARKET FOR HOSPITALITY APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 MARKET FOR HOSPITALITY APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.6 COMMERCIAL

9.6.1 INCREASING CRIMINAL ACTIVITIES IN BFSI REQUIRE HIGH-SECURITY MEASURES

TABLE 75 CONTRABAND DETECTOR MARKET FOR COMMERCIAL APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 76 MARKET FOR COMMERCIAL APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 77 MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.7 INDUSTRIAL

9.7.1 GROWING IMPORTANCE OF CONTRABAND DETECTOR SYSTEMS IN INDUSTRIES SUCH AS OIL & GAS AND MINING BOOSTS MARKET GROWTH

FIGURE 43 X-RAY IMAGING TECHNOLOGY CONTINUES TO LEAD MARKET FOR INDUSTRIAL APPLICATION DURING FORECAST PERIOD

TABLE 79 MARKET FOR INDUSTRIAL APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 80 MARKET FOR INDUSTRIAL APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 81 MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.8 EDUCATION

9.8.1 INITIATIVES OF GOVERNMENTS ACROSS VARIOUS COUNTRIES MAKING EDUCATIONAL FACILITIES MORE SECURED PROVIDE OPPORTUNITIES FOR MARKET

TABLE 83 CONTRABAND DETECTOR MARKET FOR EDUCATION APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 84 MARKET FOR EDUCATION APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 85 MARKET FOR EDUCATION APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR EDUCATION APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.9 EVENTS AND SPORTS

9.9.1 EVENTS AT PUBLIC PLACES HAVE POTENTIAL SECURITY RISKS DUE TO LARGE GATHERINGS

FIGURE 44 X-RAY IMAGING TECHNOLOGY TO DOMINATE MARKET FOR EVENTS AND SPORTS APPLICATION DURING FORECAST PERIOD

TABLE 87 MARKET FOR EVENTS AND SPORTS APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR EVENTS AND SPORTS APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 89 MARKET FOR EVENTS AND SPORTS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 90 MARKET FOR EVENTS AND SPORTS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.10 IMPACT OF COVID-19 ON DIFFERENT APPLICATIONS OF CONTRABAND DETECTORS

10 CONTRABAND DETECTOR MARKET, GEOGRAPHIC ANALYSIS (Page No. - 110)

10.1 INTRODUCTION

FIGURE 45 NORTH AMERICA TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 91 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 92 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 46 SNAPSHOT: CONTRABAND DETECTOR MARKET IN NORTH AMERICA

FIGURE 47 US TO LEAD NORTH AMERICAN MARKET DURING FORECAST PERIOD

TABLE 93 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 94 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 48 TRANSPORTATION APPLICATION TO ACCOUNT FOR LARGEST SIZE OF NORTH AMERICAN MARKET DURING FORECAST PERIOD

TABLE 95 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 96 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 High expenditure for security purposes to boost market growth in US

10.2.2 CANADA

10.2.2.1 Increasing government initiatives in transportation sector to contribute to market growth in Canada

10.2.3 MEXICO

10.2.3.1 Illegal immigrants and activities from cross borders create demand for contraband detectors in Mexico

10.3 EUROPE

FIGURE 49 SNAPSHOT: CONTRABAND DETECTOR MARKET IN EUROPE

FIGURE 50 UK TO REGISTER HIGHEST CAGR IN EUROPEAN MARKET DURING FORECAST PERIOD

TABLE 97 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 98 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 51 TRANSPORTATION APPLICATION TO PROVIDE OPPORTUNITIES TO EUROPEAN MARKET DURING 2021–2026

TABLE 99 MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 100 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

10.3.1 UK

10.3.1.1 Growing transportation industry in UK to surge demand for contraband detectors

10.3.2 GERMANY

10.3.2.1 Germany shares huge maritime and land borders, thereby driving growth of market

10.3.3 FRANCE

10.3.3.1 Rising concerns regarding security in public places fuel growth of market in France

10.3.4 ITALY

10.3.4.1 Growing tourism industry to fuel Italian market growth

10.3.5 REST OF EUROPE

10.4 APAC

FIGURE 52 SNAPSHOT: CONTRABAND DETECTOR MARKET IN APAC

FIGURE 53 CHINA TO DOMINATE MARKET IN APAC DURING FORECAST PERIOD

TABLE 101 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 102 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 54 TRANSPORTATION APPLICATION TO HOLD LARGEST SIZE OF MARKET IN APAC BY 2026

TABLE 103 MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 104 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing investments in large-scale transportation projects to propel growth of market

10.4.2 JAPAN

10.4.2.1 Strong counter-terrorism policies to promote use of contraband detector systems

10.4.3 INDIA

10.4.3.1 Rising expansion of airport infrastructure to provide opportunity for market

10.4.4 SOUTH KOREA

10.4.4.1 Growing cargo transportation through seaports would foster South Korean market growth

10.4.5 REST OF APAC

10.5 ROW

FIGURE 55 SOUTH AMERICA TO LEAD MARKET IN TERMS OF SIZE IN ROW DURING FORECAST PERIOD

TABLE 105 CONTRABAND DETECTORS MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

FIGURE 56 TRANSPORTATION TO HOLD LARGEST SIZE OF MARKET IN ROW BY 2026

TABLE 107 MARKET IN ROW, BY APPLICATION, 2017–2020(USD MILLION)

TABLE 108 CONTRABAND DETECTORS MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Rising criminal activities fuel growth of market in South America

10.5.2 MIDDLE EAST

10.5.2.1 Growing terrorist activities creating demand for contraband detector systems in Middle East

10.5.3 AFRICA

10.5.3.1 Increasing investments in industrial sector will drive African market growth

10.6 IMPACT OF COVID-19 ON DIFFERENT REGIONS

11 COMPETITIVE LANDSCAPE (Page No. - 134)

11.1 OVERVIEW

11.2 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS

TABLE 109 OVERVIEW OF STRATEGIES DEPLOYED BY KEY CONTRABAND DETECTOR PLAYERS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 MARKET SHARE ANALYSIS: CONTRABAND DETECTOR MARKET, 2020

TABLE 110 DEGREE OF COMPETITION, 2020

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 57 CONTRABAND DETECTOR MARKET: COMPANY EVALUATION QUADRANT, 2020

11.4.5 COMPANY FOOTPRINT

TABLE 111 OVERALL COMPANY FOOTPRINT

TABLE 112 FOOTPRINT OF COMPANIES FOR DIFFERENT PRODUCTS

FIGURE 58 FOOTPRINT OF COMPANIES IN DIFFERENT APPLICATIONS

TABLE 113 FOOTPRINT OF COMPANIES IN DIFFERENT REGIONS

11.5 COMPETITIVE SCENARIO AND TRENDS

11.5.1 PRODUCT LAUNCHES

TABLE 114 PRODUCT LAUNCHES, 2020–2021

11.5.2 DEALS

TABLE 115 DEALS, 2019–2020

11.5.3 OTHERS

TABLE 116 OTHERS, 2020–2021

12 COMPANY PROFILES (Page No. - 146)

(Business Overview, Products and Solutions Offered, Recent Developments, COVID-19-related Developments, and MnM View)*

12.1 KEY PLAYERS

12.1.1 SMITHS GROUP

TABLE 117 SMITHS GROUP: BUSINESS OVERVIEW

FIGURE 59 SMITHS GROUP: COMPANY SNAPSHOT

TABLE 118 SMITHS GROUP: PRODUCT OFFERINGS

TABLE 119 SMITHS GROUP: PRODUCT LAUNCHES

TABLE 120 SMITHS GROUP: DEALS

TABLE 121 SMITHS GROUP: OTHERS

12.1.2 OSI SYSTEMS

TABLE 122 OSI SYSTEMS: BUSINESS OVERVIEW

FIGURE 60 OSI SYSTEMS: COMPANY SNAPSHOT

TABLE 123 OSI SYSTEMS: PRODUCTS OFFERED

TABLE 124 OSI SYSTEMS: PRODUCT LAUNCHES

TABLE 125 OSI SYSTEM: DEALS

TABLE 126 OSI SYSTEMS: OTHERS

12.1.3 LEIDOS

TABLE 127 LEIDOS-BUSINESS OVERVIEW

FIGURE 61 LEIDOS: COMPANY SNAPSHOT

TABLE 128 LEIDOS: PRODUCT OFFERING

TABLE 129 LEIDOS: DEALS

TABLE 130 LEIDOS: OTHERS

12.1.4 NUCTECH

TABLE 131 NUCTECH COMPANY: BUSINESS OVERVIEW

TABLE 132 NUCTECH: PRODUCTS OFFERED

TABLE 133 NUCTECH: PRODUCT LAUNCHES

TABLE 134 NUCTECH: OTHERS

12.1.5 METRASENS

TABLE 135 METRASENS: BUSINESS OVERVIEW

TABLE 136 METRASENS: PRODUCTS OFFERED

TABLE 137 METRASENS: PRODUCT LAUNCHES

TABLE 138 METRASENS: DEALS

12.1.6 ADANI SYSTEMS

TABLE 139 ADANI SYSTEMS: BUSINESS OVERVIEW

TABLE 140 ADANI SYSTEMS: PRODUCTS OFFERED

TABLE 141 ADANI SYSTEMS: PRODUCT LAUNCHES

TABLE 142 ADANI SYSTEMS: DEALS

TABLE 143 ADANI SYSTEMS: OTHERS

12.1.7 BERKELEY VARITRONICS SYSTEMS

TABLE 144 BERKELEY VARITRONICS SYSTEMS: BUSINESS OVERVIEW

TABLE 145 BERKELEY VARITRONICS SYSTEMS: PRODUCTS OFFERED

12.1.8 CEIA

TABLE 146 CEIA: BUSINESS OVERVIEW

TABLE 147 CEIA: PRODUCTS OFFERED

12.1.9 CSECO

TABLE 148 CSECO: BUSINESS OVERVIEW

TABLE 149 CSEC0: PRODUCTS OFFERED

TABLE 150 CSECO: OTHERS

12.1.10 GODREJ SECURITY SOLUTIONS

TABLE 151 GODREJ SECURITY SOLUTIONS: BUSINESS OVERVIEW

TABLE 152 GODREJ SECURITY SOLUTIONS: PRODUCT OFFERED

* Business Overview, Products and Solutions Offered, Recent Developments, COVID-19-related Developments, and MnM View might not be captured in case of unlisted companies.

12.2 OTHER KEY PLAYERS

12.2.1 3DX-RAY

12.2.2 ADAMS ELECTRONICS

12.2.3 ASTROPHYSICS

12.2.4 AUTOCLEAR

12.2.5 AVENTURA TECHNOLOGIES

12.2.6 BRUKER

12.2.7 GARRETT METAL DETECTORS

12.2.8 GILARDONI

12.2.9 GLOBAL SECURITY SOLUTIONS

12.2.10 PKI ELECTRONIC INTELLIGENCE

12.2.11 RANGER SECURITY

12.2.12 SCANNA

12.2.13 VIDISCO

12.2.14 VOTI DETECTION

12.2.15 WESTMINSTER

13 APPENDIX (Page No. - 194)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global contraband detector market. Exhaustive secondary research has been done to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include company websites, magazines, industry news, associations, and databases (OneSource, Factiva, and Bloomberg), Transport Security Administration (TSA), The International Air Transport Association (IATA) and corporate filings (such as annual reports, investor presentations, and financial statements). Secondary data has been collected and analyzed to arrive at the overall market size, further validated by primary research.

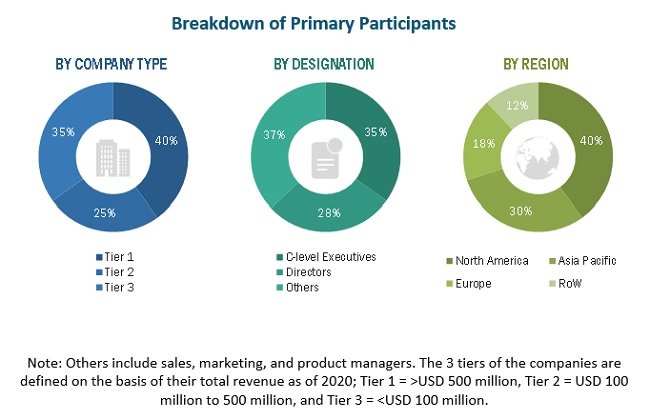

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the contraband detector market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-and supply-side players across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (the Middle East & Africa and South America). Approximately 30% and 70% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the overall size of the contraband detector market. These methods have also been used extensively to estimate the size of various market subsegments.

The research methodology used to estimate the market size by top-down approach includes the following:

- Focusing, initially, on top-line investments and expenditures being made in the ecosystem of the contraband detector market

- Calculating the market size considering revenues generated by major players through the sales of contraband detector products

- Conducting multiple on-field discussion sessions with key opinion leaders across major companies involved in the development of contraband detector products

- Estimating the geographic split using secondary sources based on various factors, such as the number of players in a specific country and region, the role of major players in the market for the development of innovative products, and adoption and penetration rates in a particular country for various applications

The research methodology used to estimate the market size by bottom-up approach includes the following:

- Identifying key participants in the contraband detector market that influence the entire market, along with the related component players.

- Analyzing major manufacturers of contraband detector technology components, studying their portfolios, and understanding different components and products. Analyzing developments undertaken by key players in the pre-COVID-19 period as well studying the measures/steps undertaken by them to deal with the COVID-19 pandemic.

- Analyzing the anticipated change in demand in the post-COVID-19 scenario.

- Analyzing trends pertaining to the use of contraband detectors for different kinds of applications.

- Tracking the ongoing and upcoming developments in the market, such as investments, R&D activities, product launches, collaborations, partnerships, and forecasting the market based on these developments and other critical parameters.

- Carrying out multiple discussions with key opinion leaders to understand different types of contraband detectors technology components and applications and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies.

- Verifying and cross-checking the estimate at every level from the discussion with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets.

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, for transportation, retail, government, hospitality, industrial, commercial, education and events and sports.

Report Objectives

- To describe and forecast the contraband detector market, in terms of value, by technology, screening type, deployment type and application.

-

To describe and forecast the market, in terms of value, by region—North America, Europe,

Asia Pacific (APAC), and Rest of the World (RoW) - To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets with regard to individual growth trends, prospects,

and contributions to the total market -

To strategically profile key players and comprehensively analyze their market position

in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders - To analyze strategic approaches such as product launches, contracts, agreements, and partnerships in the contraband detector market.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Contraband Detector Market