eGRC Market

eGRC Market by Solution (Risk Management, Compliance Management, Policy Management, Audit Management, Privacy Management), Services (Consulting, Integration, Managed), Business Function (IT, Operations, Legal, Finance) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

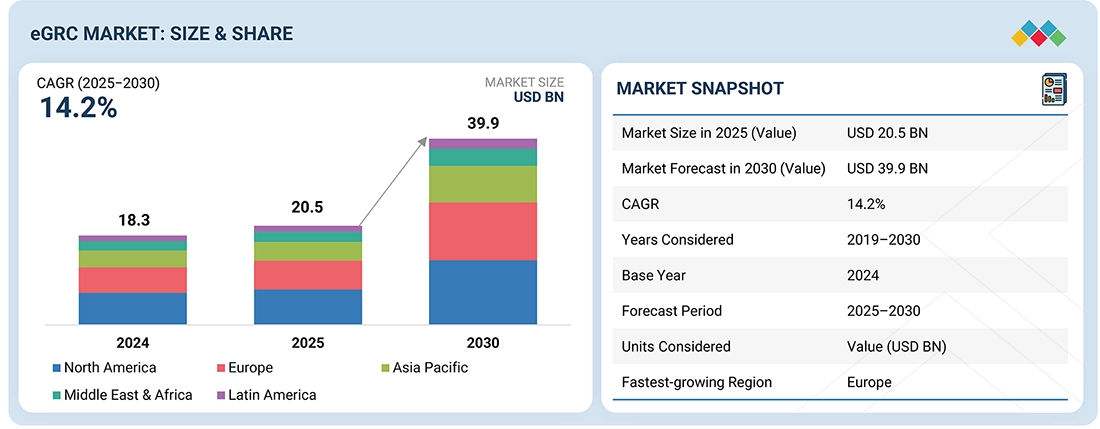

The eGRC market is projected to reach USD 39.99 billion by 2030 from USD 20.56 billion in 2025, at a CAGR of 14.2%. Growth in the eGRC market is fueled by multiple factors, including increased global regulations, rapidly evolving third-party ecosystems, and a heightened focus on cyber and data privacy risks. Expectations are increasing from investors, customers, and regulators for transparency and accountability in governance and compliance. Increasingly, organizations are moving from fragmented manual compliance processes to Integrated eGRC platforms that provide centralized risk visibility, continuous compliance monitoring, and audit-ready reporting across all business functions.

KEY TAKEAWAYS

-

BY REGIONNorth America is estimated to account for the largest share of the global eGRC market in 2025.

-

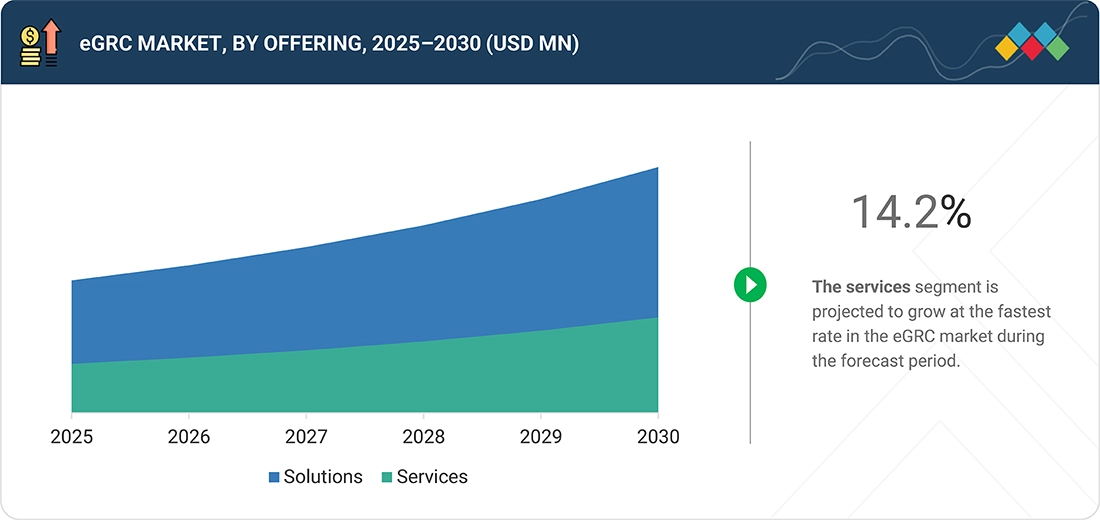

BY OFFERINGBy offering, the solutions segment is expected to dominate the market during the forecast period.

-

BY SOLUTION USAGEBy solution usage, the internal segment is expected to dominate the market during the forecast period.

-

BY DEPLOYMENT MODEBy deployment mode, the on-premise segment is expected to dominate the market during the forecast period.

-

BY ORGANIZATION SIZEBy organization size, the SMEs segment is projected to grow at a higher CAGR of 15.1% during the forecast period.

-

BY BUSINESS FUNCTIONBy business function, the IT segment is projected to grow at the highest CAGR of about 14.6% from 2025 to 2030.

-

BY VERTICALBy vertical, the healthcare segment is projected to witness the highest CAGR of 13.3% during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSWolters Kluwer, FIS, and Microsoft lead the eGRC market with broad, integrated platforms that unify risk, compliance, audit, policy, and privacy management across global enterprises.

-

COMPETITIVE LANDSCAPE - STARTUPSStandardFusion, Comensure, and DynamicGRC are emerging eGRC innovators delivering agile, cloud-native governance solutions tailored to mid-market and fast-growing organizations.

-

US eGRC marketThe US eGRC market is projected to reach USD 10.17 billion by 2030 from USD 5.45 billion in 2025, at a CAGR of 13.3% from 2025 to 2030

-

Europe eGRC MarketIn Europe eGRC Market is projected to grow from USD 6.03 billion in 2025 to USD 12.60 billion by 2030, a CAGR of 15.9%.

-

Asia Pacific eGRC marketThe Asia Pacific eGRC market is expected to reach USD 7.87 billion by 2030 from USD 3.94 billion in 2025, at a CAGR of 14.9% from 2025 to 2030.

As enterprises scale across regions, business units, and supply chains, managing risk in fragmented ways creates blind spots. This makes a centralized, real-time view of risk essential, as it helps organizations identify emerging threats early and apply consistent controls. With better visibility, enterprises can make informed decisions and maintain compliance across global operations.

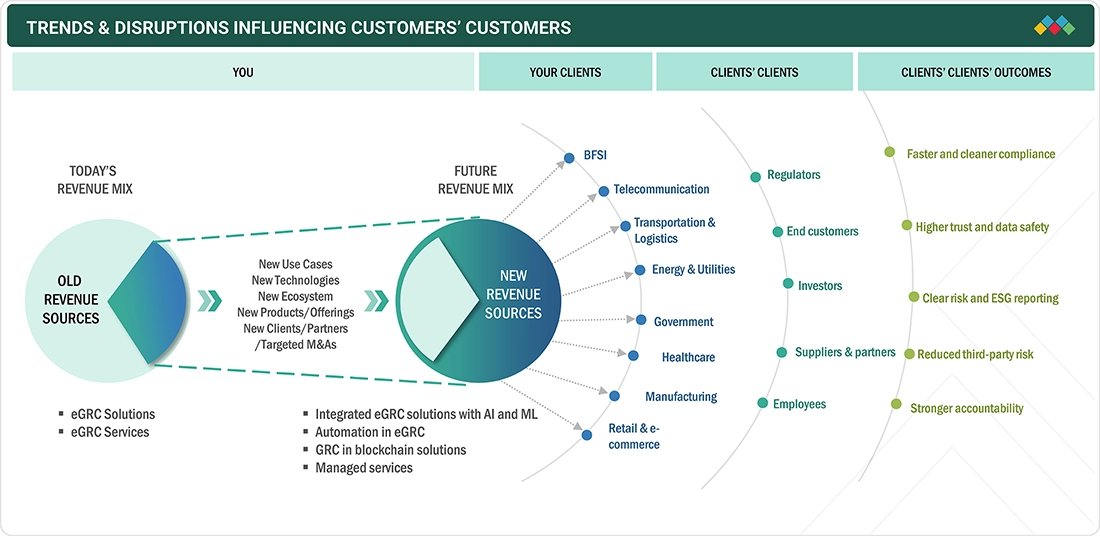

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The growing demand for eGRC solutions and services that utilize advanced technologies is creating new revenue opportunities for vendors in the eGRC market. As organizations expand their digital operations, they face more complex governance requirements, higher cyber risks, and a wider range of compliance obligations. At the same time, regulators are tightening rules and imposing stricter penalties for non-compliance. As a result, businesses are seeking eGRC platforms that enable them to manage these challenges through enhanced visibility, streamlined compliance processes, and improved risk management.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing regulatory compliance mandates

-

Rising cybersecurity threats

Level

-

Complexity in keeping pace with evolving laws and regulatory requirements

-

Inconsistent data quality limiting reliability of risk insights

Level

-

Integration of AI/ML and blockchain technologies in GRC solutions

-

Integration of eGRC with core business operations

Level

-

Gap between company’s culture and its eGRC framework

-

Provision of comprehensive eGRC solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing regulatory compliance mandates

eGRC solutions are becoming an essential tool for many organizations as they seek to manage the growing regulatory landscape for data privacy, financial reporting, and sector-specific requirements. To provide an integrated approach to compliance management, companies are leveraging solutions like risk management, compliance management, and policy management across all industries.

Restraint: Complexity in keeping pace with evolving laws and regulatory requirements

Compliance management has become complex and resource-intensive due to frequent updates to global, federal, and industry-specific regulations. There are compliance delays, operational inefficiencies, and increased regulatory penalties, as organizations often struggle to interpret new requirements, update internal policies, retrain employees, and realign controls.

Opportunity: Integration of eGRC with core business operations

eGRC can provide organizations with "real-time" visibility into risks, support consistent business decisions, and, consequently, a unified focus on the organization's performance goals by integrating eGRC into all functions. Thus, the objectives of compliance management become part of an organization's everyday operations and resiliency planning, in addition to meeting regulatory obligations.

Challenge: Gap between company’s culture and its eGRC framework

There are two critical components for successful adoption of eGRC, People and Technology. People must be assigned to leadership roles in a manner that provides clear accountability and support from every level of the organization. Organizations must have clear definitions of the regulatory risks associated with their business and established performance goals for controlling those risks. The inability of individuals to understand regulatory risks and hold themselves accountable for mitigating the associated risks, as well as the speed of adoption and the subsequent positive impact of the adoption, will be significantly reduced, thereby limiting the success of the organization's governance and compliance programs.

only Driver, Opportunity and Challenge

EGRC MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A North American bank uses Wolters Kluwer OneSumX to centralize regulatory reporting, policy management, and audit workflows across multiple subsidiaries, ensuring alignment with FFIEC and Basel guidelines. | Smoother compliance processes, minimum reporting errors, faster audits, and clear regulatory oversight |

|

Mid-sized financial institutions leverage FIS enterprise risk and compliance solutions to automate KYC, vendor risk, and operational risk assessments, such as monitoring third-party fintech partners. | Lower compliance workload, real-time risk visibility, better vendor governance, fewer manual review bottlenecks |

|

Global enterprises use Microsoft Purview and Azure-based eGRC tools to manage data governance, privacy risks, and regulatory compliance across cloud environments. | Unified risk oversight, enhanced data protection, scalable compliance management, reduced remediation time |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

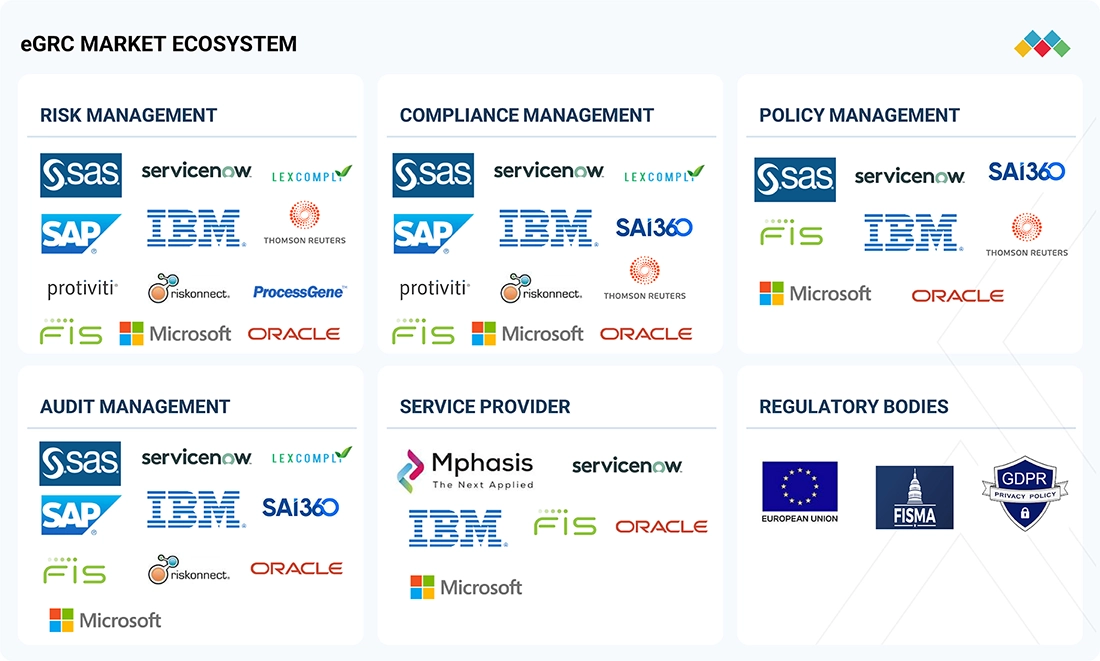

MARKET ECOSYSTEM

The eGRC ecosystem includes technology vendors that provide platforms for managing risk, compliance, policies, and audits, along with consulting and managed service providers that help organizations deploy and run these systems. Regulators play a key role by setting requirements that encourage adoption across industries as companies look for integrated ways to manage data privacy, financial controls, and cybersecurity obligations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

eGRC, By Offering

The solutions segment holds the largest share as organizations rely on software platforms to manage governance, risk, and compliance activities in a more structured way. These tools help teams gain visibility, maintain consistency, and respond faster to regulatory requirements across daily operations.

eGRC, By Solution

The risk management segment is the fastest-growing, as organizations focus on identifying and addressing risks before they affect operations. Increasing reliance on third-party vendors, digital processes, and interconnected systems has expanded exposure. As a result, businesses are prioritizing risk visibility and continuous monitoring to support informed decision-making.

eGRC, By Deployment Mode

The on-premises segment accounts for the largest market share as many organizations operate under strict regulatory and data-residency requirements. Keeping systems in-house allows closer control over sensitive compliance and risk data.

eGRC, By Organization Size

The SMEs segment is the fastest-growing segment, as rising cyber risks and tighter regulations are pushing smaller organizations to formalize governance and compliance processes. At the same time, customer expectations, partner requirements, and contractual obligations are increasingly forcing SMEs to demonstrate stronger control and accountability.

eGRC, By Solution Usage

The internal segment accounts for the largest share as organizations depend on eGRC platforms for their day-to-day governance, risk, and compliance activities. These systems are used regularly by internal teams to track controls, manage audits, and monitor risks. Keeping these processes internal helps improve coordination, strengthen accountability, and maintain consistency across the organization.

eGRC Market, By Business Function

The finance segment holds the largest share in the overall market as audits, internal controls, and regulatory reporting are primarily managed by finance teams. eGRC platforms support accuracy, transparency, and accountability in financial oversight. This helps finance teams stay prepared for reviews and reduce last-minute compliance pressure.

eGRC Market, By Vertical

The retail and e-commerce segment is the fastest-growing segment as rapid digital expansion and complex supply chains increase compliance and data privacy exposure. Organizations in this vertical are adopting eGRC to maintain control while scaling operations. It enables operational expansion without compromising risk and compliance oversight.

REGION

Europe to be fastest-growing region in global eGRC market during forecast period

The eGRC market in Europe is experiencing rapid growth due to the increasing global eGRC regulations, such as the GDPR, and the expansion of ESG disclosures. In addition, European regulations are enforced with severe penalties. Countries such as Germany, the UK, France, and the Nordic nations are at the forefront of eGRC adoption. Organizations in these markets aim to maintain operations across multiple locations and manage complex supply chains. At the same time, they face increasing data and cyber-related risks, which is pushing them toward eGRC solutions. Cloud-based, integrated eGRC platforms, along with a stronger focus on ESG and third-party risks, are driving vendors in Europe to identify new areas for growth and expansion.

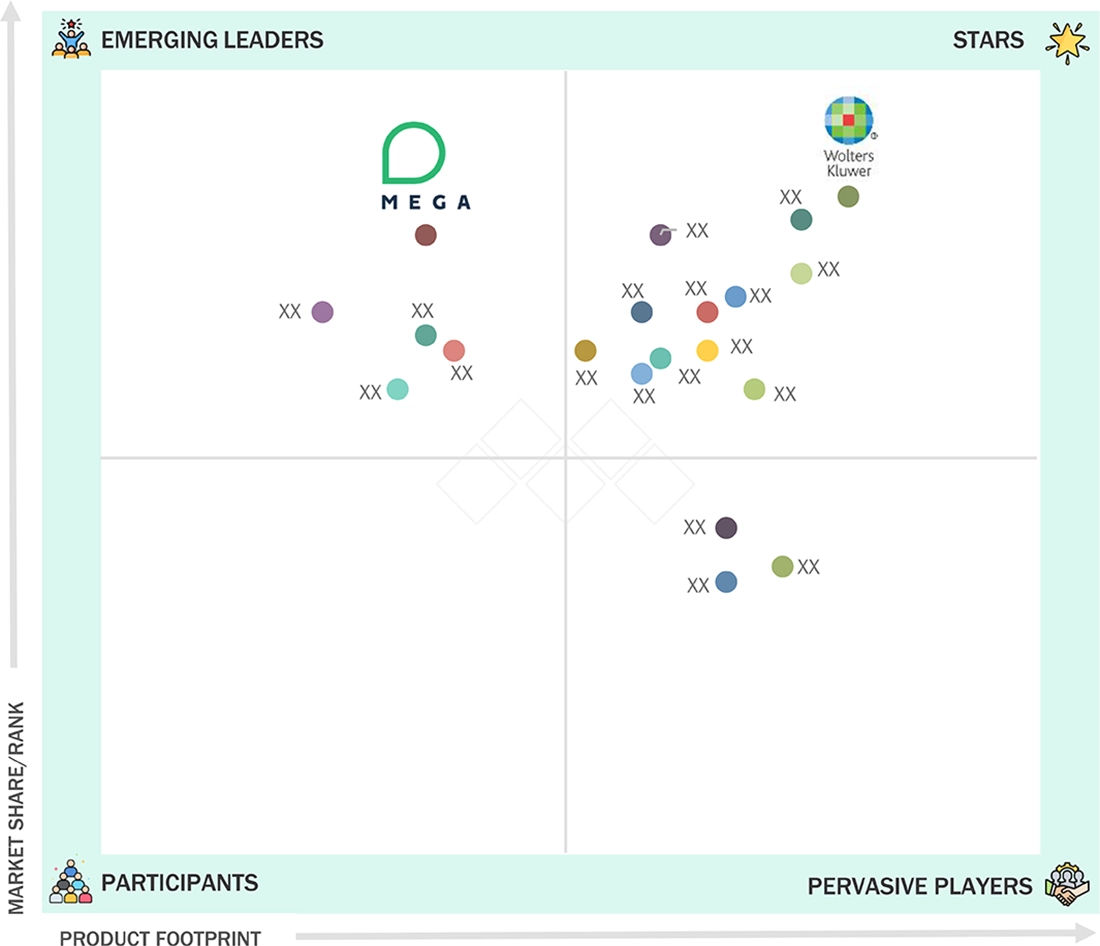

EGRC MARKET: COMPANY EVALUATION MATRIX

In the eGRC market matrix, Wolters Kluwer (Star) leads with its comprehensive OneSumX platform, deep regulatory intelligence, automated reporting, and strong integration of audit, risk, and compliance, enabling global enterprises to standardize controls and navigate multi-jurisdictional regulations with confidence. Mega International (Emerging Leader) is rapidly gaining momentum through its flexible HOPEX platform, scalable governance workflows, and expanding risk and process-management capabilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ServiceNow (US)

- Wolters Kluwer (Netherlands)

- LexisNexis (US)

- MetricStream (US)

- Riskonnect (US)

- SAS Institute (US)

- Thomson Reuters (Canada)

- FIS (US)

- IBM (US)

- Microsoft (US)

- Mphasis (India)

- Oracle (US)

- SAP (Germany)

- Navex Global (US)

- OneTrust (US)

- Mega International (France)

- LogicManager (US)

- Acuity Risk Management (UK)

- C&F SA (Poland)

- Allgress (US)

- GlobalSuite Solutions (Spain)

- Onspring (US)

- Optimiso (US)

- ReadiNow (Australia)

- SureCloud (UK)

- StandardFusion (Canada)

- Comensure (US)

- Dynamic GRC (Singapore)

- LogicGate (US)

- VComply (US)

- SmartSuite (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 18.3 Billion |

| Market Forecast in 2030 (Value) | USD 39.9 Billion |

| Growth Rate | CAGR of 14.2% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

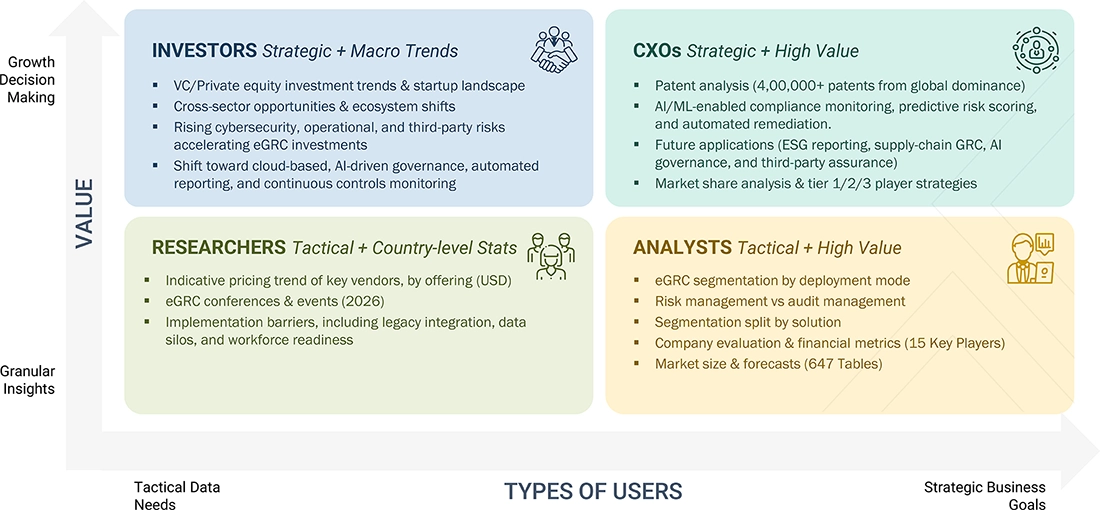

WHAT IS IN IT FOR YOU: EGRC MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Product Analysis: eGRC Solution Matrix offering an in-depth comparison of each vendor’s capabilities, including enterprise risk management, compliance automation, audit workflows, policy lifecycle management, ESG reporting, third-party risk oversight, data privacy controls, workflow orchestration, analytics, and cloud/on-premises deployment flexibility | Stronger understanding of competitive eGRC positioning, product breadth, regulatory content depth, integration maturity, and automation capabilities to support strategic investment planning, platform enhancement, and multi-year governance, risk, and compliance transformation initiatives |

| Leading Service Provider (EU) | Company Information: Detailed profiling and evaluation of additional eGRC vendors (up to 5), covering solution modules, regulatory intelligence assets, implementation methodologies, managed compliance services, AI-enabled risk scoring, assurance frameworks, and strategic partnerships across diverse regulatory jurisdictions and IT environments | Comprehensive overview of the evolving eGRC landscape, highlighting managed service growth opportunities, rising compliance outsourcing demand, vendor collaboration potential, and expansion areas driven by ESG mandates, privacy regulations, operational risk modernization, and enterprise digital governance priorities |

RECENT DEVELOPMENTS

- April 2024 : To support more sustainable business practices worldwide, AdaptiveGRC partnered with Forward Earth. While staying aligned with regulatory requirements, this partnership helps organizations better track and manage their environmental impact. Together, they aim to make sustainability and compliance easier to manage as part of everyday business operations.

- February 2024 : SAS signed an agreement with Carahsoft to bring analytics, AI, and data management solutions to the public sector. Under the agreement, Carahsoft will serve as a SAS Public Sector Distributor, making the company's analytics, AI, and data management solutions available to US government agencies through Carahsoft's reseller partners and various contract vehicles and government schedules.

- February 2024 : To modernize its planning, operations, and resource management systems, Arab Developers Holding entered into a strategic partnership with SAP. By improving how teams work, manage data, and control processes, the collaboration supports the company’s broader digital transformation goals. It is designed to simplify day-to-day operations, improve visibility, and raise overall efficiency as customer expectations continue to evolve.

Table of Contents

Methodology

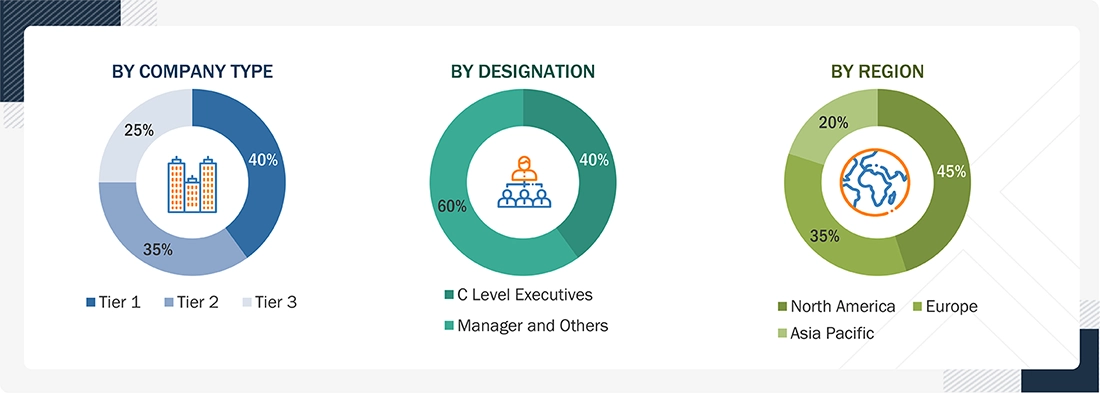

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the global eGRC market. The primary sources were mainly several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to this industry's value chain segments. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information regarding the study. The secondary sources included annual reports, press releases, investor presentations of eGRC market solution vendors; forums; certified publications, such as GRCI Publications, Compliance, and Regulatory Journal, GRC Professional Magazine, GRC Journal, From GRC 1.0 to GRC 5.0: A History of Technology for GRC; and whitepapers such as "Governance, Risk and Compliance (GRC) Framework" by MetricStream, "Governance, Risk, and Compliance Whitepaper" by Secure Digital Solutions. Secondary research was mainly used to obtain key information about the industry's value chain, the total pool of key players, market classification, and segmentation from the market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the eGRC market were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing eGRC solutions and services, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research helped identify and validate the segmentation types, industry trends, key players, a competitive landscape of eGRC solutions and services offered by several market vendors, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, the bottom-up and top-down approaches and several data triangulation methods were extensively used to perform the market estimation and forecasting for the overall market segments and subsegments listed in this report. An extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the eGRC market and the size of various other dependent sub-segments in the overall eGRC market. The research methodology used to estimate the market size includes the following details: critical players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Infographic Depicting Bottom-Up And Top-Down Approaches

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

MarketsandMarkets defines eGRC as the umbrella term that covers an organization's approach across the areas of GRC. GRC typically encompasses corporate governance, enterprise risk management, and compliance with applicable laws and regulations. It allows organizations to achieve their goals by automating workflows while complying with policy guidelines and government regulations, reducing financial risks, and safeguarding the company's brand image. The latest development of artificial intelligence (AI)-)-enabled eGRC solutions would enhance the compliance process, making it more effective.

Key Stakeholders

- eGRC solution and service providers

- GRC staff

- IT governance directors/managers

- IT risk directors/managers

- IT compliance directors/managers

- IT audit directors/managers

- Information security directors/managers

- IT directors/consultants

- End-users/consumers/enterprise users

- Government organizations

- Consultants/advisory firms

- System integrators and resellers

- Training and education service providers

- Managed service providers

Report Objectives

- To describe and forecast the eGRC market by offering, deployment mode, organization size, solution usage, business function, vertical, and region from 2024 to 2029, and analyze the various macroeconomic and microeconomic factors that affect market growth

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the major players

- To profile the key market players; provide a comparative analysis based on the business overviews, regional presence, product offerings, business strategies, and critical financials; and illustrate the market's competitive landscape.

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and research development (R&D) activities, in the market

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 100% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the eGRC Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in eGRC Market