Wireless Mesh Network Market by Component (Physical Appliances, Mesh Platform, Services), Mesh Design (Infrastructure and Ad-Hoc), Radio Frequency, Applications (Disaster Management, Smart Manufacturing), and Region - Global Forecast to 2022

[148 Pages Report] The Wireless mesh network market projected to grow from $3.57 Billion in 2016 to reach $7.44 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 13.8% during the forecast period. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

The major forces that are expected to drive the growth of the market include the critical need for network bandwidth management, and growing adoption of smart connected devices across various industry verticals. Moreover, need for consistent network and stable network, and reduction in cost of connected devices are also some of the factors that are expected to drive the market growth. The wireless mesh network market is segmented on the basis of components (physical appliances, mesh platforms, and services), mesh design, radio frequency, applications, and regions.

Objectives of the Study

The main objective of the report is to define, describe, and forecast the wireless mesh network market size on the basis of components (physical appliances, mesh platforms and services), mesh design, radio frequency, applications, and regions. The report provides detailed information on the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market. The report attempts to forecast the market size with respect to the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report strategically profiles the key market players and comprehensively analyzes their core competencies. It also tracks and analyzes the competitive developments, such as joint ventures, mergers and acquisitions, and new product developments in the market.

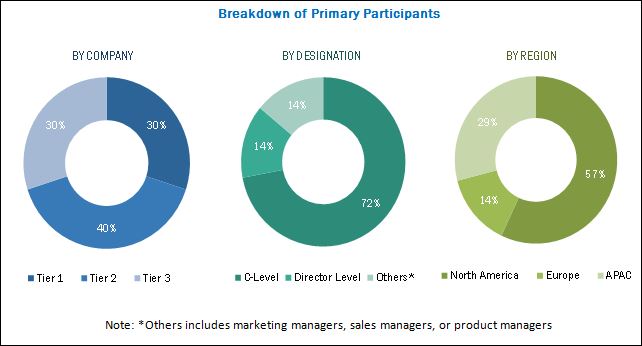

The research methodology used to estimate and forecast the wireless mesh network market size began with the collection and analysis of data on the key vendor revenues through secondary sources, including the annual reports and press releases, investor presentations, conferences and associations (13th International Wireless Communications and Mobile Computing Conference (IWCMC 2017),13th Annual Conference on Wireless On-demand Network Systems and Services 2017, WLAN Pros EU), technology journals, certified publications, articles from recognized authors, directories, and databases. The vendor offerings were also taken into consideration to determine the market segmentations. The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of the key players and their market shares. The wireless mesh network market spending across all the regions, along with the geographical split in various verticals, was considered to arrive at the overall market size. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The wireless mesh network market includes various vendors providing wireless mesh network physical appliances, mesh platforms, and services to commercial clients across the globe. Companies such as Qualcomm (US), Cisco Systems (US), Aruba Networks (US), ABB (Switzerland), Qorvo (US), Synapse Wireless (US), Wirepas (Finland), Rajant Corporation (US), Strix Systems (US), Cambium Networks (US), Ruckus Wireless (US), and Firetide (US) have adopted partnerships, agreements, and collaborations as the key strategies to enhance their market reach.

Key Target Audience for Wireless Mesh Network Market

- Network solution providers

- Telecommunication providers

- Mobile network operators

- Cloud service providers

- Enterprise data center professionals

- Third-party network testing service providers

- Managed Security Service Providers (MSSPs)

- IT suppliers

- Consultancy firms and advisory firms

- Regulatory agencies

- Technology consultants

- Government

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Wireless Mesh Network Market Report

|

Report Metric |

Details |

|

Market size available for years |

20172022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Components (physical appliances, mesh platforms and services), Mesh design, Radio Frequency, Applications and Regions |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America |

|

Companies covered |

Qualcomm (US), Cisco Systems (US), Aruba Networks (US), ABB (Switzerland), Qorvo (US), Synapse Wireless (US), Wirepas (Finland), Rajant Corporation (US), Strix Systems (US), Cambium Networks (US), Ruckus Wireless (US), and Firetide (US) |

The research report segments the wireless mesh network market into the following submarkets:

By Component:

- Physical Appliances

- Mesh Platforms

- Services

Wireless Mesh Network Market By Mesh Design

- Infrastructure Wireless Mesh

- Ad-Hoc Mesh

By Service:

- Deployment and Provisioning

- Network Planning

- Network Security

- Network Analytics

- Support and Maintenance

- Network Testing

- Network Consulting

- Network Optimization

Wireless Mesh Network Market By Radio Frequency:

- Sub 1 GHz Band

- 2.4 GHz Band

- 4.9 GHz Band

- 5 GHz Band

By Application:

- Video Streaming and Surveillance

- Telecommunication

- Disaster Management and Public Safety

- Smart Mobility

- Border Security (GPS Tracking)

- Smart Manufacturing

- Workforce and Asset Tracking

- Predictive Maintenance

- Logistics and Supply Chain Management

- Other Smart Manufacturing Applications

- Smart Building and Home Automation

- Others (Environment Monitoring, and Smart Grids and Meters)

Wireless Mesh Network Market By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

In the component segment, the physical appliances subsegment is expected to hold the largest market share. Physical appliances consist of mesh routers, switches, access points, and controllers. A mesh router is a replacement of traditional routers and provides a dynamic, policy-based, application path across various heterogeneous devices in mesh networks. Moreover, in the component segment, the mesh platforms subsegment is expected to grow at the highest rate; some of the wireless mesh network vendors offer solutions that are based on platforms and technologies that convert mesh nodes into routers and access points. Each node in the network is a receiver as well as a sender of the information. In case a node is down, the connected node would find another node to connect, thus reducing the chance of network failure.

The mesh design segment is segmented into infrastructure wireless mesh and ad-hoc mesh. The ad-hoc mesh network segment is expected to grow at the fastest rate attributed to the fact that network is created as per the requirement, without the need of any prior complex network design and planning. The ad-hoc mesh network design is useful for a short-term network, as it provides high-speed wireless connectivity for users in highly fluid situations, such as emergency response team at the time of natural disasters.

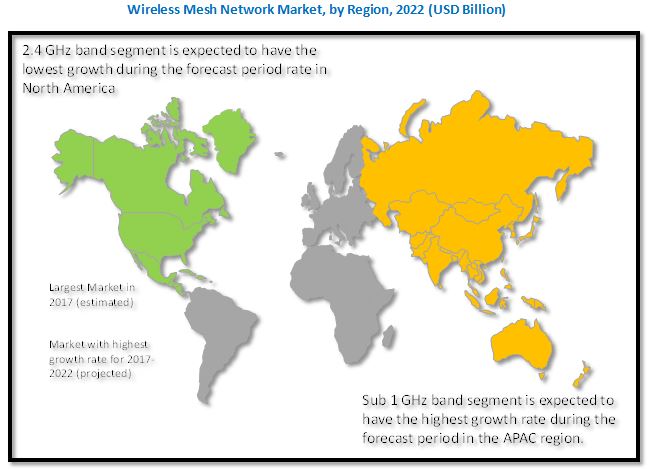

The 2.4 GHz band is expected to hold the largest market share in the radio frequency segment attributed to the fact that this band is used by large number of microwaves, Wi-Fi, Bluetooth devices, cordless phones, and other wireless devices. The disaster management and public safety segment is expected to hold the largest market share in the application segment attributed to the fact that wireless mesh networks provide high network availability. The state, county, and city governments have an increasing demand for public safety requirements and are leveraging mesh networking to connect to disaster-prone areas. The cities are promoting and implementing public broadband by leveraging the mesh architecture for city workers, municipalities, and inspectors.

North America is expected to hold the largest market share and dominate the wireless mesh network market during the forecast period. The North America region comprises the US and Canada, which are witnessing the phenomenal adoption of wireless mesh networking technologies. These countries have major dominance with sustainable and well-established economies, empowering them to strongly invest in Research and Development (R&D) activities, thereby contributing to the development of new technologies. Due to the emergence of trending technologies, such as Software-as-a-Service (SaaS)-based applications, cloud networking, network analytics, Internet of Things (IoT), and virtualization, the users and enterprises in these regions are forced to adopt wireless mesh networking technologies for establishing a cost-effective and constant network.

APAC comprises growing economies, such as Japan, China, India, Singapore, and Australia, which are expected to register high growth in the wireless mesh network market. APAC has witnessed advanced and dynamic adoption of new technologies and has always been a lucrative market for wireless mesh networks. APAC is projected to grow at the highest CAGR during the forecast period in the market. Countries such as Singapore, China, and Japan possess developed technological infrastructure, which promotes the adoption of mesh networking solutions across various industry verticals in this region.

Data security and privacy concerns are expected to be the major restraining factor for the growth of the wireless mesh network market. However, the recent developments, new product launches, and acquisitions undertaken by the major market players are expected to boost the growth of the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the US and Canada market into solutions, services, network infrastructure, organization size, deployment type, and vertical.

- Further breakdown of the UK, Germany, and France market into solutions, services, network infrastructure, organization size, deployment type, and vertical.

Company Information

- Detailed analysis and profiling of additional market players

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Wireless Mesh Network Market

4.2 Market By Application and Region

4.3 Market By Region

4.4 Market Investment Scenario

5 Wireless Mesh Network Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapid Demand for Bandwidth Requirement

5.2.1.2 Growing Adoption of Smart Connected Devices

5.2.1.3 Need for A Consistent and Stable Network

5.2.1.4 Reduction in the Cost of Connected Devices

5.2.2 Restraints

5.2.2.1 Data Security and Privacy Concerns

5.2.3 Opportunities

5.2.3.1 Adoption of Advanced Networking Technologies Among SMES

5.2.3.2 Potential Growth Opportunities for Security System Integrators

5.2.4 Challenges

5.2.4.1 Lack of Standards for Interconnectivity and Interoperability

5.3 Wireless Mesh Network Protocols

5.3.1 AD-HOC On-Demand Distance Vector

5.3.2 Destination-Sequenced Distance-Vector Routing

5.3.3 Dynamic Source Routing

5.3.4 Better Approach to Mobile AD-HOC Networking

5.3.5 Temporally Ordered Routing Algorithm

5.3.6 Hybrid Wireless Mesh Protocol

5.4 Standards

5.4.1 802.11 Standard

5.4.2 802.15 Standard

5.4.3 802.16 Standard

6 Wireless Mesh Network Market, By Component (Page No. - 41)

6.1 Introduction

6.2 Physical Appliances

6.3 Mesh Platforms

6.4 Services

7 Wireless Mesh Network Market By Mesh Design (Page No. - 48)

7.1 Introduction

7.2 Infrastructure Wireless Mesh

7.3 AD-HOC Mesh

8 Wireless Mesh Network Market, By Service (Page No. - 52)

8.1 Introduction

8.2 Deployment and Provisioning

8.3 Network Planning

8.4 Network Security

8.5 Network Analytics

8.6 Support and Maintenance

8.7 Network Testing

8.8 Network Consulting

8.9 Network Optimization

9 Wireless Mesh Network Market By Radio Frequency (Page No. - 62)

9.1 Introduction

9.2 Sub 1 GHZ Band

9.3 2.4 GHZ Band

9.4 4.9 GHZ Band

9.5 5 GHZ Band

10 Wireless Mesh Network Market, By Application (Page No. - 68)

10.1 Introduction

10.2 Video Streaming and Surveillance

10.3 Telecommunication

10.4 Disaster Management and Public Safety

10.5 Smart Mobility

10.6 Border Security (GPS Tracking)

10.7 Smart Manufacturing

10.7.1 Workforce and Asset Tracking

10.7.2 Predictive Maintenance

10.7.3 Logistics and Supply Chain Management

10.7.4 Other Smart Manufacturing Applications

10.8 Smart Building and Home Automation

10.9 Others

11 Wireless Mesh Network Market, By Region (Page No. - 81)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 103)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 New Product Launches

12.3.2 Business Expansions

12.3.3 Mergers and Acquisitions

12.3.4 Agreements and Partnerships

13 Company Profiles (Page No. - 107)

(Business Overview, Solutions Offered, Recent Developments, SWOT Analysis & MnM View)*

13.1 Qualcomm

13.2 Cisco Systems

13.3 ABB

13.4 Qorvo

13.5 Ruckus Wireless

13.6 Aruba Networks

13.7 Synapse Wireless

13.8 Wirepas

13.9 Rajant Corporation

13.10 Strix Systems

13.11 Cambium Networks

13.12 Firetide

*Details on Business Overview, Solutions Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 139)

14.1 Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (71 Tables)

Table 1 Wireless Mesh Network Market Size and Growth Rate, 20152022 (USD Million, Y-O-Y %)

Table 2 Market Size By Component, 20152022 (USD Million)

Table 3 Physical Appliances: Market Size By Region, 20152022 (USD Million)

Table 4 Mesh Platforms: Market Size By Region, 20152022 (USD Million)

Table 5 Services: Market Size By Region, 20152022 (USD Million)

Table 6 Market Size, By Mesh Design, 20152022 (USD Million)

Table 7 Infrastructure Wireless Mesh: Market Size By Region, 20152022 (USD Million)

Table 8 AD-HOC Mesh: Market Size By Region, 20152022 (USD Million)

Table 9 Wireless Mesh Network Market Size, By Service, 20152022 (USD Million)

Table 10 Deployment and Provisioning: Market Size By Region, 20152022 (USD Million)

Table 11 Network Planning: Market Size By Region, 20152022 (USD Million)

Table 12 Network Security: Market Size By Region, 20152022 (USD Million)

Table 13 Network Analytics: Market Size By Region, 20152022 (USD Million)

Table 14 Support and Maintenance: Market Size By Region, 20152022 (USD Million)

Table 15 Network Testing: Market Size By Region, 20152022 (USD Million)

Table 16 Network Consulting: Market Size By Region, 20152022 (USD Million)

Table 17 Network Optimization: Market Size By Region, 20152022 (USD Million)

Table 18 Wireless Mesh Network Market Size, By Radio Frequency, 20152022 (USD Million)

Table 19 Sub 1 GHZ Band: Market Size By Region, 20152022 (USD Million)

Table 20 2.4 GHZ Band: Market Size By Region, 20152022 (USD Million)

Table 21 4.9 GHZ Band: Market Size By Region, 20152022 (USD Million)

Table 22 5 GHZ Band: Market Size By Region, 20152022 (USD Million)

Table 23 Market Size, By Application, 20152022 (USD Million)

Table 24 Video Streaming and Surveillance: Market Size By Region, 20152022 (USD Million)

Table 25 Telecommunication: Market Size By Region, 20152022 (USD Million)

Table 26 Disaster Management and Public Safety: Market Size By Region, 20152022 (USD Million)

Table 27 Smart Mobility: Market Size By Region, 20152022 (USD Million)

Table 28 Border Security (GPS Tracking): Market Size By Region, 20152022 (USD Million)

Table 29 Wireless Mesh Network Market Size, By Smart Manufacturing Application, 20152022 (USD Million)

Table 30 Workforce and Asset Tracking Market Size, By Region, 20152022 (USD Million)

Table 31 Predictive Maintenance Market Size, By Region, 20152022 (USD Million)

Table 32 Logistics and Supply Chain Management Market Size, By Region, 20152022 (USD Million)

Table 33 Other Smart Manufacturing Applications Market Size, By Region, 20152022 (USD Million)

Table 34 Smart Building and Home Automation: Market Size By Region, 20152022 (USD Million)

Table 35 Others: Market Size By Region, 20152022 (USD Million)

Table 36 Wireless Mesh Network Market Size, By Region, 20152022 (USD Million)

Table 37 North America: Market Size By Component, 20152022 (USD Million)

Table 38 North America: Market Size By Mesh Design, 20152022 (USD Million)

Table 39 North America: Market Size By Service, 20152022 (USD Million)

Table 40 North America: Market Size By Radio Frequency, 20152022 (USD Million)

Table 41 North America: Market Size By Application, 20152022 (USD Million)

Table 42 North America: Market Size By Smart Manufacturing Application, 20152022 (USD Million)

Table 43 Europe: Market Size, By Component, 20152022 (USD Million)

Table 44 Europe: Market Size By Mesh Design, 20152022 (USD Million)

Table 45 Europe: Market Size By Service, 20152022 (USD Million)

Table 46 Europe: Market Size By Radio Frequency, 20152022 (USD Million)

Table 47 Europe: Market Size By Application, 20152022 (USD Million)

Table 48 Europe: Market Size By Smart Manufacturing Application, 20152022 (USD Million)

Table 49 Asia Pacific: Wireless Mesh Network Market Size, By Component, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size By Mesh Design, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size By Service, 20152022 (USD Million)

Table 52 Asia Pacific: Market Size By Radio Frequency, 20152022 (USD Million)

Table 53 Asia Pacific: Market Size By Application, 20152022 (USD Million)

Table 54 Asia Pacific: Market Size By Smart Manufacturing Application, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Component, 20152022 (USD Million)

Table 56 Middle East and Africa: Market Size By Mesh Design, 20152022 (USD Million)

Table 57 Middle East and Africa: Market Size By Service, 20152022 (USD Million)

Table 58 Middle East and Africa: Market Size By Radio Frequency, 20152022 (USD Million)

Table 59 Middle East and Africa: Market Size By Application, 20152022 (USD Million)

Table 60 Middle East and Africa: Market Size By Smart Manufacturing Application, 20152022 (USD Million)

Table 61 Latin America: Wireless Mesh Network Market Size, By Component, 20152022 (USD Million)

Table 62 Latin America: Market Size By Mesh Design, 20152022 (USD Million)

Table 63 Latin America: Market Size By Service, 20152022 (USD Million)

Table 64 Latin America: Market Size By Radio Frequency, 20152022 (USD Million)

Table 65 Latin America: Market Size By Application, 20152022 (USD Million)

Table 66 Latin America: Market Size By Smart Manufacturing Application, 20152022 (USD Million)

Table 67 Market Ranking for the Wireless Mesh Network Market, 2017

Table 68 New Product Launches, 20162018

Table 69 Business Expansions, 2017

Table 70 Mergers and Acquisitions, 20152017

Table 71 Partnerships, Agreements, and Collaborations, 20162017

List of Figures (42 Figures)

Figure 1 Wireless Mesh Network Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primaries: By Company, Designation and Region

Figure 4 Data Triangulation

Figure 5 Wireless Mesh Network Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Wireless Mesh Network Market, Top 3 Segments, 2017

Figure 8 Market By Component, 2017

Figure 9 Rapid Demand for Bandwidth and Need for Consistent Networks are Driving the Wireless Mesh Network Market

Figure 10 Disaster Management and Public Safety Application, and North America are Estimated to Have the Largest Market Shares in 2017

Figure 11 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 12 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 13 Wireless Mesh Network Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Physical Appliances Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 15 North America is Expected to Dominate the Physical Appliances Segment During the Forecast Period

Figure 16 Asia Pacific is Expected to Grow at the Highest CAGR in the Mesh Platforms Segment During the Forecast Period

Figure 17 Asia Pacific is Expected to Grow at the Highest CAGR in the Services Segment During the Forecast Period

Figure 18 Infrastructure Wireless Mesh Segment is Expected to Have A Larger Market Size During the Forecast Period

Figure 19 Network Consulting Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 20 North America is Expected to Have the Largest Market Size in the Network Planning Segment During the Forecast Period

Figure 21 2.4 GHZ Band Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 North America is Expected to Have the Largest Market Size in the Sub 1 GHZ Band Segment During the Forecast Period

Figure 23 North America is Expected to Have the Largest Market Size in the 5 GHZ Band Segment During the Forecast Period

Figure 24 Smart Manufacturing Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Middle East and Africa is Expected to Grow at the Highest CAGR in the Smart Mobility Segment During the Forecast Period

Figure 26 Predictive Maintenance is Expected to Grow at the Highest CAGR in the Smart Manufacturing Segment During the Forecast Period

Figure 27 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 28 Asia Pacific is Expected to Be an Attractive Destination in the Wireless Mesh Network Market During the Forecast Period

Figure 29 North America: Market Snapshot

Figure 30 Mesh Platforms Segment is Expected to Exhibit the Highest CAGR in the Components Segment During the Forecast Period

Figure 31 Asia Pacific: Market Snapshot

Figure 32 Key Development By the Leading Players in Wireless Mesh Network Market for 20142018

Figure 33 Qualcomm: Company Snapshot

Figure 34 Qualcomm: SWOT Analysis

Figure 35 Cisco Systems: Company Snapshot

Figure 36 Cisco Systems: SWOT Analysis

Figure 37 ABB: Company Snapshot

Figure 38 ABB: SWOT Analysis

Figure 39 Qorvo: Company Snapshot

Figure 40 Qorvo: SWOT Analysis

Figure 41 Ruckus Wireless: Company Snapshot

Figure 42 Ruckus Wireless: SWOT Analysis

Growth opportunities and latent adjacency in Wireless Mesh Network Market

Understaning wireless MESH technology