DOAS Market by Capacity (Less than 20, 20–40, 40–60, and Greater than 60), Implementation Type (New Construction, Retrofit), Vertical, Requirement (Heating, Cooling, Ventilation, Dehumidification) - Global Forecast to 2027

Updated on : October 23, 2024

The Dedicated Outside Air System (DOAS) market is experiencing robust growth, driven by increasing demand for energy-efficient HVAC solutions that improve indoor air quality (IAQ) in commercial, institutional, and residential buildings. DOAS units are designed to supply fresh, dehumidified air separately from other heating and cooling functions, making them essential in environments where precise ventilation is required, such as hospitals, schools, and offices. Key trends propelling the market include rising awareness of the importance of IAQ, stricter building codes and energy efficiency regulations, and the growing focus on sustainable building practices. The adoption of DOAS is further accelerated by advancements in sensor technology and smart HVAC systems, as well as the need for systems that offer flexibility and improved occupant comfort while reducing overall energy consumption.

DOAS Market Size & Growth

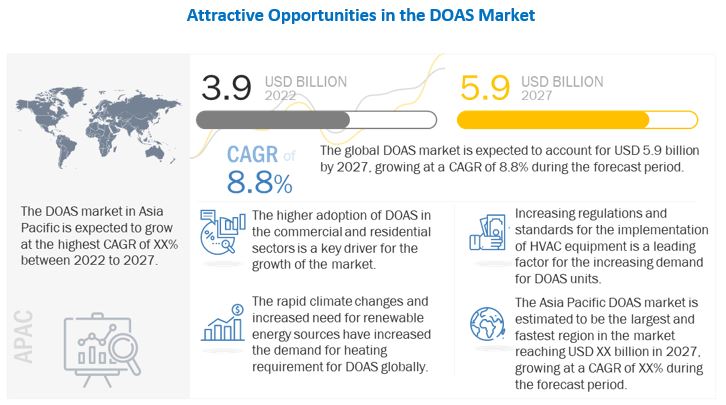

The Dedicated Outside Air System Market is projected to grow from USD 3.9 billion in 2022 to USD 5.9 billion by 2027, growing at a CAGR of 8.8% during the forecast period from 2022 to 2027.

Government regulations for HVAC equipment, increasing adoption of DOAS for residential and commercial applications, and increasing focus on indoor air and environmental quality are the key factors expected to boost the growth of the DOAS market in the next five years. However, a lack of consumer awareness and complexity in implementation are expected to be the key challenges for the growth of the market players. Construction activities in the commercial sector are growing globally, leading to increased adoption from the vertical.

The objective of the report is to define, describe, and forecast the DOAS (Dedicated Outside Air System) market based on capacity, implementation type, vertical, requirement, and region.

DOAS Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

DOAS (Dedicated Outside Air System) Market Trends and Dynamics

Drivers: Regulation for HVAC equipment

Various regulations are implemented to improve energy efficiency and regulate HVAC equipment. ASHRAE Standard 62-1989 (Standard 62-89) is the heating, ventilating, and air-conditioning (HVAC) industry consensus for ventilation air in commercial buildings. ASHRAE 62.1 regulations establish the amount of outside air required based on space area and number of occupants. To meet this standard, DOAS provides better indoor air quality by delivering the correct amount of outdoor air to designated spaces. Additionally, the performance of the HVAC unit should meet or surpass the ASHRAE 90.1 energy efficiency standards of ISMRE 11.1 and ISCOP 8.0 and adhere to a rating of less than NC-40. This meets the minimum requirements of energy-efficient design for most buildings, except low-rise residential buildings. DOAS provides 15% to 30% energy savings for commercial buildings. Implementation of regulations for HVAC and their adherence with the help of DOAS has led to the increasing demand for DOAS equipment.

In addition, governments in key countries also support the market with various initiatives. For instance, in 2021, the US Department of Energy announced an initiative to promote greener HVAC systems in residential and commercial buildings. Furthermore, in India, the government has taken measures through the national budget to push infrastructure growth in the HVAC-R industry.

Restraints: Lack of consumer awareness

With continuous technological development, it is imperative to make consumers aware of the benefits of new products. In the case of DOAS, the awareness regarding cost- and environment-related benefits of DOAS is low; they are usually perceived to be expensive and cumbersome, which acts as a restraint for market penetration in developing and underdeveloped economies. There is also a lack of awareness of opportunities for energy savings among consumers. Despite various innovations, such as the development of low GWP refrigerants for HVAC, the adoption rate of HVAC systems is not at par with the benefits they provide.

There are various advantages of DOAS, such as constant flow, through which outdoor airflow can be appropriately balanced into each space. DOAS systems offer higher efficiency air filters. The energy consumption of DOAS is lesser because it moves a low amount of air than conventional recirculating air systems, and the resistance of the return air ductwork does not exist. DOAS also ensures higher air flow rates to flush out potential contaminants. Consumers are not aware of such technical benefits of DOAS. Additionally, with respect to contractors of DOAS, there is a lack of knowledge about the standards for DOAS. This hampers consumer experience and the growth of the Dedicated Outside Air System market.

Opportunities: Increasing construction activities to boost adoption of DOAS

Development in the construction industry plays a pivotal role in increasing the demand for HVAC systems. An increase in the construction of new and modern buildings and the reconstruction of existing buildings equipped with DOAS has enabled the growth of the dedicated outside air system market. Innovation and adoption of new techniques in the construction sector have boosted the growth of this market, especially in Asia Pacific. Emerging economies, such as China, India, Indonesia, and Singapore, have increased investments in the construction sector owing to rapid urbanization and industrialization.

Increasing construction activities, rising population, and changing climate conditions are among the major factors attributed to the growth of the Asia Pacific market. Several government regulations, acts, and associations support the adoption of DOAS. For instance, in the US, the Environmental Protection Agency runs the Energy Star (ES) program that offers rebates to purchase efficient HVAC equipment. As the focus on the construction of green buildings is increasing, energy-efficient DOAS will also increase in demand. Additionally, benefits such as reduced operating costs, increased energy efficiency, and favorable government incentives have led to the increased implementation of DOAS for new and existing buildings in developed countries such as the US, the UK, Germany, and Japan.

Challenges: Complexity in implementation of DOAS system

DOAS technology employs an innovative design that combines indirect evaporative cooling and vapor compression in a packaged unitary air handler, which cools ventilation air for commercial buildings. It can be configured to use stale room air as the process air for indirect evaporative cooling. Evaporative cooling is a process of heat and mass transfer based on the transformation of sensible heat into latent heat.

Radiant heating and cooling systems require expert installation and coordination across building design disciplines and trades due to increased complexity relative to forced air systems. Care must be taken while designing and installing mechanical systems and building envelopes. Any radiant cooling system installed in humid climates must be in a sealed building where humidity can be tightly controlled mechanically.

DOAS Market Segmentation

40–60-ton DOAS to gain high demand from the commercial sector during the forecast period

DOAS, with a 40–60 ton capacity, provides extreme efficiency with additional features and multi-zone capacity of a system to provide 100% outside air proficiency, reducing the outdoor airflow by conditioning only the amount of air necessary for each zone. 40-ton DOAS capacity units also provide chilled or hot water for a fan coil handler to pre-treat outside air, radiant floor heating, and hydronic heating or cooling applications. This ton capacity of a system is widely used in commercial and industrial buildings. Players such as Johnson Controls, LG HVAC, GreenHeck Fan, and Desert-Aire, among others, offer DOAS 40–60-ton capacity.

The demand for DOAS with 40–60 ton is exceptionally high in the commercial and industrial sectors. For instance, the rising development of technology hubs in Asian countries results in higher demand for high-capacity DOAS such as 40–60 ton.

New construction to account for the largest share of Dedicated Outside Air System market

New construction and development projects play a pivotal role in the continued existence of the DOAS industry. Growing urbanization, economic growth, and rising disposable income in emerging economies, such as Asia Pacific and Middle East&Africa, fuel the growth of the DOAS industry.

Governments are making large investments in the commercial sector to develop infrastructure, which would, in turn, positively impact the dedicated outside air system market to grow in the future. With the fast-growing construction sector, the increasing development of energy-efficient buildingsdesigned to reduce energy consumption, conserve water, reduce pollution, and protect health helps boost the demand for DOAS.

Market for the cooling requirement to hold second-highest share during the forecastperiod

DOAS must be designed to provide decoupling of the latent building load from the zone cooling system. Generally, the outdoor air is cooled to a temperature of 55°F (13°C) DB, thereby making the outdoor air neutral on humidity ratio, which is colder than the space condition. This will shift a significant latent load (depending on location) to the terminal units, likely beyond what they are designed to deliver. A total energy recovery device, such as an enthalpy wheel, may cool and dehumidify the outdoor air, which when mixed with return air, will no longer require other mechanical cooling. This is where DOAS comes into play.

DOAS has earned a reputation as one of the ideal systems for sustainable air-cooling designs. As DOAS uses sensible cooling systems in conjunction with advanced ventilation systems, it helps in energy conservation, making DOAS an energy-efficient alternative to conventional cooling and ventilation systems.

Retrofits to gain increased adoption from the residential sector during the forecast period

Retrofits are a favorable alternative to achieve the required efficiency in energy consumption, cost savings, and comfort. The trend among building owners is also evolving. The introduction of integrated smart technologies and the Internet of Things (IoT) in DOAS has made DOAS systems more efficient than older systems. Consequently, the demand for DOAS in the residential sector is expected to be higher than in the commercial sector during the forecast period.

Concerns such as upfront installation cost and slow return on investment are hindering the growth of the DOAS retrofitting market in the commercial and industrial sectors. However, the savings from utility costs by installing new and highly efficient DOAS can be substantial and help building owners recover costs faster. Retrofit for older buildings has a few advantages, such as cost savings by reducing energy and water usage and higher comfort levels in a building by improving the airflow and temperature within the building. Additionally, retrofitting DOAS improves the sustainability of the building and reduces GHG emissions.

Ventilation DOAS market to witness high growth during the forecast period

The primary function of DOAS is to provide ventilation air to achieve acceptable indoor air quality in the building environment. DOAS contains two parallel working systems—one is for the distribution of ventilation air to the spaces and the other for total latent loads in the spaces. DOAS units have been proposed to treat outdoor air before it enters the building, reducing the load on the zone equipment.

DOAS uses equipment to condition the outdoor air brought into a building for ventilation directly or in conjunction with local or central HVAC units. There are various ASHRAE standards to establish ventilation airflow, such as ASHRAE Standard 62.1. ANSI/ASHRAE Standard 62.1, Ventilation for Acceptable Indoor Air Quality, provides minimum outdoor-air-flow requirements for design conditions. Ventilation has the highest demand from the commercial vertical and is expected to grow further as development in commercial real estate continues.

DOAS Industry Regional Analysis

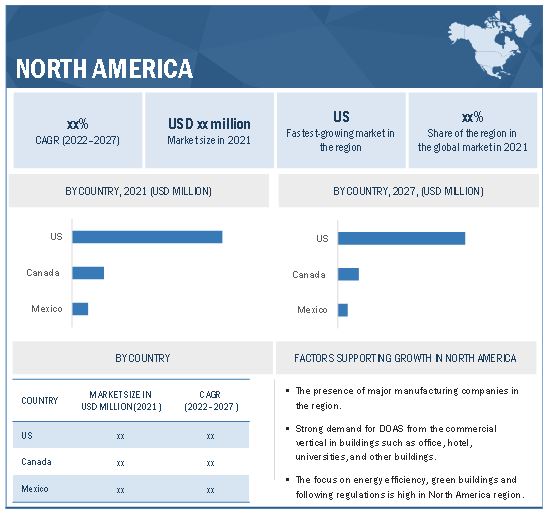

DOAS market in North America to rank second following Asia Pacific

North America is one of the leading regions in the DOAS market as countries such as the US and Canada drive the growth for DOAS in this region. There is a high demand for DOAS in retail, hospital, and office applications in North America as this region homes many enterprises, medical facilities, and commercial spaces where a massive number of DOAS are required.

The Dedicated Outside Air System market in North America has been fueled by factors such as the need for energy efficiency, improved indoor air quality, and growing demand for DOAS from commercial and residential buildings. The US is expected to be a major contributor to the growth of the DOAS market in North America. Government regulations in the region have supported the growth of the market. For instance, government programs supporting the growth of the DOAS market are Weatherization Assistance Program (WAP) and The ENERGY STAR Verified HVAC Installation Program (ESVI).

DOAS Market by Region

To know about the assumptions considered for the study, download the pdf brochure

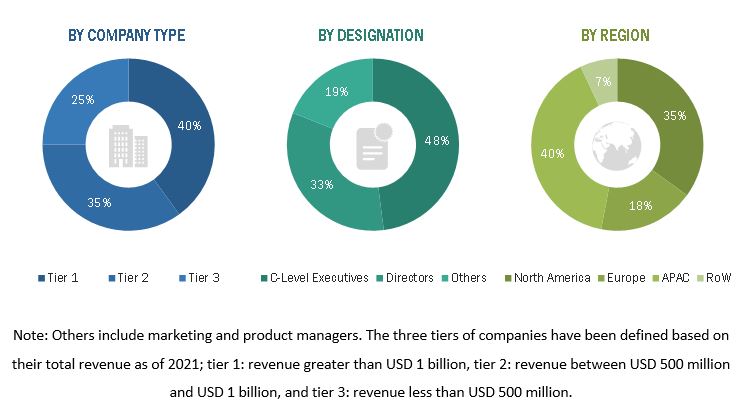

The break-up of primary participants for the DOAS Market report has been shown below:

- By Company Type: Tier 1–40%, Tier 2– 35%, and Tier 3– 25%

- By Designation: C-level Executives– 48%, Directors– 33%, and Others – 19%

- By Region:North America–35%, Asia Pacific– 40%, Europe – 18%, and RoW– 7%

Top DOAS Companies - Key Market Players

Major players in the DOAS companies include

- Johnson Controls (Ireland),

- Carrier Global (US),

- Daikin (Japan),

- Trane Technologies (US),

- LG Electronics (South Korea),

- Samsung Electronics (South Korea),

- Greenheck Fan (US),

- Nortek (US), among others.

DOAS (Dedicated Outdoor Air System) Market report Scope

|

Report Metric |

Details |

| Market size value in 2022 | USD 3.9 Billion |

| Market size value in 2027 | USD 5.9 Billion |

| Growth rate | CAGR of 8.8% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Capacity, Implementation Type, Vertical, Requirement, and Geography |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Johnson Controls (Ireland), Carrier Global (US), Greenheck Fan (US), Daikin (Japan), Nortek (US), Trane Technologies (Ireland), Mitsubishi Electric (Japan), LG Electronics (South Korea), and Samsung Electronics (South Korea) |

DOAS Market Highlights

This report categorizes the DOAS (Dedicated Outside Air System) market based on capacity, implementation type, vertical, requirement, and geography.

|

Aspects |

Details |

|

Dedicated Outdoor Air System Market, By Capacity |

|

|

Dedicated Outdoor Air System Market, By Implementation Type |

|

|

Dedicated Outdoor Air System Market, By Requirement |

|

|

Dedicated Outdoor Air System Market, By Implementation Type |

|

|

Dedicated Outdoor Air System Market, By Requirement |

|

Recent Developments in DOAS Industry

- In May 2022, Mitsubishi Electric announced the investment of 1.44 billion Turkish lira (USD 113 million) in a new plant at Mitsubishi Electric Air Conditioning Systems Manufacturing Turkey Joint Stock Company (MACT), the company's air-conditioner production base in Turkey. The expansion will expand MACT's annual capacity for air-to-water (ATW) heat pumps* to 300,000 units, up by 100,000 units from the current capacity, and room air conditioners to 1,100,000 units, up by 300,000 units. Production will begin in February 2024.

- In March 2022, Johnson Controls launched a new DOAS, the York DOAS, which meets ASHRAE 62.1 fresh air requirements, delivering up to 100% clean, dehumidified outside air in all weather and climate conditions. The York DOAS is fully configurable, with several factory-installed options. It offers robust construction, foam panel double-wall construction, renewable/organic insulation material, R13 insulation value, pre-painted G90 galvanized steel, hinged safe bottom lifting, and lockable doors.

- In February 2022, Carrier Global agreed to buy Toshiba’s ownership stake in a longstanding joint venture between the two companies to expand its role in the supply of VRF and light commercial systems. This acquisition of Toshiba Carrier Corporation (TCC) by Carrier Global is expected to allow Carrier’s global production capabilities for Variable Refrigerant Flow (VRF) systems.

- In August 2021, LG introduced the Split Rooftop and Split Compact Dedicated Outdoor Air System, or DOAS—two of the most effective and efficient units available today. This enables building owners and facility managers to efficiently condition outside air for improved indoor air quality and comfort without sacrificing flexibility, reliability, or ease of integration.

- In June 2021, Trane launched its new offerings to help customers meet energy efficiency, sustainability, and indoor air quality goals as part of its Wellsphere holistic approach to indoor environmental quality (IEQ). One of the key products launched by the company is the Trane Mixed Air DOAS unit, which offers up to 100% fresh air to improve IAQ that meets ASHRAE 62.1 requirements.

Key Questions Addressed in the Report

Which are the major companies in the DOAS market? What are their key strategies to strengthen their market presence?

Johnson Controls (Ireland), Carrier Global (US), Daikin (Japan), Trane Technologies (Ireland), and LG Electronics (South Korea) are among the key players in the market. These companies have adopted organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to gain a competitive advantage in the market.

Which is the potential market for DOAS in terms of regions?

Asia Pacific has high growth opportunities due to increased adoption of DOAS from not only the major countries such as China and Japan but also developing countries such as India. Additionally, government programs such as the green building initiative have supported the DOAS market growth in the region.

What are the opportunities for new market entrants?

The demand for low-capacity DOAS is increasing, and it is expected that DOAS with a capacity of 20–40 and lower will see high growth. The rising demand for lower capacity DOAS will likely allow new players to enter the market easily. Additionally, the demand for DOAS in the residential vertical is increasing for heating and ventilation requirements.

Which verticals are expected to drive market growth in the next six years?

Commercial and residential verticals are expected to drive the demand for DOAS during the forecasted period. As commercial construction is increasing rapidly, the opportunity for DOAS is expected to be more significant. Players such as Johnson Controls, Daikin, Mitsubishi Electric, and LG Electric offer their DOAS for commercial and residential verticals.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 DOAS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

FIGURE 2 MARKET, BY REGION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 3 DOAS MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 4 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 5 MARKET: RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Breakdown of primaries

2.1.3.3 Key data from primary sources

2.1.3.4 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to capture market size by bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach to capture market size by top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY FOR DEDICATED OUTDOOR AIR SYSTEM MARKET USING SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DEDICATED OUTDOOR AIR SYSTEM MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 RESEARCH ASSUMPTIONS

FIGURE 10 ASSUMPTIONS FOR RESEARCH STUDY

2.4.2 LIMITATIONS

2.5 RISK ASSESSMENT

FIGURE 11 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 12 20–40 TON SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY CAPACITY, IN 2022

FIGURE 13 COMMERCIAL SEGMENT TO REGISTER HIGHEST CAGR IN MARKET, BY VERTICAL, FROM 2022 TO 2027

FIGURE 14 MARKET TO WITNESS FASTEST GROWTH IN ASIA PACIFIC DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES FOR DOAS MARKET PLAYERS

FIGURE 15 INCREASING DEMAND FROM COMMERCIAL AND RESIDENTIAL SECTORS TO BOOST MARKET

4.2 DEDICATED OUTDOOR AIR SYSTEM MARKET, BY REQUIREMENT

FIGURE 16 VENTILATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY REGION AND VERTICAL

FIGURE 17 ASIA PACIFIC AND COMMERCIAL SEGMENTS ACCOUNTED FOR LARGEST SHARES OF MARKET IN 2021

4.4 MARKET, BY IMPLEMENTATION TYPE

FIGURE 18 NEW CONSTRUCTION SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 DOAS (DEDICATED OUTDOOR AIR SYSTEM) MARKET, BY GEOGRAPHY

FIGURE 19 CHINA TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 INCREASING ADOPTION OF DOAS FOR COMMERCIAL AND RESIDENTIAL APPLICATIONS TO SUPPORT MARKET GROWTH

5.2.1 DRIVERS

FIGURE 21 ANALYSIS OF IMPACT OF DRIVERS ON MARKET

5.2.1.1 Regulations for HVAC equipment leading to heightened demand for DOAS

5.2.1.2 Increasing adoption of DOAS for residential and commercial applications

5.2.1.3 Efficiency of DOAS in improving indoor air and environment quality

5.2.2 RESTRAINTS

FIGURE 22 ANALYSIS OF IMPACT OF RESTRAINTS ON MARKET

5.2.2.1 Lack of consumer awareness regarding benefits of DOAS

5.2.3 OPPORTUNITIES

FIGURE 23 ANALYSIS OF IMPACT OF OPPORTUNITIES ON MARKET

5.2.3.1 Growing demand for energy-efficient DOAS for retrofitting and new construction

5.2.3.2 Increasing construction activities and focus on energy efficiency globally

5.2.4 CHALLENGES

FIGURE 24 ANALYSIS OF IMPACT OF CHALLENGES ON MARKET

5.2.4.1 Complexities associated with implementation of DOAS

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS OF MARKET

5.4 ECOSYSTEM

FIGURE 26 DOAS ECOSYSTEM

TABLE 1 COMPANIES AND THEIR ROLES IN DOAS ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE OF DOAS OFFERED BY KEY PLAYERS, BY IMPLEMENTATION TYPE

FIGURE 27 AVERAGE SELLING PRICE OF DOAS OFFERED BY KEY PLAYERS, BY IMPLEMENTATION TYPE (USD)

TABLE 2 AVERAGE SELLING PRICE TREND FOR DOAS

5.6 TREND ANALYSIS

5.6.1 SPLIT DOAS

5.6.2 CHILLED WATER TERMINAL UNITS

5.6.3 INTEGRATING DOAS WITH ENERGY RECOVERY VENTILATION (ERV) AND VARIABLE REFRIGERANT FLOW (VRF) UNITS

5.7 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR DEDICATED OUTDOOR AIR SYSTEM MARKET

FIGURE 28 REVENUE SHIFTS IN MARKET

5.8 TECHNOLOGY ANALYSIS

5.8.1 BUILDING INFORMATION MODELING (BIM)

5.8.2 INTERNET OF THINGS (IOT)

5.8.3 HVAC ENERGY ANALYSIS SOFTWARE

5.8.4 VIRTUAL REALITY

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 PORTER’S 5 FORCES IMPACT ON MARKET

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS: DEDICATED OUTDOOR AIR SYSTEM MARKET, 2021

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 KEY STAKEHOLDERS & BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS (%)

5.11 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR VERTICALS

TABLE 5 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

5.12 CASE STUDY ANALYSIS

5.12.1 USE CASE 1: PROMERUS

5.12.2 USE CASE 2: WASILLA (ALASKA) POLICE STATION

5.12.3 USE CASE 3: COMMERCIAL TESTING LABORATORY

5.13 TRADE ANALYSIS

5.13.1 AIR CONDITIONERS

FIGURE 32 EXPORT DATA FOR AIR CONDITIONING EQUIPMENT, 2017–2021 (USD MILLION)

FIGURE 33 IMPORT DATA FOR AIR CONDITIONING EQUIPMENT, 2017–2021 (USD MILLION)

5.14 PATENT ANALYSIS

FIGURE 34 TOP COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

FIGURE 35 NO. OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

TABLE 6 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

TABLE 7 LIST OF MAJOR PATENTS

5.15 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 8 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.16 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO DOAS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.17 STANDARDS AND REGULATIONS RELATED TO MARKET

5.17.1 NORTH AMERICA

5.17.1.1 US

5.17.1.1.1 ANSI/ASHRAE/IES Standard 90.1-2019

5.17.1.1.2 ANSI/ASHRAE/ Standard 111-2008

5.17.1.1.3 ANSI/ASHRAE/USGBC/IES Standard 189.1-2020

5.17.1.1.4 ANSI/ASHRAE Standard 198-2013

5.17.1.1.5 ANSI/ASHRAE Standard 62.1-2019

5.17.1.1.6 U.S. DOE rooftop unit regulations

5.17.1.1.7 AHRI Standard 920 (I-P)-2020

5.17.2 EUROPE

5.17.2.1 CEN Standard EN 16798-3:2017

5.17.2.2 EN 14511:2013

5.17.3 ASIA PACIFIC

5.17.3.1 India

5.17.3.1.1 ASHRAE Standards 15 and 34 – Considerations for VRV/VRF Systems

5.17.3.1.2 Part 8, Section 3 of NBC 2016

5.17.3.1.3 ISHRAE RAMA AHU Standard- 2020

5.17.3.1.4 INDOOR ENVIRONMENTAL QUALITY STANDARD ISHRAE STANDARD- 10001: 2019 (IEQ2019)

5.17.3.2 Japan

5.17.3.2.1 JRA 4068T:2016R Requirements of refrigerant leak detector and alarm for air conditioning and refrigeration equipment

6 DOAS MARKET, BY CAPACITY (Page No. - 82)

6.1 INTRODUCTION

FIGURE 36 20–40 TON SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 13 MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 14 MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

6.2 LESS THAN 20 TON

6.2.1 WIDELY USED IN RESIDENTIAL AND COMMERCIAL BUILDINGS

FIGURE 37 RESIDENTIAL MARKET FOR LESS THAN 20 TON CAPACITY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 15 LESS THAN 20 TON: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 16 LESS THAN 20 TON: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

6.3 20–40 TON

6.3.1 USED IN COMMERCIAL BUILDINGS

FIGURE 38 COMMERCIAL SEGMENT TO LEAD MARKET FOR 20–40 TON CAPACITY DURING FORECAST PERIOD

TABLE 17 20–40 TON: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 18 20–40 TON: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

6.4 40–60 TON

6.4.1 PROVIDE 100% OUTDOOR AIR PROFICIENCY

FIGURE 39 COMMERCIAL MARKET FOR 40–60 TON CAPACITY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 19 40–60 TON: DEDICATED OUTDOOR AIR SYSTEM MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 20 40–60 TON: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

6.5 GREATER THAN 60 TON

6.5.1 IDEAL FOR APPLICATIONS IN INDUSTRIAL SECTOR

TABLE 21 GREATER THAN 60 TON: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 22 GREATER THAN 60 TON: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

7 DOAS MARKET, BY IMPLEMENTATION TYPE (Page No. - 90)

7.1 INTRODUCTION

FIGURE 40 NEW CONSTRUCTION SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 23 MARKET, BY IMPLEMENTATION TYPE, 2018–2021 (USD MILLION)

TABLE 24 MARKET, BY IMPLEMENTATION TYPE, 2022–2027 (USD MILLION)

7.2 NEW CONSTRUCTION

7.2.1 NEW CONSTRUCTION SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 41 COMMERCIAL SEGMENT TO LEAD MARKET FOR NEW CONSTRUCTION DURING FORECAST PERIOD

TABLE 25 NEW CONSTRUCTION: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 26 NEW CONSTRUCTION: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

7.3 RETROFIT

7.3.1 RESIDENTIAL BUILDING RETROFITS TO FOSTER MARKET GROWTH

FIGURE 42 RESIDENTIAL SEGMENT TO GROW AT HIGHEST CAGR IN MARKET FOR RETROFIT DURING FORECAST PERIOD

TABLE 27 RETROFIT: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 28 RETROFIT: DEDICATED OUTDOOR AIR SYSTEM MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8 DOAS MARKET, BY REQUIREMENT (Page No. - 95)

8.1 INTRODUCTION

FIGURE 43 VENTILATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 29 MARKET, BY REQUIREMENT, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY REQUIREMENT, 2022–2027 (USD MILLION)

8.2 HEATING

8.2.1 INCREASING HEATING REQUIREMENT FROM COMMERCIAL VERTICAL TO DRIVE MARKET DURING FORECAST PERIOD

FIGURE 44 COMMERCIAL SEGMENT TO HOLD LARGEST SIZE OF MARKET FOR HEATING DURING FORECAST PERIOD

TABLE 31 HEATING: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 32 HEATING: DEDICATED OUTDOOR AIR SYSTEM MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8.3 COOLING

8.3.1 RESIDENTIAL VERTICAL TO GENERATE HIGH DEMAND FOR COOLING DURING FORECAST PERIOD

TABLE 33 COOLING: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 34 COOLING: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8.4 VENTILATION

8.4.1 SURGING VENTILATION REQUIREMENT IN COMMERCIAL SPACES TO GENERATE DEMAND FOR DOAS

TABLE 35 VENTILATION: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 36 VENTILATION: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8.5 DEHUMIDIFICATION

8.5.1 DOAS UNITS TO WITNESS HIGH ADOPTION IN COMMERCIAL SECTOR FOR DEHUMIDIFICATION

TABLE 37 DEHUMIDIFICATION: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 38 DEHUMIDIFICATION: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9 DOAS MARKET, BY VERTICAL (Page No. - 102)

9.1 INTRODUCTION

FIGURE 45 COMMERCIAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 39 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 40 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 COMMERCIAL

9.2.1 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 41 COMMERCIAL: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 42 COMMERCIAL: MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 43 COMMERCIAL: MARKET, BY IMPLEMENTATION TYPE, 2018–2021 (USD MILLION)

TABLE 44 COMMERCIAL: MARKET, BY IMPLEMENTATION TYPE, 2022–2027 (USD MILLION)

TABLE 45 COMMERCIAL: MARKET, BY REQUIREMENT, 2018–2021 (USD MILLION)

TABLE 46 COMMERCIAL: MARKET, BY REQUIREMENT, 2022–2027 (USD MILLION)

FIGURE 46 ASIA PACIFIC TO DOMINATE MARKET FOR COMMERCIAL DURING FORECAST PERIOD

TABLE 47 COMMERCIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 COMMERCIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 49 COMMERCIAL: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 50 COMMERCIAL: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 51 COMMERCIAL: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 52 COMMERCIAL: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 53 COMMERCIAL: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 54 COMMERCIAL: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 55 COMMERCIAL: MARKET IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 COMMERCIAL: MARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

9.3 RESIDENTIAL

9.3.1 NEW CONSTRUCTION SEGMENT TO LEAD RESIDENTIAL DOAS MARKET DURING FORECAST PERIOD

TABLE 57 RESIDENTIAL: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 58 RESIDENTIAL: MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

FIGURE 47 NEW CONSTRUCTION SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 59 RESIDENTIAL: MARKET, BY IMPLEMENTATION TYPE, 2018–2021 (USD MILLION)

TABLE 60 RESIDENTIAL: MARKET, BY IMPLEMENTATION TYPE, 2022–2027 (USD MILLION)

TABLE 61 RESIDENTIAL: MARKET, BY REQUIREMENT, 2018–2021 (USD MILLION)

TABLE 62 RESIDENTIAL: MARKET, BY REQUIREMENT, 2022–2027 (USD MILLION)

TABLE 63 RESIDENTIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 RESIDENTIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 65 RESIDENTIAL: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 66 RESIDENTIAL: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 67 RESIDENTIAL: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 68 RESIDENTIAL: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 48 CHINA TO HOLD LARGEST SIZE OF RESIDENTIAL MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 69 RESIDENTIAL: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 70 RESIDENTIAL: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 71 RESIDENTIAL: MARKET IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 RESIDENTIAL: MARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

9.4 INDUSTRIAL

9.4.1 DOAS HELP TO MAINTAIN TEMPERATURE IN WAREHOUSES AND OTHER INDUSTRIAL UNITS

TABLE 73 INDUSTRIAL: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 74 INDUSTRIAL: MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

FIGURE 49 NEW CONSTRUCTION SEGMENT TO LEAD INDUSTRIAL MARKET DURING FORECAST PERIOD

TABLE 75 INDUSTRIAL: MARKET, BY IMPLEMENTATION TYPE, 2018–2021 (USD MILLION)

TABLE 76 INDUSTRIAL: MARKET, BY IMPLEMENTATION TYPE, 2022–2027 (USD MILLION)

TABLE 77 INDUSTRIAL: MARKET, BY REQUIREMENT, 2018–2021 (USD MILLION)

TABLE 78 INDUSTRIAL: MARKET, BY REQUIREMENT, 2022–2027 (USD MILLION)

FIGURE 50 ASIA PACIFIC TO DOMINATE INDUSTRIAL MARKET DURING FORECAST PERIOD

TABLE 79 INDUSTRIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 INDUSTRIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 81 INDUSTRIAL: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 82 INDUSTRIAL: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 83 INDUSTRIAL: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 84 INDUSTRIAL: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 85 INDUSTRIAL: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 86 INDUSTRIAL: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 87 INDUSTRIAL: MARKET IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 INDUSTRIAL: MARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

10 DOAS MARKET, BY REGION (Page No. - 125)

10.1 INTRODUCTION

FIGURE 51 MARKET TO GROW AT HIGHEST CAGR IN CHINA DURING FORECAST PERIOD

FIGURE 52 MARKET TO GROW AT HIGHEST CAGR IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 89 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 53 NORTH AMERICA: DOAS MARKET SNAPSHOT

FIGURE 54 US TO DOMINATE MARKET IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 91 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Demand from residential vertical to drive market

TABLE 95 US: DOAS MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 96 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Government focus on energy efficiency to motivate adoption of DOAS

TABLE 97 CANADA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 98 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Growth of commercial real estate to support market growth

TABLE 99 MEXICO: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 100 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 55 EUROPE: MARKET SNAPSHOT

FIGURE 56 GERMANY TO LEAD MARKET IN EUROPE DURING FORECAST PERIOD

TABLE 101 EUROPE: DEDICATED OUTDOOR AIR SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany to lead DOAS market in Europe during forecast period

TABLE 105 GERMANY: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 106 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Energy efficiency targets to boost uptake of DOAS in UK

TABLE 107 UK: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 108 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Formation of Association Française de la Ventilation to propel market growth

TABLE 109 FRANCE: MARKET, BY VERTICAL, 2018–2027 (USD MILLION)

TABLE 110 FRANCE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Growth of HVAC market to induce demand for DOAS

TABLE 111 ITALY: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 112 ITALY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.5 REST OF EUROPE

TABLE 113 REST OF EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 114 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 57 ASIA PACIFIC: DOAS MARKET SNAPSHOT

FIGURE 58 CHINA TO LEAD MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 115 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to dominate DOAS market in Asia Pacific during forecast period

TABLE 119 CHINA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 120 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Commercial applications of DOAS to augment market growth during forecast period

TABLE 121 JAPAN: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 122 JAPAN: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 India to account for largest size of commercial DOAS market in Asia Pacific during forecast period

TABLE 123 INDIA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 124 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 Commercial applications to drive market in South Korea during forecast period

TABLE 125 SOUTH KOREA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 126 SOUTH KOREA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 127 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 128 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5 REST OF THE WORLD

FIGURE 59 MIDDLE EAST & AFRICA TO DOMINATE DOAS MARKET IN REST OF THE WORLD DURING FORECAST PERIOD

TABLE 129 REST OF THE WORLD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 130 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 131 REST OF THE WORLD: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 132 REST OF THE WORLD: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.1 SOUTH & CENTRAL AMERICA

10.5.1.1 Commercial applications to drive market in South & Central America

TABLE 133 SOUTH & CENTRAL AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 134 SOUTH & CENTRAL AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Initiation of smart building projects to boost demand for DOAS during forecast period

TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 152)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 137 MARKET EVALUATION FRAMEWORK

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 ORGANIC/INORGANIC PLAY

11.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 60 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET, 2017–2021

11.4 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2021

TABLE 138 GLOBAL DOAS MARKET: MARKET SHARE ANALYSIS

11.5 COMPANY EVALUATION QUADRANT, 2021

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 61 DOAS MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

11.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 62 DOAS MARKET (GLOBAL): SMES EVALUATION QUADRANT, 2021

11.6.5 DOAS MARKET: COMPANY FOOTPRINT

TABLE 139 COMPANY REQUIREMENT FOOTPRINT (10 COMPANIES)

TABLE 140 COMPANY VERTICAL FOOTPRINT (10 COMPANIES)

TABLE 141 COMPANY REGION FOOTPRINT (10 COMPANIES)

TABLE 142 OVERALL COMPANY FOOTPRINT (10 COMPANIES)

11.7 DOAS MARKET: SMES MATRIX

TABLE 143 MARKET: DETAILED LIST OF KEY SMES

TABLE 144 MARKET: COMPETITIVE BENCHMARKING OF KEY SMES

11.8 COMPETITIVE SCENARIOS AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 145 DEDICATED OUTDOOR AIR SYSTEM MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS

11.8.2 DEALS

TABLE 146 DEDICATED OUTDOOR AIR SYSTEM MARKET: DEALS

11.8.3 OTHERS

TABLE 147 MARKET: OTHERS

12 COMPANY PROFILES (Page No. - 170)

12.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

12.1.1 JOHNSON CONTROLS

TABLE 148 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 63 JOHNSON CONTROLS: COMPANY SNAPSHOT

12.1.2 CARRIER GLOBAL CORPORATION

TABLE 149 CARRIER GLOBAL CORPORATION: BUSINESS OVERVIEW

FIGURE 64 CARRIER GLOBAL CORPORATION: COMPANY SNAPSHOT

12.1.3 GREENHECK FAN CORPORATION

TABLE 150 GREENHECK FAN CORPORATION: BUSINESS OVERVIEW

12.1.4 DAIKIN INDUSTRIES LTD.

TABLE 151 DAIKIN: BUSINESS OVERVIEW

FIGURE 65 DAIKIN: COMPANY SNAPSHOT

12.1.5 NORTEK, INC.

TABLE 152 NORTEK: BUSINESS OVERVIEW

12.1.6 TRANE TECHNOLOGIES

TABLE 153 TRANE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 66 TRANE TECHNOLOGIES: COMPANY SNAPSHOT

12.1.7 MITSUBISHI ELECTRIC

TABLE 154 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 67 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

12.1.8 LG ELECTRONICS

TABLE 155 LG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 68 LG ELECTRONICS: COMPANY SNAPSHOT

12.1.9 FLAKTGROUP SEMCO

TABLE 156 FLAKTGROUP SEMCO: BUSINESS OVERVIEW

12.1.10 SAMSUNG ELECTRONICS

TABLE 157 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 69 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12.2 OTHER KEY PLAYERS

12.2.1 RUPP AIR MANAGEMENT SYSTEMS

12.2.2 ADDISON

12.2.3 DESERT AIRE LLC.

12.2.4 DESICCANT ROTORS INTERNATIONAL PVT. LTD. (DRI)

12.2.5 VENTACITY SYSTEMS INC.

12.2.6 PETRA

12.2.7 RENEWAIRE

12.2.8 MUNTERS

12.2.9 CAPTIVEAIRE

12.2.10 UNITED COOLAIR, LLC

12.2.11 APPLIED AIR

12.2.12 AQUA AURA INDIA PVT LTD.

12.2.13 CLIMATEMASTER

12.2.14 SWEGON NORTH AMERICA

12.2.15 XETEX

13 APPENDIX (Page No. - 216)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

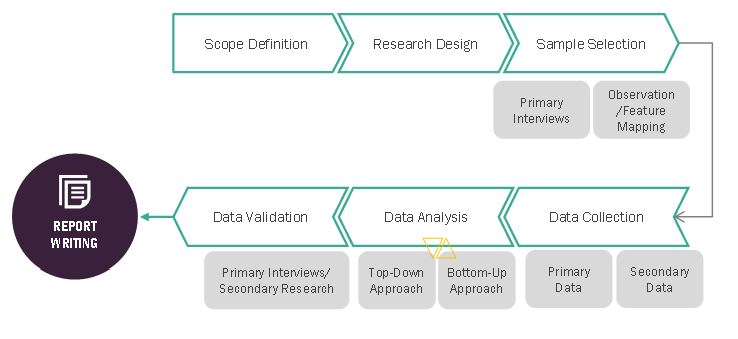

The research process for this study included the systematic gathering, recording, and analysis of data about customers and companies operating in the DOAS market. This research study involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for this comprehensive, technical, market-oriented, and commercial study of the market. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information and assess growth prospects. Key players in the market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

In the primary research process, various key correspondents from the supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report. Primary sources from the supply side include CEOs, vice presidents, marketing directors, business development executives, end users, and related executives from various key companies and organizations operating in the DOAS market.

Process flow of market size Estimation

Secondary Research

In the secondary research, various sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, DOAS products-related journals, and certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, the total pool of key players, market classification and segmentation based on industry trends to the bottom-most level, geographic markets, and key developments from the market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and key executives from major companies and organizations operating in the DOAS market.

After going through the entire market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information, verify, and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the DOAS market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for both quantitative and qualitative insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

DOAS Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the DOAS market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the DOAS market, in terms of value, segmented by capacity, implementation type, requirement, vertical, and geography

- To forecast the market size, in terms of value, for North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a comprehensive overview of the value chain of the DOAS ecosystem

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, and provide a detailed competitive landscape of the market

- To analyze major strategies such as collaborations, acquisitions, product launches, and expansions adopted by the key players to enhance their position in the market

Available Customizations

With the given market data, MaketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in DOAS Market