Crowd Analytics Market by Component (Solution, Service), Application (Customer Management, Marketing Campaign Measurement, Market Forecasting, Pricing Analytics), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2021

[141 Pages Report] The crowd analytics market size is estimated to grow from USD 385.1 million in 2016 to USD 1,142.5 million by 2021, at a Compound Annual Growth Rate (CAGR) of 24.3% during the forecast period. In the report, 2015 is considered the base year while the forecast period is 20162021. Crowd analytics is the analytics applied over data that is collected with respect to the movement and behavior of the crowd in a particular area, such as a retail store, restaurant, or bus station. Various means of collecting such data include Internet Protocol (IP)-enabled video cameras, sensors, mobile phone beacons, and data collected from telecom operators. The solution greatly helps in strategy making with respect to the delivery of services, pricing, marketing, and site selection for businesses, resulting in optimized revenue generation.

Market Dynamics

Drivers

- Increasing security threats and need for intelligent video systems

- Increasing need for BI solutions

- Increased spending on analytics tools and solutions

Restraints

- High initial upfront cost

Opportunities

- Cloud-based crowd analytics

- Development of smart cities

Challenges

- Data security and privacy concerns

The need for intelligent video systems for enhanced security drives the global crowd analytics market

Increasing crimes, terrorist attacks, and other security threats have raised governments and defense bodies concern for the defense and security of critical facilities, commercial buildings, and safety of its public. Crowd analytics helps governments in probing suspects in advance by analyzing their behavior and activities from the captured visuals. Thus, it helps governments take a proactive approach to fight against domestic crimes and terror attacks and reduce it to a certain extent, year-over-year. The capabilities of intelligent surveillance systems, such as pattern recognition, incident detection, and facial recognition, allow end users to receive early alerts about the potential risk and threat situations, which enables end users to make advanced decisions for mitigating such situations.

The following are the major objectives of the study

- To define, describe, and forecast the global crowd analytics market on the basis of component (standalone solution and services), application, deployment mode, organization size, vertical, and region

- To provide a detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for the stakeholders and detail the competitive landscape for the market leaders

- To forecast the market size of the various market segments with respect to the regions of North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To strategically profile key players and comprehensively analyze their growth strategies and core competencies

- To track and analyze competitive developments such as partnerships and collaborations, mergers and acquisitions, Research and Development (R&D) activities, and new product launches in the crowd analytics market

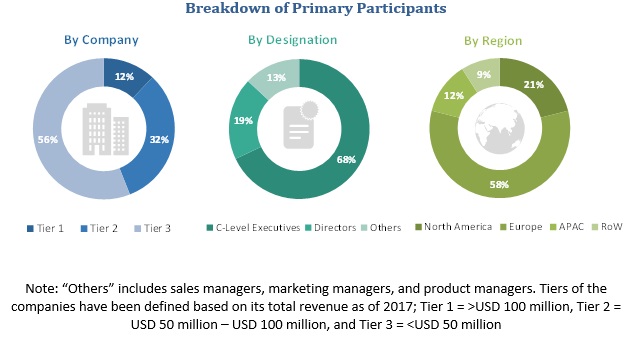

The research methodology used to estimate and forecast the crowd analytics market begins with capturing data on key vendors revenues through secondary sources, such as company financials, journals, press releases, paid databases, annual reports, and others. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global crowd analytics market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of primary profiles is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The crowd analytics ecosystem comprises crowd analytics vendors, such as Nokia Corporation (Finland), AGT International (Switzerland), NEC Corporation (Japan), Walkbase (Finland), Spigit, Inc. (U.S.), Wavestore (U.K.), Savannah Simulations AG (Switzerland), CrowdANALYTIX, Inc. (U.S.), Securion Systems (Ireland), Crowd Dynamics (U.K.), and Sightcorp (The Netherlands); service providers; system integrators; and enterprises. Other stakeholders of the crowd analytics market include crowd analytics service providers, consulting service providers, IT service providers, resellers, enterprise users, and technology providers.

Major Market Developments

- In October 2016, NEC launched an artificial intelligence software NeoFace Image data mining (NeoFace Idm), which has the capabilities to search video for specific individuals and to search for subjects who appear at specific times and locations.

- In September 2016, Nokia launched Network Planning and Optimization (NPO) transformation service that leveraged on its global planning and optimization expertise, innovative software tools, and proven methodologies. This offered more agility to operators, helped them meet customer demand, and enabled them to tap into new business opportunities.

- In April 2016, Spigit launched a new mobile experience that helped organizations generate ideas by enhancing their employee engagement and collaboration.

The target audiences of the crowd analytics market report are given below

- Crowd analytics solution/service providers

- Telecom service providers

- Cloud service providers

- Managed service providers

- Data center operators

- Smart city solution providers

- IT consulting firms

- Resellers

- Enterprises

- Government

The study answers several questions for the stakeholders; primarily, which market segments to focus in the next two to five years for prioritizing the efforts and investments.

Scope of the Report

The research report categorizes the crowd analytics market to forecast the revenues and analyze the trends in each of the following subsegments:

By Component

- Standalone solution

- Services

- By professional services

- System integration

- Training and education

- Support and maintenance

- Consulting

- By managed services

- By professional services

By Application

- Customer management

- Marketing campaign measurement

- Market forecasting

- Pricing analytics

- Revenue optimization

- Incident response and alerting

By Deployment Mode

- Cloud

- On-premises

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large enterprises

By Industry Vertical

- Consumer Packaged Goods (CPG) and retail

- Travel and tourism

- Transportation

- Media and entertainment

- Public safety

- Healthcare and life sciences

- Banking, Financial Services and Insurance (BFSI)

- Others

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia-Pacific (APAC)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American crowd analytics market

- Further breakdown of the European crowd analytics market

- Further breakdown of the APAC crowd analytics market

- Further breakdown of the MEA crowd analytics market

- Further breakdown of the Latin American crowd analytics market

Company Information

- Detailed analysis and profiling of additional market players

The crowd analytics market size is expected to grow from 385.1 million in 2016 to 1,142.5 million by 2021, at a Compound Annual Growth Rate (CAGR) of 24.3% during the forecast period. The major growth drivers of the crowd analytics market include the need to install new and advanced surveillance systems and the growing need for business intelligence solutions.

Crowd analytics is the analytics applied over data that is collected with respect to the movement and behavior of the crowd in a particular area, such as a retail store, restaurant, or bus station. Various means of collecting such data include Internet Protocol (IP)-enabled video cameras, sensors, mobile phone beacons, and data collected from telecom operators. The solution greatly helps in strategy making with respect to the delivery of services, pricing, marketing, and site selection for businesses, resulting in optimized revenue generation. Some of the prominent verticals that apply crowd analytics are Consumer Packaged Goods (CPG) & retail, transportation, media & entertainment, and travel & tourism.

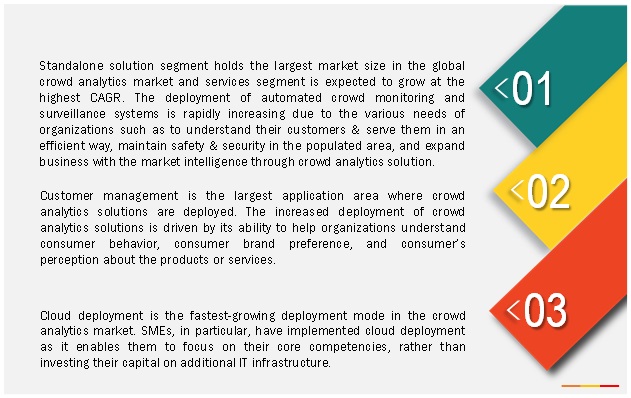

The crowd analytics market is segmented by standalone solution, service, application, deployment mode, organization size, vertical, and region. The services segment is expected to grow at the highest CAGR during the forecast period; as the deployment of crowd analytics solutions is increasing, so the services associated with it is also growing.

Customer management application holds the largest share of the crowd analytics market in 2016. The growth is fueled with the increasing need of business intelligence solutions by the organizations to understand consumer insights and strategize business to achieve long term growth. The travel and tourism vertical is expected to hold the highest CAGR during the forecast period due to the rapid growth of the sector needing real time data and business intelligence solutions to understand consumer insights and expand the business.

Organizations are rapidly deploying crowd analytics solutions either on-premises or on cloud. The demand for cloud-based crowd analytics solutions is increasing due to the cost-effective and time-efficient features of cloud; its growth is specifically high in enterprises, where low cost solutions are much required.

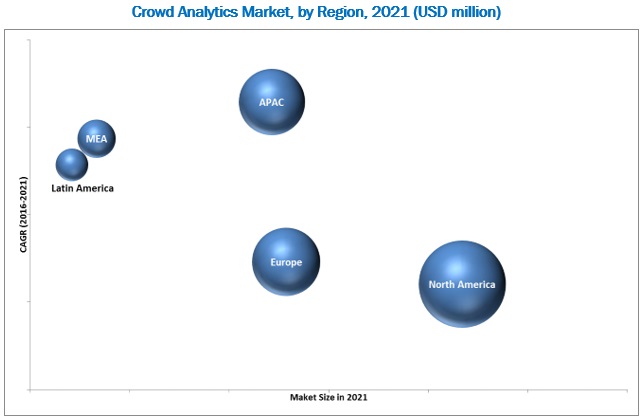

The global market has been segmented on the basis of regions into North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America to provide a region-specific analysis in the report. The North American region, followed by Europe, is expected to become the largest revenue generating region for crowd analytics vendors in 2016. This is mainly because in the developed economies of the U.S. and Canada, there is high focus on innovations obtained from research and development and technology. The APAC region is expected to be the fastest-growing region in the crowd analytics market. The growth in this region is primarily driven by the growing need of business intelligence solutions and the need to install new and advanced surveillance systems.

Increasing security threats and need for intelligent video systems drives the growth of crowd analytics market

Consumer packaged goods and retail

The global CPG and retail vertical is growing rapidly. The huge customer base is helping the sector to generate huge revenue. The competition in the field is also stiff and there is a possibility of brand switching by the customer due to dissatisfaction from the existing one. Thus, the enterprises in the industry are focusing on customer management functions, but it is very difficult to manage large numbers of customers. The crowd analytics vendors offer crowd analytics platform that collects the information about footfall, stays duration, movement patterns, and returning visitors to analyze the crowd in retail store premises. The visual outcome of crowd analytics solution shows the detailed analysis of the crowd, which help the retailers to make business decisions in an effective way.

Transportation

The different transportation means such as road, rail, and air transport are witnessing the challenges of time and cost reduction and at the same time maximizing the efficiency of the business operations to enhance productivity. It is a very critical task to overcome these challenges, but the crowd analytics solutions provide a visualized solution that makes it easy. The outcomes of crowd analytics solution help user to know real time information on the roads and provides the most efficient routes in the city to travel. The solution combines the capabilities of intelligence and real time data to provide the real time situation in a visualized form.

Media and entertainment

The crowd analytics solution is provided with the real time audio visual inputs, which are integrated with the intelligence to deliver the hidden patterns in the human behavior. These results are found to be very useful in analyzing the effectiveness of outdoor media. The sentimental analysis help monitor and analyze the mood of the crowd that enables brands to precisely measure the effectiveness of their advertisement campaigns and generates the right content with respect to the collected data. It also provides the insights into the interest of the viewer in the advertisement.

Public safety

The governments in different countries are very serious about the public safety especially at the places where large numbers of people are involved. Thus, the governments are taking various security initiatives to avoid mishaps at the populated places. Crowd analytics solution deployment is one of the initiatives, which is becoming popular in making the crowded places safer. The real time crowd analytics in public places is becoming necessary to avoid disasters related to crowd and ensure public safety. The solution captures real time crowd-related data and combines its artificial intelligence to deliver detailed visual analysis of the crowd. The analysis includes the number of people in the crowd, their behavior, and other characteristics, which help the user in situational analysis and make appropriate decisions as per the situation.

Critical questions the report answers

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for crowd analytics?

High initial upfront cost is a major factor restraining the growth of the market. Using dedicated Central Processing Units (CPUs), servers, DVRs, NVRs, and other appliances for video analytics is a costly process. The volume of video streams from day-to-day surveillance is rising and will continue to increase among the organizations and various other end users. Analyzing the huge and ever-increasing volume of video streams require centralized and high-performance processors which are very expensive. Moreover, in a server-based approach, each processing unit can support only a limited number of cameras, and requires higher network bandwidth as well as video management capabilities. Furthermore, edge-based video analytics appliances are also expensive due to embedded analytics and Wi- Fi capabilities. Hence, the high cost of systems is a major restraint for the video analytics market.

Major vendors that offer crowd analytics solutions across the globe are Nokia Corporation (Finland), AGT International (Switzerland), NEC Corporation (Japan), Walkbase (Finland), Spigit, Inc. (U.S.), Wavestore (U.K.), Savannah Simulations AG (Switzerland), CrowdANALYTIX, Inc. (U.S.), Securion Systems (Ireland), Crowd Dynamics (U.K.), and Sightcorp (The Netherlands). These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships & collaborations, and mergers & acquisitions to expand their offerings in the crowd analytics market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Market

4.2 Snapshot: By Component, 20162021

4.3 Snapshot: By Region and Vertical, 2016

4.4 Crowd Analytics Regional Market Potential, 20162021

4.5 Lifecycle Analysis, By Region, 2016

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Component

5.3.2 By Application

5.3.3 By Deployment Mode

5.3.4 By Organization Size

5.3.5 By Vertical

5.3.6 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Security Threats and Need for Intelligent Video Systems

5.4.1.2 Increasing Need for Bi Solutions

5.4.1.3 Increased Spending on Analytics Tools and Solutions

5.4.2 Restraints

5.4.2.1 High Initial Upfront Cost

5.4.3 Opportunities

5.4.3.1 Cloud-Based Crowd Analytics

5.4.3.2 Development of Smart Cities

5.4.4 Challenges

5.4.4.1 Data Security and Privacy Concerns

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Architecture

6.3 Value Chain Analysis

6.4 Strategic Benchmarking

6.4.1 Strategic Benchmarking: Technology Integration and Product Enhancement

7 Crowd Analytics Market Analysis, By Component (Page No. - 43)

7.1 Introduction

7.2 Standalone Solution

7.3 Services

7.3.1 Professional Services

7.3.1.1 System Integration

7.3.1.2 Training and Education

7.3.1.3 Support and Maintenance

7.3.1.4 Consulting

7.3.2 Managed Services

8 Crowd Analytics Market Analysis, By Application (Page No. - 53)

8.1 Introduction

8.2 Customer Management

8.3 Marketing Campaign Measurement

8.4 Market Forecasting

8.5 Pricing Analytics

8.6 Revenue Optimization

8.7 Incident Response and Alerting

9 Crowd Analytics Market Analysis, By Deployment Mode (Page No. - 61)

9.1 Introduction

9.2 Cloud

9.3 On-Premises

10 Crowd Analytics Market Analysis, By Organization Size (Page No. - 65)

10.1 Introduction

10.2 Small and Medium Enterprises

10.3 Large Enterprises

11 Crowd Analytics Market Analysis, By Vertical (Page No. - 69)

11.1 Introduction

11.2 Consumer Packaged Goods and Retail

11.3 Travel and Tourism

11.4 Transportation

11.5 Media and Entertainment

11.6 Public Safety

11.7 Healthcare and Life Sciences

11.8 Banking, Financial Services, and Insurance

11.9 Others

12 Geographic Analysis (Page No. - 77)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 98)

13.1 Overview

13.2 Vendor Analysis

13.3 Competitive Situations and Trends

13.3.1 New Product Launches

13.3.2 Partnerships, Agreements, and Collaborations

13.3.3 Business Expansions

13.3.4 Mergers and Acquisitions

14 Key Innovators (Page No. - 107)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.1 Introduction

14.2 Nokia Corporation

14.3 AGT International

14.4 NEC Corporation

14.5 Walkbase

14.6 Spigit, Inc.

14.7 Sightcorp BV.

14.8 Wavestore

14.9 Savannah Simulations AG

14.10 Crowdanalytix, Inc.

14.11 Securion Systems

14.12 Crowd Dynamics

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 131)

15.1 Other Developments

15.1.1 Other Developments: Partnerships, Agreements, and Collaborations

15.2 Industry Experts

15.3 Discussion Guide

15.4 Knowledge Store: Marketsandmarkets Subscription Portal

15.5 Introduction RT: Real-Time Market Intelligence

15.6 Available Customizations

15.7 Related Reports

15.8 Author Details

List of Tables (76 Tables)

Table 1 Crowd Analytics Market Size and Growth Rate, 20142021 (USD Million, Yoy %)

Table 2 Market Size, By Component, 20142021 (USD Million)

Table 3 Market Size, By Component, 20142021 (USD Million)

Table 4 Standalone Solution: Market Size, By Region, 20142021 (USD Million)

Table 5 Crowd Analytics Market Size, By Service, 20142021 (USD Million)

Table 6 Services: Market Size, By Region, 20142021 (USD Million)

Table 7 Professional Services: Market Size, By Type, 20142021 (USD Million)

Table 8 Professional Services: Market Size, By Region, 20142021 (USD Million)

Table 9 System Integration Market Size, By Region, 20142021 (USD Million)

Table 10 Training and Education Market Size, By Region, 20142021 (USD Million)

Table 11 Support and Maintenance Market Size, By Region, 20142021 (USD Million)

Table 12 Consulting Market Size, By Region, 20142021 (USD Million)

Table 13 Managed Services: Market Size, By Region, 20142021 (USD Million)

Table 14 Crowd Analytics Market Size, By Application, 20142021 (USD Million)

Table 15 Customer Management: Market Size, By Region, 20142021 (USD Million)

Table 16 Marketing Campaign Measurement: Market Size, By Region, 20142021 (USD Million)

Table 17 Market Forecasting: Market Size, By Region, 20142021 (USD Million)

Table 18 Pricing Analytics: Market Size, By Region, 20142021 (USD Million)

Table 19 Revenue Optimization: Market Size, By Region, 20142021 (USD Million)

Table 20 Incident Response and Alerting: Market Size, By Region, 20142021 (USD Million)

Table 21 Crowd Analytics Market Size, By Deployment Mode, 20142021 (USD Million)

Table 22 Cloud: Market Size, By Region, 20142021 (USD Million)

Table 23 On-Premises: Market Size, By Region, 20142021 (USD Million)

Table 24 Market Size, By Organization Size, 20142021 (USD Million)

Table 25 Small and Medium Enterprises: ytics Market Size, By Region, 20142021 (USD Million)

Table 26 Large Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 27 Market Size, By Vertical, 20142021 (USD Million)

Table 28 Consumer Packaged Goods and Retail: Market Size, By Region, 20142021 (USD Million)

Table 29 Travel and Tourism: Market Size, By Region, 20142021 (USD Million)

Table 30 Transportation: Market Size, By Region, 20142021 (USD Million)

Table 31 Media and Entertainment: Market Size, By Region, 20142021 (USD Million)

Table 32 Public Safety: Market Size, By Region, 20142021 (USD Million)

Table 33 Healthcare and Life Sciences: Market Size, By Region, 20142021 (USD Million)

Table 34 Banking, Financial Services, and Insurance: Market Size, By Region, 20142021 (USD Million)

Table 35 Others: Market Size, By Region, 20142021 (USD Million)

Table 36 Crowd Analytics Market Size, By Region, 20142021 (USD Million)

Table 37 North America: Market Size, By Component, 20142021 (USD Million)

Table 38 North America: Market Size, By Service, 20142021 (USD Million)

Table 39 North America: Market Size, By Professional Service, 20142021 (USD Million)

Table 40 North America: Market Size, By Application, 20142021 (USD Million)

Table 41 North America: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 42 North America: Market Size, By Organization Size, 20142021 (USD Million)

Table 43 North America: Market Size, By Vertical, 20142021 (USD Million)

Table 44 Europe: Crowd Analytics Market Size, By Component, 20142021 (USD Million)

Table 45 Europe: Market Size, By Service, 20142021 (USD Million)

Table 46 Europe: Market Size, By Professional Service, 20142021 (USD Million)

Table 47 Europe: Market Size, By Application, 20142021 (USD Million)

Table 48 Europe: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 49 Europe: Market Size, By Organization Size, 20142021 (USD Million)

Table 50 Europe: Market Size, By Vertical, 20142021 (USD Million)

Table 51 Asia-Pacific: Crowd Analytics Market Size, By Component, 20142021 (USD Million)

Table 52 Asia-Pacific: Market Size, By Service, 20142021 (USD Million)

Table 53 Asia-Pacific: Market Size, By Professional Service, 20142021 (USD Million)

Table 54 Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 55 Asia-Pacific: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 56 Asia-Pacific: Market Size, By Organization Size, 20142021 (USD Million)

Table 57 Asia-Pacific: Market Size, By Vertical, 20142021 (USD Million)

Table 58 Middle East and Africa: Market Size, By Component, 20142021 (USD Million)

Table 59 Middle East and Africa: Market Size, By Service, 20142021 (USD Million)

Table 60 Middle East and Africa: Market Size, By Professional Service, 20142021 (USD Million)

Table 61 Middle East and Africa: Market Size, By Application, 20142021 (USD Million)

Table 62 Middle East and Africa: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 63 Middle East and Africa: Market Size, By Organization Size, 20142021 (USD Million)

Table 64 Middle East and Africa: Market Size, By Vertical, 20142021 (USD Million)

Table 65 Latin America: Crowd Analytics Market Size, By Component, 20142021 (USD Million)

Table 66 Latin America: Market Size, By Service, 20142021 (USD Million)

Table 67 Latin America: Market Size, By Professional Service, 20142021 (USD Million)

Table 68 Latin America: Market Size, By Application, 20142021 (USD Million)

Table 69 Latin America: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 70 Latin America: Market Size, By Organization Size, 20142021 (USD Million)

Table 71 Latin America: Market Size, By Vertical, 20142021 (USD Million)

Table 72 New Product Launches, 2016

Table 73 Partnerships, Agreements, and Collaborations, 20132016

Table 74 Business Expansions, 20142016

Table 75 Mergers and Acquisitions, 20132016

Table 76 Other Developments: New Product Launches, 2013 2016

List of Figures (45 Figures)

Figure 1 Crowd Analytics Market: Research Methodology

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 North America is Expected to Hold the Largest Market Share in 2016

Figure 6 Consumer Packaged Goods and Retail Vertical is Expected to Have the Largest Market Size During the Forecast Period

Figure 7 Crowd Analytics Market is Expected to Witness Remarkable Growth Opportunities Due to Increasing Need for Analytics Solutions Across All Verticals

Figure 8 Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 North America is Expected to Hold the Largest Market Share in the Crowd Analytics Market in 2016

Figure 10 Asia-Pacific is Expected to Exhibit the Highest Growth Potential During the Forecast Period

Figure 11 Regional Lifecycle: Asia-Pacific is Expected to Offer High Growth Opportunities During the Forecast Period

Figure 12 Evolution of the Crowd Analytics Market

Figure 13 Market Segmentation: By Component

Figure 14 Market Segmentation: By Application

Figure 15 Market Segmentation: By Deployment Mode

Figure 16 Market Segmentation: By Organization Size

Figure 17 Market Segmentation: By Vertical

Figure 18 Market Segmentation: By Region

Figure 19 Market Drivers, Restraints, Opportunities, and Challenges

Figure 20 Market Architecture

Figure 21 Market Value Chain

Figure 22 Strategic Benchmarking: Technology Integration and Product Enhancement

Figure 23 Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 Managed Services Segment to Grow at the Highest CAGR During the Forecast Period

Figure 25 Support and Maintenance Services Segment to Grow at the Highest CAGR During the Forecast Period

Figure 26 Marketing Campaign Measurement Segment to Grow at the Highest CAGR During the Forecast Period

Figure 27 Cloud-Based Deployment Mode is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Small and Medium Enterprises Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Travel and Tourism Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 Regional Snapshot: Asia-Pacific is the Emerging Region in the Crowd Analytics Market

Figure 32 North America Market Snapshot

Figure 33 Asia-Pacific Market Snapshot

Figure 34 Companies Adopted New Product Launches as the Key Growth Strategy From 2013 to 2016

Figure 35 Vendor Analysis for Product Offering

Figure 36 Vendor Analysis for Business Strategy

Figure 37 Market Evaluation Framework

Figure 38 Battle for Market Share: New Products Launches is the Key Strategy Adopted By Players in the Crowd Analytics Market During the Period 20132016

Figure 39 Nokia Corporation: Company Snapshot

Figure 40 Nokia Corporation: SWOT Analysis

Figure 41 AGT International: SWOT Analysis

Figure 42 NEC Corporation: Company Snapshot

Figure 43 NEC Corporation: SWOT Analysis

Figure 44 Walkbase: SWOT Analysis

Figure 45 Spigit, Inc.: SWOT Analysis

Growth opportunities and latent adjacency in Crowd Analytics Market