Mobility as a Service Market by Service (Ride-Hailing, Car Sharing, micro-mobility, Bus, Train), Solution, Transportation, Vehicle, OS, Business Model, Payment (Subscription, PAYG), Commute (Daily, Last Mile, Occasional) Region - Global Forecast to 2030

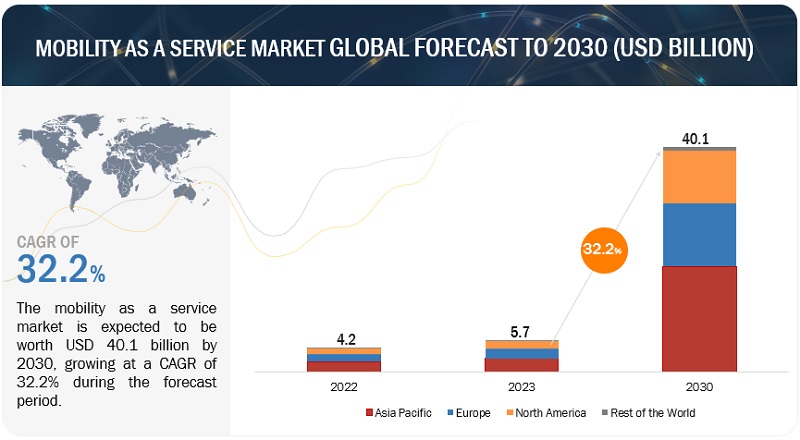

[218 Pages Report] The global mobility as a service market size is valued at USD 5.7 billion in 2023 and is expected to reach USD 40.1 billion by 2030, at a CAGR of 32.2% over the forecast period. With rapid urbanization, congestion and traffic-related challenges are increasing. MaaS offers a solution by providing users with multimodal transportation options, which in turn reduces the number of private vehicles on the road, and alleviates traffic congestion. In most cases, these services are flexible and highly customized per independent user. Faster internet connectivity, falling vehicle ownership, and the need to reduce traffic congestion and vehicular emissions will fuel the demand for seamless MaaS applications for end-to-end multimodal transport solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Mobility as a Service Market Dynamics

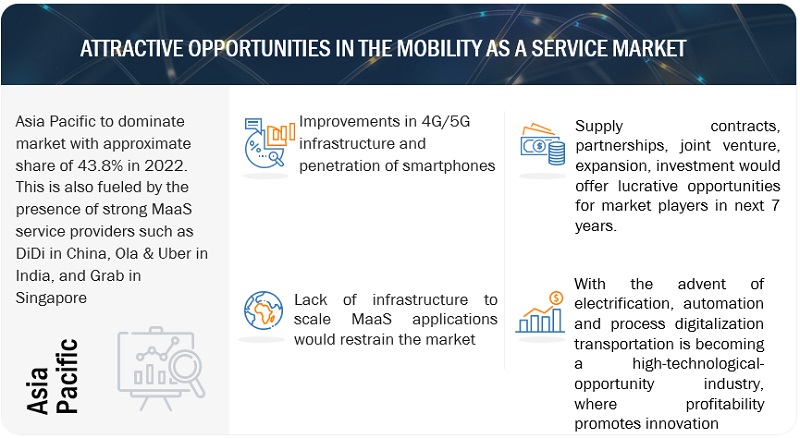

Driver: Improvements in 4G/5G infrastructure and penetration of smartphones

As an internet-enabled service, connectivity is a basic requirement for MaaS. According to the International Telecommunication Union, by the end of 2023, an estimated 64.4% of the global population, or 5.16 billion people, will be using the Internet. Smartphones are vital infrastructure for new mobility models since mobility services like ride-sharing run on smartphones and require good connectivity. Over the last few years, smartphone use has increased significantly across the world, with developed countries accounting for around 80% of smartphone ownership.

5G network and better telecom infrastructure are expected to pave the way for a revolution in cities and in inter-city mobility. Wireless communication technologies (such as DSRC) can help improve traffic safety and increase traffic flow throughput. With onboard units (OBU), connected and automated vehicles (CAVs) can reduce the driver's perception-reaction time and improve safety. Vehicular communication can enable CAVs to collect information from other vehicles and roadside units (RSUs) and coordinate with other CAVs to control and manage the platoon, such as merging, splitting, and maintaining a particular gap. The ongoing development of OBU, RSU, etc., enables and enhances the MaaS of vehicle platooning and would require better and faster telecom infrastructure. Hence, the increasing penetration of smartphones with efficient telecom infrastructure will not only assist vehicle platooning for MaaS but also assist in seamless navigation and payment services through MaaS mobile applications

Restraint: Lack of infrastructure to scale MaaS applications

For MaaS to work, a user must be able to access all available transport modalities on one application. This application needs to host a variety of mobility operators and transport companies with their unique pricing and conditions of service. Mobility as a service, at least in its present form, has little commercial sustainability and will probably not scale due to the complex software involved and difficulties in managing data collected and settling financials. While some operators have the capacity to develop their own software, many cannot. The differences in approach to the software involved, depending on the objectives of the operator, create a disjointed experience for the user and may lead to legal and ethical questions being raised about the handling of data. MaaS pilots around the world have not yet achieved the full set of goals foundational to the idea of MaaS, despite the enthusiasm of municipalities and transport professionals, as well as the proliferation of user apps. Aggregation of mobility services offers journey planning, fare determination, fare payment, and ticketing in one service and subsequently splits the revenue generated by the platform between the transportation providers on the platform.

To be attractive and draw customers away from the car-ownership model, MaaS players must achieve a range of services and options for users at scale, nudging them where necessary to make optimal choices for their personal needs. Stakeholders must thus have a trustworthy partnership with public transport operators, who have much to lose should their assets become under-utilized.

The increased complexity of the software used in developing the application, the lack of a regulatory structure to facilitate the integration of public transport authorities with private transportation providers, and poor infrastructure for payment settlement and ticketing solutions restrict the ability of a MaaS platform to scale; this is likely to stunt the growth of the mobility-as-a-service market

Opportunities: Inclusion of on-demand ferry and freight services

Urban transportation systems are usually run by state-owned mobility as a service companies, while intercity transport is mostly run by private entities. Thus, pricing for urban transportation is not flexible in general, while ferries (and airlines as well) adopt flexible pricing schemes based on modern revenue-management techniques. With the advent of electrification, automation, and process digitalization, transportation is becoming a high-technological-opportunity industry where profitability promotes innovation. These principles easily apply to MaaS and, more specifically, MaaS in the ferry industry.

In the urban context, mobility is largely based on transport mode ownership. Hence, MaaS aspires to transform the existing asset ownership model into a subscription-based mobility model. However, in the case of sea passenger transportation, very few people own a vehicle (i.e., a ship/catamaran/yacht, etc). Consequently, for sea trips, the main objective of MaaS is to fill the need for an integrated system that offers different transport solutions together and consolidates trip planning and ticketing for every part of the total trip.

MaaS application providers can extend their services in the commercial freight segment as well. Their capability to connect users to on-demand transportation allows them to help supply chain players with their load management. Using MaaS applications can benefit supply chain stakeholders by reducing their overall cost and helping them lower supply chain emissions.

MaaS is also used in Freight Brokering, in which shippers and carriers connect on-demand to ship-specific loads. This involves the integration of different transport modes and services to optimize the movement of goods, making freight logistics more efficient, cost-effective, and sustainable. Existing players in this area include Transfix, Convoy, and Uber Freight, which provide apps that serve as an aggregated marketplace.

Thus, there is a huge opportunity for MaaS application providers to integrate on-demand ferry and freight services into their service offerings to open up new revenue streams.

Challenges: Difficulty in integrating ticketing and payment systems

In order to accomplish complete implementation of MaaS it is important to integrate payment of all the transport modes used in a single app. Thus, the user can manage the entire transportation experience through the MaaS app instead of being redirected to another app or another external system to pay for the ticket. The involvement of different ticketing and payment gateways and the lack of an account-based system has proved to be inconvenient for users, deterring them from adopting MaaS applications.

Seamless partner settlements and financial management are important to encourage a critical mass of operators to participate in a single MaaS platform. The higher the number of transportation providers, the greater the appeal of the application for users.

Sometimes public transport systems have physical barriers and require a ticket validation for access. For validation by MaaS applications, such public transport systems must facilitate the scanning of smartphones. Due to the involvement of multiple stakeholders, such as the payment gateway, ticket verification structures, and financial settlement parties, MaaS application providers are facing logistical and regulatory challenges in integrating a seamless journey planning and ticketing experience for their users.

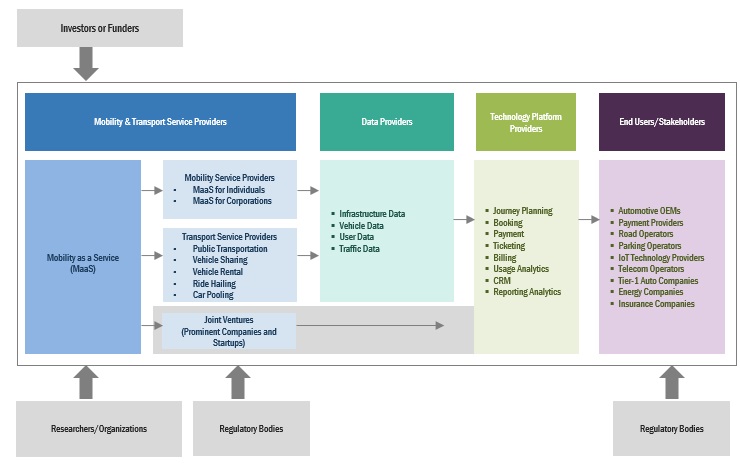

Mobility as a Service Market Ecosystem

B2B to dominate the revenue generation business model.

A business-to-business (B2B) model is one in which a business deals in commercial transactions with another business. B2B mobility sharing allows the sharing of mobility services with other businesses to reduce vehicle parking space and the number of fleets by enabling car-sharing services within an organization; this helps to lower traffic congestion and emission from vehicles. The utilization of B2B mobility services improves business processes and results in higher employee satisfaction with improved productivity of the workforce. Major service sector regions like the US and Europe thus have a dominant share in the segment. IoMob (Spain) is the first B2B player to develop and launch a MaaS solution that simultaneously offers intercity mobility travel coupled with intracity and micro-mobility services. For instance, for the Renfe project in Spain, IoMob integrated Renfe’s high-speed and suburban rail service between Madrid and Barcelona with a range of services such as taxis and ride-hailing (Cabify), bike sharing, and car sharing. Europe and North America are expected to drive the B2B business model in the market for mobility as a service, while the Rest of the World is projected to be the fastest-growing regional market. Europe and North America were estimated to account for approximately 71% of the market in 2021. Key players operating in the B2B mobility sharing market include Car2go (Germany), Lyft (US), Sixt (Germany), and Uber (US).

Technology Platforms solutions leads the mobility as a service market in terms of value.

Mobility as a Service (MaaS) technology platforms play a crucial role in enabling the seamless integration of various transportation services and modes into a single, user-friendly interface. The technology platform is basically an app that serves as an open platform for integrated mobility. The purpose of this platform is to facilitate the opening up, interoperability, and utilization of existing services to bring them together and make them accessible. The technology platforms segment in Europe was estimated to hold approximately 38% of the mobility technology market in 2022. The region is a major contributor to the MaaS sector because of the presence of prominent players such as Moovit (US), Citymapper (UK), and MaaS Global (Finland). Moovit relies on big data technology and released public transit trends during the pandemic, thus promoting the use of technology platforms to refine its services.

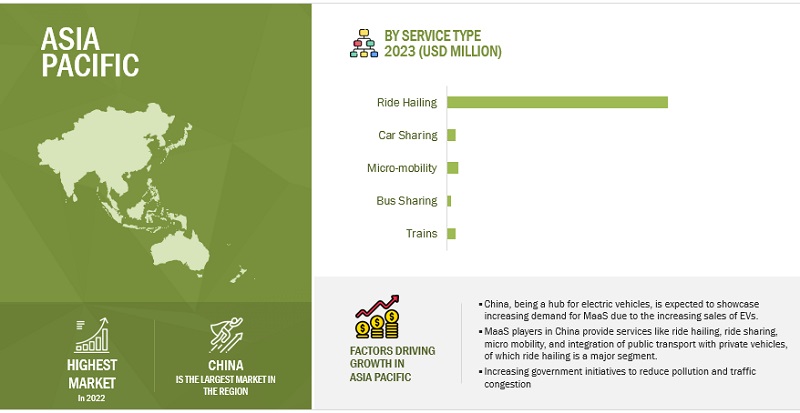

Asia Pacific region holds the largest market share in the mobility as a service market in terms of value.

Asia Pacific owing to its large population will hold a significant share of the MaaS market. The region is a growing market for mobility as a service, with China (a global hub for EVs) and Japan (an important automotive hub with a focus on autonomous vehicles) being the major countries driving growth. The presence of prominent ride-sharing providers, MaaS applications, and automotive OEMs such as Uber, Grab, Didi, Toyota, Hyundai, and Honda are expected to prompt product development and push automakers to adopt the technology in their models. A high population growth rate in the region, as well as increasing urbanization, have intensified the need for efficient transportation. Developing countries in the Asia Pacific, especially India, and Indonesia, are projected to experience significant growth in urban transportation, while most other countries are also shifting their focus to smart personal mobility to reduce travel time and congestion. China, being a hub for electric vehicles, is expected to showcase increasing demand for MaaS due to the increasing sales of EVs. The Asia Pacific mobility market is also expected to be driven by the emergence of MaaS in Singapore, Indonesia, and India.

Asia Pacific: Mobility as a Service Market

Key Market Players

The global mobility as a service market is led by established players, such as Moovit (Israel), MaaS Global (Finland), Citymapper (UK), FOD Mobility UK Ltd. (UK), and SkedGo (Australia), all of which adopted several strategies to gain traction in the market.

Scope of the Report

|

Report Attribute |

Details |

|

The base year for estimation |

2022 |

|

Forecast period |

2023 - 2030 |

|

Market Growth forecast |

USD 40.1 Billion by 2030 from USD 5.7 Billion in 2023 at 32.2% CAGR |

|

Companies |

|

|

Segments Covered |

By Service Type, By Business Model, By Solution Type, Transportation type, Vehicle Type, Application Type, Operating Systems, Propulsion Type, Payment type, Commute type |

|

Region |

Asia Pacific (China, Japan, Singapore, Indonesia, Australia, India), North America (US, Canada, Mexico), Europe (Germany, France, Finland, Spain, Netherlands, Italy, Russia, UK, Turkey), Rest of the world (Brazil, South Africa) |

The study segments mobility as a service market based on By Service Type, By Business Model, By Solution Type, Transportation type, Vehicle Type, Application Type, Operating Systems, Propulsion Type, Payment type, Commute type, and the region at the regional and global level.

By Service

- Ride-Hailing

- Car Sharing

- Micro-Mobility

- Bus Sharing

- Train Services

By Business Model

- Business-To-Business

- Business-To-Consumer

- Peer-To-Peer

By Solution type

- Technology Platforms

- Payment Engines

- Navigation Solutions

- Telecom Connectivity Providers

- Ticketing Solutions

- Insurance Services

By Transporation type

- Private

- Public

By Vehicle type

- Buses

- Four-Wheelers

- Micro-Mobility

- Trains

By Application type

- Personalized Application Services

- Journey Management

- Journey Planning

- Flexible Payments & Transactions

By Operating System

- Android

- iOS

- Others

By Propulsion Type

- ICE

- EV

- Hybrid electric

- CNG/LPG

By Payment Type

- Subscription

- Pay-as-you-go

By Commute Type

- Daily

- Last mile connectivity

- Occasional

By Region

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- Moovit, in November 2022, announced a new feature enabling commuters to decrease uncertainty and stress. The feature will allow Moovit users to follow their transit line’s movements along the map in real time for an additional layer of reliable information on route progress. Available for buses, trains, trams, subways, ferries, and even cable cars with GPS tracking, the feature will initially roll out in more than 220 cities across 38 countries.

- In October 2022, Cycling SDK by Citymapper helped integrate cycle routing and turn-by-turn navigation instantly, with just a few lines of code. SDK is designed to integrate seamlessly with the customer’s product and allows the configuration of colors, fonts, and icons to match the look and feel; it offers a choice of a range of features and details to match the use case.

- In October 2022, SkedGo announced its support for the Leicester Buses Partnership in the UK. This integration aims to provide travelers with personalized, door-to-door bus trip planning based on their preferences. Additionally, it serves as a platform to highlight and encourage the utilization of various local bus travel choices available in the area.

Frequently Asked Questions (FAQ):

What is the current size of the Mobility as a Service market?

Mobility as a Service market is projected to grow from USD 5.7 Billion in 2023 to USD 40.1 Billion by 2030, at a CAGR of 32.2% over the forecast period.

Who are the top key players in the Mobility as a Service market?

The global mobility as a service market is led by established players, such as Moovit (Israel), MaaS Global (Finland), Citymapper (UK), FOD Mobility UK Ltd. (UK), and SkedGo (Australia)

What are the trends in the Mobility as a Service market?

Increasing use of autonomous cars and electric vehicles

Use of big data to refine MaaS offerings

Inclusion of on-demand ferry and freight services.

Which are the most prominent factors driving the Mobility as a Service market?

Increasing smart city initiatives

Improvements in 4G/5G infrastructure and penetration of smartphones

Need to reduce CO2 emission.

What are the new opportunities in the mobility as a service market?

Increasing use of autonomous cars and electric vehicles

Use of big data to refine MaaS offerings

Inclusion of on-demand ferry and freight services

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing smart city initiatives- Improvements in 4G/5G infrastructure and penetration of smartphones- Need to reduce CO2 emissionsRESTRAINTS- Rising post-pandemic demand for car rentals/station-based mobility- Lack of infrastructure to scale MaaS applicationsOPPORTUNITIES- Increasing use of autonomous cars and electric vehicles- Use of big data to refine MaaS offerings- Inclusion of on-demand ferry and freight servicesCHALLENGES- Integration of public and private stakeholders- Limited connectivity in developing countries- Difficulty in integrating ticketing and payment systems

-

5.3 TRENDS/DISRUPTIONS IMPACTING MAAS MARKET

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 TECHNOLOGY ANALYSISMONTHLY SUBSCRIPTION PLANSIMPACT OF MULTIMODAL TRANSPORTATION ON MAASIMPACT OF AUTONOMOUS VEHICLES ON MAASFIRST MILE & LAST MILE SOLUTIONS

-

5.6 REGULATORY FRAMEWORK AND CHALLENGESMARKET ACCESS & INTEGRATION BARRIERSSALES CHANNEL RESTRICTIONS & PAYMENT INTEGRATIONUNDEFINED PRINCIPLES FOR DATA SHARING & ACCESS

- 5.7 AVERAGE JOURNEY COST

-

5.8 PATENT ANALYSIS

-

5.9 CASE STUDY ANALYSISMOBILLEOCONDUENT

-

5.10 KEY CONFERENCES AND EVENTS, 2023?2024BUYING CRITERIA

-

6.1 FOCUS ON SOUTHEAST ASIAN COUNTRIES TO ENSURE RAPID REVENUE GROWTH FOR MAAS PLAYERSIMPORTANT REGULATIONS AND ACCREDITATION FOR MAAS DEVELOPMENTUI DEVELOPERS SHOULD ENSURE BETTER INTEGRATION OF STAKEHOLDERSSERVICE PROVIDERS SHOULD PRIORITIZE PERSONALIZATION

- 6.2 CONCLUSION

-

7.1 INTRODUCTIONINDUSTRY INSIGHTS

-

7.2 RIDE HAILINGE-HAILING TO DRIVE DEMANDCAR SHARING- Presence of top service providers in Europe to boost marketMICROMOBILITY- Need for last mile connectivity to drive demandBUS SHARING- Growing use of bus rapid transit systems in Europe to boost segmentTRAIN SERVICES- Increasing network of high-speed trains to fuel segment growth

-

8.1 INTRODUCTIONINDUSTRY INSIGHTS

-

8.2 BUSINESS-TO-BUSINESSEUROPE AND NORTH AMERICA TO BE KEY MARKETS

-

8.3 BUSINESS-TO-CONSUMERASIA PACIFIC REGION TO DOMINATE MARKET

-

8.4 PEER-TO-PEERREST OF THE WORLD TO BE FASTEST-GROWING MARKET

-

9.1 INTRODUCTIONINDUSTRY INSIGHTS

-

9.2 TECHNOLOGY PLATFORMSBIG DATA, IOT, AND MOBILE TECHNOLOGIES TO DRIVE SEGMENT

-

9.3 PAYMENT ENGINESASIA PACIFIC TO LEAD SEGMENT THROUGH FORECAST PERIOD

-

9.4 NAVIGATION SOLUTIONSREAL-TIME DATA AND ROUTE PLANNING FEATURES TO BOOST DEMAND

-

9.5 TELECOM CONNECTIVITY PROVIDERS5G INFRASTRUCTURE IN ASIA PACIFIC TO BOOST MARKET

-

9.6 TICKETING SOLUTIONSINTEGRATED ELECTRONIC TICKETING TO DRIVE MARKET

-

9.7 INSURANCE SERVICESINCREASING INTEGRATION OF VEHICLES TO DRIVE SEGMENT

-

10.1 INTRODUCTIONINDUSTRY INSIGHTS

-

10.2 PRIVATEGROWING DEMAND FOR PERSONAL MOBILITY OPTIONS TO DRIVE SEGMENT

-

10.3 PUBLICHIGH COST OF VEHICLE OWNERSHIP TO INCREASE USE OF PUBLIC TRANSPORT

-

11.1 INTRODUCTIONINDUSTRY INSIGHTS

-

11.2 PERSONALIZED APPLICATION SERVICESMULTIPLE CUSTOMIZED FEATURES TO DRIVE SEGMENT GROWTH

-

11.3 JOURNEY MANAGEMENTEXPECTED TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

-

11.4 JOURNEY PLANNINGAVAILABILITY OF REAL-TIME DATA TO DRIVE SEGMENT

-

11.5 FLEXIBLE PAYMENTS & TRANSACTIONSUSER-FRIENDLY PAYMENT OPTIONS TO BOOST SEGMENT

-

12.1 INTRODUCTIONINDUSTRY INSIGHTS

-

12.2 BUSESRISING FUEL PRICES TO DRIVE USE OF BUSES

-

12.3 FOUR-WHEELERSRISING DEMAND FOR RIDE HAILING AND CAR SHARING TO BOOST SEGMENT

-

12.4 MICROMOBILITYSUITABILITY TO LAST MILE CONNECTIVITY TO DRIVE MARKET

-

12.5 TRAINSINVESTMENT IN MONORAILS AND METROS TO BOOST SEGMENT

-

13.1 INTRODUCTIONINDUSTRY INSIGHTS

-

13.2 ICEPHASING OUT OF FOSSIL FUELS TO REDUCE MARKET SHARE

-

13.3 EVHIGHER ENERGY EFFICIENCY TO DRIVE SEGMENT

-

13.4 PHEVEXPECTED TO EASE TRANSITION FROM ICE TO EV

-

14.1 INTRODUCTIONINDUSTRY INSIGHTS

-

14.2 ANDROIDSEGMENT TO DOMINATE GLOBAL MARKET THROUGH FORECAST PERIOD

-

14.3 IOSEXPECTED TO DOMINATE IN NORTH AMERICA THROUGH FORECAST PERIOD

-

14.4 OTHER OSNEGLIGIBLE MARKET SHARE EXPECTED DURING FORECAST PERIOD

-

15.1 INTRODUCTIONINDUSTRY INSIGHTS

-

15.2 PRIVATEINTRODUCTION OF AUTONOMOUS VEHICLES TO IMPACT SEGMENT GROWTH

-

15.3 PUBLICECONOMIC BENEFITS OF ELECTRIFICATION OF PUBLIC TRANSPORT SERVICES TO DRIVE MARKET

-

16.1 INTRODUCTIONINDUSTRY INSIGHTS

-

16.2 SUBSCRIPTIONGROWING USE BY DAILY COMMUTERS TO DRIVE DEMAND

-

16.3 PAY-AS-YOU-GOTOURISTS AND OCCASIONAL COMMUTERS TO DRIVE SEGMENT

-

17.1 INTRODUCTIONINDUSTRY INSIGHTS

-

17.2 DAILYNEW SUBSCRIPTION PACKAGES TO ATTRACT DAILY COMMUTERS

-

17.3 LAST MILE CONNECTIVITYEXPANDING E-COMMERCE TO DRIVE GROWTH OF SEGMENT

-

17.4 OCCASIONALB2C BUSINESS MODEL TO DRIVE SEGMENT OWING TO FALLING VEHICLE OWNERSHIP

-

18.1 INTRODUCTIONINDUSTRY INSIGHTS

-

18.2 ASIA PACIFICCHINA- Large EV market to drive demand for MaaSJAPAN- Local MaaS players to boost marketSINGAPORE- Increasing government focus on clean transportation to drive marketAUSTRALIA- MaaS partnerships and agreements to be key to market successINDONESIA- New public transport system in Jakarta to propel demandINDIA- Significant opportunities for MaaS market in near future

-

18.3 EUROPEFINLAND- Government initiatives to drive marketGERMANY- Presence of major automotive OEMs to boost marketFRANCE- Government initiatives to bolster marketUK- Investment in smart transportation to boost marketSPAIN- Efficient mobility infrastructure to support marketNETHERLANDS- Ride hailing segment to drive demandITALY- Increasing use of shared mobility services in cities to drive demandRUSSIA- Government initiatives to boost marketTURKEY- Demand for smart mobility to create market opportunities

-

18.4 NORTH AMERICAUS- Presence of industry leaders to drive marketCANADA- High adoption of innovative technologies to propel marketMEXICO- Need to reduce traffic congestion and pollution to boost demand for MaaS

-

18.5 REST OF THE WORLDBRAZIL- Growing popularity of ride sharing services to impact marketSOUTH AFRICA- Emergence of local ride hailing companies to drive demand

- 19.1 OVERVIEW

- 19.2 MOBILITY AS A SERVICE MARKET SHARE ANALYSIS, 2022

-

19.3 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE LEADERSHIP MAPPING–MAAS PROVIDERS

- 19.4 COMPETITIVE LEADERSHIP MAPPING – MAAS SMES

-

19.5 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS, 2019–2022

- 19.6 RIGHT TO WIN

- 19.7 COMPETITIVE BENCHMARKING

-

20.1 KEY PLAYERSCITYMAPPER- Business overview- Recent developments- MnM viewMAAS GLOBAL (UMOB)- Business overview- Recent developments- MnM viewMOOVIT- Business overview- Recent developments- MnM viewFOD MOBILITY UK LTD.- Business overview- Recent developments- MnM viewSKEDGO- Business overview- Recent developments- MnM viewUBIGO- Business overview- Recent developmentsSPLYT TECHNOLOGIES- Business overview- Recent developmentsCOMMUNAUTO- Business overview- Recent developmentsQIXXIT- Business overview- Recent developmentsTRANZER- Business overview- Recent developments

-

20.2 OTHER KEY PLAYERSMOOVEL GROUPSMILE MOBILITYSHARE NOW GMBHVELOCIA INC.UBERLYFTDIDI CHUXINGGRAB HOLDINGS INC.MOBILITYX PTE LTD.BRIDJANI TECHNOLOGIES PVT. LTD (OLA)MOBILITY TECHNOLOGIES CO., LTDWIWIGOEASY TAXIVIA TRANSPORTATION INC.

- 21.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 21.2 DISCUSSION GUIDE

- 21.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

21.4 CUSTOMIZATION OPTIONSMOBILITY AS A SERVICE MARKET, BY CITY- Helsinki- Rome- Paris- Los Angeles- Hanover- Berlin- Sydney

- 21.5 RELATED REPORTS

- 21.6 AUTHOR DETAILS

- TABLE 1 UPCOMING RAIL PROJECTS, BY COUNTRY

- TABLE 2 KEY REGULATORY CHALLENGES IN IMPLEMENTATION OF MAAS

- TABLE 3 JOURNEY PLANNING AVERAGE COST 2022

- TABLE 4 KEY BUYING CRITERIA FOR TRANSPORTATION TYPES IN MAAS MARKET

- TABLE 5 MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 6 MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 7 E-HAILING: TOP PLAYERS

- TABLE 8 RIDE HAILING: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 9 RIDE HAILING: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 10 CAR SHARING - TOP PLAYERS

- TABLE 11 CAR SHARING: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 12 CAR SHARING: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 13 MICROMOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 14 MICROMOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 15 BUS SHARING: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 16 BUS SHARING: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 17 TRAIN SERVICES: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 18 TRAIN SERVICES: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 19 MOBILITY AS A SERVICE MARKET, BY BUSINESS MODEL, 2020–2025 (USD MILLION)

- TABLE 20 MOBILITY AS A SERVICE MARKET, BY BUSINESS MODEL, 2026–2030 (USD MILLION)

- TABLE 21 BUSINESS-TO-BUSINESS: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 22 BUSINESS-TO-BUSINESS: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 23 BUSINESS-TO-CONSUMER: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 24 BUSINESS-TO-CONSUMER: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 25 PEER-TO-PEER: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 26 PEER-TO-PEER: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 27 MOBILITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2020–2025 (USD MILLION)

- TABLE 28 MOBILITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2026–2030 (USD MILLION)

- TABLE 29 TECHNOLOGY PLATFORMS: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 30 TECHNOLOGY PLATFORMS: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 31 PAYMENT ENGINES: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 32 PAYMENT ENGINES: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 33 NAVIGATION SOLUTIONS: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 34 NAVIGATION SOLUTIONS: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 35 TELECOM CONNECTIVITY PROVIDERS: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 36 TELECOM CONNECTIVITY PROVIDERS: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 37 TICKETING SOLUTIONS: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 38 TICKETING SOLUTIONS: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 39 INSURANCE SERVICES: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 40 INSURANCE SERVICES: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 41 MOBILITY AS A SERVICE MARKET, BY TRANSPORTATION TYPE, 2020–2025 (USD MILLION)

- TABLE 42 MOBILITY AS A SERVICE MARKET, BY TRANSPORTATION TYPE, 2026–2030 (USD MILLION)

- TABLE 43 PRIVATE: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 44 PRIVATE: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 45 PUBLIC: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 46 PUBLIC: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 47 MOBILITY AS A SERVICE MARKET, BY APPLICATION TYPE, 2020–2025 (USD MILLION)

- TABLE 48 MOBILITY AS A SERVICE MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 49 PERSONALIZED APPLICATION SERVICES: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 50 PERSONALIZED APPLICATION SERVICES: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 51 JOURNEY MANAGEMENT: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 52 JOURNEY MANAGEMENT: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 53 JOURNEY PLANNING: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 54 JOURNEY PLANNING: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 55 FLEXIBLE PAYMENTS & TRANSACTIONS: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 56 FLEXIBLE PAYMENTS & TRANSACTIONS: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 57 MOBILITY AS A SERVICE MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

- TABLE 58 MOBILITY AS A SERVICE MARKET, BY VEHICLE TYPE, 2026–2030 (USD MILLION)

- TABLE 59 BUSES: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 60 BUSES: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 61 FOUR-WHEELERS: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 62 FOUR-WHEELERS: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 63 MICROMOBILITY: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 64 MICROMOBILITY: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 65 TRAINS: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 66 TRAINS: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 67 MOBILITY AS A SERVICE MARKET, BY PROPULSION TYPE, 2020–2025 (USD MILLION)

- TABLE 68 MOBILITY AS A SERVICE MARKET, BY PROPULSION TYPE, 2026–2030 (USD MILLION)

- TABLE 69 ICE: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 70 ICE: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 71 EV: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 72 EV: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 73 PHEV: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 74 PHEV: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 75 MOBILITY AS A SERVICE MARKET, BY OPERATING SYSTEM, 2020–2025 (USD MILLION)

- TABLE 76 MOBILITY AS A SERVICE MARKET, BY OPERATING SYSTEM, 2026–2030 (USD MILLION)

- TABLE 77 ANDROID: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 78 ANDROID: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 79 IOS: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 80 IOS: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 81 OTHER OS: MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 82 OTHER OS: MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 83 MOBILITY AS A SERVICE MARKET FOR ELECTRIC VEHICLE, BY MODE, 2020–2025 (USD MILLION)

- TABLE 84 MOBILITY AS A SERVICE MARKET FOR ELECTRIC VEHICLES, BY MODE, 2026–2030 (USD MILLION)

- TABLE 85 PRIVATE: MOBILITY AS A SERVICE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2020–2025 (USD MILLION)

- TABLE 86 PRIVATE: MOBILITY AS A SERVICE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2026–2030 (USD MILLION)

- TABLE 87 PUBLIC: MOBILITY AS A SERVICE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2020–2025 (USD MILLION)

- TABLE 88 PUBLIC: MOBILITY AS A SERVICE MARKET FOR ELECTRIC VEHICLES, BY REGION, 2026–2030 (USD MILLION)

- TABLE 89 MOBILITY AS A SERVICE MARKET, BY PAYMENT TYPE, 2020–2025 (USD MILLION)

- TABLE 90 MOBILITY AS A SERVICE MARKET, BY PAYMENT TYPE, 2026–2030 (USD MILLION)

- TABLE 91 SUBSCRIPTION: MOBILITY AS A SERVICE MARKET, BY PAYMENT & TRANSPORTATION TYPE, 2020–2025 (USD MILLION)

- TABLE 92 SUBSCRIPTION: MOBILITY AS A SERVICE MARKET, BY PAYMENT & TRANSPORTATION TYPE, 2026–2030 (USD MILLION)

- TABLE 93 PAY-AS-YOU-GO: MOBILITY AS A SERVICE MARKET, BY PAYMENT & TRANSPORTATION TYPE, 2020–2025 (USD MILLION)

- TABLE 94 PAY-AS-YOU-GO: MOBILITY AS A SERVICE MARKET, BY PAYMENT & TRANSPORTATION TYPE, 2026–2030 (USD MILLION)

- TABLE 95 MOBILITY AS A SERVICE MARKET, BY COMMUTE TYPE, 2020–2025 (USD MILLION)

- TABLE 96 MOBILITY AS A SERVICE MARKET, BY COMMUTE TYPE, 2026–2030 (USD MILLION)

- TABLE 97 DAILY COMMUTE: MOBILITY AS A SERVICE MARKET, BY BUSINESS MODEL, 2020–2025 (USD MILLION)

- TABLE 98 DAILY COMMUTE: MOBILITY AS A SERVICE MARKET, BY BUSINESS MODEL, 2026–2030 (USD MILLION)

- TABLE 99 LAST MILE CONNECTIVITY COMMUTE: MOBILITY AS A SERVICE MARKET, BY BUSINESS MODEL, 2020–2025 (USD MILLION)

- TABLE 100 LAST MILE CONNECTIVITY COMMUTE: MOBILITY AS A SERVICE MARKET, BY BUSINESS MODEL, 2026–2030 (USD MILLION)

- TABLE 101 OCCASIONAL COMMUTE: MOBILITY AS A SERVICE MARKET, BY BUSINESS MODEL, 2020–2025 (USD MILLION)

- TABLE 102 OCCASIONAL COMMUTE: MOBILITY AS A SERVICE MARKET, BY BUSINESS MODEL, 2026–2030 (USD MILLION)

- TABLE 103 MOBILITY AS A SERVICE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 104 MOBILITY AS A SERVICE MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MOBILITY AS A SERVICE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MOBILITY AS A SERVICE MARKET, BY COUNTRY, 2026–2030 (USD MILLION)

- TABLE 107 CHINA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 108 CHINA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 109 JAPAN: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 110 JAPAN: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 111 SINGAPORE: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 112 SINGAPORE: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 113 AUSTRALIA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 114 AUSTRALIA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 115 INDONESIA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 116 INDONESIA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 117 INDIA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 118 INDIA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 119 EUROPE: MOBILITY AS A SERVICE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 120 EUROPE: MOBILITY AS A SERVICE MARKET, BY COUNTRY, 2026–2030 (USD MILLION)

- TABLE 121 FINLAND: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 122 FINLAND: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 123 GERMANY: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 124 GERMANY: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 125 FRANCE: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 126 FRANCE: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 127 UK: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 128 UK: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 129 SPAIN: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 130 SPAIN: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 131 NETHERLANDS: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 132 NETHERLANDS: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 133 ITALY: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 134 ITALY: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 135 RUSSIA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 136 RUSSIA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 137 TURKEY: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 138 TURKEY: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: MOBILITY AS A SERVICE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 140 NORTH AMERICA: MOBILITY AS A SERVICE MARKET, BY COUNTRY, 2026–2030 (USD MILLION)

- TABLE 141 US: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 142 US: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 143 CANADA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 144 CANADA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 145 MEXICO: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 146 MEXICO: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 147 REST OF THE WORLD: MOBILITY AS A SERVICE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 148 REST OF THE WORLD: MOBILITY AS A SERVICE MARKET, BY COUNTRY, 2026–2030 (USD MILLION)

- TABLE 149 BRAZIL: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 150 BRAZIL: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 151 SOUTH AFRICA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 152 SOUTH AFRICA: MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2026–2030 (USD MILLION)

- TABLE 153 MARKET SHARE ANALYSIS, 2022

- TABLE 154 PRODUCT LAUNCHES, FEBRUARY 2019–NOVEMBER 2022

- TABLE 155 DEALS, MARCH 2019–NOVEMBER 2022

- TABLE 156 OTHERS, APRIL 2019–FEBRUARY 2022

- TABLE 157 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS, PARTNERSHIPS, AND SUPPLY CONTRACTS AS KEY GROWTH STRATEGIES DURING 2019–2022

- TABLE 158 MOBILITY AS A SERVICE MARKET: KEY START-UPS/SMES

- TABLE 159 MOBILITY AS A SERVICE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 160 CITYMAPPER: OVERVIEW

- TABLE 161 CITYMAPPER: PRODUCT LAUNCHES

- TABLE 162 MAAS GLOBAL (UMOB): OVERVIEW

- TABLE 163 MAAS GLOBAL (UMOB): PRODUCT LAUNCHES

- TABLE 164 MAAS GLOBAL (UMOB): EXPANSIONS

- TABLE 165 MAAS GLOBAL (UMOB): DEALS

- TABLE 166 MOOVIT: OVERVIEW

- TABLE 167 MOOVIT: PRODUCT LAUNCHES

- TABLE 168 MOOVIT: DEALS

- TABLE 169 FOD MOBILITY UK LTD.: OVERVIEW

- TABLE 170 FOD MOBILITY UK LTD.: PRODUCT LAUNCHES

- TABLE 171 FOD MOBILITY UK LTD.: DEALS

- TABLE 172 SKEDGO: OVERVIEW

- TABLE 173 SKEDGO: PRODUCT LAUNCHES

- TABLE 174 SKEDGO: DEALS

- TABLE 175 UBIGO: OVERVIEW

- TABLE 176 UBIGO: PRODUCT LAUNCHES

- TABLE 177 UBIGO: EXPANSIONS

- TABLE 178 SPLYT TECHNOLOGIES: OVERVIEW

- TABLE 179 SPLYT TECHNOLOGIES: DEALS

- TABLE 180 COMMUNAUTO: OVERVIEW

- TABLE 181 COMMUNAUTO: DEALS

- TABLE 182 QIXXIT: OVERVIEW

- TABLE 183 QIXXIT: PRODUCT LAUNCHES

- TABLE 184 QIXXIT: DEALS

- TABLE 185 TRANZER: OVERVIEW

- TABLE 186 TRANZER: DEALS

- TABLE 187 MOOVEL GROUP: BUSINESS OVERVIEW

- TABLE 188 SMILE MOBILITY: BUSINESS OVERVIEW

- TABLE 189 SHARE NOW GMBH: BUSINESS OVERVIEW

- TABLE 190 VELOCIA INC.: BUSINESS OVERVIEW

- TABLE 191 UBER: BUSINESS OVERVIEW

- TABLE 192 LYFT: BUSINESS OVERVIEW

- TABLE 193 DIDI CHUXING: BUSINESS OVERVIEW

- TABLE 194 GRAB HOLDINGS INC.: BUSINESS OVERVIEW

- TABLE 195 MOBILITYX PTE LTD.: BUSINESS OVERVIEW

- TABLE 196 BRIDJ: BUSINESS OVERVIEW

- TABLE 197 ANI TECHNOLOGIES PVT. LTD (OLA): BUSINESS OVERVIEW

- TABLE 198 MOBILITY TECHNOLOGIES CO., LTD: BUSINESS OVERVIEW

- TABLE 199 WIWIGO: BUSINESS OVERVIEW

- TABLE 200 EASY TAXI: BUSINESS OVERVIEW

- TABLE 201 VIA TRANSPORTATION INC.: BUSINESS OVERVIEW

- FIGURE 1 MARKET SEGMENTATION: MOBILITY AS A SERVICE MARKET

- FIGURE 2 MOBILITY AS A SERVICE MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

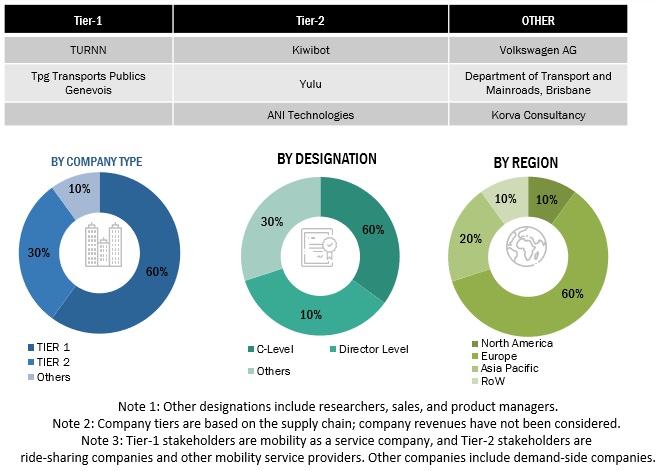

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 BOTTOM-UP APPROACH: MOBILITY AS A SERVICE MARKET

- FIGURE 6 TOP-DOWN APPROACH: MOBILITY AS A SERVICE MARKET

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 MOBILITY AS A SERVICE MARKET OUTLOOK

- FIGURE 9 MOBILITY AS A SERVICE MARKET, BY REGION

- FIGURE 10 INCREASING SMART CITY INITIATIVES WORLDWIDE TO DRIVE MARKET

- FIGURE 11 TECHNOLOGY PLATFORMS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 RIDE HAILING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 JOURNEY PLANNING TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 FOUR-WHEELERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 ANDROID TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 16 BUSINESS-TO-BUSINESS SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 17 PRIVATE TRANSPORTATION TO COMMAND LARGER SHARE DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC ANTICIPATED TO BE LARGEST MARKET BY 2030

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MAAS MARKET

- FIGURE 20 GLOBAL INTERNET USAGE, 2010–2023 (BILLION)

- FIGURE 21 COMPARISON OF DIFFERENT MODALITIES OF TRANSPORT IN TERMS OF CO2 FOOTPRINT

- FIGURE 22 GLOBAL CAR SHARING & CAR RENTAL MARKET, 2020-2027

- FIGURE 23 ELECTRIC VEHICLE SALES, 2019?2027

- FIGURE 24 MOBILITY AS A SERVICE ECOSYSTEM

- FIGURE 25 MULTIMODAL MOBILITY PLATFORM

- FIGURE 26 KEY BUYING CRITERIA FOR TRANSPORTATION TYPES IN MAAS MARKET

- FIGURE 27 MOBILITY AS A SERVICE MARKET, BY SERVICE TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 28 MOBILITY AS A SERVICE MARKET, BY BUSINESS MODEL, 2022 VS. 2030 (USD MILLION)

- FIGURE 29 MOBILITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 30 MOBILITY AS A SERVICE MARKET, BY TRANSPORTATION TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 31 MOBILITY AS A SERVICE MARKET, BY APPLICATION TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 32 MOBILITY AS A SERVICE MARKET, BY VEHICLE TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 33 MOBILITY AS A SERVICE MARKET, BY PROPULSION TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 34 MOBILITY AS A SERVICE MARKET, BY OPERATING SYSTEM, 2022 VS. 2030 (USD MILLION)

- FIGURE 35 MOBILITY AS A SERVICE MARKET FOR ELECTRIC VEHICLES, BY MODE, 2022 VS. 2030 (USD MILLION)

- FIGURE 36 MOBILITY AS A SERVICE MARKET, BY PAYMENT TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 37 MOBILITY AS A SERVICE MARKET, BY COMMUTE TYPE, 2022 VS. 2030 (USD MILLION)

- FIGURE 38 MOBILITY AS A SERVICE MARKET, BY REGION, 2022 VS. 2030 (USD MILLION)

- FIGURE 39 ASIA PACIFIC: MOBILITY AS A SERVICE MARKET SNAPSHOT

- FIGURE 40 EUROPE: MOBILITY AS A SERVICE MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: MOBILITY AS A SERVICE MARKET, 2022 VS. 2030 (USD MILLION)

- FIGURE 42 REST OF THE WORLD: MOBILITY AS A SERVICE MARKET, 2022 VS. 2030 (USD MILLION)

- FIGURE 43 MOBILITY AS A SERVICE MARKET SHARE ANALYSIS, 2022

- FIGURE 44 COMPETITIVE EVALUATION MATRIX (MOBILITY AS A SERVICE PROVIDERS), 2022

- FIGURE 45 COMPETITIVE EVALUATION MATRIX (MOBILITY AS A SERVICE SMES), 2022

- FIGURE 46 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2019–2022

Various secondary sources, directories, and databases have been used to identify and collect information for an extensive study of the mobility as a service (MaaS) market. The study involved four main activities in estimating the current size of the MaaS market: secondary research, validation through primary research, assumptions, and market analysis. Exhaustive secondary research was carried out to collect information on the market, such as the service types as well as the upcoming technologies and trends. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

The secondary sources referred to for this research study include company publications, technical journals, white papers, magazines, trade & business publications, and other articles published by transport associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research was conducted after obtaining an understanding of mobility as a service market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across three major regions—North America, Europe, and Asia Pacific. Participants include taxi service and ride-hailing service providers, public transport companies, car-sharing platforms, and other technology vendors for MaaS apps. Primary data was collected through questionnaires, e-mails, and telephonic interviews. During the canvassing of primaries, we have tried to cover various departments within organizations, including sales, operations, and administration, to provide a holistic viewpoint in our reports.

After interacting with industry participants, we conducted brief sessions with experienced independent consultants to confirm the findings from the primaries. This, along with opinions from in-house subject matter experts, led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

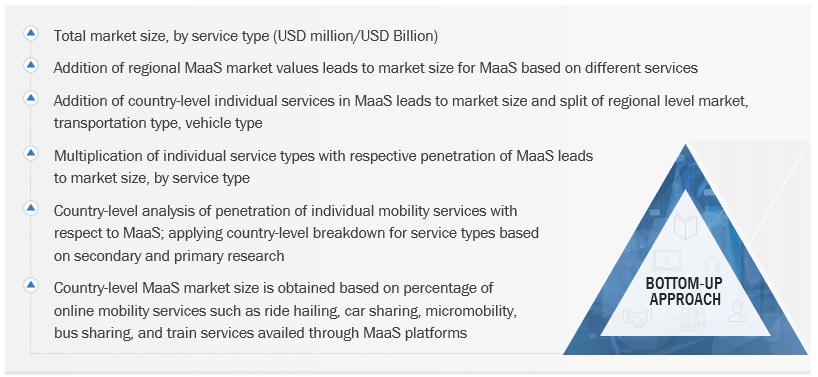

Bottom-Up Approach

The bottom-up approach was used to estimate and validate the size of the MaaS market by service type, transportation type, and vehicle type. To determine the MaaS market size by service type, the country-level estimated share of the MaaS market for each service was multiplied by the overall ride-sharing market, which includes ride-hailing, car sharing, micro-mobility, bus sharing, and train services.

The country-level market sizes were summed up to arrive at the regional market sizes, which were further totaled to derive the global MaaS market size.

Bottom-Up Approach: Mobility as a Service Market

To know about the assumptions considered for the study, Request for Free Sample Report

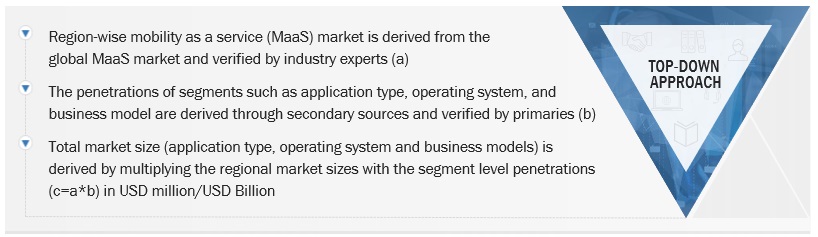

Top-Down Approach

The market sizes of the business model, propulsion type, mode, solution type, operating system, and application type segments were derived using a top-down approach and were based on the country-level penetration of MaaS and sub-segments. For instance, the application type segment size was derived based on the penetration of MaaS across different countries and the usage level of people. The business model segment size was derived based on acceptance patterns in business-to-business vs. business-to-consumer models, along with penetration in the peer-to-peer model.

The regional market for transportation type and vehicle type was derived by adding up the market numbers for different services relevant to specific transportation or vehicle types.

Top-Down Approach: Mobility as a Service Market

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that are expected to affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Market Definition

Mobility as a Service (MaaS) is the integration of and access to different transport services (such as public transport, ride-sharing, car sharing, bike-sharing, scooter-sharing, taxi, car rental, and ride-hailing) in a single digital mobility offering, with active mobility and an efficient public transport system at its base. This tailor-made service suggests the most suitable solutions based on a user’s travel needs. MaaS is available anytime and offers integrated planning, booking, and payment, as well as en route information to provide easy mobility without having to own a car.

Stakeholders

- Investment Firms

- Mobility as a Service Solution Provider

- Ride Sharing Service Providers

- Public Transport Organizations

- Regulatory Authorities

Report Objectives

- To describe and forecast the mobility as a service market, in terms of value, based on By Service Type, By Business Model, By Solution Type, Transportation type, Vehicle Type, Application Type, Operating Systems, Propulsion Type, Payment type, Commute type.

- To describe and forecast the market size, in terms of value, with respect to 4 main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze the market through Porter’s Five Forces analysis, trade analysis, trends/disruptions impacting buyers, case studies, patent analysis, supply chain analysis, market ecosystem, regulatory analysis, and technology trends.

- To analyze the market share of leading players in the market and evaluate competitive leadership mapping.

- To strategically analyze the key player strategies/right to win and company revenue analysis.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To provide an analysis of recent developments, alliances, joint ventures, mergers & acquisitions, product launches, and other activities carried out by key industry participants in the mobility as a service market.

Additional Customization

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs.

- Country-wise information

- Analysis of additional countries (up to five)

- Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mobility as a Service Market

mobility as a service market report was published in Dec 2021, and it covers the market trends and growth factors with respect to Mobility as a Service Market. It also covered the Market estimations of Mobility as a Service in terms of Value by Services/ Solutions/ Application / Transportation/ Vehicle/ Operating System/ Business Model/ Propulsion at regional and country level for the period 2020-2030. The report also covers the detail competitive landscape with key players Market Share Analysis, Developments of Key Market Players Like There Contracts & Agreements, Investments & Expansions, Joint Venture, Partnerships, And Collaborations and their Business Overview, Products/solutions/services Offered, Recent Developments, SWOT Analysis. We track this market since last 4 years and this is our latest edition providing the regional level addressable market size and growth forecast and forecast factors that impact the growth rate, for Insurance services as well as other services, such as Technology Platforms, Ticketing, Navigation, Telecom Connectivity Providers, payment engines, etc.

Mobility as a service market research study involved the use of extensive secondary sources, directories, and databases to classify and gather facts and figures useful for this technical, market-oriented, and commercial study of mobility as a service (MaaS) market. 1) The study involves four main activities to estimate the current size of the Mobility as a service (MaaS) market: Secondary research, Validation of findings through Primaries, Assumptions, and Market analysis. 2) Exhaustive secondary research was done to collect information on the market, such as the service types, upcoming technologies and trends. 3) The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Top-down approach was employed to estimate the complete market size for different segments considered under this study. 4) The MaaS market is very dynamic owing to the constant developments taking place in the mobility ecosystem. As the research covers a niche market, the data available in secondary sources is very limited. Hence, the report is driven through primary interviews. 5) We connected with industry experts such as taxi service suppliers, app developers, OEMs, and other experts for primary interviews to understand the future trends, growth drivers, and challenges in this market. 6) The MaaS market size, in terms of value (USD billion/million), for various regions has been derived using forecasting techniques based on the demand and offering trends of the services.

Which are the top technologies that will reshape the mobility as a service market?

We are interested in Mobility as a Service Market report which covers the topics like end-to-end trip planning, electronic ticketing, and payment services across all modes of public and private transportation.

We are interested in Mobility as a Service Market size for the North US region for the 2022 to 2027 Forecast year.

What is the market size for the North American region for the estimated forecast period?

We would like to know about the ride hailing /ride sharing industry statistics, market share and size in Singapore .

I am working on my study these for the Master 2 in Exploitation and network development at Cergy University. The theme of my these is about micro mobility and other networks influence. Thank you.

Determining the size of the demand for peer to peer and owner operated car sharing when considering ownership changing radically over the next 5 years - to such an extent that current owners will not renew their cars, buy sign up to sharing platforms in order to get access to a much wider range of vehicles to suit their varying needs and desires. If 5 of global owners did this, and each owner had 10 trips per year (Low case) - the demand for shared cars would be huge. What do you think ?