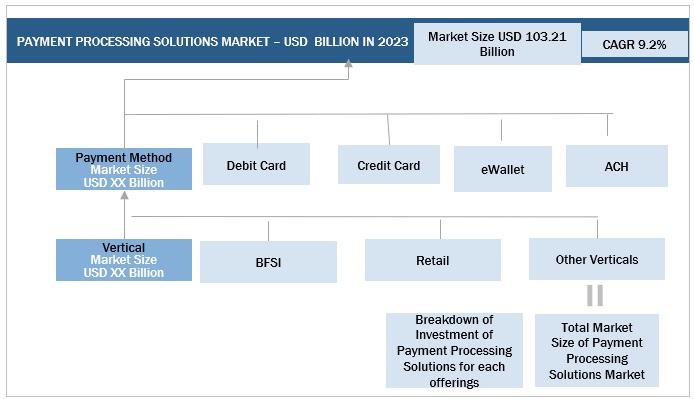

Payment Processing Solutions Market by Payment Method (Debit Card, Credit Card, ACH, eWallet), Vertical (BFSI, Retail, Healthcare, Telecom, Travel & Hospitality, Real Estate), and Region(North America, Europe, APAC, RoW) - Global Forecast to 2028

Updated on : Nov 17, 2025

Payment Processing Solutions Market Summary

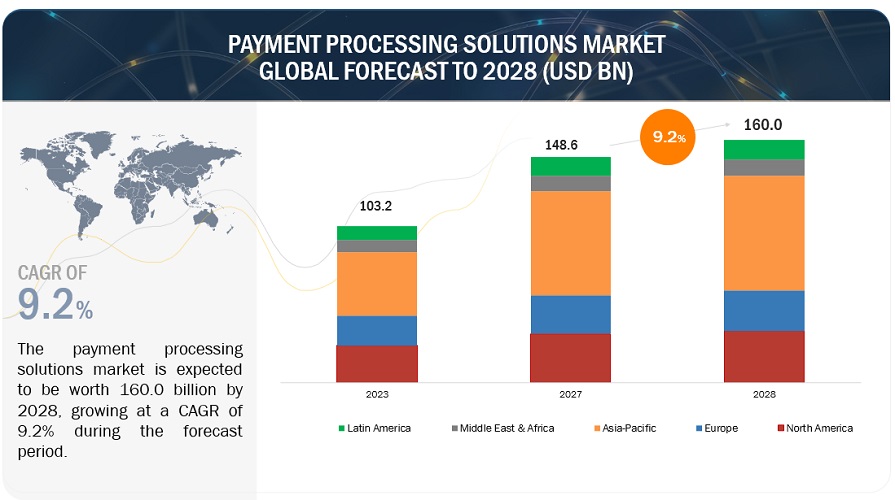

The global payment processing solutions market size was estimated at USD 103.2 billion in 2023 and is projected to reach USD 160.0 billion by 2028, growing at a CAGR of 9.2% from 2023 to 2028. Growth is driven by governments and financial institutions promoting cashless transactions to enhance transparency, combat financial crimes, and reduce reliance on physical currency.

Payment Processing Solutions Market Key Trends & Insights

- Increasing Focus on Security and Fraud Prevention: Advanced encryption techniques and two-factor authentication are enhancing secure payment transactions, building consumer trust and mitigating financial risks.

- Lack of Digital Literacy in Emerging Countries: Low digital literacy rates, particularly in African nations, limit adoption of online and mobile payments and slow market growth.

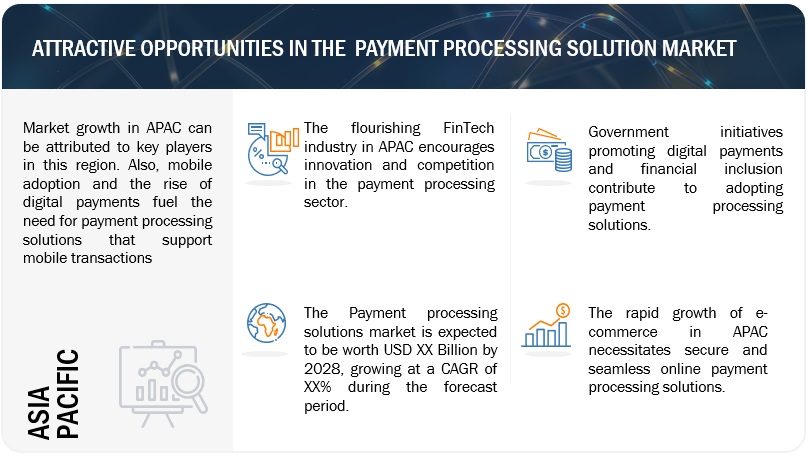

- Global E-commerce Growth: Rising online shopping and mobile payments create demand for secure, seamless payment processing solutions supporting multiple payment methods.

- Regulatory Compliance Challenges: Adhering to PCI DSS, GDPR, AML/CFT, and KYC requirements demands significant investments and continuous monitoring.

- eWallet Adoption: E-wallets with encryption, tokenization, NFC, and QR code integration are driving mobile and contactless payments, boosting cross-border transactions and loyalty program engagement.

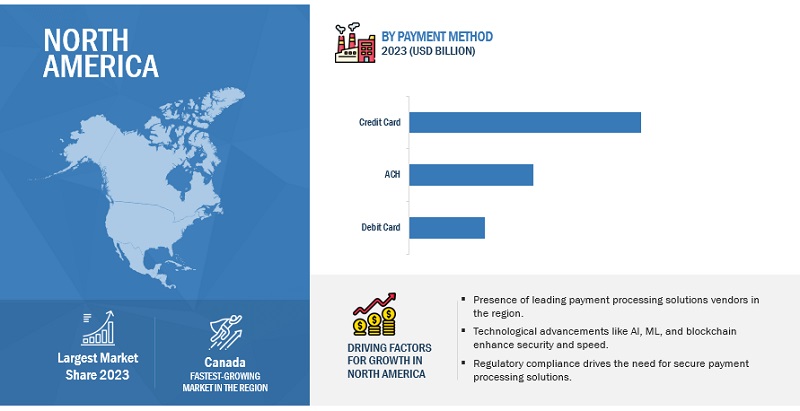

- North America Market: Second-largest regional market, led by the US and Canada, with strong R&D, innovation, and strategic partnerships between payment processors and financial institutions.

Payment Processing Solutions Market Size & Forecast

- 2023 Market Size: USD 103.2 Billion

- 2028 Projected Market Size: USD 160.0 Billion

- CAGR (2023–2028): 9.2%

- Largest Market in 2023: North America

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Payment Processing Solutions Market Dynamics

Driver: Increasing Focus on Security and Fraud Prevention

The increasing focus on security and fraud prevention in payment processing solutions is driven by the need to build consumer trust, protect sensitive payment information, and mitigate financial risks associated with fraudulent activities. By implementing robust security measures and fraud prevention techniques, payment processors and merchants can ensure secure and reliable payment transactions, fostering customer confidence in digital payment systems.

Encryption techniques ensure that payment data is transmitted securely between the customer, merchant, and payment processor. This encryption safeguards the payment information from unauthorized access or interception by encrypting it into unreadable code. Also, Two-factor authentication adds an extra layer of security to payment processing. It requires users to provide additional verification, such as a one-time password (OTP) sent to their registered mobile device and their regular login credentials. This authentication method helps ensure that only authorized users can initiate and complete payment transactions.

Restraint: Lack of digital literacy in emerging countries

Many emerging countries still lack digital literacy, which hinders the wide-scale adoption of online and mobile payments, and in turn, negatively impacts the market growth of payment processing solutions. Digital literacy comprises a wide range of skills, such as the ability to read and make sense of the technical knowledge that helps individuals operate and make use of digital technologies. Most countries in the African continent have a very low digital literacy rate, and due to this, individuals are unable to exploit the potential of digital technologies. Technology vendors are also hesitant in making investments due to the low number of digital transactions. Hence, low digital literacy in emerging countries is expected to slow down the growth of the payment processing solutions market.

Opportunity: Global e-commerce growth

The continuous growth of e-commerce presents a significant opportunity for payment processing solutions. As more businesses establish online presence and consumers increasingly shop online, the demand for secure, seamless, and reliable payment processing solutions will continue to rise. This includes supporting various payment methods, such as credit/debit cards, digital wallets, and alternative payment options, to cater to diverse customer preferences. Also, the increasing adoption of mobile payment methods in e-commerce sector offers a substantial opportunity for payment processing solutions. With the widespread use of smartphones and the convenience of mobile apps, consumers are increasingly embracing mobile payment solutions. Payment processors that offer robust mobile payment capabilities, including in-app payments and mobile point-of-sale (mPOS) solutions, can tap into this growing market segment.

Challenge: Regulatory compliance

The payment processing industry is subject to a complex and evolving regulatory landscape. Compliance with regulations such as Payment Card Industry Data Security Standard (PCI DSS), General Data Protection Regulation (GDPR), Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) and Know Your Customer (KYC) requirements can be challenging for payment processors and merchants. Adhering to these regulations requires significant investments in infrastructure, resources, and ongoing monitoring to ensure compliance, which can pose challenges, particularly for small businesses.

Some jurisdictions have regulations requiring the localization of payment data or imposing restrictions on cross-border data transfer. Compliance with these regulations can be challenging, particularly for global payment processors that process and store data across different locations. Payment processors must navigate these regulations while ensuring data security and implementing appropriate data transfer mechanisms, such as binding corporate rules or standard contractual clauses. Non-compliance with regulatory requirements can result in significant penalties, fines, reputational damage, and legal consequences. Payment processors must establish robust compliance programs, conduct internal audits, and implement effective risk management and monitoring systems to ensure regulation adherence. They must also keep track of regulatory updates and proactively address any compliance gaps.

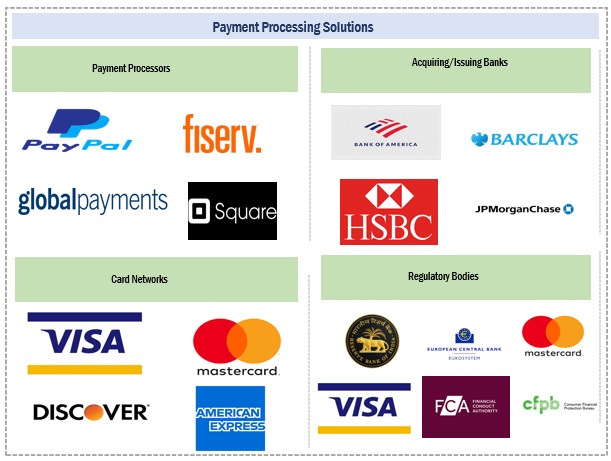

Payment Processing Solutions Market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of payment processing solutions. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include PayPal, Fiserv, global payments, and Mastercard.

By payment method, eWallet method is expected to register higher CAGR during forecast period

eWallets have become instrumental in facilitating seamless and secure mobile payments, allowing users to make transactions conveniently using their smartphones or other mobile devices. With advanced security measures like encryption and tokenization, e-wallets instill trust in consumers and encourage the adoption of digital payment methods, fueling the demand for payment processing solutions supporting e-wallet transactions. Additionally, the rise of contactless payments, driven by e-wallets' integration with NFC technology and QR codes, further contributes to the market's growth. E-wallets have a global reach, enabling cross-border transactions and attracting businesses seeking to expand internationally. Loyalty programs and incentives offered by e-wallets also boost user engagement and drive the usage of these digital payment solutions. As e-wallet adoption continues to soar, payment processing solutions providers are incorporating e-wallet integration to meet the evolving demands of consumers and businesses alike.

Based on region, North America is the largest market size during the forecast period

The payment processing solutions market in North America is characterized by intense competition, primarily driven by the United States and Canada's strong emphasis on research and development (R&D) and innovation. North America has consistently been a global leader in payment technology and the retail and financial services sectors.

Various initiatives, including partnerships and collaborations propel the region's payment processing solutions market. In the United States, for example, strategic alliances are growing between payment processors and banks or card issuers. This collaboration is aimed at offering enhanced services to individuals and small businesses. One notable partnership between PayPal and several financial institutions enables individuals and small businesses to access their funds quickly through the Instant Transfer feature.

Market Players:

The major vendors in this payment processing solutions industry include PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Square (US), Mastercard (US), Visa (US), Adyen (Netherland), Stripe (US), PayU (Netherland), Jack Henry & Associates (US), Paysafe (UK), PhonePe (India), Razorpay (India), Secure Payment Systems (US), Worldline (France), Spreedly (US), Fattmerchant (US), North American Bancard (US), Dwolla (US), CCBill (US), Authorize.Net (US), Alipay (China), PayProTec (US), SignaPay (US), Klik & Pay (Switzerland), Finix Payments (US), Due (US), Pineapple Payments (US), Modulr (UK), MuchBetter (UK), Paykickstart (US), AeroPay (US), and Sila (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the payment processing solutions market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By payment method, vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Square (US), Mastercard (US), Visa (US), Adyen (Netherland), Stripe (US), PayU (Netherland), Jack Henry & Associates (US), Paysafe (UK), PhonePe (India), Razorpay (India), Secure Payment Systems (US), Worldline (France), Spreedly (US), Fattmerchant (US), North American Bancard (US), Dwolla (US), CCBill (US), Authorize.Net (US), Alipay (China), PayProTec (US), SignaPay (US), Klik & Pay (Switzerland), Finix Payments (US), Due (US), Pineapple Payments (US), Modulr (UK), MuchBetter (UK), Paykickstart (US), AeroPay (US), and Sila (US). |

This research report categorizes the payment processing solutions market to forecast revenues and analyze trends in each of the following submarkets:

Based on payment method:

- Credit Card

- Debit Card

- eWallet

- Automatic Cleaning House (ACH)

- Other Payment Methods

Based on vertical:

- BFSI

- Government And Utilities

- Telecom

- Healthcare

- Real Estate

- Retail

- Media And Entertainment

- Travel And Hospitality

- Other Vertical

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Rest of Asia Pacific

-

Middle East and Africa

- UAE

- KSA

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2023, Visa acquired Pismo, to provide core banking and issuer processing capabilities across debit, prepaid, credit, and commercial cards for clients via cloud-native APIs and also provide support and connectivity for emerging payment rails, like Pix in Brazil, for financial institution clients.

- In May 2023, ACI Worldwide announced its collaboration with Red Hat OpenShift, to enable financial institutions and payment providers to utilize ACI solutions on the platform.

- In February 2022, PayPal’s investment in Skipify would allow Skipify to introduce frictionless checkout experiences for millions of shoppers and merchants alike by simplifying and streamlining the checkout process.

- In May 2022, Afterpay, a company acquired by Square, partnered with Rite Aid, to offer online shoppers to pay for everyday items in four installments at no additional cost.

Frequently Asked Questions (FAQ):

What is Payment Processing Solution?

A payment processing solution refers to a system or service that facilitates the electronic processing of financial transactions. It involves the secure transfer of funds from a customer to a merchant, typically for goods or services purchased. Payment processing solutions encompass various components, including payment gateways, merchant accounts, and back-end infrastructure that handle transaction authorization, settlement, and reconciliation. These solutions enable businesses to accept payments through various channels, such as credit cards, debit cards, digital wallets, and online banking. The primary purpose of payment processing solutions is to ensure the secure, efficient, and reliable processing of electronic payments, providing convenience for both businesses and consumers.

What is the market size of the payment processing solutions market?

The payment processing solutions market size is projected to grow from USD 103.2 billion in 2023 to USD 160.0 billion by 2028, at a CAGR of 9.2% during the forecast period.

What are the major drivers in the payment processing solutions market?

The key drivers of payment processing solutions include the growing popularity of digital payments, fueled by smartphone adoption and e-commerce growth. Advanced technologies, regulatory changes, and customer expectations for seamless experiences also contribute to the demand for secure and efficient payment processing solutions. Partnerships and collaborations further drive market growth and innovation.

Who are the key players operating in the payment processing solutions market?

The key vendors operating in the payment processing solutions market include PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Square (US), Mastercard (US), Visa (US), Adyen (Netherland), Stripe (US), PayU (Netherland), Jack Henry & Associates (US), Paysafe (UK), PhonePe (India), Razorpay (India), Secure Payment Systems (US), Worldline (France), Spreedly (US), Fattmerchant (US), North American Bancard (US), Dwolla (US), CCBill (US), Authorize.Net (US), Alipay (China), PayProTec (US), SignaPay (US), Klik & Pay (Switzerland), Finix Payments (US), Due (US), Pineapple Payments (US), Modulr (UK), MuchBetter (UK), Paykickstart (US), AeroPay (US), and Sila (US).

What are the opportunities for new market entrants in the payment processing solutions market?

New payment processing solutions market entrants have opportunities to tap into the growing global demand for digital payments, particularly in emerging markets. They can differentiate themselves by targeting specific industries or niche markets and leveraging advanced technologies. Strategic partnerships and a focus on delivering exceptional customer experiences can also contribute to their success in this competitive market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing eCommerce sales along with growing internet penetration- Embracing contactless payments globally- Evolving customer expectations- Rising use of mCommerce in transportation industry- Increasing focus on security and fraud preventionRESTRAINTS- Absence of global standards for cross-border transactions- Lack of digital literacy in emerging countries- Technical limitations and resistance to changeOPPORTUNITIES- Rising financial inclusion globally- Rising government and private initiatives to promote digital transactions- Global growth of eCommerceCHALLENGES- Threat of increasing cyberattacks on digital payment solutions- Regulatory compliance

- 5.3 REGULATORY LANDSCAPE

-

5.4 INDUSTRY TRENDSUSE CASES- Use case 1: PayPal- Use case 2: FIS- Use case 3: PayU- Use case 4: Stripe- Use case 5: SquareBEST PRACTICES IN PAYMENT PROCESSING SOLUTIONS MARKETVALUE CHAIN ANALYSISBRIEF HISTORY OF PAYMENT PROCESSING SOLUTIONS- 2000–2010- 2010–2020- 2020–PresentECOSYSTEMPATENT ANALYSIS- Methodology- Document type- Innovation and patent applications- Top applicantsPRICING ANALYSIS- Average selling price of key players- Average selling price trendIMPACT OF PAYMENT PROCESSING SOLUTIONS ON ADJACENT TECHNOLOGIES- Technology AnalysisTRENDS AND DISRUPTIONS IMPACTING BUYERSPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryKEY CONFERENCES & EVENTS IN 2023–24KEY STAKEHOLDERS & BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaFUTURE DIRECTION OF PAYMENT PROCESSING SOLUTIONS MARKET

-

6.1 INTRODUCTIONPAYMENT METHOD: MARKET DRIVERS

-

6.2 EWALLETINCREASING PAYMENTS BY MOBILE DEVICES TO DRIVE PAYMENT SOLUTIONS MARKET GROWTH

-

6.3 CREDIT CARDGROWING CREDIT CARD USERS TO BOOST MARKET GROWTH

-

6.4 DEBIT CARDEXCLUSIVE USE OF SOME DEBIT CARDS ON INTERNET TO DRIVE PAYMENT PROCESSING SOLUTIONS MARKET GROWTH

-

6.5 AUTOMATIC CLEARING HOUSEDEVELOPING ACH TRANSFERS WITH INCREASING SECURITY TO FUEL DEMAND FOR PAYMENT PROCESSING SOLUTIONS

- 6.6 OTHER PAYMENT METHODS

-

7.1 INTRODUCTIONVERTICAL: MARKET DRIVERS

-

7.2 BANKING, FINANCIAL SERVICES, AND INSURANCEINCREASING ADOPTION OF ADVANCED TECHNOLOGIES IN BFSI SECTOR TO DRIVE MARKET GROWTHUSE CASE- To bring powerful payment optimization tools and multiple payment methods for better customer checkout experience- FIS helped River City Bank to strengthen business continuity, regulatory compliance, and resiliency

-

7.3 GOVERNMENT AND UTILITIESGROWING SUPPORT FOR PAYMENT SOLUTIONS IN GOVERNMENT AND UTILITIES TO DRIVE MARKETUSE CASE- Need to look for new ways to engage attendees and increase sales at events- Baxter Credit Union made collection process more efficient and accessible

-

7.4 TELECOMGROWING ADOPTION OF DIGITALIZATION AND INCREASING USE OF SMARTPHONES TO DRIVE MARKET GROWTHUSE CASE- ACI payments orchestration platform used to increase revenue visibility and reduce leakage- PayPal paired with telecom giants in Europe and Latin America

-

7.5 HEALTHCAREGROWING NEED TO STREAMLINE OPERATIONS AND IMPROVE OVERALL ORGANIZATION EFFICIENCY TO DRIVE MARKET GROWTHUSE CASE- Need to help practitioners be more efficient, better collaborate with peers, and improve patient experience- Electronic payments enabled dynamic growth for leading healthcare services company

-

7.6 REAL ESTATEGROWING NEED TO MAKE TRANSACTIONS SAFE AND SECURE DIGITALLY TO LEAD TO SIGNIFICANT MARKET GROWTHUSE CASE- Developing unified API solutions to support market- Need to improve payment methods and operational efficiency to drive market growth

-

7.7 RETAILINCREASING NEED TO PROVIDE BETTER CUSTOMER EXPERIENCE AND REDUCE TRANSACTION TIME TO DRIVE MARKET GROWTHUSE CASE- Enhancing customer security with more verification systems- Enhancing customer experience with better payment solutions- To simplify cross-border payments, Amazon used Stripe- Decathlon collaborated with Stripe to support payments for new coaches and sports classes

-

7.8 MEDIA AND ENTERTAINMENTINCREASING PENETRATION OF SMARTPHONES AND OTHER PAYMENT DEVICES TO DRIVE MARKET GROWTHUSE CASE- Need to make it easy for customers to offer omnichannel experience- Agua Bendita expanded internationally with payment processing solutions from Stripe and VTEX

-

7.9 TRAVEL AND HOSPITALITYINCREASING NEED FOR DIGITAL PAYMENT TECHNOLOGIES IN TRAVEL AND HOSPITALITY INDUSTRY TO DRIVE MARKETUSE CASE- Ireland’s Mount Errigal hotel switched to Worldpay to make seamless payment improvements- Aegean Airlines used ACI Worldwide fraud prevention solution to increase efficiency and payment management

- 7.10 OTHER VERTICALS

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Presence of key payment processing solutions players in US to drive market growthCANADA- Increasing technological advancements for payment solutions to drive market growth

-

8.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Major investments by public and private sectors to drive marketGERMANY- Multiple organizations stepping up in payment processing industry to drive market growthFRANCE- Significant investments by government to drive market growthITALY- Major opportunities for payment processing solution vendors in Italy to drive market growthNORDIC COUNTRIESREST OF EUROPE

-

8.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Increasing payment transactions to boost market growth in ChinaINDIA- Digitalization across business verticals to drive market in IndiaJAPAN- Better customer experience in payment processing to drive market growthANZ- Increasing advancements in payment technologies to drive market growthREST OF ASIA PACIFIC

-

8.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTUAE- Growing need for innovations to drive market in UAEKSA- Government initiatives to develop advanced logistics and transportation systems to fuel market growthSOUTH AFRICA- Need to modernize payment methods leading to significant market growthREST OF MIDDLE EAST & AFRICA

-

8.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Increasing penetration of mobiles and other payment devices in Brazil to drive market growthMEXICO- Growing digital innovations and technological advancements to drive marketREST OF LATIN AMERICA

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 COMPETITIVE SCENARIO

- 9.4 MARKET SHARE ANALYSIS

- 9.5 HISTORICAL REVENUE ANALYSIS

- 9.6 RANKING OF KEY PLAYERS IN MARKET, 2023

-

9.7 COMPANY EVALUATION QUADRANT METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.8 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 9.9 COMPETITIVE BENCHMARKING

-

9.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

- 9.11 VALUATION AND FINANCIAL METRICS OF KEY PAYMENT PROCESSING SOLUTIONS VENDORS

-

10.1 MAJOR PLAYERSPAYPAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFISERV- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFIS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGLOBAL PAYMENTS- Business overview- Solutions offered- Recent developments- MnM viewACI WORLDWIDE- Business overview- Solutions offered- Recent developmentsSQUARE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMASTERCARD- Business overview- Products/Solutions/Services offered- Recent developmentsVISA- Business overview- Products/Solutions/Services offered- Recent developmentsADYEN- Business overview- Products/Solutions/Services offered- Recent developmentsSTRIPE- Business overview- Products/Solutions/Services offered- Recent developmentsPAYU- Business overview- Products/Solutions/Services offered- Recent developmentsJACK HENRY & ASSOCIATESPAYSAFEPHONEPERAZORPAY

-

10.2 OTHER PLAYERS/STARTUPSSECURE PAYMENT SYSTEMSWORLDLINESPREEDLYFATTMERCHANTNORTH AMERICAN BANCARDDWOLLACCBILLAUTHORIZE.NETALIPAYPAYPROTECSIGNAPAYKLIKNPAYFINIX PAYMENTSDUEPINEAPPLE PAYMENTSMODULRMUCHBETTERPAYKICKSTARTAEROPAYSILA

- 11.1 INTRODUCTION TO ADJACENT MARKETS

- 11.2 LIMITATIONS

- 11.3 DIGITAL PAYMENT MARKET

- 11.4 FINTECH AS A SERVICE MARKET

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD: INCLUSIONS & EXCLUSIONS

- TABLE 2 MARKET, BY VERTICAL: INCLUSIONS & EXCLUSIONS

- TABLE 3 USD EXCHANGE RATES, 2020–2022

- TABLE 4 FACTOR ANALYSIS

- TABLE 5 STUDY ASSUMPTIONS

- TABLE 6 PAYMENT PROCESSING SOLUTIONS MARKET: ECOSYSTEM

- TABLE 7 PATENTS FILED, 2020–2023

- TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS

- TABLE 9 DIGITAL TECHNOLOGY ENABLERS, THEIR BENEFITS, AND EXAMPLES IN PAYMENT PROCESSING SOLUTIONS MARKET

- TABLE 10MARKET: PORTER’S FIVE FORCES MODEL

- TABLE 11 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 14 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 15 MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 16 EWALLET: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 17 EWALLET: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 CREDIT CARD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 CREDIT CARD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 DEBIT CARD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 DEBIT CARD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 AUTOMATIC CLEARING HOUSE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 AUTOMATIC CLEARING HOUSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 OTHER PAYMENT METHODS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 OTHER PAYMENT METHODS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 27 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 28 BFSI: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 GOVERNMENT AND UTILITIES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 GOVERNMENT AND UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 TELECOM: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 HEALTHCARE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 REAL ESTATE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 REAL ESTATE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 RETAIL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 RETAIL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 OTHER VERTICALS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 49 NORTH AMERICA: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 51 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 54 US: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 55 US: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 56 US: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 57 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 58 CANADA: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 59 CANADA: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 60 CANADA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 61 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 62 EUROPE: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 63 EUROPE: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 64 EUROPE: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 65 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 66 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 67 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 68 UK: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 69 UK: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 70 UK: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 71 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 72 GERMANY: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 73 GERMANY: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 74 GERMANY: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 75 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 76 FRANCE: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 77 FRANCE: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 78 FRANCE: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 79 FRANCE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 80 ITALY: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 81 ITALY: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 82 ITALY: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 83 ITALY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 84 NORDIC COUNTRIES: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 85 NORDIC COUNTRIES: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 86 NORDIC COUNTRIES: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 87 NORDIC COUNTRIES: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 CHINA: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 95 CHINA: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 96 CHINA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 97 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 98 INDIA: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 99 INDIA: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 100 INDIA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 101 INDIA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 102 JAPAN: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 103 JAPAN: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 104 JAPAN: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 105 JAPAN: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 106 ANZ: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 107 ANZ: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 108 ANZ: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 109 ANZ: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 UAE: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 117 UAE: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 118 UAE: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 119 UAE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 120 KSA: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 121 KSA: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 122 KSA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 123 KSA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 124 SOUTH AFRICA: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 125 SOUTH AFRICA: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 126 SOUTH AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 127 SOUTH AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 129 LATIN AMERICA: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 130 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 131 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 133 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 134 BRAZIL: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 135 BRAZIL: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 136 BRAZIL: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 137 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 138 MEXICO: MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 139 MEXICO: MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 140 MEXICO: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 141 MEXICO: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 142 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MARKET

- TABLE 143 PAYMENT PROCESSING SOLUTIONS MARKET: DEGREE OF COMPETITION

- TABLE 144 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 145 COMPANY FOOTPRINT ANALYSIS: MARKET

- TABLE 146 COMPANY VERTICAL FOOTPRINT: PAYMENT PROCESSING SOLUTIONS MARKET

- TABLE 147 COMPANY REGION FOOTPRINT: MARKET

- TABLE 148 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 149 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY VERTICAL

- TABLE 150 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- TABLE 151 PAYMENT PROCESSING SOLUTIONS MARKET: PRODUCT LAUNCHES, 2017–2023

- TABLE 152 PAYMENT PROCESSING SOLUTIONS MARKET: DEALS, 2017–2023

- TABLE 153 PAYPAL: BUSINESS OVERVIEW

- TABLE 154 PAYPAL: SOLUTIONS OFFERED

- TABLE 155 PAYPAL: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 156 PAYPAL: DEALS

- TABLE 157 FISERV: BUSINESS OVERVIEW

- TABLE 158 FISERV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 FISERV: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 160 FISERV: DEALS

- TABLE 161 FIS: BUSINESS OVERVIEW

- TABLE 162 FIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 FIS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 164 FIS: DEALS

- TABLE 165 GLOBAL PAYMENTS: BUSINESS OVERVIEW

- TABLE 166 GLOBAL PAYMENTS: SOLUTIONS OFFERED

- TABLE 167 GLOBAL PAYMENTS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 168 GLOBAL PAYMENTS: DEALS

- TABLE 169 ACI WORLDWIDE: BUSINESS OVERVIEW

- TABLE 170 ACI WORLDWIDE: SOLUTIONS OFFERED

- TABLE 171 ACI WORLDWIDE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 172 ACI WORLDWIDE: DEALS

- TABLE 173 SQUARE: BUSINESS OVERVIEW

- TABLE 174 SQUARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 SQUARE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 176 SQUARE: DEALS

- TABLE 177 MASTERCARD: BUSINESS OVERVIEW

- TABLE 178 MASTERCARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 MASTERCARD: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 180 MASTERCARD: DEALS

- TABLE 181 VISA: BUSINESS OVERVIEW

- TABLE 182 VISA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 VISA: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 184 VISA: DEALS

- TABLE 185 ADYEN: BUSINESS OVERVIEW

- TABLE 186 ADYEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 ADYEN: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 188 ADYEN: DEALS

- TABLE 189 STRIPE: BUSINESS OVERVIEW

- TABLE 190 STRIPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 STRIPE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 192 STRIPE: DEALS

- TABLE 193 PAYU: BUSINESS OVERVIEW

- TABLE 194 PAYU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 PAYU: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 196 PAYU: DEALS

- TABLE 197 ADJACENT MARKETS AND FORECASTS

- TABLE 198 DIGITAL PAYMENT MARKET IN BFSI, BY REGION, 2016–2020 (USD MILLION)

- TABLE 199 DIGITAL PAYMENT MARKET IN BFSI, BY REGION, 2021–2026 (USD MILLION)

- TABLE 200 DIGITAL PAYMENT MARKET IN RETAIL AND ECOMMERCE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 201 DIGITAL PAYMENT MARKET IN RETAIL AND ECOMMERCE, BY REGION, 2021–2026 (USD MILLION)

- TABLE 202 DIGITAL PAYMENT MARKET IN HEALTHCARE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 203 DIGITAL PAYMENT MARKET IN HEALTHCARE, BY REGION, 2021–2026 (USD MILLION)

- TABLE 204 DIGITAL PAYMENT MARKET IN TRAVEL AND HOSPITALITY, BY REGION, 2016–2020 (USD MILLION)

- TABLE 205 DIGITAL PAYMENT MARKET IN TRAVEL AND HOSPITALITY, BY REGION, 2021–2026 (USD MILLION)

- TABLE 206 DIGITAL PAYMENT MARKET IN TRANSPORTATION AND LOGISTICS, BY REGION, 2016–2020 (USD MILLION)

- TABLE 207 DIGITAL PAYMENT MARKET IN TRANSPORTATION AND LOGISTICS, BY REGION, 2021–2026 (USD MILLION)

- TABLE 208 DIGITAL PAYMENT MARKET IN MEDIA AND ENTERTAINMENT, BY REGION, 2016–2020 (USD MILLION)

- TABLE 209 DIGITAL PAYMENT MARKET IN MEDIA AND ENTERTAINMENT, BY REGION, 2021–2026 (USD MILLION)

- TABLE 210 DIGITAL PAYMENT MARKET IN OTHER VERTICALS, BY REGION, 2016–2020 (USD MILLION)

- TABLE 211 DIGITAL PAYMENT MARKET IN OTHER VERTICALS, BY REGION, 2021–2026 (USD MILLION)

- TABLE 212 FINTECH AS A SERVICE MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 213 FINTECH AS A SERVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 214 FINTECH AS A SERVICE MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 215 FINTECH AS A SERVICE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 216 FINTECH AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 217 FINTECH AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 218 FINTECH AS A SERVICE MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 219 FINTECH AS A SERVICE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 220 FINTECH AS A SERVICE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 221 FINTECH AS A SERVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 3 PAYMENT PROCESSING SOLUTIONS MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 5 PAYMENT PROCESSING SOLUTIONS MARKET, 2021–2028 (USD MILLION)

- FIGURE 6 PAYMENT PROCESSING SOLUTIONS MARKET: REGIONAL SHARE, 2023

- FIGURE 7 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

- FIGURE 8 RISING GOVERNMENT INITIATIVES FOR DIGITAL PAYMENTS TO ACT AS OPPORTUNITY IN PAYMENT PROCESSING SOLUTIONS MARKET

- FIGURE 9 CREDIT CARD SEGMENT AND BFSI TO ACCOUNT FOR LARGE SHARES IN NORTH AMERICA

- FIGURE 10 CREDIT CARD SEGMENT AND CHINA TO ACCOUNT FOR LARGE SHARES IN ASIA PACIFIC

- FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PAYMENT PROCESSING SOLUTIONS MARKET

- FIGURE 12 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 13 EVOLUTION OF PAYMENT PROCESSING SOLUTIONS

- FIGURE 14 PAYMENT PROCESSING SOLUTIONS ECOSYSTEM

- FIGURE 15 TOTAL NUMBER OF PATENTS GRANTED, 2020–2023

- FIGURE 16 TOP TEN PATENT APPLICANTS, 2020–2023

- FIGURE 17 PAYMENT PROCESSING SOLUTIONS MARKET

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 20 EWALLET SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 RETAIL VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 MARKET: REGIONAL SNAPSHOT

- FIGURE 23 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 26 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 27 MARKET RANKING OF KEY PLAYERS, 2023

- FIGURE 28 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 29 PAYMENT PROCESSING SOLUTIONS MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 30 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 31 PAYMENT PROCESSING SOLUTIONS MARKET, STARTUP/SME EVALUATION MATRIX

- FIGURE 32 VALUATION AND FINANCIAL METRICS OF PAYMENT PROCESSING SOLUTIONS VENDORS

- FIGURE 33 PAYPAL: COMPANY SNAPSHOT

- FIGURE 34 FISERV: COMPANY SNAPSHOT

- FIGURE 35 FIS: COMPANY SNAPSHOT

- FIGURE 36 GLOBAL PAYMENTS: COMPANY SNAPSHOT

- FIGURE 37 ACI WORLDWIDE: COMPANY SNAPSHOT

- FIGURE 38 SQUARE: COMPANY SNAPSHOT

- FIGURE 39 MASTERCARD: COMPANY SNAPSHOT

- FIGURE 40 VISA: COMPANY SNAPSHOT

- FIGURE 41 ADYEN: COMPANY SNAPSHOT

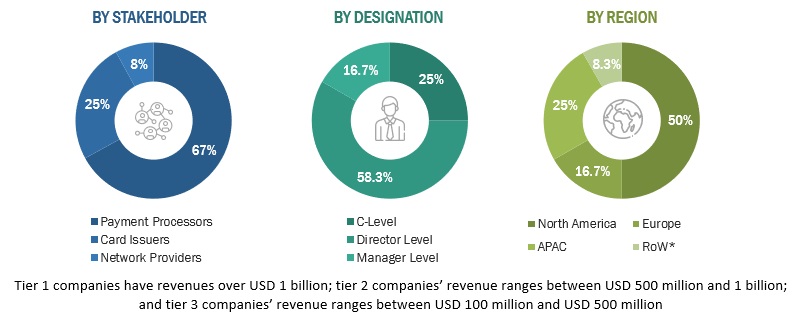

The research study involved the use of extensive secondary sources, directories, and databases, such as Factiva, D&B Hoovers, and Bloomberg, to identify and collect information useful for the comprehensive market research study on the payment processing solutions market. The primary sources were mainly industry experts from the core and related industries, preferred payment processing solutions and service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information, as well as to assess the prospects

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included companies’ annual reports, press releases, and investor presentations, and white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology, and innovation directors, and related key executives from various key companies and organizations providing payment processing solutions and associated services. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region.

The break-up of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the Payment processing solutions market. The first approach involves estimating the market size by summating companies’ revenue generated through Payment processing solutions. In this approach for market estimation, we identified the key companies offering Payment processing solutions by payment methods.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Payment processing solutions market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and break-ups have been determined using secondary sources and verified through primary sources.

Payment processing solutions Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the payment processing solutions market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Payment processing refers to the processes and services that automate payment transactions between the shopper and the merchant. It is usually a third-party service that is a system of computer processes that processes, verifies, and accepts or declines credit card, debit card, or eWallet transactions on behalf of the merchant through secure internet connections.

Report Objectives

- To determine and forecast the global payment processing solutions market by payment method, vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market.

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- In the market, track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Payment Processing Solutions Market