Digital MRO Market by Application (Inspection, Predictive Maintenace, Parts Replacement, Performance Monitoring, Training, Inventory Management, Mobility), Technology (AR/VR, 3D Printing, Blockchain, Others), End User, and Region - Global Forecast to 2030

Update: 11/22/2024

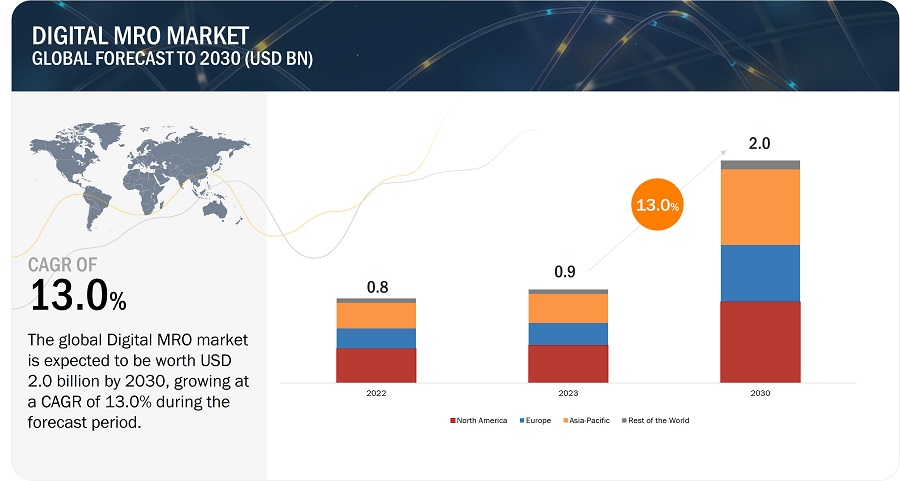

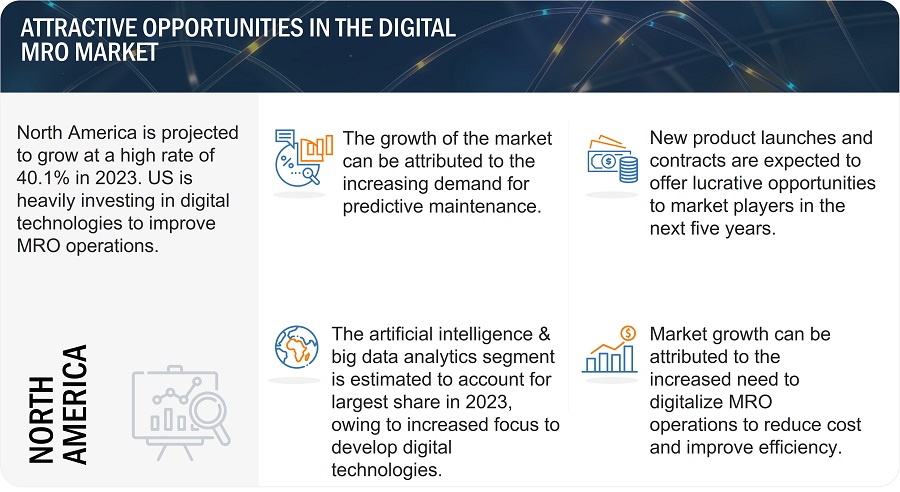

The Global Digital MRO Market Size was valued at USD 0.9 billion in 2023 and is estimated to reach USD 2.0 billion by 2030, growing at a CAGR of 13% during the forecast period. The market is driven by factors such as increasing adoption of digital technologies like internet of things (IoT),augmented reality (AR), artificial intelligence (AI) and big data analytics by MROs and increasing need for replacing legacy aviation management information systems.

Digital MRO Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Digital MRO Market Dynamics

Drivers: Growing adoption of software-as-a-service (SaaS)

Traditionally, on-premises field services were costly, involving a lot of paperwork and the availability of old data rather than updated information, which subsequently led to disappointed customers, low growth, and low revenues. In recent years, the demand for SaaS-based solutions has been increasing. SaaS is a customizable platform for enterprises that provides customers with tailored services according to their requirements. This, in turn, is expected to create new opportunities for the developers of cloud-based aviation MRO software. Cloud-based MRO software services and solutions benefit tier 2 and tier 3 MRO due to the introduction of the pay-as-you-use model, which reduces expenses. Other advantages of using SaaS-based solutions include the huge availability of storage space and updated information, increased flexibility, on-demand software upgrades, and systematic scheduling and dispatch functions. The advantages of SaaS-based solutions are helping enterprises transform and expand their businesses, which, in turn, is projected to drive the market for cloud-based MRO software.

Cloud-based maintenance systems capture data digitally and maintain records in the form of manuals, maintenance logs, flight plans, aircraft maintenance tracking reports, record books for adherence to airworthiness regulations, and service bulletins. These systems enable fast and inexpensive management of different types of maintenance data by offering real-time access to spare part inventories.

Cloud-based maintenance systems offer the following benefits:

- Reduce maintenance costs of IT systems

- Eliminate hardware, software, database, and server costs

- Enable warehouse management

- Aid in planning the consumption of spare parts

- Aid in material planning

- Help in workforce scheduling

- Enable allocation of MRO tools

- Aid in line maintenance planning

Restraints: Lack of common data standard

The aviation industry is highly fragmented. Data received from multiple data centers, such as airports, airlines, aircraft OEMs, engine OEMs, and component OEMs, is not standardized and difficult to analyze, thus impacting multiple algorithms of MRO software analysis. Additionally, MRO functionalities are based on different types of MRO, such as line, component, and engine MRO. Hence, data generated from these MRO is disparate. MRO software focuses on the integration of maintenance, materials, engineering, and accounts and financial data. The integrated information is based on the core functionalities and activities of different MRO service providers. The lack of common data standards adds to the cost of the software, as the process of data integration becomes complex owing to the disparate nature of data.

The integration of analytical data of airlines and MRO operations is a critical procedure that involves the computerization of activities at each level. It involves the integration of ERP systems, maintenance, planning, and execution systems, and workforce management systems with dashboards and reporting tools that are used at mid-management and senior management levels. This data needs to be analyzed, segmented, and bifurcated using advanced data modeling tools. Data generated by data centers is required frequently, which results in an additional load on IT servers and IT infrastructure. Thus, the lack of common data standards is restraining the growth of the Digital MRO Industry.

Opportunities: Growing demand for 3D-printed parts and robotic inspection

3D printing of parts offers numerous benefits, including reduced inventory, fuel consumption, and cost; part consolidation; and on-demand manufacturing. Aircraft parts can be 3D printed in-house as and when required, thus helping in reducing inventory stockpiling and the lead time between procuring the part from the vendor. MRO companies can either outsource 3D printing of parts to a 3D printing company or purchase a 3D printer and print the parts on their own. Since 3D-printed parts need to adhere to certain standards and stringent regulations, only vendor-manufactured parts are accepted. MRO companies are using 3D printing for non-critical flight components, but it is expected that with the advancements in 3D printing technologies and materials, critical flight parts will also be 3D printed in the future.

Airlines are turning toward robotics to inspect aircraft. Robotic inspection is expected to increase in the future to increase the agility and accuracy in the inspection of aircraft. Drone-based inspection is gaining traction in the MRO industry. It is expected to not only improve safety but reduce inspection time as well. In October 2021, Proponent (US), a distributor of aircraft parts, and Materialise (Belgium) have joined together to investigate how 3D printing might benefit aerospace OEMs. According to the companies, on-demand manufacturing will be made possible through a digitized supply chain, and 3D printing will be "brought into the procurement domain" to make it easier for MROs to source 3D printed parts.

Challenges: Increasing cybersecurity concerns

As processes get digitalized, concerns regarding their security arise. Software companies are continuously upgrading their solutions to make them unhackable. Airlines and MROs have large pools of sensitive information stored in their IT platforms, including aircraft and parts information, which may get into the wrong hands. Hence, these companies will be at a high risk of cyberattacks, which can cause heavy losses. Lufthansa Technik has access to data from multiple airlines through its Aviator platform. This data can be kept available or hidden, depending on what the host airline is willing to share. Increasing adoption of digitalization would result in a rising rise in cyber-threats and cybercrimes by professional attackers on aerospace organizations to steal crucial aircraft operational data, hence creating a threat to national security. To counter such attacks, sophisticated solutions will be required. Developing such solutions would call for increased investments by software companies.

Digital Mro Market Ecosystem

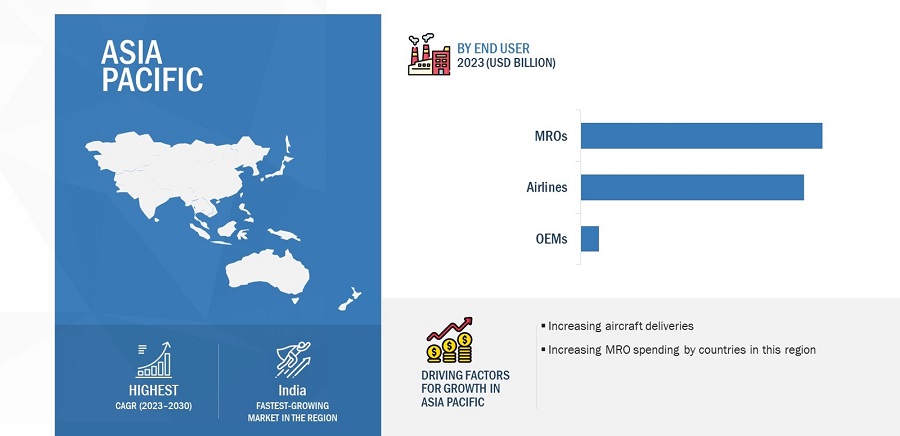

Based on end user, the OEMs segment of the market is projected to grow at the second highest CAGR from 2023 to 2030.

Based on end user, the digital MRO market has been segmented into OEMs, MROs and airlines. The increased need to facilitate real-time data sharing with airlines and MROs is driving the OEM segment of digital MRO market.

Based on technology, the AR/VR segment is projected to grow at the second highest CAGR from 2023 to 2030.

Based on technology, the digital MRO market has been segmented into AR/VR, cloud computing, blockchain, artificial intelligence and big data analytics, robotic, digital twin and simulation, internet of things and 3D printing. The demand for use of AR/VR to train engineers to reduce human errors and need to optimize aviation manufacturing and design process is expected to drive the growth of the AR/VR technology segment in the digital MRO market.

Asia Pacific is expected to account for the highest CAGR in the forecasted period and second largest share in 2023.

Asia Pacific is estimated to account for the highest CAGR in forecasted period and second largest share in 2023. The countries in Asia pacific region offer significant opportunities for digitalization of MRO operations as this region has been heavily investing in the digital technologies. Increased MRO services in this region is expected to drive the digital MRO market.

Digital MRO Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Digital MRO Companies are dominated by a few globally established players such as Airbus (France), Jet Support Servces, Inc. (US), Rusada (Switzerland), Ansys Inc. (US) and Capegemini (France). The report covers various industry trends and new technological innovations in the digital MRO market for the period, 2020-2030.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

13.0% |

|

Estimated Market Size in 2023 |

USD 0.9 Billion |

|

Projected Market Size in 2030 |

USD 2.0 Billion |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Technology, Application, End User |

|

Geographies covered |

North America, Europe, Asia Pacific and RoW |

|

Companies covered |

SAP (Germany), The Boeing Company (US), Ramco Systems (India), IBM (US), Lufthansa Technik (Germany) and others. Total 25 Market Players |

Digital MRO Market Highlights

The study categorizes the Digital MRO market based on technology, application, end user and region.

|

Segment |

Subsegment |

|

By Technology |

|

|

By Application |

|

|

By End User |

|

|

By Region |

|

Recent Developments

- In April 2023, ATR and Swiss-AS have partnered to improve the digitalization of airline maintenance management further. Through this collaboration - a first between an aircraft manufacturer and an MRO software company - the two partners are working hand in hand to improve and customize the integration of ATR maintenance data into the AMOS software provided by Swiss-AS to ATR operators. The aim is to enable airlines to digitalize their maintenance management most efficiently with software tailored to their needs and operational constraints.

- In March 2023, Lufthansa Technik signed two major contracts with Emirates for the MRO of its Airbus A380 fleet. Lufthansa Technik will overhaul the main landing gears of the aircraft and will provide the airline with highly flexible extra capacity for base maintenance such as c-checks, the first time the carrier has outsourced such work from its in-house maintenance team.

- In March 2023, Honeywell International Inc. and Lufthansa Technik are increasing their collaboration in aviation analytics. Honeywell Connected Maintenance analytics are fully integrated into the Predictive Health Analytics (PHA) suite of Lufthansa Technik’s digital platform AVIATAR. This will grow to more than 100 predictors for multiple Airbus and Boeing aircraft types.

- In March 2023, Lufthansa Technik signed two major contracts with Emirates for the MRO of its Airbus A380 fleet. Lufthansa Technik will overhaul the main landing gears of the aircraft and will provide the airline with highly flexible extra capacity for base maintenance such as c-checks, the first time the carrier has outsourced such work from its in-house maintenance team.

- In February 2023, Philippine Airlines, Inc. signed an agreement with Ramco Systems to deploy its state-of-the-art Aviation Suite V5.9. The solution will replace standalone legacy systems, integrating, automating, and enhancing business performances across PAL and its affiliate PAL Express..

Frequently Asked Questions (FAQ):

What is the current size of the digital MRO market?

Response: The digital MRO market is expected to grow from an estimated USD 0.9 billion in 2023 to USD 2.0 billion by 2030 at a CAGR of 13.0% from 2023 to 2030.

Who are the winners in the digital MRO market?

Response: IBM (US), SAP (Germany), Lufthansa Technik (Germany), General Electric (US), and The Boeing Company (US) are some of the winners in the market.

What are some of the opportunities of the digital MRO market?

Response: Growing demand for 3D-printed parts and robotic inspection and Increasing adoption of Internet of Things (IoT), Artificial Intelligence (AI), Blockchain, Augmented Reality (AR) and Big data analytics by MROs are few of the opportunities of the digital MRO market.

What are some of the technological advancements in the market?

Response: Blockchain, Aviation cloud, prescriptive maintainance among others are few technological advancements in the digital MRO market.

What are the factors driving the growth of the digital MRO market?

Rising need for replacing legacy aviation management information systems and growing adoption of software-as-a-service (SaaS) are some of the key factors driving the growth in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for predictive, prescriptive, and condition-based maintenance through data shared by connected aircraft- Growing adoption of Software-as-a-Service (SaaS)- Rising need for replacing legacy aviation management information systemsRESTRAINTS- High acquisition cost of integrated MRO software suite- Lack of common data standardOPPORTUNITIES- Increasing adoption of IoT, AI, blockchain, AR, and big data analytics by MRO- Growing demand for 3D-printed parts and robotic inspectionCHALLENGES- Compliance with stringent aviation regulations- Increasing cybersecurity concerns

-

5.3 DIGITAL MRO MARKET ECOSYSTEMDIGITAL TECHNOLOGY PROVIDERSMROSAIRLINES

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR DIGITAL MRO PLAYERS

-

5.5 TECHNOLOGY ANALYSISINTERNET OF THINGS (IOT)PRESCRIPTIVE MAINTENANCEAUGMENTED REALITYBLOCKCHAIN APPLICATION IN MRO

-

5.6 VALUE CHAIN ANALYSISDESIGN AND ENGINEERINGTECHNOLOGY DEVELOPMENTMAINTENANCE AND SUPPORTSIMULATION AND TRAINING

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 CASE STUDY ANALYSISAIRCRAFT MANUFACTURER ATR ADOPTED DIGITAL MROGE AVIATION PROCURED DIGITAL TWIN FOR MAINTENANCE

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE, BY TECHNOLOGY

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 KEY CONFERENCES AND EVENTS IN 2023–2024

- 6.1 INTRODUCTION

-

6.2 EMERGING TECHNOLOGY TRENDSMAINTENANCE ON-THE-GOAVIATION CLOUDINCREASED MOBILITY3D PRINTINGBIG DATA

- 6.3 IMPACT OF MEGATRENDS–AVIATION CLOUD

-

6.4 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 AR/VRTRAINING- Reduces chances of human errorsOPERATIONS- MROS- Airlines- OEMs

-

7.3 3D PRINTINGREDUCED TIME TO SOURCE PARTS DURING MAINTENANCE

-

7.4 BLOCKCHAINUSES CRYPTOGRAPHY TO ENSURE SECURED DATA

-

7.5 ARTIFICIAL INTELLIGENCE AND BIG DATA ANALYTICSAUTOMATES REPETITIVE TASKS AND OPTIMIZES SUPPLY CHAIN MANAGEMENT

-

7.6 ROBOTICSDRONES- Reduce inspection timeROBOTS- Complete tasks in dangerous or inaccessible areas

-

7.7 DIGITAL TWIN AND SIMULATIONOPTIMIZES MRO PROCESS TO INCREASE EFFECTIVENESS

-

7.8 INTERNET OF THINGSINTEGRATES AR/VR SENSORS ON AIRCRAFT AND ROBOTS

-

7.9 CLOUD COMPUTINGSTORES LARGE VOLUMES OF DATA

- 8.1 INTRODUCTION

-

8.2 INSPECTIONENHANCES ASSET PERFORMANCE

-

8.3 PREDICTIVE MAINTENANCEREDUCES DOWNTIME AND INCREASES OPERATIONAL EFFICIENCY FOR AIRLINES

-

8.4 PARTS REPLACEMENTENABLES IMPROVED PERFORMANCE WITH ON-TIME REPAIR AND REPLACEMENT

-

8.5 PERFORMANCE MONITORINGUSES IOT AND ANALYTICS FOR BETTER MONITORING SOLUTIONS

-

8.6 TRAININGEQUIPS TECHNICIANS WITH EVOLVING TECHNOLOGY AND EQUIPMENT

-

8.7 INVENTORY MANAGEMENTASSISTS IN LOWERING INVENTORY EXPENSES WITH BETTER PURCHASING SELECTIONS

-

8.8 MOBILITYIMPROVES PRODUCTIVITY AND ASSET PERFORMANCE

- 9.1 INTRODUCTION

-

9.2 AIRLINESSMALL AIRLINES- Use of digital MRO solutions to streamline maintenance and repairsMEDIUM AIRLINES- Use sophisticated software for core operationsLARGE AIRLINES- Complete digitalization by sharing real-time data

-

9.3 MROSMALL MROS- Use of cloud-based inventory management systems for enhanced performanceMEDIUM MROS- Shift from ERP module to digitalizationLARGE MROS- Use of digital MRO solutions to optimize maintenance schedules

-

9.4 OEMSAIRCRAFT OEMS- Digital technologies to facilitate real-time data sharing with airlines and MROsENGINE OEMS- Use of data to analyze performance and predict maintenance

- 10.1 INTRODUCTION

- 10.2 REGIONAL RECESSION IMPACT ANALYSIS

-

10.3 NORTH AMERICANORTH AMERICA: PESTLE ANALYSISUS- Increased procurement and upgrades of existing aircraftCANADA- Modernization plans to enhance narrow-body aircraft fleet

-

10.4 EUROPEEUROPE: PESTLE ANALYSISFRANCE- Rapid market expansion through modernization programsUK- Presence of major aircraft OEM subsidiaries to increase demand for MRO servicesGERMANY- Focus on digitalization of IT infrastructureRUSSIA- Upgrading existing aircraft components and procurement of new aircraftSWEDEN- Increased fleet size of leading airlinesSPAIN- High demand for digital MRO from small airlines and OEM facilitiesNETHERLANDS- Need for digitalization of MRO services and expansion of medium MROs and airlinesREST OF EUROPE

-

10.5 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISCHINA- Demand for MRO for narrow-body and wide-body aircraftJAPAN- Increasing aircraft deliveries and need to upgrade existing aircraft systemsINDIA- High demand for MRO services from airlinesSINGAPORE- Increased adoption of MRO servicesREST OF ASIA PACIFIC

-

10.6 REST OF THE WORLDREST OF THE WORLD: PESTLE ANALYSISLATIN AMERICA- Expansion of airline industryMIDDLE EAST- Increased investments in airspace infrastructure and high demand for MRO servicesAFRICA- Increased demand for part replacement MRO services

- 11.1 INTRODUCTION

-

11.2 COMPANY OVERVIEWKEY DEVELOPMENTS/STRATEGIES ADOPTED BY LEADING PLAYERS IN DIGITAL MRO MARKET

- 11.3 RANKING ANALYSIS OF KEY PLAYERS IN DIGITAL MRO MARKET, 2022

- 11.4 REVENUE ANALYSIS, 2022

- 11.5 MARKET SHARE ANALYSIS, 2022

-

11.6 COMPETITIVE EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 11.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORK- Deals- Other developments

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSIBM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHE BOEING COMPANY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSAP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGENERAL ELECTRIC (GE)- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLUFTHANSA TECHNIK- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Services/Solutions offered- Recent developmentsANSYS, INC.- Business overview- Products/Services/Solutions offeredIFS- Business overview- Products/Services/Solutions offered- Recent developmentsAIRBUS- Business overview- Products/Services/Solutions offered- Recent developmentsRAMCO SYSTEMS- Business overview- Products/Services/Solutions offered- Recent developmentsCAPGEMINI- Business overview- Products/Solutions/Services offered- Recent developmentsHEXAWARE TECHNOLOGIES LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsRUSADA- Business overview- Products/Services/Solutions offered- Recent developmentsSWISS AVIATIONSOFTWARE LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsJET SUPPORT SERVICES, INC. (JSSI)- Business overview- Products/Services/Solutions offered- Recent developments

-

12.3 OTHER PLAYERSAIIR INNOVATIONSSITAEON REALITYWINAIRJASORENFUTURE VISUALFOUNTXMAGIC LEAPAEROSTRATEMPOWERMX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 KEY PRIMARY SOURCES

- TABLE 3 DIGITAL MRO MARKET: ROLE IN ECOSYSTEM

- TABLE 4 DIGITAL MRO MARKET: PORTER’S FIVE FORCE ANALYSIS

- TABLE 5 AIRCRAFT MANUFACTURER ATR ADOPTED DIGITAL MRO

- TABLE 6 GE AVIATION PROCURED DIGITAL TWIN FOR MAINTENANCE

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORM TYPES (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 9 DIGITAL MRO MARKET: KEY CONFERENCES AND EVENTS

- TABLE 10 INNOVATIONS AND PATENT REGISTRATIONS, 2018–2022

- TABLE 11 DIGITAL MRO MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 12 DIGITAL MRO MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 13 AR/VR IN DIGITAL MRO MARKET, BY FUNCTION, 2020–2022 (USD MILLION)

- TABLE 14 AR/VR IN DIGITAL MRO MARKET, BY FUNCTION, 2023–2030 (USD MILLION)

- TABLE 15 AR/VR OPERATIONS IN DIGITAL MRO MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 16 AR/VR OPERATIONS IN DIGITAL MRO MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 17 DIGITAL MRO MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 18 DIGITAL MRO MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 19 DIGITAL MRO MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 20 DIGITAL MRO MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 21 DIGITAL MRO MARKET, BY AIRLINE TYPE, 2020–2022 (USD MILLION)

- TABLE 22 DIGITAL MRO MARKET, BY AIRLINE TYPE, 2023–2030 (USD MILLION)

- TABLE 23 DIGITAL MRO MARKET, BY MRO TYPE, 2020–2022 (USD MILLION)

- TABLE 24 DIGITAL MRO MARKET, BY MRO TYPE, 2023–2030 (USD MILLION)

- TABLE 25 DIGITAL MRO MARKET, BY OEM TYPE, 2020–2022 (USD MILLION)

- TABLE 26 DIGITAL MRO MARKET, BY OEM TYPE, 2023–2030 (USD MILLION)

- TABLE 27 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 28 DIGITAL MRO MARKET, BY REGION, 2020−2022 (USD MILLION)

- TABLE 29 DIGITAL MRO MARKET, BY REGION, 2023−2030 (USD MILLION)

- TABLE 30 NORTH AMERICA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 32 NORTH AMERICA: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 34 NORTH AMERICA: DIGITAL MRO MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: DIGITAL MRO MARKET, BY APPLICATION, 2023−2030 (USD MILLION)

- TABLE 36 NORTH AMERICA: DIGITAL MRO MARKET, BY COUNTRY, 2020−2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: DIGITAL MRO MARKET, BY COUNTRY, 2023−2030 (USD MILLION)

- TABLE 38 US: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 39 US: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 40 US: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 41 US: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 42 CANADA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 43 CANADA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 44 CANADA: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 45 CANADA: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 46 EUROPE: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 47 EUROPE: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 48 EUROPE: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 49 EUROPE: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 50 EUROPE: DIGITAL MRO MARKET, BY COUNTRY, 2020−2022 (USD MILLION)

- TABLE 51 EUROPE: DIGITAL MRO MARKET, BY COUNTRY, 2023−2030 (USD MILLION)

- TABLE 52 EUROPE: DIGITAL MRO MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 53 EUROPE: DIGITAL MRO MARKET, BY APPLICATION, 2023−2030 (USD MILLION)

- TABLE 54 FRANCE: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 55 FRANCE: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 56 FRANCE: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 57 FRANCE: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 58 UK: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 59 UK: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 60 UK: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 61 UK: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 62 GERMANY: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 63 GERMANY: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 64 GERMANY: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 65 GERMANY: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 66 RUSSIA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 67 RUSSIA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 68 RUSSIA: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 69 RUSSIA: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 70 SWEDEN: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 71 SWEDEN: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 72 SWEDEN: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 73 SWEDEN: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 74 SPAIN: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 75 SPAIN: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 76 SPAIN: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 77 SPAIN: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 78 NETHERLANDS: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 79 NETHERLANDS: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 80 NETHERLANDS: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 81 NETHERLANDS: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 82 REST OF EUROPE: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 83 REST OF EUROPE: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 84 REST OF EUROPE: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 85 REST OF EUROPE: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: DIGITAL MRO MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: DIGITAL MRO MARKET, BY APPLICATION, 2023−2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: DIGITAL MRO MARKET, BY COUNTRY, 2020−2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: DIGITAL MRO MARKET, BY COUNTRY, 2023−2030 (USD MILLION)

- TABLE 94 CHINA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 95 CHINA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 96 CHINA: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 97 CHINA: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 98 JAPAN: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 99 JAPAN: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 100 JAPAN: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 101 JAPAN: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 102 INDIA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 103 INDIA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 104 INDIA: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 105 INDIA: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 106 SINGAPORE: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 107 SINGAPORE: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 108 SINGAPORE: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 109 SINGAPORE: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 114 REST OF THE WORLD: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 115 REST OF THE WORLD: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 116 REST OF THE WORLD: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 117 REST OF THE WORLD: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 118 REST OF THE WORLD: DIGITAL MRO MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 119 REST OF THE WORLD: DIGITAL MRO MARKET, BY APPLICATION, 2023−2030 (USD MILLION)

- TABLE 120 REST OF THE WORLD: DIGITAL MRO MARKET, BY REGION, 2020−2022 (USD MILLION)

- TABLE 121 REST OF THE WORLD: DIGITAL MRO MARKET, BY REGION, 2023−2030 (USD MILLION)

- TABLE 122 LATIN AMERICA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 123 LATIN AMERICA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 124 LATIN AMERICA: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 125 LATIN AMERICA: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 126 MIDDLE EAST: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 127 MIDDLE EAST: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 128 MIDDLE EAST: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 129 MIDDLE EAST: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 130 AFRICA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2020−2022 (USD MILLION)

- TABLE 131 AFRICA: DIGITAL MRO MARKET, BY TECHNOLOGY, 2023−2030 (USD MILLION)

- TABLE 132 AFRICA: DIGITAL MRO MARKET, BY END USER, 2020−2022 (USD MILLION)

- TABLE 133 AFRICA: DIGITAL MRO MARKET, BY END USER, 2023−2030 (USD MILLION)

- TABLE 134 DIGITAL MRO MARKET: DEGREE OF COMPETITION

- TABLE 135 DIGITAL MRO MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 136 DIGITAL MRO MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 137 COMPANY FOOTPRINT

- TABLE 138 COMPANY TYPE FOOTPRINT

- TABLE 139 DEALS, 2020–2023

- TABLE 140 OTHER DEVELOPMENTS, 2020–2022

- TABLE 141 IBM: COMPANY OVERVIEW

- TABLE 142 IBM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 143 IBM: DEALS

- TABLE 144 IBM: OTHER DEVELOPMENTS

- TABLE 145 THE BOEING COMPANY: COMPANY OVERVIEW

- TABLE 146 THE BOEING COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 147 THE BOEING COMPANY: DEALS

- TABLE 148 SAP: COMPANY OVERVIEW

- TABLE 149 SAP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 150 SAP: DEALS

- TABLE 151 GENERAL ELECTRIC (GE): COMPANY OVERVIEW

- TABLE 152 GENERAL ELECTRIC (GE): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 153 GENERAL ELECTRIC (GE): DEALS

- TABLE 154 LUFTHANSA TECHNIK: COMPANY OVERVIEW

- TABLE 155 LUFTHANSA TECHNIK: PRODUCTS /SERVICES/SOLUTIONS OFFERED

- TABLE 156 LUFTHANSA TECHNIK: DEALS

- TABLE 157 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 158 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 159 HONEYWELL INTERNATIONAL INC: DEALS

- TABLE 160 ANSYS, INC.: COMPANY OVERVIEW

- TABLE 161 ANSYS, INC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 162 IFS: COMPANY OVERVIEW

- TABLE 163 IFS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 IFS: DEALS

- TABLE 165 AIRBUS: COMPANY OVERVIEW

- TABLE 166 AIRBUS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 AIRBUS: DEALS

- TABLE 168 RAMCO SYSTEMS: COMPANY OVERVIEW

- TABLE 169 RAMCO SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 RAMCO SYSTEMS: DEALS

- TABLE 171 CAPGEMINI: COMPANY OVERVIEW

- TABLE 172 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 HEXAWARE TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 174 HEXAWARE TECHNOLOGIES LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 175 RUSADA: COMPANY OVERVIEW

- TABLE 176 RUSADA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 RUSADA: DEALS

- TABLE 178 SWISS AVIATIONSOFTWARE LTD.: COMPANY OVERVIEW

- TABLE 179 SWISS AVIATIONSOFTWARE LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 180 SWISS AVIATIONSOFTWARE LTD.: DEALS

- TABLE 181 JET SUPPORT SERVICES, INC. (JSSI): COMPANY OVERVIEW

- TABLE 182 JET SUPPORT SERVICES, INC. (JSSI): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 JET SUPPORT SERVICES, INC. (JSSI): OTHERS

- TABLE 184 AIIR INNOVATIONS: COMPANY OVERVIEW

- TABLE 185 SITA: COMPANY OVERVIEW

- TABLE 186 EON REALITY: COMPANY OVERVIEW

- TABLE 187 WINAIR: COMPANY OVERVIEW

- TABLE 188 JASOREN: COMPANY OVERVIEW

- TABLE 189 FUTURE VISUAL: COMPANY OVERVIEW

- TABLE 190 FOUNTX: COMPANY OVERVIEW

- TABLE 191 MAGIC LEAP: COMPANY OVERVIEW

- TABLE 192 AEROSTRAT: COMPANY OVERVIEW

- TABLE 193 EMPOWERMX: COMPANY OVERVIEW

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 RESEARCH ASSUMPTIONS

- FIGURE 7 MROS SEGMENT TO DOMINATE MARKET FROM 2023 TO 2030

- FIGURE 8 ARTIFICIAL INTELLIGENCE AND BIG DATA ANALYTICS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 PREDICTIVE MAINTENANCE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2023 TO 2030

- FIGURE 11 INCREASED ADOPTION OF AR/VR, BIG DATA, AND AI TO DRIVE MARKET

- FIGURE 12 PREDICTIVE MAINTENANCE TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC DIGITAL MRO MARKET IN 2023

- FIGURE 13 MROS SEGMENT OF EUROPEAN DIGITAL MRO MARKET TO GROW FASTEST RATE FROM 2023 TO 2030

- FIGURE 14 DIGITAL MRO MARKET IN INDIA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DIGITAL MRO MARKET

- FIGURE 16 DIGITAL MRO MARKET: ECOSYSTEM MAPPING

- FIGURE 17 DIGITAL MRO MARKET: REVENUE SHIFT

- FIGURE 18 DIGITAL MRO MARKET: VALUE CHAIN MODEL

- FIGURE 19 DIGITAL MRO MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 DIGITAL MRO MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 AVERAGE SELLING PRICES OF DIGITAL MRO, BY TECHNOLOGY

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOLUTIONS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 24 ARTIFICIAL INTELLIGENCE AND BIG DATA ANALYTICS SEGMENT TO LEAD DIGITAL MRO MARKET DURING FORECAST PERIOD

- FIGURE 25 PREDICTIVE MAINTENANCE SEGMENT TO LEAD DIGITAL MRO MARKET DURING FORECAST PERIOD

- FIGURE 26 MROS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN DIGITAL MRO MARKET DURING FORECAST PERIOD

- FIGURE 27 ASIA PACIFIC TO BE LARGEST DIGITAL MRO MARKET IN 2023

- FIGURE 28 NORTH AMERICA: DIGITAL MRO MARKET SNAPSHOT

- FIGURE 29 EUROPE: DIGITAL MRO MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: DIGITAL MRO MARKET SNAPSHOT

- FIGURE 31 REST OF THE WORLD: DIGITAL MRO MARKET SNAPSHOT

- FIGURE 32 RANKING OF KEY PLAYERS IN DIGITAL MRO MARKET, 2022

- FIGURE 33 REVENUE ANALYSIS OF KEY COMPANIES IN DIGITAL MRO MARKET, 2020–2022

- FIGURE 34 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 35 DIGITAL MRO MARKET: COMPETITIVE LEADERSHIP MAPPING OF KEY PLAYERS, 2022

- FIGURE 36 DIGITAL MRO MARKET: COMPETITIVE LEADERSHIP MAPPING OF STARTUPS/SMES, 2022

- FIGURE 37 IBM: COMPANY SNAPSHOT

- FIGURE 38 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 39 SAP: COMPANY SNAPSHOT

- FIGURE 40 GENERAL ELECTRIC (GE): COMPANY SNAPSHOT

- FIGURE 41 LUFTHANSA TECHNIK: COMPANY SNAPSHOT

- FIGURE 42 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 43 ANSYS, INC.: COMPANY SNAPSHOT

- FIGURE 44 IFS: COMPANY SNAPSHOT

- FIGURE 45 AIRBUS: COMPANY SNAPSHOT

- FIGURE 46 RAMCO SYSTEMS: COMPANY SNAPSHOT

- FIGURE 47 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 48 HEXAWARE TECHNOLOGIES LIMITED: COMPANY SNAPSHOT

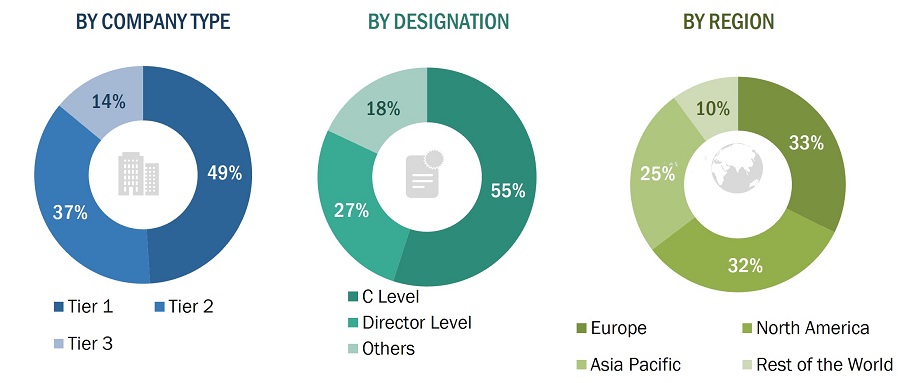

This research study on the digital MRO market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva, to identify and collect information relevant to the market. The primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain in this industry. In-depth interviews with various primary respondents, including key industry participants, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the digital MRO market and to assess its growth prospects.

Secondary Research

The ranking analysis of companies in the digital MRO market was determined using secondary data from paid and unpaid sources and by analyzing the product portfolios of major companies. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study included financial statements of companies offering advanced MRO solutions and robotics and various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the digital MRO market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across regions, namely, North America, Europe, Asia Pacific, and Rest of the World. This data was collected through questionnaires, emails, and telephonic interviews. In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), and directors, from business development, marketing, and product development/innovation teams, and related key executives from digital MRO vendors.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Digital MRO is an upcoming and emerging market that has been enabled due to advancements in technologies and innovations to simplify complex processes. Both top-down and bottom-up approaches were used to estimate and validate the market size. The research methodology used to estimate the market size also includes the following.

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Research Approach and Methodology Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the digital MRO market by estimating the revenues of key players and their shares in the market. The average selling price for different types of advanced digital technologies was derived for key countries. This price was multiplied by the total numbers of MROs, airlines, and OEMs and the adoption rate of digital technologies to arrive at the market size at the country level. Values obtained for multiple countries were summed up to arrive at the regional market size and the global market size.

Top Down Approach

segments through percentage splits obtained from primary and secondary research. For the calculation of the size of specific market segments, the size of the immediate parent market was used to implement the top-down approach. The bottom-up approach was also implemented to validate the revenues obtained for various segments.

Market share was estimated for each company to verify revenue shares used in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the sizes of the parent market and each individual segment were determined and confirmed in this study.

Market Definition

Digital Maintenance, Repair, And Overhaul (MRO) is the implementation of digital technologies in the maintenance, repair, and overhaul procedures of the aviation sector. Data analytics, artificial intelligence, and other cutting-edge technologies are integrated to streamline aviation maintenance and repair processes, cut downtime, and boost safety and reliability. The implementation of digital MRO is anticipated to revolutionize the aviation sector by raising standards for reliability, efficiency, and safety while lowering expenses and downtime.

Key Stakeholders

- Aircraft MROs

- Airlines and Aircraft Operators

- Aircraft Manufacturers

- Aircraft Engine Manufacturers

- Regulatory Bodies

- Research Institutes and Organizations

- Wholesalers, Retailers, and Distributors of MRO Software and Services

Objectives of the Report

- To define, describe, segment, and forecast the size of the digital maintenance, repair, and overhaul (MRO) market based on end user, technology, application, and region for the forecast period from 2023 to 2030

- To forecast the size of various segments of the digital MRO market with respect to 4 major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), along with the major countries in each of these regions

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the digital MRO market

- To identify and analyze various regional contracts in the digital MRO market

- To identify industry trends, market trends, and technology trends currently prevailing in the digital MRO market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the degree of competition in the digital MRO market by identifying key market players

- To analyze competitive developments such as contracts, acquisitions, partnerships, agreements, collaborations, funding, and new product launches & developments of key players in the digital MRO market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the digital MRO market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the digital MRO market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital MRO Market

Interested in market developments within the MRO and digital services markets for aerospace and defense.