Blockchain IoT Market by Component (Hardware (IoT Sensors & Crypto-Wallets), Software and Platform, and Services), Application (Smart Contract, Security, and Asset Tracking and Management), Organization Size, Vertical, and Region - Global Forecast to 2026

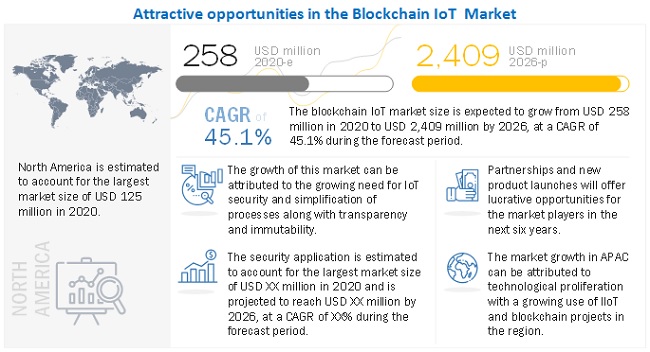

The global Blockchain IoT Market size was valued USD 258 million in 2020 and is projected to reach USD 2,409 million by 2026, at a CAGR of 45.1% from 2020 to 2026. The growing need for IoT security, simplified processes supported with transparency and immutability, and high adoption of blockchain-based IoT solutions using smart contracts and AI is expected to surge demand for blockchain IoT market globally.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. Due to the COVID-19 pandemic, the dependency on online businesses has increased significantly. BFSI, healthcare and life sciences, manufacturing, automotive, retail, transport and logistics, among others, are leveraging the internet to provide necessary services to consumers. Vendors have experienced decreased demand for a blockchain IoT system. The lockdown implemented around the world had affected the demand and supply of the various hardware components required for blockchain IoT. The healthcare and government verticals are set to witness a moderate adoption globally to protect hospitals, government buildings, and civilians during pandemics and disasters in the near future using IoT sensors and blockchain.

Blockchain IoT Market Dynamics

Driver: Growing need for IoT security

The widespread use of IoT devices is observed in several applications, such as smart city projects, smart transportation, vehicular connectivity, smart grids, and smart homes. However, with increased connectivity, IoT devices are massively becoming victims of security vulnerabilities, such as Distributed Denial of Service (DDoS) attacks, botnet attacks, and insecure ecosystem interfaces. Unsecure IoT devices provide easy access for cybercriminals to exploit the security systems. Blockchain solutions create a decentralized network of IoT devices, which eliminates the need for a central location to handle device communication. Blockchain offers an intriguing solution for IoT security powered by strong protection against data tampering and illegal access to IoT devices. Leveraging blockchain to store IoT data ensures an added layer of security, robust encryption, and transparency so that only the authorized individual is enabled access to the IoT network. Hence, enterprises that use IoT-enabled sensors are increasingly relying on blockchain technology to enhance the security of their IoT assets.

Restraint: Scalability, processing power, and storage issues

The IoT ecosystems are very diverse. The designing of IoT devices in alignment with blockchain technology poses several difficulties. One of the major hurdles faced by IoT is scalability, which includes handling a massive volume of data collected by a large network of sensors. Moreover, the processing power and time required to perform encryption of all IoT devices in a blockchain-based ecosystem are not as desired. Storage is another major issue in blockchain systems that store the ledger on edge nodes. IoT smart devices at the edge are still not capable of storing huge volumes of data or handling high computational power. Blockchain and IoT are both emerging technologies that possess great benefits. However, they still lack widespread adoption due to the aforementioned technical and security concerns.

Opportunity: Higher adoption of blockchain-based IoT solutions using smart contracts and AI

Smart contracts are the next-enabling technology for novel IoT applications. A smart contract is another key application area, which is the central component of the next-generation blockchain platforms. Ethereum, a public blockchain platform, is currently the most advanced smart contract-enabled blockchain. Smart contracts are terms and conditions that parties can specify to ensure trust and provide visibility in the enforceability of a contract. Blockchain-IoT provides numerous benefits when combined with smart contract technology. For example, Biz4Intellia’s Intellia IoT smart contract solution, uses one of the best combinations of blockchain and IoT with customized smart contracts; the smart contracts eliminate the manipulation of contracts, the sensors mounted on goods monitor information in real time as mentioned in smart contracts, and parties are immediately notified in case of breaches.

Challenge: Lack of awareness related to blockchain-IoT technology

The major limitation to the growth of the blockchain IoT market is the lack of awareness about distributed ledger technology, integration of blockchain with IoT, and its application in various sectors. End-users in various verticals lack an understanding of the benefits of this disruptive technology and how it works with IoT. This could restrain companies from investing in this evolving technology, which is still decentralized and lacks regulatory status. In its current form, blockchain technology is something of a vast, unknown frontier with uncertain growth. Investors, the public, and entrepreneurs are yet to leverage its potential for transforming business processes.

Based on vertical, the building management vertical to grow at the highest CAGR during the forecast period

The building management segment is expected to increasingly adopting blockchain IoT solutions. With the help of blockchain, smart home devices become immutable and safe from cyberattacks. Blockchain also enables building owners to securely enable other parties to access specific areas and devices without giving them access to everything. Increasing marketplace efficiency is advantageous in facility management too. The blockchain is a secure way to automate transactions and transfer data. It has changed the way buildings are being operated. By using the blockchain in automation, it provides facility management services, equipment warranties, indoor occupancy tracking, and track of spaces available. Therefore, the building management segment registers the highest growth rate during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

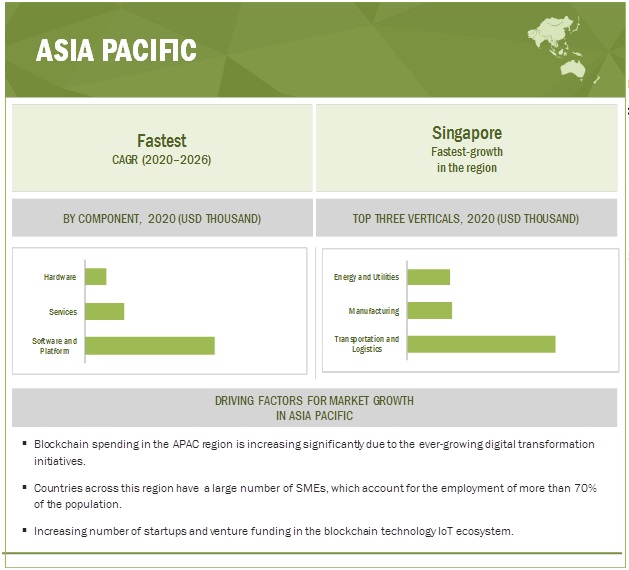

APAC to account for the highest CAGR during the forecast period

Asia Pacific (APAC) has witnessed an advanced and dynamic adoption of new technologies and is expected to record the highest CAGR in the global Blockchain IoT market during the forecast period. The market in Asia Pacific (APAC) is projected to grow at the highest CAGR during the forecast period. APAC countries are increasingly investing in blockchain IoT projects. The region comprises emerging economies, such as ANZ, China, Japan, and Singapore. With the proliferation of IoT in the APAC region, security and fraud concerns have risen; the integration of blockchain with IoT would enhance enterprise databases' trust and security. Enterprises in the APAC region are embracing blockchain technologies. Companies operating in APAC would benefit from the flexible economic conditions, industrialization-motivated policies, political transformation, and the growing digitalization, which is expected to have a significant impact on the business community and drive the market growth.

This research study outlines the market potential, market dynamics, and key and innovative vendors in the Blockchain IoT market include IBM (US), Microsoft (US), Intel (US), Amazon Web Services (US), Huawei (China), Cisco (US), SAP (Germany), Ethereum Foundation (Switzerland), The Linux Foundation (US), R3 (US), Arctouch (US), Waltonchain (China), Helium (US), Factom (US), HYPR (US), Chronicled (US), KrypC (India), IoTeX (Singapore), Discovery (Malta), Iota (Germany), Atonomi (US), Xage (US), Ambrosus (Estonia), NetObjex (US), and Grid+ (US).

The study includes an in-depth competitive analysis of these key players in the Blockchain IoT market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2020 |

USD 258 million |

|

Revenue forecast for 2026 |

USD 2,409 million |

|

Growth Rate |

45.1% CAGR |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2026 |

|

Segments covered |

Component, Application, Organization Size, Vertical, and Regions. |

|

Geographies covered |

North America, Europe, APAC, Middle East and Africa (MEA), and Latin America. |

|

Top companies covered |

IBM (US), Microsoft (US), Intel (US), Amazon Web Services (US), Huawei (China), Cisco (US), SAP (Germany), Ethereum Foundation (Switzerland), The Linux Foundation (US), R3 (US), Arctouch (US), Waltonchain (China), Helium (US), Factom (US), HYPR (US), Chronicled (US), KrypC (India), IoTeX (Singapore), Discovery (Malta), Iota (Germany), Atonomi (US), Xage (US), Ambrosus (Estonia), NetObjex (US), and Grid+ (US). |

This research report categorizes the blockchain IoT market to forecast revenues and analyze trends in each of the following submarkets:

Based on the component:

-

Hardware

-

IoT Sensors

- Motion Sensors

- GPS

- Temperature Sensors

- Vehicle Information

- Connected Devices

- Crypto-wallets

-

IoT Sensors

- Software and Platform

-

Services

- Technology Advisory and Consulting Services

- Deployment and Integration Services

- Support and Maintenance

Based on applications:

- Smart Contracts

- Security

- Data Sharing/ Communication

- Asset Tracking and Management

- Other applications* (real-time workforce tracking and workforce management)

Based on organization size:

- Large Enterprises

- SMEs

Based on the vertical:

- Energy and Utilities

- Transportation and Logistics

- Manufacturing

- Building Management

- Healthcare

- Retail

- Wearable and Mobile Devices

- Smart City

- Other verticals** (food and beverages, pharmaceutical, mining, agriculture, construction, and real estate)

Based on the region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe (EU and Non-EU countries)

-

APAC

- China

- Japan

- Singapore

- Rest of APAC (India, the Philippines, Vietnam, Indonesia, Taiwan, and South Korea)

-

Middle East and Africa (MEA)

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America (Chile, Argentina, Colombia, and Peru)

Recent Developments:

- In January 2021, IBM collaborated with Thai Reinsurance Public Company Limited (Thai Re) to launch the Insurer Network, a reinsurance smart contract platform using IBM blockchain technology on IBM Cloud. The IBM Blockchain technology built on the highly secured IBM Cloud will enable Thai Re to gain efficiency and speed in processing reinsurance contracts with a secure single version of truth documentation.

- In June 2020, Intel signed a Memorandum of Understanding (MoU) with the ADDA. It is aimed at accelerating digital transformation in Abu Dhabi by leveraging Intel’s Innovation Centre in Dubai and Intel’s expertise in the field of AI, video analytics, edge computing, blockchain, IoT, workplace transformation, and Augmented Reality (AR). The MoU also supports the Abu Dhabi Vision 2030.

- In September 2020, Huawei updated its blockchain-based cloud service, Blockchain Service 2.0 (BCS 2.0). The new and enhanced platform meets performance requirements of 50,000 Transactions Per Second (TPS), which is much higher than Bitcoin and Ethereum. Furthermore, BCS 2.0 extension capacity will reach more than 1,000 nodes, thereby meeting the requirements of commercial and large-scale blockchain networks.

- In October 2020, R3 partnered with Mphasis. The motive of this partnership was to develop a blockchain-based payment and financing solution for global supply chains. R3's blockchain platform, Corda, is used by Mphasis to extend its Payments and Trade Finance technology solutions portfolio.

- In December 2020, AWS teamed up with BMW Group to accelerate data innovation in the automotive industry. The BMW Group’s PartChain Platform leveraged AWS services, such as Amazon Elastic Kubernetes Service (Amazon EKS), in line with the open-source blockchain management tools to trace automotive parts and raw materials throughout the automotive supply chain.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Blockchain IoT market?

The global blockchain IoT market size is projected to grow from USD 258 million in 2020 to USD 2,409 million by 2026, at a Compound Annual Growth Rate (CAGR) of 45.1% during the forecast period.

Which region has the highest market share in the Blockchain IoT market?

North America has the highest market share in the Blockchain IoT market.

What is the definition of blockchain IoT?

Blockchain IoT is the convergence of blockchain and IoT used for building applications that leverage the power of both technology models. Blockchain enables the integration of IoT data for delivering actionable insights. It sets up trust, accountability, and transparency while streamlining business processes.

Who are the major vendors in the Blockchain IoT market?

Key and innovative vendors in the Blockchain IoT market include IBM (US), Microsoft (US), Intel (US), Amazon Web Services (US), Huawei (China), Cisco (US), SAP (Germany), Ethereum Foundation (Switzerland), The Linux Foundation (US), R3 (US), Arctouch (US), Waltonchain (China), Helium (US), Factom (US), HYPR (US), Chronicled (US), KrypC (India), IoTeX (Singapore), Discovery (Malta), Iota (Germany), Atonomi (US), Xage (US), Ambrosus (Estonia), NetObjex (US), and Grid+ (US).

What are the major drivers in the blockchain IoT market?

The growing need for IoT security, simplified processes supported with transparency and immutability, and high adoption of blockchain-based IoT solutions using smart contracts and AI is expected to surge demand for blockchain IoT market globally. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 6 BLOCKCHAIN IOT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE FROM HARDWARE, SOFTWARE AND PLATFORM, AND SERVICES OF BLOCKCHAIN IOT VENDORS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL HARDWARE, SOFTWARE AND PLATFORM, AND SERVICES OF BLOCKCHAIN IOT VENDORS

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF COMPANY REVENUE ESTIMATION

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3, TOP DOWN (DEMAND SIDE): SHARE OF BLOCKCHAIN IOT IN THE OVERALL INFORMATION TECHNOLOGY MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE): BLOCKCHAIN IOT MARKET ESTIMATIONS THROUGH VERTICALS

2.4 IMPLICATION OF COVID-19 ON THE MARKET

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY: COVID-19 MARKET

2.4.1 IMPACT OF THE COVID-19 PANDEMIC

2.5 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.6 COMPETITIVE EVALUATION MATRIX METHODOLOGY

FIGURE 14 COMPETITIVE EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 15 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.8 ASSUMPTIONS FOR THE STUDY

2.9 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 62)

FIGURE 16 BLOCKCHAIN IOT MARKET AND Y-O-Y GROWTH, 2018–2021

FIGURE 17 GLOBAL MARKET TO WITNESS A DECLINE IN GROWTH DURING THE FORECAST PERIOD

FIGURE 18 SEGMENTS WITH HIGH GROWTH RATES DURING THE FORECAST PERIOD

FIGURE 19 MARKET: REGIONAL SNAPSHOT

FIGURE 20 GEOGRAPHIC DISTRIBUTION OF THE MARKET, 2020 VS 2026

4 PREMIUM INSIGHTS (Page No. - 68)

4.1 ATTRACTIVE OPPORTUNITIES IN THE BLOCKCHAIN IOT MARKET

FIGURE 21 SIMPLIFICATION OF PROCESSES ALONG WITH TRANSPARENCY AND IMMUTABILITY TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY COMPONENT

FIGURE 22 SOFTWARE AND PLATFORM SEGMENT TO ACCOUNT FOR THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY HARDWARE

FIGURE 23 IOT SENSORS SEGMENT TO ACCOUNT FOR A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

4.4 MARKET, BY SERVICE

FIGURE 24 SUPPORT AND MAINTENANCE SERVICES SEGMENT TO ACCOUNT FOR A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

4.5 MARKET, BY ORGANIZATION SIZE

FIGURE 25 LARGE ENTERPRISES SEGMENT TO LEAD THE BLOCKCHAIN IOT MARKET DURING THE FORECAST PERIOD

4.6 MARKET, BY APPLICATION

FIGURE 26 SECURITY SEGMENT TO HAVE THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

4.7 MARKET, BY VERTICAL

FIGURE 27 TRANSPORTATION AND LOGISTICS SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

4.8 MARKET INVESTMENT SCENARIO

FIGURE 28 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 72)

5.1 MARKET DYNAMICS

FIGURE 29 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: BLOCKCHAIN IOT MARKET

5.1.1 DRIVERS

5.1.1.1 Growing need for IoT security

FIGURE 30 TYPE OF IOT SECURITY BREACH, 2016–2019

5.1.1.2 Simplification of processes along with transparency and immutability

5.1.1.3 Low operational costs

5.1.2 RESTRAINTS

5.1.2.1 Limited number of blockchain IoT experts

5.1.2.2 Uncertain regulatory and compliance environment

5.1.2.3 Scalability, processing power, and storage issues

5.1.3 OPPORTUNITIES

5.1.3.1 Higher adoption of blockchain-based IoT solutions using smart contracts and AI

5.1.3.2 Combating deepfake content using blockchain

5.1.4 CHALLENGES

5.1.4.1 Lack of awareness related to blockchain-IoT technology

5.1.4.2 Security, privacy, and control of blockchain transactions

FIGURE 31 BLOCKCHAIN HACKS, 2020

5.2 COVID-19-DRIVEN MARKET DYNAMICS

5.2.1 DRIVERS AND OPPORTUNITIES

FIGURE 32 BLOCKCHAIN IOT MARKET: CUMULATIVE GROWTH FROM DRIVERS

FIGURE 33 MARKET: CUMULATIVE GROWTH FROM OPPORTUNITIES

5.2.2 RESTRAINTS AND CHALLENGES

FIGURE 34 MARKET: CUMULATIVE DECLINE DUE TO RESTRAINTS AND CHALLENGES

5.2.3 CUMULATIVE GROWTH ANALYSIS

5.3 VALUE CHAIN ANALYSIS

FIGURE 35 VALUE CHAIN ANALYSIS

5.4 BLOCKCHAIN ECOSYSTEM

FIGURE 36 BLOCKCHAIN PROVIDER ECOSYSTEM

FIGURE 37 BLOCKCHAIN IOT PROJECT ECOSYSTEM

5.5 AVERAGE SELLING PRICE/PRICING MODEL, 2019-2020

FIGURE 38 2019-2020 AVERAGE SELLING PRICE MODEL

5.5.1 IOT SENSORS AND CRYPTO-WALLETS AVERAGE SELLING PRICE

FIGURE 39 IOT SENSORS AVERAGE SELLING PRICE TREND

FIGURE 40 CRYPTO-WALLETS AVERAGE SELLING PRICE TREND

5.6 TECHNOLOGY ANALYSIS

5.6.1 BIG DATA ANALYTICS

5.6.2 CLOUD

5.6.3 OTHER TECHNOLOGIES

5.7 REVENUE SHIFT – YC/YCC SHIFT

FIGURE 41 YC/YCC SHIFT

5.8 PATENT ANALYSIS

FIGURE 42 BLOCKCHAIN PATENT APPLICATIONS PER YEAR

FIGURE 43 TOP BLOCKCHAIN APPLICATION AREAS

5.8.1 BLOCKCHAIN IOT PATENTS

TABLE 3 BLOCKCHAIN IOT PATENTS

5.9 PORTER’S FIVE FORCES MODEL ANALYSIS

FIGURE 44 BLOCKCHAIN IOT MARKET: PORTER'S FIVE FORCE ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 BLOCKCHAIN ASSOCIATIONS AND CONSORTIUMS

5.10.1 ENTERPRISE ETHEREUM ALLIANCE

5.10.2 HYPERLEDGER CONSORTIUM

5.10.3 GLOBAL BLOCKCHAIN BUSINESS COUNCIL

5.10.4 BLOCKCHAIN COLLABORATIVE CONSORTIUM

5.10.5 R3CEV BLOCKCHAIN CONSORTIUM

5.10.6 CONTINUOUS LINKED SETTLEMENT GROUP

5.10.7 GLOBAL PAYMENTS STEERING GROUP

5.10.8 FINANCIAL BLOCKCHAIN SHENZHEN CONSORTIUM

5.10.9 CULEDGER

5.10.10 WALL STREET BLOCKCHAIN ALLIANCE

5.10.11 OTHER BLOCKCHAIN ASSOCIATIONS

5.11 USE CASES

5.11.1 AQUAI, A SMART WATER COMPANY, LEVERAGED NETOBJEX’S DIGITAL TWIN PLATFORM

5.11.2 CARREFOUR SA JOINED IBM’S BLOCKCHAIN-BASED FOOD TRUST NETWORK

5.11.3 THE VIRGIN DIAMOND USED NETOBJEX’S DIGITAL TWIN PLATFORM

5.11.4 GE AVIATION’S DIGITAL GROUP STREAMLINED TRACKING OF AIRCRAFT PARTS WITH MICROSOFT AZURE BLOCKCHAIN

5.11.5 CURRY & COMPANY TEAMED UP WITH INTEL’S INTEGRATED BLOCKCHAIN-BASED IOT SOLUTION TO TRACK PERISHABLE GOODS

5.11.6 BUMBLE BEE SEAFOODS COLLABORATED WITH SAP TO TRACE THE FISH SUPPLY CHAIN IN AN INDONESIAN VILLAGE

6 BLOCKCHAIN IOT MARKET, BY COMPONENT (Page No. - 97)

6.1 INTRODUCTION

FIGURE 45 SOFTWARE AND PLATFORM SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 4 MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 5 COMPONENT: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

6.2 HARDWARE

6.2.1 HARDWARE: MARKET DRIVERS

6.2.2 HARDWARE: COVID-19 IMPACT

FIGURE 46 IOT SENSORS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 6 MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 7 HARDWARE: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

TABLE 8 MARKET SIZE, BY HARDWARE, 2018–2026 (THOUSAND UNITS)

6.2.3 IOT SENSORS

TABLE 9 IOT SENSORS: BLOCKCHAIN IOT MARKET SIZE, BY REGION,2018–2026 (USD THOUSAND)

6.2.3.1 Motion Sensors

6.2.3.2 GPS

6.2.3.3 Temperature Sensors

6.2.3.4 Vehicle Information

6.2.3.5 Connected Devices

6.2.4 CRYPTO WALLETS

TABLE 10 CRYPTO WALLETS: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

6.3 SOFTWARE AND PLATFORM

6.3.1 SOFTWARE AND PLATFORM: MARKET DRIVERS

6.3.2 SOFTWARE AND PLATFORM: COVID-19 IMPACT

TABLE 11 SOFTWARE AND PLATFORM: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

6.4 SERVICES

6.4.1 SERVICES: MARKET DRIVERS

6.4.2 SERVICES: COVID-19 IMPACT

FIGURE 47 DEVELOPMENT AND INTEGRATION SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 12 BLOCKCHAIN IOT MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 13 SERVICES: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

6.4.3 TECHNOLOGY ADVISORY AND CONSULTING SERVICES

TABLE 14 TECHNOLOGY ADVISORY AND CONSULTING SERVICES: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

6.4.4 DEVELOPMENT AND INTEGRATION SERVICES

TABLE 15 DEVELOPMENT AND INTEGRATION SERVICES: MARKET SIZE,BY REGION, 2018–2026 (USD THOUSAND)

6.4.5 SUPPORT AND MAINTENANCE

TABLE 16 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

7 BLOCKCHAIN IOT MARKET, BY ORGANIZATION SIZE (Page No. - 109)

7.1 INTRODUCTION

FIGURE 48 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 17 MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 18 ORGANIZATION SIZE: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

7.2 LARGE ENTERPRISES

7.2.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 19 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

7.2.2 LARGE ENTERPRISES: COVID-19 IMPACT

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

7.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

7.3.2 SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 20 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

8 BLOCKCHAIN IOT MARKET, BY APPLICATION (Page No. - 114)

8.1 INTRODUCTION

FIGURE 49 ASSET TRACKING AND MANAGEMENT SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 21 MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 22 APPLICATION: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

8.2 SMART CONTRACTS

8.2.1 SMART CONTRACTS: MARKET DRIVERS

8.2.2 SMART CONTRACTS: COVID-19 IMPACT

TABLE 23 SMART CONTRACTS: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

8.3 SECURITY

8.3.1 SECURITY: MARKET DRIVERS

8.3.2 SECURITY: COVID-19 IMPACT

TABLE 24 SECURITY: BLOCKCHAIN IOT MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

8.4 DATA SHARING/COMMUNICATION

8.4.1 DATA SHARING/COMMUNICATION: MARKET DRIVERS

8.4.2 DATA SHARING/COMMUNICATION: COVID-19 IMPACT

TABLE 25 DATA SHARING/COMMUNICATION: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

8.5 ASSET TRACKING AND MANAGEMENT

8.5.1 ASSET TRACKING AND MANAGEMENT: MARKET DRIVERS

8.5.2 ASSET TRACKING AND MANAGEMENT: COVID-19 IMPACT

TABLE 26 ASSET TRACKING AND MANAGEMENT: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

8.6 OTHER APPLICATIONS

TABLE 27 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

9 BLOCKCHAIN IOT MARKET, BY VERTICAL (Page No. - 122)

9.1 INTRODUCTION

FIGURE 50 BUILDING MANAGEMENT SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 28 MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

TABLE 29 VERTICAL: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

9.2 ENERGY AND UTILITIES

9.2.1 ENERGY AND UTILITIES: MARKET DRIVERS

9.2.2 ENERGY AND UTILITIES: COVID-19 IMPACT

TABLE 30 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

9.3 TRANSPORTATION AND LOGISTICS

9.3.1 TRANSPORTATION AND LOGISTICS: MARKET DRIVERS

9.3.2 TRANSPORTATION AND LOGISTICS: COVID-19 IMPACT

TABLE 31 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

9.4 MANUFACTURING

9.4.1 MANUFACTURING: BLOCKCHAIN IOT MARKET DRIVERS

9.4.2 MANUFACTURING: COVID-19 IMPACT

TABLE 32 MANUFACTURING: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

9.5 BUILDING MANAGEMENT

9.5.1 BUILDING MANAGEMENT: MARKET DRIVERS

TABLE 33 BUILDING MANAGEMENT: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

9.6 HEALTHCARE

9.6.1 HEALTHCARE: MARKET DRIVERS

9.6.2 HEALTHCARE: COVID-19 IMPACT

TABLE 34 HEALTHCARE: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

9.7 RETAIL

9.7.1 RETAIL: MARKET DRIVERS

9.7.2 RETAIL: COVID-19 IMPACT

TABLE 35 RETAIL: BLOCKCHAIN IOT MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

9.8 WEARABLE AND MOBILE DEVICES

9.8.1 WEARABLE AND MOBILE DEVICES: MARKET DRIVERS

9.8.2 WEARABLE AND MOBILE DEVICES: COVID-19 IMPACT

TABLE 36 WEARABLE AND MOBILE DEVICES: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

9.9 SMART CITY

9.9.1 SMART CITY: MARKET DRIVERS

9.9.2 SMART CITY: COVID-19 IMPACT

TABLE 37 SMART CITY: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

9.10 OTHER VERTICALS

TABLE 38 OTHER VERTICALS: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

10 BLOCKCHAIN IOT MARKET, BY REGION (Page No. - 133)

10.1 INTRODUCTION

FIGURE 51 ASIA PACIFIC TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 52 SINGAPORE TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 53 ASIA PACIFIC: HOTSPOT FOR INVESTMENTS DURING THE FORECAST PERIOD

TABLE 39 MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 54 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 55 SOFTWARE AND PLATFORM SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN NORTH AMERICA

TABLE 40 NORTH AMERICA: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

FIGURE 56 NORTH AMERICA: COUNTRY-WISE ANALYSIS

TABLE 46 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2026 (USD THOUSAND)

10.2.4 UNITED STATES

TABLE 47 UNITED STATES: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 48 UNITED STATES: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 49 UNITED STATES: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 50 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 51 UNITED STATES: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 52 UNITED STATES: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.2.5 CANADA

TABLE 53 CANADA: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 54 CANADA: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 55 CANADA: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 56 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 57 CANADA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 58 CANADA: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATORY LANDSCAPE

FIGURE 57 SOFTWARE AND PLATFORM SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN EUROPE

TABLE 59 EUROPE: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT,2018–2026 (USD THOUSAND)

TABLE 60 EUROPE: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 61 EUROPE: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 62 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 63 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 64 EUROPE: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

FIGURE 58 EUROPE: COUNTRY-WISE ANALYSIS

TABLE 65 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2026 (USD THOUSAND)

10.3.4 UNITED KINGDOM

TABLE 66 UNITED KINGDOM: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 67 UNITED KINGDOM: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 68 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 69 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 70 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 71 UNITED KINGDOM: MARKET SIZE, BY VERTICAL,2018–2026 (USD THOUSAND)

10.3.5 GERMANY

TABLE 72 GERMANY: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 73 GERMANY: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 74 GERMANY: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 75 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 76 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 77 GERMANY: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.3.6 FRANCE

TABLE 78 FRANCE: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 79 FRANCE: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 80 FRANCE: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 81 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 82 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 83 FRANCE: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.3.7 REST OF EUROPE

TABLE 84 REST OF EUROPE: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 85 REST OF EUROPE: MARKET SIZE, BY HARDWARE,2018–2026 (USD THOUSAND)

TABLE 86 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 87 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 88 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 89 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 59 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 60 SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN ASIA PACIFIC

TABLE 90 ASIA PACIFIC: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

FIGURE 61 ASIA PACIFIC: COUNTRY-WISE ANALYSIS

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2026 (USD THOUSAND)

10.4.4 AUSTRALIA AND NEW ZEALAND

TABLE 97 AUSTRALIA AND NEW ZEALAND: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 98 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 99 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 100 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 101 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 102 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.4.5 CHINA

TABLE 103 CHINA: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 104 CHINA: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 105 CHINA: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 106 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 107 CHINA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 108 CHINA: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.4.6 JAPAN

TABLE 109 JAPAN: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 110 JAPAN: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 111 JAPAN: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 112 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 113 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 114 JAPAN: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.4.7 SINGAPORE

TABLE 115 SINGAPORE: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 116 SINGAPORE: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 117 SINGAPORE: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 118 SINGAPORE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 119 SINGAPORE: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 120 SINGAPORE: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.4.8 REST OF ASIA PACIFIC

TABLE 121 REST OF ASIA PACIFIC: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 122 REST OF ASIA PACIFIC: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 123 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 124 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 125 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 126 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

FIGURE 62 SOFTWARE AND PLATFORM SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN THE MIDDLE EAST AND AFRICA

TABLE 127 MIDDLE EAST AND AFRICA: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE,2018–2026 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUB REGION, 2018–2026 (USD THOUSAND)

10.5.4 MIDDLE EAST

TABLE 134 MIDDLE EAST: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT,2018–2026 (USD THOUSAND)

TABLE 135 MIDDLE EAST: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 136 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 137 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 138 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 139 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.5.5 AFRICA

TABLE 140 AFRICA: MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 141 AFRICA: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 142 AFRICA: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 143 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE,2018–2026 (USD THOUSAND)

TABLE 144 AFRICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 145 AFRICA: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: BLOCKCHAIN IOT MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

FIGURE 63 HARDWARE SEGMENT TO GROW AT A HIGHEST CAGR DURING THE FORECAST PERIOD IN LATIN AMERICA

TABLE 146 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 147 LATIN AMERICA: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 148 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 149 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 150 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 151 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

TABLE 152 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2026 (USD THOUSAND)

10.6.4 BRAZIL

TABLE 153 BRAZIL: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 154 BRAZIL: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 155 BRAZIL: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 156 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 157 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 158 BRAZIL: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.6.5 MEXICO

TABLE 159 MEXICO: MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 160 MEXICO: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 161 MEXICO: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 162 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 163 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 164 MEXICO: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

10.6.6 REST OF LATIN AMERICA

TABLE 165 REST OF LATIN AMERICA: BLOCKCHAIN IOT MARKET SIZE, BY COMPONENT, 2018–2026 (USD THOUSAND)

TABLE 166 REST OF LATIN AMERICA: MARKET SIZE, BY HARDWARE, 2018–2026 (USD THOUSAND)

TABLE 167 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2018–2026 (USD THOUSAND)

TABLE 168 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2026 (USD THOUSAND)

TABLE 169 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD THOUSAND)

TABLE 170 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2018–2026 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 199)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 64 MARKET EVALUATION FRAMEWORK

11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.3.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY BLOCKCHAIN IOT VENDORS

11.4 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 65 REVENUE SHARE ANALYSIS OF THE BLOCKCHAIN IOT MARKET IN 2020

11.5 HISTORIC REVENUE ANALYSIS

FIGURE 66 HISTORIC FIVE YEARS REVENUE ANALYSIS OF LEADING BLOCKCHAIN IOT PROVIDERS

11.6 COMPETITIVE EVALUATION MATRIX, 2020

11.6.1 STAR

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

11.6.4 PARTICIPANTS

FIGURE 67 MARKET (GLOBAL), COMPETITIVE EVALUATION MATRIX, 2020

11.7 STRENGTH OF PRODUCT PORTFOLIO ANALYSIS OF BLOCKCHAIN IOT PLAYERS

FIGURE 68 PRODUCT FOOTPRINT ANALYSIS OF PLAYERS IN THE MARKET

11.8 BUSINESS STRATEGY EXCELLENCE ANALYSIS OF BLOCKCHAIN IOT PLAYERS

FIGURE 69 BUSINESS STRATEGY EXCELLENCE ANALYSIS PLAYERS IN THE MARKET

11.9 STARTUP/SME EVALUATION MATRIX, 2020

11.9.1 PROGRESSIVE COMPANIES

11.9.2 RESPONSIVE COMPANIES

11.9.3 DYNAMIC COMPANIES

11.9.4 STARTING BLOCKS

FIGURE 70 BLOCKCHAIN IOT MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

11.10 RANKING OF KEY PLAYERS IN THE MARKET, 2020

FIGURE 71 RANKING OF TOP FIVE BLOCKCHAIN IOT PLAYERS, 2020

12 COMPANY PROFILES (Page No. - 209)

12.1 INTRODUCTION

FIGURE 72 GEOGRAPHIC REVENUE MIX OF MAJOR INDUSTRY PLAYERS

12.2 KEY PLAYERS

(Business Overview, Solutions Offered, Recent Developments, COVID-19-Related Development, MNM view, Key strengths/right to win, Strategic choices made and Weaknesses and competitive threats)*

12.2.1 IBM

TABLE 171 IBM: BUSINESS OVERVIEW

FIGURE 73 IBM: COMPANY SNAPSHOT

12.2.2 MICROSOFT

TABLE 172 MICROSOFT: BUSINESS OVERVIEW

FIGURE 74 MICROSOFT: COMPANY SNAPSHOT

12.2.3 INTEL

TABLE 173 INTEL: BUSINESS OVERVIEW

FIGURE 75 INTEL: COMPANY SNAPSHOT

12.2.4 AMAZON WEB SERVICES

TABLE 174 AMAZON WEB SERVICES: BUSINESS OVERVIEW

FIGURE 76 AMAZON WEB SERVICES: COMPANY SNAPSHOT

12.2.5 HUAWEI

TABLE 175 HUAWEI: BUSINESS OVERVIEW

FIGURE 77 HUAWEI: COMPANY SNAPSHOT

12.2.6 CISCO

TABLE 176 CISCO: BUSINESS OVERVIEW

FIGURE 78 CISCO: COMPANY SNAPSHOT

12.2.7 SAP

TABLE 177 SAP: BUSINESS OVERVIEW

FIGURE 79 SAP: COMPANY SNAPSHOT

12.2.8 ETHEREUM FOUNDATION

TABLE 178 ETHEREUM FOUNDATION: BUSINESS OVERVIEW

12.2.9 THE LINUX FOUNDATION

TABLE 179 THE LINUX FOUNDATION: BUSINESS OVERVIEW

12.2.10 R3

TABLE 180 R3: BUSINESS OVERVIEW

12.2.11 ARCTOUCH

12.2.12 WALTONCHAIN

12.2.13 HELIUM

12.3 STARTUP/SME PROFILES

12.3.1 FACTOM

12.3.2 HYPR

12.3.3 CHRONICLED

12.3.4 KRYPC

12.3.5 IOTEX

12.3.6 DISCOVERY

12.3.7 IOTA

12.3.8 ATONOMI

12.3.9 XAGE

12.3.10 AMBROSUS

12.3.11 NETOBJEX

12.3.12 GRID+

*Details on Business Overview, Solutions Offered, Recent Developments, COVID-19-Related Development, MNM view, Key strengths/right to win, Strategic choices made and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT MARKET (Page No. - 259)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 BLOCKCHAIN MARKET

13.3.1 INTRODUCTION

13.3.2 BY COMPONENT

TABLE 181 BLOCKCHAIN MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

13.3.3 BY APPLICATION AREA

FIGURE 80 BANKING AND FINANCIAL SERVICES SEGMENT TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 182 BLOCKCHAIN MARKET SIZE, BY APPLICATION AREA, 2018–2025 (USD MILLION)

TABLE 183 APPLICATION AREA: BLOCKCHAIN MARKET SIZE, BY REGION,2018–2025 (USD MILLION)

13.4 AI IN IOT MARKET

13.4.1 INTRODUCTION

13.4.2 BY COMPONENT

FIGURE 81 SOFTWARE SOLUTIONS SEGMENT TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 184 AI IN IOT MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

13.4.3 BY TECHNOLOGY

FIGURE 82 NATURAL LANGUAGE PROCESSING SEGMENT TO WITNESS A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 185 AI IN IOT MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

13.5 BLOCKCHAIN AI MARKET

13.5.1 INTRODUCTION

13.5.2 BY COMPONENT

FIGURE 83 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 186 COMPONENT: BLOCKCHAIN AI MARKET SIZE, 2018–2025 (USD MILLION)

TABLE 187 COMPONENT: BLOCKCHAIN AI MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14 APPENDIX (Page No. - 266)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the Blockchain IoT. Exhaustive secondary research was done to collect information on the Blockchain IoT. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases, have been referred to identify and collect information for this study. The data was also collected from secondary sources, such as Cambridge Blockchain Forum, Blockchain Research Institute, Cleveland Blockchain and Digital Futures Hub, Slovenian Blockchain Think Tank, ThinkBLOCKTank, and CRYSTAL Centre. Additionally, the blockchain investment and spending of various countries were extracted from their respective security associations, such as Government Blockchain Association (GBA).

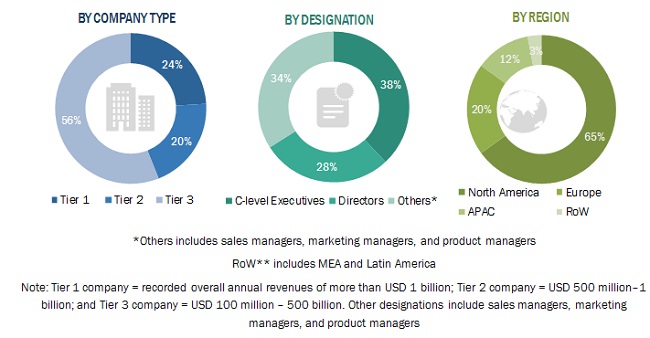

Primary Research

The In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from blockchain solution vendors, blockchain service providers, industry associations, independent blockchain consultants, and key opinion leaders. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs), and installation teams, of governments/end users using blockchain solutions, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current use of blockchain solutions, which would affect the overall blockchain IoT market.

Following is the breakup of the primary respondent:

To know about the assumptions considered for the study, download the pdf brochure

Blockchain IoT Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Blockchain IoT. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at each market segment's exact statistics and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global Blockchain IoT by technology, component, application, deployment mode, organization size, vertical, and region from 2020 to 2026, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the market segments' size with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall Blockchain IoT

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Blockchain IoT

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall blockchain IoT market and its sub-segments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the APAC market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blockchain IoT Market