Core HR Software Market by Component (Software (Learning Management, Payroll & Compensation Management, Benefits & Claims Management) and Services) Deployment Type, Vertical (Government, BFSI, Manufacturing) and Region - Global Forecast to 2028

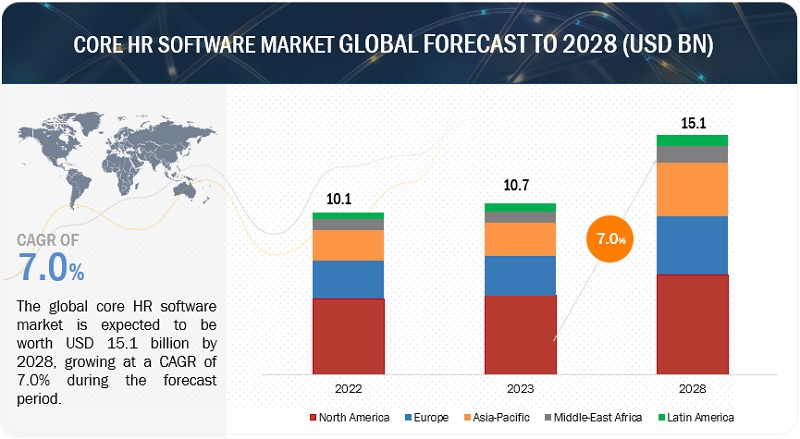

[234 Pages Report] The core HR software market size is expected to grow from USD 10.7 billion in 2023 to USD 15.1 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 7.0% during the forecast period. As technology advanced, core HR software prioritized user-friendly interfaces, self-service functionality, and mobile apps to empower employees. AI and predictive analytics empower talent acquisition, retention strategies, and improved workforce planning. Today, core HR software is characterized by its focus on intelligent automation, leveraging AI and machine learning to automate routine tasks, enhance employee engagement, and provide strategic insights. The journey of core HR software reflects a continuous evolution from the automation of basic functions to the sophisticated, interconnected systems that empower organizations to manage their workforce efficiently and strategically in the modern business landscape.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Core HR software market

The global recession caused by factors such as the Russia-Ukraine war, the pandemic, inflation, rising interest rates, and oil prices have reduced spending by organizations, which may affect the demand for core HR software across industries in the short term. The convergence of the ongoing recession, the Russia-Ukraine conflict, rising oil prices, and the global COVID-19 pandemic have significantly shaped the core HR software market landscape. These complex and interrelated events have ushered in a series of challenges and opportunities for HR technology. The recession and economic uncertainties have prompted organizations to reevaluate their budgets and priorities, potentially affecting software adoption and upgrades. The Russia-Ukraine conflict has highlighted the importance of robust HR systems in managing cross-border teams and ensuring employee safety. Simultaneously, the volatility of oil prices has underscored the need for agile workforce planning and cost optimization, which core HR software with advanced analytics can facilitate. The pandemic has brought about an unprecedented shift to remote work and has underscored the importance of HR software that supports virtual onboarding, collaboration, and employee engagement.

Core HR software market Dynamics

Driver: Demand for centralization and automation of routine HR processes to reduce manual errors

Centralization and automation are revolutionizing the core HR software market, reshaping how organizations manage human resources. Traditionally, HR processes were fragmented, with data scattered across various systems and manual workflows, leading to inefficiencies and data inconsistencies. However, with the advent of core HR software, all HR-related functions, including employee records, payroll, benefits, and performance management, are consolidated into a unified platform. This centralization streamlines HR operations, enabling a holistic view of workforce data, which fosters informed decision-making and strategic planning. Moreover, automation eliminates repetitive, time-consuming tasks, freeing HR professionals to focus on strategic initiatives and employee engagement. Routine processes like onboarding, leave management, and performance reviews are now automated, reducing errors and ensuring consistent implementation. As a result, organizations experience improved efficiency, reduced administrative overheads, and enhanced compliance with regulations. The transformative impact of centralization and automation in the core HR software market is evident in the way businesses can now harness the power of data-driven insights, foster a more engaged workforce, and align HR strategies with overall organizational goals, ultimately leading to greater competitiveness and success in today’s dynamic business landscape.

Restraint: High cost of implementation of core HR software among SMEs

The cost of implementing core HR software has become a significant factor restraining its adoption, particularly for small and medium-sized enterprises (SMEs). Implementation expenditure includes software licensing fees, customization, data migration, employee training, and ongoing maintenance costs. Additionally, a report by Sierra-Cedar on HR tech spending in 2021 revealed that the cost of implementing core HR software could range from tens of thousands to millions of dollars, depending upon the size and complexity of the organization. Such expenditures can be prohibitive for SMEs with limited budgets, deterring them from upgrading their HR systems. Moreover, some companies fear that the return on investment may not be realized in the short term, making them reluctant to invest in such technology. As a result, many organizations continue to rely on legacy systems or manual processes, hindering their ability to streamline HR operations, improve data accuracy, and enhance employee experiences. Addressing the cost challenges and providing more flexible pricing models could potentially unlock the untapped potential of core HR software adoption across various business sectors.

Opportunity: Growing adoption of AI and automation for transforming HR processes

AI and automation are revolutionizing the core HR software market, offering tremendous opportunities for enhancing HR processes and workforce management. AI-driven algorithms are transforming candidate assessment by analyzing vast data to identify the best-fit candidates, reducing the time to hire, and improving the quality of hires. For instance, a leading recruitment software provider, HireVue, reported a 32% increase in hiring efficiency and a 17% reduction in employee turnover for companies using their AI-powered video interviewing platform. Automation streamlines routine HR tasks such as onboarding, benefits administration, and leave management, allowing HR teams to focus on strategic initiatives and employee development. A case in point is Workday, whose core HR platform has helped companies achieve an 18% reduction in administrative time, leading to significant cost savings and improved productivity. AI and automation create exciting opportunities for core HR software, enabling organizations to build a more agile, data-driven, and employee-centric workforce.

Challenge: Privacy and security concerns over the implementation of core HR software

Core HR software contains many sensitive employee information, such as personal details, payroll data, performance evaluations, and other confidential records. As organizations transition from traditional paper-based HR processes to digital platforms, the potential risks of data breaches and privacy violations become more pronounced. Ensuring robust data security measures to protect against unauthorized access, data breaches, and cyber threats is paramount. Compliance with data protection regulations, such as GDPR and CCPA, adds a layer of complexity, especially for multinational organizations operating in different jurisdictions. The consequences of data security breaches can be severe, leading to reputational damage, legal liabilities, and financial losses. Consequently, organizations and software providers must invest in robust encryption, access controls, regular security audits, and employee training to mitigate data security and privacy risks and build trust among users to encourage the adoption of core HR software.

The services segment is projected to witness the highest CAGR during the forecast period based on components.

The need for professional services such as integration and & implementation, maintenance and & support, and consulting is paramount. Integration and & implementation services are crucial in ensuring a seamless adoption of core HR software within an organization’s infrastructure. These services involve configuring the software to align with specific business processes, integrating it with other essential systems, and facilitating a smooth transition to the new technology. As organizations increasingly recognize the strategic value of core HR software, consulting services become vital for guiding them through strategic decisions, best practices, and customization options tailored to their unique needs. Maintenance and & support services provide ongoing assistance, troubleshooting, and updates, enabling businesses to maximize the software’s performance and stay up-to-date with evolving industry regulations and technological advancements. In an era where HR operations are intricately linked to digital solutions, these professional services’ expertise and guidance significantly optimize the efficiency, effectiveness, and long-term success of core HR software implementations.

By Vertical, the consumer goods & retail segment is expected to grow at the highest CAGR during the forecast period.

Core HR software plays a significant role in the consumer goods and & retail industry vertical by revolutionizing human resources management and addressing the unique challenges faced by companies in this sector. The consumer goods and & retail industry vertical is characterized by a large and diverse workforce, high turnover rates, seasonal fluctuations, and a constant need to meet customer demands. Core HR software streamlines the recruitment process, making it easier for consumer goods and & retail companies to attract top talent, manage job postings, and quickly fill positions, especially during peak seasons. The system also helps track and manage applicant data efficiently, enhancing the overall hiring experience for candidates and recruiters. In an industry that often experiences seasonal peaks and valleys, core HR software aids in effective workforce management. Companies can better forecast staffing needs, manage temporary hires, and schedule shifts to meet customer demands during busy periods. In the retail industry, employee retention is essential. Core HR software helps measure employee engagement, gather feedback, and implement strategies to improve workplace satisfaction, reducing turnover rates and increasing employee loyalty.

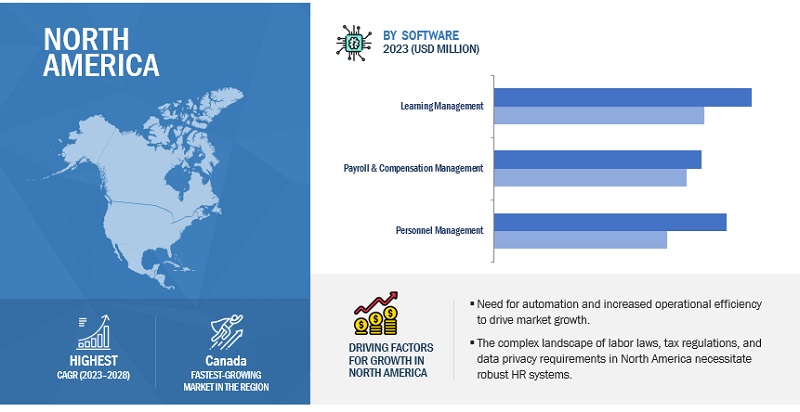

Based on Region, North America holds the largest market share during the forecast period.

The core HR software market is critical in the North American region, significantly impacting how businesses manage their human resources functions. The core HR software market is robust and continuously evolving in North America, which comprises the USnited States and Canada. The region’s large and diverse corporate landscape, ranging from small and medium-sized enterprises (SMEs) to multinational corporations, creates substantial demand for such solutions. Moreover, North America also has complex and ever-changing labor laws and regulations. The core HR software helps organizations comply with these laws by accurately managing payroll, tax calculations, and reporting. The adoption of cloud-based core HR software is rising in the region due to its flexibility, scalability, and cost-effectiveness. Cloud solutions enable easy access to HR data, even for remote or distributed teams.

Further, companies in North America are placing a higher emphasis on employee experience and satisfaction. Core HR software facilitates seamless onboarding, employee self-service portals, and real-time access to information, enhancing the overall employee experience. Lastly, the core HR software in North America is competitive, with numerous established vendors and emerging players offering a range of solutions. This competition drives innovation and ensures businesses access cutting-edge features and functionalities.

Key Market Players

The core HR software market is dominated by a few globally established players such as Workday (US), SAP (Germany), ADP (US), UKG (US), and Oracle (US), among others, are the key vendors that secured core HR software contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the core HR software market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Component, Software, Services, Deployment Type, Vertical, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Workday (US), SAP (Germany), ADP (US), UKG (US), Oracle (US), Ceridian (US), IBM (US), Paycom (US), Paylocity (US), and Cornerstone OnDemand (US), Visma (US), Access Group (US), Paychex(US), EmployWise (India), HrOne (India), greytHR(India), PeopleStrong (India), Personio (Germany), Sprout Solutions (Philippines), Darwinbox (India), ServiceNow (US), HiBob (US), APS Payroll (US), BambooHR(US), Paycor (US), Zoho (India), Namely (US), Gusto (US), and Rippling (US). |

This research report categorizes the core HR software market to forecast revenue and analyze trends in each of the following submarkets:

Based on Component:

- Software

- Services

Based on Software:

- Benefits & Claims Management

- Payroll & Compensation Management

- Personnel Management

- Learning Management

- Pension Management

- Compliance Management

- Other Software

Based on Services:

- Implementation & Integration

- Maintenance & Support

- Consulting

Based on Deployment Type:

- Cloud

- On-premises

Based on Vertical:

- Government

- Manufacturing

- Energy & Utilities

- Consumer Goods & Retail

- Healthcare

- Transportation & Logistics

- IT & Telecom

- BFSI

- Other Verticals

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- UAE

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2023, Workday announced the expansion of its partnership with Samsung SDS, a system integrator and cloud-based HR technology provider, to drive business and deliver unified HCM for HR professionals in the region.

- In June 2023, UKG acquired Immedis, a workforce management, and HR payroll solution provider, to transform the global payroll landscape by launching UKG One View, a multi-country payroll solution.

- In April 2023, Oracle announced enhancements to Oracle ME, an employee experience platform, Oracle Grow, an innovative AI-driven offering that unifies learning, skill development, and career advancement into a personalized journey, empowering individuals to pursue self-guided learning opportunities.

- In March 2023, Ceridian announced that Center Parcs UK & Ireland chose Dayforce to enhance its workforce efficiency, boost employee engagement, and ensure regulatory compliance. With Dayforce’s extensive workforce management features, including time and attendance tracking, intelligent scheduling, task management, and people analytics, Center Parcs aims to empower and retain its front-line workers effectively.

- In October 2022, ADP announced the launch of Voice of the Employee, an employee survey solution to help employers to collect employee feedback throughout the employee lifecycle and improve the employee workplace experience.

- In October 2021, SAP announced SAP SuccessFactors Opportunity Marketplace, a new solution that connects workers with individualized recommendations to fuel personal growth and development and increase organizational agility.

Frequently Asked Questions (FAQ):

What is Core HR Software?

Core HR software is a set of solutions or platforms for employee management. These solutions are beneficial for the organization and employees as well. They help organizations with individual employee management and engagement. The HR industry is undergoing transformational changes due to the evolving issues of managing resources, declining employee engagement rates, and high attrition rates. To overcome such problems, HR professionals are adopting tools to manage their workforces in better and more planned ways. Core HR software reduces the tedious activities and time HR personnel consume in managing an organization’s employees individually.

Which country is the early adopter of Core HR Software?

The US is at the initial stage of adopting Core HR Software.

Which are the key vendors exploring Core HR Software?

Some of the significant vendors offering core HR software across the globe include Workday (US), SAP (Germany), ADP (US), UKG (US), Oracle (US), Ceridian (US), IBM (US), Paycom (US), Paylocity (US), and Cornerstone OnDemand (US), Visma (US), Access Group (US), Paychex(US), EmployWise (India), HrOne (India), greytHR(India), PeopleStrong (India), Personio (Germany), Sprout Solutions (Philippines), Darwinbox (India), ServiceNow (US), HiBob (US), APS Payroll (US), BambooHR(US), Paycor (US), Zoho (India), Namely (US), Gusto (US), and Rippling (US).

What is the total CAGR expected to be recorded for the core HR software market from 2023 to 2028?

The core HR software market is expected to record a CAGR of 7.0% from 2023-2028

What is the projected market value of the core HR software market?

The core HR software market size is expected to grow from USD 10.7 billion in 2023 to USD 15.1 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 7.0% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need for improved compliance and risk management to adhere to employment laws and regulations- Analytics and reporting capabilities enable data-driven decisions- Demand for centralization and automation of routine HR processes to reduce manual errorsRESTRAINTS- High cost of implementation of core HR software for SMEsOPPORTUNITIES- Growing adoption of AI and automation for transforming HR processes- Adoption of remote working models to boost adoption of core HR software- Rapid adoption of cloud-based HR software to improve efficiency and scalabilityCHALLENGES- Interactive training for infrequent users of core HR software- Privacy and security concerns over implementation of core HR software

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: REAL-TIME DATA VISIBILITY ENABLED PVR CINEMAS TO OPTIMIZE STAFFINGCASE STUDY 2: INDICA LABS CONSOLIDATED AND SECURED EMPLOYEE DATA AND STREAMLINED TIME-CONSUMING HR PROCESSES WITH BAMBOOHRCASE STUDY 3: MOD PIZZA PROVIDED EXCEPTIONAL EMPLOYEE EXPERIENCES WITH SAP SUCCESS FACTOR SOLUTIONSCASE STUDY 4: GANETT LEVERAGED CERIDIAN TO BOOST SCALABILITY, RESILIENCE, AND IMPROVE EMPLOYEE EXPERIENCE- Case Study 5: Paylocity enabled Crafton Tull to rebuild HR on firmer foundations

-

6.1 INTRODUCTIONCOMPONENT: MARKET DRIVERS

-

6.2 SOFTWAREDEMAND FOR CENTRALIZING ADMINISTRATIVE TASKS

-

6.3 SERVICESOPTIMIZATION OF EFFECTIVENESS OF CORE HR SOFTWARE

-

7.1 INTRODUCTIONSOFTWARE: MARKET DRIVERS

-

7.2 BENEFITS & CLAIMS MANAGEMENTSEAMLESS DESIGN, CUSTOMIZATION, AND COMMUNICATION OF BENEFITS

-

7.3 PAYROLL & COMPENSATION MANAGEMENTSTRATEGIC PLANNING, ADMINISTRATION, AND PROCESSING OF COMPENSATION TO DRIVE MARKET

-

7.4 PERSONNEL MANAGEMENTENHANCEMENT OF WORKFORCE PRODUCTIVITY, ENGAGEMENT, AND STRATEGIC DECISION-MAKING TO DRIVE MARKET

-

7.5 LEARNING MANAGEMENTCREATION, DELIVERY, AND MANAGEMENT OF EMPLOYEE TRAINING AND DEVELOPMENT PROGRAMS TO DRIVE MARKET

-

7.6 PENSION MANAGEMENTENABLES ACCOMMODATION OF DIFFERENT RETIREMENT STRUCTURES FOR DIVERSE WORKFORCES, GLOBAL OPERATIONS, CURRENCIES, AND REGULATIONS

-

7.7 COMPLIANCE MANAGEMENTCOMPLIES WITH LAWS, MITIGATES RISK, AND ENSURES ETHICAL HR PRACTICES

-

7.8 OTHER SOFTWARENURTURES INTERNAL TALENT FOR BUSINESS CONTINUITY AND GROWTH

-

8.1 INTRODUCTIONSERVICES: MARKET DRIVERS

-

8.2 IMPLEMENTATION & INTEGRATIONBETTER VISIBILITY AND CONNECTIVITY TO DRIVE MARKET

-

8.3 SUPPORT & MAINTENANCEOFFER SUPPORT, SOFTWARE MAINTENANCE, CUSTOMER PORTAL, POST-DEPLOYMENT ASSISTANCE, AND CLIENT TESTIMONIAL SERVICES

-

8.4 CONSULTINGASSISTANCE IN NAVIGATING COMPLEX MODERN HUMAN RESOURCE MANAGEMENT LANDSCAPE

-

9.1 INTRODUCTIONDEPLOYMENT TYPE: MARKET DRIVERS

-

9.2 CLOUDINCREASING ADOPTION OF CLOUD-BASED SERVICES TO DRIVE GROWTH

-

9.3 ON-PREMISESUTILIZED IN HEALTHCARE AND BFSI TO MINIMIZE DATA BREACHES

-

10.1 INTRODUCTIONVERTICAL: MARKET DRIVERS

-

10.2 GOVERNMENTTRANSPARENCY, PRODUCTIVITY, AND EMPLOYEE SATISFACTION CONTRIBUTE TO EFFECTIVE AND EFFICIENT DELIVERY OF PUBLIC SERVICES

-

10.3 MANUFACTURINGOPTIMIZES WORKFORCE PLANNING, TRAINING AND SKILL DEVELOPMENT, COMPLIANCE MANAGEMENT, AND PERFORMANCE EVALUATION

-

10.4 ENERGY & UTILITIESMANAGES AND TRACKS EMPLOYEE CERTIFICATIONS, LICENSES, AND SAFETY TRAINING

-

10.5 CONSUMER GOODS & RETAILENABLES EFFECTIVE WORKFORCE MANAGEMENT

-

10.6 HEALTHCARESTREAMLINES HR OPERATIONS, ENHANCES PATIENT CARE, AND MAINTAINS COMPLIANCE WITH INDUSTRY REGULATIONS

-

10.7 TRANSPORTATION & LOGISTICSFACILITATES SCHEDULING, TRACKS EMPLOYEE HOURS, AND MANAGES SHIFT ASSIGNMENTS

-

10.8 IT & TELECOMOPTIMIZES WORKFORCE DEPLOYMENT, AVOIDS OVERSTAFFING OR UNDERSTAFFING, AND ENSURES EFFICIENT EXECUTION OF PROJECTS

-

10.9 BFSIATTRACTS TOP TALENT, CONDUCTS COMPREHENSIVE BACKGROUND CHECKS, AND EXPEDITES HIRING PROCESS

- 10.10 OTHER VERTICALS

-

11.1 INTRODUCTIONNORTH AMERICANORTH AMERICA: MARKET DRIVERSIMPACT OF RECESSION ON NORTH AMERICAUS- Myriad labor laws and regulations at federal, state, and local levels to drive marketCANADA- Compliance with varied and complex regulations to drive market

-

11.2 EUROPEEUROPE: MARKET DRIVERSIMPACT OF RECESSION ON EUROPEUK- Growing adoption of cloud and other technologies to drive marketGERMANY- Cloud-based solutions to drive marketFRANCE- Optimization of HR applications to drive marketREST OF EUROPE

-

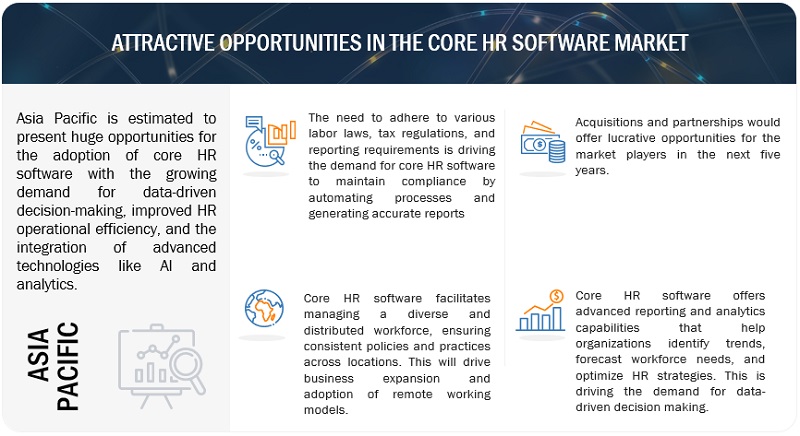

11.3 ASIA PACIFICASIA PACIFIC: CORE HR SOFTWARE MARKET DRIVERSIMPACT OF RECESSION ON ASIA PACIFICCHINA- Innovative technologies to drive marketJAPAN- Increased R&D investments and skilled professionals drive marketREST OF ASIA PACIFIC

-

11.4 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSIMPACT OF RECESSION ON MIDDLE EAST & AFRICAKINGDOM OF SAUDI ARABIA- Workforce optimization to drive marketUAE- Adoption of advancements in latest technologies to drive marketREST OF MIDDLE EAST & AFRICA

-

11.5 LATIN AMERICALATIN AMERICA: MARKET DRIVERSIMPACT OF RECESSION ON LATIN AMERICABRAZIL- Digital transformation across industries to drive marketMEXICO- Scalability and flexibility for businesses to drive marketREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 REVENUE ANALYSIS

- 12.3 MARKET SHARE ANALYSIS

-

12.4 COMPANY EVALUATION METRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.5 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHES & ENHANCEMENTSDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSWORKDAY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewADP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUKG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCERIDIAN- Business overview- Products/Solutions/Services offered- Recent developmentsIBM- Business overview- Products/Solutions/Services offeredPAYCOM- Business overview- Products/Solutions/Services offered- Recent developmentsPAYLOCITY- Business overview- Products/Solutions/Services offered- Recent developmentsCORNERSTONE ONDEMAND- Business overview- Products/Solutions/Services offered- Recent developments

-

13.3 OTHER PLAYERSVISMAACCESS GROUPPAYCHEXEMPLOYWISEHRONEGREYTHRPEOPLESTRONGPERSONIOSPROUT SOLUTIONSDARWINBOXSERVICENOWHIBOBAPS PAYROLLBAMBOOHRPAYCORZOHONAMELYGUSTORIPPLING

-

14.1 INTRODUCTIONRELATED MARKETS

- 14.2 ENTERPRISE ASSET MANAGEMENT MARKET

- 14.3 HUMAN CAPITAL MANAGEMENT MARKET

- 14.4 WORKFORCE MANAGEMENT MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2015–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 CORE HR SOFTWARE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 5 MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 6 SOFTWARE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 7 SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 8 SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 9 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 10 MARKET, BY SOFTWARE, 2018–2022 (USD MILLION)

- TABLE 11 CORE HR SOFTWARE MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 12 BENEFITS & CLAIMS MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 13 BENEFITS & CLAIMS MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 PAYROLL & COMPENSATION MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 15 PAYROLL & COMPENSATION MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 PERSONNEL MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 17 PERSONNEL MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 LEARNING MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 LEARNING MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 PENSION MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 PENSION MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 COMPLIANCE MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 COMPLIANCE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 OTHER SOFTWARE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 OTHER SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 CORE HR SOFTWARE MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 27 MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 28 IMPLEMENTATION & INTEGRATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 IMPLEMENTATION & INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 CONSULTING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 35 CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 36 CLOUD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 ON-PREMISES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 CORE HR SOFTWARE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 41 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 42 GOVERNMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 GOVERNMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 MANUFACTURING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 ENERGY & UTILITIES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 ENERGY & UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 CONSUMER GOODS & RETAIL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 CONSUMER GOODS & RETAIL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 HEALTHCARE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 IT & TELECOM: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 IT & TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 BFSI: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 OTHER VERTICALS: CORE HR SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 CORE HR SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY SOFTWARE, 2018–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 74 US: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 75 US: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 76 US: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 77 US: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 79 CANADA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 80 CANADA: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 81 CANADA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 83 EUROPE: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY SOFTWARE, 2018–2022 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 91 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 93 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 UK: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 95 UK: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 96 UK: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 97 UK: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 98 GERMANY: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 99 GERMANY: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 100 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 101 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 102 FRANCE: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 103 FRANCE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 104 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 105 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 106 REST OF EUROPE: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY SOFTWARE, 2018–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 CHINA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 123 CHINA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 124 CHINA: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 125 CHINA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 126 JAPAN: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 127 JAPAN: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 128 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 129 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE, 2018–2022 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 146 KSA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 147 KSA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 148 KSA: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 149 KSA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 150 UAE: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 151 UAE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 152 UAE: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 153 UAE: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 154 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST & AFRICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 159 LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: MARKET, BY SOFTWARE, 2018–2022 (USD MILLION)

- TABLE 161 LATIN AMERICA: MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 163 LATIN AMERICA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 164 LATIN AMERICA: CORE HR SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 165 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 166 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 167 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 168 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 169 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 170 BRAZIL: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 171 BRAZIL: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 172 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 173 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 174 MEXICO: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 175 MEXICO: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 176 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 177 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 179 REST OF LATIN AMERICA: CORE HR SOFTWARE MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 180 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 181 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 182 MARKET SHARE OF KEY PLAYERS IN 2022

- TABLE 183 PRODUCT LAUNCHES & ENHANCEMENTS, 2020–2023

- TABLE 184 DEALS, 2021–2023

- TABLE 185 WORKDAY: COMPANY OVERVIEW

- TABLE 186 WORKDAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 WORKDAY: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 188 WORKDAY: DEALS

- TABLE 189 ADP: COMPANY OVERVIEW

- TABLE 190 ADP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 ADP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 192 ADP: DEALS

- TABLE 193 SAP: COMPANY OVERVIEW

- TABLE 194 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 SAP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 196 SAP: DEALS

- TABLE 197 UKG: COMPANY OVERVIEW

- TABLE 198 UKG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 UKG: DEALS

- TABLE 200 ORACLE: COMPANY OVERVIEW

- TABLE 201 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 ORACLE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 203 ORACLE: DEALS

- TABLE 204 CERIDIAN: COMPANY OVERVIEW

- TABLE 205 CERIDIAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 CERIDIAN: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 207 CERIDIAN: DEALS

- TABLE 208 IBM: COMPANY OVERVIEW

- TABLE 209 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 PAYCOM: COMPANY OVERVIEW

- TABLE 211 PAYCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 PAYCOM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 213 PAYLOCITY: COMPANY OVERVIEW

- TABLE 214 PAYLOCITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 PAYLOCITY: DEALS

- TABLE 216 CORNERSTONE ONDEMAND: COMPANY OVERVIEW

- TABLE 217 CORNERSTONE ONDEMAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 CORNERSTONE ONDEMAND: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 219 CORNERSTONE ONDEMAND: DEALS

- TABLE 220 ENTERPRISE ASSET MANAGEMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 221 ENTERPRISE ASSET MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 222 ENTERPRISE ASSET MANAGEMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 223 ENTERPRISE ASSET MANAGEMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 224 ENTERPRISE ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2018–2021 (USD MILLION)

- TABLE 225 ENTERPRISE ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

- TABLE 226 ENTERPRISE ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 227 ENTERPRISE ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 228 ENTERPRISE ASSET MANAGEMENT MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 229 ENTERPRISE ASSET MANAGEMENT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 230 ENTERPRISE ASSET MANAGEMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 231 ENTERPRISE ASSET MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 232 HUMAN CAPITAL MANAGEMENT MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

- TABLE 233 HUMAN CAPITAL MANAGEMENT MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 234 HUMAN CAPITAL MANAGEMENT MARKET, BY SOFTWARE, 2017–2020 (USD MILLION)

- TABLE 235 HUMAN CAPITAL MANAGEMENT MARKET, BY SOFTWARE, 2021–2026 (USD MILLION)

- TABLE 236 HUMAN CAPITAL MANAGEMENT MARKET, BY SERVICE, 2017–2020 (USD MILLION)

- TABLE 237 HUMAN CAPITAL MANAGEMENT MARKET, BY SERVICE, 2021–2026 (USD MILLION)

- TABLE 238 HUMAN CAPITAL MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

- TABLE 239 HUMAN CAPITAL MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

- TABLE 240 HUMAN CAPITAL MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

- TABLE 241 HUMAN CAPITAL MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 242 HUMAN CAPITAL MANAGEMENT MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

- TABLE 243 HUMAN CAPITAL MANAGEMENT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 244 HUMAN CAPITAL MANAGEMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 245 HUMAN CAPITAL MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 246 WORKFORCE MANAGEMENT MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 247 WORKFORCE MANAGEMENT MARKET, BY SOLUTION, 2018–2025 (USD MILLION)

- TABLE 248 WORKFORCE MANAGEMENT MARKET, BY SERVICE, 2018–2025 (USD MILLION)

- TABLE 249 WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2018–2025 (USD MILLION)

- TABLE 250 WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

- TABLE 251 WORKFORCE MANAGEMENT MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

- TABLE 252 WORKFORCE MANAGEMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 CORE HR SOFTWARE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF CORE HR SOFTWARE FROM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CORE HR SOFTWARE VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – (DEMAND SIDE)

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM CORE HR SOFTWARE COMPONENT

- FIGURE 10 FASTEST-GROWING SEGMENTS IN CORE HR SOFTWARE MARKET, 2023–2028

- FIGURE 11 SOFTWARE SEGMENT TO BE LARGER MARKET DURING FORECAST PERIOD

- FIGURE 12 LEARNING MANAGEMENT SEGMENT TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 13 IMPLEMENTATION & INTEGRATION SERVICES SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- FIGURE 14 CLOUD SEGMENT TO BE LARGER DURING FORECAST PERIOD

- FIGURE 15 GOVERNMENT VERTICAL SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- FIGURE 16 CORE HR SOFTWARE MARKET REGIONAL SNAPSHOT

- FIGURE 17 ONGOING DIGITAL TRANSFORMATION AND RISE IN ADOPTION OF REMOTE WORKING MODELS TO DRIVE GROWTH OF CORE HR SOFTWARE MARKET

- FIGURE 18 SOFTWARE SEGMENT EXPECTED TO BE LARGER DURING FORECAST PERIOD

- FIGURE 19 LEARNING MANAGEMENT SOFTWARE SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- FIGURE 20 IMPLEMENTATION & INTEGRATION SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- FIGURE 21 CLOUD SEGMENT TO BE LARGER DURING FORECAST PERIOD

- FIGURE 22 GOVERNMENT VERTICAL TO BE LARGEST DURING FORECAST PERIOD

- FIGURE 23 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN CORE HR SOFTWARE DURING NEXT FIVE YEARS

- FIGURE 24 MARKET DYNAMICS: CORE HR SOFTWARE MARKET

- FIGURE 25 PROGRESS IN REPORTING AND ANALYTICS CAPABILITIES IN HR

- FIGURE 26 FACTORS RESTRAINING TECH ADOPTION IN HR

- FIGURE 27 UTILIZATION OF HR TECHNOLOGY TO BETTER MANAGE REMOTE WORK

- FIGURE 28 HR TECHNOLOGY MODEL, 2020 VS. 2023

- FIGURE 29 CORE HR SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 LEARNING MANAGEMENT SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- FIGURE 31 IMPLEMENTATION & INTEGRATION SEGMENT TO BE LARGEST DURING FORECAST PERIOD

- FIGURE 32 CLOUD SEGMENT TO BE LARGER DURING FORECAST PERIOD

- FIGURE 33 GOVERNMENT SEGMENT ESTIMATED TO BE LARGEST IN 2023

- FIGURE 34 NORTH AMERICA TO BE LARGEST MARKET BY 2028

- FIGURE 35 NORTH AMERICA: CORE HR SOFTWARE MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 HISTORICAL FOUR-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 38 CORE HR SOFTWARE MARKET SHARE ANALYSIS, 2022

- FIGURE 39 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- FIGURE 40 CORE HR SOFTWARE MARKET, KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 RANKING OF KEY PLAYERS IN CORE HR SOFTWARE MARKET, 2022

- FIGURE 42 WORKDAY: COMPANY SNAPSHOT

- FIGURE 43 ADP: COMPANY SNAPSHOT

- FIGURE 44 SAP: COMPANY SNAPSHOT

- FIGURE 45 ORACLE: COMPANY SNAPSHOT

- FIGURE 46 CERIDIAN: COMPANY SNAPSHOT

- FIGURE 47 IBM: COMPANY SNAPSHOT

- FIGURE 48 PAYCOM: COMPANY SNAPSHOT

- FIGURE 49 PAYLOCITY: COMPANY SNAPSHOT

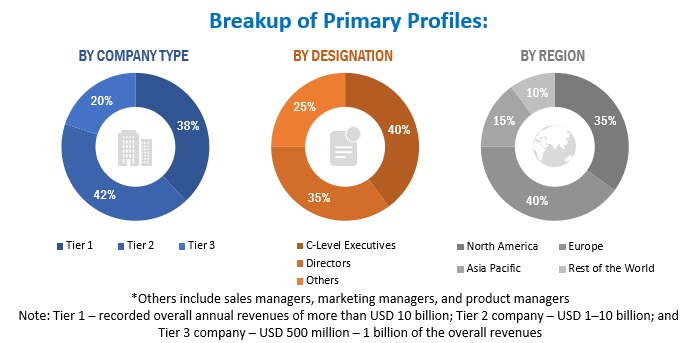

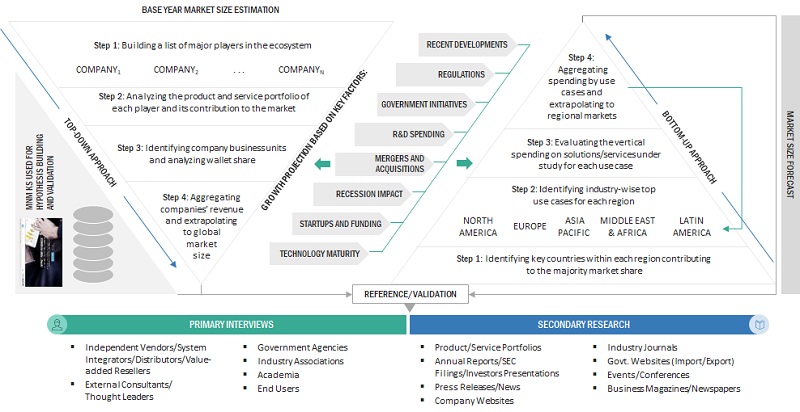

The study involved four major activities in estimating the current market size of the core HR software market. Extensive secondary research was done to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were referred to estimate the size of the core HR software market segments.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to for identifying and collecting valuable information for this technical, market-oriented, and commercial study of the core HR software market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of governments/end users using core HR software; and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of services, which would affect the overall core HR software market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the core HR software market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The top-down and bottom-up approaches were used to estimate and validate the size of the core HR software market and various other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research.

- This procedure included studying top market players’ annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits, and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Core HR software market: Top-down and bottom-up approaches

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the core HR software market.

Market Definition

According to MarketsandMarkets, Core HR software can be understood as a set of organizational solutions or platforms for employee management. These solutions are beneficial for the organization and employees as well. They help organizations with individual employee engagement and leadership. The HR industry is undergoing transformational changes due to the evolving issues of managing resources, declining employee engagement rates, and high attrition rates. To overcome such problems, HR professionals are adopting practical tools to manage their workforces in better and more planned ways. Core HR software reduces the tedious activities and time HR personnel spend working with an organization’s employees individually.

Key Stakeholders

- Value-Added Resellers (VARs)

- Software providers

- Research organizations

- Consulting companies

- Application Service Providers

- Cloud Platform Providers

- Investors and Venture Capitalists

- System integrators

- Technology providers

- Suppliers, distributors, and contractors

- End-Users/Enterprise Users

Report Objectives

- To define, describe, and forecast the core Human Resources (HR) software market based on component, software, service, deployment type, vertical, and region

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To strategically analyze markets concerning growth trends, prospects, and contributions to the overall market

- To analyze and forecast the market size in terms of value

- To forecast the market size for five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players of the market and comprehensively analyze their market size and core competencies in each subsegment

- To analyze competitive developments such as agreements, alliances, joint ventures, and mergers and acquisitions in the market

- To analyze the impact of the recession on the global core HR software market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Core HR Software Market

Interested in Software products and services in the HR space

Great job! Hats off to your clarity, your article was very informative and it was very useful for developers.