X-Ray Detectors Market Size, Growth, Share & Trends Analysis

X-Ray Detectors Market by Technology (FPD (Csl, A-si, A-se, Gadox, CMOS, Fixed, Portable, Digital, Retrofit), Line scan, CCD, CR), Application (Medical (Ortho, Mammography, Oncology, Chest, fluoroscopy, CVD, Surg), Vet, Defence, Industry) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

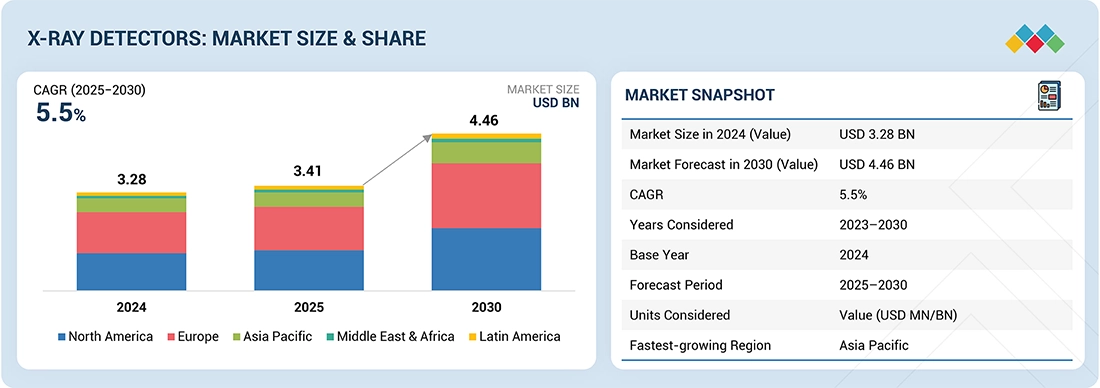

The global X-ray detectors market, valued at USD 3.28 billion in 2024, stood at USD 3.41 billion in 2025 and is projected to advance at a resilient CAGR of 5.5% from 2025 to 2030, culminating in a forecasted valuation of USD 4.46 billion by the end of the period. The global X-ray detectors market is witnessing robust growth, driven by increasing adoption of advanced medical imaging technologies across healthcare systems worldwide. These detectors, which convert X-rays into digital signals, are essential for diagnostic imaging in radiography, fluoroscopy, mammography, and dental applications. The market’s expansion is supported by the rising prevalence of chronic diseases, increased investments in digital radiography infrastructure, and a growing shift from computed radiography (CR) to flat-panel digital detectors (FPDs). Continuous innovation in detector materials, enhanced portability, and improved image resolution are also accelerating market penetration in both developed and emerging economies.

KEY TAKEAWAYS

- North America is dominate the x-ray detectors market with a share 37.2% in 2024

- By Technology, the flat panel detectors segment held a 65% share in terms of value in 2024.

- By Type, the amorphous silicon flat panel detectors segment is projected to lead the market, registering the highest CAGR of 6.7% during the forecast period from 2025 to 2030

- By panel type, the larger-area flat panel detectors segment represented 65% of the market value in 2024.

- The portable flat panel segment held 74% of the market value in 2024.

- The portable flat panel segment is projected to record the highest CAGR of 6.6% from 2025 to 2030.

- By Application, the security and defense application segment is projected to record the highest CAGR of 6.0% from 2025 to 2030.

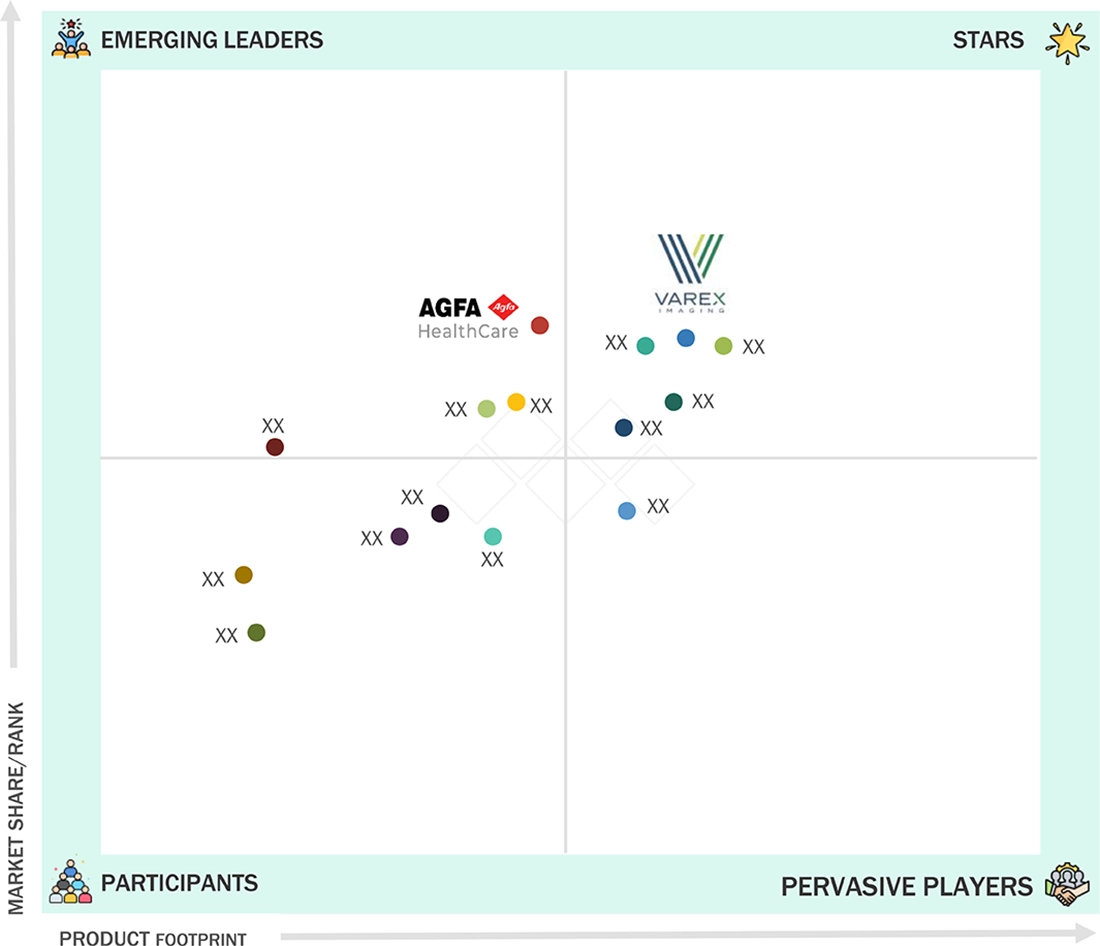

- Varex Imaging, Thales, and Canon Inc. were recognized as key players in the X-ray detectors market due to their significant market share and extensive product presence.

- Companies such as JPI Healthcare, IBIS S.r.l., and New Medical Imaging Co. Ltd. have set themselves apart among startups and SMEs by establishing a solid presence in specialized detector technologies, highlighting their strong potential as emerging leaders in the market.

Recent market trends emphasize a transition toward lightweight, wireless, and portable detectors, catering to point-of-care and mobile imaging needs. The shift from amorphous silicon (a-Si) to complementary metal-oxide-semiconductor (CMOS) and amorphous selenium (a-Se) technologies is enhancing image quality, reducing radiation dose, and improving diagnostic throughput. Vendors are increasingly focusing on AI-integrated detectors that support automatic exposure control, defect correction, and image post-processing to enhance workflow efficiency. Furthermore, non-medical sectors—such as security screening, industrial inspection, and veterinary imaging—are emerging as complementary revenue streams, indicating the market’s diversification.

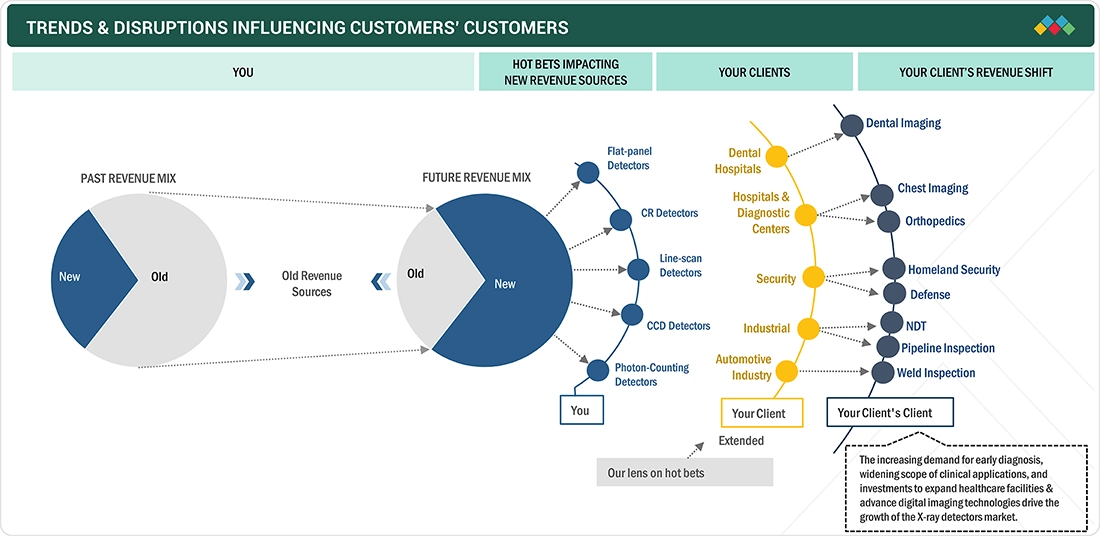

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customers in the radiology and imaging ecosystem are being impacted by three major disruptions: (1) the transition from analog and CR systems to digital radiography, which is forcing hospitals to recalibrate procurement budgets and IT infrastructure; (2) the integration of AI and automation into X-ray imaging workflows, enabling faster diagnosis but demanding new data management capabilities; and (3) increasing regulatory focus on radiation safety, quality assurance, and detector calibration standards, requiring manufacturers to innovate in dose optimization and compliance. Additionally, supply chain consolidation among detector component suppliers and OEMs is reshaping pricing models and lead times for healthcare providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing target patient population

-

Growing demand for X-ray detectors in security and industrial applications

Level

-

High cost of X-ray detectors

-

Stringent regulatory and compliance requirements

Level

-

Rising demand for portable and mobile imaging

-

Emerging non-medical uses of X-ray detectors

Level

-

Lack of skilled radiologists and technicians

-

Rising adoption of refurbished X-ray units

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing target patient population

Key growth drivers include the growing global burden of cardiovascular, orthopedic, and oncological conditions requiring diagnostic imaging; rising healthcare infrastructure investments in emerging economies; and technological advancements that have reduced exposure times and improved image clarity. The push for early and accurate disease detection in public health programs is further boosting demand for high-performance detectors across hospitals, imaging centers, and outpatient facilities.

Restraint: High cost of X-ray detectors

High initial costs associated with flat-panel detector systems, especially in low- and middle-income countries, remain a key restraint. Additionally, limited reimbursement coverage for digital imaging upgrades in certain markets, as well as ongoing device maintenance expenses, discourage smaller facilities from adopting newer systems. Regulatory delays and stringent approval processes for new detector technologies also slow market entry for innovators.

Opportunity: Rising demand for portable and mobile imaging

The emerging demand for portable and handheld X-ray systems in home healthcare, military, and mobile diagnostic units presents a high-growth niche. Moreover, the integration of detectors with AI-enabled imaging analytics platforms and cloud-based PACS (Picture Archiving and Communication Systems) offers new business models for OEMs and software providers alike.

Challenge: Lack of skilled Radiologists and technicians

A shortage of skilled radiologists and technicians limits the effective use of X-ray detectors, especially in developing regions. The lack of training leads to poor image quality, radiation risks, and reduced diagnostic accuracy. Vacancy rates for radiologic technologists have increased sharply, exacerbating delays and healthcare strain. Efforts such as training programs and AI tools help, but the workforce gap must be fully addressed for the impact to be realized.

X-Ray Detectors Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

United Imaging Healthcare’s X-ray detectors are utilized in advanced radiography systems to support comprehensive medical imaging with precision and efficiency. | They deliver high-resolution images, lower radiation exposure, streamlined workflow, enhanced system integration, and greater diagnostic reliability. |

|

Siemens Healthineers AG’s X-ray detectors are deployed in diagnostic imaging systems to enable accurate, real-time digital radiography across clinical specialties. | They offer exceptional image quality, reduced dose exposure, faster throughput, seamless interoperability, and enhanced diagnostic confidence. |

|

Canon Medical’s X-ray detectors are used in clinical imaging systems to deliver precise, real-time digital radiography for diverse medical applications. | They provide superior image quality, reduced radiation dose, fast workflow, seamless system integration, and improved diagnostic confidence. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The X-ray detectors ecosystem comprises raw material suppliers (for scintillators, photodiodes, and electronics), OEMs manufacturing detectors and imaging systems, software solution providers for image processing, and end users across healthcare, industrial, and security sectors. Strategic collaborations between detector manufacturers and medical imaging giants—such as GE Healthcare, Siemens Healthineers, Canon Medical, and Agfa-Gevaert—are fostering the development of integrated solutions that combine hardware, software, and AI algorithms. Distribution networks, system integrators, and service providers further support end-user adoption through localized calibration and maintenance services.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

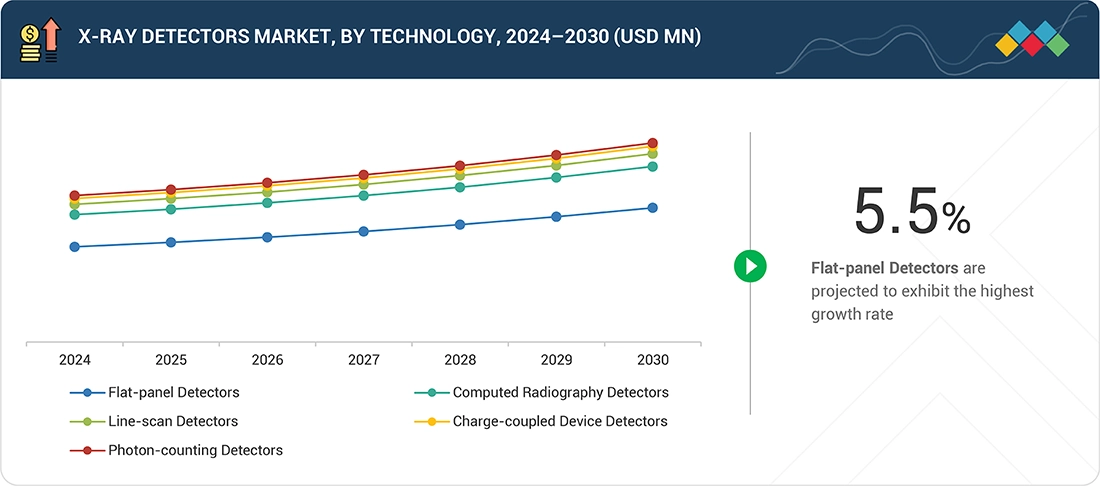

X ray Detectors Market, by Technology

Flat-panel detectors (FDPs) make up the largest and fastest-growing part of the X-ray detectors market. Their leading position is due to better image quality, faster image capture, and lower radiation exposure compared to computed radiography and charge-coupled device (CCD) detectors. Among FDPs, indirect conversion detectors (a-Si and CMOS) are gaining popularity for general radiography and fluoroscopy due to their high spatial resolution and cost-effectiveness. Manufacturers are working on improving wireless and durable designs to support mobile diagnostic applications.

X ray Detectors Market, by Application

Medical imaging accounts for the largest share of the market, driven by widespread use in general radiography, mammography, and dental imaging. The segment benefits from continuous upgrades in hospital imaging departments and an increasing number of diagnostic centers globally. Among medical applications, general radiography holds the lion’s share due to its role in routine diagnostic workflows, emergency care, and chest and skeletal examinations.

REGION

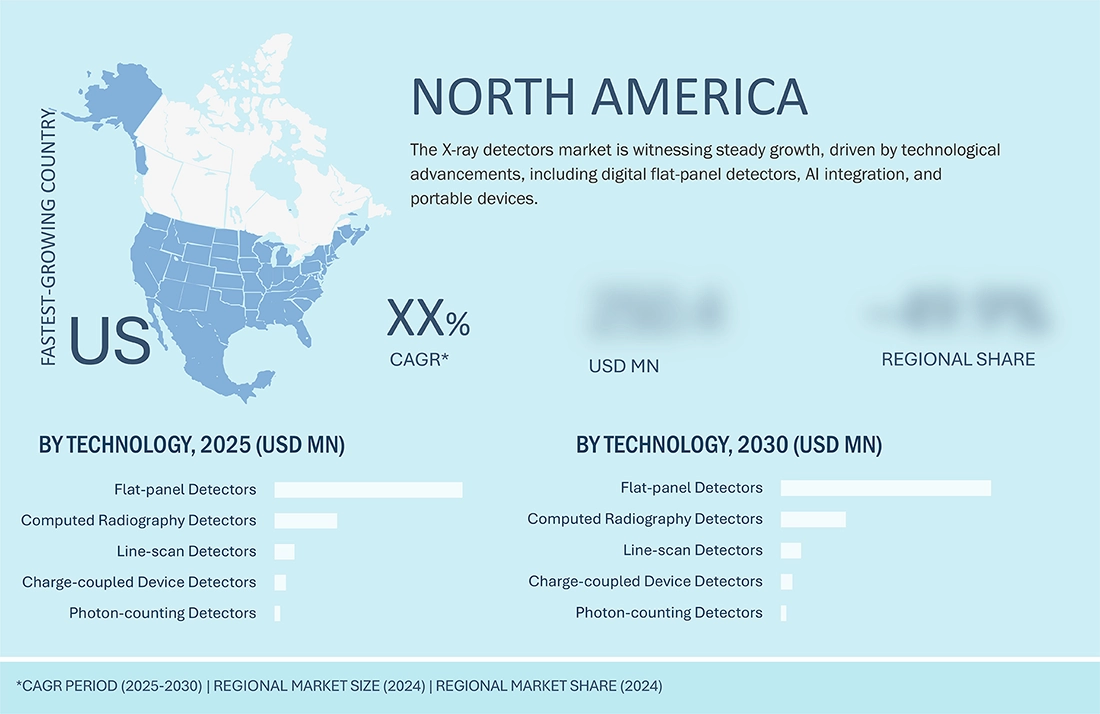

North America to be dominant region in global X-ray Detectors market during forecast period

North America leads the global X-ray detectors market, securing the largest revenue share in 2024. This dominance is driven by a well-established healthcare system, early adoption of flat-panel digital detectors, and ongoing upgrades in diagnostic imaging. The U.S. specifically benefits from robust reimbursement policies for digital imaging, high replacement rates of outdated analog and computed radiography systems, and the swift adoption of AI-enabled detectors in major hospitals and imaging networks. Additionally, the increasing rates of chronic diseases, regulatory efforts such as the FDA and ACR’s low-dose radiology standards, and the presence of key manufacturers like Varex Imaging, Carestream Health, Canon Medical, and Agfa-Gevaert strengthen the region’s position. Canada also plays a crucial role in government initiatives focusing on digital health and radiology modernization. Overall, North America continues to be a center for technological innovation, with hospitals and OEMs working together to improve detector performance, portability, and data integration.

X-Ray Detectors Market: COMPANY EVALUATION MATRIX

The X-ray detectors market is moderately consolidated, with key players including Varex Imaging, Canon Medical Systems, Agfa-Gevaert, FUJIFILM Holdings, Carestream Health, Hamamatsu Photonics, Teledyne DALSA, and Konica Minolta, which lead through technological innovation and product diversification. The competitive matrix is shaped by parameters such as technology leadership (CMOS and a-Se), breadth of product portfolio, global distribution strength, pricing competitiveness, and after-sales support. Companies with integrated AI algorithms, detector miniaturization, and cloud connectivity capabilities are gaining a strategic edge, while emerging Asian manufacturers are challenging incumbents through cost-effective product lines and regional partnerships.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.28 Billion |

| Market Forecast in 2030 (Value) | USD 4.46 Billion |

| Growth Rate | CAGR of 5.5% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

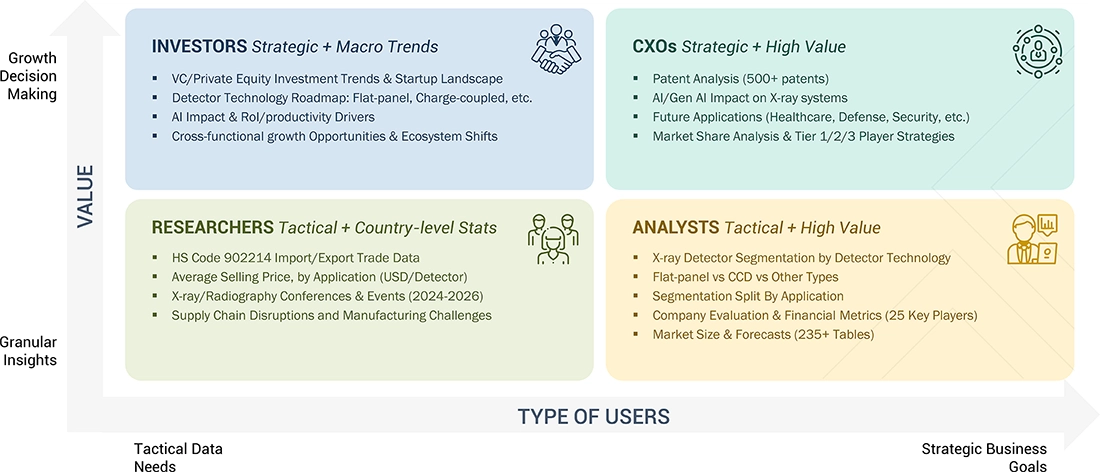

WHAT IS IN IT FOR YOU: X-Ray Detectors Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading X-ray Detectors OEM |

|

|

| Raw Material Supplier |

|

|

| Defense Contractor |

|

|

RECENT DEVELOPMENTS

- January 2025 : Carestream Health has obtained CE Marking approval from the European Union for its Focus HD Detectors and the DRX-Rise Mobile X-ray System.

- December 2024 : Varex Imaging introduced the LUMEN HD and LUMEN HD Pro digital radiography detectors, developed to address the advancing requirements of modern healthcare imaging.

- June 2024 : Carestream Health has entered into an agreement with BSF Medical - SARL, a prominent distributor of medical solutions in Algeria, specializing in cardiology, urology, endoscopy, radiology, and pharmaceutical products.

Table of Contents

Methodology

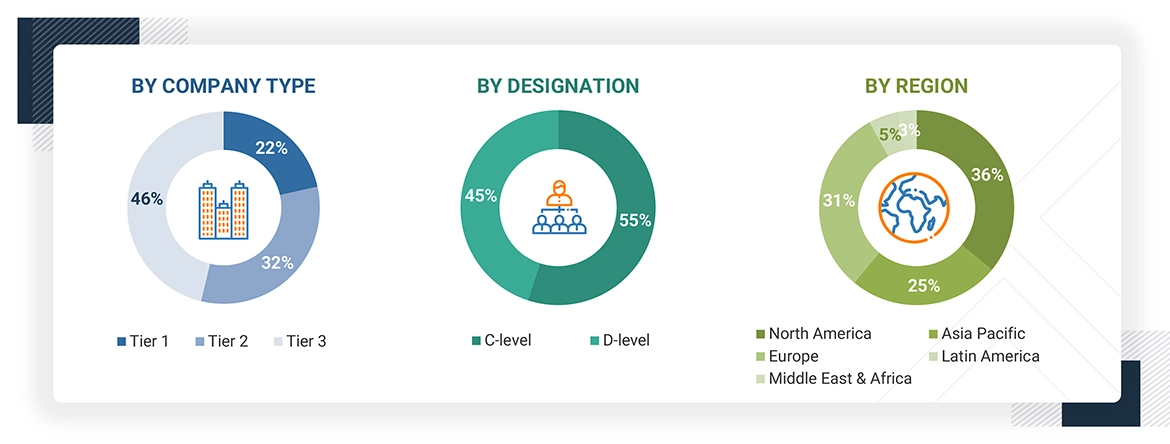

This research study extensively utilized secondary sources, directories, and databases to identify and gather valuable information for analyzing the global X-ray detectors market. Additionally, in-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives from leading market players, and industry consultants. These interviews helped obtain and validate critical qualitative and quantitative data while assessing the growth prospects. The global market size, initially estimated through secondary research, was then refined and finalized through triangulation with insights from primary research.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the global X-ray detectors market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various companies and organizations in the global X-ray detectors market. The primary sources from the demand side include OEMs, private and contract testing organizations, and service providers. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

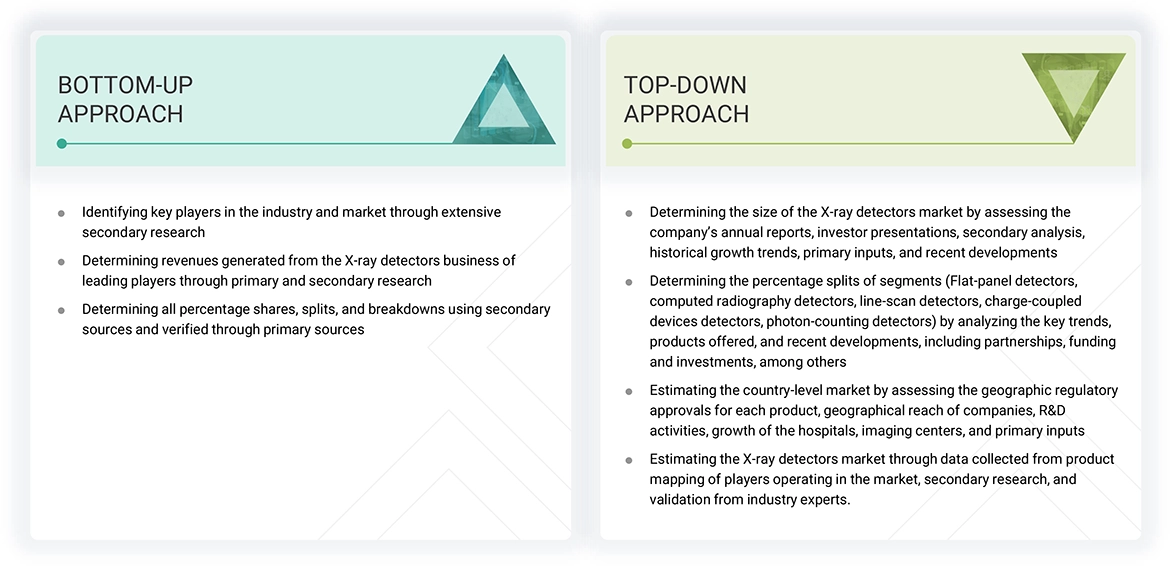

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the X-ray detectors market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- A list of the major global players operating in the X-ray detectors market was generated.

- Mapping annual revenues generated by leading global players from the X-ray detectors segment (or nearest reported business unit/service category)

- Revenue mapping of key players to cover a significant share of the global market as of 2024

- Extrapolating the global value of the X-ray detectors industry

Global X-ray detectors Market Size: Bottom-up Approach and Top-down Approach

Data Triangulation

After arriving at the market size from the estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

X-ray detectors transform X-ray photons into electronic signals to rapidly produce high-quality images. It absorbs X-ray photons, initiating ionization and energy transfer within the detector material. Technological advancements aim to improve image resolution, enhance sensitivity, and reduce radiation exposure. Driven by innovations, rising healthcare awareness, demand for non-invasive diagnostics, and increased focus on security, X-ray detectors are widely used across medical, dental, industrial, veterinary, and security applications.

Stakeholders

- X-ray detector manufacturers & suppliers

- Original equipment manufacturers (OEMs)

- Suppliers of raw materials and manufacturing equipment

- Medical imaging device manufacturers & suppliers

- Hospitals

- Diagnostic imaging centers

- R&D companies

- Business research & consulting service providers

- Medical research laboratories

- Academic medical centers & universities

- Government agencies

- Regulatory agencies

- X-ray system manufacturers

Report Objectives

- To define, describe, and forecast the global X-ray detectors market based on technology, type, application, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global X-ray detectors market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets concerning individual growth trends, prospects, and contributions to the global X-ray detectors market

- To analyze key growth opportunities in the global X-ray detectors market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments concerning five major regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and the rest of Asia Pacific), Latin America (Brazil, Mexico, and the rest of Latin America), and the Middle East & Africa (GCC Countries and the rest of the Middle East & Africa)

- To profile the key players in the global X-ray detectors market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global X-ray detectors market, such as agreements, expansions, and & acquisitions

Frequently Asked Questions (FAQ)

What will the addressable market value of the global X-ray detectors market be during the forecast period?

The market is projected to reach USD 4.4 billion by 2030 from USD 3.4 billion in 2025, growing at a CAGR of 5.5%.

Which product type segments have the highest potential for growth in the X-ray detectors market?

Flat-panel detectors are expected to exhibit the highest growth rates.

Who are the top 3 players in the market?

The leading players are Varex Imaging (US), Thales (France), and Canon Inc. (Japan).

What major strategies are leading players adopting to enter emerging regions?

Distribution agreements, partnerships, product launches, and product approvals are the key strategies.

Which application segment will likely show the highest growth in the X-ray detectors market?

The medical applications segment is expected to grow at the highest rate.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the X-Ray Detectors Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in X-Ray Detectors Market

Sara

May, 2022

Looking to gain information on Industrial X-Ray Detectors Market.

Lara

May, 2022

I believe that this research has a more positive impact on the industry and high quality innovation. Is it possible to share knowledge about x-ray detectors market in digital radiography ?.

Jacob

Mar, 2022

Can you enlighten us on geographical growth analysis in X-Ray Detectors Market?.