Edge Data Center Market

Edge Data Center Market by Component (Edge Hardware (Servers, Gateways, Sensors, Devices), Edge Software (Data Management)), Edge Application (Edge AI & Inference, Real-time Processing & Control, Immersive & Interactive Experiences) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global edge data center market is projected to rise from USD 50.86 billion in 2025 to USD 109.20 billion by 2030, registering a CAGR of 16.5% during the forecast period. Building on this momentum, executive priorities are shifting from isolated pilots to scaled, distributed estates capable of supporting next-generation workloads. The edge data center market is growing rapidly as organizations shift computing closer to end-users to support 5G, IoT, AI, and immersive applications requiring ultra-low latency. Rising energy costs, strict ESG regulations, and carbon-reduction targets are pushing operators toward renewable power integration, green cooling, and efficient power management to reduce operational costs and environmental impact. Government incentives and data-residency mandates further drive regional edge deployments. By offering higher resilience, enhanced security, and local compliance, edge data centers enable scalable, real-time services while reducing data transport costs, positioning them as a sustainable backbone for next-generation digital infrastructure.

KEY TAKEAWAYS

- Asia Pacific leads growth at 20.0% CAGR, supported by aggressive 5G rollout, digital manufacturing expansion, smart city deployments, and national data-localization mandates. Rising enterprise AI workloads and strong infrastructure investments further accelerate the region’s edge data center adoption.

- Software expands rapidly at 22.1% CAGR, driven by rising use of orchestration platforms, container management, and AI-enabled analytics needed to run distributed edge environments. Increasing workload automation and multi-site deployment requirements strengthen software’s role in enabling efficient edge operations.

- AR/VR & Immersive Experiences grows the fastest at 31.6% CAGR as enterprises adopt immersive training, simulation, and retail experiences that demand ultra-low latency. Growth is fueled by edge-based rendering, localized compute, and rapid expansion of consumer and enterprise XR devices.

- Metro edge data centers dominate deployments, offering scalable, low-latency infrastructure supporting AI, IoT, and real-time services in urban hubs. Regional and network edge facilities grow due to aggregation nodes linking distributed micro-sites, ensuring resilient connectivity and efficient content delivery at scale.

- Hyperscalers and cloud providers expand distributed compute footprints to deliver scalable, latency-sensitive applications and immersive services closer to users. Colocation providers and enterprises adopt carrier-neutral, interconnection-rich edge environments, enabling cost-effective, secure infrastructure for diverse industry applications globally.

- Manufacturing leads enterprise adoption, deploying edge data centers for predictive maintenance, robotics, and Industry 4.0 automation, enhancing operational efficiency. Enterprises across retail, healthcare, and BFSI integrate edge infrastructure for AI-driven analytics, IoT, and data sovereignty compliance, ensuring secure operations.

- Dell Technologies, HPE, and Schneider Electric dominate with strong edge-optimized portfolios integrating compute, networking, and power systems. Their scale, global deployment capabilities, and ability to support AI-driven, latency-sensitive workloads reinforce their leadership across enterprise and telecom edge environments.

- CoolIT Systems, Active Power, and Riello UPS gain traction with specialized thermal efficiency, compact power continuity solutions, and modular designs suited for distributed edge sites. Their focus on cost-efficient, high-density, and rapidly deployable systems strengthens adoption across emerging edge use cases.

The edge data center market is expanding rapidly due to strict sustainability regulations, rising energy costs, and growing demand for resilient, low-latency infrastructure. Organizations are moving workloads closer to users to support 5G, IoT, AI, and immersive applications. This shift drives adoption of advanced cooling, renewable energy integration, and intelligent power management to enhance efficiency and cut emissions. Strengthened ESG mandates and government incentives further encourage distributed edge facilities. By combining operational resilience, scalability, and sustainable design, edge data centers are becoming a strategic foundation for digital transformation, supporting real-time analytics, autonomous systems, and mission-critical applications with reduced environmental impact.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The edge data center market is being reshaped by rapid digitalization, surging cloud adoption, and rising energy costs, compelling operators to seek more efficient, sustainable power solutions. Growing ESG mandates and carbon-reduction targets are driving investments in renewable integration, advanced UPS systems, and intelligent power distribution. Increased deployment of hyperscale, edge, and colocation facilities adds pressure to deliver reliable, low-latency, and high-density power infrastructure. At the same time, grid constraints and stricter regulations are pushing the market toward modular, scalable, and grid-independent systems. Together, these trends are transforming power strategies into a core enabler of cost efficiency and operational resilience.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in AI/ML workloads and real-time analytics driving demand for low-latency, distributed edge infrastructure

-

Rising IoT deployments accelerating demand for distributed edge infrastructure

Level

-

Shortage of skilled edge infrastructure professionals and complex integration requirements across heterogeneous environments

-

High initial capital investment for distributed edge infrastructure build-out

Level

-

Rise of liquid cooling in AI-driven data center infrastructure to meet next-gen density requirements

-

Emerging edge software platforms – virtualization, orchestration, analytics & AI

Level

-

Integration challenges with legacy infrastructure and core data centers

-

Power and cooling constraints in space-restricted edge installations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising IoT deployments accelerating demand for distributed edge infrastructure

Global IoT connections are set to rise from 18.8 billion in 2024 to 43 billion by 2030, as reported in Ericsson’s 2024 Mobility Report, with cellular IoT exceeding 7 billion. Around 60% will be Broadband IoT, demanding low-latency processing. Traditional infrastructure struggles with this scale, driving localized edge data centers for real-time analytics, smart cities, manufacturing, and healthcare. Rising IoT deployments accelerate distributed edge infrastructure to handle diverse, latency-sensitive workloads efficiently.

Restraint: Shortage of skilled edge infrastructure professionals and complex integration requirements across heterogeneous environments

Talent shortages and integration challenges are major restraints on edge data center growth. According to Uptime Institute’s 2023 survey, 58% of operators struggle to recruit and 40% to retain staff, with hybrid skills in automation, networking, and infrastructure scarce. Distributed edge sites demand multi-skilled professionals, while complex architectures like 5G, telco-cloud, and network slicing drive higher training, automation, and monitoring costs, hindering efficient large-scale deployment.

Opportunity: Rise of liquid cooling in AI-driven data center infrastructure to meet next-gen density requirements

The surge in AI workloads is driving demand for liquid cooling as traditional air systems cannot handle next-gen rack densities. According to Uptime Institute’s 2024 survey, few sites exceed 30 kW per rack. Hyperscalers like Microsoft, AWS, Meta, and Google are deploying direct-to-chip and liquid-ready racks to boost efficiency, reduce footprint, and support GPUs beyond 100 kW. Enterprises and colocation providers are also rapidly adopting liquid cooling as a new industry standard.

Challenge: Power and cooling constraints in space-restricted edge installations

Space-restricted edge installations face major power and cooling challenges as they expand to support 5G, IoT, and autonomous systems. Confined sites lack traditional infrastructure, driving demand for compact, energy-efficient solutions. Modular, liquid, and hybrid cooling systems with smart controls and remote monitoring optimize energy use, reduce costs, and ensure uptime. Autonomous controls and standardized infrastructure improve reliability, scalability, and compliance, enabling sustainable edge operations in diverse and space-constrained environments.

Edge Data Center Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

SK Telecom deployed a 5G Multi-Access Edge Computing (MEC) platform with Dell Technologies, Intel, AWS Wavelength, MobiledgeX, and Bridge Alliance, featuring on-site MEC infrastructure and AI offloading | Enabled AI offloading with neural processing units, quantum cryptography, and Telco API services; improved scalability, low latency edge delivery, and created new revenue streams from edge services |

|

P&G accelerated global manufacturing with Microsoft Azure IoT Edge solutions, deploying Azure Arc, Kubernetes-native MQTT brokers, Azure Data Lake, and AI/ML models across 35+ countries | 90% reduction in AI model deployment time, scalable edge AI deployment across plants, improved OEE, enhanced quality assurance, cloud-to-edge integration, and strategic innovation via real-time data-driven insights |

|

Afterpay used Digital Realty’s edge computing network for distributed infrastructure, cloud optimization, and real-time decision-making at the data source | Faster access to cloud resources for 450+ employees, significant latency reduction, improved IT scalability, enhanced monitoring, streamlined and responsive user experience globally |

|

TED enhanced media delivery and productivity with 365 Data Centers’ edge infrastructure, deploying distributed colocation edge centers, low-latency networks, and scalable connectivity for HD video workflows | Deployed 2 Gbps low-latency network, enabled near-real-time HD video transfers, enhanced productivity and operational efficiency, reduced bandwidth cost versus traditional cloud/on-prem |

|

Georgia Tech advanced high-performance research using DataBank’s edge-enabled High-Performance Computing Cluster with distributed edge data centers and integrated data flow architecture | Delivered cost-effective and high-performing HPCC infrastructure, increased network backup and data capacity, reduced cooling/space demands, enabled complex research at optimized cost and performance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The edge data center ecosystem features hardware providers split into Power Infrastructure, Facility Infrastructure, and IT Infrastructure, plus Software Providers and Service Providers. This integrated network supplies resilient power, advanced cooling, IT hardware, monitoring software, and expert services, enabling organizations to design, deploy, and manage high-performance, sustainable, net-zero-ready edge data centers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Edge Data Center Market, By Component

Infrastructure accounts for the largest share of the edge data center component market, forming the backbone of localized, low-latency computing. It includes IT systems—servers, storage, networking—and power and cooling infrastructure such as UPS, BESS, PDUs, and advanced liquid cooling. Together, these enable resilient, scalable, and efficient edge operations aligned with evolving digital demands.

Edge Data Center Market, By Application

5G Services and Network Function Virtualization (NFV) account for the largest share of applications within the edge data center market. They enable network slicing, private campus deployments, and multi-access edge computing for scalable connectivity and real-time security. Together, these power low-latency services, expanding edge capabilities across industries while supporting resilience, scalability, and next-generation digital transformation.

Edge Data Center Market, By Deployment Location

Metro edge data centers account for the largest share of deployment locations within the edge data center market. Positioned in urban hubs, they enable low-latency processing for AI, IoT, and immersive applications. By supporting 5G rollouts, content delivery, and real-time mobility services, metro edge facilities drive scalable, integrated infrastructure to meet evolving digital demands.

Edge Data Center Market, By End User

Hyperscalers and cloud service providers account for the largest share of end users within the edge data center market. They extend distributed compute footprints to support latency-sensitive applications, real-time analytics, and immersive services. By driving carrier-neutral, scalable infrastructure, these leaders accelerate edge adoption, enabling automation, IoT integration, and compliance across global industries.

Edge Data Center Market, By Enterprises

Manufacturing accounts for the largest share of enterprise adoption within the edge data center market. By positioning compute and storage near factory floors, manufacturers enable predictive maintenance, robotics, and real-time analytics. This supports Industry 4.0 automation, IoT integration, and data sovereignty compliance, enhancing agility, efficiency, and secure handling of critical operational data across distributed ecosystems.

REGION

Asia Pacific to be the fastest-growing region in the global edge data center market during the forecast period

Asia Pacific is emerging as the fastest-growing region in the edge data center market, fueled by surging digitalization, 5G rollout, hyperscale expansion, and supportive government initiatives. Sustainability mandates and rising workloads are driving the adoption of modular power, advanced cooling, and AI-driven monitoring to improve efficiency and cut carbon intensity. Operators are increasingly integrating renewable energy, liquid cooling, and energy reuse systems to enhance resilience, scalability, and performance across diverse climates and dense urban environments, positioning Asia Pacific as a global edge leader.

Edge Data Center Market: COMPANY EVALUATION MATRIX

In the edge data center market matrix, Dell Technologies (Star) leads with a strong product footprint and market share, enabling large-scale deployments. Broadcom (Emerging Leader) advances with innovative IT and network solutions. Together, they showcase leadership in performance, sustainability, and scalability across enterprise and hyperscale edge environments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 | USD 40.46 Billion |

| Market Forecast in 2030 | USD 109.20 Billion |

| Growth Rate | CAGR of 16.5% from 2025-2030 |

| Actual Data | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Edge Data Center Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- July 2025 : HPE acquired Juniper Networks, forming HPE Networking. The new unit combines offerings from HPE, Aruba, and Juniper under one company, delivering an AI-native, secure LAN-to-WAN stack enhanced by Mist AIOps. Integrated with HPE GreenLake, it enables AI-driven user experiences and high-performance data-center fabrics.

- July 2025 : DDC Solutions partnered with Quantum Technology Systems to stock and rapidly deliver its S-Series cooling cabinets (15?kW–600?kW+ heat abatement per rack). Quantum will bundle in-stock S-Series platforms with full white-space infrastructure and integration services, enabling hyperscalers, enterprises, and colo providers to deploy AI/HPC-ready cooling at scale with minimal lead times.

- June 2025 : KDDI and HPE collaborated to launch the Osaka Sakai AI Data Center by early 2026, featuring NVIDIA Blackwell-accelerated infrastructure. The facility uses HPE’s hybrid cooling system, combining air and direct liquid cooling, optimizing AI workloads while improving energy efficiency and reducing environmental impact for next-generation AI deployment.

- June 2025 : Cisco partnered with global neocloud providers to deliver AI-ready data center solutions, including AI PODs and Nexus Dashboard. These integrated solutions support scalable AI workloads, enhance hybrid cloud orchestration, and enable enterprise clients to deploy next-gen AI infrastructure with lower latency and higher security across distributed data center environments.

- June 2025 : NVIDIA partnered with Deutsche Telekom to build the world’s first industrial AI cloud in Germany. The AI factory will feature 10,000 GPUs using NVIDIA DGX B200 systems and RTX PRO Servers. Deutsche Telekom will manage infrastructure, operations, and security to accelerate AI deployment across European manufacturing and industrial sectors.

- January 2025 : IBM partnered with CoreWeave to deploy an AI supercomputer using NVIDIA GB200 NVL72 systems and an IBM storage scale system. The supercomputer will support training of IBM Granite models, while IBM Storage will be available to CoreWeave customers within its dedicated environments and AI cloud platform.

Table of Contents

Methodology

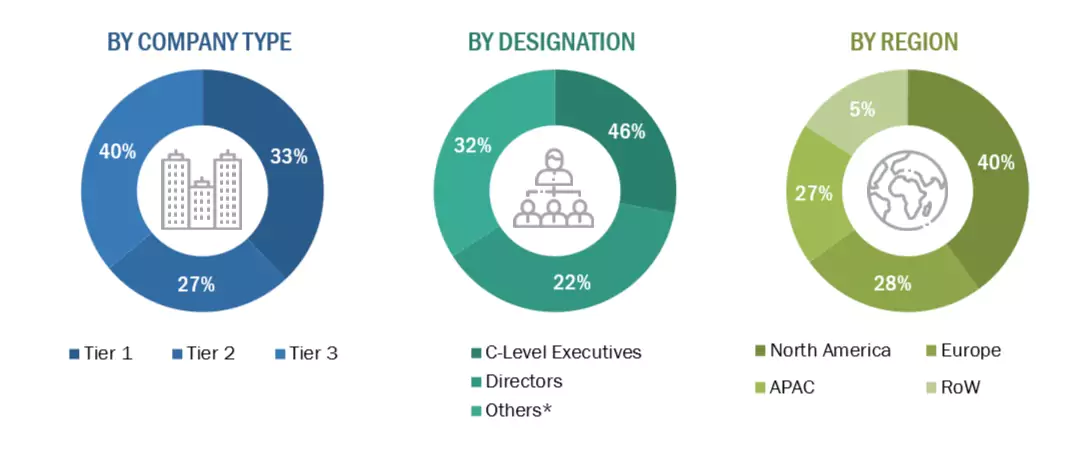

This research study on the edge data center market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred edge data center providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the edge data center spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and edge data center providers. It also included key executives from edge data center vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between

USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

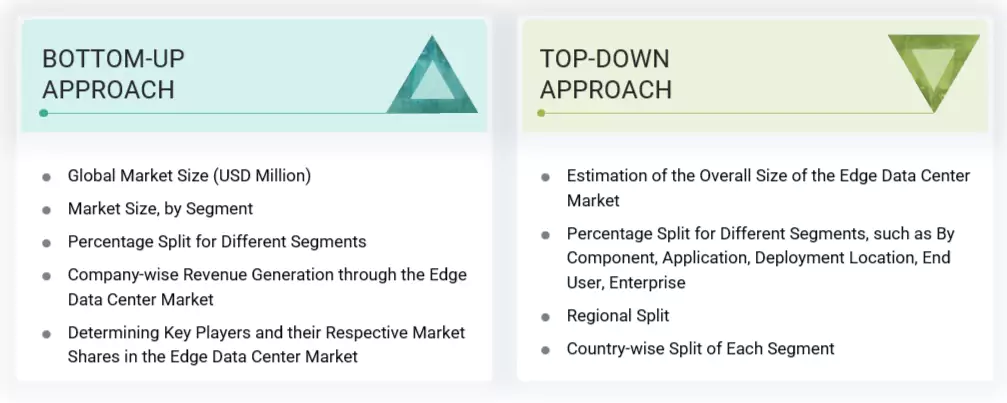

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the edge data center market. The first approach involved estimating the market size by companies’ revenue generated through the sale of edge data center services.

Market Size Estimation Methodology- Top-down approach

The top-down approach for the edge data center market begins with estimating the overall market size and then breaking it down into smaller segments for a detailed view. This methodology leverages macro-level market statistics and applies percentage splits to distribute the total value across different components such as hardware, software, and services. It further dissects the market by application, organization size, deployment model, and vertical to provide a comprehensive segmentation. The analysis also incorporates regional and country-wise splits to account for geographical variations in demand and adoption. This approach is particularly useful for aligning forecasts with strategic planning and investment decisions, as it relies on broad industry data, trends, and top-level insights from authoritative reports. By starting from an aggregate figure and allocating shares based on weighted assumptions and historical patterns, the top-down method ensures that the derived estimates align with the global market perspective, supporting stakeholders in assessing high-level growth opportunities and regional priorities in the edge data center ecosystem.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach to estimating the edge data center market focuses on deriving market size from the granular level by aggregating data across individual companies and segments. This methodology involves assessing company-wise revenue generation within the edge data center ecosystem, examining their respective contributions to the overall market. It begins by analyzing the global market size in monetary terms and then segmenting it by various dimensions such as hardware, software, and services. Furthermore, percentage splits for different segments are calculated to understand the relative contribution of each component or application area. A critical aspect of this approach includes identifying key players in the edge data center domain and determining their respective market shares based on actual sales data, partnerships, and regional presence. This process ensures a highly accurate and realistic estimation, as it relies on validated data sources and bottom-line financials, making it particularly suitable for understanding competitive landscapes, micro-market trends, and investment opportunities in edge data center solutions.

Edge Data Center Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The edge data center market refers to the segment of the data center industry focused on deploying smaller, decentralized facilities located closer to end users and data sources to deliver low-latency processing, high bandwidth, and real-time data management. Unlike traditional centralized data centers, edge data centers are designed to support emerging technologies such as IoT, 5G, artificial intelligence (AI), and real-time analytics, enabling faster response times and reducing the dependency on distant cloud or core facilities. These facilities integrate critical IT infrastructure, including servers, storage, and networking, with advanced cooling systems and energy-efficient designs to handle high-performance and AI-driven workloads. Edge data centers are strategically positioned in metropolitan areas, remote sites, and near critical applications to optimize performance for industries such as telecommunications, healthcare, manufacturing, retail, and autonomous systems. The market encompasses hardware, software, and services that enable distributed computing, virtualization, orchestration, and secure connectivity. As businesses and service providers increasingly adopt digital transformation strategies, the edge data center market plays a pivotal role in enhancing scalability, resilience, and operational efficiency. This evolution positions edge data centers as a foundational component of next-generation digital infrastructure, supporting mission-critical applications and delivering superior user experiences.

Stakeholders

- Training and consulting service providers

- Information Technology (IT) infrastructure providers

- Component providers

- System Integrators (SI)

- Support service providers

- Cloud Service Providers (CSPs)

- Government organizations and standardization bodies

- Data center providers

- Regional associations

- Independent hardware and software vendors

- Value-added resellers and distributors

Report Objectives

- To forecast the market based on Component (IT Infrastructure (storage, server, networking), Data Center Power Infrastructure (Power Generation (Generators, Gas Turbines), Power Backup (Uninterrupted Power Supply (UPS), Battery Energy Storage System (Bess)), Power Distribution (Switchboards, Busways, Power Distribution Units (PDUs), Other Power Distribution), Switchgear (High Voltage Switchgear, Medium Voltage Switchgear, Low Voltage Switchgear), Cabling Infrastructure, Data Center Racks & Enclosure (Open Frame, Enclosed), Data Center Cooling Infrastructure ((Air Cooling (Air-Cooled Chillers, Cooling Towers, Other Air-cooling Solutions), Liquid Cooling (Heat Exchangers, Water-cooled Chillers, Coolant Distribution Unit (CDU), Other Liquid Cooling Solutions), Software (DCIM Software, Building/Facility Management Software, Virtualization, Automation & Orchestration Software, Compliance & Security Software, Analytics & Edge AI Software), Service (Design & Consulting, Integration & Deployment, Support & Maintenance), Application (Edge AI Inference & Real-time Analytics, AR/VR & Immersive Experiences, 5G?Services & Network Function Virtualization (NFV), Content?Delivery Network (CDN) & Caching, Industrial?IoT & Automation, Interactive Gaming & Competitive Play, Connected & Autonomous Mobility, Other Applications (Smart Facility Security & Access Management and Smart Buildings & Facility Management), Deployment Location (Metro Edge Data Center, Network Edge Data Center, Regional Edge Data Center), End User (Hyperscalers & Cloud Service Providers, Colocation Service Providers, Enterprises), Enterprise (Manufacturing, Retail and E-commerce, Telecom, Energy & Utilities, Banking, Financial Services, and Insurance (BFSI), Healthcare & Life Sciences, Technology & Software, Government & Public Sector, Other Enterprises (Transportation & Logistics and Media & Entertainment), and Region

- To forecast the market size of five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets with respect to growth trends, prospects, and their contributions to the overall market

- To analyze the industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze the competitive developments such as mergers & acquisitions, product launches, and partnerships & collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American edge data center market

- Further breakup of the European edge data center market

- Further breakup of the Asia Pacific edge data center market

- Further breakup of the Middle East & African edge data center market

- Further breakup of the Latin American edge data center market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What are edge data centers?

According to Supermicro, “An edge data center is a small, decentralized computing facility that is located close to the edge of a network, where data is being generated and consumed. Unlike traditional, centralized data centers that are often situated in faraway locations, edge data centers are distributed geographically closer to users and devices. This proximity significantly reduces latency and bandwidth use, enhancing the performance of applications that require real-time data processing.”

What are the different deployment locations for edge data centers?

Edge data centers are deployed across metro, network, and regional layers, each serving distinct roles in distributed infrastructure. Metro edge sites include enterprise micro edges, telco access nodes, and industrial facilities that deliver localized processing for enterprises, telecoms, and smart factories. Network edge spans tower, inner, and outer edge deployments, positioned close to mobile users and 5G networks to minimize latency and support real-time services. Regional edge encompasses interconnection campuses, telco aggregation hubs, and cloud/CDN-run compute regions, balancing localized reach with scalable infrastructure. Together, these deployment models ensure efficient performance, compliance, and agility for data-intensive applications.

What factors are accelerating the adoption of edge data centers?

Adoption is being fueled by the surge in AI/ML and real-time analytics, which require low-latency, distributed infrastructure. Rising IoT deployments are also driving demand for localized processing to handle massive device data streams. Additionally, 5G network slicing and ultra-low latency services are pushing operators and enterprises to expand distributed edge infrastructure for next-generation applications.

How do edge data centers differ from cloud computing and traditional data centers?

Unlike cloud computing, which relies on a centralized, distant data center, edge computing processes data locally. This is crucial for latency-sensitive applications like autonomous vehicles or real-time analytics. Traditional data centers are typically large, on-premises facilities, while edge data centers are smaller, modular, and designed for geographically dispersed deployments.

What challenges are hindering the adoption of edge data centers?

Adoption faces hurdles due to integration challenges with legacy infrastructure and core data centers, making interoperability and workload orchestration complex. Additionally, power and cooling constraints in space-restricted edge installations create design and operational limitations, requiring innovative solutions for efficiency and scalability.

Who are the key vendors in the edge data center market?

The key vendors in the global edge data center market include Dell Technologies (US), Broadcom (US), Nvidia (US), HPE (US), Supermicro Computer Inc. (US), Lenovo (China), Schneider Electric (France), Huawei (China), IBM (US), and Cisco (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Edge Data Center Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Edge Data Center Market