De-oiled Lecithin Market by Source (Soybean, Sunflower, Rapeseed & Canola, Eggs), Nature (Non-GMO and GMO), Form (Powder and Granules), Application (Food & Beverages, Feed, Industrial and Healthcare Products) and Region - Global Forecast to 2028

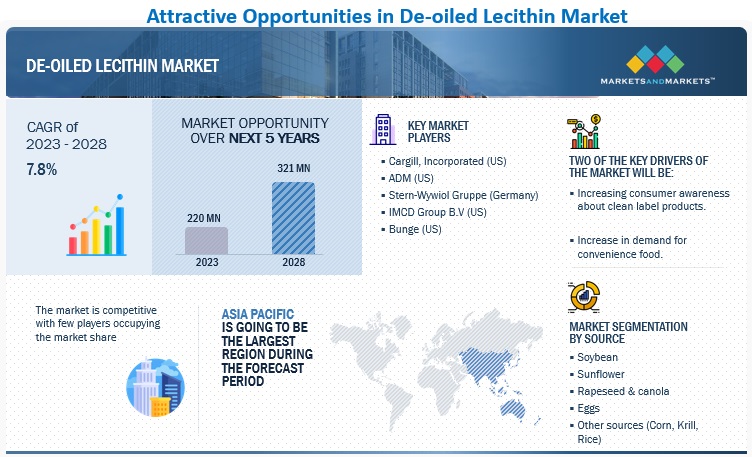

[324 Pages Report] The de-oiled lecithin market is estimated at USD 220 million in 2023 and is projected to reach USD 321 million by 2028, at a CAGR of 7.8% from 2023 to 2028. The increased demand for nutrients for the human body has resulted from urbanization and a fast-paced lifestyle. As a result, food additives have been mixed into food products. Natural food additives boost the nutritious content of the foods they are mixed with without causing any harm. Natural ingredients are in high demand in both the conventional and organic food industries. According to article by BakeryandSnacks (leading online news source for the bakery and snacks sectors) 2022, natural ingredients are leading consumer trends: approximately 47% of global consumers ask for natural products, and 55% of respondents look for natural features when buying products in at least one category. Natural food additives are in high demand because of stringent EU regulations prohibiting the use of synthetic additives. As a result, the food additives market has grown exponentially. De-oiled Lecithin is one such additive derived from many sources such as soy, egg, and sunflower. De-oiled Lecithin contains lipids, which are essential for the body. The demand for food products laced with de-oiled Lecithin is increasing to maintain a healthy lifestyle.

To know about the assumptions considered for the study, Request for Free Sample Report

De-oiled lecithin Market Dynamics

Driver: Increasing consumer awareness about clean label products.

Natural and clean label health product sales are increasing as more people adopt better lifestyles. Natural and organic health products are regarded to be safer and of higher quality. According to a survey conducted on behalf of Food Supplements Europe 2021, 56% of respondents consider organic, natural, or non-GMO labelling when purchasing supplements. This corresponds to an increase in demand for organic products. In 2020, European organic retail sales surpassed €52 billion, up roughly 15% from the previous year. Consumers in Europe want to avoid synthetic chemicals and pesticides in the food. Many people are concerned about the environmental impact of conventional farming and prefer organic farming methods. Additionally, organic food and beverages do not include synthetic food additives. This opens a new market for natural food additive suppliers in developing countries. As the organic food market grows, so does the demand for natural food additives. Consumers are becoming more health-conscious and are looking for food products that are free from synthetic ingredients and additives. De-oiled lecithin is a natural alternative to synthetic emulsifiers and stabilizers, making it a popular choice for manufacturers of organic and natural food products. Natural ingredients are in high demand in both the conventional and organic food industries.

Restraint: Volatile prices of raw materials

One of the primary challenges presented by fluctuations in raw material prices is the impact on production costs. When the price of soybeans increases, the cost of producing de-oiled lecithin also increases, which can lead to higher production costs for manufacturers. In turn, this can lead to higher prices for finished products that contain de-oiled lecithin as an ingredient. Consumers may be reluctant to pay these higher prices, which can impact demand for these products and ultimately impact the profitability of manufacturers. Another challenge presented by fluctuations in raw material prices is supply chain disruptions. If the price of soybeans increases suddenly, manufacturers may struggle to secure a reliable supply of de-oiled lecithin at a reasonable price. This can lead to delays in production, increased lead times, and potentially even shortages of products that contain de-oiled lecithin. These disruptions can have significant consequences for manufacturers and consumers alike. As raw material prices change, manufacturers may need to adjust their production processes, which can impact the quality and consistency of the finished product. This can be particularly challenging for manufacturers that produce products with strict quality control requirements, as even small variations in the quality of the raw material can impact the quality of the finished product. Overall, fluctuations in raw material prices can be a challenge for the de-oiled lecithin market because they can create uncertainty and instability in pricing and supply chain management.

Opportunity: Emerging markets & changing consumer lifestyles

Consumer preference for low-fat products is quickly increasing, and marketing campaigns are being developed to highlight their use and health benefit claims. Cargill (US) manufactures de-oiled lecithin, which serves as a low-fat dressing, attracting the interest of companies seeking to manufacture low-fat food products. The expansion in processed food production and innovation in almost all areas, such as meat products, dairy, and bakery & confectionery items, may drive demand for low-fat products. However, demand for de-oiled lecithin is likely to expand continuously in early adopting nations like Japan, and exponentially in new and emerging markets like Australia and other Asia Pacific countries. Furthermore, Asia provides a cost advantage in terms of production and processing. Strong demand, combined with low production costs, is an important ability that would benefit De-oiled lecithin suppliers.

Companies in the de-oiled lecithin market are broadening their product offerings and increasing their distribution base to pursue aggressive expansion strategies in emerging economies. They concentrate on tapping emerging economies with expanding urban demographics. Major players can strengthen their position by expanding their consumer base to Asia Pacific, South America, the Middle East, and Africa. Manufacturers have already begun to focus on these regions to expand their footprint; corporations are launching new products and gaining approval from regional governments to position their products in those countries. In April 2014, Cargill received license to use sunflower lecithin in Japan. Development in these growing regions in the next years will provide exciting opportunities for business expansion. As a result, the players in this market can tap new markets to gain profits. In 2021, Lecico, the subsidiary of Avril Group went into an agreement deal with Ciranda for the North American de-oiled lecithin market which would help the company with expansion of Non-GMO products in the market.

Challenge: Stringent government regulations

The de-oiled lecithin business is growing in popularity around the world. It is increasingly used in food, feed, healthcare, and personal care, directly affecting the health or interests of customers. As a result, the de-oiled lecithin market is regulated to protect customers' interests because it is utilized in vital industries such as food, beverages, healthcare, and personal care. The stringent government regulations that monitor, control, and regulate the manufacturing, distribution, and consumption of de-oiled lecithin will pose a challenge to the market's growth.

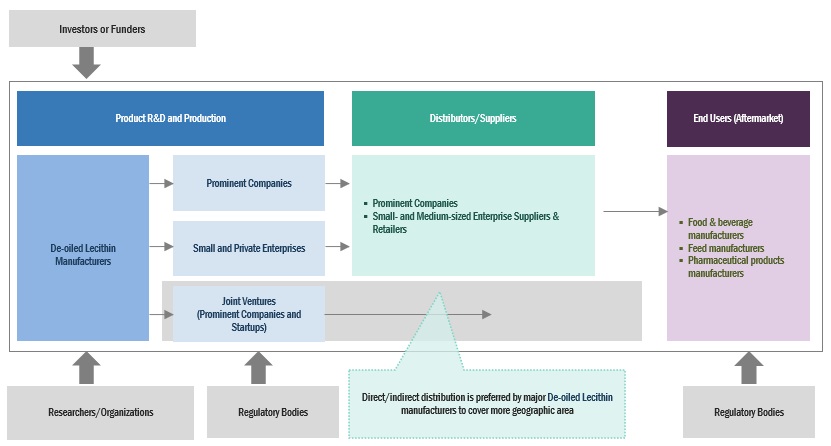

De-oiled Lecithin Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of de-oiled lecithin. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Cargill Incorporated (US), ADM (US), Stern-Wywiol Gruppe (Germany), IMCD Group B.V. (US), and Bunge (US).

To know about the assumptions considered for the study, download the pdf brochure

Based on Source, soybean segment is estimated to account for the largest market share of the De-oiled lecithin market

Based on Source, the soybean segment is estimated to account for the largest market share. Soybean is a legume that originated in East Asia. According to USDA, in 2021/2022, China was the leading soybean oil-producing country with a production volume of about 15.68 million metric tons. Soy lecithin is used as an emulsifier and as a lubricant. When added to food, it is also known to provide antioxidants. Soy lecithin also helps to preserve food flavors. Because of its ease of availability, soybean is favored among de-oiled lecithin manufacturers. Additionally, the extraction of de-oiled lecithin from soybean is inexpensive in comparison to other commodities, making it a cost-effective endeavor for producers. De-oiled soybean is becoming more popular in the personal care and pharmaceutical industries. As a result, the growing personal care and pharmaceutical industries will benefit soybean development.

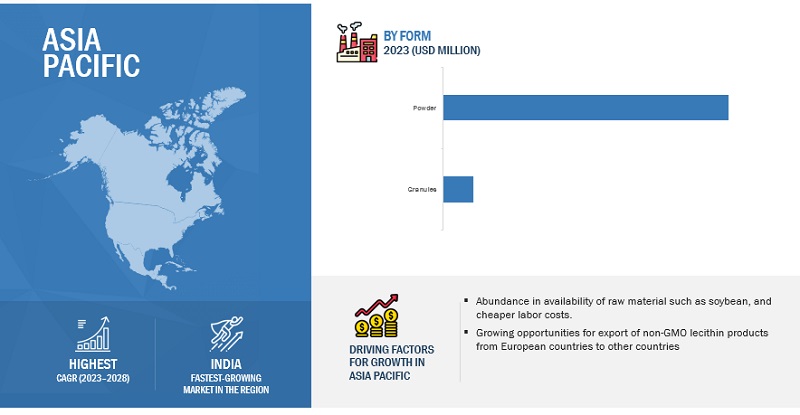

The powder form of the de-oiled lecithin market is projected to witness the highest CAGR during the forecast period.

Based on form, the powder segment is estimated to account for the highest growth rate. The powder form of De-oiled lecithin is easier to handle and transport. It has a longer shelf life than liquid lecithin, which can spoil if not stored properly. This makes it more convenient for manufacturers to use and store and reduces the risk of product wastage. The powder form of de-oiled lecithin is more versatile than other forms. It can be easily added to dry mixtures, such as bakery mixes, without affecting the texture or moisture content of the final product. This makes it ideal for use in a wide range of applications, including food, feed, and industrial products.

Based on application, the Food & beverages segment are anticipated to dominate the market.

Based on application, the market is segmented into food & beverages, feed industry, and Healthcare. De-oiled Lecithin is a natural preservative that helps baked foods last longer. It helps in the retention of moisture in baked goods, hence increasing their freshness. It protects the flavor of food and contains antioxidants, which contributes to its increasing use in the food industry. It is used as an emulsifier in packaged foods. De-oiled Lecithin is now being utilized to improve the consistency, flavor, shelf-life, and texture of vegan products. The growing use of de-oiled lecithin in the food industry propels the segment's growth.

The Asia Pacific market is projected to contribute the largest share of the De-oiled lecithin market.

Asia Pacific is expected to lead the de-oiled lecithin market in 2023. The Asia Pacific region currently dominates the de-oiled lecithin market because of the large agriculture sectors of India, China, and Japan, which supply raw materials such as soybean and sunflower for lecithin manufacture. According to United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), the agriculture and food processing industries accounted for more than a quarter of the GDP of Asia Pacific’s developing countries in 2020. Livestock is also common throughout the Asia Pacific, serving as an additional source of income for the region's large farming community. With the region's growing livestock, the feed industry will grow. According to the 11th annual Alltech feed survey, Global feed production increased 2.3% in 2021, and found that Asia Pacific feed production increased to 44.221 MMT, up from 43.201 MMT in 2020. Furthermore, the region's low labor costs and good manufacturing and business environments make lecithin extraction a cost-effective process, attracting major market players.

Key Market Players

The key players in this include Cargill, Incorporated (US), ADM (US), Stern-Wywiol Gruppe (Germany), IMCD Group B.V. (US), Bunge (US), Sonic Biochem (India), Avril Group (France), American Lecithin Company (US), VAV Life Sciences Pvt. Ltd (India). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments covered |

by source (Soybean, Sunflower, Rapeseed & canola, Eggs, and Other Sources), by nature (GMO & Non-GMO), by method of extraction (Acetone extraction, carbon dioxide extraction, Ultrafiltration Process), by form (powder and granules), by application (Food & Beverages, Feed, Industrial, Healthcare products) and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Latin America, and Rest of the World |

|

Companies covered |

Cargill Incorporated (US), ADM (US), Stern-Wywiol Gruppe (Germany), IMCD Group B.V. (US), and Bunge (US). |

This research report categorizes the de-oiled lecithin market based on source, nature, method of extractions, form, applications, and region.

Based on source, the de-oiled lecithin market has been segmented as follows:

- Soybean

- Sunflower

- Rapeseed & Canola

- Eggs

- Other sources (corn, krill, and rice)

Based on nature, the de-oiled lecithin market has been segmented as follows:

- GMO

- NON-GMO

Based on the method of extractions, the de-oiled lecithin market has been segmented as follows:

- Acetone Extraction

- Carbon Dioxide Extraction

- Ultrafiltration Process

Based on the form, the de-oiled lecithin market has been segmented as follows:

- Powder

- Granules

Based on the applications, the de-oiled lecithin market has been segmented as follows:

-

Food & beverages

- Bakery products

- Convenience food

- Confectioneries

- Beverages

- Dairy & non-dairy products

- Other food applications

- Feed

- Industrial

- Health care products

Based on the region, the de-oiled lecithin market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Latin America

- Rest of the World (Middle East & Africa)

Recent Developments

- In June 2021, Bunge Limited signed an agreement with IMCD Group BV. The agreement allowed IMCD Group BV to distribute Bunge Loders Croklaan’s complete BungeMaxx lecithin portfolio in Austria, Belgium, Denmark, France, Germany, Ireland, Italy, The Netherlands, Norway, Sweden, Switzerland, and the UK. Moreover, this agreement caters to the customer's preference for premium quality natural emulsifiers and allows to further grow into key market segments in the European food industry.

- In March 2021, STERN-WYWIOL GRUPPE launched a non - GMO and allergen-free alternative to chemically modified emulsifiers. Its functionality exceeds all expectations and opens a broad range of applications, from plant-based milk alternatives to nutritional supplement products. It improves the bioavailability of fat-soluble nutrients. The launch of SternPur SDH-50 is likely to have a positive impact on Stern-Wywiol Gruppe by expanding their product line, differentiating them from competitors, and demonstrating their commitment to meeting market demands and driving innovation.

- In March 2021, Lecico, a subsidiary of Avril Group (France), signed an exclusive distribution partnership agreement with Ciranda for the North American market. Ciranda supplies brand and manufacturers worldwide with a variety of high-quality certified organic ingredients and non-GMO ingredients. This will strengthen the position of Lecico in North America market.

- In August 2020, Fismer Lecithin, and the international confectionery trade association Sweets Global Network E. V. (SG), with over three hundred member companies, formed a strategic partnership that significantly impacted Fismer Lecithin for getting information and communication in special lecithin for confectionery and bakery items. The partnership with Sweets Global Network has the potential to be a positive development for Fismer Lecithin, helping the company to expand its reach, improve its products, increase its brand awareness, and access valuable industry expertise.

Frequently Asked Questions (FAQ):

Which are the major companies in the De-oiled Lecithin market? What are their major strategies to strengthen their market presence?

The key players in this Cargill, Incorporated (US), ADM (US), Stern-Wywiol Gruppe (Germany), IMCD Group B.V. (US), Bunge (US), STERN-WYWIOL GRUPPE (Germany), Sonic Biochem (India), Avril Group (France), American Lecithin Company (US), VAV Life Sciences Pvt. Ltd (India). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

What are the drivers and opportunities for the De-oiled Lecithin market?

As consumers become more health-conscious and environmentally aware, there is a growing demand for natural and plant-based ingredients in food, feed, and other products. De-oiled lecithin is a natural and plant-based ingredient that is widely used in various applications, and the demand for it is expected to increase in the coming years. The food and feed industries are expected to grow in the coming years, driven by an increasing population and changing food habits. De-oiled lecithin is a widely used ingredient in these industries, and the growth of these industries is expected to drive the growth of the de-oiled lecithin market.

Which region is expected to hold the highest market share?

The market in Asia Pacific will dominate the market share in 2022, showcasing strong demand for de-oiled lecithin in the region. The Asia Pacific region has a large population and a growing middle class with changing food habits, which is driving the demand for processed and convenience foods. De-oiled lecithin is a widely used ingredient in these foods, and the growing demand for such foods is driving the growth of the de-oiled lecithin market in the region.

Which are the key technology trends prevailing in the De-oiled lecithin market?

Water degumming is a newer technology that uses water instead of solvents to remove the phospholipids from the oil. In this process, the oil is mixed with water, and the phospholipids form a sludge that can be separated from the oil. Spray drying is a technology used to convert liquid lecithin into a powder form. In this process, the liquid lecithin is sprayed into a chamber where it is dried using hot air, resulting in a powder form that is easier to handle and store.

What is the total CAGR expected to be recorded for the De-oiled lecithin market during 2023-2028?

The CAGR for the de-oiled lecithin market is estimated to be 7.8 % from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASING OBESITY RATE

-

5.3 MARKET DYNAMICSDRIVERS- Increasing demand for natural food additives and growing consumer awareness regarding clean-label products- Increased demand for convenience food- Growing adoption of sunflower-based lecithin- Rising awareness regarding health benefits of functional foodsRESTRAINTS- Replicability of de-oiled lecithin with synthetic alternatives- Health concerns associated with soy and other allergen productsOPPORTUNITIES- Changing consumer lifestyles- Growing popularity of plant-based diet cultureCHALLENGES- Fluctuations in raw material prices- Concerns associated with genetically modified organism (GMO) de-oiled lecithin products

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGQUALITY AND SAFETY CONTROLLERSDISTRIBUTION, MARKETING, AND SALESEND USERS

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 MARKET MAP AND ECOSYSTEM ANALYSISDEMAND-SIDE ECOSYSTEMSUPPLY-SIDE ECOSYSTEM

-

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR DE-OILED LECITHIN PROVIDERS

- 6.6 TECHNOLOGY ANALYSIS

-

6.7 PRICING ANALYSISAVERAGE SELLING PRICE OF DE-OILED LECITHINAVERAGE SELLING PRICE OF DE-OILED LECITHIN OFFERED BY KEY PLAYERS, BY SOURCEAVERAGE SELLING PRICE, BY SOURCE

-

6.8 PATENT ANALYSIS

-

6.9 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

6.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORK- US- CanadaEUROPE- Commission Regulation (EU) No. 231/2012 of March 9, 2012, laying down specifications for food additives- Regulatory framework by EUINDIA- Food Safety and Standards Authority of India (FSSAI)

- 6.13 CASE STUDY ANALYSIS

- 6.14 KEY CONFERENCES AND EVENTS, 2023–2024

- 7.1 INTRODUCTION

- 7.2 ACETONE EXTRACTION

- 7.3 CARBON DIOXIDE EXTRACTION

- 7.4 ULTRAFILTRATION PROCESS

- 8.1 INTRODUCTION

-

8.2 SOYBEANHIGH HEALTH BENEFITS OF SOY IS INCREASING USAGE IN LECITHIN PRODUCTION

-

8.3 SUNFLOWERINCREASING DEMAND FOR NATURAL AND ALLERGEN-FREE LECITHIN

-

8.4 RAPESEED & CANOLAINCREASING DEMAND FOR PLANT-BASED DE-OILED LECITHIN

-

8.5 EGGSRISING APPLICATIONS OF EGG LECITHIN IN PHARMACEUTICAL INDUSTRY

- 8.6 OTHER SOURCES

- 9.1 INTRODUCTION

-

9.2 POWDERPOWDER FORM IS EASIER TO HANDLE, STORE, AND TRANSPORT AND HAS LONGER SHELF LIFE

-

9.3 GRANULESGRANULE FORM FEATURES BETTER DISPERSIBILITY AND SOLUBILITY IN WATER THAT CAN IMPROVE TEXTURE AND STABILITY OF FOOD PRODUCTS

- 10.1 INTRODUCTION

-

10.2 GENETICALLY MODIFIED ORGANISMS (GMO)HIGH RESISTANCE TO VARIOUS DISEASES

-

10.3 NON-GENETICALLY MODIFIED ORGANISMS (GMO)RISING AWARENESS REGARDING HARMFUL CONSEQUENCES OF EATING GENETICALLY MODIFIED ORGANISMS (GMO) FOOD

- 11.1 INTRODUCTION

-

11.2 FOOD AND BEVERAGESINCREASING DEMAND FOR NATURAL AND ORGANIC INGREDIENTSBAKERYCONFECTIONERIESCONVENIENCE FOODSBEVERAGESDAIRY & NON-DAIRY PRODUCTSOTHER FOOD APPLICATIONS

-

11.3 FEEDGROWING DEMAND FOR ANIMAL-BASED PRODUCTS

-

11.4 INDUSTRIALRISING USE OF DE-OILED LECITHIN IN PAPER COATING, CANDLE, AND PRINTING INK INDUSTRIES

-

11.5 HEALTHCARE PRODUCTSINCREASING USE OF DE-OILED LECITHIN IN TABLET AND PILL FORMULATIONS TO IMPROVE BIOAVAILABILITY AND STABILITY OF ACTIVE PHARMACEUTICAL INGREDIENTS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Increasing demand for high-protein food productsCANADA- Booming food industry

-

12.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISFRANCE- Growing concerns regarding food quality and healthITALY- Rising demand for artisanal productsUK- Increasing concerns about food safety and demand for natural food productsSPAIN- Expanding food & beverage industry and changing lifestylesGERMANY- Increasing demand for processed food productsREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Rising demand for bakery productsINDIA- Shift toward healthy and high-quality productsJAPAN- Rapid expansion of convenience store chains over last decadeAUSTRALIA & NEW ZEALAND- Increasing use of lecithin as fat replacerREST OF ASIA PACIFIC

-

12.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACT ANALYSISBRAZIL- High consumption of bakery productsARGENTINA- Expanding lecithin industryMEXICO- Increasing consumption of poultry productsCHILE- Growing food processing industryREST OF LATIN AMERICA

-

12.6 ROWROW: RECESSION IMPACT ANALYSISMIDDLE EAST- Significant increase in demand for premium food productsAFRICA- Increasing demand for processed food

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS, 2021

- 13.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 13.4 STRATEGIES ADOPTED BY KEY PLAYERS

-

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

13.6 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2021PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

13.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

14.1 KEY PLAYERSCARGILL, INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewADM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBUNGE LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIMCD GROUP B.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSTERN-WYWIOL GRUPPE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMERICAN LECITHIN COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSONIC BIOCHEM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVRIL GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFISMER LECITHIN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCLARKSON GRAIN COMPANY, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMITEX AGRO PRODUCT PRIVATE LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLASENOR EMUL, S.L.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLECITAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE SCOULAR COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGIIAVA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSUN NUTRAFOODS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVAV LIFE SCIENCES PVT LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVI AGRI BUSINESS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLECILITE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLECITEIN- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

-

15.3 LECITHIN & PHOSPHOLIPIDS MARKETMARKET DEFINITIONMARKET OVERVIEWLECITHIN & PHOSPHOLIPIDS MARKET, BY SOURCE- IntroductionLECITHIN & PHOSPHOLIPIDS MARKET, BY REGION- Introduction

-

15.4 FOOD EMULSIFIERS MARKETMARKET DEFINITIONMARKET OVERVIEWFOOD EMULSIFIERS MARKET, BY TYPE- IntroductionFOOD EMULSIFIERS MARKET, BY REGION- Introduction

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 3 DE-OILED LECITHIN MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 4 DE-OILED LECITHIN MARKET: ECOSYSTEM ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF DE-OILED LECITHIN SOURCES, 2022 (USD/KG)

- TABLE 6 SOYBEAN DE-OILED LECITHIN: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/KG)

- TABLE 7 SUNFLOWER DE-OILED LECITHIN: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/KG)

- TABLE 8 RAPESEED & CANOLA DE-OILED LECITHIN: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/ KG)

- TABLE 9 KEY PATENTS PERTAINING TO DE-OILED LECITHIN, 2022

- TABLE 10 TOP 10 IMPORTERS OF DE-OILED LECITHIN, 2021 (USD THOUSAND)

- TABLE 11 TOP 10 EXPORTERS OF DE-OILED LECITHIN, 2021 (USD THOUSAND)

- TABLE 12 DE-OILED LECITHIN MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REGULATORY POLICIES FOR LECITHIN

- TABLE 21 GROWING DEMAND FOR NON-GMO PRODUCTS

- TABLE 22 DE-OILED LECITHIN MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 23 PHOSPHOLIPID COMPOSITION OF FLUID AND DE-OILED CANOLA LECITHIN

- TABLE 24 DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 25 DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 26 DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (TONS)

- TABLE 27 DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (TONS)

- TABLE 28 SOYBEAN: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 29 SOYBEAN: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 30 SOYBEAN: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 31 SOYBEAN: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 32 SUNFLOWER: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 33 SUNFLOWER: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 34 SUNFLOWER: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 35 SUNFLOWER: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 36 RAPESEED & CANOLA: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 37 RAPESEED & CANOLA: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 38 RAPESEED & CANOLA: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 39 RAPESEED & CANOLA: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 40 EGGS: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 41 EGGS: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 42 EGGS: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 43 EGGS: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 44 OTHER SOURCES: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 45 OTHER SOURCES: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 46 OTHER SOURCES: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 47 OTHER SOURCES: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 48 DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 49 DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 50 POWDER: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 51 POWDER: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 52 GRANULES: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 53 GRANULES: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 54 DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 55 DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 56 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 57 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 58 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 59 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 60 BAKERY: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 61 BAKERY: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 62 CONFECTIONERIES: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 63 CONFECTIONERIES: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 64 CONVENIENCE FOODS: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 65 CONVENIENCE FOODS: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 66 BEVERAGES: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 67 BEVERAGES: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 68 DAIRY & NON-DAIRY PRODUCTS: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 69 DAIRY & NON-DAIRY PRODUCTS: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 70 OTHER FOOD APPLICATIONS: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 71 OTHER FOOD APPLICATIONS: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 72 FEED: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 73 FEED: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 74 INDUSTRIAL: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 75 INDUSTRIAL: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 76 HEALTHCARE PRODUCTS: DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 77 HEALTHCARE PRODUCTS: DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 78 DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 79 DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 80 DE-OILED LECITHIN MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 81 DE-OILED LECITHIN MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 82 DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 83 DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 84 DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (TONS)

- TABLE 85 DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (TONS)

- TABLE 86 DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 87 DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 88 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 89 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 90 DE-OILED LECITHIN MARKET, BY NATURE, 2018–2022 (USD THOUSAND)

- TABLE 91 DE-OILED LECITHIN MARKET, BY NATURE, 2023–2028 (USD THOUSAND)

- TABLE 92 DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 93 DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 94 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 95 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 96 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018–2022 (TONS)

- TABLE 97 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023–2028 (TONS)

- TABLE 98 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 99 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 100 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (TONS)

- TABLE 101 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (TONS)

- TABLE 102 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 103 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 104 NORTH AMERICA: DE-OILED LECITHIN MARKET FOR FOOD & BEVERAGES, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 105 NORTH AMERICA: DE-OILED LECITHIN MARKET FOR FOOD & BEVERAGES, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 106 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 107 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 108 US: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 109 US: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 110 US: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 111 US: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 112 US: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 113 US: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 114 CANADA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 115 CANADA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 116 CANADA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 117 CANADA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 118 CANADA: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 119 CANADA: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 120 EUROPE: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 121 EUROPE: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 122 EUROPE: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018–2022 (TONS)

- TABLE 123 EUROPE: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023–2028 (TONS)

- TABLE 124 EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 125 EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 126 EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (TONS)

- TABLE 127 EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (TONS)

- TABLE 128 EUROPE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 129 EUROPE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 130 EUROPE: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 131 EUROPE: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 132 EUROPE: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 133 EUROPE: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 134 FRANCE: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 135 FRANCE: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 136 FRANCE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 137 FRANCE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 138 FRANCE: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 139 FRANCE: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 140 ITALY: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 141 ITALY: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 142 ITALY: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 143 ITALY: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 144 ITALY: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 145 ITALY: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 146 UK: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 147 UK: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 148 UK: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 149 UK: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 150 UK: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 151 UK: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 152 SPAIN: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 153 SPAIN: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 154 SPAIN: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 155 SPAIN: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 156 SPAIN: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 157 SPAIN: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 158 GERMANY: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 159 GERMANY: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 160 GERMANY: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 161 GERMANY: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 162 GERMANY: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 163 GERMANY: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 164 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 165 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 166 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 167 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 168 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 169 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 170 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 171 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 172 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018–2022 (TONS)

- TABLE 173 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023–2028 (TONS)

- TABLE 174 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 175 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 176 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (TONS)

- TABLE 177 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (TONS)

- TABLE 178 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 179 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 180 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 181 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 182 ASIA PACIFIC: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 183 ASIA PACIFIC: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 184 CHINA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 185 CHINA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 186 CHINA: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 187 CHINA: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 188 CHINA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 189 CHINA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 190 INDIA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 191 INDIA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 192 INDIA: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 193 INDIA: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 194 INDIA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 195 INDIA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 196 JAPAN: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 197 JAPAN: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 198 JAPAN: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 199 JAPAN: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 200 JAPAN: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 201 JAPAN: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 202 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 203 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 204 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 205 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 206 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 207 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 208 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 209 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 210 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 211 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 212 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 213 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 214 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 215 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 216 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018–2022 (TONS)

- TABLE 217 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023–2028 (TONS)

- TABLE 218 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 219 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 220 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (TONS)

- TABLE 221 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (TONS)

- TABLE 222 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 223 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 224 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 225 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 226 LATIN AMERICA: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 227 LATIN AMERICA: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 228 BRAZIL: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 229 BRAZIL: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 230 BRAZIL: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 231 BRAZIL: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 232 BRAZIL: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 233 BRAZIL: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 234 ARGENTINA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 235 ARGENTINA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 236 ARGENTINA: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 237 ARGENTINA: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 238 ARGENTINA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 239 ARGENTINA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 240 MEXICO: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 241 MEXICO: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 242 MEXICO: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 243 MEXICO: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 244 MEXICO: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 245 MEXICO: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 246 CHILE: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 247 CHILE: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 248 CHILE: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 249 CHILE: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 250 CHILE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 251 CHILE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 252 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 253 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 254 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 255 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 256 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 257 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 258 ROW: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 259 ROW: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 260 ROW: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018–2022 (TONS)

- TABLE 261 ROW: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023–2028 (TONS)

- TABLE 262 ROW: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 263 ROW: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 264 ROW: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (TONS)

- TABLE 265 ROW: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (TONS)

- TABLE 266 ROW: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 267 ROW: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 268 ROW: DE-OILED LECITHIN MARKET FOR FOOD & BEVERAGES, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 269 ROW: DE-OILED LECITHIN MARKET FOR FOOD & BEVERAGES, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 270 ROW: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 271 ROW: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 272 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 273 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 274 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 275 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 276 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 277 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 278 AFRICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018–2022 (USD THOUSAND)

- TABLE 279 AFRICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 280 AFRICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018–2022 (USD THOUSAND)

- TABLE 281 AFRICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 282 AFRICA: DE-OILED LECITHIN MARKET, BY FORM, 2018–2022 (USD THOUSAND)

- TABLE 283 AFRICA: DE-OILED LECITHIN MARKET, BY FORM, 2023–2028 (USD THOUSAND)

- TABLE 284 DE-OILED LECITHIN MARKET: DEGREE OF COMPETITION

- TABLE 285 STRATEGIES ADOPTED BY KEY DE-OILED LECITHIN MANUFACTURERS

- TABLE 286 SOURCE: COMPANY FOOTPRINT

- TABLE 287 APPLICATION: COMPANY FOOTPRINT

- TABLE 288 REGION: COMPANY FOOTPRINT

- TABLE 289 OVERALL COMPANY FOOTPRINT

- TABLE 290 DE-OILED LECITHIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 291 DE-OILED LECITHIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 292 DE-OILED LECITHIN MARKET: PRODUCT LAUNCHES, 2021

- TABLE 293 DE-OILED LECITHIN MARKET: DEALS, 2019-2021

- TABLE 294 DE-OILED LECITHIN MARKET: OTHER DEVELOPMENTS, 2019

- TABLE 295 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 296 CARGILL, INCORPORATED: PRODUCTS OFFERED

- TABLE 297 ADM: COMPANY OVERVIEW

- TABLE 298 ADM: PRODUCTS OFFERED

- TABLE 299 BUNGE LIMITED: COMPANY OVERVIEW

- TABLE 300 BUNGE LIMITED: PRODUCTS OFFERED

- TABLE 301 BUNGE LIMITED: DEALS

- TABLE 302 IMCD GROUP B.V.: COMPANY OVERVIEW

- TABLE 303 IMCD GROUP B.V.: PRODUCTS OFFERED

- TABLE 304 IMCD GROUP B.V.: DEALS

- TABLE 305 STERN-WYWIOL GRUPPE: COMPANY OVERVIEW

- TABLE 306 STERN-WYWIOL GRUPPE: PRODUCTS OFFERED

- TABLE 307 STERN-WYWIOL GRUPPE: PRODUCT LAUNCHES

- TABLE 308 AMERICAN LECITHIN COMPANY: COMPANY OVERVIEW

- TABLE 309 AMERICAN LECITHIN COMPANY: PRODUCTS OFFERED

- TABLE 310 SONIC BIOCHEM: COMPANY OVERVIEW

- TABLE 311 SONIC BIOCHEM: PRODUCTS OFFERED

- TABLE 312 AVRIL GROUP: COMPANY OVERVIEW

- TABLE 313 AVRIL GROUP: PRODUCTS OFFERED

- TABLE 314 AVRIL GROUP: DEALS

- TABLE 315 FISMER LECITHIN: COMPANY OVERVIEW

- TABLE 316 FISMER LECITHIN: PRODUCTS OFFERED

- TABLE 317 FISMER LECITHIN: DEALS

- TABLE 318 CLARKSON GRAIN COMPANY, INC.: COMPANY OVERVIEW

- TABLE 319 CLARKSON GRAIN COMPANY, INC.: PRODUCTS OFFERED

- TABLE 320 AMITEX AGRO PRODUCT PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 321 AMITEX AGRO PRODUCT PRIVATE LIMITED.: PRODUCTS OFFERED

- TABLE 322 LASENOR EMUL, S.L.: COMPANY OVERVIEW

- TABLE 323 LASENOR EMUL, S.L.: PRODUCTS OFFERED

- TABLE 324 LECITAL: COMPANY OVERVIEW

- TABLE 325 LECITAL: PRODUCTS OFFERED

- TABLE 326 THE SCOULAR COMPANY: COMPANY OVERVIEW

- TABLE 327 THE SCOULAR COMPANY: PRODUCTS OFFERED

- TABLE 328 THE SCOULAR COMPANY: OTHERS

- TABLE 329 GIIAVA: COMPANY OVERVIEW

- TABLE 330 GIIAVA: PRODUCTS OFFERED

- TABLE 331 SUN NUTRAFOODS: COMPANY OVERVIEW

- TABLE 332 SUN NUTRAFOODS: PRODUCTS OFFERED

- TABLE 333 VAV LIFE SCIENCES PVT LTD.: COMPANY OVERVIEW

- TABLE 334 VAV LIFE SCIENCES PVT LTD.: PRODUCTS OFFERED

- TABLE 335 AVI AGRI BUSINESS LIMITED: COMPANY OVERVIEW

- TABLE 336 AVI AGRI BUSINESS LIMITED: PRODUCTS OFFERED

- TABLE 337 LECILITE: COMPANY OVERVIEW

- TABLE 338 LECILITE: PRODUCTS OFFERED

- TABLE 339 LECITEIN: COMPANY OVERVIEW

- TABLE 340 LECITEIN: PRODUCTS OFFERED

- TABLE 341 LECITHIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 342 LECITHIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 343 LECITHIN MARKET, BY SOURCE, 2018–2021 (TON)

- TABLE 344 LECITHIN MARKET, BY SOURCE, 2022–2027 (TON)

- TABLE 345 LECITHIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 346 LECITHIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 347 LECITHIN MARKET, BY REGION, 2018–2021 (TON)

- TABLE 348 LECITHIN MARKET, BY REGION, 2022–2027 (TON)

- TABLE 349 FOOD EMULSIFIERS MARKET, BY TYPE, 2016–2019 (USD MILLION)

- TABLE 350 FOOD EMULSIFIERS MARKET, BY TYPE, 2020–2025 (USD MILLION)

- TABLE 351 FOOD EMULSIFIERS MARKET, BY TYPE, 2016–2019 (KT)

- TABLE 352 FOOD EMULSIFIERS MARKET, BY TYPE, 2020–2025 (KT)

- TABLE 353 FOOD EMULSIFIERS MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 354 FOOD EMULSIFIERS MARKET, BY REGION, 2020–2025 (USD MILLION)

- FIGURE 1 DE-OILED LECITHIN MARKET: SEGMENTATION

- FIGURE 2 DE-OILED LECITHIN MARKET: REGIONAL SCOPE

- FIGURE 3 DE-OILED LECITHIN MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 DE-OILED LECITHIN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 DE-OILED LECITHIN MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 DE-OILED LECITHIN MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 8 DE-OILED LECITHIN MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 RECESSION INDICATORS AND THEIR IMPACT ON DE-OILED LECITHIN MARKET

- FIGURE 11 GLOBAL DE-OILED LECITHIN MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 12 DE-OILED LECITHIN MARKET, BY SOURCE, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 13 DE-OILED LECITHIN MARKET, BY APPLICATION, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 14 DE-OILED LECITHIN MARKET, BY FORM, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 15 DE-OILED LECITHIN MARKET, BY REGION, 2022

- FIGURE 16 GROWING CONSUMER AWARENESS REGARDING CLEAN-LABEL PRODUCTS AND RISING DEMAND FOR NATURAL FOOD ADDITIVES

- FIGURE 17 CONFECTIONERIES SEGMENT AND CHINA DOMINATED ASIA PACIFIC DE-OILED LECITHIN MARKET IN 2022

- FIGURE 18 INDIA DE-OILED LECITHIN MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO DOMINATE DE-OILED LECITHIN MARKET FOR ALL SOURCES, 2023 VS. 2028

- FIGURE 20 FOOD AND BEVERAGES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 21 GMO SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BY 2028

- FIGURE 22 OBESITY RATE AMONG ADULTS, BY COUNTRY, 2023 (%)

- FIGURE 23 DE-OILED LECITHIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 FLUCTUATIONS IN RAW MATERIAL PRICES, 2011–2020 (USD/MT)

- FIGURE 25 DE-OILED LECITHIN MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 DE-OILED LECITHIN MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 DE-OILED LECITHIN MARKET MAP

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 29 AVERAGE SELLING PRICE OF DE-OILED LECITHIN OFFERED BY KEY PLAYERS, BY SOURCE (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE, BY SOURCE, 2018–2022 (USD/KG)

- FIGURE 31 DE-OILED LECITHIN MARKET: PATENTS GRANTED, 2012–2022

- FIGURE 32 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DE-OILED LECITHIN, 2011–2021

- FIGURE 33 IMPORT DATA FOR DE-OILED LECITHIN, BY KEY COUNTRY, 2018–2022

- FIGURE 34 EXPORT DATA FOR DE-OILED LECITHIN, BY KEY COUNTRY, 2018–2022

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- FIGURE 37 DE-OILED LECITHIN MARKET, BY SOURCE, 2023 VS. 2028

- FIGURE 38 TOP 10 SOYBEAN EXPORTING COUNTRIES, 2017–2022 (USD BILLION)

- FIGURE 39 DE-OILED LECITHIN MARKET, BY FORM, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 40 DE-OILED LECITHIN MARKET, BY APPLICATION, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 41 US HELD LARGEST SHARE OF DE-OILED LECITHIN MARKET IN 2022

- FIGURE 42 NORTH AMERICA DE-OILED LECITHIN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 43 EUROPE DE-OILED LECITHIN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 44 ASIA PACIFIC DE-OILED LECITHIN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 45 LATIN AMERICA DE-OILED LECITHIN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 46 ROW DE-OILED LECITHIN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 47 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD BILLION)

- FIGURE 48 DE-OILED LECITHIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 49 DE-OILED LECITHIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (START-UP/SME)

- FIGURE 50 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 51 ADM: COMPANY SNAPSHOT

- FIGURE 52 BUNGE LIMITED: COMPANY SNAPSHOT

- FIGURE 53 IMCD GROUP B.V.: COMPANY SNAPSHOT

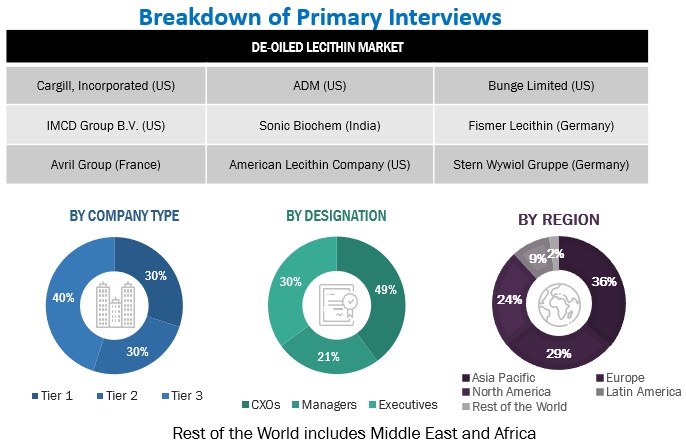

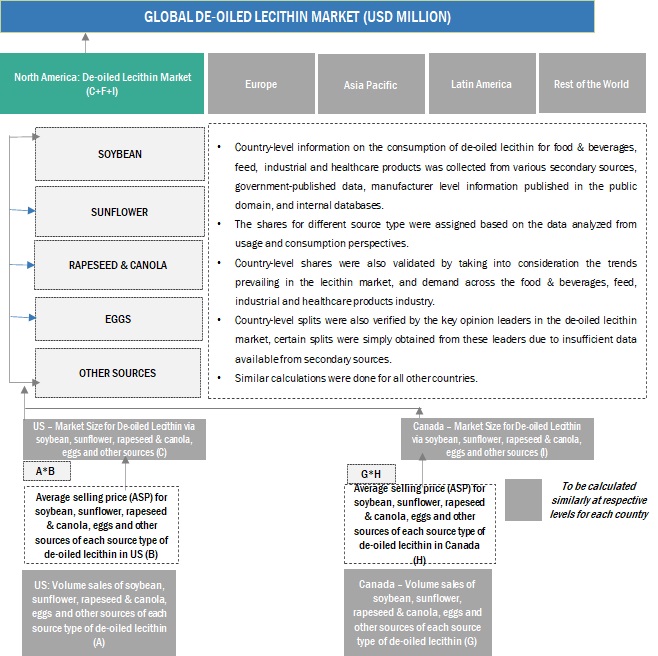

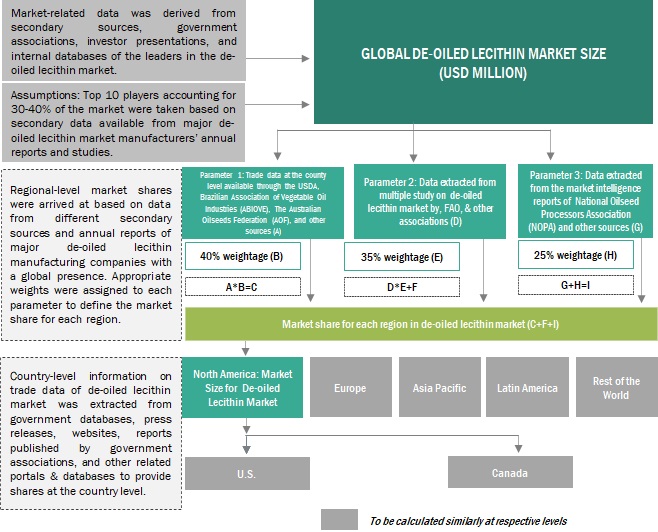

The study involved four major activities in estimating the current size of the de-oiled lecithin market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles from regulatory bodies, trade directories, by recognized authors, and databases were used to identify and collect information for this study.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The de-oiled lecithin market includes several stakeholders in the supply chain, including raw material suppliers, de-oiled lecithin manufacturers, end-product manufacturers, and regulatory organizations. The demand side of the market is characterized by the presence of key food producers and processors, food importers/exporters, manufacturers engaged in the production of lecithin and related government agencies. The supply side is characterized by key manufacturers of de-oiled lecithin and suppliers of raw materials.

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the food & beverage and feed sectors. The primary sources from the supply side include key opinion leaders and key manufacturers in the de-oiled lecithin market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the de-oiled lecithin market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent market—the lecithin market and vegetable protein market—was considered to validate further the market details of de-oiled lecithin.

-

Bottom-up approach:

- The market size was analyzed based on the share of each source of de-oiled lecithin and its penetration within the application and form at regional and country levels. Thus, the global market was estimated with a bottom-up approach at the country level.

- Other factors include demand within the supply chain, including the food & beverages, feed, healthcare, and industrial applications; and function trends; pricing trends; adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the de-oiled lecithin market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global de-oiled lecithin market Size: Bottom-Up Approach

The bottom-up approach used the data extracted from secondary research to validate the market segment sizes obtained. The approach was employed to arrive at the overall size of the de-oiled lecithin market in particular regions, and its share in the de-oiled lecithin market at the country and regional levels was validated through primary interviews conducted with suppliers, dealers, and distributors.

To know about the assumptions considered for the study, Request for Free Sample Report

Global de-oiled lecithin market Size: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the segmentation) through percentage splits from secondary and primary research.

The top-down approach used to triangulate the data obtained through this study is explained in the next section:

- In the global de-oiled lecithin market, related secondary sources such as US Department of Agriculture (USDA), Food and Drug Administration (FDA), US Department of Agriculture (USDA), National Oilseed Processors Association (NOPA), The Australian Oilseed Federation (AOF), The European Vegetable Oil and Protein meal Industry (FEDOIL), Brazilian Association of Vegetable Oil Industries (ABIOVE) and company annual reports of all major players were considered to arrive at the global market size.

- The global number for de-oiled lecithin was arrived upon after giving certain weightage factors for the data obtained from these secondary and primary sources.

- With the data triangulation procedure and data validation through primaries (from both supply and demand sides), the shares and sizes of the regional markets and individual markets were determined and confirmed.

- Data on company revenues, area harvested, product launches, and global regulations for de-oiled lecithin in the last four years was used to arrive at the country-wise market size, and CAGR estimation of type and application segments was then validated from primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall de-oiled lecithin market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the International Food Additives Council (IFAC), de-oiled lecithin products contain almost no vegetable oil and are high in polyunsaturated fatty acids. They are available in granular and powdered forms.

De-oiled lecithin is simply - lecithin with nearly no oil. It is practically oil-free and includes a high concentration of polyunsaturated fatty acids. Powdered lecithin is de-oiled lecithin and has hydrophilic properties. It is the most used form of lecithin and is more refined than granules. Powdered lecithin contains less fat than liquid lecithin. It is light yellow in color. It differs from liquid lecithin in that it has no effect on the color of the mixture or the product. Powdered or granular lecithin is a compact, easier-to-handle concentrated lecithin product.

Key Stakeholders

- De-oiled lecithin manufacturers

- De-oiled lecithin importers and exporters

- De-oiled lecithin distributors and suppliers

- Manufacturers from industry such as confectionery, chocolate, bakeries, processed food, nutrition and supplements, cosmetics, pharmaceuticals, paints, herbicides, and animal feed using de-oiled lecithin.

- Government and research organizations

-

Associations and industry bodies

- National Soybean Processors Association (NSPA)

- The United States Department of Agriculture (USDA

- The Food and Drug Administration (FDA)

- The European Vegetable Oil and Protein meal Industry (FEDOIL)

- European Feed Manufacturers' Federation (FEFAC)

- European Feed Safety Ingredients Certification (EFISC)

- The Soybean Processors Association of India (SOPA)

- American Soybean Association (ASA)

- United Soybean Board (USB)

- Brazilian Association of Vegetable Oil Industries (ABIOVE)

- Canadian Oilseed Processors Association (COPA)

- Cosmetics Toiletries and Fragrance Association (CTFA),

- The International Soybean Growers Alliance (ISGA)

- The Australian Oilseeds Federation (AOF)

- The Paraguayan Chamber of Cereal and Oilseed Exporters (CAPECO)

- Cámara de la Industria Aceitera de la República Argentina (CIARA)

- National Oilseed Processors Association (NOPA).

Report Objectives

Market Intelligence

- Determining and projecting the size of the de-oiled lecithin market based on source, type, nature, method of extraction, form, application, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the de-oiled lecithin market

Competitive Intelligence

- Identifying and profiling the key market players in the de-oiled lecithin market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations and technology in the de-oiled lecithin market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe market into Netherlands, Poland, Belgium, Denmark, and others

- Further breakdown of the Rest of Asia Pacific market into Thailand, Malaysia, South Korea, Indonesia, Singapore, and others

- Further breakdown of the Rest of Latin America market into Peru, Uruguay, Paraguay, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in De-oiled Lecithin Market