Customer Intelligence Platform Market by Component, Application (Customer Data Collection & Management, and Customer Segmentation & Targeting), Deployment Mode, Organization Size, Data Channel, Vertical and Region - Global Forecast to 2027

Customer Intelligence Platform Market Overview

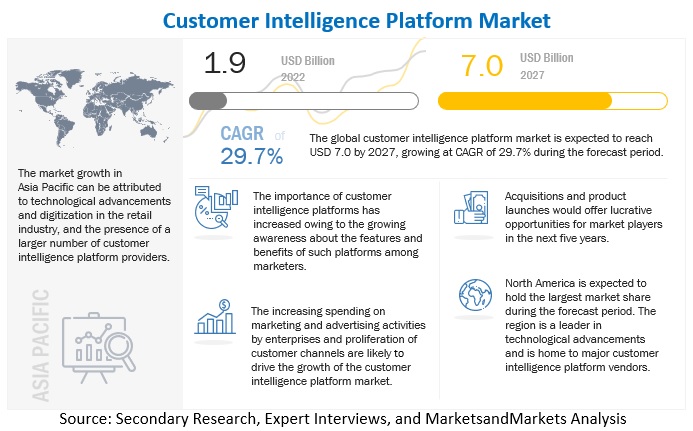

The Customer Intelligence Platform Market size was estimated at $1.9 billion in 2022 and is poised to generate revenue around $7.0 billion by the end of 2027, exhibits a CAGR of 29.7%. The growing need for personalized customer experiences, the demand to gain a holistic view of customer data, combined with the rising adoption of customer intelligence platforms to monitor changes in the market as they occur are some of the key factors boosting the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Customer Intelligence Platform Market Growth Dynamics

Driver: Need to gain a holistic view of customer data

Large amounts of customer data flow into an organization through various channels, including customer activity on the website and/or app, purchase and return patterns, customer-initiated communications, and customer responses to previous company-initiated communications (the information collected for analysis includes behavioral data, demographic data, customer sentiment, survey data, social media actions, customer preferences, etc.). Although practically every system used by B2B and B2C organizations stores and uses customer data, the information is frequently erroneous, partial, and segregated. Because of this, programs that promote a superior customer experience cannot fully utilize that data. Companies must create a real 360-degree customer picture by combining what they already know and what they can infer about their customer to get the most value out of massive amounts of customer data. The creation of a single unified customer profile for each customer, which combines profile, transactional, and behavioral data from across the businesses, is at the heart of the customer intelligence platform. Hence the rising need to gain a holistic view of customer data is driving the adoption of customer intelligence platforms.

Restraint: Need to ensure compliance with data privacy laws and protect customer data

Customer intelligence platforms combine first-party customer data from multiple channels and sources to create a single customer view. According to the General Data Protection Regulation (GDPR) and other data privacy laws, it is necessary for marketers to receive marketing consent from consumers. Customer data is highly vulnerable to cyberattacks and breaches. Thus, it is necessary for a customer intelligence platform to understand the key challenges associated with the management of data, such as the protection of sensitive customer information and the marketing consent of consumers. A customer intelligence platform should be based on a consent-based data model; this helps store the information of customer journey and consent for marketing and provides customers transparency and control over how their data is used. If the customer has opted out of permission to use their data, then the customer intelligence platform should include them in a direct mail suppression list and ensure that it does not receive any unwanted marketing content through any other channels. In countries with less stringent or no laws around customer data privacy, customer intelligence platform solutions are implemented with existing data privacy scenarios or in anticipation of the laws that might surface in the near future. It could create complications when such new laws are introduced around customer data privacy. Thus, the need to ensure the privacy of customer data and compliance with data privacy laws is key to the adoption of customer intelligence platforms.

Opportunity: Heightened adoption of customer intelligence platforms to monitor changes in the market as they occur

The ability to understand the market has evolved into an everyday challenge. This means that a lack of market awareness causes a significant setback for businesses in increasingly competitive domains like eCommerce, retail, and other consumer-facing industries. It only takes a few seconds to fall behind the competition, and those few seconds can mean the difference between profitable operations and crippling losses. Customer intelligence focuses on providing a steady stream of data that quickly converts into actionable insights. Customer intelligence offers data to give users a better experience. Marketers gather customer intelligence (CI) and analyze the information regarding customers’ details and activities to build deeper and more effective relationships and improve decision-making. In today’s customer-centric world, gathering customer intelligence allows brands to tap into critical information, gain a competitive advantage, enhance customer loyalty, and improve profitability. Businesses can make better decisions for customers as well as incorporate predictive and prescriptive analytics into their strategy as and when market changes occur.

Challenge: Organizational failures pertaining to optimized use of customer data

Modern-day businesses have access to an unprecedented amount of customer data; however, in most cases, they do not know what to do with all this data. In fact, this data deluge has created more problems for organizations because they still operate with legacy systems that make it difficult to achieve their goals for data integration, standardization, and quality. Poor data quality is yet another issue that regularly hampers efforts to create a single customer view. Without accurate and reliable data, the effort to create a single customer view is wasted. Customer experience teams need to align with data owners across the organization to better understand the data collection process and how it can be improved to reduce or altogether eliminate the chances of human error. Data also becomes redundant or outdated quickly. It is important to monitor data sources over time to ensure that the quality of data is not deteriorating.

Retail & eCommerce vertical to grow at highest CAGR during the forecast period

A customer intelligence platform enables retailers to tap into growing opportunities effortlessly. Customer intelligence platform delivers intelligent and automated personalized experiences, conversational AI-based customer care, loyalty engagement and cost optimization. This is an outcome of leveraging data to extract behavioral insights that shape personalized customer communication and deliver value across channels. A customer intelligence platform is easy to implement and has a proven ability to rapidly unlock incremental revenues.

Mobile data channel segment to hold the highest CAGR during the forecast period

The developing level of big data overloaded customer-facing teams left them with no practical way to successfully integrate all customer data points to ensure a completely data-driven decision-making approach. So, designed with the business user in mind, a customer intelligence platform emphasizes on creating a central location for all customer data, including socio-demographic data, product portfolio, transactional data to web and mobile browsing history, email, chat, and phone interactions with the brand, social media behavior, and more. The interface through smartphone devices enables users to communicate with businesses in a more personalized manner. The penetration of smartphones and tablets has been increasing at a rapid pace and generating huge amounts of data. Thus, enterprises are implementing customer intelligence platforms to analyze smartphone data.

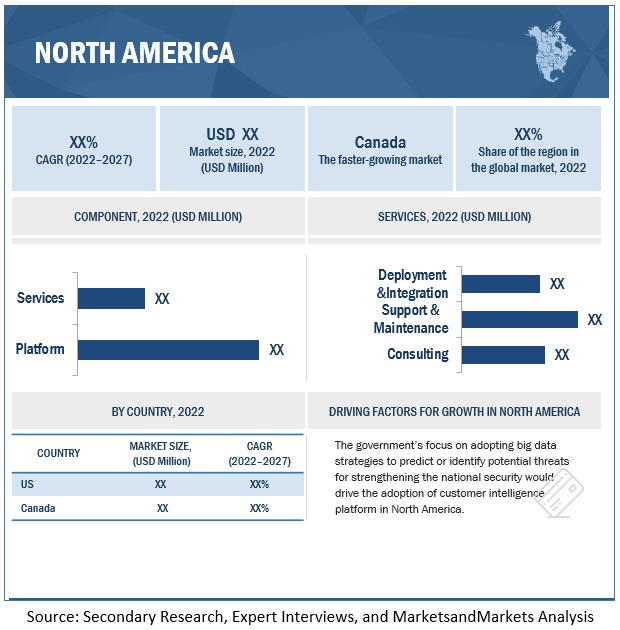

North America to account for the largest market size during the forecast period

The customer intelligence platform market has been segmented into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Among these regions, North America is projected to hold the largest market size during the forecast period. Increasing technological advancements favor the growth of the customer intelligence platform market in North America. The growing number of customer intelligence platform players across regions is expected to drive market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The customer intelligence platform vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global customer intelligence platform market include IBM (US), Oracle (US), Microsoft (US), Adobe (US), SAS (US), Salesforce(US), Google (US), Accenture (Ireland), Informatica (US), SAP (Germany), Verint (US), Teradata (US), Zeta Global (US), TIBCO (US), NICE (Israel), TransUnion (US), Alida (Canada), Algonomy (US), NetBase Quid (US), NGDATA (Belgium), Zeotap (Germany), ActionIQ (US), Amperity(US), UserIQ (US), Datashift (Belgium), Staircase AI (US), Terminus(US), and Lifesight (Singapore).The study includes an in-depth competitive analysis of these key players in the customer intelligence platform market with their company profiles, recent developments, and key market strategies.

Scope of the Report

>

|

Report Metrics |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, Deployment Mode, Organization Size, Application, Data Channel, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Oracle (US), Microsoft (US), Adobe (US), SAS Institute (US), Salesforce (US), Google (US), Accenture (Ireland), Informatica (US), SAP (Germany), Verint (US), Teradata (US), Zeta Global (US), TIBCO (US), NICE (Israel), TransUnion (US), Alida (Canada), Algonomy (US), NetBase Quid (US), NGDATA (Belgium), Zeotap (Germany), ActionIQ (US), Amperity (US), UserIQ (US), Datashift (Belgium), Staircase AI (US), Terminus (US), and Lifesight (Singapore). |

This research report categorizes the customer intelligence platform market based on component, deployment mode, organization size, application, data channel, vertical, and region.

By Component:

- Platform

-

Services

- Consulting Services

- Support & Maintenance

- Deployment & Integration

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

By Application:

- Customer Data Collection & Management

- Customer Segmentation & Targeting

- Customer Behaviour Analytics

- Customer Experience Management

- Customer Retention & Engagement

- Personalized Recommendation

- Omnichannel Marketing

- Other Applications

By Data Channel:

- Web

- Social Media

- Mobile

- In-store

- Call Centers

- Other Data Sources (Surveys, Promotional Data, and Sales Representatives)

By Vertical:

- BFSI

- Retail & eCommerce

- Healthcare & Life Sciences

- Telecom

- Government & Defense

- Travel & hospitality

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Australia

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In December 2022, Accenture acquired Fiftyfive5 to boost its customer intelligence capability in Australia and New Zealand. Fiftyfive5’, with its 200 employees across New Zealand, Australia and Singapore, is now a part of Accenture Song, formerly Accenture Interactive. This acquisition enabled to strengthen Accenture’s capabilities across product innovation, commerce, marketing, sales and service, helping the company to strengthen its foothold in the growing global customer analytics market.

- In September 2022, new Customer 360 innovations from Salesforce were released that give businesses access to robust automation and intelligence solutions to promote efficient growth, deliver individualised customer experiences at scale, and enable clients to accomplish more with less.

- In June 2022, Zeta Global launched Opportunity Explorer(SM), a real-time market and consumer data analytics and insights solution. Zeta Global is a data-driven marketing technology firm that uses unique data and artificial intelligence to help businesses acquire, grow, and retain consumers. Opportunity Explorer(SM) gathers demographic, behavioural, and location signals from Zeta's proprietary data set of 2.4 billion identities globally, synthesises the data in real time, and produces a customizable, interactive display of actionable insights. It is designed to assist marketers in identifying, segment, and act upon growth opportunities for their businesses.

- In July 2020, SAS released four new service offerings and updates to SAS Customer Intelligence 360 to help brands accelerate the value delivered through analytics with a hybrid marketing approach.

Frequently Asked Questions (FAQ):

What is a customer intelligence platform?

A customer intelligence platform collects customer data from a range of relevant data sources and unifies that data to make it analysis-ready. The platform then applies sophisticated analytics, using AI/ML as well as human-driven analytics to glean actionable insight from customer data.

Which countries are considered in Europe?

The report includes an analysis of the UK, Germany, and France in Europe.

Which are key verticals adopting customer data platform solutions and services?

Key verticals adopting customer intelligence platforms and services include BFSI, retail & e-commerce, healthcare & life sciences, telecom, government & defense, travel & hospitality, manufacturing, energy & utilities, media & entertainment, and other verticals (IT & ITeS, transportation & logistics, and education).

Which are the key drivers supporting the growth of the customer intelligence platform market?

The key drivers supporting the growth of the customer data platform market include rising need to gain holistic view of customer data, intensifying need to deliver omnichannel experience, rising demand for personalized customer experiences, and shift toward data-driven marketing and advertising.

Who are the key vendors in the customer intelligence platform market?

The key vendors operating in the customer intelligence platform market are IBM (US), Oracle Corporation (US), Microsoft (US), Adobe (US), SAS (US), Salesforce (US), Google (US), Accenture (Ireland), Informatica (US), SAP (Germany), Verint (US), Teradata (US), Zeta Global (US), TIBCO Software (US), NICE Systems Ltd.(Israel), TransUnion (US), Alida (Canada), Algonomy (US), NetBase Quid (US), NGDATA (Belgium), Zeotap (Germany), ActionIQ (US), Amperity (US), UserIQ (US), Datashift (Belgium), Staircase AI (US), Terminus(US), and Lifesight (Singapore).These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and mergers and acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need to gain holistic view of customer data- Intensifying need to deliver omnichannel experience- Rising demand for personalized customer experiences- Shift toward data-driven marketing and advertisingRESTRAINTS- Need to ensure compliance with data privacy laws and protect customer dataOPPORTUNITIES- Development of AI- and ML-based customer intelligence platforms- Heightened adoption of customer intelligence platforms to monitor changes in market- Rising investments in customer intelligence platforms by large enterprisesCHALLENGES- Organizational failures pertaining to optimized use of customer data- Lack of skilled workforce

-

5.3 CASE STUDY ANALYSISCASE STUDY 1- To understand increasingly diverse customer base across industriesCASE STUDY 2- To create more personalized and relevant interactionsCASE STUDY 3- To analyze consumer behavior on all touchpointsCASE STUDY 4- To build better direct relationships with patientsCASE STUDY 5- To provide real-time and automated customer service

-

5.4 TECHNOLOGY ANALYSISCLOUD COMPUTING AND CUSTOMER INTELLIGENCE PLATFORMSBIG DATA AND ANALYTICS AND CUSTOMER INTELLIGENCE PLATFORMS

-

5.5 FEATURES OF CUSTOMER INTELLIGENCE PLATFORMSCUSTOMER SERVICE SOFTWAREMARKETING AUTOMATION SOFTWAREPOINT OF SALE SYSTEMSECOMMERCE PLATFORMSCUSTOMER RELATIONSHIP MANAGEMENT (CRM) SOFTWARE

-

5.6 TYPES OF DATA COLLECTED FOR CUSTOMER INTELLIGENCEDEMOGRAPHIC DATAPSYCHOGRAPHIC DATATRANSACTIONAL DATABEHAVIORAL DATA

-

5.7 ECOSYSTEM ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 SUPPLY CHAIN ANALYSIS

-

5.10 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATIONS AND PATENT APPLICATIONS- Top applicants

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 REGULATIONS AND INDUSTRIAL STANDARDSGENERAL DATA PROTECTION REGULATION (GDPR)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)INTERNATIONAL ORGANIZATION FOR STANDARDIZATION/INTERNATIONAL ELECTROTECHNICAL COMMISSION 27000 STANDARDSCLOUD SECURITY ALLIANCE (CSA) CONTROLSGOVERNANCE, RISK, AND COMPLIANCE (GRC)EUROPEAN UNION DATA PROTECTION REGULATIONSARBANES-OXLEY ACT OF 2002GRAMM–LEACH–BLILEY ACTEUROPEAN UNION DATA PROTECTION REGULATIONCAN-SPAM ACT

-

5.13 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PRICING ANALYSIS

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.16 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN CUSTOMER INTELLIGENCE PLATFORM MARKET

- 5.17 KEY CONFERENCES AND EVENTS, 2023–2024

-

6.1 INTRODUCTIONCOMPONENT: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERS

-

6.2 PLATFORMAI AND ML USED BY CUSTOMER INTELLIGENCE PLATFORM TO MANAGE AND ANALYZE DATA FROM MULTIPLE DISPARATE SOURCES

-

6.3 SERVICESCONSULTING SERVICES- Help organizations develop, implement, and maintain data-driven marketing operationsSUPPORT & MAINTENANCE SERVICES- Include upgrading of existing systems, software maintenance, and proactive servicesDEPLOYMENT & INTEGRATION SERVICES- Ensure efficient communication between systems to improve production processes

-

7.1 INTRODUCTIONDEPLOYMENT MODE: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERS

-

7.2 CLOUDFACILITATES CUSTOMER INTELLIGENCE PLATFORM DEPLOYMENT WITHOUT NEED FOR IT STAFF TO MANAGE SOFTWARE

-

7.3 ON-PREMISESPROVIDES ORGANIZATIONS WITH FULL CONTROL OVER ALL PLATFORMS AND SYSTEMS

-

8.1 INTRODUCTIONORGANIZATION SIZE: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERS

-

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)ADOPT CUSTOMER INTELLIGENCE PLATFORM TO GENERATE MAXIMUM ROI FROM THEIR MARKETING SPEND

-

8.3 LARGE ENTERPRISESDEPLOY CUSTOMER INTELLIGENCE PLATFORM TO EFFECTIVELY MANAGE VOLUMINOUS CUSTOMER DATA AND DERIVE ACTIONABLE INSIGHTS

-

9.1 INTRODUCTIONDATA CHANNEL: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERS

-

9.2 WEBFIRST POINT OF CONTACT FOR CUSTOMERS TO INTERACT WITH BUSINESSES

-

9.3 SOCIAL MEDIALARGEST SOURCE OF CUSTOMER INSIGHTS FOR MARKETERS

-

9.4 MOBILEENABLES PERSONALIZED COMMUNICATION BETWEEN USERS AND BUSINESSES

-

9.5 EMAILHELPS BUILD BETTER CUSTOMER RELATIONSHIPS BY DELIVERING PERSONALIZED CONTENT

-

9.6 IN-STOREGIVES CONSOLIDATED INFORMATION TO CUSTOMERS FOR BETTER UNDERSTANDING

-

9.7 CALL CENTERHANDLES ALL CUSTOMER-RELATED PROBLEMS AND QUERIES THROUGH CALLS

- 9.8 OTHER DATA CHANNELS

-

10.1 INTRODUCTIONAPPLICATION: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERS

-

10.2 CUSTOMER SEGMENTATION & TARGETINGENABLE MARKETERS TO DEVELOP DEEPER UNDERSTANDING OF CUSTOMER NEEDS

-

10.3 CUSTOMER RETENTION & ENGAGEMENTADOPTION OF PERSONALIZED APPS AND RECOMMENDATION OF USEFUL PRODUCTS TO RETAIN LOYAL CUSTOMERS

-

10.4 CUSTOMER BEHAVIOR ANALYTICSUSES DATA TO ANALYZE CUSTOMER REQUIREMENTS

-

10.5 CUSTOMER EXPERIENCE MANAGEMENTPRIORITIZES ORCHESTRATION AND PERSONALIZATION OF END-TO-END CUSTOMER EXPERIENCE

-

10.6 CUSTOMER DATA COLLECTION & MANAGEMENTHELPS IMPROVE SERVICES, UNDERSTAND CONSUMER NEEDS, REFINE BUSINESS STRATEGIES, AND RETAIN CUSTOMERS

-

10.7 OMNICHANNEL MARKETINGPROVIDES SEAMLESS SHOPPING EXPERIENCE ACROSS ALL CHANNELS

-

10.8 PERSONALIZED RECOMMENDATIONCUSTOMER INTELLIGENCE PLATFORM PROVIDING REAL-TIME DATA TO MARKETERS TO HELP THEM OFFER PERSONALIZED RECOMMENDATIONS

- 10.9 OTHER APPLICATIONS

-

11.1 INTRODUCTIONVERTICAL: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERS

-

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)USES CUSTOMER INTELLIGENCE PLATFORM TO INCREASE ONLINE ENGAGEMENT AND PROVIDE PERSONALIZED CUSTOMER EXPERIENCE

-

11.3 GOVERNMENT & DEFENSEUSES CUSTOMER INTELLIGENCE PLATFORM TO STRENGTHEN DATA COMPUTING CAPABILITIES, ENHANCE DATA SECURITY, AND REDUCE COSTS

-

11.4 TELECOMUTILIZES CUSTOMER INTELLIGENCE PLATFORM TO MANAGE HUGE DATA VOLUMES

-

11.5 RETAIL & ECOMMERCEUSES CUSTOMER INTELLIGENCE PLATFORM TO ACHIEVE AUTOMATED PERSONALIZED EXPERIENCES AND OPTIMIZE COSTS

-

11.6 MANUFACTURINGUSES CUSTOMER INTELLIGENCE PLATFORM TO INCREASE PERFORMANCE AND YIELD, REDUCE COSTS, AND OPTIMIZE SUPPLY CHAINS

-

11.7 MEDIA & ENTERTAINMENTINCORPORATES CUSTOMER INTELLIGENCE PLATFORM TO PROVIDE REAL-TIME CONTENT RECOMMENDATIONS BASED ON CONSUMER DATA

-

11.8 TRAVEL & HOSPITALITYUSES CIPS TO PROVIDE ENRICHING EXPERIENCES TO ENSURE CUSTOMER LOYALTY

-

11.9 HEALTHCARE & LIFE SCIENCESUSES CUSTOMER INTELLIGENCE PLATFORM TO UNDERSTAND PATIENT BEHAVIOR AND DELIVER PERSONALIZED EXPERIENCE

-

11.10 ENERGY & UTILITIESADOPTS CUSTOMER INTELLIGENCE PLATFORM TO TRACK CONSUMER BEHAVIOR AND PROVIDE BETTER SERVICES

- 11.11 OTHER VERTICALS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATIONS- Health Insurance Portability and Accountability Act of 1996- California Consumer Privacy Act- Health Information Technology for Economic and Clinical Health Act- Sarbanes Oxley Act- United States Securities and Exchange Commission- International Organization for Standardization 27001- California Consumer Privacy Act- Federal Information Security Management Act- Payment Card Industry Data Security Standard- Federal Information Processing StandardsUS- Development of innovative solutions to gain insights from customer intelligence platform to drive marketCANADA- Cloud adoption to support market growth

-

12.3 EUROPEEUROPE: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATIONS- GDPR 2016/679- General Data Protection Regulation- European Committee for Standardization- European Technical Standards InstituteUK- Rapid adoption of customer intelligence platform and services to drive marketGERMANY- Rising digital mobility in major industries to fuel customer intelligence platform marketFRANCE- Digital transformation in France to favor market growthREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERSASIA PACIFIC: REGULATIONS- Privacy Commissioner for Personal Data- Act on the Protection of Personal Information- International Organization for Standardization 27001- Personal Data Protection ActCHINA- Growing need to effectively manage huge volumes of data to boost demand for customer intelligence platformJAPAN- Growing adoption of customer intelligence platform to handle rising data volumes to accelerate market growthINDIA- Demand from BFSI, retail, and eCommerce sectors to substantiate market growthREST OF ASIA PACIFIC

-

12.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATIONS- Israeli Privacy Protection Regulations (Data Security), 5777-2017- GDPR- Protection of Personal Information Act (POPIA)KINGDOM OF SAUDI ARABIA- Newly published data protection laws to fuel market growthUNITED ARAB EMIRATES- Growing inclination toward advanced technologies to propel marketSOUTH AFRICA- Rising investments by customer intelligence platform vendors in South Africa to expedite market growthREST OF MIDDLE EAST & AFRICA

-

12.6 LATIN AMERICALATIN AMERICA: CUSTOMER INTELLIGENCE PLATFORM MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATIONS- Brazil Data Protection Law- Argentina Personal Data Protection Law No. 25.326BRAZIL- Adoption of customer intelligence platform by retail, BFSI, healthcare, and life sciences verticals to augment market growthMEXICO- Presence of SAS, SAP, and Oracle to foster market growthREST OF LATIN AMERICA

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

13.3 FIVE-YEAR REVENUE ANALYSISHISTORICAL REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.5 MARKET EVALUATION FRAMEWORK

-

13.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 13.7 COMPETITIVE BENCHMARKING

-

13.8 STARTUPS/SMES EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.9 STARTUPS/SMES COMPETITIVE BENCHMARKING

-

13.10 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSIBM- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewADOBE- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewSAS- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewSALESFORCE- Business overview- Platforms/Solutions/Services offered- Recent developmentsGOOGLE- Business overview- Platforms/Solutions/Services offered- Recent developmentsACCENTURE- Business overview- Platforms/Solutions/Services offered- Recent developmentsINFORMATICA- Business overview- Platforms/Solutions/Services offered- Recent developmentsSAP- Business overview- Platforms/Solutions/Services offered- Recent developmentsVERINT- Business overview- Platforms/Solutions/Services offered- Recent developmentsTERADATA- Business overview- Platforms/Solutions/Services offered- Recent developmentsZETA GLOBAL- Business overview- Platforms/Solutions/Services offered- Recent developmentsTIBCO SOFTWARE- Business overview- Platforms/Solutions/Services offered- Recent developmentsNICE- Business overview- Platforms/Solutions/Services offered- Recent developmentsTRANSUNION- Business overview- Platforms/Solutions/Services offered- Recent developments

-

14.3 SMES/STARTUPSALIDAALGONOMYNETBASE QUIDNGDATAZEOTAPACTIONIQAMPERITYUSERIQDATASHIFTSTAIRCASE AITERMINUSLIFESIGHT

- 15.1 INTRODUCTION

-

15.2 CUSTOMER JOURNEY ANALYTICS MARKET—GLOBAL FORECAST TO 2026MARKET DEFINITIONMARKET OVERVIEW- Customer journey analytics market, by component- Customer journey analytics market, by application- Customer journey analytics market, by deployment mode- Customer journey analytics market, by organization size- Customer journey analytics market, by industry vertical- Customer journey analytics market, by region

-

15.3 RETAIL ANALYTICS MARKET - GLOBAL FORECAST TO 2025MARKET DEFINITIONMARKET OVERVIEW- Retail analytics market, by component- Retail analytics market, by business function- Retail analytics market, by application- Retail analytics market, by organization size- Retail analytics market, by end user- Retail analytics market, by region

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 CUSTOMER INTELLIGENCE PLATFORM MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y%)

- TABLE 5 MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y%)

- TABLE 6 ECOSYSTEM ANALYSIS: MARKET

- TABLE 7 PATENTS FILED, 2019–2022

- TABLE 8 PORTER’S FIVE FORCES ANALYSIS: MARKET

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS 0N BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 16 CSUTOMER INTELLIGENCE PLATFORM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 17 CUSTOMER INTELLIGENCE PLATFORM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 18 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 19 PLATFORM: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 20 PLATFORM: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 21 SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 22 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 SERVICES: MARKET, BY SERVICE TYPE, 2018–2021 (USD MILLION)

- TABLE 24 SERVICES: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 25 CONSULTING SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 26 CONSULTING SERVICES: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY REGION, 2022–2027(USD MILLION)

- TABLE 27 SUPPORT & MAINTENANCE SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 28 SUPPORT & MAINTENANCE SERVICES: MARKET, BY REGION, 2022–2027(USD MILLION)

- TABLE 29 DEPLOYMENT & INTEGRATION SERVICES: MARKET, BY REGION, 2018–2021(USD MILLION)

- TABLE 30 DEPLOYMENT & INTEGRATION SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 31 MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 32 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 33 CLOUD: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 34 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 ON-PREMISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 36 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 38 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 39 SMES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 40 SMES: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 LARGE ENTERPRISES: MARKET, BY REGION, 2018–2021(USD MILLION)

- TABLE 42 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027(USD MILLION)

- TABLE 43 MARKET, BY DATA CHANNEL, 2018–2021 (USD MILLION)

- TABLE 44 MARKET, BY DATA CHANNEL, 2022–2027 (USD MILLION)

- TABLE 45 WEB: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 46 WEB: MARKET, BY REGION, 2022–2027(USD MILLION)

- TABLE 47 SOCIAL MEDIA: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 48 SOCIAL MEDIA: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 MOBILE: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 50 MOBILE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 EMAIL: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 52 EMAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 IN-STORE: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 54 IN-STORE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 CALL CENTER: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 56 CALL CENTER: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 57 OTHER DATA CHANNELS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 58 OTHER DATA CHANNELS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 59 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 60 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 61 CUSTOMER SEGMENTATION & TARGETING: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 62 CUSTOMER SEGMENTATION & TARGETING: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 63 CUSTOMER RETENTION & ENGAGEMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 64 CUSTOMER RETENTION & ENGAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 65 CUSTOMER BEHAVIOR ANALYTICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 66 CUSTOMER BEHAVIOR ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 CUSTOMER EXPERIENCE MANAGEMENT: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 68 CUSTOMER EXPERIENCE MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 69 CUSTOMER DATA COLLECTION & MANAGEMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 70 CUSTOMER DATA COLLECTION & MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 71 OMNICHANNEL MARKETING: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 72 OMNICHANNEL MARKETING: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 73 PERSONALIZED RECOMMENDATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 74 PERSONALIZED RECOMMENDATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 75 OTHER APPLICATIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 76 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 77 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 78 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 79 BFSI: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 80 BFSI: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 81 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 82 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 83 TELECOM: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 84 TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 85 RETAIL & ECOMMERCE: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 86 RETAIL & ECOMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 87 MANUFACTURING: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 88 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 89 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 90 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 91 TRAVEL & HOSPITALITY: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 92 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 93 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 94 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 95 ENERGY & UTILITIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 96 ENERGY & UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 97 OTHER VERTICALS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 98 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 99 MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 100 MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 101 NORTH AMERICA: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 102 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 103 NORTH AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: MARKET, BY DATA CHANNEL, 2018–2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: MARKET, BY DATA CHANNEL, 2022–2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 110 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 111 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 112 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 113 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 114 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 115 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 116 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 117 US: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 118 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 119 US: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 120 US: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 121 CANADA: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 122 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 123 CANADA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 124 CANADA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 125 EUROPE: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 126 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 127 EUROPE: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 128 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 129 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 130 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 131 EUROPE: MARKET, BY DATA CHANNEL, 2018–2021 (USD MILLION)

- TABLE 132 EUROPE: MARKET, BY DATA CHANNEL, 2022–2027 (USD MILLION)

- TABLE 133 EUROPE: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 134 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 135 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 136 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 137 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 138 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 139 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 140 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 141 UK: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 142 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 143 UK: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 144 UK: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 145 GERMANY: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 146 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 147 GERMANY: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 148 GERMANY: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 149 FRANCE: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 150 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 151 FRANCE: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 152 FRANCE: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 155 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 158 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 159 ASIA PACIFIC: MARKET, BY DATA CHANNEL, 2018–2021 (USD MILLION)

- TABLE 160 ASIA PACIFIC: MARKET, BY DATA CHANNEL, 2022–2027 (USD MILLION)

- TABLE 161 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 164 ASIA PACIFIC: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 165 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 166 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 168 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 169 CHINA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 170 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 171 CHINA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 172 CHINA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 173 JAPAN: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 174 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 175 JAPAN: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 176 JAPAN: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 177 INDIA: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 178 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 179 INDIA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 180 INDIA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY DATA CHANNEL, 2018–2021 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY DATA CHANNEL, 2022–2027 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 197 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 198 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 199 KINGDOM OF SAUDI ARABIA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 200 KINGDOM OF SAUDI ARABIA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 201 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 202 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 203 UNITED ARAB EMIRATES: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 204 UNITED ARAB EMIRATES: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 205 SOUTH AFRICA: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 206 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 207 SOUTH AFRICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 208 SOUTH AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 209 LATIN AMERICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 210 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 211 LATIN AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 212 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 213 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 214 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 215 LATIN AMERICA: MARKET, BY DATA CHANNEL, 2018–2021 (USD MILLION)

- TABLE 216 LATIN AMERICA: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY DATA CHANNEL, 2022–2027 (USD MILLION)

- TABLE 217 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 218 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 219 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 220 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 221 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 222 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 223 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 224 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 225 BRAZIL: CUSTOMER INTELLIGENCE PLATFORM MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 226 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 227 BRAZIL: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 228 BRAZIL: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 229 MEXICO: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 230 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 231 MEXICO: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 232 MEXICO: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 233 OVERVIEW OF STRATEGIES ADOPTED BY KEY CUSTOMER INTELLIGENCE PLATFORM VENDORS

- TABLE 234 MARKET: DEGREE OF COMPETITION

- TABLE 235 COMPANY PRODUCT FOOTPRINT

- TABLE 236 COMPANY REGION FOOTPRINT

- TABLE 237 CUSTOMER INTELLIGENCE PLATFORM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 238 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 239 PRODUCT LAUNCHES, 2019–2022

- TABLE 240 DEALS, 2019–2022

- TABLE 241 IBM: BUSINESS OVERVIEW

- TABLE 242 IBM: PRODUCTS OFFERED

- TABLE 243 IBM: SERVICES OFFERED

- TABLE 244 IBM: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 245 IBM: MARKET: DEALS

- TABLE 246 ORACLE: BUSINESS OVERVIEW

- TABLE 247 ORACLE: PRODUCTS OFFERED

- TABLE 248 ORACLE: SERVICES OFFERED

- TABLE 249 ORACLE: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 250 ORACLE: MARKET: DEALS

- TABLE 251 MICROSOFT: BUSINESS OVERVIEW

- TABLE 252 MICROSOFT: PRODUCTS OFFERED

- TABLE 253 MICROSOFT: SERVICES OFFERED

- TABLE 254 MICROSOFT: CUSTOMER INTELLIGENCE PLATFORM MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 255 MICROSOFT: MARKET: DEALS

- TABLE 256 ADOBE: BUSINESS OVERVIEW

- TABLE 257 ADOBE: PRODUCTS OFFERED

- TABLE 258 ADOBE: SERVICES OFFERED

- TABLE 259 ADOBE: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 260 ADOBE: MARKET: DEALS

- TABLE 261 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 262 SAS INSTITUTE: PRODUCTS OFFERED

- TABLE 263 SAS INSTITUTE: SERVICES OFFERED

- TABLE 264 SAS INSTITUTE: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 265 SAS INSTITUTE: MARKET: DEALS

- TABLE 266 SALESFORCE: BUSINESS OVERVIEW

- TABLE 267 SALESFORCE: PRODUCTS OFFERED

- TABLE 268 SALESFORCE: SERVICES OFFERED

- TABLE 269 SALESFORCE: CUSTOMER INTELLIGENCE PLATFORM MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 270 SALESFORCE: MARKET: DEALS

- TABLE 271 GOOGLE: BUSINESS OVERVIEW

- TABLE 272 GOOGLE: PRODUCTS OFFERED

- TABLE 273 GOOGLE: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 274 GOOGLE: MARKET: DEALS

- TABLE 275 ACCENTURE: BUSINESS OVERVIEW

- TABLE 276 ACCENTURE: PRODUCTS OFFERED

- TABLE 277 ACCENTURE: SERVICES OFFERED

- TABLE 278 ACCENTURE: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 279 ACCENTURE: MARKET: DEALS

- TABLE 280 INFORMATICA: BUSINESS OVERVIEW

- TABLE 281 INFORMATICA: PRODUCTS OFFERED

- TABLE 282 INFORMATICA: CUSTOMER INTELLIGENCE PLATFORM MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 283 INFORMATICA: MARKET: DEALS

- TABLE 284 SAP: BUSINESS OVERVIEW

- TABLE 285 SAP: PRODUCTS OFFERED

- TABLE 286 SAP: SERVICES OFFERED

- TABLE 287 SAP: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 288 SAP: MARKET: DEALS

- TABLE 289 VERINT: BUSINESS OVERVIEW

- TABLE 290 VERINT: PRODUCTS OFFERED

- TABLE 291 VERINT: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 292 TERADATA: BUSINESS OVERVIEW

- TABLE 293 TERADATA: PRODUCTS OFFERED

- TABLE 294 TERADATA: SERVICES OFFERED

- TABLE 295 TERADATA: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 296 TERADATA: CUSTOMER INTELLIGENCE PLATFORM MARKET: DEALS

- TABLE 297 ZETA GLOBAL: BUSINESS OVERVIEW

- TABLE 298 ZETA GLOBAL: PRODUCTS OFFERED

- TABLE 299 ZETA GLOBAL: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 300 ZETA GLOBAL: MARKET: DEALS

- TABLE 301 TIBCO SOFTWARE: BUSINESS OVERVIEW

- TABLE 302 TIBCO SOFTWARE: PRODUCTS OFFERED

- TABLE 303 TIBCO SOFTWARE: SERVICES OFFERED

- TABLE 304 TIBCO SOFTWARE: MARKET: DEALS

- TABLE 305 NICE: BUSINESS OVERVIEW

- TABLE 306 NICE: PRODUCTS OFFERED

- TABLE 307 NICE: SERVICES OFFERED

- TABLE 308 NICE: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 309 NICE: MARKET: DEALS

- TABLE 310 TRANSUNION: BUSINESS OVERVIEW

- TABLE 311 TRANSUNION: PRODUCTS OFFERED

- TABLE 312 TRANSUNION: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 313 TRANSUNION: CUSTOMER INTELLIGENCE PLATFORM MARKET: DEALS

- TABLE 314 CUSTOMER JOURNEY ANALYTICS MARKET, BY COMPONENT, 2015–2019 (USD MILLION)

- TABLE 315 CUSTOMER JOURNEY ANALYTICS MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

- TABLE 316 CUSTOMER JOURNEY ANALYTICS MARKET, BY APPLICATION, 2015–2019 (USD MILLION)

- TABLE 317 CUSTOMER JOURNEY ANALYTICS MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

- TABLE 318 CUSTOMER JOURNEY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

- TABLE 319 CUSTOMER JOURNEY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

- TABLE 320 CUSTOMER JOURNEY ANALYTICS MARKET, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

- TABLE 321 CUSTOMER JOURNEY ANALYTICS MARKET, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

- TABLE 322 CUSTOMER JOURNEY ANALYTICS MARKET, BY VERTICAL, 2015–2019 (USD MILLION)

- TABLE 323 CUSTOMER JOURNEY ANALYTICS MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

- TABLE 324 CUSTOMER JOURNEY ANALYTICS MARKET, BY REGION, 2015–2019 (USD MILLION)

- TABLE 325 CUSTOMER JOURNEY ANALYTICS MARKET, BY REGION, 2020–2026 (USD MILLION)

- TABLE 326 RETAIL ANALYTICS MARKET SIZE AND GROWTH RATE, 2016–2019 (USD MILLION, Y-O-Y %)

- TABLE 327 RETAIL ANALYTICS MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y %)

- TABLE 328 RETAIL ANALYTICS MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

- TABLE 329 RETAIL ANALYTICS MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

- TABLE 330 RETAIL ANALYTICS MARKET, BY BUSINESS FUNCTION, 2016–2019 (USD MILLION)

- TABLE 331 RETAIL ANALYTICS MARKET, BY BUSINESS FUNCTION, 2019–2025 (USD MILLION)

- TABLE 332 RETAIL ANALYTICS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

- TABLE 333 RETAIL ANALYTICS MARKET, BY APPLICATION, 2019–2025 (USD MILLION)

- TABLE 334 RETAIL ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

- TABLE 335 RETAIL ANALYTICS MARKET, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

- TABLE 336 RETAIL ANALYTICS MARKET, BY END USER, 2016–2019 (USD MILLION)

- TABLE 337 RETAIL ANALYTICS MARKET, BY END USER, 2019–2025 (USD MILLION)

- TABLE 338 RETAIL ANALYTICS MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 339 RETAIL ANALYTICS MARKET, BY REGION, 2019–2025 (USD MILLION)

- FIGURE 1 CUSTOMER INTELLIGENCE PLATFORM MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) — ESTIMATION OF REVENUES GENERATED FROM CUSTOMER INTELLIGENCE PLATFORMS/SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE)—COLLECTIVE REVENUE GENERATED FROM ALL CUSTOMER INTELLIGENCE PLATFORMS/SERVICES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3 BOTTOM-UP (DEMAND SIDE)—ESTIMATION OF SHARE OF CUSTOMER INTELLIGENCE PLATFORMS IN OVERALL SPENDING

- FIGURE 7 PLATFORM SEGMENT ACCOUNTED FOR LARGER MARKET SIZE IN 2022

- FIGURE 8 SUPPORT & MAINTENANCE SERVICE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 9 CLOUD SEGMENT HELD LARGER MARKET SIZE IN 2022

- FIGURE 10 LARGE ENTERPRISES SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- FIGURE 11 CUSTOMER DATA COLLECTION & MANAGEMENT SEGMENT HELD LARGEST MARKET SIZE IN 2022

- FIGURE 12 WEB SEGMENT CAPTURED LARGEST MARKET SHARE IN 2022

- FIGURE 13 RETAIL & ECOMMERCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 NORTH AMERICA HELD LARGEST SHARE OF MARKET IN 2022

- FIGURE 15 INCREASING SPENDING ON MARKETING AND ADVERTISING ACTIVITIES BY ENTERPRISES

- FIGURE 16 RETAIL & ECOMMERCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2022

- FIGURE 18 PLATFORM AND BFSI SEGMENTS HELD LARGEST SHARES OF NORTH AMERICAN MARKET IN 2022

- FIGURE 19 CUSTOMER INTELLIGENCE PLATFORM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 VALUE CHAIN ANALYSIS: MARKET

- FIGURE 21 SUPPLY CHAIN ANALYSIS: MARKET

- FIGURE 22 TOTAL NUMBER OF PATENTS GRANTED PER YEAR, 2019–2022

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

- FIGURE 24 PORTER’S FIVE FORCES ANALYSIS: MARKET

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 26 CUSTOMER INTELLIGENCE PLATFORM MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 27 PLATFORM SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 28 DEPLOYMENT & INTEGRATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 CLOUD SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 MOBILE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 CUSTOMER DATA COLLECTION & MANAGEMENT SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 33 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2027

- FIGURE 34 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: SNAPSHOT OF CUSTOMER INTELLIGENCE MARKET

- FIGURE 37 ASIA PACIFIC: SNAPSHOT OF CUSTOMER INTELLIGENCE MARKET

- FIGURE 38 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS, 2018–2022 (USD MILLION)

- FIGURE 39 MARKET SHARE ANALYSIS FOR KEY COMPANIES

- FIGURE 40 MARKET EVALUATION FRAMEWORK: STRATEGIES ADOPTED IN MARKET BETWEEN 2020 AND 2022

- FIGURE 41 MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 42 CUSTOMER INTELLIGENCE PLATFORM MARKET: STARTUPS/SMES EVALUATION QUADRANT, 2022

- FIGURE 43 IBM: COMPANY SNAPSHOT

- FIGURE 44 ORACLE: COMPANY SNAPSHOT

- FIGURE 45 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 46 ADOBE: COMPANY SNAPSHOT

- FIGURE 47 SAS INSTITUTE: COMPANY SNAPSHOT

- FIGURE 48 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 49 GOOGLE: COMPANY SNAPSHOT

- FIGURE 50 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 51 SAP: COMPANY SNAPSHOT

- FIGURE 52 VERINT: COMPANY SNAPSHOT

- FIGURE 53 TERADATA: COMPANY SNAPSHOT

- FIGURE 54 ZETA GLOBAL: COMPANY SNAPSHOT

- FIGURE 55 NICE: COMPANY SNAPSHOT

- FIGURE 56 TRANSUNION: COMPANY SNAPSHOT

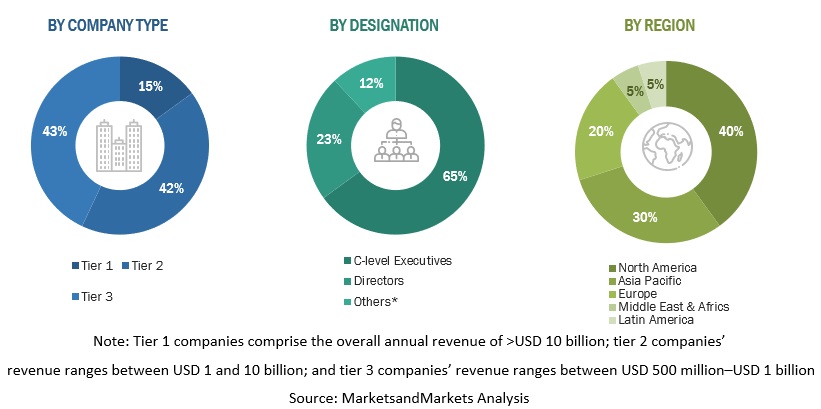

The research study for the customer intelligence platform market report involved the use of extensive secondary sources, directories, as well as several journals and magazines to identify and collect information that is useful for this technical and market-oriented study. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, high-level executives of various companies offering customer intelligence platforms and services, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases. Secondary research was used to obtain key information about the industry’s value chain and supply chain to identify the key players according to their offerings and industry trends related to technology, application, and region, and key developments from both market and technology-oriented perspectives.

Primary Research

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using customer intelligence platform, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of customer intelligence platform and services, which would impact the overall customer intelligence platform market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the top-down approach, an exhaustive list of all the vendors offering platforms and services in the customer int<

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For converting various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the customer intelligence platform market by component (platform and services), organization size, data channel, deployment mode, application, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the customer intelligence platform market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American customer intelligence platform market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA customer intelligence platform market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Customer Intelligence Platform Market