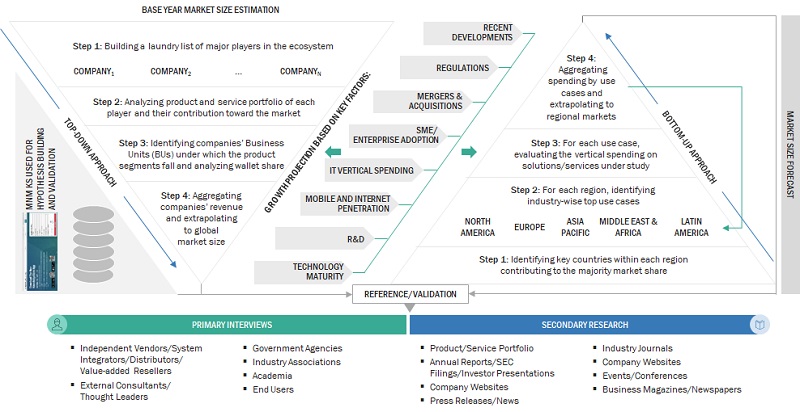

The study involved four major activities in estimating the current video analytics market size. We performed extensive secondary research to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, we used the market breakup and data triangulation procedures to estimate the market size of the various segments in the video analytics market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. We referred to these sources to identify and collect valuable information for this technical, market-oriented, and commercial study of the video analytics market.

Primary Research

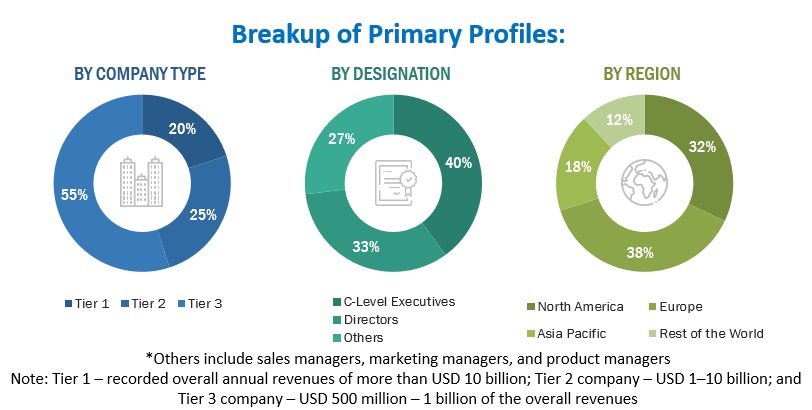

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market's prospects.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); the installation teams of governments/end users using video analytics software & services; and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall video analytics market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the video analytics market and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the size of the video analytics market and various other dependent subsegments.

The research methodology used to estimate the market size included the following details:

-

We identified key players in the market through secondary research. We then determined their revenue contributions in the respective countries through primary and secondary research.

-

This entire procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

-

All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Video analytics market: Top-down and bottom-up approaches

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying several factors and trends from both the demand and supply sides in the video analytics market.

Market Definition

Video analytics is the technology used for computerized processing and analysis of video streams. It is also known as Video Content Analysis (VCA), intelligent video analysis, or video surveillance analytics. The video streams used for analysis are captured using various devices, such as network cameras, Digital Video Recorders (DVRs), and Network Video Recorders (NVRs). The captured video streams are then analyzed using video analytics software for various purposes, such as recognizing people, sending safety alerts, recognizing license plates, detecting unattended objects, and tracking footfalls.

Key Stakeholders

-

Video Analytics Software Providers

-

Video Surveillance System Providers

-

Video Management Software Providers

-

Internet Service Providers (ISPs)

-

Cloud Service Providers (CSPs)

-

Security Camera Manufacturers

-

System Integrators

-

Networking Companies

-

Third-party Providers

-

Value-added Resellers (VARs)

-

Government Agencies

-

Law Enforcement Agencies

-

Consultants/Consultancies/Advisory Firms

-

Support and Maintenance Service Providers

-

Artificial Intelligence (AI) Solutions Providers

-

Facial Recognition Solution Providers

-

Smart Initiatives Project Teams

Report Objectives

-

To define, describe, and forecast the video analytics market based on offerings, applications, deployment models, types, industry verticals, and regions

-

To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

-

To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

-

To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze the macro and micromarkets1 concerning growth trends, prospects, and their contributions to the overall market

-

To analyze the industry trends, patents and innovations, and pricing data related to the video analytics market.

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

-

To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies across segments and subsegments.

-

To track and analyze the competitive developments, such as mergers and acquisitions, product developments, and partnerships and collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

-

The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

-

Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further breakup of the North American market into countries contributing 75% to the regional market size

-

Further breakup of the Latin American market into countries contributing 75% to the regional market size

-

Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

-

Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Video Analytics Market