Dental Practice Management Software Market by Deployment Mode (Cloud-based, Web-based), Application (Patient Communication, Insurance Management, Billing/Invoice), End User (Dental Clinics, Hospitals, DSO, Academic Institutes) & Region - Global Forecast to 2028

Market Growth Outlook Summary

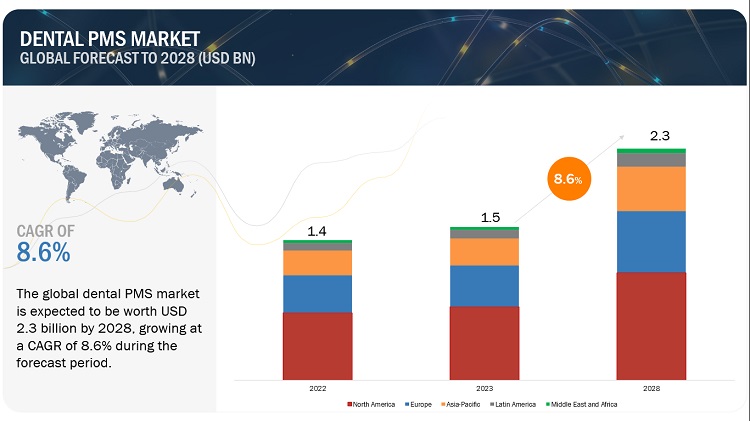

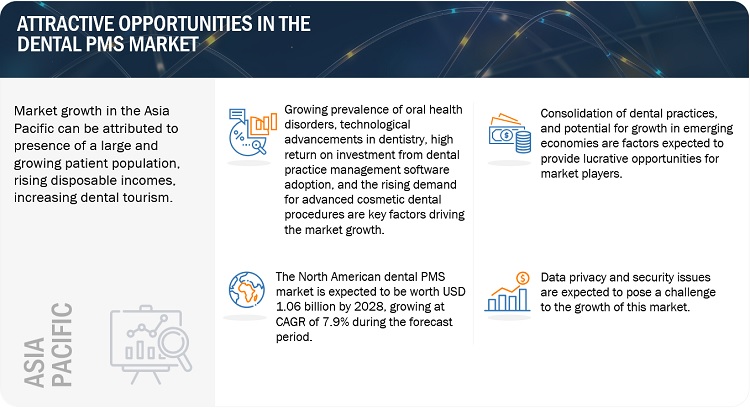

The global dental practice management software market, valued at US$1.4 billion in 2022, stood at US$1.5 billion in 2023 and is projected to advance at a resilient CAGR of 8.6% from 2023 to 2028, culminating in a forecasted valuation of US$2.3 billion by the end of the period. Key market drivers include the rising demand for advanced cosmetic dental procedures, growing oral hygiene awareness, and increased dental tourism in developing countries. Data privacy and security issues remain a challenge, while the consolidation of dental practices through Dental Support Organizations (DSOs) presents significant growth opportunities. The market is segmented by type (e.g., pureplay PMS, dental PMS add-ons), deployment mode, application, end user (e.g., dental clinics, hospitals), and region (with North America leading in market share).

Dental Practice Management Software Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Dental Practice Management Software Market Dynamics

Driver: Rising demand for advanced cosmetic dental procedures

Cosmetic dentistry is one of the fastest-growing segments in the dental industry. With increasing disposable incomes, the willingness to undergo expensive cosmetic procedures has increased, specifically among the aging population. While the demand for tooth whitening procedures has grown significantly, veneers, non-metallic inlays and onlays, dental crowns, and bonding agents are the most preferred cosmetic products.

Restraint: Data privacy and security issues

Electronic information exchange ensures quality care. However, it also raises the biggest challenge regarding the security of data. According to a survey from Software Advice, 90% of small-to-medium-sized dental practices utilize dental practice management software to manage patient data, billing, and insurance claims. Federal legislation such as the Health Insurance Portability and Accountability Act (HIPAA) and the Health Information Technology for Economic and Clinical Health (HITECH) Act are working to tackle the issue of data security. These security breaches and concerns over data privacy are expected to act as a restraint for the market.

Opportunity: Consolidation of dental practices

DSOs have shown rapid growth in recent years, especially in the US, the UK, Spain, and parts of Southeast Asia, including China. According to the American Dental Education Association Survey of the US Dental School Seniors, the percentage of young dentists willing to join DSOs has increased from 12% in 2015 to 37.7% in 2022. This number is expected to reach 61.5% by 2027.

In the UK, most of the largest DSOs (7 out of the top 10 DSOs) are backed by private-equity investors. Similarly, in the US, 27 out of the top 30 DSOs are backed by private equity. This helps DSOs achieve economies of scale through increased purchasing power and shared resources and invest in resources such as practice management software. Additionally, in the US, several states have passed legislation that allows non-dentists to own dental practices, which enabled DSOs to expand more rapidly.

The introduction of DSOs and their rising adoption by dentists worldwide are expected to offer significant growth opportunities for the market.

Challenge: Resistance to switch to dental PMS

The adoption of new technologies in dental practices, especially for practices operating in developing countries, is challenging. Dental professionals show resistance toward the implementation of newer dental technologies. This is in part due to the lack of funds and resources to adopt and manage new technologies, coupled with a lack of knowledge about the functioning of new technologies. The ability of many private clinics in developing countries to make investments is substantially lower than in developed countries.

Dental Practice Management Software Market Ecosystem

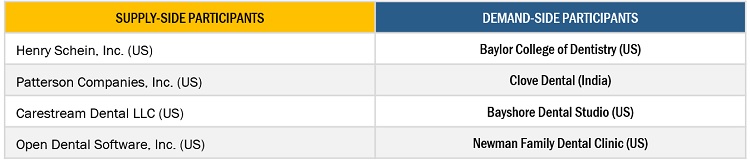

Prominent companies in this market include well-established brand names. These companies have comprehensive products, strong consumer service network, and state-of-the-art technologies.

Some key market players include Henry Schein Inc (US), Patterson Companies, Inc. (US), CareStack, Inc. (US), Open Dental Software, Inc. (US) and Carestream Dental LLC (US).

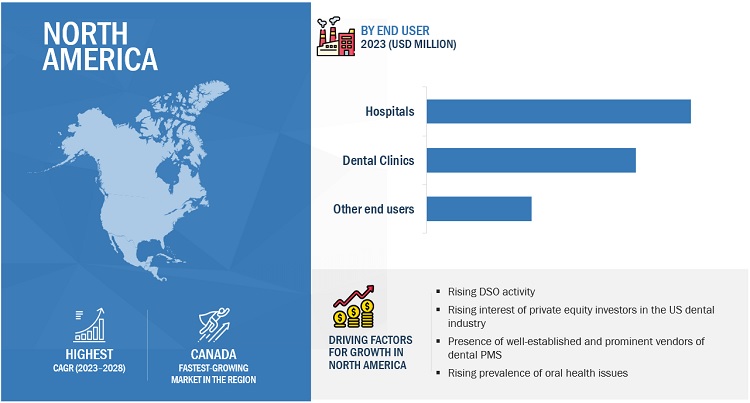

Among end users, other end users of the dental practice management software industry to show the highest CAGR from 2023 to 2028.

The dental clinics, occupy the largest share of the dental practice management software market. Other end users, which includes DSOs and academic and research institutes, is exected to grow at the highest CAGR during the forecast period. The increasing private-equity funding for DSOs, benefits of economies of scale offered by DSOs, the increasing number of industry-academic agreements and collaborations, rising funding for dental research projects, and growing demand for specialized dental courses are some of the key factors driving the growth of the other end users segment.

North America was the largest market in the world for dental practice management software industry in 2022

In 2022, the North America occupied the largest share globally, in the dental practice management software market. This can mainly be attributed to the rising geriatric population, increasing patient awareness about the advantages of various dental procedures over traditional treatments, increase in private equity funding for dental practices/DSOs, higher per capita income, and high quality of treatments.

To know about the assumptions considered for the study, download the pdf brochure

The key players in the Dental practice management software market include Henry Schein Inc, (US), Patterson Companies, Inc (US), CareStack, Inc. (US), and Carestream Dental LLC (US).

These companies adopted strategies such as partnerships, acquisitions, collaborations and joint ventures to strengthen their presence in the market.

Scope of the Dental Practice Management Software Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$1.5 billion |

|

Projected Revenue Size by 2028 |

$2.3 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 8.6% |

|

Market Driver |

Rising demand for advanced cosmetic dental procedures |

|

Market Opportunity |

Consolidation of dental practices |

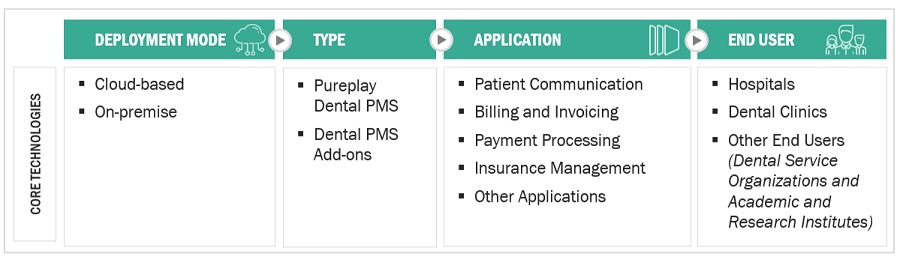

The study categorizes the Dental Practice Management Software Market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Pureplay PMS

- Dental PMS Add-ons

By Deployment Mode

- Web Based

- Cloud Based

- On premise

By Application

- Patient communication software

- Invoice/Billing software

- Payment processing software

- Insurance management software

- Other applications

By End User

- Dental Clinics

- Hospitals

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments of Dental Practice Management Software Industry

- In January 2023 A Henry Schein, Inc. (US) subsidiary, eAssist Dental Solutions (US), acquired a majority interest in Unitas PPO Solutions (US) to improve fee analysis services offered by Henry Schein, and enhance the collection processes of the eAssist platform.

- In April 2023, Henry Schein, Inc. (US) acquired a majority ownership position in Biotech Dental SAS (France), aiming to create a digital workflow that provides a seamless journey for customers to increase case acceptance and improve clinical outcomes for practitioners.

- In November 2022, The Curve Dental LLC (US) and Pearl Inc. (US) organizations announced plans to integrate Pearl’s Second Opinion disease detection capabilities within Curve Dental’s all-in-one SuperHero practice management system.

- In February 2022, Straumann Group acquired a minority share (29.6%) in CareStack, which gradually increased to 36.3%. This enabled CareStack to expand its service offering and presence in the US.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global dental practice management software market between 2023 and 2028?

The global dental practice management software market is projected to grow from USD 1.5 billion in 2023 to USD 2.3 billion by 2028, demonstrating a robust CAGR of 8.6%.

What are the major factors driving the dental practice management software market?

Key factors driving the market include the rising demand for advanced cosmetic dental procedures, growing awareness of oral hygiene, and the consolidation of dental practices through Dental Support Organizations (DSOs), which enhance operational efficiency.

What challenges does the dental practice management software market face?

Challenges include data privacy and security concerns, particularly related to electronic patient information exchange. Compliance with regulations like HIPAA and HITECH is crucial for market players, and resistance to technology adoption in developing countries also presents a hurdle.

What opportunities exist in the dental practice management software market?

The consolidation of dental practices through Dental Support Organizations (DSOs) offers significant growth opportunities. DSOs benefit from economies of scale, increased purchasing power, and shared resources, leading to greater investment in practice management software.

Which region dominates the dental practice management software market?

North America holds the largest share of the global dental practice management software market, primarily driven by the rising geriatric population, increasing private equity funding for DSOs, and higher patient awareness of advanced dental treatments.

How is the consolidation of dental practices influencing the market?

Consolidation of dental practices through DSOs is increasing globally, offering operational efficiencies, shared resources, and better purchasing power, which in turn drives demand for dental practice management software.

What technological advancements are shaping the dental practice management software market?

Technological advancements such as cloud-based software, automated patient communication, billing integration, and enhanced data security are shaping the future of dental practice management software, providing greater efficiency for dental practices.

What are the key product types in the dental practice management software market?

The market is segmented into pureplay PMS and dental PMS add-ons, both of which offer features like patient communication, billing software, and insurance management. Cloud-based software is becoming more popular due to its accessibility and efficiency.

Which end-user segment is expected to show the highest growth in this market?

The "Other End Users" segment, which includes DSOs and academic institutions, is expected to show the highest growth. Factors like private equity funding, industry-academic collaborations, and growing demand for specialized dental training contribute to this growth.

What is the impact of data privacy concerns on the dental practice management software market?

Data privacy concerns, especially around electronic patient records, pose a challenge for the market. Regulatory frameworks like HIPAA and HITECH aim to safeguard patient data, but breaches can slow down software adoption among dental practices.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing prevalence of oral health disorders- Technological advancements in dentistry- High return on investment from dental practice management software adoption- Rising demand for advanced cosmetic dental proceduresRESTRAINTS- Data privacy and security issuesOPPORTUNITIES- Consolidation of dental practices- Potential for growth in emerging countriesCHALLENGES- Shortage of healthcare IT professionals- Resistance to switch to dental PMS

-

5.3 INDUSTRY TRENDSREDUCTION IN NUMBER OF SOLO DENTAL PRACTICES IN USHIGH INVESTMENT ACTIVITY IN DENTAL PRACTICES IN US AND UK

-

5.4 TECHNOLOGY ANALYSISGROWING ADOPTION OF CLOUD-BASED DENTAL TECHNOLOGYARTIFICIAL INTELLIGENCE AND AUTOMATION IN DENTAL PMS

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM MAPPING

-

5.7 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR DENTAL PMSINSIGHTS ON JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.8 ADJACENT MARKETS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 REGULATORY ANALYSISREGULATIONS IN NORTH AMERICAREGULATIONS IN EUROPEREGULATIONS IN ASIA PACIFICREGULATIONS IN MIDDLE EAST & AFRICAREGULATIONS IN LATIN AMERICAREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.12 PRICING ANALYSISAVERAGE SELLING PRICE OF DENTAL PMS OF TOP PLAYERS, BY DEPLOYMENT MODEAVERAGE SELLING PRICE TRENDS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS, BY END USERBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 CLOUD-BASED DENTAL PMSSEVERAL ADVANTAGES SUCH AS FLEXIBILITY, SCALABILITY AND AFFORDABILITY TO DRIVE SEGMENT GROWTH

-

6.3 ON-PREMISE DENTAL PMSHIGH UPFRONT AND MAINTENANCE COSTS TO LIMIT GROWTH

- 7.1 INTRODUCTION

-

7.2 PUREPLAY DENTAL PMSPUREPLAY DENTAL PMS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

-

7.3 DENTAL PMS ADD-ONSEASIER CUSTOMIZATION OF ADD-ONS COMPARED TO PUREPLAY DENTAL PMS TO DRIVE MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 PATIENT COMMUNICATIONPATIENT COMMUNICATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

-

8.3 INVOICING/BILLINGINCREASING DEMAND FOR DIGITAL INVOICES TO DRIVE GROWTH

-

8.4 PAYMENT PROCESSINGINCREASING FOCUS ON IMPROVING EFFICIENCY OF PAYMENT PROCESS TO DRIVE GROWTH

-

8.5 INSURANCE MANAGEMENTFAVORABLE REIMBURSEMENT POLICIES AND INCREASING POPULARITY OF DENTAL PAYMENT PLANS TO DRIVE GROWTH

- 8.6 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 DENTAL CLINICSGROWING DEMAND FOR DENTAL PROCEDURES TO DRIVE GROWTH

-

9.3 HOSPITALSGROWING NUMBER OF DENTAL CLINICS TO RESTRAIN MARKET GROWTH

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICAN DENTAL PMS MARKET: RECESSION IMPACTUS- US to dominate North American dental PMS market during forecast periodCANADA- Increasing awareness regarding dental disorders to drive growth

-

10.3 EUROPEEUROPEAN DENTAL PMS MARKET: RECESSION IMPACTGERMANY- Presence of robust dental infrastructure to propel growthFRANCE- Government support to boost market developmentUK- Rising government funding for NHS services to drive growthITALY- Increasing demand for advanced solutions to drive growthSPAIN- Increasing demand for cosmetic dentistry and growing medical tourism to propel growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC DENTAL PMS MARKET: RECESSION IMPACTJAPAN- Growing popularity of cosmetic dentistry to boost growthCHINA- Increasing prevalence of dental diseases to drive growthINDIA- Growing dental care sector and rising foreign investments to drive growthREST OF ASIA PACIFIC

-

10.5 LATIN AMERICAINCREASING DEMAND FOR COSMETIC DENTISTRY TO DRIVE GROWTHLATIN AMERICAN DENTAL PMS MARKET: RECESSION IMPACT

-

10.6 MIDDLE EAST AND AFRICAGROWING AWARENESS OF DENTAL HYGIENE TO BOOST GROWTHMIDDLE EAST AND AFRICA DENTAL PMS MARKET: RECESSION IMPACT

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY PLAYERS IN DENTAL PMS MARKET

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXGLOBAL EVALUATION MATRIX- Stars- Emerging Leaders- Pervasive Players- ParticipantsNORTH AMERICAN EVALUATION MATRIX- Stars- Emerging Leaders- Pervasive Players- Participants

- 11.6 COMPETITIVE BENCHMARKING

- 11.7 REGIONAL FOOTPRINT ANALYSIS OF COMPANIES

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND ENHANCEMENTSDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSHENRY SCHEIN, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPATTERSON COMPANIES, INC.- Business overview- Products offered- MnM viewCARESTREAM DENTAL LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCD NEWCO, LLC (CURVE DENTAL, LLC)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPLANET DDS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOPEN DENTAL SOFTWARE, INC.- Business overview- Products/Solutions/Services offeredTAB32- Business overview- Products/Solutions/Services offered- Recent developmentsCARESTACK, INC.- Business overview- Products offered- Recent developmentsASSURANCE TECHNOLOGY PTE. LTD.- Business overview- Products/Solutions/Services offeredDSN SOFTWARE, INC.- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSAERONA SOFTWARE- Business overview- Products/Solutions/Services offeredADMOR LIMITED- Business overview- Products/Solutions/Services offeredBAKER HEATH ASSOCIATES LTD.- Business overview- Products/Solutions/Services offeredMOGO, INC.- Business overview- Products/Solutions/Services offeredPLATO MEDICAL PTE LTD.- Business overview- Products/Solutions/Services offeredPRACTICE-WEB INC.- Business overview- Products/Solutions/Services offeredGAARGLE SOLUTIONS INC.- Business overview- Products/Solutions/Services offeredDENTIMAX, LLC- Business overview- Products/Solutions/Services offeredSYSTEMS FOR DENTISTS LTD.- Business overview- Products/Solutions/Services offeredDENTIFLOW- Business overview- Products/Solutions/Services offeredIDENTALSOFT- Business overviewACE DENTAL- Business overviewMAXIDENT- Business overviewORYX DENTAL SOFTWARE LLC- Business overviewXLDENT- Business overview

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RISK ASSESSMENT

- TABLE 3 US: PEOPLE WITH UNTREATED DENTAL CARIES, BY AGE GROUP, 2019 (PERCENTAGE OF POPULATION)

- TABLE 4 PROJECTED INCREASE IN NUMBER OF PEOPLE AGED OVER 65 YEARS, BY REGION, 2019–2050 (MILLION)

- TABLE 5 AVERAGE PROCEDURAL COST IN TOP TEN DENTAL TOURISM DESTINATIONS (USD)

- TABLE 6 LIST OF SOME RECENT DEALS BACKED BY PRIVATE EQUITY IN US, 2020–2022

- TABLE 7 DENTAL PMS MARKET: LIST OF MAJOR PATENTS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR DENTAL PMS, BY END USER

- TABLE 15 KEY BUYING CRITERIA FOR DENTAL PMS, BY DEPLOYMENT MODE

- TABLE 16 DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 17 CLOUD-BASED: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 18 ON-PREMISE: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 19 DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 20 PUREPLAY DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 21 LIST OF SOME DENTAL PMS ADD-ONS

- TABLE 22 DENTAL PMS ADD-ONS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 23 DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 24 PATIENT COMMUNICATION: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 25 INVOICING/BILLING: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 26 PAYMENT PROCESSING: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 27 INSURANCE MANAGEMENT: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 28 OTHER APPLICATIONS: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 29 DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 30 TOP DESTINATIONS FOR COST-EFFECTIVE DENTAL TREATMENT

- TABLE 31 DENTAL CLINICS: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 32 HOSPITALS: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 33 TOP TEN YEARLY RESEARCH GRANTS BY NATIONAL INSTITUTE OF DENTAL AND CRANIOFACIAL RESEARCH TO US DENTAL INSTITUTIONS (USD MILLION)

- TABLE 34 OTHER END USERS: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 35 DENTAL PMS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 41 US: MACROECONOMIC INDICATORS

- TABLE 42 US: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 43 US: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 44 US: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 45 US: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 46 CANADA: MACROECONOMIC INDICATORS

- TABLE 47 CANADA: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 48 CANADA: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 49 CANADA: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 50 CANADA: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 51 EUROPE: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 52 EUROPE: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 53 EUROPE: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 54 EUROPE: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 55 EUROPE: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 56 GERMANY: DENTAL INDUSTRY OVERVIEW, 2011–2018

- TABLE 57 GERMANY: MACROECONOMIC INDICATORS

- TABLE 58 GERMANY: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 59 GERMANY: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 60 GERMANY: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 61 GERMANY: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 62 FRANCE: MACROECONOMIC INDICATORS

- TABLE 63 FRANCE: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 64 FRANCE: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 65 FRANCE: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 66 FRANCE: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 67 UK: MACROECONOMIC INDICATORS

- TABLE 68 UK: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 69 UK: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 70 UK: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 71 UK: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 72 ITALY: MACROECONOMIC INDICATORS

- TABLE 73 ITALY: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 74 ITALY: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 75 ITALY: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 76 ITALY: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 77 SPAIN: MACROECONOMIC INDICATORS

- TABLE 78 SPAIN: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 79 SPAIN: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 80 SPAIN: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 81 SPAIN: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 82 REST OF EUROPE: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 83 REST OF EUROPE: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 84 REST OF EUROPE: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 85 REST OF EUROPE: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: DENTAL PMS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 91 JAPAN: MACROECONOMIC INDICATORS

- TABLE 92 JAPAN: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 93 JAPAN: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 94 JAPAN: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 95 JAPAN: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 96 CHINA: MACROECONOMIC INDICATORS

- TABLE 97 CHINA: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 98 CHINA: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 99 CHINA: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 100 CHINA: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 101 INDIA: MACROECONOMIC INDICATORS

- TABLE 102 INDIA: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 103 INDIA: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 104 INDIA: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 105 INDIA: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 110 LATIN AMERICA: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 111 LATIN AMERICA: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 112 LATIN AMERICA: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 113 LATIN AMERICA: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST AND AFRICA: DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2020–2028 (USD MILLION)

- TABLE 115 MIDDLE EAST AND AFRICA: DENTAL PMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 116 MIDDLE EAST AND AFRICA: DENTAL PMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 117 MIDDLE EAST AND AFRICA: DENTAL PMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 118 DENTAL PMS MARKET: DEGREE OF COMPETITION

- TABLE 119 OVERALL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 120 DEPLOYMENT MODE FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 121 APPLICATION FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 122 END-USER FOOTPRINT ANALYSIS OF COMPANIES

- TABLE 123 PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2019–MAY 2023

- TABLE 124 DEALS, JANUARY 2019–MAY 2023

- TABLE 125 OTHER DEVELOPMENTS, JANUARY 2019–MAY 2023

- TABLE 126 HENRY SCHEIN, INC.: BUSINESS OVERVIEW

- TABLE 127 PATTERSON COMPANIES, INC.: BUSINESS OVERVIEW

- TABLE 128 CARESTREAM DENTAL LLC: BUSINESS OVERVIEW

- TABLE 129 CD NEWCO, LLC: BUSINESS OVERVIEW

- TABLE 130 PLANET DDS: BUSINESS OVERVIEW

- TABLE 131 OPEN DENTAL SOFTWARE, INC.: BUSINESS OVERVIEW

- TABLE 132 TAB32: BUSINESS OVERVIEW

- TABLE 133 CARESTACK, INC.: BUSINESS OVERVIEW

- TABLE 134 ASSURANCE TECHNOLOGY PTE. LTD.: BUSINESS OVERVIEW

- TABLE 135 DSN SOFTWARE, INC.: BUSINESS OVERVIEW

- TABLE 136 AERONA SOFTWARE: BUSINESS OVERVIEW

- TABLE 137 ADMOR LIMITED: BUSINESS OVERVIEW

- TABLE 138 BAKER HEATH ASSOCIATES LTD.: BUSINESS OVERVIEW

- TABLE 139 MOGO, INC.: BUSINESS OVERVIEW

- TABLE 140 PLATO MEDICAL PTE LTD.: BUSINESS OVERVIEW

- TABLE 141 PRACTICE-WEB INC.: BUSINESS OVERVIEW

- TABLE 142 GAARGLE SOLUTIONS INC.: BUSINESS OVERVIEW

- TABLE 143 DENTIMAX, LLC: BUSINESS OVERVIEW

- TABLE 144 SYSTEMS FOR DENTISTS LTD.: BUSINESS OVERVIEW

- TABLE 145 DENTIFLOW: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

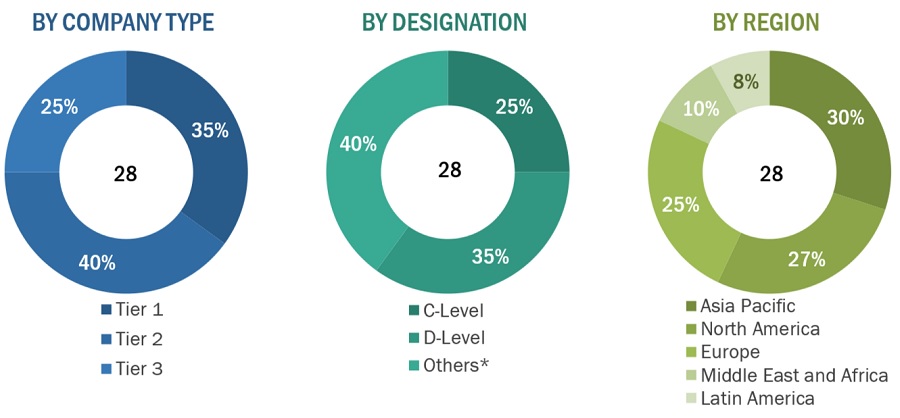

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY END USER, DESIGNATION, AND REGION

- FIGURE 6 MARKET SIZE ESTIMATION (SUPPLY SIDE): REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS FOR HENRY SCHEIN, INC.

- FIGURE 8 DENTAL PMS MARKET: SUPPLY-SIDE ANALYSIS, 2022

- FIGURE 9 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CAGR PROJECTIONS

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 11 TOP-DOWN APPROACH

- FIGURE 12 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 13 DENTAL PMS MARKET, BY DEPLOYMENT MODE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 DENTAL PMS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 DENTAL PMS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 DENTAL PMS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 GEOGRAPHIC SNAPSHOT: DENTAL PMS MARKET

- FIGURE 18 INCREASING PREVALENCE OF ORAL HEALTH DISORDERS TO DRIVE GROWTH

- FIGURE 19 ON-PREMISE DENTAL PMS SEGMENT DOMINATED NORTH AMERICAN MARKET IN 2022

- FIGURE 20 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 NORTH AMERICA TO DOMINATE DENTAL PMS MARKET DURING FORECAST PERIOD

- FIGURE 22 DEVELOPING MARKETS TO REGISTER HIGH GROWTH DURING FORECAST PERIOD

- FIGURE 23 DENTAL PRACTICE MANAGEMENT SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 PREVALENCE OF DENTAL CARIES IN 6–19-YEAR AGE GROUP, BY COUNTRY, 2019 (PERCENTAGE OF POPULATION)

- FIGURE 25 DENTAL PMS MARKET: STAKEHOLDERS IN SUPPLY CHAIN

- FIGURE 26 DENTAL PMS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 PATENT PUBLICATION TRENDS (2013–2023)

- FIGURE 28 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR DENTAL PMS PATENTS, 2013–2023

- FIGURE 29 TOP 10 APPLICANT COUNTRIES/REGIONS FOR DENTAL PMS PATENTS, 2013–2023

- FIGURE 30 DENTAL PMS MARKET: ADJACENT MARKETS

- FIGURE 31 DENTAL PMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 32 AVERAGE SELLING PRICE OF DENTAL PMS OF TOP PLAYERS, BY DEPLOYMENT MODE

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR DENTAL PMS, BY END USER

- FIGURE 34 KEY BUYING CRITERIA FOR DENTAL PMS

- FIGURE 35 US: ESTIMATED GROWTH IN PERCENTAGE OF DENTISTS ASSOCIATED WITH DSOS, 2020–2027

- FIGURE 36 GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 37 NORTH AMERICA: DENTAL PMS MARKET SNAPSHOT

- FIGURE 38 US: RISE IN DENTAL EXPENDITURE, 2010–2030

- FIGURE 39 ASIA PACIFIC: DENTAL PMS MARKET SNAPSHOT

- FIGURE 40 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 41 DENTAL PMS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 42 DENTAL PMS MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 43 NORTH AMERICAN DENTAL PMS MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 44 HENRY SCHEIN, INC.: COMPANY SNAPSHOT

- FIGURE 45 PATTERSON COMPANIES, INC.: COMPANY SNAPSHOT

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the Dental practice management software market is provided below:

Tiers are defined based on a company’s total revenue. As of 2021: Tier 1= >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Breakdown of Primary Interviews: Supply-Side and Demand-Side Participants

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation

The total size of the market was determined after data triangulation from four approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Global Market Size

Approach to calculating the revenue of different players in the Dental practice management software market

The size of the global market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Dental practice management software (PMS) is a category of dental software that is used to manage the day-to-day operations of dental practices. Dental PMS offers advanced scheduling, patient history, patient registration, patient communication, invoice/billing, payment processing, document storage and sharing, insurance management, and reporting.

Key Stakeholders

- Healthcare IT vendors

- Dental software vendors

- Nurse practitioners

- Dental clinic support staff

- Radiologists

- Payers

- Healthcare consultants

- Dental associations/institutes

- Dental hospitals and clinics

- Dental service organizations/dental groups

- Dental practitioners

- Hospitals and clinics

- Academic institutions

- Research institutions

- Government associations

- Market research and consulting firms

- Venture capitalists and private equity investors

Report Objectives

- To define, describe, segment, and forecast the dental practice management software market by application, type, deployment mode, end user, and region/country

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in Europe, North America, Asia Pacific, Latin America, and the Middle East and Africa.

- To strategically profile key players in the market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as such as product launches & enhancements, integrations, expansions, acquisitions, joint ventures, partnerships, and investments

- To analyze the impact of the recession on the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Additional country-level analysis of the Dental practice management software market

- Profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dental Practice Management Software Market