Backscatter X-ray Device Market Size, Share & Growth, 2032

Backscatter X-ray Device Market by Type (Portable, Fixed), X-ray Source, Sensor Module, Collimators & Shielding, Single-View Backscatter Imaging, Dual-View Backscatter Imaging, Custom & Border Protection, Airport/Aviation -Global Forecast To 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global backscatter X-ray devices market is projected to grow from USD 0.35 billion in 2025 to USD 1.37 billion by 2032, at a CAGR of 21.5% during the forecast period. Market growth is driven by the rising demand for advanced, non-intrusive inspection and security screening solutions across customs & border protection, airports, law enforcement, and defense sectors. The increasing need for high-throughput, portable, and vehicle-mounted scanning systems capable of detecting concealed contraband and threats is accelerating global adoption. Technological innovations such as multi-view and hybrid (backscatter + transmission) imaging, AI-enabled threat recognition, and automated vehicle or cargo scanning portals are enhancing detection accuracy, throughput, and operator efficiency.

KEY TAKEAWAYS

-

BY TYPEVehicle-mounted backscatter X-ray devices hold the largest share of 30% in 2025 due to their mobility, high throughput, suitability for customs & border checkpoints, and other factors.

-

BY MOBILITYMobile and vehicle-mounted backscatter systems lead the market due to their rapid deployment, wide-area coverage, high versatility, and growing use in border security.

-

BY IMAGING MODESingle-view backscatter imaging leads the market because it offers lower system costs, faster scan times, and simpler deployment.

-

BY DETECTION MODELarge-area detector panels dominate due to their superior coverage, faster scanning of vehicles and cargo, and higher detection accuracy.

-

BY COMPONENTHardware is expected to grow at a CAGR of 20.6%. X-ray sources, detectors, generators, shielding, and scanning assemblies account for the highest cost share, require frequent upgrades, and form the core functionality of backscatter imaging systems.

-

BY APPLICATIONCustoms and Border Protection leads due to high global demand for rapid, non-intrusive vehicle and cargo screening, as well as rising smuggling & trafficking activities.

-

BY REGIONNorth America holds the largest market share of 33.3% in 2025, driven by strong investments in border security modernization, widespread airport adoption, and stringent homeland security mandates.

-

COMPETITIVE LANDSCAPEKey players/stars in the backscatter X-ray devices market are Rapiscan Systems, Nuctech Company Limited, Viken Detection, Tek84, Inc., and Videray Technologies.

Backscatter X-ray devices are advanced imaging systems that detect concealed objects and security threats using scattered X-ray radiation. Unlike traditional X-rays, they capture reflected radiation, providing high-resolution images of materials hidden under clothing, inside vehicles, or in cargo containers. These systems are utilized in customs, aviation security, law enforcement, and industrial inspection for efficient threat detection. They employ various technologies, including pencil-beam raster-scan and Z-backscatter, for accurate, non-intrusive inspections. The market for backscatter X-ray devices is growing due to a focus on public safety and advancements in imaging and AI-driven threat recognition, allowing for faster and more reliable screening.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the backscatter X-ray devices market is shaped by rising security modernization programs, stricter inspection mandates, and advancements in high-efficiency imaging technologies. Over the next 4–5 years, product portfolios are expected to evolve from conventional single-view backscatter units to more advanced dual-mode, AI-enhanced, and mobile backscatter systems integrated with real-time analytics. Two key trends are driving this transition: the rapid adoption of hybrid backscatter-plus-transmission architectures for deeper penetration and material discrimination, and the integration of AI/ML-based image analysis tools for automated threat detection, anomaly identification, and workflow optimization. These innovations are enabling faster, more accurate, and more automated inspection processes across customs and border checkpoints, law enforcement, air cargo screening, defense installations, and industrial critical infrastructure. The shift toward high-energy backscatter systems, ruggedized mobile platforms, and automated scanning portals is also improving operational throughput, enhancing regulatory compliance, and strengthening security posture in high-risk environments such as ports, cargo terminals, military bases, and logistics hubs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing deployment of security solutions at public gathering spaces

-

Increase in number of terrorist attacks and illegal immigration

Level

-

High installation and maintenance costs

Level

-

Development of low-cost products

Level

-

Pressure created by rapid technological advancements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing deployment of security solutions at public gathering spaces

The increasing deployment of advanced security solutions at public gathering spaces such as airports, stadiums, government facilities, and transportation hubs is a major driver for the backscatter X-ray device market. Growing concerns about terrorism, smuggling, and public safety have prompted authorities worldwide to strengthen security screening and threat detection measures. Backscatter X-ray systems, known for their ability to detect concealed weapons, explosives, and contraband with high precision and minimal intrusion, have become vital components of modern security infrastructure. These systems provide detailed imaging of both organic and inorganic materials, enabling rapid and accurate identification without physical contact or extensive manual inspection.

Restraint: High installation and maintenance costs

One of the major restraints in the backscatter X-ray device market is the high installation and maintenance cost associated with these advanced imaging systems. Backscatter X-ray scanners require specialized components such as high-energy X-ray generators, precision detectors, shielding enclosures, and image processing software, all of which significantly increase system costs. The installation process also demands strict compliance with radiation safety standards, structural reinforcements, and trained personnel, which further elevate setup expenditures.

Opportunity: Development of low-cost products

The backscatter X-ray device market offers a significant growth opportunity through the development of low-cost products, particularly for emerging economies and small-scale security installations. High initial costs have historically limited adoption in regions with constrained budgets; however, manufacturers are now investing in cost-optimized designs using compact components, modular configurations, and efficient power systems. These innovations aim to make advanced screening technology accessible to border posts, transportation hubs, and commercial facilities that cannot afford premium systems.

Challenge: Pressure created by rapid technological advancements

The backscatter X-ray device market faces a major challenge due to pressure created by rapid technological advancements in imaging, AI-driven threat detection, and material differentiation systems. As new innovations such as multi-energy imaging, enhanced backscatter algorithms, and compact portable scanners emerge, existing device models quickly become outdated, compelling manufacturers to engage in frequent and costly product updates. This rapid pace of development increases R&D expenditure and shortens product life cycles, making it difficult for smaller players to compete with large defense and security technology firms.

backscatter-x-ray-device-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides a full range of backscatter and hybrid (backscatter + transmission) X-ray systems for scanning vehicles, cargo containers, baggage, parcels, and personnel. Solutions include fixed gantry portals, mobile/vehicle-mounted scanners (M-series), handheld/portable backscatter imagers, and high-energy hybrid inspection platforms for customs, border security, aviation cargo, defense bases, and critical infrastructure. | High-penetration imaging |

|

Manufactures a wide portfolio of backscatter and hybrid inspection systems, including large-portal gantries, drive-through cargo systems, mobile vehicle scanners, and portable backscatter units. Widely deployed in customs, airports (air cargo), ports, homeland security, and military checkpoints. Integrates advanced imaging algorithms and safety controls. | High throughput and inspection efficiency |

|

Specializes in handheld backscatter X-ray devices for rapid field inspection, such as the HBI-120 and PB-series. Used heavily by law enforcement, border agents, narcotics units, and security teams for locating contraband inside vehicles, tires, dashboards, baggage, and hidden compartments. | Cost-efficient deployment with rapid ROI due to low training needs and minimal setup time |

|

Provides advanced personnel screening systems using backscatter and millimeter-wave imaging technologies for correctional facilities, security checkpoints, and defense environments. Focuses on detecting contraband in individuals and small items with high sensitivity. | Non-contact, full-body inspection |

|

Develops ultra-portable handheld backscatter imagers (PX1, PX2 models) designed for tactical inspections, hazardous environments, and field-based security operations. Used by homeland security teams, police units, special forces, and industrial inspectors for rapid scanning of suspicious items, packages, and vehicle compartments. | Lightweight and rugged for harsh conditions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The backscatter X-ray ecosystem involves manufacturers like Rapiscan, Nuctech, and Viken designing various inspection systems from handheld to large cargo portals, integrating high-resolution imaging, detectors, and safety features supported by software. System integrators such as Leidos and OSI combine hardware, networking, and software to provide comprehensive solutions with portals, dashboards, and AI analytics for threat detection, ensuring compatibility across security environments. Distributors such as Euroteck and Bavak supply products globally, managing installation, training, and ensuring safety compliance. End-users, such as CBP and DHS, deploy these systems to detect threats in vehicles, cargo, and personal items.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Backscatter X-ray Devices Market, By Type

Portable and handheld backscatter devices are expected to record the highest CAGR due to rising demand for rapid, on-site, non-intrusive inspection by law enforcement, border patrol, and field security teams. Their low cost, mobility, ease of deployment, and suitability for roadside, tactical, and remote inspections accelerate adoption across multiple applications.

Backscatter X-ray Devices Market, By Mobility

Mobile and vehicle-mounted backscatter systems hold the largest market size because they are the primary platforms used for high-throughput vehicle and cargo inspection at borders, ports, and security checkpoints. Their ability to scan large objects quickly, support hybrid imaging, and replace manual inspections drives strong procurement from customs, defense, and law enforcement agencies.

Backscatter X-ray Devices Market, By Imaging Mode

Single-view backscatter imaging holds the largest market size because it dominates handheld, portable, and many vehicle-mounted systems, which represent the highest-volume installations. It offers low cost, simplicity, fast deployment, and sufficient imaging performance for most law enforcement, customs, and field inspection use cases, driving broad adoption across all major buyer groups.

Backscatter X-ray Devices Market, By Detection Mode

Large-area detector panels hold the largest market size because they are essential for high-energy, high-throughput cargo and vehicle inspection systems, which dominate overall market revenue. These panels enable deeper penetration, better material discrimination, and full-container imaging, making them the core component of gantry, hybrid, and mobile inspection platforms widely deployed at borders and ports.

Backscatter X-ray Devices Market, By Power Range

Low-power backscatter systems hold the largest market size because they dominate handheld and portable devices, which account for the highest shipment volumes. These systems require lower radiation output, simpler shielding, and reduced operational costs, making them ideal for law enforcement, customs field checks, and rapid inspections where mobility and safety are essential.

Backscatter X-ray Devices Market, By Component

Hardware dominates the market because backscatter systems rely on high-value physical components, including X-ray sources, detector arrays, shielding, mechanical structures, and mobile scanning platforms. These elements account for the majority of system cost, especially in cargo, vehicle, and hybrid multisensor units, where hardware complexity, durability, and safety requirements drive high capital expenditure.

Backscatter X-ray Devices Market, By Application

Customs and border protection holds the largest market size because backscatter systems are extensively used for non-intrusive inspection of vehicles, cargo, and baggage at land borders and ports. High traffic volumes, stringent contraband detection requirements, and continuous investment in mobile, fixed, and hybrid scanning infrastructure drive the segment’s dominant and sustained demand.

Backscatter X-ray Devices Market, By Region

Asia Pacific is expected to witness the highest CAGR in the backscatter X-ray devices market due to rapid expansion of cross-border trade, rising investment in port, logistics, and customs inspection infrastructure, and increasing adoption of non-intrusive inspection technologies. Strong government focus on border security, anti-smuggling initiatives, and modernization of cargo and vehicle screening systems further accelerates regional demand for advanced backscatter imaging solutions.

REGION

Asia Pacific is expected to be fastest-growing segment in the backscatter x-ra devices market during the forecast period

The Asia Pacific is expected to witness the highest CAGR in the backscatter X-ray devices market due to the rapid expansion of cross-border trade, rising investment in port, logistics, and customs inspection infrastructure, as well as the increasing adoption of non-intrusive inspection technologies. Strong government focus on border security, anti-smuggling initiatives, and modernization of cargo and vehicle screening systems further accelerates regional demand for advanced backscatter imaging solutions.

backscatter-x-ray-device-market: COMPANY EVALUATION MATRIX

In the backscatter X-ray devices market matrix, Rapiscan Systems (Star) leads with a broad global footprint and one of the most comprehensive portfolios of backscatter and hybrid non-intrusive inspection systems. Its advanced handheld, mobile, and cargo-level platforms, combined with high-resolution imaging, AI-enabled threat detection, and proven operational reliability, strengthen its dominance across customs, border security, aviation cargo, and critical infrastructure applications. The company’s continuous innovation in high-efficiency scanners and integrated screening workflows reinforces its leadership position in the global security inspection landscape. Autoclear (Emerging Leader) is gaining momentum with its expanding range of compact X-ray inspection and security screening solutions tailored for law enforcement, customs, and facility security needs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Rapiscan Systems

- Nuctech Company Limited

- Viken Detection

- Tek84, Inc

- Videray Technologies

- Autoclear

- Beijing Heweiyongtai Sci & Tech Co., Ltd.

- Scanna MSC Ltd.

- Smiths Detection Group Ltd.

- ADANI Systems, Inc.

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.26 Billion |

| Market Forecast in 2032 (Value) | USD 1.37 Billion |

| Growth Rate | CAGR of 21.5% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

| Segment Covered | By Type, Mobility, Component & Application |

| Leading Sements | By Type, Portable/Handheld Devices are projected to highest CAGR 22.4% by 2032 |

| Leading Region | North America holds the largest market share of 33.3% in 2025 |

| Driver | Increasing deployment of security solutions at public gathering spaces |

| Restraint | High installation and maintenance costs |

WHAT IS IN IT FOR YOU: backscatter-x-ray-device-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Backscatter X-ray Device Manufacturer / OEM |

|

Identify emerging technology gaps in high-resolution backscatter imaging |

| System Integrator / Security Solutions Contractor |

|

Gain insight into region-specific security adoption patterns |

| Regulatory / Security & Border Agency |

|

Support security policy alignment with international safety and radiation standards |

| Industrial / Commercial End User (Customs, Border Control, Aviation Cargo, Defense, Ports, Logistics) |

|

Enhance security effectiveness and contraband detection accuracy |

RECENT DEVELOPMENTS

- October 2024 : Rapiscan Systems, through its subsidiary AS&E, reached a legal settlement with Viken Detection regarding intellectual property rights for backscatter X-ray imaging. Under the agreement, Viken Detection agreed to pay royalties to AS&E, reinforcing Rapiscan’s ownership of patented backscatter technologies and safeguarding its competitive advantage in this domain.

- September 2023 : Viken Detection launched a mobile backscatter X-ray solution that allows fast, drive-by scanning of vehicles and containers for concealed items without unloading cargo. Enhances field operational efficiency.

- May 2021 : Viken Detection partnered with OptiSolve Ltd., a technology leader for clean, healthy, and safe spaces, where Viken will assist with the development of OptiSolve Pathfinder, a new proprietary surface imaging technology.

- March 2021 : Viken Detection had launched a compact, portable backscatter X-ray imaging device designed for rapid detection of concealed threats, narcotics, and weapons through vehicle and cargo inspection. Ideal for law enforcement and border security operations.

Table of Contents

Methodology

The research study involved four major activities in estimating the size of the backscatter X-ray devices market. Exhaustive secondary research has been conducted to gather key information about the market and its peer markets. The next step has been to validate these findings and assumptions through primary research involving industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. The market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

During the secondary research process, various secondary sources were consulted to identify and collect the information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has primarily been conducted to gather key information about the market’s value chain, the pool of key market players, market segmentation based on industry trends, regional outlook, and developments from both market and technology perspectives.

Primary Research

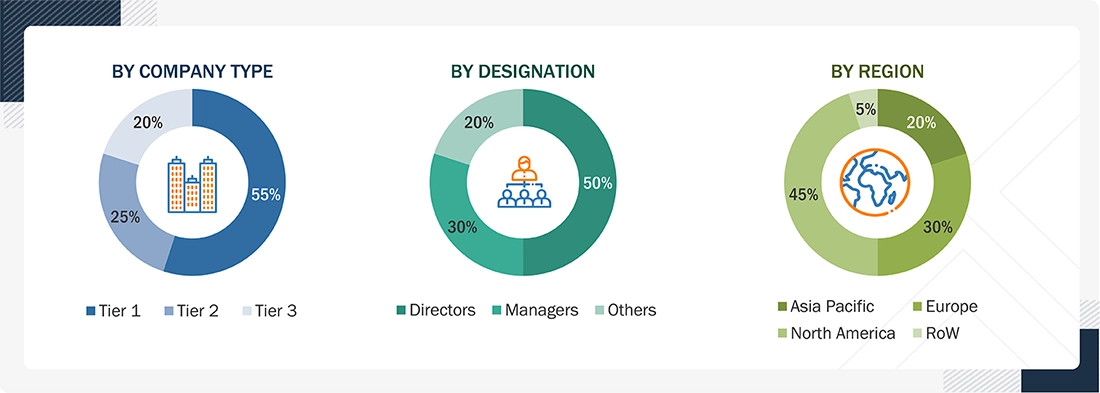

In primary research, various sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the backscatter x-ray devices market ecosystem. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary research. This, along with the opinions of our in-house subject matter experts, has led us to the findings described in the report. The breakdown of primary respondents is as follows:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the backscatter x-ray devices market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

A bottom-up procedure has been employed to determine the overall size of the backscatter X-ray devices market.

- Major companies that provide backscatter X-ray devices were identified. This included analyzing company portfolios, product offerings, and presence across various regions.

- The segment-specific revenues of the companies, particularly those related to backscatter x-ray devices, were determined.

- The product-specific revenues of the companies, particularly those related to backscatter x-ray devices, were determined.

- These individual revenue figures were compiled to determine the total revenue generated across the identified companies within the sector.

- The global market size for backscatter x-ray devices was obtained using this consolidated data.

The top-down approach has been used to estimate and validate the total size of the backscatter X-ray devices market.

- Identified top-line investments and spending in the ecosystem and major market developments to consider segment-level splits

- Estimated the overall backscatter x-ray devices market size, then segmented the global market by allocating shares based on the segments considered

- Distributed the segment-level markets into regions and countries by aligning regional backscatter x-ray devices activity with economic indicators, backscatter x-ray devices manufacturing presence, and national development initiatives

Backscatter X-ray Device Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market has been segmented into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and determine the exact statistics for each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides of the backscatter X-ray devices market.

Market Definition

The backscatter X-ray devices market involves the development of non-intrusive inspection systems that use low-energy X-rays to detect concealed threats in vehicles, cargo, baggage, and on-person scenarios. These systems provide real-time imaging, which is crucial for border security and law enforcement, enabling the identification of substances such as explosives and narcotics. Backscatter technologies utilize advanced detector arrays, X-ray modules, and automated algorithms for efficient screening, which are deployed at customs, airports, and military bases. The market growth is driven by rising cross-border trade, increasing smuggling, and stricter security regulations. Innovations such as AI-assisted image analysis and portable units enhance detection and operational efficiency, making backscatter X-ray devices essential for reliable security inspections worldwide.

Key Stakeholders

- Backscatter X-ray device manufacturers

- Security screening and imaging technology suppliers

- System integrators and non-intrusive inspection solution providers

- Border security, customs enforcement, and homeland security agencies

- Law enforcement, defense, and military organizations

- Distributors, maintenance, and calibration service providers

- Government procurement agencies and public security departments

Report Objectives

- To define, describe, segment, and forecast the backscatter X-ray devices market size by type, application, mobility, imaging mode, detection mode, component, power range, and region, in terms of value

- To assess the backscatter X-ray devices market size in four key regions: North America, Europe, Asia Pacific, and RoW, in terms of value

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the backscatter X-ray devices value chain and ecosystem, along with the average selling price by product and region

- To strategically study the regulatory landscape, tariff, standards, patents, Porter’s Five Forces, import & export scenarios, trade values, and case studies pertaining to the market under study

- To understand micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To assess opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To offer the impact of AI/Gen AI on the backscatter X-ray devices market

- To outline the macroeconomic outlook for the regions under study

- To analyze strategies such as product launches, collaborations, acquisitions, and partnerships adopted by players in the backscatter X-ray devices market

- To profile key market players and comprehensively analyze their ranking based on their revenue, market share, and core competencies

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and the Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Backscatter X-ray Device Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Backscatter X-ray Device Market