Digital Experience Platform Market by Component (Platform and Services), Deployment Type (Cloud and On-premises), Vertical (Manufacturing, IT & Telecom, BFSI, Healthcare, Travel & Hospitality, and Public Sector), and Region - Global Forecast to 2024

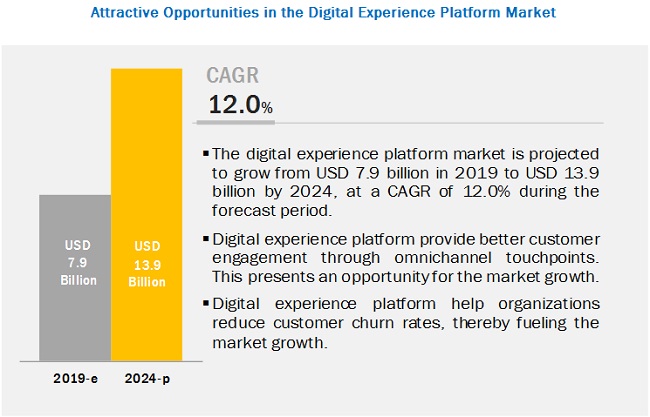

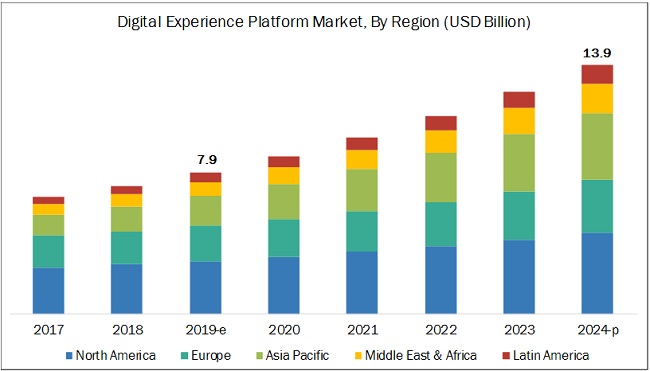

[130 Pages Report] The global Digital experience platform market size was valued USD 7.9 billion in 2019 and is estimated to reach USD 13.9 billion by 2024, at a CAGR of 12.0% during the forecast period. Major factors expected to drive the growth of the Digital Experience Platform Market include help in understanding the immediate needs of the customer, reducing the customer churn rate, growing deployment of cloud-based solutions, and rising demand for big data analytics. The other factors supporting the market growth include the increasing implementation of advanced technologies, such as AI, data analytics, and cloud computing.

By deployment type, the cloud segment to constitute a larger market size during the forecast period

By deployment type, the Digital Experience Platform Market has been segmented into cloud and on-premises. The cloud segment is expected to grow at a higher CAGR during the forecast period, due to its cost-efficiency and hassle-free integration. Various enterprises prefer cloud services due to their wide-ranging benefits. Small and Medium Enterprises (SMEs) adopt the cloud model, as it helps reduce initial IT costs, such as the costs of hardware setup and power consumption, and requires less physical space. Large enterprises can benefit from the cloud services, as they can host their large number of applications in the cloud network, which eases application management. With cloud, enterprises can achieve improved collaboration, along with faster performance, quick responsiveness, and greater agility, without having to operate a server infrastructure. The cloud deployment type offers customers a usage-based service model with the pay-per-use facility.

The managed services segment to grow at a higher CAGR during the forecast period

By services, the managed services segment is expected to hold a larger market size than the professional services segment during the forecast period as they help clients handle DXP operations on-premises as well as on the cloud. The prime responsibility of the managed services providers is to improve the efficiency of inbound and outbound operations cost-effectively for enterprises. Managed services assist clients in outsourcing the DXP to service providers for efficiently managing their key business operations. These services are very useful for companies, which do not have internal budgets or analytical skills to implement and manage the Customer Experience (CX) solution. The managed service providers handle end-to-end deployment and after sales services for the solutions.

North America to account for the largest market size during the forecast period.

The geographic analysis of the Digital Experience Platform Market includes 5 major regions, namely, North America, Asia Pacific (APAC), Europe, Latin America, and the Middle East and Africa (MEA). The market in North America is expected to grow at a high rate during the forecast period, due to the rapid adoption of advanced technologies by industries. Organizations in North America are opting for various digital channels, such as web portals, social media, call centers, and mobile phones to collect customer feedback data. In North America, the demand for DXP will be the highest in the travel and hospitality vertical. Organizations are fostering a customer-centric culture and are working to drive customer engagement by dealing with real-time customer data. For instance, Mercedes-Benz USA worked with Medallia to create a CX that empowers dealers to understand and respond to customer-generated feedback instantly.

Key Market Players

Key and emerging market players include Adobe Systems (US), Oracle (US), SAP (Germany), IBM (US), Microsoft (US), Salesforce (US), OpenText (Canada), SDL (UK), Sitecore (US), Acquia (US), Jahia (Switzerland), Episerver (US), Squiz (Australia), BloomReach (US), Liferay (US), Kentico (Czech Republic), and censhare (Germany). These players have adopted various strategies to grow in the DXP market. The companies are focused on inorganic growth strategies to strengthen their market position.

-

Adobe Systems (US) entered the DXP market with its product, Adobe Experience Cloud and has become a pioneer in offering digital experience solutions to enterprises worldwide. Adobe Systems (US) is highly dedicated to integrating the latest technologies to make data actionable; it uses Artificial Intelligence (AI) and Machine Learning (ML) technologies with its Adobe Experience Platform to help organizations position themselves for better customer understanding.

-

IBM (US) offers an elaborated range of solutions in the Digital Experience Platform Market through its AI-based solutions, IBM Watson Content Hub and IBM Digital Experience Manager. IBM (US) offers various solutions in the form of predictive analytics, premium insights, and web content management, to offer end-to-end solutions in the market. IBM (US) has been able to maintain a leading position globally with its capabilities, such as cognitive solutions and cloud platforms, through which it has been able to create a wide range of services, software, and analytics tools for its customers in the DXP market. Microsoft (US) is also one of the leading DXP service providers across the globe.

-

Microsoft (US) invests a substantial part of its annual revenue in Research and Development (R&D) in enhancing and upgrading its products and services. For instance, it invested USD 14.7 billion in R&D activities in 2018. Customers across the globe widely adopt Microsoft's (US) cloud offerings. Microsoft (US) was also one of the early vendors in the cloud Enterprise Resource Planning (ERP) space, and since then, the company has grown its presence by launching regular updates to its ERP portfolio.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component (Platform and Services), Deployment Type (Cloud and On-premises), Services (Professional Services and Managed Services), Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America and Middle East and Africa |

|

Companies covered |

Adobe Systems (US), Oracle (US), SAP (Germany), IBM (US), Microsoft (US), Salesforce (US), OpenText (Canada), SDL (UK), Sitecore (US), Acquia (US), Jahia (Switzerland), Episerver (US), Squiz (Australia), BloomReach (US), Liferay (US), Kentico (Czech Republic), and censhare (Germany) |

The research report categorizes the Digital Experience Platform (DXP) market to forecast the revenues and analyze trends in each of the following subsegments:

By Component

- Platform

-

Services

- Professional Services

- Managed Services

By Region

- North America

- Europe

- APAC

- Latin America

- MEA

By Vertical

- Retail

- BFSI

- Travel & Hospitality

- IT & Telecom

- Healthcare

- Manufacturing

- Media and Entertainment

- Public Sector

- Others (Education, Transportation & Logistics, and Utilities)

By Component

- Cloud

- On-premises

Recent Developments

- In March 2019, Adobe partnered with ServiceNow, a leading cloud computing firm, to provide an industry-first solution for integrating digital experience data with customer data. It would enable customers to have seamless digital workflows and personalized CXs across all touchpoints.

- In March 2019, Oracle partnered with TWINSET, an Italian Clothing Brand, for providing the company with Oracle Retail’s modern Point-of-Service (POS) technology. This technology would help in enhanceing CX at TWINSET stores by providing all transactional details to the in-store staffs, thus helping them suggest customers necessary styling and information related to the latest merchandise and more.

- In February 2019, IBM partnered with BUCKiTDREAM, US based provider of digital entertainment, e-commerce, media and entertainment solutions, to provide it with Watson Marketing for improved personalized brand engagement experiences for its customers. This partnership would analyze customer data patterns, thereby providing actionable insights for greater discovery and personalization to drive commerce conversions.

- In January 2019, SAP acquired Qualtrics International, one of the global pioneers of the experience management software. This acquisition would help SAP accelerate the CX solutions by combining experience data and operational data.

- In January 2019, Oracle launched Oracle Retail Xstore Office Cloud Service that offers enterprises greater inventory visibility and mobile reporting. This service would help retailers enhance customer engagement along with improving operational efficiency and creating a more responsive business model.

Frequently Asked Questions (FAQ):

What is the Growth for Digital Experience Platform (DXP) Market?

Which region have the highest market share in digital experience platform market?

Which deployment segment is expected to witness adoption rate in coming years?

Who are the major vendors in the digital experience platform market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Digital Experience Platform Market

4.2 Market in Asia Pacific, By Component and Country

4.3 Market Major Countries

5 Market Overview and Industry Trends (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 DXP Helps Understand the Immediate Need of Customers

5.2.1.2 Accurate Data Obtained Through DXP Used for Marketing and Customer Engagement

5.2.1.3 DXP Helps Reduce Customer Churn Rate

5.2.2 Restraints

5.2.2.1 Difficulty in Integrating Omnichannel-Generated Data

5.2.3 Opportunities

5.2.3.1 Deliver an Individualized Experience for Each Customer in Real Time

5.2.3.2 High Investments in AI Technology

5.2.4 Challenges

5.2.4.1 Unclear Data About ROI

5.2.4.2 Difficulty in Integrating Various Software

5.3 Use Cases

5.3.1 Use Case 1: Danone Nutricia Transforms ITs Customer Experience With Sitecore

5.3.2 Use Case 2: Dollywood Uses Sitecore Experience Platform to Better Prepare Its Customers

5.3.3 Use Case 3: Spark44 Uses Censhare to Help Save Jaguar Land Rover Cost and Speed Up Content Production

5.3.4 Use Case 4: Coach Used Liferay to Create Its Corporate Intranet – Coachweb, Which Give Employees A Single Consolidated Mobile-Friendly Source for All Its Content and News

6 Digital Experience Platform Market By Component (Page No. - 39)

6.1 Introduction

6.2 Platform

6.2.1 Web Content Management

6.2.1.1 Web Content Management to Focus on Enhancing CX By Offering Personalized and Localized Interactive Online Experiences

6.2.2 Digital Asset Management

6.2.2.1 Dam Solution to Gain Importance Due to Its Increasing Use Across All Major Industry Verticals

6.2.3 Product Information Management

6.2.3.1 Pim Solutions to Create A Single View of the Product for an Enterprise

6.2.4 Analytics, Artificial Intelligence, and Machine Learning

6.2.4.1 ML to Help Find Out Customer Trends in A Fast and Error-Free Manner

6.2.5 Others

6.3 Services

6.3.1 Professional Services

6.3.1.1 Consulting

6.3.1.1.1 Consulting to Facilitate Organizations for Optimizing Global Operations Related to DXP

6.3.1.2 Support and Maintenance

6.3.1.2.1 Support and Maintenance to Ensure A Faster Resolution to Customer Queries and Increase the Productivity of Agents

6.3.1.3 Training

6.3.1.3.1 to Ensure That the DXP Work at Its Optimum Performance Level Led to Requirement of Training

6.3.2 Managed Services

6.3.2.1 Managed Service Providers to Improve the Efficiency of Inbound and Outbound Operations of the Organization

7 Digital Experience Platform Market By Deployment Type (Page No. - 47)

7.1 Introduction

7.2 On-Premises

7.2.1 Rising Security Threats and Increasing Control of Deployed Platforms to Increase On-Premises Deployments

7.3 Cloud

7.3.1 Easy Deployment, Low Deployment Cost, and Easy Upgradeability to Increase the Adoption of Cloud Deployment Type

8 Market By Vertical (Page No. - 51)

8.1 Introduction

8.2 IT and Telecom

8.2.1 Intense Competition to Drive the Adoption of DXP By IT and Telecom Companies

8.3 Banking, Financial Services, and Insurance

8.3.1 Customer Data Analytics and Its Key Insights to Spur the Demand for DXP Market in the BFSI Vertical

8.4 Retail

8.4.1 Changing Consumer Behavior to Boost the Growth of CX Industry in the Retail Vertical

8.5 Healthcare

8.5.1 Growing Demand for AI and ML in Healthcare to Drive the DXP Market

8.6 Manufacturing

8.6.1 Customer-Focused Behavior to Drive the Demand for DXPs in the Manufacturing Vertical

8.7 Travel and Hospitality

8.7.1 Customer Engagement Services to Boost the Growth of the DXP Market in the Travel and Hospitality Vertical

8.8 Media and Entertainment

8.8.1 Increasing Digitalization of Services to Boost the Market Growth in Media and Entertainment Vertical

8.9 Public Sector

8.9.1 Focus on Providing Next Level CX and Intense Competition From Private Sector to Drive the Adoption of DXP By Public Sector

8.10 Others

9 Digital Experience Platform Market By Region (Page No. - 61)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.1.1 Wide Adoption of Artificial Engineering, ML, and Data Analytics Technologies By Enterprises to Drive the Growth of DXP Market in the Us

9.2.2 Canada

9.2.2.1 Focus on Increasing CX to Drive the Growth of DXP Market in Canada

9.3 Europe

9.3.1 United Kingdom

9.3.1.1 Digital Transformation to Drive the Growth of DXP Market in the UK

9.3.2 Germany

9.3.2.1 High Digital Spending to Drive the Growth of DXP Market in Germany

9.3.3 France

9.3.3.1 Increasing Digital Transformation to Drive the Growth of DXP Market in France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 Australia and New Zealand

9.4.1.1 Rapid Technological Adoption to Drive the Growth of DXP Market in Australia and New Zealand

9.4.2 India

9.4.2.1 Adoption of Customer-Centric Strategies By Organizations to Drive the Growth of DXP Market in India

9.4.3 China

9.4.3.1 High Investment in the Private Sector and Huge Population to Boost the Adoption of DXPs

9.4.4 Rest of Asia Pacific

9.5 Latin America

9.5.1 Brazil

9.5.1.1 Adoption of Cloud Computing to Drive the Growth of DXP Market in Brazil

9.5.2 Mexico

9.5.2.1 Rapid Digitization to Drive the Growth of DXP Market in Mexico

9.5.3 Rest of Latin America

9.6 Middle East and Africa

9.6.1 United Arab Emirates

9.6.1.1 Economic Growth to Lead to the Adoption of DXP in the UAE

9.6.2 Saudi Arabia

9.6.2.1 Adoption of Cloud Computing and Customer-Oriented Strategies By Organizations to Drive the Growth of DXP Market in Saudi Arabia

9.6.3 South Africa

9.6.3.1 Strategic Implementation of CX Solutions By Businesses to Drive the Growth of DXP Market in South Africa

9.6.4 Rest of Middle East and Africa

10 Competitive Landscape (Page No. - 85)

10.1 Competitive Leadership Mapping

10.1.1 Visionary Leaders

10.1.2 Innovators

10.1.3 Dynamic Differentiators

10.1.4 Emerging Companies

10.2 Strength of Product Portfolio

10.3 Business Strategy Excellence

10.4 Market Ranking for the Digital Experience Platform Market, 2019

11 Company Profiles (Page No. - 90)

11.1 Adobe

(Business Overview, Products & Solutions, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.2 IBM

11.3 Oracle

11.4 SAP

11.5 Microsoft

11.6 Salesforce

11.7 Opentext

11.8 SDL

11.9 Sitecore

11.10 Acquia

11.11 Jahia

11.12 Episerver

11.13 Squiz

11.14 Bloomreach

11.15 Liferay

11.16 Kentico

11.17 Censhare

*Details on Business Overview, Products & Solutions, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 123)

12.1 Industry Excerpts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (52 Tables)

Table 1 Factor Analysis

Table 2 Digital Experience Platform Market Size, By Component, 2017–2024 (USD Million)

Table 3 Platform: Market Size By Region, 2017–2024 (USD Million)

Table 4 Services: Market Size By Type, 2017–2024 (USD Million)

Table 5 Services: Market Size By Region, 2017–2024 (USD Million)

Table 6 Professional Services: Market Size, By Type, 2017–2024 (USD Million)

Table 7 Professional Services: Market Size By Region, 2017–2024 (USD Million)

Table 8 Managed Services: Market Size By Region, 2017–2024 (USD Million)

Table 9 Market, By Deployment Type, 2017–2024 (USD Million)

Table 10 On-Premises: Market By Region, 2017–2024 (USD Million)

Table 11 Cloud: Market By Region, 2017–2024 (USD Million)

Table 12 Market, By Vertical, 2017–2024 (USD Million)

Table 13 IT and Telecom: Market By Region, 2017–2024 (USD Million)

Table 14 Banking, Financial Services, and Insurance: Market By Region, 2017–2024 (USD Million)

Table 15 Retail: Market, By Region, 2017–2024 (USD Million)

Table 16 Healthcare: Market Size By Region, 2017–2024 (USD Million)

Table 17 Manufacturing: Market By Region, 2017–2024 (USD Million)

Table 18 Travel and Hospitality: Market By Region, 2017–2024 (USD Million)

Table 19 Media and Entertainment: Market By Region, 2017–2024 (USD Million)

Table 20 Public Sector: Market By Region, 2017–2024 (USD Million)

Table 21 Others: Market By Region, 2017–2024 (USD Million)

Table 22 Digital Experience Platform Market Size, By Region, 2017–2024 (USD Million)

Table 23 North America: Market Size, By Component, 2017–2024 (USD Million)

Table 24 North America: Market Size By Service, 2017–2024 (USD Million)

Table 25 North America: Market Size By Professional Service, 2017–2024 (USD Million)

Table 26 North America: Market Size By Vertical, 2017–2024 (USD Million)

Table 27 North America: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 28 North America: Market Size By Country, 2017–2024 (USD Million)

Table 29 Europe: Market Size, By Component, 2017–2024 (USD Million)

Table 30 Europe: Market Size By Service, 2017–2024 (USD Million)

Table 31 Europe: Market Size By Professional Service, 2017–2024 (USD Million)

Table 32 Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 33 Europe: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 34 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 35 Asia Pacific: Market Size, By Component, 2017–2024 (USD Million)

Table 36 Asia Pacific: Market Size By Service, 2017–2024 (USD Million)

Table 37 Asia Pacific: Market Size By Professional Service, 2017–2024 (USD Million)

Table 38 Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 39 Asia Pacific: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 40 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 41 Latin America: Digital Experience Platform Market Size, By Component, 2017–2024 (USD Million)

Table 42 Latin America: Market Size By Service, 2017–2024 (USD Million)

Table 43 Latin America: Market Size By Professional Service, 2017–2024 (USD Million)

Table 44 Latin America: Market Size By Vertical, 2017–2024 (USD Million)

Table 45 Latin America: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 46 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 47 Middle East and Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 48 Middle East and Africa: Market Size By Service, 2017–2024 (USD Million)

Table 49 Middle East and Africa: Market Size By Professional Service, 2017–2024 (USD Million)

Table 50 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 51 Middle East and Africa: Market Size By Deployment Type, 2019–2024 (USD Million)

Table 52 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

List of Figures (32 Figures)

Figure 1 Digital Experience Platform Market: Research Design

Figure 2 Market Size 2017–2024

Figure 3 Platform Segment to Hold A Larger Market Size in 2019

Figure 4 Cloud Segment to Account for A Higher Market Share in 2019

Figure 5 Manufacturing Vertical to Hold the Largest Market Size in 2019

Figure 6 Market: Regional Snapshot

Figure 7 Increasing Use of Digital Experience Platform to Get Accurate Data for Marketing and Customer Engagement to Drive the Market Growth

Figure 8 Platform Segment and China to Account for the Highest Market Shares in Asia Pacific in 2019

Figure 9 Australia and New Zealand to Register the Highest CAGR During the Forecast Period

Figure 10 Drivers, Restraints, Opportunities, and Challenges: Market

Figure 11 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 12 Cloud Segment to Account for A Larger Market Size During the Forecast Period

Figure 13 Manufacturing Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 14 North America to Hold the Highest Market Share During the Forecast Period

Figure 15 Asia Pacific Digital Experience Platform Market to Grow at the Highest CAGR During the Forecast Period

Figure 16 North America: Market Snapshot

Figure 17 Asia Pacific: Market Snapshot

Figure 18 Market (Global) Competitive Leadership Mapping

Figure 19 Market Ranking, 2019

Figure 20 Adobe: Company Snapshot

Figure 21 Adobe: SWOT Analysis

Figure 22 IBM: Company Snapshot

Figure 23 IBM: SWOT Analysis

Figure 24 Oracle: Company Snapshot

Figure 25 Oracle: SWOT Analysis

Figure 26 SAP: Company Snapshot

Figure 27 SAP: SWOT Analysis

Figure 28 Microsoft: Company Snapshot

Figure 29 Microsoft: SWOT Analysis

Figure 30 Salesforce: Company Snapshot

Figure 31 Opentext: Company Snapshot

Figure 32 SDL: Company Snapshot

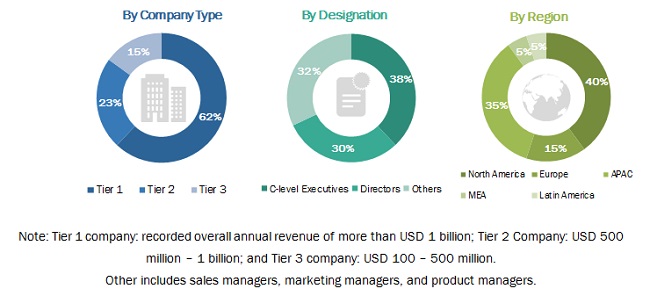

The study involved 4 major activities to estimate the current size of the Digital Experience Platform (DXP) market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of segments and subsegments of the Digital Experience Platform Market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred, to identify and collect information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; crypto asset management technology, Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both the supply and demand sides of the Digital Experience Platform Market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors who provide DXPs in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Digital Experience Platform Market Size Estimation

In order to make market estimations and forecast the DXP market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall size of the global DXP market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the Digital Experience Platform Market based on component (platform and services), deployment type (cloud, and on-premises), vertical, and region.

- To provide detailed information related to the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market segments with respect to 5 major regions, namely North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA).

- To profile the key players and comprehensively analyze their recent developments and positioning in the market

- To analyze the competitive developments, such as mergers and acquisitions, new product developments, and R&D activities in the market

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the digital experience platform market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakup of the North American digital experience platform market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Digital Experience Platform Market

How is the COVID-19 impacting the business landscape of Digital Experience Platform vendors?

Which vertical is fastest growing in digital experience platform Industry?