Edge Computing in Healthcare Market by Component (Hardware, Software, Services), Application (Diagnostics, Robotic Surgery, Telehealth, RPM, and Ambulances), End User (Hospitals, Clinics, Ambulatory Care Center), & Region - Global Forecast to 2028

Market Growth Outlook Summary

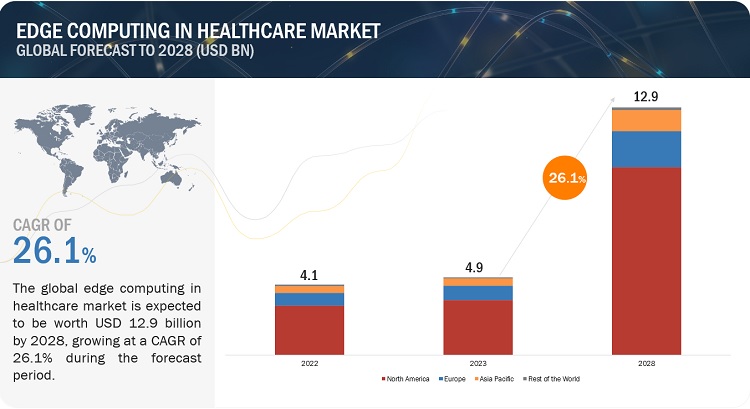

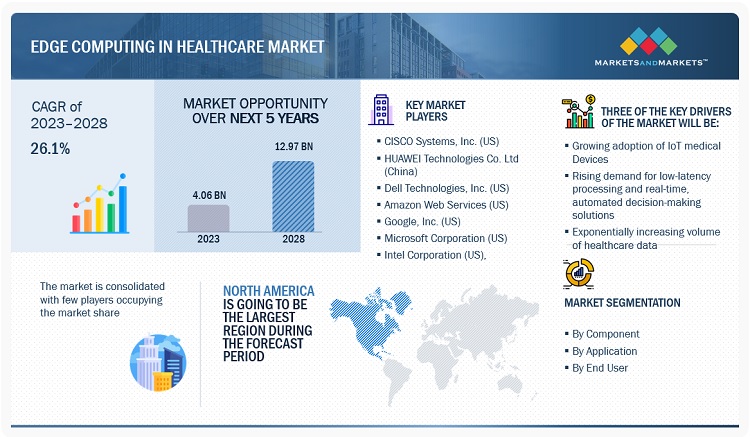

The global edge computing in healthcare market, valued at US$4.1 billion in 2022, stood at US$4.9 billion in 2023 and is projected to advance at a resilient CAGR of 26.1% from 2023 to 2028, culminating in a forecasted valuation of US$12.9 billion by the end of the period. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

With the rise of the number of devices and the increased use of internet services, edge computing has become increasingly popular across industries. It offers several benefits, including low latency, traffic distribution, improved reliability, and reduced costs, which have led to its rapid acceptance by healthcare organizations worldwide. In addition, edge computing provides greater security and privacy for sensitive data, making it an attractive option for organizations dealing with confidential information.

Edge Computing in Healthcare Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Edge Computing in Healthcare Market Dynamics

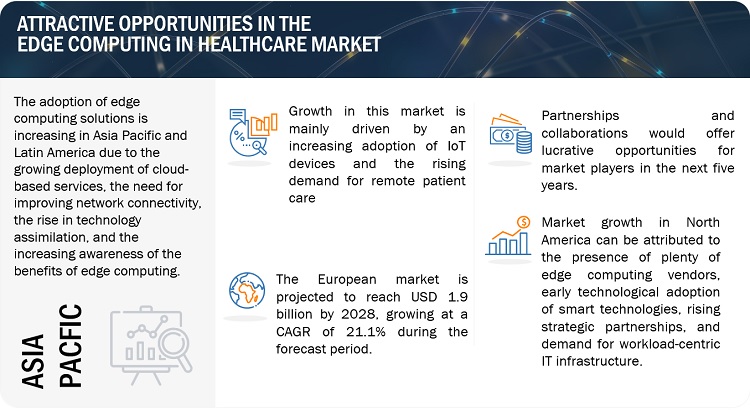

Driver: Growing adoption of IoT medical devices

The proliferation of IoT devices has led to a significant increase in data, due to which healthcare organizations are increasingly relying on centralized cloud computing and storage solutions. The global IoT medical devices market is expected to grow at a CAGR of 28.9% during the period from 2021 to 2026. According to a research study, the number of active IoT devices is expected to grow to ~31 billion by 2025. Accenture predicts that IoT could add USD 14.2 trillion to the global economy by 2030. Migrating the entire IT infrastructure to the cloud poses latency and economic feasibility issues. Hence, organizations using IoT sensors, actuators, and other IoT devices are increasingly looking for edge computing solutions, such as edge nodes, devices, and hyper-localized data centers. Edge computing supplements the existing cloud paradigm by facilitating data processing closer to the data source, thereby enabling organizations to speed up decision-making.

IoT devices, such as wearables, smart sensors, and medical devices, can generate vast amounts of data that can be used to monitor patients in real time, track their health status, and facilitate early detection of potential health issues.

One example of IoT devices in healthcare is remote patient monitoring (RPM) systems. These systems use wearable devices, smart sensors, and other IoT devices to monitor patients’ vital signs, activity levels, and other health-related data in real time. This data is then transmitted to healthcare providers, who can use it to monitor patients remotely and make informed decisions about their care. RPM systems are particularly useful for patients with chronic conditions, such as diabetes, heart disease, and chronic obstructive pulmonary disease (COPD), who require ongoing monitoring and supports.

Restraint: High CAPEX and OPEX associated with edge computing systems

One of the key restraints for the adoption of edge computing solutions in healthcare settings is the initial capital expenditure (CAPEX) required for infrastructure. Edge computing systems require significant investment in hardware, software, and networking infrastructure, which limits adoption among healthcare organizations with limited budgets. For instance, the deployment of edge computing systems for medical imaging requires significant investment in high-performance computing infrastructure, including servers, storage systems, and networking equipment. Companies such as NVIDIA and Intel offer high-performance edge computing solutions for medical imaging, but the initial CAPEX for these systems can be substantial.

Another example is the deployment of edge computing systems for remote patient monitoring. Companies such as Philips and Qualcomm offer edge computing solutions for remote patient monitoring, which require investment in both hardware and software infrastructure. The initial CAPEX for these systems can be significant, which may limit the adoption of edge computing solutions for remote patient monitoring in healthcare settings.

In addition to the CAPEX required for infrastructure, healthcare organizations may also have to bear high operating expenditure (OPEX) associated with edge computing systems, including maintenance, upgrades, and staff training. These ongoing expenses can further limit the adoption of edge computing solutions in healthcare settings.

To overcome this restraint, healthcare organizations can consider alternative deployment models for edge computing, such as cloud-based edge computing solutions or managed services. Companies such as Microsoft and Amazon offer cloud-based edge computing solutions, which can help to reduce the initial CAPEX for infrastructure. Additionally, healthcare organizations can partner with managed service providers that specialize in edge computing, which can help to reduce the ongoing operating expenses associated with edge computing systems.

Opportunity: Advent of 5G network

5G is expected to enable life-altering advancements in the near future. According to Ericsson Mobility Report 2020, global 5G subscriptions are expected to reach 2.8 billion by the end of 2025, accounting for 30% of total subscriptions. 5G will provide greater benefits for the deployment of edge computing solutions. 5G does not improve the user experience when businesses centralize their APIs. Approximately 99% of APIs are centralized in one or two data centers. Healthcare organizations must find ways to bring data streaming edge messaging solutions or design a network for edge that provides distributed access. 5G, with an edge messaging system, enhances application connectivity speed with 5G and delivers instant communication experiences. Cisco predicted that 5G’s impact would be tangible and significant by 2022. 5G brings cloud, core, and edge together. It will bring network architectures that are faster and more robust, bringing the core near the end and reducing the dependence on edge technology for various applications. Thus, 5G will be an accelerator for edge deployments and new edge use cases.

Challenge: Susceptibility to cyberattacks and limited authentication capabilities of edge computing architecture

Despite the benefits, the edge computing architecture is susceptible to cyberattacks due to the addition of vulnerable edge nodes and IoT devices. Various IoT devices, such as security cameras, smart doorbells, and baby monitors, have limited capabilities of authentication and encryption. Hence, they are prone to tampering, eavesdropping, malicious congestion, and identity forging. With the increasing number of IoT startups and rising competition, many small companies rely on security through obscurity while neglecting the risk of cyberattacks. As these devices lack robust IT hardware protocols, users having less or no knowledge about IT security might lose critical data, paving the way for malware that could shun the entire edge network. This could also lead to large security breaches and can cause huge economic losses to the entire ecosystem. Eliminating authentication and enumeration vulnerabilities is the biggest challenge for IoT device manufacturers until the companies introduce some tough protocols and authentication systems within the devices.

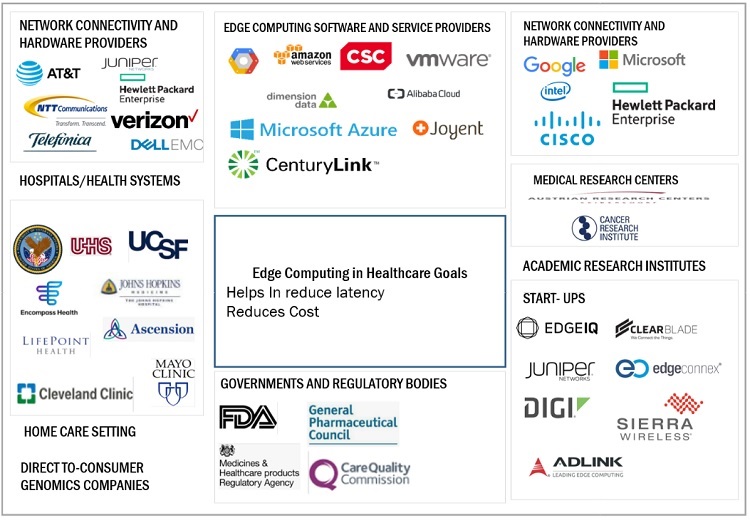

Edge Computing in healthcare Market Ecosystem

Well-known, financially secure producers of Edge computing in healthcare systems and platforms are prominent players in this market. These companies have been in operation for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. Key companies in this market include CISCO Systems, Inc. (US) | HUAWEI Technologies Co. Ltd (China) | Dell Technologies, Inc. (US) | Amazon Web Services (US) | Google, Inc. (US) | Microsoft Corporation (US) | Intel Corporation (US) | General Electric Digital (US) | Hewlett Packard Enterprise Company (US) | VMware, Inc. (US)

Hardware acquires largest size of edge computing in healthcare industry, by component

Based on component, the edge computing in healthcare market is segmented into hardware, software, and services. The hardware segment dominated this market in 2022, this is due to the high-scale deployment of edge hardware by healthcare organizations to achieve high performance, scale, and flexibility.

Based on application, telehealth & remote patient monitoring segment is anticipated to dominate the edge computing in healthcare industry

Based on application, the edge computing in healthcare market is segmented into diagnostics, Among these applications, telehealth and remote patient monitoring are expected to dominate the market during the forecast period. By implementing edge computing, telehealth providers can provide patients with a more streamlined and integrated experience, leading to higher engagement and satisfaction. Patients can receive remote consultations with healthcare professionals, access their medical records, and monitor their health and wellness using wearable devices, all from the convenience of their homes. This approach also ensures greater convenience, privacy, and accessibility for patients, enabling them to receive care anytime, anywhere.

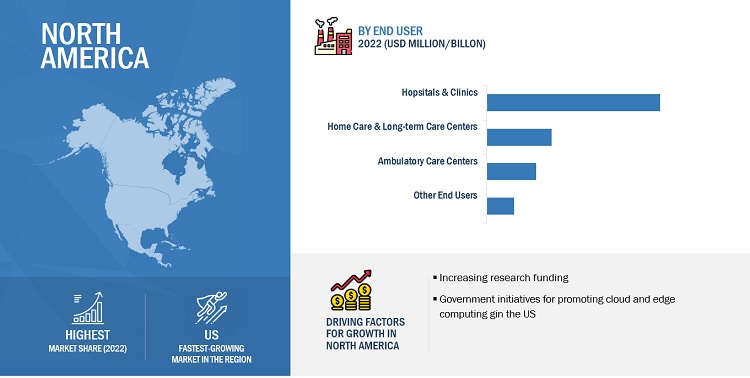

Based on the end user, hospitals & clinics accounted for the largest share of the edge computing in healthcare industry

Based on end-users, hospitals & clinics garner high revenue owing to their huge generation of data, attributed to the widespread geographical presence and customer base. Edge computing is transforming the way hospitals and clinics manage data, enabling faster, more efficient decision-making and reducing the burden on IT infrastructure. This technology is helping to improve patient outcomes, enhance the patient experience, and increase the overall efficiency of healthcare systems.

To know about the assumptions considered for the study, download the pdf brochure

North America is expected to account for the largest share in edge computing in healthcare industry in 2022

Based on region, the global edge computing in healthcare market has been segmented into North America, Europe, Asia Pacific, and the Rest of the World. In 2022, North America accounted for the largest market share followed by Europe. The increasing number of alliances and partnerships among edge computing and other technology providers for continuous technological innovations and advancements in edge computing have further added to the growth of the global edge computing market in North America.

The edge computing in healthcare market is dominated by a few globally established players such as CISCO Systems, Inc. (US), Dell Technologies, Inc. (US), Amazon Web Services (US), Google, Inc. (US), Microsoft Corporation (US), Intel Corporation (US), among others.

Scope of the Edge Computing in Healthcare Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$4.1 billion |

|

Projected Revenue Size by 2028 |

$12.9 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 26.1% |

|

Market Driver |

Growing adoption of IoT medical devices |

|

Market Opportunity |

Advent of 5G network |

The study categorizes the Edge computing in healthcare market to forecast revenue and analyze trends in each of the following submarkets:

By component

- Hardware

- Software

- Services

By Application

- Diagnostics

- Telehealth & Remote Patient Monitoring

- Robotic Surgery

- Ambulances

- Other Applications

By End User

- Hospitals & Clinics

- Long-term Care Centers and Home Care Settings

- Ambulatory Care Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- Japan

- South Korea

- Other Asia Pacific Countries

- Rest of the World

Recent Developments of Edge Computing in Healthcare Industry

- In December 2022, Intel Labs and the Perelman School of Medicine at the University of Pennsylvania (Penn Medicine) completed of a joint research study using distributed machine learning (ML) and artificial intelligence (AI) approaches to help international healthcare and research institutions identify malignant brain tumors.

- In February 2023, Cisco Systems, Inc. (US) partnered with the NTT DATA (Tokyo) to boost private 5G adoption and edge computing solutions across the Automotive, Logistics, Healthcare, Retail, and public sectors. Cisco Systems, Inc. also collaborated with Bharti Airtel and Apollo Hospitals, Inc. to develop 5G-connected ambulances

- In February 2022, Kyndryl partnered with Amazon Web Services to establish a Cloud Centre of Excellence to provide joint solutions, such as mainframe, network, edge computing, and ERP services for mission-critical infrastructure.

- In October 2021, Dell Technologies enhanced its edge innovations across its infrastructure and PC portfolios to assist organizations in simplifying deployments and capturing more value from data generated and processed outside of the traditional data center and public cloud—from rugged and remote locations to retail stores and factory floors. For instance, VxRail satellite node single-node deployments automate day-to-day operations, health monitoring, eliminating the need for local technical and specialized staff.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the edge computing in healthcare market?

The edge computing in healthcare market boasts a total revenue value of $12.9 billion by 2028.

What is the estimated growth rate (CAGR) of the edge computing in healthcare market?

The global edge computing in healthcare market has an estimated compound annual growth rate (CAGR) of 26.1% and a revenue size in the region of $4.1 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing adoption of IoT medical devices- Exponentially increasing network traffic and volume of healthcare data- Rising need to curtail healthcare costs- Rising demand for low-latency processing and real-time, automated decision-making solutionsRESTRAINTS- High CAPEX and OPEX associated with edge computing systems- Interoperability challenges related to edge computing across different healthcare systemsOPPORTUNITIES- Advent of 5G networkCHALLENGES- Complexities in integrating edge computing systems with existing cloud architecture- Susceptibility to cyberattacks and limited authentication capabilities of edge computing architecture

- 6.1 INTRODUCTION

- 6.2 OVERVIEW OF KEY INDUSTRY TRENDS

-

6.3 CASE STUDY ANALYSISSENTARA IMPROVED RESPONSE TIME WITH DELL’S EDGE COMPUTING SOLUTIONSRED HAT HELPED HCA HEALTHCARE IMPROVE SEPSIS DIAGNOSISAI-ASSISTED HOME-BASED PATIENT MONITORING FACILITATED BY BIOBEAT DURING COVID-19ZELLA DC FACILITATED HOME-BASED PATIENT MONITORING FOR CENTERS FOR DISEASE CONTROL AND PREVENTION (CDC)

-

6.4 ECOSYSTEM ANALYSIS

- 6.5 PRICING ANALYSIS

-

6.6 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR EDGE COMPUTING IN HEALTHCARE MARKETJURISDICTION AND TOP APPLICANT ANALYSIS

-

6.7 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE AND MACHINE LEARNING5GINTERNET OF THINGS (IOT)AUGMENTED REALITY (AR) AND VIRTUAL REALITY (VR)SYSTEM ARCHITECTURE FOR HEALTHCARE EDGE COMPUTING SOLUTIONS

- 6.8 SUPPLY CHAIN ANALYSIS

-

6.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.10 KEY CONFERENCES & EVENTS, 2023–2024

-

6.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.12 REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST AND SOUTH AFRICALATIN AMERICA

-

6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 7.1 INTRODUCTION

-

7.2 HARDWAREREFER TO PHYSICAL COMPONENTS REQUIRED TO RUN APPLICATIONS

-

7.3 SOFTWAREENHANCE COMPUTING CAPABILITIES OF EDGE DEVICES AND DATA CENTERS

-

7.4 SERVICESINCLUDE CONSULTING, PRODUCT SUPPORT, INTEGRATION, UPDATES, AND MAINTENANCE OF INTEGRATED EDGE DEVICES AND SOLUTIONS

- 8.1 INTRODUCTION

-

8.2 DIAGNOSTICSGROWING ADOPTION OF TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING TECHNOLOGIES TO AUGMENT MARKET GROWTH

-

8.3 ROBOTIC SURGERYINCREASING ADOPTION OF EDGE AI IN ROBOTIC SURGERIES TO PROPEL MARKET GROWTH

-

8.4 TELEHEALTH & REMOTE PATIENT MONITORINGINCREASING USE OF INTEGRATED WEARABLES AND PENETRATION OF MEDICAL IOT DEVICES TO SUPPORT MARKET GROWTH

-

8.5 AMBULANCESRISING FOCUS ON MINIMIZING RESPONSE TIMES IN EMERGENCY SITUATIONS TO LEAD TO ADOPTION OF EDGE COMPUTING IN AMBULANCES

- 8.6 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 HOSPITALS & CLINICSADOPTION OF TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING TECHNOLOGIES TO AUGMENT MARKET GROWTH

-

9.3 LONG-TERM CARE CENTERS AND HOME CARE SETTINGSRISE IN GLOBAL GERIATRIC POPULATION REQUIRING LONG-TERM CARE TO SUPPORT MARKET GROWTH

-

9.4 AMBULATORY CARE CENTERSGRADUAL SHIFT FROM INPATIENT TO OUTPATIENT CARE TO BOOST MARKET

- 9.5 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Accounted for largest share of North American market in 2022CANADA- Increasing collaborations and efforts to promote adoption of edge computing in healthcare to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACTUK- Growing penetration of wearables to fuel market growthGERMANY- Government initiatives to expedite development of digital healthcare ecosystem to enhance market growthFRANCE- Government’s eHealth 2022 plan to boost marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Introduction of cutting-edge edge healthcare computing technologies to induce market growthSOUTH KOREA- Prevalence of chronic diseases to drive implementation of edge computing in healthcareREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACT

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES

- 11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2022

- 11.4 MARKET SHARE ANALYSIS, 2022

- 11.5 COMPETITIVE BENCHMARKING

-

11.6 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.7 START-UPS/SMES EVALUATION QUADRANTPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIES

-

11.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT/SERVICE LAUNCHESDEALS

-

12.1 KEY PLAYERSCISCO SYSTEMS, INC.- Business overview- Products & services offered- Recent developments- MnM viewHUAWEI TECHNOLOGIES CO., LTD.- Business overview- Products & services offered- Recent developments- MnM viewDELL TECHNOLOGIES, INC.- Business overview- Products & services offered- Recent developments- MnM viewAMAZON WEB SERVICES- Business overview- Products & services offered- Recent developments- MnM viewGOOGLE, INC.- Business overview- Products & services offered- Recent developments- MnM viewMICROSOFT CORPORATION- Business overview- Products & services offered- Recent developmentsINTEL CORPORATION- Business overview- Products & services offered- Recent developmentsGENERAL ELECTRIC DIGITAL- Business overview- Products & services offeredHEWLETT PACKARD ENTERPRISE COMPANY- Business overview- Products & services offered- Recent developmentsVMWARE, INC.- Business overview- Products & services offered- Recent developmentsNOKIA- Business overview- Products & services offered- Recent developmentsNVIDIA CORPORATION- Business overview- Products & services offered- Recent developmentsCAPGEMINI- Business overview- Products & services offered- Recent developmentsIEI INTEGRATION CORPORATION- Business overview- Products & services offered- Recent developmentsADVANTECH CO., LTD.- Business overview- Products & services offered- Recent developments

-

12.2 OTHER PLAYERSSAGUNA NETWORKS LTD.FASTLY, INC.STACKPATH, LLCADLINK TECHNOLOGY, INC.DIGI INTERNATIONAL, INC.SIERRA WIRELESS (A SEMTECH COMPANY)JUNIPER NETWORKS, INC.EDGECONNEX, INC.CLEARBLADE, INC.EDGEIQ

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 4 PRICING ANALYSIS OF MICROSOFT EDGE COMPUTING SOLUTIONS

- TABLE 5 PRICING ANALYSIS OF AWS EDGE COMPUTING SOLUTIONS

- TABLE 6 EDGE COMPUTING IN HEALTHCARE MARKET: LIST OF PATENTS/PATENT APPLICATIONS, 2020–2023

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 8 KEY BUYING CRITERIA, BY END USER (%)

- TABLE 9 EDGE COMPUTING IN HEALTHCARE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 10 EDGE COMPUTING IN HEALTHCARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 12 HARDWARE: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 13 HARDWARE: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 HARDWARE: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 HARDWARE: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 SOFTWARE: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 SOFTWARE: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 SOFTWARE: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 SOFTWARE: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 SERVICES: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 SERVICES: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 SERVICES: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 SERVICES: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 25 DIAGNOSTICS: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 DIAGNOSTICS: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 DIAGNOSTICS: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 DIAGNOSTICS: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ROBOTIC SURGERY: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 ROBOTIC SURGERY: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 ROBOTIC SURGERY: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 ROBOTIC SURGERY: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 CHRONIC DISEASES AND THEIR COST BURDEN ON US

- TABLE 34 TELEHEALTH & REMOTE PATIENT MONITORING: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 TELEHEALTH & REMOTE PATIENT MONITORING: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 TELEHEALTH & REMOTE PATIENT MONITORING: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 TELEHEALTH & REMOTE PATIENT MONITORING: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 AMBULANCES: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 AMBULANCES: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 AMBULANCES: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 AMBULANCES: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 OTHER APPLICATIONS: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 OTHER APPLICATIONS: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 OTHER APPLICATIONS: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 OTHER APPLICATIONS: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 47 HOSPITALS & CLINICS: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 48 HOSPITALS & CLINICS: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 HOSPITALS & CLINICS: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 HOSPITALS & CLINICS: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 LONG-TERM CARE CENTERS & HOME CARE FACILITIES: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 LONG-TERM CARE CENTERS & HOME CARE FACILITIES: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 LONG-TERM CARE CENTERS & HOME CARE FACILITIES: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 LONG-TERM CARE CENTERS & HOME CARE FACILITIES: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 AMBULATORY CARE CENTERS: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 AMBULATORY CARE CENTERS: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 AMBULATORY CARE CENTERS: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 AMBULATORY CARE CENTERS: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 OTHER END USERS: EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 60 OTHER END USERS: EDGE COMPUTING IN HEALTHCARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 OTHER END USERS: EDGE COMPUTING IN HEALTHCARE MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 OTHER END USERS: EDGE COMPUTING IN HEALTHCARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 EDGE COMPUTING IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: EDGE COMPUTING IN HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 68 US: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 69 US: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 US: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 CANADA: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 72 CANADA: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 73 CANADA: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: EDGE COMPUTING IN HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 EUROPE: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 77 EUROPE: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 78 UK: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 79 UK: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 80 UK: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 81 GERMANY: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 82 GERMANY: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 83 GERMANY: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 84 FRANCE: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 85 FRANCE: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 FRANCE: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 REST OF EUROPE: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 88 REST OF EUROPE: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: EDGE COMPUTING IN HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 94 JAPAN: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 95 JAPAN: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 96 JAPAN: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 SOUTH KOREA: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 98 SOUTH KOREA: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 99 SOUTH KOREA: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 100 REST OF ASIA PACIFIC: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 103 REST OF THE WORLD: EDGE COMPUTING IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 104 REST OF THE WORLD: EDGE COMPUTING IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 105 REST OF THE WORLD: EDGE COMPUTING IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 106 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN EDGE COMPUTING IN HEALTHCARE MARKET

- TABLE 107 COMPANY FOOTPRINT ANALYSIS

- TABLE 108 PRODUCT FOOTPRINT ANALYSIS (25 COMPANIES)

- TABLE 109 APPLICATION FOOTPRINT ANALYSIS (25 COMPANIES)

- TABLE 110 REGION FOOTPRINT ANALYSIS (25 COMPANIES)

- TABLE 111 EDGE COMPUTING IN HEALTHCARE MARKET: PRODUCT/SERVICE LAUNCHES, 2020–2023

- TABLE 112 EDGE COMPUTING IN HEALTHCARE MARKET: DEALS, 2020–2023

- TABLE 113 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 114 CISCO SYSTEMS, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 115 CISCO SYSTEMS, INC.: DEALS

- TABLE 116 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 117 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS & SERVICES OFFERED

- TABLE 118 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- TABLE 119 DELL TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 120 DELL TECHNOLOGIES, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 121 DELL TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 122 DELL TECHNOLOGIES, INC.: DEALS

- TABLE 123 AMAZON WEB SERVICES: COMPANY OVERVIEW

- TABLE 124 AMAZON WEB SERVICES: PRODUCTS & SERVICES OFFERED

- TABLE 125 AMAZON WEB SERVICES: PRODUCT LAUNCHES

- TABLE 126 AMAZON WEB SERVICES: DEALS

- TABLE 127 GOOGLE, INC.: COMPANY OVERVIEW

- TABLE 128 GOOGLE, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 129 GOOGLE, INC.: DEALS

- TABLE 130 MICROSOFT CORPORATION: COMPANY OVERVIEW

- TABLE 131 MICROSOFT CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 132 MICROSOFT CORPORATION: PRODUCT LAUNCHES

- TABLE 133 MICROSOFT CORPORATION: DEALS

- TABLE 134 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 135 INTEL CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 136 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 137 INTEL CORPORATION: DEALS

- TABLE 138 GENERAL ELECTRIC DIGITAL: COMPANY OVERVIEW

- TABLE 139 GENERAL ELECTRIC DIGITAL: PRODUCTS & SERVICES OFFERED

- TABLE 140 HEWLETT PACKARD ENTERPRISE COMPANY: COMPANY OVERVIEW

- TABLE 141 HEWLETT PACKARD ENTERPRISE COMPANY: PRODUCTS & SERVICES OFFERED

- TABLE 142 HEWLETT PACKARD ENTERPRISE COMPANY: PRODUCT LAUNCHES

- TABLE 143 HEWLETT PACKARD ENTERPRISE COMPANY: DEALS

- TABLE 144 VMWARE, INC.: COMPANY OVERVIEW

- TABLE 145 VMWARE, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 146 VMWARE, INC.: DEALS

- TABLE 147 NOKIA: COMPANY OVERVIEW

- TABLE 148 NOKIA: PRODUCTS & SERVICES OFFERED

- TABLE 149 NOKIA: DEALS

- TABLE 150 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 151 NVIDIA CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 152 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 153 NVIDIA CORPORATION: DEALS

- TABLE 154 CAPGEMINI: COMPANY OVERVIEW

- TABLE 155 CAPGEMINI: PRODUCTS & SERVICES OFFERED

- TABLE 156 CAPGEMINI: DEALS

- TABLE 157 CAPGEMINI: OTHERS

- TABLE 158 IEI INTEGRATION CORPORATION: COMPANY OVERVIEW

- TABLE 159 IEI INTEGRATION CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 160 IEI INTEGRATION CORPORATION: DEALS

- TABLE 161 ADVANTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 162 ADVANTECH CO., LTD.: PRODUCTS & SERVICES OFFERED

- TABLE 163 ADVANTECH CO., LTD.: PRODUCT LAUNCHES

- TABLE 164 ADVANTECH CO., LTD.: DEALS

- FIGURE 1 EDGE COMPUTING IN HEALTHCARE MARKET: MARKET SEGMENTATION

- FIGURE 2 EDGE COMPUTING IN HEALTHCARE MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 DATA TRIANGULATION

- FIGURE 5 EDGE COMPUTING IN HEALTHCARE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): ESTIMATION OF REVENUE GENERATED BY VENDORS FROM EDGE COMPUTING

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – BOTTOM-UP APPROACH (SUPPLY SIDE): ESTIMATION OF COLLECTIVE REVENUE OF EDGE COMPUTING VENDORS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 9 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 10 TELEHEALTH & REMOTE PATIENT MONITORING SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 11 HOSPITALS & CLINICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 RISING DEMAND FOR LOW-LATENCY PROCESSING AND REAL-TIME, AUTOMATED DECISION-MAKING SOLUTIONS TO DRIVE MARKET GROWTH

- FIGURE 14 NORTH AMERICA TO DOMINATE EDGE COMPUTING IN HEALTHCARE MARKET DURING FORECAST PERIOD

- FIGURE 15 HOSPITALS & CLINICS AND US DOMINATED MARKET IN NORTH AMERICA IN 2022

- FIGURE 16 SOFTWARE SEGMENT TO HOLD MAJORITY MARKET SHARE IN 2028

- FIGURE 17 HOSPITALS & CLINICS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 18 TELEHEALTH & REMOTE PATIENT MONITORING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 19 EDGE COMPUTING IN HEALTHCARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 HEALTHCARE EXPENDITURE, BY COUNTRY, 2021 (% OF GDP)

- FIGURE 21 PERCENTAGE SHARE OF DIFFERENT MOBILE NETWORK CONNECTIONS, BY REGION, 2023

- FIGURE 22 EDGE COMPUTING IN HEALTHCARE MARKET: ECOSYSTEM

- FIGURE 23 PATENT PUBLICATION TRENDS, JANUARY 2012–APRIL 2023

- FIGURE 24 TOP PATENT APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR HEALTHCARE EDGE COMPUTING SOLUTIONS, JANUARY 2012– APRIL 2023

- FIGURE 25 TOP APPLICANT COUNTRIES/JURISDICTIONS FOR HEALTHCARE EDGE COMPUTING SOLUTIONS PATENTS, JANUARY 2012–APRIL 2023

- FIGURE 26 EDGE COMPUTING IN HEALTHCARE MARKET: SYSTEM ARCHITECTURE

- FIGURE 27 EDGE COMPUTING IN HEALTHCARE MARKET: SUPPLY CHAIN

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 29 KEY BUYING CRITERIA, BY END USER

- FIGURE 30 EDGE COMPUTING IN HEALTHCARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR EDGE COMPUTING IN HEALTHCARE MARKET

- FIGURE 32 SOFTWARE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 33 TELEHEALTH & REMOTE PATIENT MONITORING SEGMENT HELD LARGEST MARKET SHARE, BY APPLICATION, IN 2022

- FIGURE 34 HOSPITALS & CLINICS SEGMENT CAPTURED LARGEST MARKET SHARE, BY END USER, IN 2022

- FIGURE 35 OUTPATIENT APPOINTMENTS AND ATTENDANCES IN UK, 2011–2022

- FIGURE 36 NORTH AMERICA TO EMERGE AS NEW HOTSPOT DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA HELD LARGEST SHARE OF EDGE COMPUTING IN HEALTHCARE MARKET IN 2022

- FIGURE 38 NORTH AMERICA: EDGE COMPUTING IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 39 EUROPE: EDGE COMPUTING IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 40 KEY DEVELOPMENTS UNDERTAKEN BY MAJOR PLAYERS BETWEEN JANUARY 2020 AND MARCH 2023

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 42 EDGE COMPUTING IN HEALTHCARE MARKET: MARKET SHARE ANALYSIS, 2022

- FIGURE 43 EDGE COMPUTING IN HEALTHCARE MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 44 EDGE COMPUTING IN HEALTHCARE MARKET: START-UPS/SMES EVALUATION QUADRANT, 2022

- FIGURE 45 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT, 2022

- FIGURE 46 DELL TECHNOLOGIES, INC.: COMPANY SNAPSHOT, 2022

- FIGURE 47 AMAZON WEB SERVICES: COMPANY SNAPSHOT, 2022

- FIGURE 48 GOOGLE, INC.: COMPANY SNAPSHOT, 2022

- FIGURE 49 MICROSOFT CORPORATION: COMPANY SNAPSHOT, 2022

- FIGURE 50 INTEL CORPORATION: COMPANY SNAPSHOT, 2022

- FIGURE 51 HEWLETT PACKARD ENTERPRISE COMPANY: COMPANY SNAPSHOT, 2022

- FIGURE 52 VMWARE, INC.: COMPANY SNAPSHOT, 2022

- FIGURE 53 NOKIA: COMPANY SNAPSHOT, 2022

- FIGURE 54 NVIDIA CORPORATION: COMPANY SNAPSHOT, 2022

- FIGURE 55 CAPGEMINI: COMPANY SNAPSHOT, 2022

- FIGURE 56 IEI INTEGRATION CORPORATION: COMPANY SNAPSHOT, 2022

- FIGURE 57 ADVANTECH CO., LTD.: COMPANY SNAPSHOT, 2022

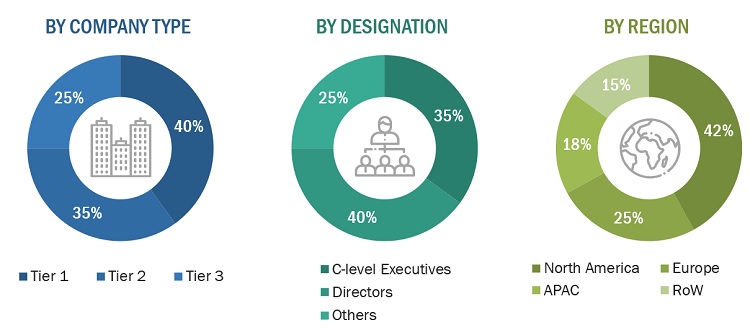

The study involved major activities in estimating the current size of the global edge computing in healthcare market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations; and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the edge computing in healthcare market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the edge computing in healthcare market. The primary sources from the demand side include key executives from research centers, academic institutes, & government organizations, hospitals, healthcare providers, and individual physicians. After the complete market engineering process (which includes calculations for the market statistics, market breakdown, market size estimation, market forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers obtained.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to offering, technology, application, functionality, end user, and region.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

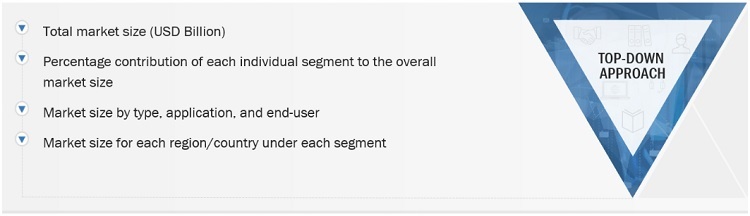

Market Size Estimation

Both top-down (segmental analysis of major segments) and bottom-up approaches (assessment of utilization/adoption/penetration trends, by product & service, end user, and region) were used to estimate and validate the total size of the edge computing in healthcare market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Edge Computing in Healthcare Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market definition

Edge computing is a distributed computing model that aims to reduce the distance between data storage and computation and the data sources, such as various sensors, connected devices, and IoT devices. Instead of transferring the data to the cloud or data centers, data is transmitted from the sensors and devices to be stored and processed on the edge of the network, close to the devices. By eliminating the need for centralized data storage and processing, Edge computing enables real-time data analysis without being impacted by slow network speeds and latency issues, which ultimately results in bandwidth savings.

Key Stakeholders

- Edge Computing in Healthcare Solution Providers

- Platform Providers

- Technology Providers

- AI System Providers

- Hospitals and Clinics

- Long-term Care Facilities

- Ambulatory Care Centers

- Physician Groups and Organizations

- Universities and Research Organizations

- Forums, Alliances, and Associations

- Academic Research Institutes

- Healthcare Institutions

- Distributors

- Venture Capitalists

- Government Organizations

- Institutional Investors and Investment Banks

- Investors/Shareholders

- Consulting Companies in the Edge Computing and Healthcare Sector

- Raw Materials and Component Manufacturers

Objectives of the Study

- To define, describe, and forecast the edge computing in healthcare market size on the basis of segmentation by component, application, end user, and region, in terms of value

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in four main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, and the Rest of the World, in terms of value

- To provide key industry insights such as supply chain analysis, regulatory analysis, patent analysis, recession impact analysis, among others.

- To profile the key players in the market and comprehensively analyze their core competencies3

- To track and analyze competitive developments such as product launches, expansions, collaborations, alliances, partnerships, and R&D activities of the leading players in the market

- To benchmark players within the market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further Brekadown of Latin American edge computing in healthcare market into Brazil, Mexico, and rest of Latin America.

- Further breakdown of the Middle East & Africa edge computing in healthcare market into the UAE, Saudi Arabia, South Africa and rest of MEA countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Edge Computing in Healthcare Market