Digital Signature Market by Offering, Type (SES, AES, and QES), Deployment Mode (On-Premises and Cloud), Vertical (BFSI, Government & Defense, Healthcare & Life Sciences, Legal, Real Estate, IT & ITeS, Education) and Region - Global Forecast to 2028

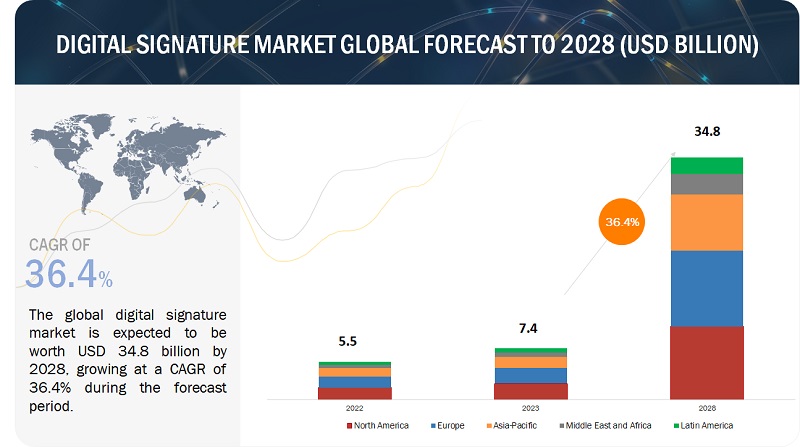

[329 Pages Report] The global digital signature market size is projected to grow from USD 7.4 billion in 2023 to USD 34.8 billion by 2028 at a CAGR of 36.4% during the forecast period.

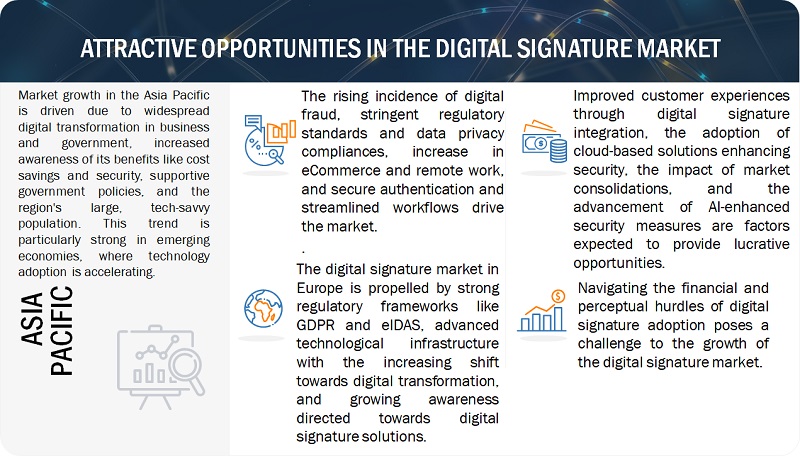

Several key factors drive the digital signature market. Firstly, the rise in digital fraud has emphasized the need for secure authentication methods, with digital signatures providing a reliable solution. Secondly, strict regulatory standards and data privacy laws worldwide have increased the demand for compliant digital signature solutions. Additionally, the growth in eCommerce and the shift towards remote work have accelerated the adoption of digital signatures, as they offer a secure and efficient way to handle online transactions. Furthermore, the need for streamlined workflows and fast-paced business processes has further boosted the demand for digital signature solutions.

The digital signature market presents several opportunities for growth and innovation. One significant opportunity is the integration of advanced technologies like AI and blockchain, which enhances security and efficiency in digital signing processes. There is also a growing trend towards cloud-based solutions, offering scalability and accessibility for businesses of all sizes. The expanding e-commerce sector and increasing remote work culture open up new avenues for digital signature applications. Additionally, as more countries adopt legal frameworks recognizing digital signatures, there is an opportunity for global expansion. The push towards paperless operations across industries further broadens the scope for digital signature solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

In times of a potential worldwide recession, as suggested by indicators like the European Central Bank&r>squo;s rate hikes and soaring inflation rates in major economies like the EU and the UK, the digital signature market is poised for a complex trajectory. Historically, downturns often result in tightened IT budgets; however, the increasing significance of cybersecurity amidst a digital transformation era, combined with escalating concerns surrounding insider threats, tends to counterbalance this trend in the digital signature sector. As organizations seek cost-effective solutions, they tend to gravitate towards optimizing the existing systems rather than large-scale new implementations. Moreover, with increased regulatory compliance demands and the intrinsic value of safeguarding critical data, investments in digital signature solutions will remain a priority for businesses, even in strained economic times. Still, the broader financial strain will slow the adoption rate for smaller enterprises or those in severely impacted sectors.

Digital Signature Market Dynamics

Driver: eCommerce & remote work accelerated digital signature adoption

In recent years, the growth of eCommerce and the shift towards remote work have significantly accelerated the adoption of digital signatures. As businesses move online and teams work from different locations, the need for secure, efficient, and legally binding ways to sign documents has become crucial. Digital signatures offer a reliable solution, enabling businesses to streamline their operations and reduce paper-related costs. This technology not only enhances security but also ensures compliance with various legal standards globally. By integrating digital signatures, companies expedite processes, from contract signing to employee onboarding, thereby enhancing overall productivity and customer experience. The digital signature market is poised for further growth, driven by these trends, as more organizations recognize the need to adapt to a rapidly evolving digital landscape.

Restraint: Divergent regulations & misconceptions

The adoption of digital signatures, while beneficial, is often restrained by divergent regulations and prevalent misconceptions. The legal landscape for digital signatures varies widely across different regions and countries, leading to confusion about their legality and enforceability. This lack of uniformity in regulations proves to be a significant barrier for businesses operating on a global scale, as they must navigate a complex web of legal requirements. Additionally, there are common misconceptions regarding the security and authenticity of digital signatures. Many people still question their reliability and safety compared to traditional signatures despite technological advancements ensuring high levels of security. These misconceptions, coupled with regulatory inconsistencies, act as major restraints in the wider acceptance and adoption of digital signatures. Overcoming these is essential for the digital signature market to grow and for businesses to fully leverage the efficiency and security benefits that digital signatures offer.

Opportunity: Enhancing customer experiences with digital signature integration

Integrating digital signatures into business operations presents a significant opportunity to enhance customer experiences, an aspect crucial in today's competitive market. Digital signatures streamline the document signing process, making it faster and more convenient for customers. This convenience is especially appreciated in sectors like banking, insurance, and real estate, where timely and efficient processing of documents is essential. Customers no longer need to physically be present to sign documents, reducing wait times and eliminating geographical barriers. Moreover, the transparency and security offered by digital signatures add a layer of trust and reliability to transactions. Businesses that adopt this technology are seen as modern, customer-focused, and efficient, which can significantly improve customer satisfaction and loyalty. The opportunity to enhance customer experiences with digital signatures contributes to the growth of the digital signature market, as businesses seek to stay ahead in a digitally evolving landscape.

Challenge: Navigating the financial and perceptual hurdles of digital signature adoption

Navigating the financial and perceptual hurdles presents a significant challenge for the adoption of digital signatures in the market. Firstly, the initial cost of implementing digital signature technology can be a deterrent, especially for small and medium-sized businesses. This cost includes not just the technology itself but also the training and integration into existing systems. Secondly, there's a perceptual barrier where some businesses and individuals still view digital signatures as less secure or less legally binding than traditional handwritten signatures. This skepticism is often rooted in a lack of understanding of the technology and its legal implications. Overcoming these financial and perceptual challenges is crucial for broader acceptance and utilization of digital signatures. Businesses need to be educated about the long-term cost benefits, security features, and legal validity of digital signatures to fully appreciate their potential in streamlining processes and enhancing security. Addressing these hurdles effectively is essential for the continued growth and integration of digital signatures in various sectors.

Digital Signature Market Ecosystem

By type, the AES segment accounts for the highest CAGR during the forecast period.

The AES segment is expected to exhibit the highest CAGR during the forecast period. This anticipated growth is primarily due to the enhanced security and authentication features that AES offers compared to basic electronic signatures. AES signatures are uniquely linked to the signatory, capable of identifying the signer, and are securely attached to the document in a way that any subsequent changes to the document are detectable. These features are increasingly important in sectors such as government, healthcare, and finance, where security and compliance are paramount. Additionally, with growing cybersecurity concerns and the need for secure online transactions, businesses and individuals gravitate towards more secure signing methods. The rising awareness about the benefits of AES in preventing fraud and ensuring the integrity of digital documents is also a significant factor contributing to its rapid growth. The global shift towards digital solutions in business processes further accelerates the demand for AES, positioning it for substantial growth in the digital signature market.

By solution, the software segment accounts for the highest CAGR during the forecast period.

The software segment is anticipated to hold the highest CAGR during the forecasted period. This growth is driven by several factors. Firstly, the increasing digital transformation of businesses demands efficient, secure ways to execute and manage contracts and documents, which digital signature software provides. As more companies adopt remote work and digital workflows, the need for such software becomes even more critical. Secondly, the continuous evolution in regulatory compliance worldwide pushes businesses to adopt legally binding and secure digital signature solutions. Furthermore, advancements in technology are making digital signature software more accessible, user-friendly, and cost-effective, which appeals to a broader range of businesses, including small and medium-sized enterprises. These trends indicate a growing reliance on digital signature software, making it a key growth area in the digital signature market in the future.

By type, the SES segment accounts for the largest market size during the forecast period.

The SES segment is anticipated to dominate the digital signature market in terms of market size in the forecasted period, primarily due to its wide-ranging applicability and ease of use. SES, encompassing electronic versions of traditional signatures, like scanned images of handwritten signatures or typed names, is highly versatile and user-friendly. This simplicity makes it ideal for a broad spectrum of applications, from personal use to small businesses and large enterprises. Additionally, as the digital transformation accelerates across various industries, the demand for a straightforward, efficient method to sign documents electronically is increasing. While SES may not offer the same level of security as more advanced digital signatures, its adequacy for many everyday uses, coupled with minimal technical requirements, makes it particularly attractive. The growing acceptance and legal recognition of SES in numerous countries further contribute to its anticipated dominance in the market.

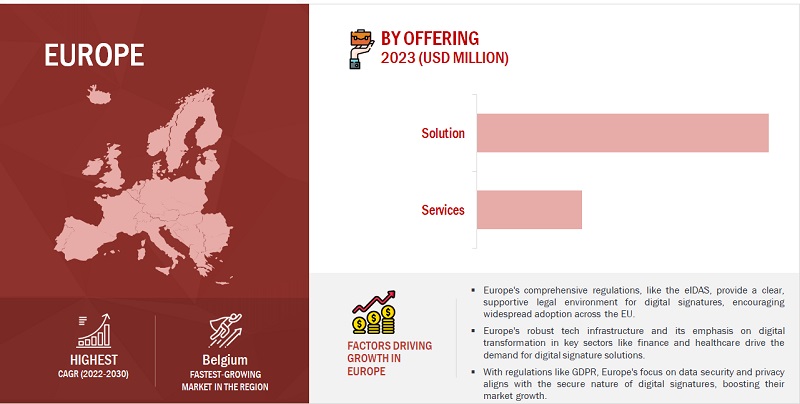

By region, Europe accounts for the largest market size during the forecast period.

The European region is projected to hold the largest market size in the digital signature market in the forecasted period, primarily due to its strong regulatory framework and the rapid adoption of digital solutions across various sectors. Europe has been at the forefront of implementing regulations like the eIDAS, which provides a clear legal framework for digital signatures and boosts their acceptance across the EU. This regulatory environment encourages businesses and government entities to adopt digital signatures for secure and efficient document processing. Furthermore, Europe's emphasis on data security and privacy, exemplified by the GDPR, aligns well with the enhanced security features of digital signatures. The region's advanced technological infrastructure and the increasing shift towards digital transformation in industries such as finance, healthcare, and government services also contribute to the growth of the digital signature market. These factors, combined with a growing awareness of the benefits of digital signatures in terms of efficiency, cost savings, and environmental impact, position Europe as a leading market for digital signature adoption.

Key Market Players

Some of the well-established and key market players in the digital signature market include Adobe (US), DocuSign (US), Thales (France), Zoho (India), Entrust (US), DigiCert (US), OneSpan (US), Ascertia (UK), GlobalSign (Belgium), IdenTrust (HID Global) (US), Nitro (US), Dioss (Belgium), Dokobit (Signicat) (Lithuania), Penneo (Denmark), QuickSign (France), Symtrax (US), AlphaTrust (US), Notarius (US), Actalis (Italy), SIGNiX (US), SigniFlow (UK), vintegrisTECH (Spain), Signority (Canada), Bit4id (Italy), LAWtrust (South Africa), DigiSigner GmbH (Germany), WISeKey (Switzerland), itsme (Belgium), and SignWell (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

|

|

Base year considered |

|

|

Forecast period |

|

|

Forecast units |

|

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

|

By Region:

Recent Developments

- In June 2023, Adobe’s product Adobe Acrobat Sign was enhanced to deliver an advanced e-signature solution, integrating over 50 global Trust Service Providers (TSPs) and Identity Providers (IDPs) for robust identity verification and digital signature capabilities. This upgrade focuses on streamlining document approval and signing workflows, providing higher levels of assurance and compliance with regional and industry-specific regulations. The enhanced Acrobat Sign ensures secure, compliant, and efficient digital transactions, catering to the demands of a rapidly evolving digital landscape.

- In February 2023, Zoho enhanced its Zoho Sign for ISVs and OEMs service, a comprehensive service that allows software vendors and equipment manufacturers to embed Zoho's digital signature capabilities into their products. It includes powerful APIs, mobile SDKs for app integration, SSO authentication, and options for full white labeling to reinforce brand identity. Features like enterprise-grade security, custom domain branding, and compliance with major data protection regulations enable streamlined, legally binding e-signature workflows within existing applications.

- In January 2023, DocuSign partnered with TechnoBind to bring eSignature technology to the Indian market, aligning with the Digital India initiative. This collaboration leverages DocuSign's suite of applications and integrations to automate the end-to-end agreement process, featuring capabilities such as eSignature, contract lifecycle management, and document generation. The partnership aims to provide users with secure and efficient electronic signature solutions and support digital business transformation at scale.

- In June 2022, Entrust acquired Evidos Solutions. This acquisition enhances Entrust's presence in the electronic signature market, allowing for the enablement of all digital workflows with trusted cloud-based e-signature solutions. Integrating Evidos' technology, Entrust will offer an end-to-end e-signature process including basic, advanced, and qualified electronic signatures, fully aligned with eIDAS regulations. This move is aimed at providing secure and seamless digital transaction experiences, essential for a range of industries requiring trusted document execution.

- In May 2022, Thales partnered with SAP and introduced its CipherTrust tokenization as the first SAP-certified tokenization solution available to SAP customers that is used to secure sensitive data. Available via SAP data custodian, Thales’ tokenization solution provides more granular data protection and user access controls.

Frequently Asked Questions (FAQ):

What are the opportunities in the global digital signature market?

Enhancing customer experiences with digital signature integration, digital signature adoption through cloud-enhanced security solutions, navigating the wave of digital signature market consolidations, and AI-enhanced security create market opportunities for the global digital signature market.

What is the definition of the digital signature market?

The digital signature market is defined as the sector that deals with the creation, distribution, and management of digital signatures, which are electronic versions of handwritten signatures. They are used to authenticate the origin, identity, and status of electronic documents, transactions, or digital messages. Digital signatures are created using cryptography and serve as a unique electronic link between the signer's identity and the message's origin, effectively serving as an equivalent to a personal written signature. These signatures are essential in verifying informed consent and maintaining the integrity of electronic communications and documents?.

Which region is expected to show the highest market share in the digital signature market?

Europe is expected to account for the largest market share during the forecast period.

What are the challenges in the global digital signature market?

The challenge in the digital signature market is navigating the financial and perceptual hurdles of digital signature adoption.

What are the major market players covered in the report?

Major vendors, namely, include Adobe (US), DocuSign (US), Thales (France), Zoho (India), Entrust (US), DigiCert (US), OneSpan (US), Ascertia (UK), GlobalSign (Belgium), IdenTrust (HID Global) (US), Nitro (US), Dioss (Belgium), Dokobit (Signicat) (Lithuania), Penneo (Denmark), QuickSign (France), Symtrax (US), AlphaTrust (US), Notarius (US), Actalis (Italy), SIGNiX (US), SigniFlow (UK), vintegrisTECH (Spain), Signority (Canada), Bit4id (Italy), LAWtrust (South Africa), DigiSigner GmbH (Germany), WISeKey (Switzerland), itsme (Belgium), and SignWell (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

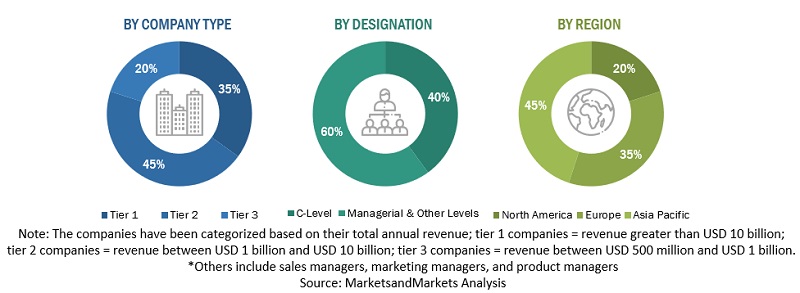

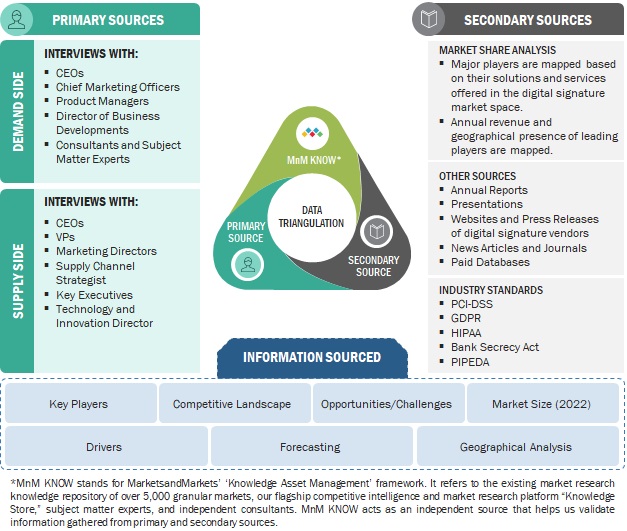

The study involved significant activities in estimating the current market size for digital signature. Intensive secondary research was conducted to collect information about digital signature and related ecosystems. The industry executives validated these findings, assumptions, and sizing across the value chain using a primary research process as a next step. Top-down and bottom-up market estimation approaches were used to estimate the market size globally, followed by the market breakup and data triangulation procedures to assess the market segment and sub-segments in digital signature.

Secondary Research Process:

In the secondary research process, various sources were referred to for identifying and collecting information regarding digital signature. These sources include annual reports, press releases, digital signature software and service vendor investor presentations, forums, vendor-certified publications, and industry/association white papers. These secondary sources were utilized to obtain key information about digital signature’s solutions and services supply & value chain, a list of 100+ key players and SMEs, market classification, and segmentation per the industry trends and regional markets. The secondary research also gives us insights into the key developments from market and technology perspectives, which primary respondents further validated.

The factors considered for estimating the regional market size include technological initiatives undertaken by governments of different countries, gross domestic product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of primary digital signature solutions and service vendors.

Primary Research Process:

We have conducted primary research with industry executives from both the supply and demand sides. The primary sources from the supply side include chief executive officers (CEOs), vice presidents (VPs), marketing directors, and technology and innovation executives of key companies operating in the digital signature market. We have conducted primary interviews with the executives to obtain qualitative and quantitative information for digital signature.

The market engineering process implemented the top-down and bottom-up approaches and various data triangulation methods to estimate and forecast the market segments and subsegments. During the post-market engineering process, we conducted primary research to verify and validate the critical numbers we arrived at. The primary analysis was also undertaken to identify the segmentation types, industry trends, the competitive landscape of the digital signature market players, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation Process:

Both top-down and bottom-up approaches were implemented for market size estimation to estimate, project, and forecast the size of the global and other dependent sub-segments in the overall digital signature market.

The research methodology that has been used to estimate the market size includes these steps:

- The key players, SMEs, and startups were identified through secondary sources. Their revenue contributions in the market were determined through primary and secondary sources.

- Annual and financial reports of the publicly listed market players were considered for the company’s revenue details, and,

- Primary interviews were also conducted with industry leaders to collect information about their companies, competitors, and key players in the market.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Top-down and Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Data triangulation is a crucial step in the market engineering process for digital signature. It involves utilizing multiple data sources and methodologies to validate and cross-reference findings, thereby enhancing the reliability and accuracy of the market segment and subsegment statistics. To conduct data triangulation, various factors and trends related to the digital signature market are studied from both the demand and supply sides. It includes analyzing data from diverse sources such as market research reports, industry publications, regulatory bodies, financial institutions, and technology providers. By examining data from different perspectives and sources, data triangulation helps mitigate potential biases and discrepancies. It provides a more comprehensive understanding of the market dynamics, including the size, growth rate, market trends, and customer preferences.

Furthermore, data triangulation aids in identifying any inconsistencies or outliers in the data, enabling researchers to refine their analysis and make informed decisions. It strengthens the credibility of the market engineering process by ensuring that the conclusions drawn are based on robust and corroborated data. Data triangulation is a rigorous and systematic approach that enhances the reliability and validity of market segment and subsegment statistics in the digital signature. It provides a solid foundation for informed decision-making and strategic planning within the industry.

Market Definition

A digital signature is a type of electronic signature that uses a routine mathematical algorithm to validate the authenticity and integrity of a digital document. Digital signatures create a virtual fingerprint unique to a person or entity and are used to identify users and protect the information in digital messages or documents. The email content becomes a part of the digital signature in emails. Digital signatures are significantly more secure than other forms of electronic signatures.

Key Stakeholders

- Chief Technology and Data Officers

- Business Analysts

- Information Technology (IT) Professionals

- Government Agencies

- Investors and Venture Capitalists

- Small and Medium-Sized Enterprises (SMEs) And Large Enterprises

- Third-Party Providers

- Consultants/Consultancies/Advisory Firms

- Managed and Professional Service Providers

- Third-Party Providers

Report Objectives

- To define, describe, and forecast the digital signature market based on offering, type deployment mode, verticals, and regions:

- To predict and estimate the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the digital signature market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the digital signature market

- To profile the key players of the digital signature market and comprehensively analyze their market size and core competencies.

- Track and analyze competitive developments, such as new product launches, mergers and acquisitions, partnerships, agreements, and collaborations in the global digital signature market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional digital signature market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Signature Market