Data Governance Market by Component, Deployment Model, Organisation Size, Application (Risk Management, Incident Management, and Compliance Management), Vertical (Manufacturing, Healthcare and BFSI), and Region - Global Forecast to 2025

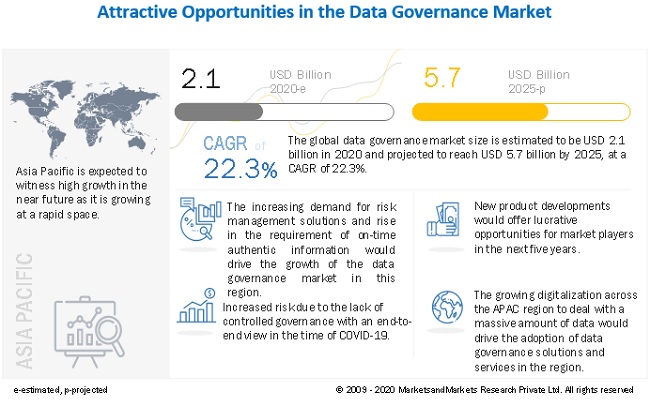

The worldwide Data Governance market size was valued at USD 2.1 billion in 2020 and is expected to grow at a CAGR of 22.3% from 2020 to 2025. The revenue forecast for Data Governance industry is projected to reach $5.7 billion by 2025. The base year for estimation is 2019, and the historical data spans from 2020 to 2025. Data governance include the factors such as the rapidly increasing growth in data volumes, rising regulatory and compliance mandates, and enhancing strategic risk management and decision-making with the increasing business collaborations are expected to drive the growth of the market.

Data Governance Market Dynamics

Driving Factors

Data governance is a set of processes that ensures the systematic management and protection of important and critical data throughout the organization. It ensures trusted information is used for accounting, decision-making, and other critical business processes. With the advent of several data regulations by governments, it has become more critical than ever to ensure data within an organization is stored, used, and discarded appropriately. Organizations wish to achieve data regulation compliance to observe international and national laws and standards, along with industry-specific regulatory data requirements. Several US states are developing legislation and passing laws about data privacy that are similar to the General Data Protection Regulation (GDPR). In particular, California has passed the California Consumer Privacy Act (CCPA) mandating the protection of personal data of individuals. For instance, according to Deutsche Bank, GDPR fines alone could wipe out 2% from Google’s revenue.

Restraining Factors

Extracting value from data has become a key requirement for companies to successfully mitigate risks, target valuable customers, and evaluate their overall business performance. In addition, monetizing data assets require the availability of a sufficient amount of data. However, data consolidation from distinct data sources into meaningful information can set into motion a variety of new challenges for most organizations, especially centralized business enterprises. Data exchange and data ecosystem deliver the required tools to analyze the collected data at a centralized location and help extract and cross-check business-critical components. The development of data exchanges and data ecosystems varies, based on the assumptions made in the value of the data for each customer segment. Various data governance providers offer unified data aggregation and data analytics platforms that help users successfully aggregate and analyze data from disparate data sources.

Solution Insights

Organizations are beginning to take a deeper look at gaining information about continuously flowing data. The ability of organizations to act as soon as events are generated improves operational responsiveness and organizational effectiveness. Any enterprise that collects money, processes, and stores customer and payment data, and partners with other enterprises are required to comply with certain controls. These controls set some expectations on what the architecture and DevOps practices must conform to. DevOps is a set of practices that automates the processes between software development and IT teams to build, test, and release software faster and with better reliability. There is a strong correlation between DevOps adoption and the implementation of a data governance program.

Component Insights

The growing Bring Your Own Device (BYOD) trend has led to a decline in the number of Personal Computers (PCs) and fixed assets across organizations, globally. According to a market survey assessment conducted by Symantec, more than 50% of respondents reported that mobile device security, data breach security, mobile data security, and mobile application security are the 4 areas that require prompt attention from the BYOD perspective. Hence, as employees are increasingly operating their devices for work-related activities, the costs associated with cyberattacks on these employee devices can have a sizable impact on businesses. Though this works in favor of solution providers in terms of the growing demand, complexities associated with securing these devices can be painstakingly intricate as well as expensive to deploy and maintain. Additionally, inconsistent risk and compliance practices present a greater complication to the existing business setting. This further enhances the presence of inherent risks associated with the functioning of an organization

By component, the solution segment is expected to account for the higher market share during the forecast period

Data governance solutions enable business users across verticals to efficiently and effectively monitor, manage, and control data movement across organizations. The increased use of mobile devices among individuals within an organization and the easy availability and ubiquitous accessibility of data have enabled organizations and individuals to adopt data governance solutions.

By deployment type, the on- premise deployment segment to record the higher CAGR during the forecast period

The on-premises deployment of data governance solutions and services is a more commonly used practice of offering enterprises the power to manage risks, business processes, industry policies, and compliance management. Total control over the security and privacy of enterprise master data would drive the on-premises segment

By organization size, the SME segment to record the higher CAGR during the forecast period

SMEs are adopting data governance solutions at a good pace to enhance their GRC programs. To help SMEs meet various regulatory requirements, vendors in the market roll data governance solutions with the intent to cater to the organizations. The growing market share of SMEs across industry verticals, such as healthcare and life sciences, manufacturing, and energy and utilities, and their focus on adopting technologically advanced solutions and processes would drive the adoption of data governance solutions and services.

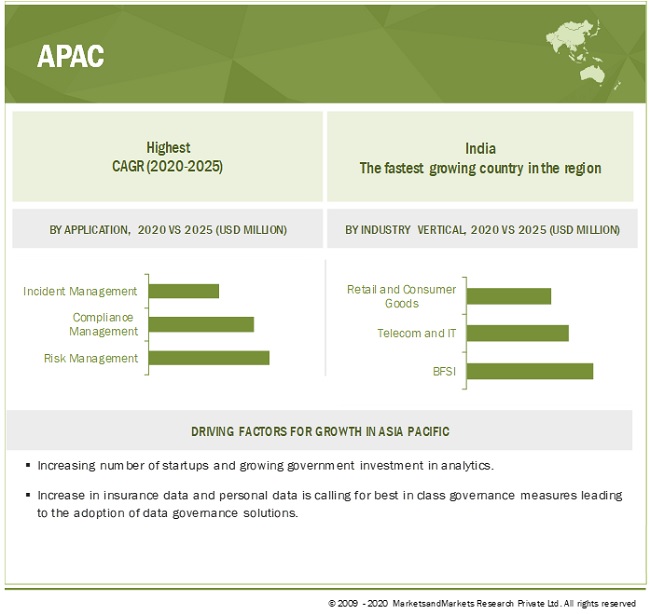

APAC to account for the largest market size during the forecast period

APAC shows tremendous growth opportunities, especially in the regions of developing economies, such as China, India, Bangladesh, and others. With the growth of smart cities and the proliferation of IoT devices, the region is expected to witness ultra-growth in the coming years. For instance, in India, the government backing initiatives, such as the “Digital India Scheme,” with a vision to transform India into a digitally empowered society and knowledge economy. The emphasis of the Indian government on the “Digital India” campaign and stringent rules of the Reserve Bank of India on tightening its regulations to counter non-performing assets will prove to boost the market growth.

Key Market Players

IBM (US), Oracle (US), SAP (Germany), SAS (US), Collibra (US), Informatica (US), Talend (US), TopQuadrant (US), Information Builders (US), Alation (US), TIBCO (US), Varonis (US), erwin (US), Data Advantage Group (US), Syncsort (US), Infogix (US), Magnitude Software (US), Ataccama (US), Reltio (US), Global Data Excellence (Switzerland), Global IDs (US), Innovative Routines International (US), Denodo (US), Adaptive (US), Microsoft (US), Zaloni (US), Alex Solutions (Australia), Microfocus (UK) and Mindtree(US).

Informatica (US) is recognized as one of the leading market players in the data governance market. It offers various solutions related to data management and big data, such as data quality, data security, data integration, MDM, and associated cloud solutions. The company majorly serves the banking and capital markets, healthcare, insurance, retail, and life sciences sectors. With its data governance offering, the company helps business users uphold data stewardship by maintaining up-to-date data with improved accuracy and as per industry regulations. Through its data governance segment, the company provides solutions, such as Intelligent Data Quality, Data Masking, Multidomain MDM, Data Archive, and other cloud-related applications.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

BY COMPONENT, DEPLOYMENT MODEL, ORGANISATION SIZE, APPLICATION (RISK MANAGEMENT, INCIDENT MANAGEMENT, AND COMPLIANCE MANAGEMENT), VERTICAL (MANUFACTURING, HEALTHCARE AND BFSI), AND REGION |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Oracle (US), SAP (Germany), SAS (US), Collibra (US), Informatica (US), Talend (US), TopQuadrant (US), Information Builders (US), Alation (US), TIBCO (US), Varonis (US), erwin (US), Data Advantage Group (US), Syncsort (US), Infogix (US), Magnitude Software (US), Ataccama (US), Reltio (US), Global Data Excellence (Switzerland), Global IDs (US), Innovative Routines International (US), Denodo (US), Adaptive (US), Microsoft (US), Zaloni (US), Alex Solutions (Australia), Microfocus (UK) and Mindtree(US). |

The research report categorizes the data governance market to forecast the revenues and analyze the trends in each of the following subsegments:

By Application

- Incident management

- Process management

- Compliance management

- Risk management

- Audit management

- Data quality and security management

- Others (Network management and Employee performance management)

By Industry vertical

- BFSI

- Retail and Consumer Goods

- Telecom and IT

- Government

- Healthcare

- Manufacturing

- Energy and Utilities

- Transportation and Logistics

- Others ()

By Component

- Solutions

-

Services

- Managed services

-

Professional services

- Consulting services

- Support and maintenance services

- Deployment and Integration Services

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large enterprises

By Deployment Model

- On-premises

- Cloud

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Retail and consumer goods

- Government and defense

- Healthcare and life sciences

- Manufacturing

- Telecommunications and IT

- Energy and utilities

- Construction and engineering

- Others (Research, Education, Travel and hospitality, and Real estate)

By Region

- North America

- Europe

- APAC

- Latin America

- MEA

Recent Developments

- In June 202, erwin and Mikan Associates announced a strategic partnership to help organizations adopt data governance solutions.

- In May 2020, in an effort to support the worldwide community of people working to combat the COVID-19 pandemic, Alation announced the creation of a public data catalog populated with information on COVID-19. The data catalog was designed as a collaboration platform where a community of data scientists, researchers, and epidemiologists can work together to answer key questions about the disease caused by infection with the novel coronavirus.

- In May 2020, Informatica expanded capabilities for its Cloud Data Quality solution. The updates include profiling intelligence and automation through Informatica’s AI-powered CLAIRE engine, as well as enhancements to parsing and deduplication.

Frequently Asked Questions (FAQ):

What is data governance?

According to IBM Data governance is the overall management of availability, usability, integrity and security of data used in an enterprise. Many organizations have multiple business functions that generate data sets with no unified view.

What is the size of data governance market?

The global data governance market size is expected to grow from USD 2.1 billion in 2020 to USD 5.7 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 22.3% during the forecast period. Major factors driving the market include the advent of various data regulations by governments. It has become more critical than ever to ensure that data within an organization is stored, used, and discarded appropriately.

Who are the top vendors in the data governance market?

The major vendors operating in the data governance market include Talend, IRI, Collibra, IBM, Ataccama and Informatica. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and mergers and acquisitions.

What are the major applications of data governance solutions?

Major applications of data governance solutions include risk management, compliance management, incident management and audit management. Enterprises with limited financial capabilities and unskilled IT professionals have started implementing data governance solutions, which enables enterprises to effectively handle centrally managed data sets, enhance data quality, and adhere to the data auditing, risk management, and compliance management policies.

Which verticals are adopting data governance solutions and services?

The top verticals adopting data governance solutions and services include BFSI, energy and utilities, healthcare, and telecom and IT. Data governance solutions are gaining acceptance among all verticals to improve profitability and reduce overall costs.

Does this report include the impact of COVID-19 on data governance market?

Yes, the report includes the impact of COVID-19 on data governance. It also throws light on regional impact of COVID-19 in data governance market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.6 MARKET SCOPE

1.6.1 INCLUSIONS AND EXCLUSIONS

1.6.2 MARKET SEGMENTATION

1.6.3 REGIONS COVERED

1.6.4 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 53)

2.1 RESEARCH DATA

FIGURE 6 DATA GOVERNANCE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

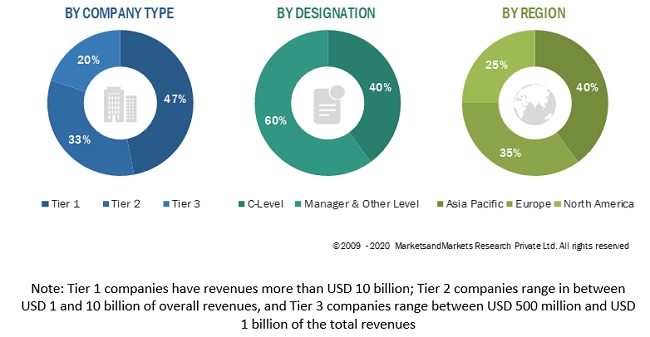

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF PRODUCTS/SOLUTIONS/SERVICES OF MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1— BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS/SOLUTIONS/ SERVICES OF MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2—BOTTOM-UP (DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES SOLD AND THEIR AVERAGE SELLING PRICE

FIGURE 11 DATA GOVERNANCE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

2.7 COMPETITIVE LEADERSHIP MAPPING RESEARCH METHODOLOGY

TABLE 4 EVALUATION CRITERIA

2.7.1 VENDOR INCLUSION CRITERIA

3 EXECUTIVE SUMMARY (Page No. - 66)

TABLE 5 GLOBAL DATA GOVERNANCE MARKET SIZE AND GROWTH RATE, 2014–2019 (USD MILLION, Y-O-Y %)

TABLE 6 GLOBAL MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y %)

FIGURE 12 MARKET SNAPSHOT, BY COMPONENT

FIGURE 13 MARKET SNAPSHOT, BY SERVICE

FIGURE 14 MARKET SNAPSHOT, BY DEPLOYMENT MODEL

FIGURE 15 MARKET SNAPSHOT, BY ORGANIZATION SIZE

FIGURE 16 MARKET SNAPSHOT, BY APPLICATION

FIGURE 17 MARKET SNAPSHOT, BY VERTICAL

FIGURE 18 MARKET SNAPSHOT, BY REGION

4 PREMIUM INSIGHTS (Page No. - 71)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE DATA GOVERNANCE MARKET

FIGURE 19 EFFICIENT DATA GOVERNANCE ENHANCES THE QUALITY OF DATA BY ESTABLISHING DATA QUALITY METRICS TO IDENTIFY QUALITY ISSUES AND REMEDIATION PLANS

4.2 MARKET: TOP 3 APPLICATIONS

FIGURE 20 RISK MANAGEMENT SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET: BY REGION

FIGURE 21 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4.4 MARKET IN NORTH AMERICA, BY APPLICATION AND INDUSTRY VERTICAL

FIGURE 22 RISK MANAGEMENT AND BFSI SEGMENTS TO ACCOUNT FOR LARGEST MARKET SHARES IN THE NORTH AMERICAN MARKET IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 74)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DATA GOVERNANCE MARKET

5.2.1 DRIVERS

5.2.1.1 Growing regulatory compliance and privacy concerns for data security

5.2.1.2 Increasing demand to ensure high data quality and lineage throughout an organization’s data life cycle

5.2.1.3 Improving BI and analytics to decrease customer risks

5.2.2 RESTRAINTS

5.2.2.1 Integration of data from data silos

5.2.3 OPPORTUNITIES

5.2.3.1 Growing applications of AI in data governance

5.2.3.2 Adoption of DevOps across all company software

5.2.4 CHALLENGES

5.2.4.1 Complexities in governing security across BYOD and cloud platforms

5.2.4.2 Increased risk due to the lack of controlled governance with an end-to-end view in the time of COVID-19

5.2.4.3 Data governance problems resulting from the COVID-19 pandemic

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 ADJACENT MARKETS

TABLE 7 ADJACENT MARKETS TO THE DATA GOVERNANCE MARKET

5.4 USE CASES

5.4.1 USE CASE: SCENARIO 1

5.4.2 USE CASE: SCENARIO 2

5.4.3 USE CASE: SCENARIO 3

5.4.4 USE CASE: SCENARIO 4

5.4.5 USE CASE: SCENARIO 5

5.4.6 USE CASE: SCENARIO 6

5.5 REGULATORY IMPLICATIONS

5.5.1 GENERAL DATA PROTECTION REGULATION

5.5.2 CALIFORNIA CONSUMER PRIVACY ACT

5.5.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

5.5.4 HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH ACT

5.5.5 EUROPEAN MARKET INFRASTRUCTURE REGULATION

5.5.6 BASEL COMMITTEE ON BANKING SUPERVISION 239 COMPLIANCE

5.5.7 SARBANES-OXLEY ACT OF 2002

5.5.8 PERSONAL DATA PROTECTION ACT

6 DATA GOVERNANCE MARKET: COVID-19 IMPACT (Page No. - 85)

FIGURE 24 MARKET TO WITNESS A MINOR DECLINE BETWEEN 2020 AND 2021

7 DATA GOVERNANCE MARKET, BY APPLICATION (Page No. - 86)

7.1 INTRODUCTION

7.1.1 APPLICATION: COVID-19 IMPACT

FIGURE 25 COMPLIANCE MANAGEMENT SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 8 MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 9 MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

7.2 INCIDENT MANAGEMENT

7.2.1 INCIDENT MANAGEMENT: MARKET DRIVERS

TABLE 10 INCIDENT MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 11 INCIDENT MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 PROCESS MANAGEMENT

7.3.1 PROCESS MANAGEMENT: MARKET DRIVERS

TABLE 12 PROCESS MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 13 PROCESS MANAGEMENT: DATA GOVERNANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.4 COMPLIANCE MANAGEMENT

7.4.1 COMPLIANCE MANAGEMENT: MARKET DRIVERS

TABLE 14 COMPLIANCE MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 15 COMPLIANCE MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.5 RISK MANAGEMENT

7.5.1 RISK MANAGEMENT: MARKET DRIVERS

TABLE 16 RISK MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 17 RISK MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.6 AUDIT MANAGEMENT

7.6.1 AUDIT MANAGEMENT: MARKET DRIVERS

TABLE 18 AUDIT MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 19 AUDIT MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.7 DATA QUALITY AND SECURITY MANAGEMENT

7.7.1 DATA QUALITY AND SECURITY MANAGEMENT: DATA GOVERNANCE MARKET DRIVERS

TABLE 20 DATA QUALITY AND SECURITY MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 21 DATA QUALITY AND SECURITY MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.8 OTHERS

TABLE 22 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 23 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 DATA GOVERNANCE MARKET, BY COMPONENT (Page No. - 99)

8.1 INTRODUCTION

8.1.1 COMPONENT: COVID-19 IMPACT

FIGURE 26 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 24 MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 25 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

8.2 SOLUTIONS

8.2.1 SOLUTIONS: MARKET DRIVERS

TABLE 26 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 27 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 SERVICES

8.3.1 SERVICES: MARKET DRIVERS

FIGURE 27 PROFESSIONAL SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 28 SERVICES: DATA GOVERNANCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 29 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 30 SERVICES: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 31 SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

8.3.2 MANAGED SERVICES

TABLE 32 MANAGED SERVICES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 33 MANAGED SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.3 PROFESSIONAL SERVICES

FIGURE 28 DEPLOYMENT AND INTEGRATION SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 34 MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 35 DATA GOVERNANCE MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 36 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 37 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.3.1 Consulting Services

TABLE 38 CONSULTING SERVICES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 39 CONSULTING SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.3.2 Support and maintenance

TABLE 40 SUPPORT AND MAINTENANCE SERVICES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 41 SUPPORT AND MAINTENANCE SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.3.3 Deployment and integration

TABLE 42 DEPLOYMENT AND INTEGRATION SERVICES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 43 DEPLOYMENT AND INTEGRATION SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 DATA GOVERNANCE MARKET, BY DEPLOYMENT MODEL (Page No. - 112)

9.1 INTRODUCTION

9.1.1 DEPLOYMENT MODEL: COVID-19 IMPACT

FIGURE 29 ON-PREMISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 44 MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 45 MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

9.2 ON-PREMISES

9.2.1 ON-PREMISES: MARKET DRIVERS

TABLE 46 ON-PREMISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 47 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 CLOUD

9.3.1 CLOUD: MARKET DRIVERS

TABLE 48 CLOUD: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 49 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 DATA GOVERNANCE MARKET, BY ORGANIZATION SIZE (Page No. - 117)

10.1 INTRODUCTION

10.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 30 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 50 MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 51 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.2 SMALL AND MEDIUM-SIZED ENETRPRISES

10.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 52 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 53 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.3 LARGE ENTERPRISES

10.3.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 54 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 55 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11 DATA GOVERNANCE MARKET, BY VERTICAL (Page No. - 122)

11.1 INTRODUCTION

11.1.1 INDUSTRY VERTICAL: COVID-19 IMPACT

FIGURE 31 TELECOM AND IT VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 56 MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 57 MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE

11.2.1 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET DRIVERS

TABLE 58 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 59 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.3 RETAIL AND CONSUMER GOODS

11.3.1 RETAIL AND CONSUMER GOODS: MARKET DRIVERS

TABLE 60 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 61 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.4 GOVERNMENT

11.4.1 GOVERNMENT: DATA GOVERNANCE MARKET DRIVERS

TABLE 62 GOVERNMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 63 GOVERNMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.5 HEALTHCARE

11.5.1 HEALTHCARE: MARKET DRIVERS

TABLE 64 HEALTHCARE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 65 HEALTHCARE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.6 MANUFACTURING

11.6.1 MANUFACTURING: MARKET DRIVERS

TABLE 66 MANUFACTURING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 67 MANUFACTURING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.7 TELECOM AND IT

11.7.1 TELECOM AND IT: MARKET DRIVERS

TABLE 68 TELECOM AND IT: DATA GOVERNANCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 69 TELECOM AND IT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.8 ENERGY AND UTILITIES

11.8.1 ENERGY AND UTILITIES: MARKET DRIVERS

TABLE 70 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 71 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.9 TRANSPORTATION AND LOGISTICS

11.9.1 TRANSPORTATION AND LOGISTICS: MARKET DRIVERS

TABLE 72 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 73 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.10 OTHERS

TABLE 74 OTHER VERTICALS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 75 OTHER VERTICALS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12 DATA GOVERNANCE MARKET, BY REGION (Page No. - 138)

12.1 INTRODUCTION

FIGURE 32 ASIA PACIFIC TO HAVE THE HIGHEST CAGR IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 33 INDIA TO HAVE THE HIGHEST CAGR IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 34 NORTH AMERICA TO HOLD THE LARGEST SHARE DURING THE FORECAST PERIOD

TABLE 76 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 77 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: DATA GOVERNANCE MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 78 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.2.3 UNITED STATES

TABLE 94 US: DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 95 US: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 96 US: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 97 US: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 98 US: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 99 US: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 100 US: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 101 US: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 102 US: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 103 US: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

12.2.4 CANADA

TABLE 104 CANADA: DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 105 CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 106 CANADA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 107 CANADA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 108 CANADA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 109 CANADA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 110 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 111 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 112 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 113 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: DATA GOVERNANCE MARKET DRIVERS

12.3.2 EUROPE: COVID-19 IMPACT

TABLE 114 EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.3.3 UNITED KINGDOM

TABLE 130 UK: DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 131 UK: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 132 UK: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 133 UK: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 134 UK: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 135 UK: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 136 UK: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 137 UK: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 138 UK: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 139 UK: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

12.3.4 FRANCE

TABLE 140 FRANCE: DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 141 FRANCE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 142 FRANCE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 143 FRANCE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 144 FRANCE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 145 FRANCE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 146 FRANCE: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 147 FRANCE: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 148 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 149 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

12.3.5 GERMANY

TABLE 150 GERMANY: DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 151 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 152 GERMANY: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 153 GERMANY: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 154 GERMANY: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 155 GERMANY: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 156 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 157 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 158 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 159 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

12.3.6 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: DATA GOVERNANCE MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 170 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.4.3 CHINA

TABLE 176 CHINA: DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 177 CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 178 CHINA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 179 CHINA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 180 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 181 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 182 CHINA: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 183 CHINA: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 184 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 185 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

12.4.4 INDIA

TABLE 186 INDIA: DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 187 INDIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 188 INDIA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 189 INDIA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 190 INDIA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 191 INDIA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 192 INDIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 193 INDIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 194 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 195 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

12.4.5 JAPAN

TABLE 196 JAPAN: DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 197 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 198 JAPAN: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 199 JAPAN: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 200 JAPAN: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 201 JAPAN: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 202 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 203 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 204 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 205 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

12.5 LATIN AMERICA

12.5.1 LATIN AMERICA: DATA GOVERNANCE MARKET DRIVERS

12.5.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 206 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 218 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 219 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

12.5.3 BRAZIL

12.5.4 MEXICO

12.5.5 REST OF LATIN AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 MIDDLE EAST AND AFRICA: DATA GOVERNANCE MARKET DRIVERS

12.6.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 220 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 221 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 222 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 223 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 224 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 225 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 226 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 227 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 228 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 229 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

TABLE 230 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 231 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 232 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 233 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

12.6.3 MIDDLE EAST

12.6.4 AFRICA

13 COMPETITIVE LANDSCAPE (Page No. - 208)

13.1 COMPETITIVE LEADERSHIP MAPPING

13.1.1 VISIONARY LEADERS

13.1.2 INNOVATORS

13.1.3 DYNAMIC DIFFERENTIATORS

13.1.4 EMERGING COMPANIES

FIGURE 37 DATA GOVERNANCE MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2019

13.2 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 38 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

13.3 BUSINESS STRATEGY EXCELLENCE

FIGURE 39 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

14 COMPANY PROFILES (Page No. - 212)

14.1 INTRODUCTION

(Business overview, Solutions and services offered, Recent Developments, SWOT Analysis)*

14.2 IBM

FIGURE 40 IBM: COMPANY SNAPSHOT

FIGURE 41 IBM: SWOT ANALYSIS

14.3 ORACLE

FIGURE 42 ORACLE: COMPANY SNAPSHOT

FIGURE 43 ORACLE: SWOT ANALYSIS

14.4 SAP

FIGURE 44 SAP: COMPANY SNAPSHOT

FIGURE 45 SAP: SWOT ANALYSIS

14.5 SAS

FIGURE 46 SAS: COMPANY SNAPSHOT

FIGURE 47 SAS: SWOT ANALYSIS

14.6 COLLIBRA

FIGURE 48 COLLIBRA: SWOT ANALYSIS

14.7 INFORMATICA

14.8 TALEND

FIGURE 49 TALEND: COMPANY SNAPSHOT

14.9 TOPQUADRANT

14.10 INFORMATION BUILDERS

14.11 ALATION

14.12 TIBCO

14.13 VARONIS

FIGURE 50 VARONIS: COMPANY SNAPSHOT

14.14 ERWIN

14.15 DATA ADVANTAGE GROUP

14.16 SYNCSORT

14.17 INFOGIX

14.18 MAGNITUDE SOFTWARE

14.19 ATACCAMA

14.20 RELTIO

14.21 GLOBAL DATA EXCELLENCE

14.22 GLOBAL IDS

14.23 INNOVATIVE ROUTINES INTERNATIONAL

14.24 DENODO

14.25 ADAPTIVE

14.26 MICROSOFT

14.27 ZALONI

14.28 ALEX SOLUTIONS

14.29 AWS

14.30 MICRO FOCUS

14.31 MINDTREE

14.32 RIGHT-TO-WIN

*Details on Business overview, Solutions and services offered, Recent Developments, SWOT Analysis might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 268)

15.1 ADJACENT MARKETS

15.1.1 MASTER DATA MANAGEMENT MARKET

15.1.1.1 Introduction

TABLE 234 MASTER DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 235 MASTER DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 236 MASTER DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 237 MASTER DATA MANAGEMENT MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 238 MASTER DATA MANAGEMENT MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 239 NORTH AMERICA: MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 240 EUROPE: MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 241 ASIA PACIFIC: MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 242 MIDDLE EAST AND AFRICA: MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 243 LATIN AMERICA: MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

15.1.2 DATA QUALITY TOOLS

15.1.2.1 Introduction

TABLE 244 DATA QUALITY TOOLS MARKET SIZE, BY DATA TYPE, 2016–2022 (USD MILLION)

TABLE 245 DATA QUALITY TOOLS MARKET SIZE, BY BUSINESS FUNCTION, 2016–2022 (USD MILLION)

TABLE 246 DATA QUALITY TOOLS MARKET SIZE, BY COMPONENT, 2016–2022 (USD MILLION)

TABLE 247 DATA QUALITY TOOLS MARKET SIZE, BY SERVICE, 2016–2022 (USD MILLION)

TABLE 248 DATA QUALITY TOOLS MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2022 (USD MILLION)

TABLE 249 DATA QUALITY TOOLS MARKET SIZE, BY ORGANIZATION SIZE, 2016–2022 (USD MILLION)

TABLE 250 DATA QUALITY TOOLS MARKET SIZE, BY VERTICAL, 2016–2022 (USD MILLION)

15.1.3 ENTERPRISE DATA MANAGEMENT MARKET

15.1.3.1 Introduction

TABLE 251 ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 252 ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 253 ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 254 ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 255 ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 256 NORTH AMERICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 257 NORTH AMERICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 258 NORTH AMERICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 259 NORTH AMERICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 260 NORTH AMERICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 261 EUROPE: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 262 EUROPE: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 263 EUROPE: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 264 EUROPE: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 265 EUROPE: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 266 ASIA PACIFIC: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 267 ASIA PACIFIC: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 268 ASIA PACIFIC: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 269 ASIA PACIFIC: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 270 ASIA PACIFIC: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 271 MIDDLE EAST AND AFRICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 272 MIDDLE EAST AND AFRICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 273 MIDDLE EAST AND AFRICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 274 MIDDLE EAST AND AFRICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 275 MIDDLE EAST AND AFRICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 276 LATIN AMERICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 277 LATIN AMERICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 278 LATIN AMERICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 279 LATIN AMERICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 280 LATIN AMERICA: ENTERPRISE DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

15.1.4 BIG DATA MARKET

15.1.4.1 Introduction

TABLE 281 BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 282 BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 283 BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 284 BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 285 BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 286 BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 287 NORTH AMERICA: BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 288 NORTH AMERICA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 289 NORTH AMERICA: BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 290 NORTH AMERICA: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 291 NORTH AMERICA: BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 292 NORTH AMERICA: BIG DATA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 293 EUROPE: BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 294 EUROPE: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 295 EUROPE: BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 296 EUROPE: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 297 EUROPE: BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 298 EUROPE: BIG DATA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 299 ASIA PACIFIC: BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 300 ASIA PACIFIC: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 301 ASIA PACIFIC: BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 302 ASIA PACIFIC: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 303 ASIA PACIFIC: BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 304 ASIA PACIFIC: BIG DATA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 305 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 306 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 307 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 308 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 309 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 310 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 311 LATIN AMERICA: BIG DATA MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 312 LATIN AMERICA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 313 LATIN AMERICA: BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 314 LATIN AMERICA: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 315 LATIN AMERICA: BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 316 LATIN AMERICA: BIG DATA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATION

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

The study involves four major activities to estimate the current market size for data governance solutions and services. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to, to identify and collect information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, and articles by recognized authors; gold standard and silver standard websites; data governance technology, Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides of the data governance market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors who provide the data governance software; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the data governance market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global data governance market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the data governance market based on solution, services, application, deployment models, organization size, industry verticals, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market segments with respect to all the five major regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze recent developments and their positioning related to the data governance market

- To analyze competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American data governance market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the Latin American market

- Further breakdown of the MEA market

Company Information

- Detailed analysis and profiling of additional market players upto 5.

Growth opportunities and latent adjacency in Data Governance Market