Micro Server IC Market by offering (Hardware, Software), Processor type (X86, ARM) Application (Web Hosting and Enterprise Applications, Analytics and Cloud Computing, Edge Computing), End-User (Enterpises and Data Center) and Region 2026

Updated on : October 23, 2024

Micro Server IC Market Size & Growth

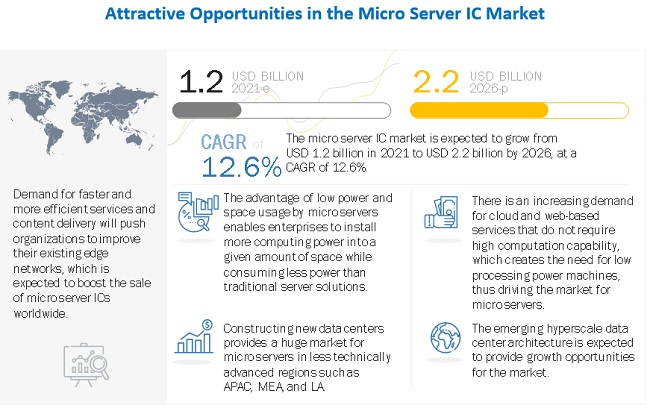

Micro server IC market is projected to reach USD 2.2 billion by 2026, growing at a CAGR of 12.6% during the forecast period from 2021 to 2026.

Some of the key driving factors of the Micro server IC market are low power consumption and low space utilization of micro servers, growth in the trend of cloud computing and web hosting, and emergence of hyperscale data center architecture.

Impact of AI Micro Server IC Market

The impact of artificial intelligence (AI) on the micro server IC market is driving significant advancements in performance, scalability, and energy efficiency for data-centric applications. AI enhances the capabilities of micro server integrated circuits by enabling intelligent workload management, real-time data processing, and optimized resource allocation, making them ideal for edge computing, cloud services, and AI inference tasks. As data volumes grow exponentially, AI-powered micro server ICs support faster decision-making, lower latency, and improved power consumption, meeting the demands of modern computing environments. This convergence is accelerating innovation across industries such as telecommunications, healthcare, and finance, where compact, high-efficiency processing is essential.

To know about the assumptions considered for the study, Request for Free Sample Report

Micro Server IC Market Key Players

The micro server IC market includes major Tier I and II players like Intel Corporation (US), Advanced Micro Devices, Inc. (US), Hewlett Packard Enterprise Development LP (US), Quanta Computer Inc. (Taiwan), NVIDIA Corporation (US), and others.

Micro Server IC Market Trends and Dynamics

Driver: Low power consumption and low space utilization of micro servers

The power consumption and space usage of micro servers is lower than traditional high-end servers. Micro servers use low-power ICs that are normally used in commercial personal computers. In addition, the power consumption of micro servers' stripped-back silicon is far below the 90-W-plus thermal design power (TDP) of processors inside high-end servers, with micro server chips typically having a TDP of below 45 W and dropping to sub-10-W levels. Lower power consumption equals lower running costs, making them more useful for computing work per dollar. The advantage of low power and space usage by micro servers enables enterprises to install more computing power into a given amount of space while consuming less power than traditional server solutions. This helps in reducing electricity bills, thus reducing the operating costs of a data center significantly.

Restraint: Application-specific nature of micro server demands additional servers for separate applications

Micro servers provide scale out architecture that is preferred for application-specific use. Therefore, they are best suited for predefined workload environments, such as web hosting. In order to increase the capacity, users need to increase the nodes and related software to make it compatible for handling excessive workloads. This limitation of micro server acts as a restraint for the micro server market in comparison to other traditional servers where such upgrading of system is usually not required. In the coming years, with advancements in technology, there are chances that manufacturers would overcome this restriction of micro servers.

Opportunity: Increasing need for new data centers across emerging regions

Micro server ICs are gaining popularity in data center applications as these are less expensive, consume less power, and save physical space as compared to enterprise-class rack servers. Growing demand for data centers in various business domains such as IT & telecom, banking, healthcare, agricultural, and government is expected to aid in the growth of the market. The number of internet users have increased over the previous year (2018), due to which internet traffic has increased, thereby creating a need for more data centers. For instance, according to International Telecommunication Union (ITU), there were 4.1 billion internet users in the world as of 2019. The rising number of data centers would provide growth opportunities for micro server IC industry.

Challenge: Blade servers may limit scope of micro server usage

A blade server is a server chassis housing multiple slim, modular electronic circuit boards, known as server blades. Each blade is a server, often dedicated to a single application. Blade servers are currently the most efficient large computing devices and are often used by modern businesses as the backbone of official computer infrastructure. Blade servers are gaining popularity over rack-mounted servers in large office operations all across the world. Micro servers are limited to some applications such as web servers that do not require multi-CPU cores. The development of new hardware and software technology with increased computing power such as 64-bit processors by Intel (US) and ARM (UK) and low-power SoCs by ARM (UK) would make micro servers a better competitor for blade servers. These developments would help micro servers to serve more technologies such as server clustering and cloud data centers so that they can run traditional businesses of high workload applications.

Hardware segment of micro server IC market to hold highest market share during the forecast period

Micro Server IC Market Segmentation

Hardware is expected to constitute the largest market share of micro server ICs during the forecast year. Since hardware constitutes the main part of an SoC, companies such as Intel and ARM are working toward increasing the capability of their ICs by making the architecture denser and more efficient. Rising adoption of micro servers for dedicated hosting, front-end web, big data workloads, content delivery network, computing applications, and low space and application-specific functionality drive market growth. Moreover, the emerging edge computing ecosystem, namely the provisioning of advanced computational, storage and networking capability near data sources to achieve both low-latency event processing and high-throughput analytical processing, is expected to drive the market for micro server hardware in the coming years.

Egde computing application to hold highest CAGR in micro server IC market

Edge computing is one of the emerging applications for micro server ICs and is expected to hold the highest growth rate during the forecast period. The implementation of hyperscale cloud and growing investments in IoT have pushed edge computing into further limelight. As organizations strive to remain competitive in the digital business era, especially in a post-pandemic world, edge computing is a new enabler of customer insights and retention. Independent software vendors, system integrators, and enterprises will look to build cloud-independent solutions which will drive edge computing applications. Additionally, the growing adoption of 5G solutions will offer reduced latency and a way to connect the rising number of edge devices, particularly in the consumer space. There has been the rising need for edge computing for applications such as connected and autonomous vehicles, smart manufacturing and IoT, and smart cities. It has spurred the growth of edge data centers, and the rising importance of compact servers due to space constraints provides opportunity for micro servers.

Enterpise end user segment to hold highest market share during the forecast period

The enterprise end-user segment of the micro server IC market is expected to hold the highest market share during the forecast period. With the growth of smartphones, social platforms, big data, and IoT, the quantity and diversity of data has become huge. Managing dense workloads, ramping up data storage and security, upgrading legacy systems, and accommodating the technology demand a mobile workforce. Therefore, it has become important to modernize IT infrastructure, especially servers, to make them easy to manage and completely secure—whether critical applications and data are hosted on-site or in the cloud. Small and medium enterprises need server platforms that not only address current needs but also seamlessly handle future workloads, while lowering costs. Micro servers utilize lower power per node, reduce costs, and increase operational efficiency which makes them an ideal choice for medium-size enterprises.

Micro Server IC Industry Regional Analysis

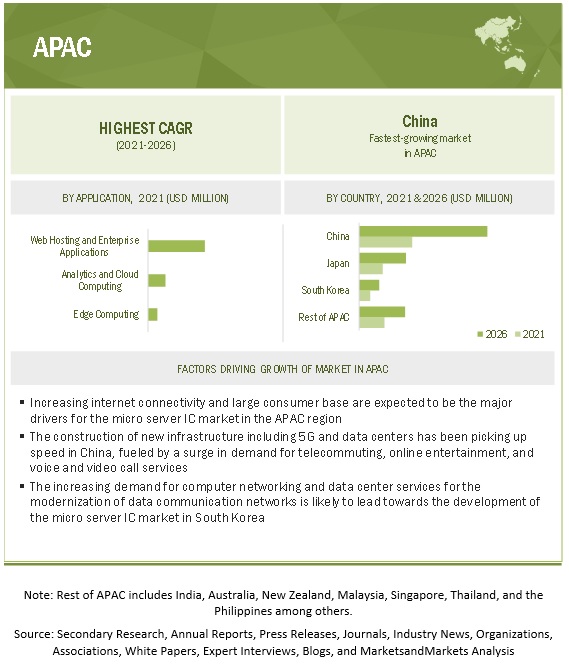

Micro server IC market in APAC to grow at the highest rate

APAC is expected to grow at the fastest rate for the micro server IC market owing to the presence of countries with large populations and rising adoption of micro servers across small and medium enterprises. The increasing penetration of internet services, along with the adoption of smart devices, has been fueling data generation. This further fuels the expansion of data centers in the APAC region. Rising importance of micro servers due to low power consumption and cost-effective solutions can be used for light load applications in data centers, which also drives the growth of the market. Data centers have become the hotspot of the IT market in China in recent years. China plans to invest an estimated USD 1.4 trillion over 6 years to 2025, in collaboration with government and private technology giants such as Alibaba and Huawei to generate opportunities for connected devices, AI, and autonomous driving applications, which will further drive edge computing applications.

To know about the assumptions considered for the study, download the pdf brochure

Top Micro Server IC Companies - Key Market Players

The market is dominated by micro server IC companies such as Intel Corporation (US), Advanced Micro Devices, Inc. (US), Hewlett Packard Enterprise Development LP (US), Quanta Computer Inc. (Taiwan), and NVIDIA Corporation (US).

Micro Server IC Market Scope

|

Report Attributes |

Details |

|

Estimated Market Size |

USD 1.2 Billion |

| Projected Market Size | USD 2.2 Billion |

| Growth Rate | 12.6% |

| Base Year Considered | 2017 |

| Historical Data Available for Years | 2017–2026 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Low power consumption and low space utilization of micro servers |

| Key Market Opportunity | Increasing need for new data centers across emerging regions |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Enterpise end user Segment |

| Highest CAGR Segment | Hardware Segment |

| Largest Application Market Share | Edge Computing Application |

The study categorizes the micro server IC market based on offering, processor type, application and end user at the regional and global level.

Micro server IC Market, By Offering

- Hardware

- Software

Market, By Processor type

- X86

- ARM

Market, By Application

- Web hosting and enterprise applications

- Analytics and cloud computing

- Edge computing

Market, By End User

- Enterprises

- Data center

Micro server IC Market, By Region

- North America

- Europe

- APAC

- RoW

Recent Developments in Micro Server IC Market

- In October 2020, Intel Corporation is bringing its Software Guard Extension confidential computing technology to the company’s Xeon Scalable lineup for the first time with the upcoming Ice Lake server processors, which will come with expanded capabilities and new security features.

- In October 2020, AMD acquired Xilinx in an all-stock transaction valued at USD 35.0 billion. The combination will create the industry’s leading high-performance computing company, significantly expanding the breadth of AMD’s product portfolio and customer set across diverse growth markets where Xilinx is an established leader.

- In October 2020, NVIDIA launched DPUs, a new kind of processor, supported by DOCA, a novel data-center-infrastructure-on-a-chip architecture that enables breakthrough networking, storage, and security performance. It features the new NVIDIA BlueField-2 family of DPUs and NVIDIA DOCA software development kit for building applications on DPU-accelerated data center infrastructure services.

- In September 2020, NVIDIA and SoftBank Group Corp. (SBG) announced a definitive agreement under which NVIDIA will acquire ARM Limited from SoftBank in a transaction valued at USD 40.0 billion. The combination will bring together NVIDIA’s leading AI computing platform with ARM’s vast ecosystem to create a premier computing company for the age of AI, accelerating innovation while expanding into large, high-growth markets.

- In September 2020, ARM announced Cortex-R82, the highest performance Cortex-R processor with 64-bit support and Linux-capability, which is designed to accelerate the development and deployment of next-generation enterprise and computational storage solutions. It combines higher performance and access to greater memory with extensive ARM Linux and server ecosystems.

- In March 2020, HPE launched its HPE Small Business Solutions Portfolio, with 3 new offerings around the latest HPE ProLiant Gen10 Plus MicroServer. The solution’s use cases are Office in a Box, Scalable File and Backup, and Edge to Cloud. HPE’s new server is a configured, tested, and validated solution that offers automated deployment and a monthly subscription starting at less than USD 20 per month.

- In February 2020, QCT, a global data center solution provider, supports its customers with comprehensive 5G end-to-end hardware products and solutions spanning on-premises uCPE, edge computing, 5G NR, 5G Core, service assurance, and applications. Due to the rise of 5G in 2020, QCT is mainly focusing on its “Infrastructure of the Future, Now.”

Frequently Asked Questions (FAQ):

What is the market size for the Micro server IC market?

The micro server IC marketis estimated to be USD 1.2 billion in 2021 and is projected to reach USD 2.2 billion by 2026; it is expected to grow at a CAGR of 12.6% from 2021 to 2026.

What are the major driving factors and opportunities in the micro server IC market ?

Low power consumption and low space utilization of micro servers, growth in the trend of cloud computing and web hosting, and emergence of hyperscale data center architecture are the major factors driving the growth of the micro server IC market. Increasing need for new data centers across emerging regions and rising importance of edge computing and micro data centers are projected to create lucrative opportunities for the players operating in the micro server IC market during the forecast period.

Who are the leading players in the global micro server IC market?

Companies such as Intel Corporation (US), Advanced Micro Devices, Inc. (US), Hewlett Packard Enterprise Development LP (US), Quanta Computer Inc. (Taiwan),and NVIDIA Corporation (US), are the leading players in the market. Moreover, these companies rely on strategies such as which includes new product launches and developments, partnership and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What is the COVID-19 impact on micro server IC market?

According to discussions with various primaries, the impact of COVID-19 on the micro server IC market has been considered to be for the short-to-medium term; hence, it has been assumed that impact of COVID-19 prevail from the first quarter of 2020 to its fourth quarter.

What are some of the technological advancements in the market?

One of the emerging applications of the micro server IC market is edge computing. Edge computing aims to move computing from distant cloud environments to the edges of the networks. As innovative devices such as autonomous vehicles and medical sensors become more common, edge computing will have an increasingly large impact on society. The number of IoT devices in circulation currently is already staggering, and this figure is expected to increase significantly in the coming years. With many IoT devices connected to networks across the world, edge computing is already having a major impact on how companies design their systems. The ongoing demand for faster, more efficient services and content delivery will push organizations to improve their existing edge networks. Several applications can benefit from edge computing such as AI models, AR applications, video analytics, IoT, location services, and data caching. Such a rise in edge computing applications is expected to boost the sale of micro server ICs globally. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.4 INCLUSIONS AND EXCLUSIONS

1.5 YEARS CONSIDERED

1.6 CURRENCY

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE) – IDENTIFICATION OF REVENUES GENERATED BY COMPANIES FROM MICRO SERVER OFFERINGS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis (demand side)

FIGURE 5 MARKET: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FOR ESTIMATING SIZE OF MARKET

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 7 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 10 HARDWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 EDGE COMPUTING APPLICATION OF MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 ENTERPRISES END-USER SEGMENT TO HOLD HIGHEST MARKET SHARE IN MARKET DURING FORECAST PERIOD

FIGURE 13 MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 14 RISING DEMAND FOR EDGE COMPUTING IN VARIOUS COUNTRIES TO IMPLEMENT MORE MICRO SERVER ICS ACROSS ENTERPRISES AND DATA CENTERS

4.2 MARKET IN NORTH AMERICA, BY COUNTRY AND PROCESSOR TYPE

FIGURE 15 US AND INTEL PROCESSOR TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2021

4.3 MARKET FOR APAC, BY APPLICATION

FIGURE 16 WEB HOSTING AND ENTERPRISE APPLICATIONS TO HOLD HIGHEST MARKET SHARE FOR MARKET IN APAC DURING FORECAST PERIOD

4.4 MARKET, BY COUNTRY

FIGURE 17 MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 GROWING TREND OF CLOUD COMPUTING AND WEB HOSTING TO DRIVE MARKET FOR MICRO SERVER ICS

FIGURE 19 IMPACT ANALYSIS OF DRIVERS IN MARKET

FIGURE 20 IMPACT ANALYSIS OF OPPORTUNITIES IN MARKET

FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS AND CHALLENGES IN MARKET

5.2.1 DRIVERS

5.2.1.1 Low power consumption and low space utilization of micro servers

5.2.1.2 Growth in trend of cloud computing and web hosting

5.2.1.3 Emergence of hyperscale data center architecture

5.2.2 RESTRAINTS

5.2.2.1 Application-specific nature of micro server demands additional servers for separate applications

5.2.2.2 Lack of standard specifications

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing need for new data centers across emerging regions

5.2.3.2 Rising importance of edge computing and micro data centers

5.2.4 CHALLENGES

5.2.4.1 Blade servers may limit scope of micro server usage

5.3 VALUE CHAIN ANALYSIS

5.4 MICRO SERVER ECOSYSTEM

5.5 PORTER’S FIVE FORCES MODEL

TABLE 1 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6 USE CASES FOR MARKET

5.7 TECHNOLOGY ANALYSIS

5.8 AVERAGE SELLING PRICE (ASP) TREND ANALYSIS

FIGURE 22 AVERAGE SELLING PRICE TREND ANALYSIS

5.9 TRADE ANALYSIS

TABLE 2 EXPORT SCENARIO FOR HS CODE: 854231, BY COUNTRY, 2015–2019 (USD THOUSAND)

TABLE 3 IMPORT SCENARIO FOR HS CODE: 854231, BY COUNTRY, 2015–2019 (USD THOUSAND)

5.10 PATENT ANALYSIS

5.11 REGULATION AND STANDARDS RELATED TO MARKET

6 MICRO SERVER IC MARKET, BY OFFERING (Page No. - 71)

6.1 INTRODUCTION

FIGURE 23 HARDWARE OF MARKET TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 4 MARKET, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 5 MARKET, BY OFFERING, 2020–2026 (USD MILLION)

6.2 HARDWARE

6.2.1 RISING ADOPTION OF MICRO SERVERS BY ENTERPRISE CUSTOMERS DRIVES MARKET GROWTH

TABLE 6 MARKET FOR HARDWARE, BY PROCESSOR TYPE, 2017–2019 (USD MILLION)

TABLE 7 MARKET FOR HARDWARE, BY PROCESSOR TYPE, 2020–2026 (USD MILLION)

FIGURE 24 ENTERPRISES SEGMENT OF MICRO SERVER IC HARDWARE MARKET TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 8 MARKET FOR HARDWARE, BY END USER, 2017–2019 (USD MILLION)

TABLE 9 MARKET FOR HARDWARE, BY END USER, 2020–2026 (USD MILLION)

TABLE 10 MARKET FOR HARDWARE FOR ENTERPRISES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 11 MARKET FOR HARDWARE FOR ENTERPRISES, BY TYPE, 2020–2026 (USD MILLION)

FIGURE 25 NORTH AMERICA TO LEAD MICRO SERVER IC HARDWARE MARKET DURING FORECAST PERIOD

TABLE 12 MARKET FOR HARDWARE, BY REGION, 2017–2019 (USD MILLION)

TABLE 13 MARKET FOR HARDWARE, BY REGION, 2020–2026 (USD MILLION)

6.3 SOFTWARE

6.3.1 SOFTWARE PLAYS IMPORTANT PART AS IT HELPS PROVIDE BETTER PORTABILITY AND FUNCTIONING OF SOC

TABLE 14 MARKET FOR SOFTWARE, BY PROCESSOR TYPE, 2017–2019 (USD MILLION)

TABLE 15 MARKET FOR SOFTWARE, BY PROCESSOR TYPE, 2020–2026 (USD MILLION)

TABLE 16 MARKET FOR SOFTWARE, BY END USER, 2017–2019 (USD MILLION)

TABLE 17 MARKET FOR SOFTWARE, BY END USER, 2020–2026 (USD MILLION)

TABLE 18 MARKET FOR SOFTWARE FOR ENTERPRISES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 19 MARKET FOR SOFTWARE FOR ENTERPRISES, BY TYPE, 2020–2026 (USD MILLION)

TABLE 20 MARKET FOR SOFTWARE, BY REGION, 2017–2019 (USD MILLION)

TABLE 21 MARKET FOR SOFTWARE, BY REGION, 2020–2026 (USD MILLION)

7 MICRO SERVER IC MARKET, BY PROCESSOR TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 26 INTEL PROCESSOR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 22 MARKET, BY PROCESSOR TYPE, 2017–2019 (USD MILLION)

TABLE 23 MARKET, BY PROCESSOR TYPE, 2020–2026 (USD MILLION)

TABLE 24 MARKET, BY PROCESSOR TYPE, 2020–2026 (MILLION UNITS)

7.2 INTEL

7.2.1 RISING ADOPTION OF MICRO SERVERS FOR WEB SERVING AND CONTENT DELIVERY NETWORKS PROVIDE OPPORTUNITY FOR INTEL-BASED MICRO SERVERS

TABLE 25 MARKET FOR INTEL PROCESSOR, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 26 MARKET FOR INTEL PROCESSOR, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 27 MARKET FOR INTEL PROCESSOR, BY REGION, 2017–2019 (USD MILLION)

TABLE 28 MARKET FOR INTEL PROCESSOR, BY REGION, 2020–2026 (USD MILLION)

7.3 ARM

7.3.1 ARM OFFERS LOW-POWER PROCESSORS TARGETED AT MARKET

TABLE 29 MARKET FOR ARM PROCESSOR, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 30 MARKET FOR ARM PROCESSOR, BY OFFERING, 2020–2026 (USD MILLION)

FIGURE 27 ARM PROCESSORS OF MARKET TO GROW AT HIGHEST RATE IN APAC DURING FORECAST PERIOD

TABLE 31 MARKET FOR ARM PROCESSOR, BY REGION, 2017–2019 (USD MILLION)

TABLE 32 MARKET FOR ARM PROCESSOR, BY REGION, 2020–2026 (USD MILLION)

7.4 IMPACT OF COVID-19

8 MICRO SERVER IC MARKET, BY APPLICATION (Page No. - 86)

8.1 INTRODUCTION

FIGURE 28 WEB HOSTING AND ENTERPRISE APPLICATIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 33 MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 34 MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

8.2 WEB HOSTING AND ENTERPRISE APPLICATIONS

8.2.1 MICRO SERVERS MAINLY USED BY ENTERPRISES FOR WEB HOSTING AND CONTENT DELIVERY NETWORK APPLICATIONS

FIGURE 29 APAC MARKET TO GROW AT HIGHEST RATE FOR WEB HOSTING AND ENTERPRISE APPLICATIONS DURING FORECAST PERIOD

TABLE 35 MARKET FOR WEB HOSTING AND ENTERPRISE APPLICATIONS, BY REGION, 2017–2019 (USD MILLION)

TABLE 36 MARKET FOR WEB HOSTING AND ENTERPRISE APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

8.3 ANALYTICS AND CLOUD COMPUTING

8.3.1 WORKLOADS MIGRATING TO CLOUD PROVIDE OPPORTUNITY FOR MICRO SERVERS

TABLE 37 MARKET FOR ANALYTICS AND CLOUD COMPUTING APPLICATIONS, BY REGION, 2017–2019 (USD MILLION)

TABLE 38 MARKET FOR ANALYTICS AND CLOUD COMPUTING APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

8.4 EDGE COMPUTING

8.4.1 GROWING MARKET FOR EDGE COMPUTING SERVICES AND HOSTED MOBILE APPLICATIONS TO FUEL LOW-POWER MICRO SERVER SALES

FIGURE 30 APAC MARKET TO GROW AT HIGHEST RATE FOR EDGE COMPUTING DURING FORECAST PERIOD

TABLE 39 MARKET FOR EDGE COMPUTING, BY REGION, 2017–2019 (USD MILLION)

TABLE 40 MARKET FOR EDGE COMPUTING, BY REGION, 2020–2026 (USD MILLION)

8.5 IMPACT OF COVID-19

9 MICRO SERVER IC MARKET, BY END USER (Page No. - 94)

9.1 INTRODUCTION

FIGURE 31 ENTERPRISES TO HAVE LARGEST MARKET SHARE FOR MICRO SERVER IC DURING FORECAST PERIOD

TABLE 41 MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 42 MARKET, BY END USER, 2020–2026 (USD MILLION)

9.2 ENTERPRISES

FIGURE 32 MEDIUM SCALE ENTERPRISES TO HOLD LARGEST MARKET SHARE IN MARKET DURING FORECAST PERIOD

TABLE 43 MICRO SERVER IC MARKET FOR ENTERPRISES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 44 MARKET FOR ENTERPRISES, BY TYPE, 2020–2026 (USD MILLION)

TABLE 45 MARKET FOR ENTERPRISES, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 46 MARKET FOR ENTERPRISES, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 47 MARKET FOR HARDWARE FOR ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 48 MARKET FOR HARDWARE FOR ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

TABLE 49 MARKET FOR SOFTWARE FOR ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 50 MARKET FOR SOFTWARE FOR ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

TABLE 51 MARKET FOR ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 52 MARKET FOR ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

9.2.1 SMALL SCALE ENTERPRISES

9.2.1.1 Cheap costs and less processing power makes micro servers suitable for small enterprises

TABLE 53 MARKET FOR SMALL SCALE ENTERPRISES, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 54 MARKET FOR SMALL SCALE ENTERPRISES, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 55 MARKET FOR HARDWARE FOR SMALL SCALE ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 56 MARKET FOR HARDWARE FOR SMALL SCALE ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

TABLE 57 MARKET FOR SOFTWARE FOR SMALL SCALE ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 58 MARKET FOR SOFTWARE FOR SMALL SCALE ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

TABLE 59 MARKET FOR SMALL SCALE ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 60 MARKET FOR SMALL SCALE ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

9.2.2 MEDIUM SCALE ENTERPRISES

9.2.2.1 Micro servers—easy to set up, use, and maintain without taking up a lot of space

TABLE 61 MICRO SERVER IC MARKET FOR MEDIUM SCALE ENTERPRISES, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 62 MARKET FOR MEDIUM SCALE ENTERPRISES, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 63 MARKET FOR HARDWARE FOR MEDIUM SCALE ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 64 MARKET FOR HARDWARE FOR MEDIUM SCALE ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

FIGURE 33 SOFTWARE MARKET FOR MEDIUM SCALE ENTERPRISES TO GROW AT HIGHEST CAGR FOR APAC REGION DURING FORECAST PERIOD

TABLE 65 MARKET FOR SOFTWARE FOR MEDIUM SCALE ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 66 MARKET FOR SOFTWARE FOR MEDIUM SCALE ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

TABLE 67 MARKET FOR MEDIUM SCALE ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 68 MARKET FOR MEDIUM SCALE ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

9.2.3 LARGE SCALE ENTERPRISES

9.2.3.1 Technological advancements in micro servers provide growth opportunities

TABLE 69 MARKET FOR LARGE SCALE ENTERPRISES, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 70 MARKET FOR LARGE SCALE ENTERPRISES, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 71 MARKET FOR HARDWARE FOR LARGE SCALE ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 72 MARKET FOR HARDWARE FOR LARGE SCALE ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

TABLE 73 MARKET FOR SOFTWARE FOR LARGE SCALE ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 74 MARKET FOR SOFTWARE FOR LARGE SCALE ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

TABLE 75 MARKET FOR LARGE SCALE ENTERPRISES, BY REGION, 2017–2019 (USD MILLION)

TABLE 76 MARKET FOR LARGE SCALE ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

9.3 DATA CENTERS

9.3.1 EU-FUNDED M2DC PROJECT PROVIDES SIGNIFICANT BENEFITS FOR DATA CENTERS, MINIMIZING THEIR TOTAL COST OF OWNERSHIP

TABLE 77 MICRO SERVER IC MARKET FOR DATA CENTERS, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 78 MARKET FOR DATA CENTERS, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 79 MARKET FOR HARDWARE FOR DATA CENTERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 80 MARKET FOR HARDWARE FOR DATA CENTERS, BY REGION, 2020–2026 (USD MILLION)

TABLE 81 MARKET FOR SOFTWARE FOR DATA CENTERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 82 MARKET FOR SOFTWARE FOR DATA CENTERS, BY REGION, 2020–2026 (USD MILLION)

TABLE 83 MARKET FOR DATA CENTERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 84 MARKET FOR DATA CENTERS, BY REGION, 2020–2026 (USD MILLION)

9.4 IMPACT OF COVID-19

10 GEOGRAPHIC ANALYSIS (Page No. - 112)

10.1 INTRODUCTION

FIGURE 34 NORTH AMERICA TO HAVE LARGEST MARKET FOR MICRO SERVER IC DURING FORECAST PERIOD

TABLE 85 MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 86 MARKET, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA MARKET SNAPSHOT

TABLE 87 MICRO SERVER IC MARKET IN NORTH AMERICA, BY PROCESSOR TYPE, 2017–2019 (USD MILLION)

TABLE 88 MARKET IN NORTH AMERICA, BY PROCESSOR TYPE, 2020–2026 (USD MILLION)

TABLE 89 MARKET IN NORTH AMERICA, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 90 MARKET IN NORTH AMERICA, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 91 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 92 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 93 MARKET IN NORTH AMERICA, BY END USER, 2017–2019 (USD MILLION)

TABLE 94 MARKET IN NORTH AMERICA, BY END USER, 2020–2026 (USD MILLION)

TABLE 95 MARKET IN NORTH AMERICA FOR ENTERPRISES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 96 MARKET IN NORTH AMERICA FOR ENTERPRISES, BY TYPE, 2020–2026 (USD MILLION)

TABLE 97 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.1 US

10.2.1.1 US—manufacturing and R&D hub for several leading micro sever and microprocessor businesses

10.2.2 CANADA

10.2.2.1 Rising investments in data centers to provide growth opportunities

10.2.3 MEXICO

10.2.3.1 Rising use of connected devices to provide growth opportunities

10.3 EUROPE

FIGURE 36 EUROPE MARKET SNAPSHOT

TABLE 99 MICRO SERVER IC MARKET IN EUROPE, BY PROCESSOR TYPE, 2017–2019 (USD MILLION)

TABLE 100 MARKET IN EUROPE, BY PROCESSOR TYPE, 2020–2026 (USD MILLION)

TABLE 101 MARKET IN EUROPE, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 102 MARKET IN EUROPE, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 103 MARKET IN EUROPE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 104 MARKET IN EUROPE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 105 MARKET IN EUROPE, BY END USER, 2017–2019 (USD MILLION)

TABLE 106 MARKET IN EUROPE, BY END USER, 2020–2026 (USD MILLION)

TABLE 107 MARKET IN EUROPE FOR ENTERPRISES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 108 MARKET IN EUROPE, FOR ENTERPRISES, BY TYPE, 2020–2026 (USD MILLION)

TABLE 109 MARKET IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 110 MARKET IN EUROPE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Big data and IoT technology play important role in increasing investments in data center market as enterprises in Germany observe high data generation across industries

10.3.2 UK

10.3.2.1 Rising adoption of connected devices, IoT, and smart solutions are expected to create opportunities for micro servers.

10.3.3 FRANCE

10.3.3.1 French government launched several initiatives to boost digitization and promote SMEs to develop dynamic start-up ecosystem

10.3.4 ITALY

10.3.4.1 Rising adoption of IoT solutions to provide opportunities for edge computing applications

10.3.5 REST OF EUROPE

10.4 APAC

FIGURE 37 APAC MARKET SNAPSHOT

TABLE 111 MICRO SERVER IC MARKET IN APAC, BY PROCESSOR TYPE, 2017–2019 (USD MILLION)

TABLE 112 MARKET IN APAC, BY PROCESSOR TYPE, 2020–2026 (USD MILLION)

TABLE 113 MARKET IN APAC, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 114 MARKET IN APAC, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 115 MARKET IN APAC, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 116 MARKET IN APAC, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 117 MARKET IN APAC, BY END USER, 2017–2019 (USD MILLION)

TABLE 118 MARKET IN APAC, BY END USER, 2020–2026 (USD MILLION)

TABLE 119 MARKET IN APAC FOR ENTERPRISES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 120 MARKET IN APAC FOR ENTERPRISES, BY TYPE, 2020–2026 (USD MILLION)

TABLE 121 MARKET IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 122 MARKET IN APAC, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Adoption of advent technology such AI and IoT along with expansion of data center to drive market growth

10.4.2 JAPAN

10.4.2.1 Japan has enhanced investments from several cloud service providers to set up data centers across country

10.4.3 SOUTH KOREA

10.4.3.1 Rising importance of IoT and connected devices would create ample opportunities for edge computing applications

10.4.4 REST OF APAC (ROAPAC)

10.5 REST OF THE WORLD (ROW)

TABLE 123 MICRO SERVER IC MARKET IN ROW, BY PROCESSOR TYPE, 2017–2019 (USD MILLION)

TABLE 124 MARKET IN ROW, BY PROCESSOR TYPE, 2020–2026 (USD MILLION)

TABLE 125 MARKET IN ROW, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 126 MARKET IN ROW, BY OFFERING, 2020–2026 (USD MILLION)

TABLE 127 MARKET IN ROW, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 128 MARKET IN ROW, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 129 MARKET IN ROW, BY END USER, 2017–2019 (USD MILLION)

TABLE 130 MARKET IN ROW, BY END USER, 2020–2026 (USD MILLION)

TABLE 131 MARKET IN ROW FOR ENTERPRISES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 132 MARKET IN ROW FOR ENTERPRISES, BY TYPE, 2020–2026 (USD MILLION)

TABLE 133 MARKET IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 134 MARKET IN ROW, BY REGION, 2020–2026 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Technological adoption in businesses and smart devices to create opportunities for micro servers

10.5.2 MIDDLE EAST AND AFRICA

10.5.2.1 Rise in expansion of data centers to create growth opportunities

10.6 IMPACT OF COVID-19

11 COMPETITIVE LANDSCAPE (Page No. - 137)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

TABLE 135 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MICRO SERVER IC PLAYERS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 REVENUE ANALYSIS OF LEADING PLAYERS (2016–2020)

FIGURE 38 HISTORICAL REVENUE ANALYSIS

11.4 MARKET RANKING ANALYSIS: MARKET, 2020

FIGURE 39 RANKING ANALYSIS OF MARKET, 2020

11.5 MARKET SHARE ANALYSIS: MARKET, 2020

FIGURE 40 MARKET SHARE ANALYSIS OF MARKET IN 2020

11.6 COMPANY EVALUATION MATRIX

11.6.1 STAR

11.6.2 EMERGING LEADER

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 41 COMPANY EVALUATION MATRIX, 2020

FIGURE 42 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS

11.7 START-UP EVALUATION MATRIX

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 43 STARTUP (SME) EVALUATION MATRIX, 2020

11.8 COMPETITIVE SITUATIONS AND TRENDS

11.8.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 136 PRODUCT LAUNCHES AND DEVELOPMENTS, 2020

11.8.2 PARTNERSHIPS AND COLLABORATIONS

TABLE 137 PARTNERSHIPS AND COLLABORATIONS, 2018–2020

11.8.3 ACQUISITIONS

TABLE 138 ACQUISITIONS, 2019–2020

12 COMPANY PROFILES (Page No. - 150)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, COVID-19 Related Developments, and MnM View)*

12.2.1 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

FIGURE 44 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY SNAPSHOT

12.2.2 INTEL CORPORATION

FIGURE 45 INTEL CORPORATION: COMPANY SNAPSHOT

12.2.3 QUANTA COMPUTER INC.

FIGURE 46 QUANTA COMPUTER INC.: COMPANY SNAPSHOT

12.2.4 NVIDIA CORPORATION

FIGURE 47 NVIDIA CORPORATION: COMPANY SNAPSHOT

12.2.5 ADVANCED MICRO DEVICES, INC

FIGURE 48 ADVANCED MICRO DEVICES, INC: COMPANY SNAPSHOT

12.2.6 AMBEDDED TECHNOLOGY CO., LTD.

12.2.7 DELL

FIGURE 49 DELL: COMPANY SNAPSHOT

12.2.8 FUJITSU

FIGURE 50 FUJITSU: COMPANY SNAPSHOT

12.2.9 MARVELL

FIGURE 51 MARVELL: COMPANY SNAPSHOT

12.2.10 SUPER MICRO COMPUTER, INC.

FIGURE 52 SUPER MICRO COMPUTER, INC.: COMPANY SNAPSHOT

*Business Overview, Products/Solutions/Services Offered, Recent Developments, COVID-19 Related Developments, and MnM View might not be captured in case of unlisted companies.

12.3 OTHER KEY PLAYERS

12.3.1 AMPERE COMPUTING

12.3.2 BAMBOO SYSTEMS

12.3.3 CHRISTMANN INFORMATIONSTECHNIK + MEDIEN GMBH & CO. KG

12.3.4 HIRO MICRO DATA CENTERS

12.3.5 HUAWEI TECHNOLOGIES CO., LTD.

12.3.6 IBM

12.3.7 LATTICE SEMICONDUCTOR

12.3.8 NXP SEMICONDUCTORS

12.3.9 SIPEARL

12.3.10 STMICROELECTRONICS

13 APPENDIX (Page No. - 196)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

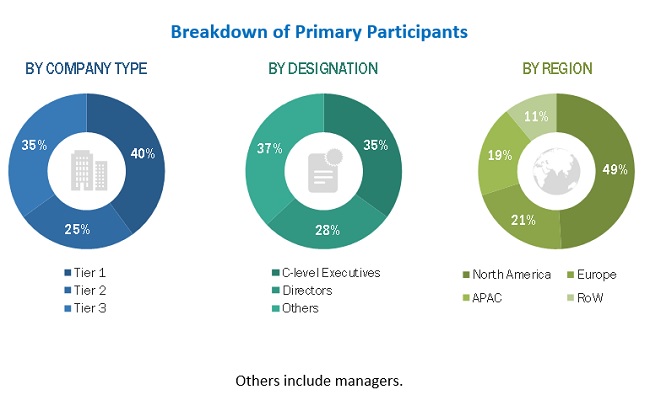

The study involved four major activities in estimating the micro server IC market. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the micro server IC market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. This research includes the study of annual reports of the market players to identify the top players, along with interviews of the key opinion leaders such as chief executive officers (CEOs), directors, and marketing personnel.

Secondary Research

Secondary sources used for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); trade journals, articles, white papers, and industry news; and business and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research. Some important secondary sources referred to for this research study are Internet World Stats (IWS) and International Telecommunication Union (ITU).

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the micro server IC market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across major regions—North America, Europe, APAC, and RoW. Approximately 30% of primary interviews has been conducted with the demand side, while 70% with the supply side. Primary data has been mainly collected through telephonic interviews, which consist of approximately 80% of the overall primary interviews. Moreover, questionnaires and emails have also been used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- In this report, both top-down and bottom-up approaches have been implemented to estimate and validate the size of the micro server IC market and various other dependent submarkets. The key players in the micro server IC market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the study of annual and financial reports of the top companies, as well as interviews with experts such as CEOs, vice presidents (VPs), directors, and marketing executives for both quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The figure shows the market estimation method for supply-side analysis.

The bottom-up approach has been used to arrive at the overall size of the micro server IC market from revenues of the key players and their shares in the market. The overall market size has been calculated based on the revenues of the key players identified in the market. The research methodology used to estimate the market size by the bottom-up approach includes the following:

- Identifying key participants that influence the overall market, along with related component providers

- Analyzing key providers of micro servers and micro server components, along with software suppliers and studying their portfolios to understand the different components and products offered by them in addition to examining the developments undertaken by the key players during the pre-COVID-19 period, as well studying the measures/steps undertaken by them to deal with COVID-19

- Predicting the anticipated change in demand for micro servers and its components in the post-COVID-19 scenario

- Analyzing trends pertaining to the use of micro servers in different applications such as web hosting and enterprise applications, cloud computing and analytics, and edge computing

- Tracking the ongoing and identifying the upcoming developments in the market in the form of investments, R&D activities, product launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the different types of micro servers used in different applications and recent trends in the market, thereby analyzing the breakup of the scope of the work carried out by the leading companies

- Arriving at the market estimates by analyzing the revenues generated by companies and combining the same to get the market estimates

- Segmenting the overall market into different segments

- Verifying and crosschecking estimates at every level through discussions with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. For the calculation of the sizes of specific market segments, the size of the most appropriate parent market has been considered to implement the top-down approach. Data from interviews has been consolidated, checked for consistency and accuracy, and inserted into a data model to arrive at the market numbers following the top-down approach. The market size in different regions have been identified and analyzed through secondary research.

Upon the estimation and validation of the size of the micro server IC market, further segmentation has been carried out based on consolidated inputs from key players with respect to regional adoption trends of micro servers and pervasiveness of the different types of micro servers across different applications and regions.

The research methodology used to estimate the market size by the top-down approach includes the following:

- Focusing on top-line investments and expenditures made in the market ecosystem

- Calculating the market size considering revenues generated by the key players through the sales of micro server and components; estimating the market size for 2020 by considering the impact of COVID-19 across the value chain of the micro server IC market; and analyzing recovery scenarios across the world to further forecast the market size

- Conducting multiple on-field discussions with key opinion leaders of key companies operating in the market to understand the pre-COVID-19 and post-COVID-19 scenarios

- Estimating the geographic split using secondary sources based on various factors such as the demand for micro servers in a specific country and region, adoption rate for various end users such as small, medium, and large enterprises and data centers for applications such as web hosting and enterprise applications, cloud computing and analytics, and edge computing

Data Triangulation

After arriving at the overall size of the micro server IC market through the process explained above, the overall market has been split into several segments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market size has also been validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the micro server IC market based on offering, processor type, application, and end user, in terms of value

- To describe and forecast the market size for the key regions, namely North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges, influencing market growth

- To provide a detailed overview of the value chain pertaining to the market, along with the average selling price trends of micro server systems

- To strategically analyze the ecosystem, patent landscape, and various case studies pertaining to the market

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2 and provide a detailed competitive landscape of the market

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the micro server IC market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Micro Server IC Market