Ride Sharing Market by Type (E-hailing, Station-Based, Car Sharing & Rental), Car Sharing (P2P, Corporate), Service (Navigation, Payment, Information), Micro-Mobility (Bicycle, Scooter), Vehicle Type, and Region - Global Forecast to 2026

[221 Pages Report] The global ride sharing market was valued at USD 85.8 billion in 2021 and is expected to reach USD 185.1 billion by 2026, at a CAGR of 16.6% during the forecast period 2021-2026. The ride sharing market has gained popularity over the past few years because companies are trying to make transportation more reliable, convenient, enjoyable, and safe. The prime purpose of such transportation is to reduce emissions, vehicle trips, and traffic congestion. Ride-sharing allows getting rid of vehicle ownership, maintenance, and component replacement costs, which makes it more popular among the millennials. The initial factors such as inconvenience caused by using public transport, unavailability of first & last mile transportation, and rising awareness among people regarding air pollution are currently driving the demand for ride-sharing, predominantly e-hailing.

Though the pandemic has impacted most mobility service providers (MSPs), it has also made the MSPs change their business models or offerings. The MSPs have diverted and gained momentum in e-Commerce, food delivery, and last-mile delivery.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Increase in cost of vehicle ownership

The ownership of a vehicle is cumulative of multiple factors such as finance, fuel, maintenance, registration/taxes, maintenance & repair, and depreciation. With each year, the cost of vehicle ownership increases. Though, according to American Automobile Association (AAA), depreciation contributes to ~43% of the ownership cost, the other costs, such as maintenance and fuel costs, contribute ~25% together. Fuel prices and maintenance costs have increased multifold in the past few years, and the same trend is estimated to continue without any decline. As cities are increasingly cramped with people and cars, owning an automobile has become more of a liability than an asset. According to AAA, the average cost to own and operate a new car increased by USD 279 in 2020, compared with 2019, to reach USD 9,561.

As the millennial generation has little to no interest in owning a car, the rate of car ownership among people aged between 18 and 35 has declined. Other reasons for the decline in car ownership are poor connectivity by public transportation in key cities and the increasing trend of online shopping, among others.

Though the trend of car ownership has grown during the pandemic, it is expected to return to the pre-pandemic trend after 2021. Hence, ride-sharing service providers can capitalize on these demographics as the new tech-savvy generation constitutes one of the largest user bases of these services.

RESTRAINT: Varying Transport policies of different countries and Resistance from traditional transport services

In many countries, the operations of app-based mobility services are not regulated by a legal authority. Hence, their operation is not defined and regulated by the government. Taxi services are required to obtain separate licenses and registration. This makes it difficult for app-based taxi services, as many app-based companies do not own the vehicles.

Regulators worldwide have proposed or adopted requirements regarding the collection, use, transfer, security, storage, and other processing of personally identifiable information and other data relating to individuals. These laws increase in numbers, enforcement, fines, and other penalties. Examples of such regulations are the European Union’s General Data Protection Regulation (GDPR), enacted in May 2018 in the EU. The California Consumer Privacy Act (CCPA), effective from January 2020, also regulates consumer data collection in the ride-sharing business.

Stringent regulations related to vehicle registration and licenses make it difficult for an app-based taxi fleet that provides ride-sharing services. This has negatively impacted the growth of ride-sharing services in many countries and regions.

OPPORTUNITY : Emergence of autonomous ride-sharing

Autonomous vehicles are still in the development stages. Many OEMs have working prototypes, which are being tested in different regions. Many companies are competing to bring a fully autonomous vehicle to the market. These include Lyft, Ford, Uber, Honda, Toyota, and Tesla. Waymo, the autonomous vehicle division of Alphabet, Google’s parent company, has begun testing trip fares with its early riders as it launches its commercial ride-sharing service in Phoenix this year. Considering these factors, developing autonomous vehicles will drive the ride sharing market in the next 6–7 years.

CHALLENGE: COVID-19 impact on Profitability & Sustainability of transport network companies

The industry suffered losses due to the pandemic, where the various ride-sharing services were completely closed. In 2020, Uber’s losses were USD 6.7 billion, Lyft reported a loss of USD 1.8 billion, and Grab’s losses were USD 0.8 billion. On the contrary, based on secondary research reports, Didi Chuxing earned a profit of ~USD 1 billion in 2020. Even after following all COVID safety guidelines, attracting customers has not been easy. Considering the COVID second wave, which has struck European countries, and the possibility of a third wave, the ride-sharing industry would still struggle to bring back customers, at least till Q3 of 2021. Gaining customer trust and recovering lost revenues will be the two biggest challenges for mobility service providers in the coming years.

The e-hailing segment by type is expected to hold the largest market share in 2021

The growing demand for e-hailing services can be attributed to ease of booking, increasing traffic congestion, passenger comfort, and rising government initiatives to increase awareness among people regarding air pollution are propelling the demand for ride-sharing, predominantly e-hailing. Also, the increasing partnership between domestic and international service providers, such as Uber and Didi in China, will likely help the e-hailing market grow.

The bikes/Bicycles segment is estimated to be the largest as well as fastest for the micro-mobility market

Bike/bicycle sharing offers an economical option offering adequate comfort for shorter commutes; hence it is gaining popularity in many countries across regions. Bicycles are eco-friendly and consume less time, and as services are readily available, they are suitable for a single person's ride. Further, electric bikes/bicycles are also becoming popular because electric assist the rider in uphill conditions, and even if the battery dies, he or she can still peddle the bike. Bike sharing is gaining more traction in Asian countries such as China, and Japan, because most cities have paved bicycle lanes, and the topography is a little flat compared to Western countries. Hence, to ease traffic jams, micro-mobility such as bike/bicycle are the most suitable mode of transportation and would remain prominent in urban areas.

Short distance segment leads the ride sharing market

The short-distance segment is estimated to account for a major share market as most of the ride-sharing models are based on an intercity short-distance model. Consumers prefer short-distance ride-sharing services such as e-hailing and micro-mobility for traveling to public transportation modes such as bus stations and railway stations and shopping, parties, and visiting friends and relatives. Many ride-sharing companies focus on several ride-sharing options under the 30–40 km range. Lyft and Uber provide carpooling options for shorter distances, and Ola has Ola Share to reduce the commute cost per customer and attract more customers choosing shorter-distance ride sharing. Thus, using a personal car or public transport for short journeys makes travel inconvenient in city traffic. Thus, to save fuel cost and time, coupled with growing awareness among people regarding air pollution in urban areas, ignite the increased demand for ride-sharing services for the short-distance commute.

The Asia Pacific is estimated to be the largest market in 2021

The market in the Asia Pacific region is projected to be the largest for the ride sharing market. In the Asia Pacific, ride-sharing services are emerging rapidly in developing countries of India, China, and Indonesia primarily due to the growing migration of skilled workforces into urban areas from rural places. This will act as a growth attribute for ride-sharing as the passenger does not necessarily require a personal vehicle for a short commute, which saves fuel costs and sharing mobility and reduces travel time and congestion due to fewer vehicles on the road. Ride-sharing can help address various issues, such as traffic congestion, air pollution, and greenhouse gas emissions, which have risen due to the rise in urban population. Also, the region is home to some of the dominant players in this market, such as Didi, Go-Jek, Grab, and Ola. These factors are anticipated to fuel the Asia Pacific ride sharing market

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Didi Chuxing (China), Uber Technologies, Inc (US), Gett (Israel), Lyft, Inc (US), and Grab (Singapore). These companies adopted new product launches and expansion to gain traction in the ride sharing market.

Scope of the Report

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$85.8 Billion |

|

Estimated Revenue by 2026 |

$185.1 Billion |

|

Revenue Rate |

Projected to grow at a CAGR of 16.6% |

|

Market Driver |

Increase in cost of vehicle ownership |

|

Market Opportunity |

Emergence of autonomous ride-sharing |

|

Key Market Players |

Didi Chuxing (China), Uber Technologies, Inc (US), Gett (Israel), Lyft, Inc (US), and Grab (Singapore). |

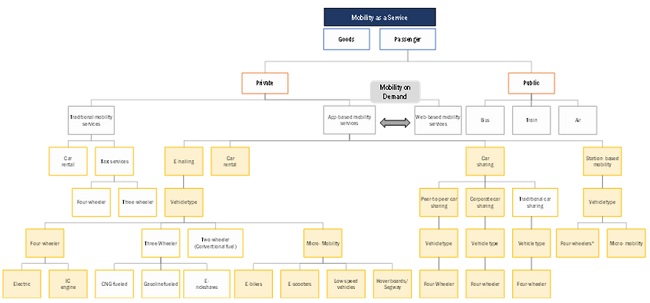

This research report categorizes the given ride sharing market based on based on service type, Car sharing market, by type, vehicle type, Micro-mobility market, by vehicle type, data service, distance, and region

By Service Type

- E-hailing

- Car sharing

- Station-based mobility

- Car rental

Car Sharing Market, by Type

- P2P car sharing

- Corporate Car Sharing

By Vehicle Type

- ICE vehicle

- Electric vehicle

- CNG/LPG vehicle

- Micro-Mobility vehicle

Micro-Mobility Market, by Vehicle Type

- Bike/bicycle

- Scooter

- Other micro-mobility vehicles

By Data Service

- Navigation

- Information service

- Payment

- Other data services

By Distance

- Short Distance

- Long Distance

By Region

- Asia Pacific

- North America

- Europe

- Rest of the World

Recent Developments

- In May 2021, The GrabPet XL and GrabCar Exec services will provide more options for Grab passengers with different mobility requirements while expanding earning opportunities for eligible driver-partners.

- In April 2021, Uber Technologies, Inc. and Walgreens unveiled a new feature that would allow consumers to book vaccination appointments at a Walgreens location and schedule their Uber ride to the vaccination appointment, all with a few taps through the Uber app. With all adults in the US eligible to receive the COVID-19 vaccine, Uber and Walgreens remain focused on helping ensure that transportation is never a barrier to receiving a vaccination.

- In January 2021, Gett raised USD 115 million, led by new backer Pelham Capital Investments Ltd., and included participation from unnamed existing investors. Including this round, Gett raised USD 750 million, with investors including VW, Access, and its founder Len Blavatnik, Kreos, MCI, and more, and its last valuation was USD 1.5 billion, pegged to a USD 200 million fundraise in May 2019

- In July 2020, Lyft launched The Lyft pass enabled a means to allow organizations to cover the costs of rides for their people—from employees and essential workers to customers, guests, and patients—while prioritizing safety, convenience, and flexibility.

- In February 2020, OLA expanded its services to London. The Ola platform would be fully operational with three categories: Comfort, Comfort XL, and Exec ride classes. Ola had over 25,000 drivers registered on the platform, bringing scale to its London offering immediately.

- In February 2020, Grab raised an investment of over USD 850 million from Japanese investors, including Mitsubishi UFJ Financial Group Inc. and TIS Inc. This investment will be used to create accessible and affordable financial services for Southeast Asia to boost financial inclusion in the region.

Frequently Asked Questions (FAQ):

How big is the ride sharing market?

USD 85.8 billion in 2021 to USD 185.1 billion by 2026 at a CAGR of 16.6% over the forecast period for ride sharing market.

Which service type is currently leading the ride sharing market?

E-hailing is leading service type in the ride sharing market.

Many companies are operating in the ride sharing market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

Didi Chuxing (China), Uber Technologies, Inc (US), Gett (Israel), Lyft, Inc (US), and Grab (Singapore). These companies adopted new product launches and expansion strategies to gain traction in the ride sharing market.

How is the demand for ride sharing varies by region?

The market in the Asia Pacific region with presence of China the largest ride sharing market in the world is projected to be the largest. Ride sharing can help address various issues such as traffic congestion, air pollution, and greenhouse gas emissions, which have risen due to the rise in urban population. Also, the region is home to some of the dominant players in this market, such as Didi, Go-Jek, Grab, and Ola.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 RIDE SHARING MARKET DEFINITION

TABLE 1 MARKET DEFINITIONS

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED IN THE STUDY

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

FIGURE 2 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources to estimate ride sharing market

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY STAKEHOLDER, DESIGNATION, & REGION

2.1.2.1 List of primary participants

2.2 RIDE SHARING MARKET ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE: BOTTOM-UP APPROACH (SERVICE TYPE AND REGION)

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE: TOP-DOWN APPROACH (VEHICLE TYPE)

FIGURE 7 MARKET SIZE: TOP-DOWN APPROACH (DATA SERVICE)

2.2.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.4.1 GLOBAL ASSUMPTIONS

TABLE 2 GLOBAL ASSUMPTIONS

2.4.2 SEGMENT ASSUMPTIONS

TABLE 3 SEGMENT ASSUMPTIONS

2.5 FACTOR ANALYSIS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

3.1 INTRODUCTION

3.1.1 PRE- VS POST-COVID-19 SCENARIO

FIGURE 9 PRE- & POST-COVID-19 SCENARIO: RIDE SHARING MARKET SIZE, 2018–2026 (USD MILLION)

TABLE 4 MARKET SIZE: PRE- VS. POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

3.2 REPORT SUMMARY

FIGURE 10 MARKET SIZE, BY SERVICE TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 11 MARKET, YOY GROWTH, BY COUNTRY, 2020

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ELECTRIC VEHICLE RIDE SHARING SPACE

FIGURE 12 RISING POPULATION & URBANIZATION TO DRIVE THE RIDE SHARING MARKET

4.2 MARKET, BY SERVICE TYPE

FIGURE 13 E-HAILING ESTIMATED TO LEAD THE GLOBAL MARKET IN 2021 (USD MILLION)

4.3 MARKET, BY VEHICLE TYPE

FIGURE 14 ELECTRIC VEHICLES ARE PROJECTED TO SHOWCASE THE FASTEST GROWTH AMONG RIDE SHARING CARS OVER THE FORECAST PERIOD

4.4 CAR SHARING MARKET, BY TYPE

FIGURE 15 P2P CAR SHARING TO DOMINATE THE CAR SHARING MARKET IN 2021

4.5 MARKET, BY DATA SERVICE

FIGURE 16 NAVIGATION TO ACCOUNT FOR THE MAJOR SHARE IN THE RIDE SHARING DATA SERVICES MARKET

4.6 MICRO-MOBILITY MARKET, BY VEHICLE TYPE

FIGURE 17 BIKE/BICYCLE TO LEAD THE MICRO-MOBILITY VEHICLE MARKET

4.7 MARKET, BY DISTANCE

FIGURE 18 SHORT DISTANCE TO ACCOUNT FOR THE DOMINANT SHARE BY 2026

4.8 MARKET, BY REGION

FIGURE 19 ASIA PACIFIC TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET IN 2021

5 RIDE SHARING MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 RIDE SHARING : MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in urbanization and internet and smartphone penetration

5.2.1.1.1 Increase in Urbanization

FIGURE 21 URBANIZATION RATE, 2019–2020

5.2.1.1.2 Increase in usage of Smartphones and growing internet penetration

FIGURE 22 SMARTPHONE PENETRATION IN MAJOR COUNTRIES, 2018–2019

5.2.1.2 Increase in costs associated with vehicle ownership

FIGURE 23 AVERAGE COST PER CAR, 2015 VS 2020 (CENTS PER MILE)

TABLE 5 US: SHARE OF LIGHT-DUTY VEHICLE PURCHASE BY AGE GROUP, 2000-2015

5.2.2 RESTRAINTS

5.2.2.1 Varying Transport policies of different countries and resistance from traditional transport services

5.2.3 OPPORTUNITIES

5.2.3.1 New business models to cover losses in ride sharing business

5.2.3.1.1 Food & Freight Delivery

5.2.3.1.2 Micro-mobility

TABLE 6 MODE OF TRANSPORTATION VARIES BY DISTANCE, MILES

5.2.3.2 Emergence of autonomous ride sharing

5.2.4 CHALLENGES

5.2.4.1 COVID-19 impact on profitability & sustainability of transport network companies

FIGURE 24 REVENUES, BY KEY SERVICE PROVIDERS, 2018–2020 (USD BILLION)

5.3 MARKET: AN ECOSYSTEM

FIGURE 25 MARKET ECOSYSTEM

5.4 MARKET ECOSYSTEM

TABLE 7 ROLE OF COMPANIES IN THE MARKET ECOSYSTEM

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 THE BARGAINING POWER OF BUYERS IS HIGH DUE TO THE PRESENCE OF LOW-COST REGIONAL PLAYERS

5.5.1 INTENSITY OF COMPETITIVE RIVALRY

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 THREAT OF NEW ENTRANTS

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 27 SUPPLY CHAIN ANALYSIS: MARKET

5.7 CASE STUDIES

5.8 PATENT ANALYSIS

5.9 MARKET SCENARIO

FIGURE 28 MARKET SCENARIO, 2018–2026 (USD MILLION)

5.9.1 REALISTIC SCENARIO

TABLE 9 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

5.9.2 LOW IMPACT SCENARIO

TABLE 10 LOW-IMPACT SCENARIO: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

5.9.3 HIGH IMPACT SCENARIO

TABLE 11 HIGH-IMPACT SCENARIO: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

5.10 TECHNOLOGY ANALYSIS

5.10.1 IMPACT OF VEHICLE AUTOMATION ON RIDE HAILING

TABLE 12 LEVELS OF AUTOMATION

5.10.1.1 Impact of automation L2 on ride hailing

5.10.1.2 Impact of automation L3 on ride hailing

5.10.1.3 Impact of automation L4/L5 on ride hailing

TABLE 13 AUTONOMOUS CARS FOR RIDE HAILING: NEW PRODUCT/SERVICE DEVELOPMENTS

TABLE 14 AUTONOMOUS CARS FOR RIDE HAILING: DEALS

5.10.2 AUTONOMOUS VEHICLES AND VEHICLE CONNECTIVITY

5.10.2.1 Vehicle-to-cloud (V2C)

5.10.2.2 Vehicle-to-pedestrian (V2P)

5.10.2.3 Vehicle-to-infrastructure (V2I)

5.10.2.4 Vehicle-to-vehicle (V2V)

5.11 REGULATORY ANALYSIS

6 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 72)

6.1 ASIA PACIFIC TO LEAD THE GLOBAL RIDE SHARING MARKET

6.2 MICRO-MOBILITY: KEY FOCUS AREAS

6.3 CONCLUSION

7 RIDE SHARING MARKET, BY SERVICE TYPE (Page No. - 74)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.1.3 INDUSTRY INSIGHTS

FIGURE 29 GLOBAL RIDE SHARING MARKET SIZE, BY SERVICE TYPE, 2021 VS 2026 (USD MILLION)

TABLE 15 GLOBAL MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 16 GLOBAL MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

7.2 E-HAILING

TABLE 17 TOP E-HAILING SERVICE PROVIDERS

7.2.1 E-HAILING TO LEAD DUE TO EASE OF BOOKING AND INCREASING TRAFFIC CONGESTION

TABLE 18 E-HAILING MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 19 E-HAILING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 CAR SHARING

TABLE 20 TOP CAR SHARING SERVICE PROVIDERS

7.3.1 COST-EFFECTIVENESS TO FUEL THE CAR SHARING MARKET

TABLE 21 CAR SHARING MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 22 CAR SHARING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 CAR RENTAL

TABLE 23 TOP CAR RENTAL SERVICE PROVIDERS

7.4.1 CAR RENTAL TO GROW AS IT ELIMINATES THE BURDEN OF OWNERSHIP COST OF VEHICLES

TABLE 24 CAR RENTAL MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 25 CAR RENTAL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 STATION-BASED MOBILITY

TABLE 26 TOP STATION-BASED SERVICE PROVIDERS

7.5.1 CONVENIENCE & COST-EFFECTIVENESS OF STATION-BASED MOBILITY TO DRIVE THE SERVICE DEMAND

TABLE 27 STATION-BASED MOBILITY MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 28 STATION-BASED MOBILITY MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 RIDE SHARING MARKET, BY DATA SERVICE (Page No. - 84)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 30 GLOBAL RIDE SHARING MARKET SIZE, BY DATA SERVICE, 2021 VS. 2026 (USD MILLION)

TABLE 29 GLOBAL MARKET SIZE, BY DATA SERVICE, 2018–2020 (USD MILLION)

TABLE 30 GLOBAL MARKET SIZE, BY DATA SERVICE, 2021–2026 (USD MILLION)

8.2 INFORMATION

8.2.1 GROWTH IN THE NUMBER OF SERVICE OFFERINGS BY RIDE SHARING COMPANIES TO FUEL THE INFORMATION SEGMENT

TABLE 31 RIDE SHARING INFORMATION SERVICES MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 32 RIDE SHARING INFORMATION SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 NAVIGATION

8.3.1 NAVIGATION WOULD BE THE MOST IMPERATIVE DATA SERVICE FOR RIDE SHARING SERVICE PROVIDERS

TABLE 33 RIDE SHARING NAVIGATION SERVICES MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 34 RIDE SHARING NAVIGATION SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 PAYMENT

8.4.1 INCREASE IN ADOPTION OF DIGITAL PAYMENT SYSTEMS IN THE MARKET

TABLE 35 RIDE SHARING PAYMENT SERVICES MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 36 RIDE SHARING PAYMENT SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.5 OTHER DATA SERVICES

TABLE 37 OTHER DATA SERVICES MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 38 OTHER DATA SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 RIDE SHARING MARKET, BY VEHICLE TYPE (Page No. - 92)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 31 GLOBAL MARKET SIZE, BY VEHICLE TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 39 GLOBAL MARKET SIZE, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 40 GLOBAL MARKET SIZE, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

9.2 INTERNAL COMBUSTION ENGINE (ICE) VEHICLE

9.2.1 ICE VEHICLES TO DOMINATE THE GLOBAL RIDE SHARING INDUSTRY

FIGURE 32 COMPARISON OF RUNNING COST PER MONTH ICE VS EV, 2020 (USD)

TABLE 41 ICE VEHICLE RIDE SHARING MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 42 ICE VEHICLE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 CNG/LPG VEHICLE

9.3.1 HIGH ADOPTION IN INDIA AND CHINA TO MAKE ASIA PACIFIC THE LARGEST CNG/LPG Market

TABLE 43 CNG/LPG VEHICLE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 44 CNG/LPG VEHICLE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 ELECTRIC VEHICLE

9.4.1 ELECTRIC VEHICLES TO CAPTURE A SIGNIFICANT SHARE OF ICE VEHICLE RIDE SHARING

TABLE 45 ELECTRIC VEHICLE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 46 ELECTRIC VEHICLE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 MICRO-MOBILITY

9.5.1 ASIA PACIFIC TO BE THE LARGEST MARKET FOR MICRO-MOBILITY

TABLE 47 MICRO-MOBILITY MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 48 MICRO-MOBILITY MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 MICRO-MOBILITY MARKET, BY VEHICLE TYPE (Page No. - 100)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 33 MICRO-MOBILITY MARKET SIZE, BY VEHICLE TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 49 MICRO-MOBILITY MARKET SIZE, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 50 MICRO-MOBILITY MARKET SIZE, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

10.2 BIKE/BICYCLE

10.2.1 ASIA PACIFIC TO DOMINATE THE BICYCLE SHARING MARKET OWING TO THE PRESENCE OF LEADERS SUCH AS OFO AND MOBIKE

TABLE 51 BIKE/BICYCLE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 52 BIKE/BICYCLE: MICRO-MOBILITY MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 SCOOTERS

10.3.1 HIGHER DEMAND FOR SCOOTERS FROM ASIAN COUNTRIES TO DRIVE SEGMENTAL GROWTH

TABLE 53 SCOOTER MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 54 SCOOTER MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 OTHER MICRO-MOBILITY VEHICLES

TABLE 55 OTHER MICRO-MOBILITY VEHICLES MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 56 OTHER MICRO-MOBILITY VEHICLES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 Market, BY DISTANCE (Page No. - 107)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 34 GLOBAL MARKET SIZE, BY DISTANCE, 2021 VS. 2026 (USD MILLION)

TABLE 57 GLOBAL MARKET SIZE, BY DISTANCE, 2018–2020 (USD MILLION)

TABLE 58 GLOBAL MARKET SIZE, BY DISTANCE, 2021–2026 (USD MILLION)

11.2 SHORT DISTANCE

11.2.1 E-HAILING AND STATION-BASED MOBILITY TO LEAD THE MARKET FOR SHORT-DISTANCE RIDE SHARING

TABLE 59 SHORT-DISTANCE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 60 SHORT-DISTANCE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3 LONG DISTANCE

11.3.1 CAR RENTALS TO DRIVE THE MARKET FOR LONG-DISTANCE RIDE SHARING

TABLE 61 LONG-DISTANCE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 62 LONG-DISTANCE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 CAR SHARING MARKET, BY TYPE (Page No. - 112)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 35 CAR SHARING MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 63 CAR SHARING MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 64 CAR SHARING MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.2 P2P CAR SHARING

TABLE 65 TOP PLAYERS OFFERING P2P CAR SHARING

12.2.1 P2P TO LEAD THE CAR SHARING MARKET WITH ADVANTAGES SUCH AS CONVENIENCE, AVAILABILITY, AND MONETARY SAVINGS

TABLE 66 P2P CAR SHARING MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 67 P2P CAR SHARING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.3 CORPORATE CAR SHARING

TABLE 68 TOP PLAYERS OFFERING CORPORATE CAR SHARING

12.3.1 CORPORATE CAR SHARING PEGGED TO GROW AS PEOPLE TRAVELING FOR BUSINESS PURPOSES ARE EASIER TO FIND

TABLE 69 CORPORATE CAR SHARING MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 70 CORPORATE CAR SHARING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13 MARKET, BY REGION (Page No. - 118)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

13.1.3 INDUSTRY INSIGHTS

FIGURE 36 GLOBAL MARKET SIZE, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 71 GLOBAL MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 72 GLOBAL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 73 GLOBAL MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 74 GLOBAL MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.2 ASIA PACIFIC

TABLE 75 ASIA PACIFIC: TOP PLAYERS

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

13.2.1 CHINA

13.2.1.1 China to be the largest in the overall MARKET with the presence of the largest player, Didi

TABLE 78 CHINA: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 79 CHINA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.2.2 INDIA

13.2.2.1 India to be the fastest-growing market in Asia Pacific

TABLE 80 INDIA: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 81 INDIA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.2.3 JAPAN

13.2.3.1 Station-based mobility estimated witness fastest market growth in Japan

TABLE 82 JAPAN: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 83 JAPAN: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.2.4 SINGAPORE

13.2.4.1 Singapore: The third-largest market for ride sharing in Asia Pacific owing to the presence of leading players such as Grab

TABLE 84 SINGAPORE: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 85 SINGAPORE: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.2.5 INDONESIA

13.2.5.1 Indonesia estimated to be the second-largest market for ride sharing in Asia Pacific

TABLE 86 INDONESIA: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 87 INDONESIA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.2.6 AUSTRALIA

13.2.6.1 Car sharing is estimated to experience the fastest growth in the Australian MARKET

TABLE 88 AUSTRALIA: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 89 AUSTRALIA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3 EUROPE

TABLE 90 EUROPE: TOP PLAYERS

FIGURE 38 EUROPE: MARKET SIZE, BY COUNTRY, 2021 VS. 2026 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 92 EUROPE:MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

13.3.1 UK

13.3.1.1 UK to be the largest market for e-hailing in Europe

TABLE 93 UK: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 94 UK: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.2 GERMANY

13.3.2.1 Car sharing to be the largest market, following e-hailing in Germany

TABLE 95 GERMANY: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 96 GERMANY: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 E-hailing to be the largest market for ride sharing in France

TABLE 97 FRANCE: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 98 FRANCE: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.4 ITALY

13.3.4.1 Station-based mobility to witness highest CAGR for ride sharing in Italy

TABLE 99 ITALY: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 100 ITALY: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.5 RUSSIA

13.3.5.1 Station-based mobility to register highest growth rate in ride sharing in Russia

TABLE 101 RUSSIA: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 102 RUSSIA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.6 SPAIN

13.3.6.1 E-hailing to be the largest in the Spainses MARKET

TABLE 103 SPAIN: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 104 SPAIN: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.7 TURKEY

13.3.7.1 Turkey to be the fastest-growing market for ride sharing in Europe

TABLE 105 TURKEY: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 106 TURKEY: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.8 NETHERLANDS

13.3.8.1 Station-based mobility has the great potential market in the Netherlands

TABLE 107 NETHERLANDS: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 108 NETHERLANDS: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.4 NORTH AMERICA

TABLE 109 NORTH AMERICA: TOP PLAYERS

TABLE 110 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

13.4.1 US

13.4.1.1 The US to be the second-largest in the global ride sharing market, owing to the presence of Uber and Lyft

TABLE 112 US: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 113 US: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.4.2 CANADA

13.4.2.1 Car sharing to experience the fastest growth in Canada

TABLE 114 CANADA: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 115 CANADA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.4.3 MEXICO

13.4.3.1 Mexico to be the fastest-growing country-level market in North America

TABLE 116 MEXICO: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 117 MEXICO: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.5 REST OF THE WORLD (ROW)

TABLE 118 ROW: TOP PLAYERS

FIGURE 40 ROW: GLOBAL RIDE SHARINGMARKET SIZE, BY COUNTRY, 2021 VS. 2026 (USD MILLION)

TABLE 119 ROW: GLOBAL MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 120 ROW: GLOBAL MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

13.5.1 BRAZIL

13.5.1.1 Car sharing to be the second-largest market by 2026, subsequent to e-hailing

TABLE 121 BRAZIL: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 122 BRAZIL: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.5.2 UAE

13.5.2.1 E-hailing to dominate the UAE ride sharing market

TABLE 123 UAE: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 124 UAE: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.5.3 SOUTH AFRICA

13.5.3.1 South Africa to be the fastest-growing country in the RoW region

TABLE 125 SOUTH AFRICA: MARKET SIZE, BY SERVICE TYPE, 2018–2020 (USD MILLION)

TABLE 126 SOUTH AFRICA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 147)

14.1 OVERVIEW

14.2 RIDE SHARING MARKET SHARE ANALYSIS, 2020

TABLE 127 MARKET SHARE ANALYSIS, 2020

FIGURE 41 MARKET SHARE, 2020

14.3 COMPANY EVALUATION QUADRANT: E-HAILING, CAR RENTAL, AND CAR SHARING SERVICE PROVIDERS

14.3.1 STARS

14.3.2 EMERGING LEADERS

14.3.3 PERVASIVE PLAYERS

14.3.4 PARTICIPANTS

TABLE 128 MARKET: COMPANY PRODUCT FOOTPRINT, 2020

TABLE 129 MARKET: VEHICLE TYPE FOOTPRINT, 2020

TABLE 130 MARKET: COMPANY REGION FOOTPRINT, 2020

FIGURE 42 COMPETITIVE EVALUATION MATRIX, E-HAILING, CAR RENTAL, AND CAR SHARING SERVICE PROVIDERS, 2020

FIGURE 43 DETAILS ON KEY DEVELOPMENTS BY LEADING PLAYERS

14.4 COMPETITIVE SCENARIO

14.4.1 NEW PRODUCT/SERVICE LAUNCHES

TABLE 131 NEW PRODUCT/SERVICE LAUNCHES, 2018–2021

14.4.2 DEALS

TABLE 132 DEALS, 2018–2021

14.4.3 OTHERS

TABLE 133 OTHERS, 2018–2021

14.5 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018–2021

FIGURE 44 COMPANIES ADOPTED NEW PRODUCT/SERVICE DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2018–2021

14.6 COMPANY EVALUATION QUADRANT: MICRO-MOBILITY SERVICE PROVIDERS

14.6.1 STARS

14.6.2 EMERGING LEADERS

14.6.3 PERVASIVE PLAYERS

14.6.4 PARTICIPANTS

FIGURE 45 COMPETITIVE EVALUATION MATRIX, MICRO-MOBILITY SERVICE PROVIDERS, 2020

15 COMPANY PROFILES (Page No. - 167)

(Business overview, Products/Services offered, Recent developments & MnM View)*

15.1 KEY PLAYERS

15.1.1 DIDI CHUXING (DIDI)

TABLE 134 DIDI: BUSINESS OVERVIEW

TABLE 135 DIDI: PRODUCTS/SERVICES OFFERED

TABLE 136 DIDI: NEW PRODUCT/SERVICE DEVELOPMENTS

TABLE 137 DIDI: DEALS

TABLE 138 DIDI: OTHER DEVELOPMENTS

15.1.2 UBER TECHNOLOGIES, INC. (UBER)

TABLE 139 UBER: BUSINESS OVERVIEW

FIGURE 46 UBER: COMPANY SNAPSHOT

TABLE 140 UBER: PRODUCTS/SERVICES OFFERED

TABLE 141 UBER: NEW PRODUCT/SERVICE DEVELOPMENTS

TABLE 142 UBER: DEALS

TABLE 143 UBER: OTHER DEVELOPMENTS

15.1.3 GETT

TABLE 144 GETT: BUSINESS OVERVIEW

TABLE 145 GETT: PRODUCTS/SERVICES OFFERED

TABLE 146 GETT: OTHER DEVELOPMENT

15.1.4 LYFT, INC (LYFT)

TABLE 147 LYFT: BUSINESS OVERVIEW

FIGURE 47 LYFT: COMPANY SNAPSHOT

TABLE 148 LYFT: PRODUCTS/SERVICES OFFERED

TABLE 149 LYFT: NEW PRODUCT/SERVICE DEVELOPMENTS

TABLE 150 LYFT: DEALS

15.1.5 GRAB

TABLE 151 GRAB: BUSINESS OVERVIEW

TABLE 152 GRAB: PRODUCTS/SERVICES OFFERED

TABLE 153 GRAB: NEW PRODUCT/SERVICE DEVELOPMENTS

TABLE 154 GRAB: DEALS

TABLE 155 GRAB: OTHER DEVELOPMENTS

15.1.6 ANI TECHNOLOGIES PVT. LTD (OLA)

TABLE 156 OLA: BUSINESS OVERVIEW

TABLE 157 OLA: PRODUCTS/SERVICES OFFERED

TABLE 158 OLA: NEW PRODUCT/SERVICE DEVELOPMENTS

TABLE 159 OLA: DEALS

TABLE 160 OLA: OTHER DEVELOPMENTS

15.1.7 BLABLACAR

TABLE 161 BLABLACAR: BUSINESS OVERVIEW

TABLE 162 BLABLACAR: PRODUCTS/SERVICES OFFERED

TABLE 163 BLABLACAR: NEW PRODUCT/SERVICE DEVELOPMENTS

TABLE 164 BLABLACAR: DEALS

TABLE 165 BLABLACAR: OTHER DEVELOPMENTS

15.1.8 INTEL

TABLE 166 INTEL: BUSINESS OVERVIEW

FIGURE 48 INTEL: COMPANY SNAPSHOT

TABLE 167 INTEL: PRODUCTS/SERVICES OFFERED

TABLE 168 INTEL: NEW PRODUCT/SERVICE DEVELOPMENTS

TABLE 169 INTEL: DEALS

15.1.9 TOMTOM INTERNATIONAL BV

TABLE 170 TOMTOM INTERNATIONAL BV: BUSINESS OVERVIEW

FIGURE 49 TOMTOM INTERNATIONAL BV: COMPANY SNAPSHOT

TABLE 171 TOMTOM INTERNATIONAL BV: PRODUCTS/SERVICES OFFERED

TABLE 172 TOMTOM INTERNATIONAL BV: NEW PRODUCT/SERVICE DEVELOPMENTS

TABLE 173 TOMTOM INTERNATIONAL BV: DEALS

15.1.10 APTIV

TABLE 174 APTIV: BUSINESS OVERVIEW

FIGURE 50 APTIV: COMPANY SNAPSHOT

TABLE 175 APTIV: PRODUCTS/SERVICES OFFERED

TABLE 176 APTIV: DEALS

15.1.11 DENSO CORPORATION

TABLE 177 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 51 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 178 DENSO CORPORATION: PRODUCTS/SERVICES OFFERED

TABLE 179 DENSO CORPORATION: DEALS

TABLE 180 DENSO CORPORATION: OTHER DEVELOPMENTS

*Details on Business overview, Products/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15.2 OTHER PLAYERS

15.2.1 IBM

TABLE 181 IBM: BUSINESS OVERVIEW

15.2.2 FORD

TABLE 182 FORD: BUSINESS OVERVIEW

15.2.3 GENERAL MOTORS

TABLE 183 GENERAL MOTORS: BUSINESS OVERVIEW

15.2.4 WAYMO

TABLE 184 WAYMO: BUSINESS OVERVIEW

15.2.5 DAIMLER

TABLE 185 DIAMLER: BUSINESS OVERVIEW

15.2.6 CAR2GO

TABLE 186 CAR2GO: BUSINESS OVERVIEW

15.2.7 BMW

TABLE 187 BMW: BUSINESS OVERVIEW

15.2.8 BOSCH

TABLE 188 BOSCH: BUSINESS OVERVIEW

15.2.9 CABIFY

TABLE 189 CABIFY: BUSINESS OVERVIEW

15.2.10 BOLT

TABLE 190 BOLT: BUSINESS OVERVIEW

15.2.11 TOYOTA

TABLE 191 TOYOTA: BUSINESS OVERVIEW

15.2.12 GOGET

TABLE 192 GOGET: BUSINESS OVERVIEW

15.2.13 VIA TRANSPORTATION, INC.

TABLE 193 VIA TRANSPORTATION, INC.: BUSINESS OVERVIEW

15.2.14 EASY TAXI

TABLE 194 EASY TAXI: BUSINESS OVERVIEW

16 APPENDIX (Page No. - 211)

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.4.1 RIDE SHARING MARKET, BY VEHICLE TYPE (KEY COUNTRIES)

16.4.1.1 Electric vehicle mobility

16.4.1.2 CNG/LPG vehicle

16.4.1.3 ICE vehicle mobility

16.4.1.4 Micro-mobility

16.4.2 RIDE SHARING MARKET, BY CITY

16.4.2.1 New York, NY, US

16.4.2.2 Los Angeles, CA, US

16.4.2.3 London, UK

16.4.2.4 Berlin, Germany

16.4.2.5 Madrid, Spain

16.4.2.6 Dubai, UAE

16.4.2.7 Toronto, Canada

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

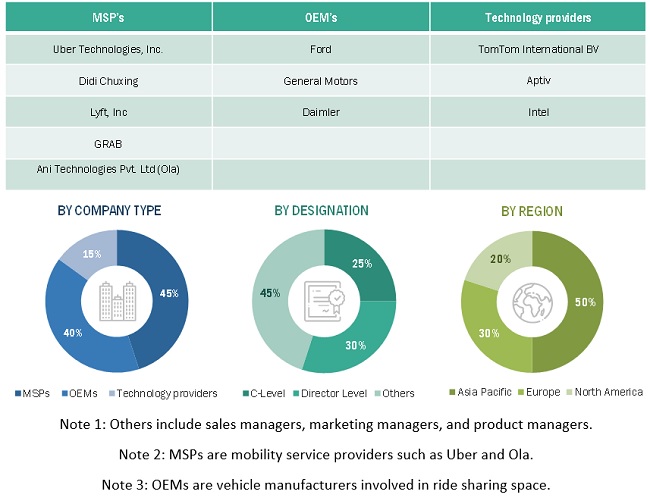

The study involves four main activities to estimate the current size of the ride sharing market. Exhaustive secondary research was done to collect information on the market, such as ride sharing service type and vehicle types. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered under this study. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study include The International Council on Clean Transportation (ICCT), Country-wise & regional automobile manufacturers’ association, US National Highway Traffic Safety Administration (NHTSA), China Center for Urban Development (CCUD); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. The secondary data was collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the ride sharing market scenario through secondary research. Several primary interviews were conducted with market experts from both the MSPs (mobility service providers), OEMs (vehicle manufacturers involved in ride sharing space) across three major regions, namely, North America, Europe, and Asia Pacific. Approximately 80% and 20% of the primary interviews were conducted from the MSPs and OEMs participants, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration strived, to provide a holistic viewpoint in reports while canvassing primaries.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, has led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of this market. The market size, by value, was derived by identifying the companies having 90%–95% (by value) presence in the ride sharing business in that country through secondary research and validated through primaries. The revenue of each company was estimated and gathered wherever data was available. In some cases, the booked value of the ride sharing company is calculated with the help of the daily or monthly average number of rides multiplied by the average cost of the ride. The addition of booked value/revenue of major players of the country gives the ride sharing market of that country. The penetration of each service type (e-hailing, car sharing, car rental, and station-based mobility) at the country level has been derived from secondary sources and validated through primaries. The penetration of each service type was multiplied by the country-level market to get this market value (USD million), by service type, for each country.

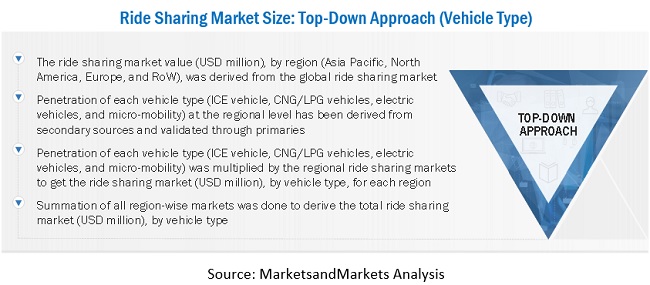

The top-down approach was used to estimate and validate the market by vehicle type in terms of value. The global market value (USD million), by region (Asia Pacific, North America, Europe, and RoW), was derived from the global market. The penetration of each vehicle type (ICE vehicle, CNG/LPG vehicles, electric vehicles, and micro-mobility) at the regional level has been derived from secondary sources and validated through primaries. The penetration of each vehicle type was multiplied by the regional market to get the ride sharing market (USD million), by vehicle type, for each region. A summation of all region-wise markets was done to derive the total ride sharing market (USD million) by vehicle type.

To know about the assumptions considered for the study, Request for Free Sample Report

Report Objectives

- To define, describe, and forecast the size of the ride sharing market in terms of value:

- By service type (e-hailing, car sharing, station-based mobility, and car rental)

- Car sharing market, by type (P2P car sharing and corporate car sharing)

- By vehicle type (ICE vehicle, electric vehicle, CNG/LPG vehicle, and micro-mobility vehicle)

- Micro-mobility market, by vehicle type (bike/bicycle, scooter, and other micro-mobility vehicles)

- By data service (navigation, information service, payment, and other data services)

- By distance (short distance and long distance)

- By region (Asia Pacific, North America, Europe, and the Rest of the World)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market share of leading players in the ride sharing market and evaluate competitive leadership mapping

- To strategically analyze the market with Porter’s five forces analysis, case studies, patent analysis, technology analysis, regulatory analysis, and COVID-19 impact analysis

- To analyze recent developments, including mergers & acquisitions, new product launches, expansions, and other activities, undertaken by key industry participants in the ride sharing market

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ride Sharing Market

Is the South American region covered in the Ride Sharing Market report?

Ride sharing market gives forecast upto 2026 which is good enough, We would like to know New Revenue Sources for Ride Sharing Industry?

Report includes table of contents of the Ride-Sharing market along with the COVID 19 impact analysis annexure report details. The report provides historical market size and growth forecast of the market at a regional and country level and further studies the market by key differentiator of MnM offerings in this analysis: 1. Market revenues for Segments By Service type, By vehicle connectivity, By Data telecommunication By Data Service and By Vehicle type is provided at a global level and further broken down at a regional level. 2. At a country level, market overview and market revenue break down is provided for different services 3. Competition landscape – We have mapped 11 Industry players who are contributing to this market or playing a vital role in Ride sharing market in detail and snippet of 16-17 additional players (region wise) is provided.

MarketsandMarkets have Ride Sharing Market size in terms of value (in USD) at a country level for Brazil. The report also has the market size in Brazil by type of service in the ride sharing market i.e., E-Hailing, Car Sharing, Station Based Mobility, Car Rental. The report also has the forecast available till 2025.We also have a study published on the Mobility as a Market with the market size forecast available till 2030. In this report we can provide you the market size (in USD) at a country level for the MaaS by service type: Ride Hailing, Car Sharing, Micro mobility, Bus Sharing, Trains.

We would like to know about the ride hailing /ride sharing industry statistics, market share and size in Singapore .

we are conducting an international market research about the ride hailing market in the US and therefore would highly appreciate to get a sample of the study. Thank you very much in advance!

can you provide the more detailed information in terms of the value of the micro-mobility segment for ride sharing market

I am interested in using ride share market data through differing means of data visualization for a class I am taking in pursuit of a masters in engineering management.

I am doing a thesis about ride-hailing in Indonesia, and need verified data, so hopefully you could help me as well, thank you

Hello I am currently studying my MBA at CASS and am trying to research the ride-sharing market and would appreciate the sample of this report. Thank you

Determining the size of the demand for peer to peer and owner operated car sharing when considering ownership changing radically over the next 5 years - to such an extent that current owners will not renew their cars, buy sign up to sharing platforms in order to get access to a much wider range of vehicles to suit their varying needs and desires. If 5 of global owners did this, and each owner had 10 trips per year (Low case) - the demand for shared cars would be huge. What do you think ?

I need market data for the Ride Sharing (Carpooling) industry specifically for South Africa and Sub-Sahara Africa.

Australia is seeing substantial growth in ride-sharing and I am interested in the impact on our cities and society.

Hi, I might need some market research data on ride-hailing for my academic research. Thanks

Hello, please add also taxi.eu its among the biggest pan-European taxi-app working in Germany, Switzerland, Austria and so on.

Interested in Ride sharing market forecast from 2022 to 2027 for India.