Specialty Fats & Oils Market by Type (Specialty Fats & Specialty Oils), Application (Chocolate & Confectionery, Bakery Product, Processed Food, Animal Nutrition, Dairy Product, and Infant Nutrition), Form (Dry & Liquid), & Region - Global Forecast to 2026

[284 Pages] The specialty fats and oils market is estimated at USD 12.6 billion in 2020; it is projected to grow at a CAGR of 7.8% to reach USD 19.8 billion by 2026. The steady onset of factors such as the rise in consumption of bakery and processed food products, increase in demand for nutritional food products as well as the growth and the rising living standards of wide sections of the population, particularly in emerging and developing markets have triggered a demand for different types edible fats & oils.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Specialty Fats & Oils Market

As this virus continues to spread rapidly at a global level, countries across the globe are trying to prevent further contagion by taking measures, such as social distancing, contact tracing, self-quarantining, surveillance, communication, and testing. The supply and demand for specialty fats & oils in the global market has shifted as a response to the coronavirus crisis, with an increasing uncertainty related to prices. Palm oil, which is the largest type of oil produced globally, faced the impact as demand dropped across the world, trade was disrupted, and production got hampered in Indonesia and Malaysia, according to the top producers of the vegetable oils such as Wilmar International and Mehwah Group that operate in the region. The bakery and confectionery industries observed a spike in sales, with people stocking up on these products during lockdowns. The bakery and confectionery industries also observed a spike in sales, with people stocking up on these products.

Specialty Fats & Oils Market Dynamics

Driver: Fluctuations in global cocoa production

Cocoa beans are among the key ingredients being used in the production of chocolate. However, in the recent past, the overall production of cocoa beans has been slightly hampered due to uncertain climatic conditions that are being endured in top cocoa-producing countries. With the rising demand for cocoa as an ingredient on the one hand, and a decline in the production rate on the other, specialty fats offer an alternative solution. Specialty fats such as cocoa butter equivalents, cocoa butter replacers possess a similar set of characteristics as that of cocoa. Moreover, specialty fats are less expensive than cocoa butter.

Restraint: Health concerns pertaining to the excessive consumption of fats and oils

Excessive consumption of hydrogenated fats & oils increases the level of LDLs (low-density lipoproteins) and decreases the level of HDLs (high-density lipoproteins) in the blood, thereby increasing the risk of the thrombosis. This is because the PUFA in vegetable oils oxidize automatically during food processing, resulting in the production of inflammatory peroxides and hydroperoxides. Thus, awareness about the negative health effects of the inclusion of trans-fatty acids is affecting the confectionery fats & shortenings market, and in turn, the confectionery ingredients and specialty fats & oils market.

Opportunity: Rise in demand for natural cosmetic products

Over the years, there has been a growing preference for natural products over artificial chemicals in the beauty and personal care industry. The culmination of factors such as the rise in the number of the millennial population specifically in the Asia Pacific region, a surge in online presence and use of the internet, increase in per capita income a growing awareness toward sustainable and environmentally-friendly products has all together driven the market for organic cosmetics and personal care products. This has resulted in an increase in the demand for specialty ingredients such as palm oil, olive oil to be used in the beauty and personal care industries in the recent past.

Challenge: High dependence on imports, leading to high costs of end products

There is a significant gap between the demand and supply of oilseed processed products, such as edible oil, owing to the limited availability of oilseeds in some domestic markets. India and European countries import palm oil on a large scale from Indonesia and Malaysia, which are the leading producers, owing to the favorable climatic conditions of these countries. Palm oil is widely used in the confectionery products sector, which experiences high demand in India and other European countries.

The specialty oils sub-segment is estimated to account for the highest market share in the by type segment for Specialty Fats & Oils market.

Specialty oils are derived from sources, such as palm, coconuts, soybeans, sunflower, rapeseed, and other sources such as peanut and olive oil. These oils have unique properties that are desirable in industrial and non-edible applications. Palm, coconut, and sunflower oils are growing in their market shares, with the increasing demand for vegetable oils, in the growing bakery and confectionery businesses. The constituent fatty acids of each culinary oil are primarily responsible for the functionality of these oils, along with their minor components. Sunflower oil is used in the cooking of foods such as French fries and frozen pre-fried foods at home, in fast-food restaurants, and in the industry. High growth is observed in developing regions such as Asia and the Middle East, with the increasing trend toward the use of vegetable oils for cooking and household use.

By Application, the infant nutrition sub-segment is estimated to observe the fastest growth in Specialty Fats & Oils market.

In highly developed and rapidly urbanizing nations, there is a rising focus on the emerging trend of feeding infants with infant formulas and infant food lipids, which are primarily mimicked based on the composition of mother’s milk. Because there were a lot of variations in mother’s milk from different regions of the world due to varied diets, the development of one such compound with optimal levels of nutrition was essential. Here, specialty fats and oils play a crucial role, as they need to be added to the product, to balance the overall fatty acid composition.

The dry sub-segment is estimated to account for the largest market share in the by form segment of the Specialty Fats & Oils market over the forecast period.

In its dry form, we majorly find specialty fat products such as cocoa butter equivalents, cocoa butter substitutes, cocoa butter replacers, cocoa butter improvers, and dairy fat replacers. These are generally liquid fats such as oils with improved melting curves. They facilitate the preservation of the product structure for trading purposes and for a longer time. The dry form of specialty fats & oils plays a major role in products such as chocolates and confectioneries via coatings and kind of butters.

To know about the assumptions considered for the study, download the pdf brochure

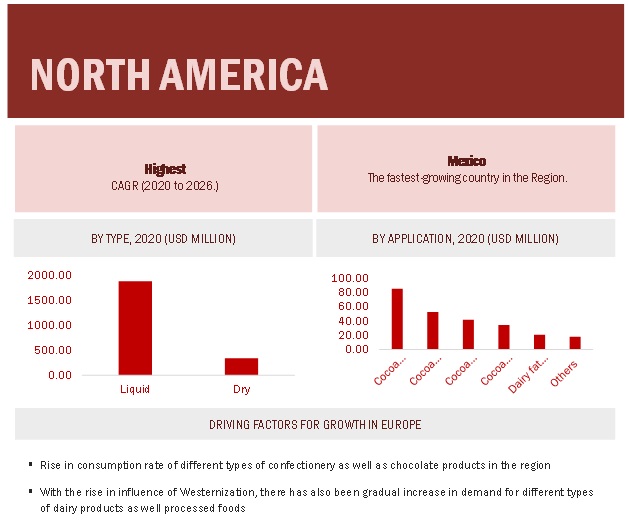

The increasing consumption of fast and processed foods in the North American region, accounts for the high market share of the region.

The region consists of a highly growing fast-food sector in the region. The region includes highly developed countries such as the US and Canada, with high-income populations. More than 60% of American diets include processed foods. The fast-food sector is a growing sector in the region. Hence, industrial food producers are focusing on developing not just quality but healthy food products in the country. These factors have led to the use of specialty fats and oils.

Key Market Players

Key players in this market includes such as Cargill, Incorporated (US), Wilmar International (Singapore), Bunge Limited (US), AAK AB (Sweden), Mehwah International (Singapore) IOI Loders Croklaan (Malaysia). Other players include Manildra (Australia), D&L Industries, Fuji Oil (Japan), Musim Mas (Singapore), and IFFCO (UAE). These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2016–2026 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2026 |

|

Units considered |

Value (USD) & Volume (KT) |

|

Segments covered |

Type, Application, Form, Functionality, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies studied |

The major market players include Cargill, Incorporated (US), Wilmar International (Singapore), Bunge Limited (US), AAK AB (Sweden), Mehwah International (Singapore) IOI Loders Croklaan (Malaysia). Other players include Manildra (Australia), D&L Industries, Fuji Oil (Japan), Musim Mas (Singapore), and IFFCO (UAE). (Total 20 companies) |

This research report categorizes the market based on Type, Applications, Form, Functionality, and Region.

On the basis of type, the Specialty Fats & Oils market has been segmented as follows:

-

Specialty Fats

- Cocoa Butter Equivalents

- Cocoa Butter Substitutes

- Cocoa Butter Replacers

- Cocoa Butter Improvers

- Dairy Fat Replacers

- Others (kokum and mango)

-

Specialty Oils

- Palm oil

- Coconut oil

- Soybean oil

- Sunflower oil

- Rapeseed oil

- Others (olive and peanut)

On the basis of application, the Specialty Fats & Oils market has been segmented as follows:

- Chocolates & confectionery

- Bakery products

- Processed foods

- Animal nutrition

- Dairy products

- Infant nutrition

- Others (cosmetics and pharmaceuticals)

On the basis of form, the Specialty Fats & Oils market has been segmented as follows:

-

Dry

- Liquid

On the basis of region, the Specialty Fats & Oils market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of World (RoW)*

*Rest of the World (RoW) includes South America, the Middle East, and Africa.

Recent Developments

- In November 2019, BASF (Germany), Cargill, Procter & Gamble (P&G) (US), and the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH (Germany) entered in a partnership under the development PPP (Public-Private Partnership). the program, to establish a certified coconut oil supply chain and improve the livelihood of coconut farmers in the Philippines and Indonesia. This would strengthen the company’s supplies for coconut oil in the countries.

- In December 2019, Cargill and nine other prominent palm oil producers—Bunge Limited, Golden Agri Resources, Musim Mas, Unilever, Wilmar, Nestlé, PepsiCo, Sime Darby Plantation, and Mondelez International—announced a collaboration to support and fund new radar-based forest monitoring systems, which would not only help detect deforestation but also help companies improve sustainability in commodity supply chains.

- In February 2019, AAK acquired Dutch company, MaasRefinery B.V, a major oilseeds refinery, to increase its production capacity, and support existing production facilities and enable continued growth.

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the Specialty Fats & Oils market and how intense is the competition?

Key players in the Specialty Fats & Oils Market include competitiors such as Cargill, Incorporated (US), Wilmar International (Singapore), Bunge Limited (US), AAK AB (Sweden), Mehwah International (Singapore) IOI Loders Croklaan (Malaysia). Other players include Manildra (Australia), D&L Industries, Fuji Oil (Japan), Musim Mas (Singapore), and IFFCO (UAE). The specialty fats & oils market includes not only established players but also strongly emerging companies. Specialty fats & oils being a growing market, the existing players are fixated upon improving their market shares, while their newer start-ups being established rapidly in the market. The specialty fats and oils can be classified as a fragmented market due to the presence of a large number of organized players accounting for more than 50, present at the global level as well as unorganized players present at the local level in several countries. There are numerous existing and emerging companies, especially in the North American and Asian Markets.

What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

The key stakeholders to the specialty fats and oils market would-be manufacturers, suppliers, and processors of the various applications such as (chocolate & Confectionery products, bakery products, processed foods, animal feed, dairy products, infant nutrition, functional nutrition, cosmetic products, pharmaceutical products); raw material suppliers, minerals ingredients manufacturers, traders & retailers, wholesalers, distributors, importers, and exporters, and regulatory bodies and associations. The key strategies adopted by these in the market would be new product launches, expansions & investments, acquisitions, and agreements, joint ventures, collaborations, and partnerships.

What are the potential challenges to the Specialty Fats & Oils market?

The global demand for specialty fats and oils is rising in regions such as North America, Europe, and Asia Pacific regions which largely depend on countries such as Malaysia, Indonesia, and Africa for the raw material supplies. This makes them highly vulnerable to price fluctuations and other market changes in their respective countries. This poses a major challenge to the growth of the specialty fats and oils market.

Which region is dominant in the Specialty fats and oils market and what are the major driver for that?

Asia Pacific region dominates the global markets for Specialty fats and oils market, as countries such as China and India record the highest vegetable oil consumption worldwide. Factors such as the large application of vegetable oils in various food sectors and the rise in awareness about the health benefits associated with the consumption of such oil among the consumers drive the demand for different types of vegetable oils, including specialty oils.

What is the impact of coronavirus on the Specialty fats and oils market?

The supply and demand for specialty fats & oils in the global market shifted as a response to the coronavirus crisis, with an increasing uncertainty related to prices. Efforts were being made in many countries to maintain stability in the market. Governments from countries such as India, China, and the US made exemptions for the sector to continue their businesses with minimal capacity amid the lockdowns; thus, as the production continued, these companies were able to mitigate the considerable impact by the continuity of operations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 SPECIALTY FATS

1.2.2 SPECIALTY OILS

1.3 MARKET SCOPE

FIGURE 1 SPECIALTY FATS & OILS MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.3.1 INCLUSIONS & EXCLUSIONS

TABLE 1 SPECIALTY FATS & OILS MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2017–2019

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 3 SPECIALTY FATS & OILS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 5 SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020 VS. 2026 (USD MILLION)

FIGURE 6 MARKET SIZE, BY APPLICATION, 2020 VS. 2026 (USD MILLION)

FIGURE 7 MARKET SIZE, BY FORM, 2020 VS. 2026 (USD MILLION)

FIGURE 8 MARKET SHARE, BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SPECIALTY FATS & OILS MARKET

FIGURE 9 GROWTH IN DEMAND FOR CLEAN LABEL PRODUCTS TO DRIVE THE MARKET

4.2 SPECIALTY FATS & OILS MARKET, BY FORM & REGION

FIGURE 10 LIQUID IS ESTIMATED TO BE THE LARGER MARKET IN 2020 (VALUE)

4.3 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET, BY KEY TYPE & APPLICATION

FIGURE 11 SPECIALTY OILS TO ACCOUNT FOR THE LARGER SHARE IN THE ASIA PACIFIC MARKET IN 2020 (VALUE)

4.4 SPECIALTY FATS & OILS MARKET, BY APPLICATION & KEY TYPE

FIGURE 12 PALM OIL TO DOMINATE THE MARKET FOR SPECIALTY FATS & OILS, 2020 (VALUE)

4.5 SPECIALTY FATS & OILS MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 13 CHINA TO BE THE LARGEST MARKET GLOBALLY FOR SPECIALTY FATS & OILS IN 2020 (VALUE)

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

TABLE 3 TYPICAL FATTY ACID COMPOSITION (WT) OF SELECTED VEGETABLE OILS AND ANIMAL FATS

TABLE 4 RAW MATERIALS/OILS USED FOR PRODUCING COCOA BUTTER ALTERNATIVE

5.1.1 MACROECONOMICAL FACTORS

5.1.1.1 Vegetable oil consumption

FIGURE 14 PER CAPITA AVAILABILITY OF VEGETABLE OILS IN SELECTED COUNTRIES, 2005–2027 (KG)

5.1.1.2 Trade scenario: oilseeds

TABLE 5 OILSEED TRADE SCENARIO, BY REGION, 2017 (KT)

5.2 MARKET DYNAMICS

FIGURE 15 MARKET DYNAMICS: SPECIALTY FATS & OILS MARKET

5.2.1 DRIVERS

5.2.1.1 Fluctuations in global cocoa production

5.2.1.2 Surge in consumption of confectionery and processed food products

FIGURE 16 EUROPE: CONFECTIONERY TRENDS, 2014–2016 (MILLION TONNES)

5.2.1.3 Rise in demand for clean label food products

5.2.2 RESTRAINTS

5.2.2.1 Health concerns pertaining to the excessive consumption of fats and oils

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand for natural cosmetic products

5.2.3.2 Growth in trend of microencapsulation of fats and oils

5.2.4 CHALLENGES

5.2.4.1 High dependence on imports, leading to high costs of end products

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 17 SUPPLY CHAIN ANALYSIS

5.4 PRICING ANALYSIS

FIGURE 18 PRICING ANALYSIS, 2016–2019 (USD/TON)

FIGURE 19 PRICING ANALYSIS, 2020–2026 (USD/TON)

5.5 ECOSYSTEM ANALYSIS

FIGURE 20 ECOSYSTEM ANALYSIS

5.6 PATENT ANALYSIS

FIGURE 21 PATENT INSIGHTS

TABLE 6 PATENTS PERTAINING TO SPECIALTY FATS & OILS, 2018–2020

6 IMPACT OF COVID -19 ON THE SPECIALTY FATS & OILS MARKET (Page No. - 71)

FIGURE 22 COVID-19: GLOBAL PROPAGATION

FIGURE 23 COVID-19 PROPAGATION: SELECT COUNTRIES

6.1 COVID-19 IMPACT ON THE SPECIALTY FATS & OILS MARKET

FIGURE 24 SPECIALTY FATS & OILS MARKET SCENARIO WITH & WITHOUT COVID-19, 2020 (USD MILLION)

7 SPECIALTY FATS & OILS MARKET, BY TYPE (Page No. - 74)

7.1 INTRODUCTION

FIGURE 25 EXPORT VOLUMES OF MAJOR VEGETABLE OILS WORLDWIDE, 2019–2020

FIGURE 26 SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020 VS. 2026 (USD MILLION)

7.2 SPECIALTY FATS

TABLE 7 SPECIALTY FATS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 8 SPECIALTY FATS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 9 SPECIALTY FATS MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 10 SPECIALTY FATS MARKET SIZE, BY TYPE, 2020–2026 (KT)

7.2.1 COCOA BUTTER EQUIVALENTS

TABLE 11 COCOA BUTTER EQUIVALENTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 COCOA BUTTER EQUIVALENTS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 13 COCOA BUTTER EQUIVALENTS MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 14 COCOA BUTTER EQUIVALENTS MARKET SIZE, BY REGION, 2020–2026 (KT)

7.2.2 COCOA BUTTER SUBSTITUTES

TABLE 15 COCOA BUTTER SUBSTITUTES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 COCOA BUTTER SUBSTITUTES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 17 COCOA BUTTER SUBSTITUTES MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 18 COCOA BUTTER SUBSTITUTES MARKET SIZE, BY REGION, 2020–2026 (KT)

7.2.3 COCOA BUTTER REPLACERS

TABLE 19 COCOA BUTTER REPLACERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 COCOA BUTTER REPLACERS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 21 COCOA BUTTER REPLACERS MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 22 COCOA BUTTER REPLACERS MARKET SIZE, BY REGION, 2020–2026 (KT)

7.2.4 COCOA BUTTER IMPROVERS

TABLE 23 COCOA BUTTER IMPROVERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 COCOA BUTTER IMPROVERS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 25 COCOA BUTTER IMPROVERS MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 26 COCOA BUTTER IMPROVERS MARKET SIZE, BY REGION, 2020–2026 (KT)

7.2.5 DAIRY FAT REPLACERS

TABLE 27 DAIRY FAT REPLACERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 DAIRY FAT REPLACERS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 29 DAIRY FAT REPLACERS MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 30 DAIRY FAT REPLACERS MARKET SIZE, BY REGION, 2020–2026 (KT)

7.2.6 OTHER SPECIALTY FATS

TABLE 31 OTHER SPECIALTY FATS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 OTHER SPECIALTY FATS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 33 OTHER SPECIALTY FATS MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 34 OTHER SPECIALTY FATS MARKET SIZE, BY REGION, 2020–2026 (KT)

7.3 SPECIALTY OILS

TABLE 35 SPECIALTY OILS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 36 SPECIALTY OILS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 37 SPECIALTY OILS MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 38 SPECIALTY OILS MARKET SIZE, BY TYPE, 2020–2026 (KT)

7.3.1 PALM OIL

FIGURE 27 PRODUCTION OF PALM OIL, 2000-2018 (MILLION TONNES)

TABLE 39 PALM OIL MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 PALM OIL MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 41 PALM OIL MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 42 PALM OIL MARKET SIZE, BY REGION, 2020–2026 (KT)

7.3.2 SOYBEAN OIL

TABLE 43 SOYBEAN OIL MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 SOYBEAN OIL MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 45 SOYBEAN OIL MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 46 SOYBEAN OIL MARKET SIZE, BY REGION, 2020–2026 (KT)

7.3.3 COCONUT OIL

TABLE 47 COCONUT OIL MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 48 COCONUT OIL MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 49 COCONUT OIL MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 50 COCONUT OIL MARKET SIZE, BY REGION, 2020–2026 (KT)

7.3.4 SUNFLOWER OIL

TABLE 51 SUNFLOWER OIL MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 SUNFLOWER OIL MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 53 SUNFLOWER OIL MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 54 SUNFLOWER OIL MARKET SIZE, BY REGION, 2020–2026 (KT)

7.3.5 RAPESEED OIL

FIGURE 28 TOP COUNTRIES IMPORTING RAPESEED OIL, 2019 (THOUSAND TONNES)

TABLE 55 RAPESEED OIL MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 56 RAPESEED OIL MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 57 RAPESEED OIL MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 58 RAPESEED OIL MARKET SIZE, BY REGION, 2020–2026 (KT)

7.3.6 OTHER SPECIALTY OILS

TABLE 59 OTHER SPECIALTY OILS MARKET SIZE, BY REGION, 2015–2023 (USD MILLION)

TABLE 60 OTHER SPECIALTY OILS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 61 OTHER SPECIALTY OILS MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 62 OTHER SPECIALTY OILS MARKET SIZE, BY REGION, 2020–2026 (KT)

8 SPECIALTY FATS & OILS MARKET, BY APPLICATION (Page No. - 102)

8.1 INTRODUCTION

FIGURE 29 SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020 VS. 2026 (USD MILLION)

TABLE 63 SPECIALTY OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 64 SPECIALTY OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 65 SPECIALTY OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 66 SPECIALTY FATS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

8.2 CHOCOLATES & CONFECTIONERY

TABLE 67 SPECIALTY OILS MARKET SIZE IN CHOCOLATES & CONFECTIONERY PRODUCTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 68 SPECIALTY OILS MARKET SIZE IN CHOCOLATES & CONFECTIONERY PRODUCTS, BY REGION, 2020–2026 (USD MILLION)

TABLE 69 CHOCOLATES & CONFECTIONERIES: SPECIALTY FATS MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 70 SPECIALTY FATS MARKET SIZE IN CHOCOLATES & CONFECTIONERY PRODUCTS, BY REGION, 2020–2026 (KT)

8.3 BAKERY PRODUCTS

TABLE 71 SPECIALTY OILS MARKET SIZE IN BAKERY PRODUCTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 72 SPECIALTY OILS MARKET SIZE IN BAKERY PRODUCTS, BY REGION, 2020–2026 (USD MILLION)

TABLE 73 SPECIALTY FATS MARKET SIZE IN BAKERY PRODUCTS, BY REGION, 2016–2019 (KT)

TABLE 74 SPECIALTY FATS MARKET SIZE IN BAKERY PRODUCTS, BY REGION, 2020–2026 (KT)

8.4 PROCESSED FOODS

TABLE 75 SPECIALTY OILS MARKET SIZE IN PROCESSED FOODS, BY REGION, 2016–2019 (USD MILLION)

TABLE 76 SPECIALTY OILS MARKET SIZE IN PROCESSED FOODS, BY REGION, 2020–2026 (USD MILLION)

TABLE 77 SPECIALTY FATS MARKET SIZE IN PROCESSED FOODS, BY REGION, 2016–2019 (KT)

TABLE 78 SPECIALTY OILS MARKET SIZE IN PROCESSED FOODS, BY REGION, 2020–2026 (KT)

8.5 ANIMAL NUTRITION

FIGURE 30 MEAT PRODUCTION, 2000-2018 (MILLION TONNES)

TABLE 79 SPECIALTY OILS MARKET SIZE IN ANIMAL NUTRITION, BY REGION, 2016–2019 (USD MILLION)

TABLE 80 SPECIALTY OILS MARKET SIZE IN ANIMAL NUTRITION, BY REGION, 2020–2026 (USD MILLION)

TABLE 81 SPECIALTY FATS MARKET SIZE IN ANIMAL NUTRITION, BY REGION, 2016–2019 (KT)

TABLE 82 SPECIALTY FATS MARKET SIZE IN ANIMAL NUTRITION, BY REGION, 2020–2026 (KT)

8.6 DAIRY PRODUCTS

TABLE 83 SPECIALTY OILS MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 84 SPECIALTY OILS MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2020–2026 (USD MILLION)

TABLE 85 SPECIALTY FATS MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2016–2019 (KT)

TABLE 86 SPECIALTY FATS MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2020–2026 (KT)

8.7 INFANT NUTRITION

TABLE 87 SPECIALTY OILS MARKET SIZE IN INFANT NUTRITION, BY REGION, 2016–2019 (USD MILLION)

TABLE 88 SPECIALTY OILS MARKET SIZE IN INFANT NUTRITION, BY REGION, 2020–2026 (USD MILLION)

TABLE 89 SPECIALTY FATS MARKET SIZE IN INFANT NUTRITION, BY REGION, 2016–2019 (KT)

TABLE 90 SPECIALTY FATS MARKET SIZE IN INFANT NUTRITION, BY REGION, 2020–2026 (KT)

8.8 OTHER APPLICATIONS

TABLE 91 SPECIALTY OILS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 92 SPECIALTY OILS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

TABLE 93 SPECIALTY FATS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (KT)

TABLE 94 SPECIALTY OILS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (KT)

9 SPECIALTY FATS & OILS MARKET, BY FORM (Page No. - 120)

9.1 INTRODUCTION

FIGURE 31 SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020 VS. 2026 (USD MILLION)

TABLE 95 MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 96 MARKET SIZE, BY FORM, 2020–2026 (USD MILLION)

TABLE 97 MARKET SIZE, BY FORM, 2016–2019 (KT)

TABLE 98 MARKET SIZE, BY FORM, 2020–2026 (KT)

9.2 DRY

TABLE 99 DRY MARKET SIZE for SPECIALTY FATS & OILS, BY REGION, 016–2019 (USD MILLION)

TABLE 100 DRY MARKET SIZE for SPECIALTY FATS & OILS, BY REGION, 2020–2026 (USD MILLION)

TABLE 101 DRY MARKET SIZE for SPECIALTY FATS & OILS, BY REGION, 2016–2019 (KT)

TABLE 102 DRY MARKET SIZE for SPECIALTY FATS & OILS, BY REGION, 2020–2026 (KT)

9.3 LIQUID

TABLE 103 LIQUID MARKET SIZE for SPECIALTY FATS & OILS, BY REGION, 2016–2019 (USD MILLION)

TABLE 104 LIQUID MARKET SIZE for SPECIALTY FATS & OILS, BY REGION, 2020–2026 (USD MILLION)

TABLE 105 LIQUID MARKET SIZE for SPECIALTY FATS & OILS, BY REGION, 2016–2019 (KT)

TABLE 106 LIQUID MARKET SIZE for SPECIALTY FATS & OILS, BY REGION, 2020–2026 (KT)

10 SPECIALTY FATS & OILS MARKET, BY FUNCTIONALITY (Page No. - 126)

10.1 INTRODUCTION

10.2 MOLDING

10.3 FILLING

10.4 COATING

10.5 STABILIZING

10.6 TEXTURING

10.7 OTHER FUNCTIONS

11 SPECIALTY FATS & OILS MARKET, BY REGION (Page No. - 129)

11.1 INTRODUCTION

FIGURE 32 GEOGRAPHIC SNAPSHOT OF SPECIALTY OILS MARKET (2020–2026): RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

TABLE 107 SPECIALTY FATS & OILS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 108 SPECIALTY FATS & OILS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 109 SPECIALTY FATS & OILS MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 110 SPECIALTY FATS & OILS MARKET SIZE, BY REGION, 2020–2026 (KT)

TABLE 111 SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 112 SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 113 SPECIALTY FATS& OILS MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 114 SPECIALTY FATS& OILS MARKET SIZE, BY TYPE, 2020–2026 (KT)

TABLE 115 SPECIALTY OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 116 SPECIALTY OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 117 SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2026 (KT)

TABLE 118 SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

TABLE 119 SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 120 SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020–2026 (USD MILLION)

TABLE 121 SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2016–2019 (KT)

TABLE 122 SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020–2026 (KT)

11.2 NORTH AMERICA

11.2.1 REGULATORY FRAMEWORK

11.2.2 US

11.2.3 CANADA

11.2.4 TRADE ANALYSIS

11.2.4.1 Increase in the global trade of specialty fats and oils

11.2.4.1.1 Export scenario of specialty fats and oils

FIGURE 33 NORTH AMERICA: PALM OIL EXPORTS, BY KEY COUNTRIES IN NORTH AMERICA, 2015–2019 (USD MILLION)

11.2.4.1.2 Import scenario of specialty fats and oils

FIGURE 34 NORTH AMERICA: PALM OIL IMPORTS, BY KEY COUNTRIES, 2015–2019 (USD THOUSAND)

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 123 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 124 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 125 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2016–2019 (KT)

TABLE 126 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2020–2026 (KT)

TABLE 127 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 128 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 129 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 130 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020–2026 (KT)

TABLE 131 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 132 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 133 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 134 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

TABLE 135 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 136 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020–2026 (USD MILLION)

TABLE 137 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2016–2019 (KT)

TABLE 138 NORTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020–2026 (KT)

11.2.5 US

TABLE 139 US: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 140 US: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 141 US: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 142 US: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.2.6 CANADA

TABLE 143 CANADA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 144 CANADA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 145 CANADA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 146 CANADA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.2.7 MEXICO

TABLE 147 MEXICO: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 148 MEXICO: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 149 MEXICO: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 150 MEXICO: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.3 EUROPE

11.3.1 REGULATORY FRAMEWORKS

11.3.2 TRADE ANALYSIS

FIGURE 36 EUROPE: IMPORTS OF VEGETABLE FATS AND OILS FOR EDIBLE PURPOSES, 2016 (KT)

FIGURE 37 EUROPE: EXPORTS OF VEGETABLE FATS AND OILS FOR EDIBLE PURPOSES, 2016 (KT)

TABLE 151 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 152 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 153 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2016–2019 (KT)

TABLE 154 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2020–2026 (KT)

TABLE 155 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 156 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 157 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 158 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020–2026 (KT)

TABLE 159 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 160 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 161 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 162 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

TABLE 163 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 164 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020–2026 (USD MILLION)

TABLE 165 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2016–2019 (KT)

TABLE 166 EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020–2026 (KT)

11.3.3 UK

TABLE 167 UK: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 168 UK: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 169 UK: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 170 UK: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.3.4 GERMANY

TABLE 171 GERMANY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 172 GERMANY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 173 GERMANY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 174 GERMANY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.3.5 FRANCE

TABLE 175 FRANCE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 176 FRANCE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 177 FRANCE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 178 FRANCE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.3.6 ITALY

TABLE 179 ITALY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 180 ITALY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 181 ITALY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 182 ITALY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.3.7 SPAIN

TABLE 183 SPAIN: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 184 SPAIN: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 185 SPAIN: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 186 SPAIN: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.3.8 NORWAY

TABLE 187 NORWAY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 188 NORWAY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 189 NORWAY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 190 NORWAY: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.3.9 REST OF EUROPE

TABLE 191 REST OF EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 192 REST OF EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 193 REST OF EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 194 REST OF EUROPE: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SNAPSHOT

11.4.1 REGULATORY FRAMEWORKS

11.4.2 TRADE ANALYSIS

FIGURE 39 MAJOR EXPORTERS OF PALM OIL, 2009–2011 (MILLION TONS)

FIGURE 40 INDIA: PALM OIL IMPORTS, 2012

FIGURE 41 CHINA: VEGETABLE OIL IMPORT, 2000–2018 (MILLION TONS)

TABLE 195 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 196 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 197 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2016–2019 (KT)

TABLE 198 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY COUNTRY, 2020–2026 (KT)

TABLE 199 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 200 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 201 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 202 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020–2026 (KT)

TABLE 203 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 204 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 205 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 206 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

TABLE 207 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 208 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020–2026 (USD MILLION)

TABLE 209 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2016–2019 (KT)

TABLE 210 ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020–2026 (KT)

11.4.3 CHINA

TABLE 211 CHINA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 212 CHINA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 213 CHINA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 214 CHINA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.4.4 INDIA

TABLE 215 INDIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 216 INDIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 217 INDIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 218 INDIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.4.5 INDONESIA

TABLE 219 INDONESIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 220 INDONESIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 221 INDONESIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 222 INDONESIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.4.6 AUSTRALIA

TABLE 223 AUSTRALIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 224 AUSTRALIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 225 AUSTRALIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 226 AUSTRALIA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.4.7 NEW ZEALAND

TABLE 227 NEW ZEALAND: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 228 NEW ZEALAND: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 229 NEW ZEALAND: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 230 NEW ZEALAND: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.4.8 REST OF ASIA PACIFIC

TABLE 231 REST OF ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 232 REST OF ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 233 REST OF ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 234 REST OF ASIA PACIFIC: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.5 REST OF THE WORLD (ROW)

11.5.1 REGULATORY FRAMEWORK

11.5.1.1 Africa

11.5.1.2 Middle East

11.5.2 TRADE ANALYSIS

11.5.2.1 Export scenario of specialty fats & oils in row countries

FIGURE 42 ROW: EDIBLE OIL EXPORTS, BY KEY COUNTRY, 2019 (USD THOUSAND)

11.5.2.2 Import scenario of specialty fats & oils in row countries

FIGURE 43 ROW: EDIBLE OIL IMPORTS, BY KEY COUNTRY, 2019 (USD THOUSAND)

TABLE 235 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 236 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 237 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY REGION, 2016–2019 (KT)

TABLE 238 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY REGION, 2020–2026 (KT)

TABLE 239 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 240 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 241 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2016–2019 (KT)

TABLE 242 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY TYPE, 2020–2026 (KT)

TABLE 243 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 244 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 245 ROW: SPECIALTY FATS& OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 246 ROW: SPECIALTY FATS& OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

TABLE 247 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 248 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020–2026 (USD MILLION)

TABLE 249 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2016–2019 (KT)

TABLE 250 ROW: SPECIALTY FATS & OILS MARKET SIZE, BY FORM, 2020–2026 (KT)

11.5.3 MIDDLE EAST

TABLE 251 MIDDLE EAST: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 252 MIDDLE EAST: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 253 MIDDLE EAST: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 254 MIDDLE EAST: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.5.4 AFRICA

TABLE 255 AFRICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 256 AFRICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 257 AFRICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 258 AFRICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

11.5.5 SOUTH AMERICA

TABLE 259 SOUTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 260 SOUTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 261 SOUTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2016–2019 (KT)

TABLE 262 SOUTH AMERICA: SPECIALTY FATS & OILS MARKET SIZE, BY APPLICATION, 2020–2026 (KT)

12 COMPETITIVE LANDSCAPE (Page No. - 227)

12.1 OVERVIEW

12.2 MARKET RANKING

FIGURE 44 TOP FIVE COMPANIES IN THE SPECIALTY FATS & OILS MARKET, 2019

12.3 MARKET SHARE ANALYSIS

FIGURE 45 SPECIALTY FATS & OILS MARKET: COMPANY MARKET SHARE OF PRODUCT MANUFACTURERS, 2018

12.4 MARKET EVALUATION FRAMEWORK

FIGURE 46 SPECIALTY FATS & OILS MARKET: TRENDS IN COMPANY STRATEGIES, 2017–2019

12.5 COMPETITIVE SCENARIO

12.5.1 EXPANSIONS & INVESTMENTS

TABLE 263 EXPANSIONS & INVESTMENTS, 2017–2018

12.5.2 ACQUISITIONS

TABLE 264 ACQUISITIONS, 2019

12.5.3 NEW PRODUCT LAUNCHES

TABLE 265 NEW PRODUCT LAUNCHES, 2017

12.5.4 AGREEMENTS, JOINT VENTURES, COLLABORATIONS, AND PARTNERSHIPS

TABLE 266 AGREEMENTS, JOINT VENTURES, COLLABORATIONS, AND PARTNERSHIPS, 2017–2019

12.6 COVID-19 SPECIFIC COMPANY RESPONSE

13 COMPANY EVALUATION MATRIX & COMPANY PROFILES (Page No. - 233)

13.1 COMPANY EVALUATION MATRIX (OVERALL MARKET)

13.1.1 STARS

13.1.2 PERVASIVE PLAYERS

13.1.3 EMERGING LEADERS

13.1.4 PARTICIPANTS

FIGURE 47 SPECIALTY FATS & OILS MARKET: COMPANY EVALUATION MATRIX, 2019

13.2 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

13.2.1 PROGRESSIVE COMPANIES

13.2.2 STARTING BLOCKS

13.2.3 RESPONSIVE COMPANIES

13.2.4 DYNAMIC COMPANIES

FIGURE 48 SPECIALTY FATS & OILS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

13.3 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

13.3.1 CARGILL, INCORPORATED

FIGURE 49 CARGILL, INCORPORATED: COMPANY SNAPSHOT

FIGURE 50 CARGILL, INCORPORATED: SWOT ANALYSIS

13.3.2 WILMAR INTERNATIONAL

FIGURE 51 WILMAR INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 52 WILMAR INTERNATIONAL: SWOT ANALYSIS

13.3.3 BUNGE LIMITED

FIGURE 53 BUNGE LIMITED: COMPANY SNAPSHOT

FIGURE 54 BUNGE LIMITED: SWOT ANALYSIS

13.3.4 MEWAH INTERNATIONAL

FIGURE 55 MEWAH INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 56 MEHWAH INTERNATIONAL: SWOT ANALYSIS

13.3.5 AAK AB

FIGURE 57 AAK AB: COMPANY SNAPSHOT

FIGURE 58 AAK AB: SWOT ANALYSIS

13.3.6 INTERNATIONAL FOODSTUFF COMPANY LIMITED (IFFCO)

13.3.7 MUSIM MAS

13.3.8 FUJI OIL

FIGURE 59 FUJI OIL: COMPANY SNAPSHOT

13.3.9 MANILDRA GROUP

13.3.10 BAKO WALES

13.3.11 PREMIUM VEGETABLE OILS SDN BHD

13.3.12 PT INGREDIENTS PARTNER INDONESIA

13.3.13 TRISTAR GLOBAL

13.3.14 UNIVERSAL MODERN INDUSTRIES CO. (UMIC)

13.3.15 PAN OLEO

13.3.16 PEERLESS HOLDINGS PTY LTD

13.3.17 WILDOILS PVT LIMITED

13.3.18 FLORIN AG

13.3.19 APICAL GROUP LTD.

13.3.20 GOLDEN AGRI-RESOURCES LTD. (GAR)

FIGURE 60 GOLDEN AGRI-RESOURCES LTD.: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 276)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

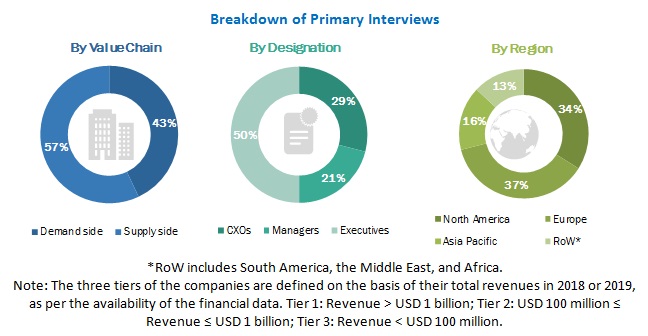

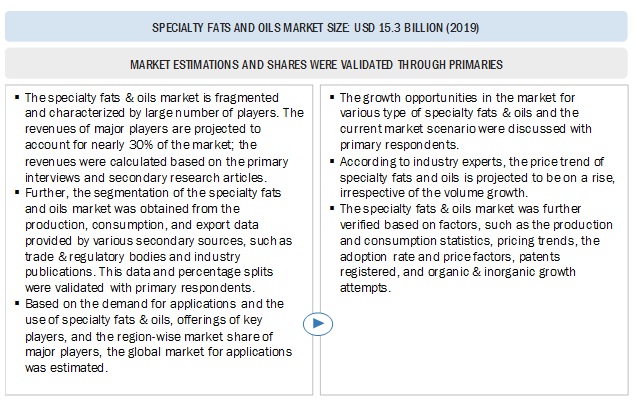

The study involved four major activities in estimating the specialty fats and oils market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources, such as the United States Food and Drug Administration (US FDA), Organisation for Economic Co-operation and Development (OECD), Food and Agriculture Organization, and the United States Department of Agriculture, were referred to identify and collect information for this study. The secondary sources also include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include raw material suppliers, equipment suppliers, and food manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply-side include food manufacturers. The primary sources from the demand-side include distributors, importers, exporters, and end-consumers.

Market Size Estimation

Market size estimation involves the determination of segmental revenue sales for specialty fats & oils of the top 20 manufacturers operating in the global market and validating the same with the determination of volume sales through a top-down approach.

-

Approach 1:

- Mapping of key specialty fat & oil manufacturers operating in the market through taking into consideration of several key factors such as annual revenue, annual production capacity and its global presence

- Determining the segment revenue sales which is responsible for generating sales of specialty fats & oils for each manufacturer

- Taking into on several factors such as market being fragmented comprising of more than 30 active players in the global market, ascertaining collective value share for top 20 players

-

Approach 2:

- Determination of annual consumption of each specialty fat and oil in terms of volume sales (tons) at the global level

- With reference to key secondary sources, determined the consumption of each of the specialty fats & oils at the regional level; this step not only provided share splits of market segment by type at regional level but also at the global level

- Initiated summation of specialty fats & oils regional consumption to arrive at the global volume sales in terms of kilotons (KT)

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the specialty fats & oils were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Specialty fats and oils Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into the product type segment and application segment. To estimate the overall specialty fats & oils and arrive at the exact statistics for all subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the specialty fats and oils market, in terms of type, application, form, and region

- To describe and forecast the specialty fats and oils market, in terms of value and volume, by region–Asia Pacific, Europe, North America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of specialty fats and oils

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the specialty fats and oils market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches, such as acquisitions, expansions, product launches, and agreements & partnerships, in the specialty fats and oils market

- This research report categorizes the specialty fats and oils market based on type, application, form, and region

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Application analysis, which gives a detailed analysis of food and non-food applications in the specialty fats & oils market

Regional Analysis

- Further breakdown of the Rest of Europe specialty fats & oils market into Russia, Switzerland, and Poland

- Further breakdown of the Rest of Asia Pacific specialty fats & oils market into Japan, Malaysia, South Korea, and Singapore

- Further breakdown of the RoW specialty fats & oils market into South America, Middle East & Africa

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Specialty Fats & Oils Market