DERMS Market

DERMS Market by Offerings (Software, Services), Application (Solar PV Systems, Wind Energy Systems, Energy Storage, Combined Heat & Power Systems, EV Charging Solutions), End-User (Residential, Commercial, Industrial) & Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The distributed energy resource management systems (DERMS) market is expected to grow from an estimated in USD 0.61 billion in 2024 to USD 1.44 billion by 2029, at a CAGR of 18.8% during the forecast period. DERMS market is a fast-rising area, driven primarily by the increased use of renewable sources of energy, grid modernization, and rising energy decentralization.

KEY TAKEAWAYS

-

BY REGIONThe distributed energy resource management systems market for the North America region is estimated to dominate with a share of 47.2% in 2024.

-

BY OFFERINGSBy offering, the software segment is expected to be the fastest growing market with a CAGR of 20.6% during the forecast period.

-

BY APPLICATIONBy Application, the solar PV segment is expected to account for the largest share of the distributed energy resource management systems market in 2024.

-

COMPETITIVE LANDSCAPEMajor players in the DERMS market are adopting both organic and inorganic strategies, including partnerships and investments, to expand their market presence. Companies such as Siemens, ABB, and General Electric are actively forming collaborations to meet the growing demand for advanced distributed energy management solutions.

-

COMPETITIVE LANDSCAPEThe strong product ecosystem and global market penetration of GridX, Virtual Peaker, and Doosan GridTech position them among the most influential startups and SMEs in the DERMS landscape.

Emerging opportunities such as expansion of DERMS solutions across emerging markets, leveraging AI and IoT for predictive analytics, and finally, integration with microgrids and virtual power plants. Novel technologies like AI-driven predictive analytics, blockchain for secure energy transactions, and cloud-based platforms are changing the market, adding scalability, reliability, and efficiency to its operation. Such developments combined with a growing trend toward sustainability and energy resilience are forming the future of the DERMS market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Key players in this industry include Siemens, General Electric Company, Schneider Electric, ABB, and Hitachi, Ltd. These prominent companies in this sector are renowned for their reliability and financial stability as providers of DERMS. They offer a diverse range of products, cutting-edge technology, extensive experience, and robust global sales and marketing networks. Their proven track record in the industry makes them trusted and knowledgeable partners for clients seeking DERMS products.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of renewable energy in power generation due to robust government policies

-

pressing need to enhance grid reliability and resilience to mitigate power outage risks

Level

-

High installation cost of derms

-

Limited adoption of derms due to uncertainties and varying regulations across different jurisdictions

Level

-

Increasing investments in modernizing aging power infrastructure

-

Expansion of electric vehicle infrastructure

Level

-

Cybersecurity risks associated with DERMS

-

Interoperability issues among different energy systems and technologies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of renewable energy in power generation due to robust government policies

The growing use of renewable energy sources in power generation is a major factor driving the DERMS market, propelled by supportive government policies and favorable regulatory frameworks. The pressing need to reduce greenhouse gas (GHG) emissions plays a crucial role in this transition; according to the World Nuclear Association, more than 40% of carbon dioxide emissions linked to energy come from burning fossil fuels for electricity. Consequently, many countries increasingly turn to renewables for power generation and other applications, including heat and steam generation, desalination and water purification, and clean cooking solutions.

Restraint: High installation cost of derms

The high initial installation cost of DERMS hinders its adoption, creating financial obstacles for many potential users. DERMS involves a sophisticated setup integrating advanced hardware and software, such as sensors, controllers, communication networks, and data analytics tools. These systems require extensive customization to adapt to different types of distributed energy resources (DERs), which vary widely between regions and energy providers. This complexity drives up costs, making implementation DERMS financially challenging, especially for smaller utilities and independent power producers with limited budgets. Installation costs can range widely but often pass USD 100,000, depending on the scale and scope of deployment, which can be prohibitive for entities without substantial capital.

Opportunity: Increasing investments in modernizing aging power infrastructure

Growing investments to modernize power infrastructure are likely to create substantial opportunities for the players in the DERMS market. As energy demands rise and electrical grids age, utilities and governments worldwide are directing large-scale funding toward modernizing the power grid to enhance its reliability, resilience, and sustainability. Traditional grid systems, built for centralized energy distribution, are increasingly unable to handle the complexity of integrating renewable and decentralized energy sources, prompting investments in advanced solutions, including DERMS. For example, the US Department of Energy has committed billions of dollars toward grid modernization initiatives through programs such as the Grid Resilience and Innovation Partnerships (GRIP), which aims to create a smarter, more resilient grid. Similar efforts are underway globally, with countries such as Germany and China leading in grid innovation and DERMS deployment, driven by national energy policies focused on renewable integration and decarbonization.

Challenge: Interoperability issues among different energy systems and technologies

Interoperability issues among different energy systems and technologies are a major challenge for the DERMS market, limiting its growth and widespread adoption. DERMS integrate a variety of distributed energy resources (DERs) such as solar panels, wind turbines, battery storage, electric vehicle (EV) chargers, and even microgrids, each of which may come from different manufacturers, operate on different protocols and have unique technical specifications. Ensuring that DERMS can communicate seamlessly with this diverse array of devices and systems is complex, as these systems often lack standardized communication protocols. The absence of universal standards for DER hardware and software can result in compatibility issues, requiring extensive customization to enable all components to work together, which increases implementation costs and time.

DERMS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Evergy (formerly KCP&L) serves more than 800,000 customers in northwest Missouri and eastern Kansas and has a service area of about 18,000 square miles. Due to severe heat, the company was facing a major strain on its energy network and wanted to deploy a DERMS. | The DERMS implementation, supported by Burns & McDonnell, helped Evergy ease network strain during severe heat peaks. Serving over 800,000 customers across an 18,000-square-mile area in northwest Missouri and eastern Kansas, Evergy tackled peak demand challenges that risked grid reliability. Through DERMS deployment, configuration, and two demand response programs, the company reduced energy use during critical periods, optimizing resources, boosting resilience, and advancing sustainability by cutting waste and delaying expensive upgrades. This ensured reliable service, cost savings, and readiness for future distributed energy growth. |

|

To effectively connect high levels of distributed energy resources (DERs), it is essential to manage grid hosting capacity to maintain network reliability. The National Renewable Energy Laboratory (NREL) aimed to explore the feasibility of accommodating over 50% DER penetration at home, community, and grid levels. | Strata Grid deployment by Smarter Grid Solutions helped NREL manage grid capacity and validate over 50% DER penetration at home, community, and grid levels, maintaining network reliability. By monitoring smart meter data and optimizing power flow from photovoltaics, EVs, and storage across homes, campuses, and networks, it ensured stable voltage and flow in high-solar settings. This real-time coordination integrated smart scenarios, showcasing scalable DER operations across regions, enhancing resilience, accelerating renewables, and offering utilities insights to reduce risks and speed decarbonization. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The DERMS market ecosystem is a complex network of stakeholders optimizing distributed energy resources (DERs). Software providers develop platforms integrating DERs with analytics, real-time monitoring, and grid control for efficient energy flows. System integrators unify hardware/software into customized DERMS solutions fitting grid/utility needs. Connectivity providers enable reliable asset communication for seamless data transfer, grid stability, and remote management. Utilities, as primary users, leverage DERMS for energy distribution, renewable integration, and resilience. End customers (residential, commercial, industrial) adopt DERs and join demand response programs, driving market growth. This interconnected system fosters innovation, ensures grid reliability, and advances decentralized, sustainable energy futures.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Distributed Energy Resource Management Systems market, By Offering

The software segment is the fastest-growing in the DERMS market due to increasing demand for intelligent energy management, real-time monitoring, and automated grid control. Utilities and energy operators are rapidly deploying advanced analytics, AI-enabled forecasting, and cloud-based DERMS platforms to manage growing DER complexity. Software solutions also offer scalability and cost advantages over hardware, supporting faster integration of renewables, storage, and EV infrastructure across both utility and enterprise networks.

Distributed Energy Resource Management Systems market, By End User

The industrial segment dominates the DERMS market as large manufacturing and processing facilities face rising electricity costs and stricter sustainability targets. Industries rely on DERMS to optimize on-site generation, manage peak demand, and improve energy efficiency. The growing use of rooftop solar, battery storage, and backup generators in industrial sites further drives the need for centralized control systems that ensure reliability, demand response participation, and improved operational visibility.

Distributed Energy Resource Management Systems market, By Application

Solar PV represents the largest application in the DERMS market due to the rapid expansion of distributed solar installations across commercial, industrial, and residential sectors. Governments and utilities are promoting solar adoption through incentives and decarbonization policies, increasing grid complexity. DERMS solutions are essential for managing the intermittency of solar power, enabling accurate forecasting, voltage regulation, and seamless grid integration to maintain network stability and optimize renewable energy utilization.

REGION

Asia Pacific is expected to dominate relay market during forecast period with highest CAGR

The North America region is expected to register a share of 47.2% in 2024. North America leads the DERMS adoption due to the rapid deployment of distributed solar, energy storage systems, and electric vehicle infrastructure. Utilities across the US and Canada are modernizing grid networks to improve resilience against outages and extreme weather events. Supportive government policies, increasing investments in smart grid technologies, and strong presence of DERMS solution providers are further accelerating the implementation of advanced energy management platforms across the region.

DERMS MARKET: COMPANY EVALUATION MATRIX

ABB, a leading provider of electrification and automation technologies and solutions is classified under the “Star” category due to its strong product portfolio. The company offers products, systems, solutions, and services related to electrification, motion, and industrial automation. Its solutions integrate engineering expertise and software, and its offerings harness power reliability, increase industrial productivity, and enhance energy efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Siemens (Germany)

- Schneider Electric (France)

- General Electric Company (US)

- ABB (Switzerland)

- Hitachi Ltd. (Japan)

- Mitsubishi Electric Power Products Inc. (US)

- Emerson Electric Co. (US)

- Itron Inc. (US)

- Enel Spa (Italy)

- Open Access Technology International Inc. (US)

- EnergyHub (US)

- Honeywell International Inc. (US)

- Oracle (US)

- AutoGrid Systems, inc. (US)

- Eaton (Ireland)

- CGI Inc. (Canada)

- Evergen (Australia)

- GridX (US)

- Aspen Technology Inc. (US)

- Doosan GridTech (US)

- GridPoint (US)

- International Business Machines Corporation (US)

- Connected Energy (England)

- mPrest (Israel)

- Virtual Peaker (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 0.44 Billion |

| Market Forecast in 2029 (Value) | USD 1.44 Billion |

| Growth Rate | 18.8% |

| Years Considered | 2019–2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, Asia Pacific, North America, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: DERMS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| A Germany-based client requested detailed DERMS market data for 52 countries spanning multiple regions, with emphasis on identifying emerging opportunities and niche growth pockets. | We assessed the DERMS market across 52 countries, covering regional segmentation, technology adoption trends, competitive landscape, regulatory frameworks, and niche market developments. The analysis provided country-level DERMS readiness, investment outlook, and application-wise potential across utilities, C&I, and microgrids. | Developed a regional DERMS adoption forecast to support long-term strategic planning and investment allocation. Delivered a granular, country-by-country DERMS opportunity matrix, enabling the client to prioritize high-potential markets. |

RECENT DEVELOPMENTS

- February 2024 : Itron, Inc., a company that offers products and services for energy and water resource management, partnered with Schneider Electric to enhance energy and grid management for utilities as homeowners and businesses increasingly adopt DERs, such as rooftop solar panels, battery energy storage solutions, electric vehicles, and microgrids at the grid edge.

- July 2023 : Schneider Electric and Pacific Gas and Electric Company (PG&E) partnered to implement a DERMS on Microsoft Azure. This collaboration aims to enhance grid reliability and promote the adoption of distributed energy resources (DERs), including electric vehicles, energy storage solutions, and rooftop solar systems.

- Feburary 2023 : Siemens partnered with EnergyHub, a provider of grid-edge management solutions, to enhance utilities' grid-edge flexibility. By integrating EnergyHub's DERMS platform with turnkey program management, the collaboration aims to provide utilities with a comprehensive and scalable next-generation solution for managing distributed energy resources.

- May 2022 : Schneider Electric partnered with Microsoft to enhance its EcoStruxure Grid portfolio. With the support of Microsoft Azure's open cloud computing platform, Schneider Electric could provide a deployment environment that allows grid planning and operations solutions to be hosted and managed in the cloud.

Table of Contents

Methodology

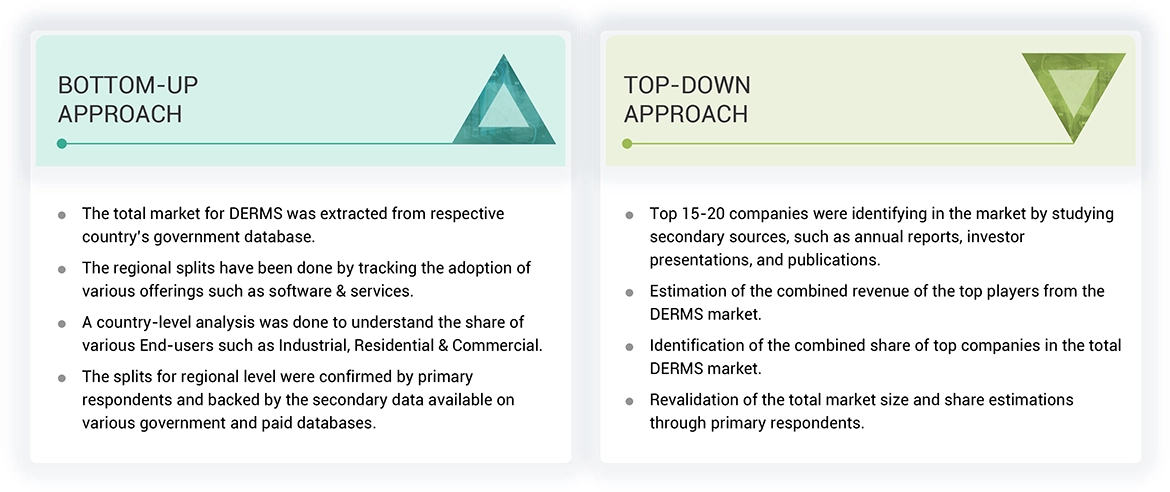

The study involved major activities in estimating the current size of the DERMS market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the DERMS market.

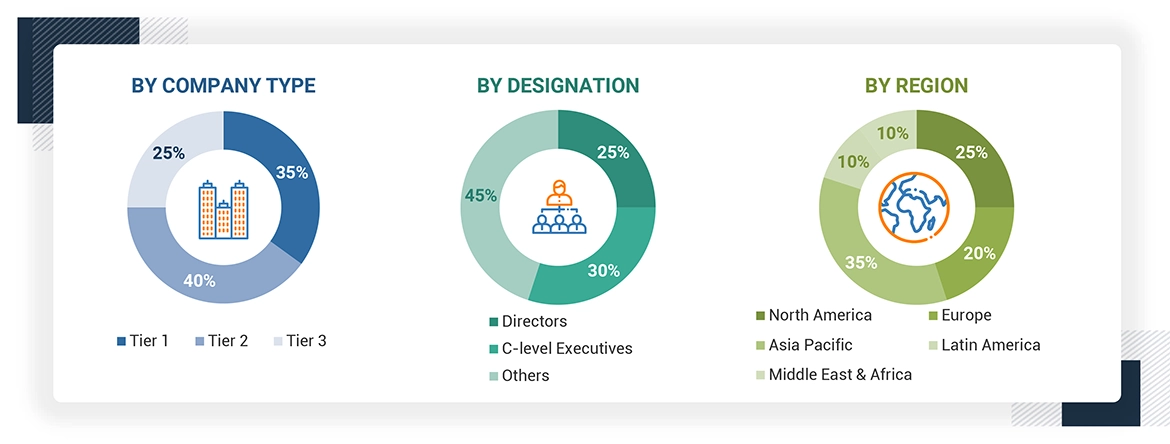

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. Following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2023: Tier 1 = > USD 1 billion,

Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the DERMS market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

DERMS Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

A DERMS platform enables real-time control and communication of distributed energy resources, such as solar panels, energy storage solutions, and EV chargers, optimizing their integration and operation within the grid. It provides flexibility, reliability, and efficient energy management across the grid. The capabilities of DERMS include aggregation, optimization, and simplification of solar PV and energy storage plants and EV charging stations, ensuring greater reliability and efficient operation of the grid. DERM systems are crucial in managing areas with significant energy distribution demands. These systems are essential for seamlessly integrating electric vehicles (EVs), efficiently controlling microgrids, promoting renewable energy sources, enabling two-way power flow, and optimizing demand response management. Embracing DERM technology enhances energy efficiency and supports a sustainable energy future.

The market for distributed energy resource management systems is the sum of revenues global companies generate through the sales of distributed energy resource management systems.

Stakeholders

- Utility companies

- Distributed energy resource providers (DERPs)

- Energy consumers

- Technology providers

- Government and regulatory agencies

- Financial institutions

- Research institutions and academic communities

- Power and energy associations

- Repairs and maintenance service providers

- State and national regulatory authorities

- Research and consulting companies in the clean energy generation sector

- Organizations, forums, alliances, and associations

- Industrial authorities and associations

- State and national regulatory authorities

- Distributed energy resource management system operators

- Research institutes

Report Objectives

- To define, describe, segment, and forecast the distributed energy resource management system (DERMS) market by offering, application, end user, and region, in terms of value

- To describe and forecast the market for five key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with their country-level market sizes, in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide supply chain analysis, trends/disruptions impacting customer business, ecosystem analysis, pricing analysis, patent analysis, technology analysis, Porter’s five forces analysis, case study analysis, key conferences and events, regulatory landscape, global macroeconomic outlook, and trade analysis pertaining to distributed energy resource management systems

- To analyze opportunities for stakeholders in the distributed energy resource management system market and draw a competitive landscape of the market

- To compare distributed energy resource management systems offered by key market players based on their specifications and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as contracts and agreements, investments and expansions, mergers and acquisitions, partnerships, joint ventures, and collaborations, in the distributed energy resource management system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the DERMS Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in DERMS Market