eDiscovery Market by Component (Solutions and Services), Deployment Type (Cloud and On-premises), Organization Size, Vertical (BFSI, IT & Telecom, Government & Public Sector, and Legal) and Region - Global Forecast to 2027

eDiscovery Market Statistics & Key Insight

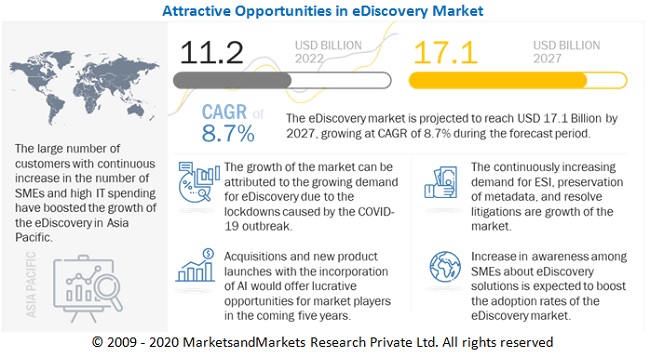

The global eDiscovery Market size was valued at USD 11.2 billion in 2022 and is anticipated to witness over 8.7% CAGR between 2022 and 2027, attributed to the growing revenue of $17.1 billion by 2027. The base year for estimation is 2022, and the historical data spans from 2021 to 2027.

eDiscovery market helps to decrease the complex legal cases, decrease the review documents time. The eDiscovery process is heavily IT-centric, requiring large amounts of structured and unstructured information to be identified, preserved, and collected in order for it to be transferred in a compliant manner to the other party for processing, review, and analysis. eDiscovery clearly necessitates a significant amount of storage space. When advanced data review and analytics technologies are used to automatically extract legal insights from the ESI corpus, eDiscovery necessitates significant compute resources.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

During the COVID-19 outbreak, there is an increase in the subscribers of free plans offered by eDiscovery solutions. After the free plan expires, users are expected to convert to paid plans, thus boosting the adoption of eDiscovery solutions. Industry experts expect the adoption of eDiscovery solutions and services would gain traction during the COVID-19 outbreak and gradually increase in the post-COVID-19 world as well. A rise in the demand for cloud-based business continuity tools and services is also expected to drive the adoption of the WFH/Remote Work model; this would lead to an increase in the demand for a range of business continuity tools and services, such as productivity suites, collaboration tools, MDM, cloud-based contact centers, and BI and analytics. Digitization has stepped in to bridge the gaps by enforced lockdown and social distancing norms. According to a survey by IBM, COVID-19 pandemic has accelerated digital transformation in 59% of organization and 66% organizations are able to overcome previous challenges with digital transformation. To successfully operate in pandemic technologies, such as AI and Machine Learning (ML), are beginning to drive innovation strategies of the business. According to PricewaterhouseCoopers, AI could contribute almost USD 15.7 trillion to the global economy by 2030.

eDiscovery Market Dynamics

How preservation of metadata from electronic documents can be the driver for eDiscovery?

The purpose of preservation metadata is to support and facilitate the long-term retention of digital information. It provides context information about a digital object’s provenance, authenticity, and environment. Preservation metadata is a type of metadata that works to preserve the viability of a digital object while ensuring continued access by providing contextual information, usage details, and rights. As a greater proportion of the world’s information output migrates from analog to digital form, preservation metadata is an essential component of most digital preservation strategies, including digital curation, eDiscovery, digital collections management, and long-term digital information preservation. It is an important part of the data lifecycle because it helps to document the authenticity of a digital object while maintaining usability across formats.

Why the increase in chances of cyberattacks and data theft during the Covid-19 pandemic is the restraining factor for the growth of eDiscovery market?

Cybersecurity is one of the most important factors for smooth business operations. In recent times, there has been a huge rise in the number of data breaches and cyberattacks—the instances of cyberattacks increased by 600% from 2016 to 2017. Cyber security attacks have increased to 12,13,784 until October 2021, according to Rajeev Chandrashekhar, Minister of State for Electronics and Information. Approximately 87,050 cyber security incidents have been directed at government organizations in the last two years. India had a total of 11,58,208 cyber security incidents in 2020-21. Data security is a growing concern, particularly for vulnerable governments to cyberattacks. And, with increasing digitalization in the aftermath of the COVID-19 pandemic, security experts have warned that cyber-attacks will only become more prevalent. Between 2020 and 2021 (until October 2021), 15 and 17 training programs were conducted, with 708 and 4,801 participants, respectively. Microsoft, led by Satya Nadella, issued a statement saying that the exploit had been patched and mitigated in 92% of the servers.

How the rise in the use of smart devices and cloud-based services is the opportunities for the growth of eDiscovery market?

Smartphones and mobile devices dictate everyone’s lives. According to smartphone usage statistics, around 3.2 billion people uses smartphone around the world, more than 5 billion people own mobile devices, kids get mobile devices at the age of 12, 194 billion people downloads mobile apps, and two-thirds of the world is now connected via smartphone. Due to this, the number of internet users has increased. It leads to high demand for smart device users and cloud-based services. Due to the cloud-based services, implementation time is reduced, secure data is easy to transfer, a large volume of data is shared within a short span of time, rapid scalability demand increases, lower the infrastructure, energy, and facility costs, which increases the opportunities for eDiscovery market.

How the high install costs of investment, installation, and maintenance can be the challenges for the growth of eDiscovery market?

Budgets are being cut across the board, despite the growing need for eDiscovery in the age of big data. Data volume is increasing at an exponential rate. The shifting data landscape (data variety) Every day, new file and data types appear on the landscape of technological development, in addition to an increase in data volume. Collaboration within and between departments. Litigation discovery in the public sector can involve many parties, both within and across departments. Resources are in short supply. Whether it's a FOIA request or litigation at the local, state, or federal levels, public sector resources are valuable and should be used with care. eDiscovery costs for a medium-sized lawsuit can range from USD 2.5 to 3.5 million. The effects of COVID-19 on communication data have exacerbated this price. According to the International Legal Technology Association (ILTA), the pandemic has resulted in a data explosion by encouraging the use of chat apps on a regular basis. Companies frequently try to reduce litigation costs by cutting labour costs, increasing review rates, and grouping documents together. However, each of these approaches has limitations. For example, it is risky for businesses to save money by using temporary attorneys or LPO firms. Though the strategy saves money, it introduces new challenges in logistics, data security, attorney-client privilege, and oversight.

Based on component, services segment to be the largest contributor to the eDiscovery market growth during the forecast period

Consulting services delivered by various vendors enable organizations to analyze their current GRC program and develop the roadmap to execute an effective GRC software solution. Training and consulting services focus on user pain points, goals, and timelines while considering the technology and Human Resource (HR) bandwidths. Service providers offer consulting services to help their clients implement new methodologies for recognizing additional revenue streams. Consulting services help in defining deployable use cases for achieving better business performance. Hence, the consulting services segment is predicted to be an important contributor to the overall revenue of the services segment. Integration services are gaining huge traction worldwide, due to the complexities faced by companies, while implementing or using eDiscovery solutions. The integration of these solutions with the existing infrastructure becomes critical for the smooth functioning of the applications. Interoperability issues are a major concern in deploying the eDiscovery software solution with hardware offerings from different vendors. Hence, by integrating the eDiscovery solution with various hardware offerings and testing, the system’s functioning is paramount. The solution provides a team of consultants with domain knowledge and technical expertise to assist organizations in successfully implementing GRC solutions.

Based on vertical, Banking, financial services and insurance segment is to be a larger dominator to the eDiscovery market during the forecast period.

The banking, financial services, and insurance sector mostly work with data used for various purposes, such as tracking customer behavior and regulatory compliance. Banking, financial services, and insurance are also a litigation sector; it works with many secure documents and paperless data. So due to all these reasons, eDiscovery plays a major role in the BFSI sector. In the healthcare sector, many clinical documents need to be shared securely, for which eDiscovery is required. In the IT sector, maintaining copyright is a difficult part; to keep copyright safe and secure, eDiscovery plays a major role. The IT & telecommunications vertical is growing in fast pace. The Lexbe eDiscovery Platform was designed to handle the most difficult and time-consuming telecommunications litigation discovery. Lexbe was designed to take advantage of the power of cloud computing, and it can instantly scale to near-unlimited computing capacity. The Platform’s cloud-based litigation document management solution allows users to self-upload and process case data for same-day review, as well as perform lightning-fast advanced search and coding. The Lexbe eDiscovery Platform includes robust case analysis and timeline functionality, as well as online document processing capabilities that can help to speed up the telecommunications capacity process and expedite the review of millions of documents.

Based on organization size, the large enterprises segment to grow at the highest growth rate during the forecast period

There are various vendors in the market that offer integrated GRC solutions that enable organizations to quickly adapt to the changing regulatory, economic, and technological environments. These solutions help key decision-makers and leaders by offering the critical information required to form the balance between risk management, cost optimization, and capacity for innovation. Large enterprises have a large corporate network and many revenue streams. Hence, there is a huge amount of data generated by them. Small & medium-sized enterprises (SMEs) are adopting eDiscovery solutions at a high pace to enhance their governance, risk, and compliance programs. To help SMEs meet various regulatory requirements, vendors in the market have been rolling eDiscovery solutions with the intent to cater to SMEs. SMEs are also facing pressure related to transparency, visibility, and accountability in their business operations, thus increasing the effectiveness of corporate governance.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific to grow at the highest CAGR during the forecast period

China is the largest developing country in the Asia Pacific region. The usage of IT is huge in China, increasing the demand for eDiscovery. Government policy support and technological integration in Japan are projected to support the growth of the eDiscovery market. The growing number of cyberattacks and cybercrimes encourages organizations to opt for effective corporate, governance, and risk strategies. This is projected to drive market growth in the region. In Japan, a tech startup, Bespoke, has launched a chatbot called Bebot to provide travelers with the latest and reliable updates on the COVID-19 outbreak. The increase in demand for online network connectivity and online purchases of essential goods due to COVID-19 would drive the usage of automation, connectivity intelligence, Robotic Process Automation (RPA), and IoT in India. The government in China has exercised new supporting policies to facilitate business continuity during the COVID-19 pandemic. These implications are an advantage for adopting eDiscovery solutions in the region. China witnesses a high adoption of eDiscovery solutions in the Asia Pacific market. Various banks have started deploying eDiscovery solutions into their operations. In February 2019, the Bank of China formed a partnership with Wolters Kluwer, where the bank in its Australian branch would deploy the OneSumX solution of Wolters Kluwer to deliver accurate and timely submission of business data to its regulators. In China, there are no direct regulations imposed by the governing body for enterprise governance, risk, and compliance management. However, there are some requirements from industries, including BFSI, which include China Banking Insurance Regulatory Commission (CBIRC), China Insurance Regulatory Commission (CIRC), and China Securities Regulatory Commission (CSRC). According to the World Bank Group report, China’s Global Index ranking is the highest among other developing countries.

Key Market Players

The eDiscovery market is dominated by companies such as, Microsoft Corporation (Microsoft, US), International Business Machines Corporation (IBM, US), CS DISCO Inc. (DISCO, US), KLDiscovery Limited (KLDiscovery, US). Nuix Limited (Nuix, Australia), Relativity (US), Logik Systems, Inc (Logikcull, US), ZyLAB Technologies (ZyLAB, Netherlands), Deloitte Touché Tohmatsu Limited (Deloitte, US), Casepoint LLC (Casepoint, US), Exterro, Inc (Exterro, US), Knovos (US), Nextpoint Inc (Nextpoint, US), OpenText Corporation (OpenText, Canada), Everlaw Inc (Everlaw, US), Epiq Systems, Inc (Epiq, US), Consilio LLC (Consilio, US), Ipro Tech LLC (IPRO, US), Servient (US), Zapproved LLC (Zapproved, US),Reveal Data Corporation (Reveal, US), CloudNine (US), Lighthouse eDiscovery, Inc (Lighthouse, US), ONE Discovery (US), Onna Technologies, Inc (Onna, US), Texifter (US), and Evichat (Canada).

eDiscovery Market Report Scope

|

Report Metrics |

Details |

|

Market Revenue in 2027 |

USD 17.1 Billion |

|

Market size value in 2022 |

USD 11.2 Billion |

|

Market Growth Rate |

8.7% CAGR |

|

Largest Market |

Asia Pacific (APAC) |

|

Market size available for years |

2021-2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2027 |

|

Segments covered |

Component, organization size, deployment type, vertical and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), DISCO (US), KLDiscovery (US), Nuix (Australia), Relativity (US), Logikcull (US), ZyLAB (Netherlands), Deloitte (US), Casepoint (US), Exterro (US), Knovos (US), Nextpoint (US), OpenText (Canada), Everlaw (US), Epiq (US), Consilio (US), IPRO (US), Servient (US), Zapproved (US),Reveal (US), CloudNine (US), Lighthouse (US), ONE Discovery (US), Onna (US), Texifter (US), and Evichat (Canada). |

This research report categorizes the eDiscovery market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Component:

- Solutions

- Services

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on Deployment mode:

- On-premises

- Cloud

Based on Vertical:

- Government & Public Sector

- Legal

- Banking, Financial Services, and Insurance

- Energy & Utilities

- Healthcare & Life Sciences

- Retail & Consumer Goods

- Manufacturing

- IT & Telecommunications

- Other Verticals* (education, travel and hospitality, transportation & logistics, and media & entertainment)

Based on regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2020, DISCO has launched DISCO Case builder. DISCO Case Builder provided a centralized, cloud-based repository for managing and organizing all case materials.

- In March 2022, KLDiscovery launched Nebula Enterprise. Nebula Enterprise extended the power, flexibility, and enhanced feature set of Nebula to customers’ data centers in the form of a plug-and-play expandable appliance designed to address a wide range of security and compliance concerns.

- In November 2020, Nuix has partnership with KordaMentha which is a leading advisory and investment firm. Through this partnership KordaMentha was providing clients with secure eDiscovery software in KordaMentha’s services and forensic expertise.

Frequently Asked Questions (FAQ):

What is the projected market value of the eDiscovery market?

The eDiscovery market is projected to grow from USD 11.2 Billion in 2022 to USD 17.1 Billion by 2027, at a compound annual growth rate (CAGR) of 8.7% during the forecast period.

Which region has the highest market share in the eDiscovery market?

North America region has the higher market share in the eDiscovery market.

Who are the players in eDiscovery market?

Microsoft (US), IBM (US), DISCO (US), KLDiscovery (US), Nuix (Australia).

What are some of the drivers in the eDiscovery market?

Preservation of metadata from electronic documents, focus on proactive governance with data analytics and emergence of new content sources, higher number of litigations across globe are the key drivers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 INCLUSIONS & EXCLUSIONS

1.3.4 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 EDISCOVERY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 List of key primary interview participants

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Breakup of primary profiles

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.3 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 EDISCOVERY MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 SUPPLY SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE OF EDISCOVERY FROM VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF EDISCOVERY VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY-SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY-SIDE): CAGR PROJECTIONS FROM THE SUPPLY SIDE

2.3.2 DEMAND-SIDE ANALYSIS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND-SIDE)

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND-SIDE): REVENUE GENERATED FROM THE EDISCOVERY COMPONENT

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 11 EDISCOVERY SERVICES TO BE A LARGER MARKET THAN SOLUTIONS DURING THE FORECAST PERIOD (USD MILLION)

FIGURE 12 MANAGED SERVICES TO ACCOUNT FOR A LARGER MARKET DURING THE FORECAST PERIOD

FIGURE 13 LARGE ENTERPRISES TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 14 IT & TELECOMMUNICATION SEGMENT TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 15 TOP GROWING SEGMENTS IN THE EDISCOVERY MARKET

FIGURE 16 NORTH AMERICA TO BE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE EDISCOVERY MARKET

FIGURE 17 SIGNIFICANT GEOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE MARKET GROWTH

FIGURE 18 SERVICES ARE PROJECTED TO DRIVE THE MARKET

4.2 MARKET, BY ORGANIZATION SIZE

FIGURE 19 LARGE ENTERPRISES TO FORM A LARGER MARKET THAN SMES DURING THE FORECAST PERIOD

4.3 MARKET, BY DEPLOYMENT MODE

FIGURE 20 CLOUD-BASED DEPLOYMENT TO FIND MORE PREFERENCE THAN ON-PREMISES VERSIONS DURING THE FORECAST PERIOD

4.4 MARKET INVESTMENT SCENARIO

FIGURE 21 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 65)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 EDISCOVERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Preservation of metadata from electronic documents

5.2.1.2 Focus on Proactive Governance with Data Analytics and Emergence of new content sources

5.2.1.3 Higher number of litigations across the globe

FIGURE 23 MOST COMMON DISPUTES, 2018 VS 2019

5.2.1.4 Growth of ESI and social media penetration

FIGURE 24 DATA EXPLOSION, 2015–2020 (BILLION GB)

5.2.1.5 Varying structure of regulatory policies

5.2.2 RESTRAINTS

5.2.2.1 Increase in chances of cyberattacks and data theft during the COVID-19 pandemic

FIGURE 25 DATA BREACH COST, BY MAJOR INDUSTRY, 2021 (USD MILLION)

5.2.2.2 Lack of skilled professional workforce

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in the use of smart devices and cloud-based services

5.2.3.2 Emergence of AI-based analytics and predictive coding for eDiscovery

5.2.3.3 Collaboration with social media platforms simplifies litigation processes

5.2.4 CHALLENGES

5.2.4.1 Collaboration within and across departments

5.2.4.2 High initial costs of investment, installation, and maintenance

5.2.4.3 Increase in data volumes

5.2.4.4 Privacy and security aspects

FIGURE 26 MALWARE INFECTION INCIDENCE, 2009–2018 (MILLION)

5.2.4.5 Lack of Awareness of eDiscovery Solutions

5.3 INDUSTRY TRENDS

5.3.1 CASE STUDY ANALYSIS

5.3.1.1 Use case 1: Internet publishing

5.3.1.2 Use case 2: Food & Beverage

5.3.1.3 Use case 3: Banking, Financial Services, and Insurance

5.3.1.4 Use case 4: Retail

5.3.1.5 Use case 5: Law

5.4 ELECTRONIC DISCOVERY REFERENCE MODEL

FIGURE 27 ELECTRONIC DISCOVERY REFERENCE MODEL PHASES

5.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 28 EDISCOVERY MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 ECOSYSTEM

FIGURE 29 MARKET: ECOSYSTEM

5.7 MARKET: COVID-19 IMPACT

FIGURE 30 MARKET TO GROW AT A SLOW PACE FROM 2020 TO 2022 OWING TO THE COVID-19 PANDEMIC

FIGURE 31 MARKET: GLOBAL SNAPSHOT

5.7.1 COVID-19 DRIVEN MARKET DYNAMICS

5.7.1.1 Drivers and opportunities

5.7.1.2 Restraints and challenges

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 32 EDISCOVERY MARKET: SUPPLY CHAIN ANALYSIS

TABLE 5 MARKET: SUPPLY CHAIN

5.9 PRICING ANALYSIS

TABLE 6 EDISCOVERY SOLUTIONS: PRICING STRUCTURE

TABLE 7 PRICING ANALYSIS: MARKET

FIGURE 33 EDISCOVERY SOLUTIONS: AVERAGE SELLING PRICES (USD)

5.10 PATENT ANALYSIS

FIGURE 34 NUMBER OF PATENTS DOCUMENTS PUBLISHED, 2012–2022

FIGURE 35 TOP FIVE GLOBAL PATENT OWNERS

TABLE 8 TOP TEN PATENT APPLICANTS

5.11 TECHNOLOGICAL ANALYSIS

5.11.1 AI AND EDISCOVERY

5.11.2 INTERNET OF THINGS AND EDISCOVERY

5.11.3 BIG DATA AND EDISCOVERY

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 36 EDISCOVERY MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

5.13 KEY CONFERENCES & EVENTS

TABLE 9 MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

FIGURE 37 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR EDISCOVERY SOFTWARE

TABLE 10 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS FOR EDISCOVERY SOFTWARE

5.14.2 BUYING CRITERIA

FIGURE 38 KEY BUYING CRITERIA FOR EDISCOVERY SOFTWARE

TABLE 11 KEY BUYING CRITERIA FOR EDISCOVERY SOFTWARE

5.15 TARIFF AND REGULATORY LANDSCAPE

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA-PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.2 REGULATIONS

5.15.2.1 North America

5.15.2.2 Europe

5.15.2.3 Asia Pacific

5.15.2.4 Middle East and South Africa

5.15.2.5 Latin America

6 EDISCOVERY MARKET, BY COMPONENT (Page No. - 101)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 39 SERVICES TO BE THE LARGER MARKET DURING THE FORECAST PERIOD

TABLE 16 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 17 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 40 PROCESSING, REVIEW, AND ANALYSIS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 18 EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 19 EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 20 EDISCOVERY SOLUTIONS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 EDISCOVERY SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 PROCESSING, REVIEW, AND ANALYSIS

TABLE 22 EDISCOVERY PROCESSING, REVIEW, AND ANALYSIS SOLUTIONS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 EDISCOVERY PROCESSING, REVIEW, AND ANALYSIS SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 IDENTIFICATION, PRESERVATION, AND COLLECTION

TABLE 24 EDISCOVERY IDENTIFICATION, PRESERVATION, AND COLLECTION SOLUTIONS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 EDISCOVERY IDENTIFICATION, PRESERVATION, AND COLLECTION SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 PRODUCTION & PRESENTATION

TABLE 26 EDISCOVERY PRODUCTION & PRESENTATION SOLUTIONS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 EDISCOVERY PRODUCTION & PRESENTATION SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 41 MANAGED SERVICES TO GROW TO BE THE LARGEST MARKET DURING THE FORECAST PERIOD

TABLE 28 EDISCOVERY SERVICES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 29 EDISCOVERY SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 30 EDISCOVERY SERVICES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 EDISCOVERY SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 MANAGED SERVICES

TABLE 32 MANAGED EDISCOVERY SERVICES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 MANAGED EDISCOVERY SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 MAINTENANCE & SUPPORT

TABLE 34 EDISCOVERY MAINTENANCE & SUPPORT SERVICES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 EDISCOVERY MAINTENANCE & SUPPORT SERVICES, BY REGION, 2022–2027 (USD MILLION)

6.3.3 TRAINING, CONSULTING, AND INTEGRATION

TABLE 36 EDISCOVERY TRAINING, CONSULTING, AND INTEGRATION SERVICES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 EDISCOVERY TRAINING, CONSULTING, AND INTEGRATION SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

7 EDISCOVERY MARKET, BY DEPLOYMENT TYPE (Page No. - 114)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

7.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

FIGURE 42 CLOUD DEPLOYMENT TO BE THE LARGER MARKET DURING THE FORECAST PERIOD

TABLE 38 MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 39 MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

7.2 ON-PREMISES

TABLE 40 ON-PREMISE EDISCOVERY DEPLOYMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 ON-PREMISE EDISCOVERY DEPLOYMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 CLOUD

TABLE 42 CLOUD-BASED EDISCOVERY DEPLOYMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 43 CLOUD-BASED EDISCOVERY DEPLOYMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8 EDISCOVERY MARKET, BY ORGANIZATION SIZE (Page No. - 119)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 43 LARGE ENTERPRISES TO BE THE LARGER ADOPTER OF EDISCOVERY DURING THE FORECAST PERIOD

TABLE 44 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 45 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 46 LARGE ENTERPRISES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 LARGE ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SMALL & MEDIUM SIZED ENTERPRISES

TABLE 48 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 49 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

9 EDISCOVERY MARKET, BY VERTICAL (Page No. - 124)

9.1 INTRODUCTION

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

FIGURE 44 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO BE THE LARGEST MARKET DURING THE FORECAST PERIOD

TABLE 50 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 51 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 GOVERNMENT & PUBLIC SECTOR

TABLE 52 GOVERNMENT & PUBLIC SECTOR VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 GOVERNMENT & PUBLIC SECTOR VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 LEGAL

TABLE 54 LEGAL VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 55 LEGAL VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 56 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 ENERGY & UTILITIES

TABLE 58 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 59 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 HEALTHCARE & LIFE SCIENCES

TABLE 60 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 61 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 RETAIL & CONSUMER GOODS

TABLE 62 RETAIL & CONSUMER GOODS VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 63 RETAIL & CONSUMER GOODS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 MANUFACTURING

TABLE 64 MANUFACTURING VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 65 MANUFACTURING VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 IT & TELECOMMUNICATIONS

TABLE 66 IT & TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 67 IT & TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 OTHER VERTICALS

TABLE 68 OTHER VERTICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 69 OTHER VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

10 EDISCOVERY MARKET, BY REGION (Page No. - 137)

10.1 INTRODUCTION

FIGURE 45 NORTH AMERICA TO BE THE LARGEST MARKET DURING THE FORECAST PERIOD

TABLE 70 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 71 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: EDISCOVERY MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

TABLE 72 NORTH AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: EDISCOVERY SERVICES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: EDISCOVERY SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.3 US

TABLE 86 US: EDISCOVERY MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 87 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 88 US: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 89 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.2.4 CANADA

TABLE 90 CANADA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 91 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 92 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 93 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: EDISCOVERY MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 94 EUROPE: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 97 EUROPE: EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: EDISCOVERY SERVICES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 99 EUROPE: EDISCOVERY SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 100 EUROPE: EDISCOVERY MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.3 UK

TABLE 108 UK: EDISCOVERY MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 109 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 110 UK: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 111 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.4 GERMANY

TABLE 112 GERMANY: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 113 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 114 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 115 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.5 FRANCE

TABLE 116 FRANCE: EDISCOVERY MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 117 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 118 FRANCE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 119 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 120 REST OF EUROPE: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 121 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 122 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 123 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: EDISCOVERY MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 124 ASIA PACIFIC: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: EDISCOVERY SERVICES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 129 ASIA PACIFIC: EDISCOVERY SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 130 ASIA PACIFIC: EDISCOVERY MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

10.4.3 CHINA

TABLE 138 CHINA: EDISCOVERY MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 139 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 140 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 141 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.4 JAPAN

TABLE 142 JAPAN: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 143 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 144 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 145 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.5 AUSTRALIA & NEW ZEALAND

TABLE 146 AUSTRALIA & NEW ZEALAND: EDISCOVERY MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 147 AUSTRALIA & NEW ZEALAND: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 148 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 149 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 150 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 151 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 153 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: EDISCOVERY MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 154 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: EDISCOVERY SERVICES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: EDISCOVERY SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: EDISCOVERY MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 KINGDOM OF SAUDI ARABIA

TABLE 168 KINGDOM OF SAUDI ARABIA: EDISCOVERY MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 169 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 170 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 171 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 172 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 173 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 174 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 175 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.5 SOUTH AFRICA

TABLE 176 SOUTH AFRICA: EDISCOVERY MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 177 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 178 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 179 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.6 REST OF THE MIDDLE EAST & AFRICA

TABLE 180 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 181 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 182 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 183 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: EDISCOVERY MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 184 LATIN AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 186 LATIN AMERICA: EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 187 LATIN AMERICA: EDISCOVERY SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 188 LATIN AMERICA: EDISCOVERY SERVICES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 189 LATIN AMERICA: EDISCOVERY SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 192 LATIN AMERICA: EDISCOVERY MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

TABLE 198 BRAZIL: EDISCOVERY MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 199 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 200 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 201 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.4 MEXICO

TABLE 202 MEXICO: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 203 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 204 MEXICO: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 205 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 206 REST OF LATIN AMERICA: EDISCOVERY MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 207 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 208 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 209 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 188)

11.1 INTRODUCTION

FIGURE 48 MARKET EVALUATION FRAMEWORK

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 210 OVERVIEW OF STRATEGIES ADOPTED BY KEY EDISCOVERY SOFTWARE VENDORS

11.3 MARKET RANKING

FIGURE 49 MARKET RANKING, 2021–2022

11.4 MARKET SHARE OF TOP VENDORS

TABLE 211 EDISCOVERY: DEGREE OF COMPETITION

FIGURE 50 EDISCOVERY MARKET: VENDOR SHARE ANALYSIS

11.5 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 51 HISTORICAL REVENUE ANALYSIS, 2017–2021 (USD MILLION)

11.6 COMPANY EVALUATION QUADRANT

FIGURE 52 KEY COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 53 EDISCOVERY MARKET: KEY PLAYER EVALUATION QUADRANT

TABLE 212 COMPANY VERTICAL FOOTPRINT

TABLE 213 COMPANY REGION FOOTPRINT

TABLE 214 COMPANY FOOTPRINT

11.7 STARTUP/SME EVALUATION QUADRANT

FIGURE 54 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.7.1 RESPONSIVE VENDORS

11.7.2 PROGRESSIVE VENDORS

11.7.3 DYNAMIC VENDORS

11.7.4 STARTING BLOCKS

FIGURE 55 EDISCOVERY MARKET: STARTUP EVALUATION MATRIX

TABLE 215 STARTUP: COMPANY VERTICAL FOOTPRINT

TABLE 216 STARTUP: COMPANY REGION FOOTPRINT

TABLE 217 STARTUP: COMPANY FOOTPRINT

11.7.5 COMPETITIVE BENCHMARKING

TABLE 218 MARKET: DETAILED LIST OF KEY STARTUP/SMES

11.8 COMPETITIVE SCENARIO

TABLE 219 MARKET: NEW LAUNCHES, 2019–2022

TABLE 220 MARKET: DEALS, 2019–2022

TABLE 221 MARKET: OTHERS, 2019–2021

12 COMPANY PROFILES (Page No. - 208)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.2.1 MICROSOFT

TABLE 222 MICROSOFT: BUSINESS OVERVIEW

FIGURE 56 MICROSOFT: COMPANY SNAPSHOT

TABLE 223 MICROSOFT: SOLUTION/SERVICE/PLATFORM OFFERED

TABLE 224 MICROSOFT: PRODUCT LAUNCHES

12.2.2 IBM

TABLE 225 IBM: BUSINESS OVERVIEW

FIGURE 57 IBM: COMPANY SNAPSHOT

TABLE 226 IBM: SOLUTION/SERVICE/PLATFORM OFFERED

TABLE 227 IBM: PRODUCT LAUNCHES

TABLE 228 IBM: DEALS

12.2.3 DISCO

TABLE 229 DISCO: BUSINESS OVERVIEW

FIGURE 58 DISCO: COMPANY SNAPSHOT

TABLE 230 DISCO: SOLUTION/SERVICE/PLATFORM OFFERED

TABLE 231 DISCO: PRODUCT LAUNCHES

TABLE 232 DISCO: DEALS

12.2.4 KLDISCOVERY

TABLE 233 KLDISCOVERY: BUSINESS OVERVIEW

FIGURE 59 KLDISCOVERY: COMPANY SNAPSHOT

TABLE 234 KLDISCOVERY: SOLUTION/SERVICE/PLATFORM OFFERED

TABLE 235 KLDISCOVERY: PRODUCT LAUNCHES

TABLE 236 KLDISCOVERY: DEALS

TABLE 237 KLDISCOVERY: OTHERS

12.2.5 NUIX

TABLE 238 NUIX: BUSINESS OVERVIEW

FIGURE 60 NUIX: COMPANY SNAPSHOT

TABLE 239 NUIX: SOLUTION/SERVICE/PLATFORM OFFERED

TABLE 240 NUIX: DEALS

12.2.6 RELATIVITY

TABLE 241 RELATIVITY: BUSINESS OVERVIEW

TABLE 242 RELATIVITY: SOLUTION/SERVICE/PLATFORM OFFERED

TABLE 243 RELATIVITY: PRODUCT LAUNCHES

TABLE 244 RELATIVITY: DEALS

TABLE 245 RELATIVITY: OTHERS

12.2.7 LOGIKCULL

TABLE 246 LOGIKCULL: BUSINESS OVERVIEW

TABLE 247 LOGIKCULL: SOLUTION/SERVICE/PLATFORM OFFERED

12.2.8 ZYLAB

TABLE 248 ZYLAB: BUSINESS OVERVIEW

TABLE 249 ZYLAB: SOLUTION/SERVICE/PLATFORM OFFERED

TABLE 250 ZYLAB: PRODUCT LAUNCHES

TABLE 251 ZYLAB: DEALS

12.2.9 DELOITTE

TABLE 252 DELOITTE: BUSINESS OVERVIEW

TABLE 253 DELOITTE: SOLUTION/SERVICE/PLATFORM OFFERED

TABLE 254 DELOITTE: PRODUCT LAUNCHES

12.2.10 CASEPOINT

TABLE 255 CASEPOINT: BUSINESS OVERVIEW

TABLE 256 CASEPOINT: SOLUTION/SERVICE/PLATFORM OFFERED

TABLE 257 CASEPOINT: DEALS

TABLE 258 CASEPOINT: OTHERS

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12.2.11 EXTERRO

12.2.12 KNOVOS

12.2.13 NEXTPOINT

12.2.14 OPENTEXT

12.2.15 EVERLAW

12.2.16 EPIQ

12.2.17 CONSILIO

12.3 STARTUP/SME PLAYERS

12.3.1 IPRO

12.3.2 SERVIENT

12.3.3 ZAPPROVED

12.3.4 REVEAL

12.3.5 CLOUDNINE

12.3.6 LIGHTHOUSE

12.3.7 ONE DISCOVERY

12.3.8 ONNA

12.3.9 TEXIFTER

12.3.10 EVICHAT

13 ADJACENT AND RELATED MARKETS (Page No. - 245)

13.1 INTRODUCTION

13.1.1 RELATED MARKETS

13.1.2 LIMITATIONS

13.2 EGRC MARKET

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.3 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY OFFERING

TABLE 259 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 260 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY OFFERING, 2020–2026 (USD MILLION)

13.2.4 GEOGRAPHIC ANALYSIS

13.2.4.1 North America

TABLE 261 NORTH AMERICA: ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 262 NORTH AMERICA: ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 263 NORTH AMERICA: ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY SOFTWARE TYPE, 2015–2020 (USD MILLION)

TABLE 264 NORTH AMERICA: ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY SOFTWARE TYPE, 2020–2026 (USD MILLION)

TABLE 265 NORTH AMERICA: ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY SOFTWARE USAGE, 2015–2020 (USD MILLION)

TABLE 266 NORTH AMERICA: ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY SOFTWARE USAGE, 2020–2026 (USD MILLION)

13.3 DATA DISCOVERY MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 DATA DISCOVERY MARKET ANALYSIS, BY COMPONENT

TABLE 267 DATA DISCOVERY MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 268 DATA DISCOVERY MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

13.3.4 DATA DISCOVERY MARKET, BY ORGANIZATION SIZE

TABLE 269 DATA DISCOVERY MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 270 DATA DISCOVERY MARKET, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 271 LARGE ENTERPRISES: DATA DISCOVERY MARKET, BY REGION, 2014–2019 (USD MILLION)

TABLE 272 LARGE ENTERPRISES: DATA DISCOVERY MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 273 SMALL & MEDIUM-SIZED ENTERPRISES: DATA DISCOVERY MARKET, BY REGION, 2014–2019 (USD MILLION)

TABLE 274 SMALL & MEDIUM-SIZED ENTERPRISES: DATA DISCOVERY MARKET, BY REGION, 2019–2025 (USD MILLION)

13.3.5 DATA DISCOVERY MARKET ANALYSIS, BY REGION

13.3.5.1 North America

TABLE 275 NORTH AMERICA: DATA DISCOVERY MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 276 NORTH AMERICA: DATA DISCOVERY MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 277 NORTH AMERICA: DATA DISCOVERY MARKET, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 278 NORTH AMERICA: DATA DISCOVERY MARKET, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 279 NORTH AMERICA: DATA DISCOVERY MARKET, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 280 NORTH AMERICA: DATA DISCOVERY MARKET, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

14 APPENDIX (Page No. - 253)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

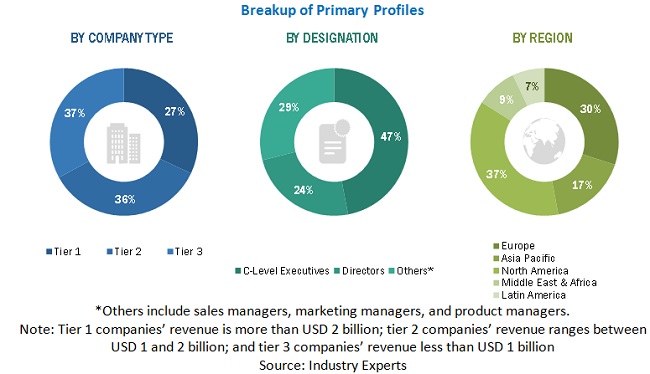

The study involved 4 major activities to estimate the current market size of eDiscovery market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

The market size of companies offering eDiscovery solutions and services was derived on the basis of the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their solution capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from eDiscovery vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of end-users using eDiscovery solutions and services, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service

providers, and their current use of eDiscovery solutions and services, which would affect the overall eDiscovery market.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the eDiscovery market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

- Key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the eDiscovery market.

Report Objectives

- To describe and forecast the global eDiscovery market based on component, deployment type, organization size, vertical and region

- To forecast the market size of regional segments: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze COVID-19 impact and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in eDiscovery Market