Electric Utility Vehicle Market by Vehicle Type, Application, Battery Type (Lead Acid, Lithium-Ion), Drive Type (2WD, 4WD, AWD), Propulsion (Pure Electric, Hybrid Electric), Seating Capacity (1-Seater, 2-Seater, >2-Seater) and Region - Global Forecast to 2027

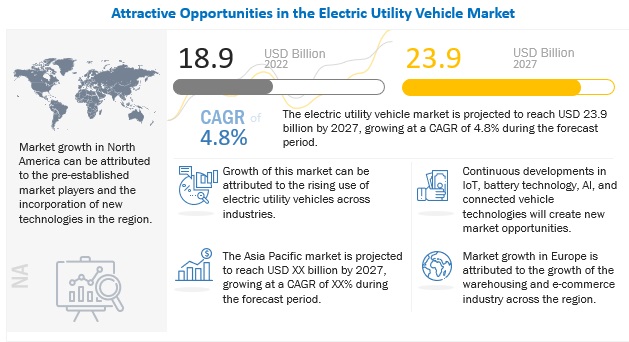

[297 Pages Report] The electric utility vehicle market is projected to grow from USD 18.9 billion in 2022 to USD 23.9 billion by 2027, registering a CAGR of 4.8%. Electric all-terrain vehicles (ATVs), utility task vehicles (UTVs), utility carts, shuttle carts, and industrial utility vehicles were mapped as part of this research. Growing demand for low-emission alternatives to off-road vehicles (e.g., ATVs and UTVs), rapid electrification of utility carts and shuttle carts, and increased shift to use of battery-operated material handling vehicles (e.g., forklifts and tow-tractors) for indoor applications have increased the demand for electric utility vehicles worldwide. Furthermore, with the rapid setup of charging stations across nations, the demand for electric utility and shuttle carts is expected to grow faster than other electric utility vehicles.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Growth in e-commerce and warehousing

The growing need to support the hub and spoke model in e-commerce, automotive component manufacturing, consumable goods, and electronics sectors is increasing the number of warehouses per country. The warehouse and fulfillment sector is expected to register double-digit growth over the next five years, increasing the demand for electric utility vehicles. The US e-commerce penetration rose from approximately 10% of all retail sales in 2019 to about 15% in 2020. As per the US Bureau of Labor Statistics, the number of warehouses in the US increased to 19,194 in 2020 from 15,255 in 2011. With global online e-commerce sales projected to double by 2027, nearly 28,500 warehouses will be added to the stock. The increased number of warehouses will likely lead to heightened demand for industrial electric utility vehicles. This, in turn, will augment revenues for the electric utility vehicle market in the industrial segment during the forecast period.

According to the US commerce department, US e-commerce ranks 2nd among the top 10 e-commerce countries. Warehousing and storage by e-commerce and logistics players such as Amazon, Walmart, and Alibaba have been key factors behind the growing demand for industrial vehicles worldwide. The supply chain fragmentation due to government policies, industrialization, and globalization would also be considered a driving factor for the market. As the number of warehouses increases, material handling will also increase, creating a demand for efficient electric forklifts. According to the European e-commerce report 2022, European e-commerce grew by 13%. The growth rate remained stable and increased slightly compared to 2020. Germany is one of the largest e-commerce markets in Europe and registered a growth rate of 24% between 2020 to 2021. Given these factors, the warehousing industry is expected to grow, catering to the electric utility vehicle market growth.

Restraint: Lower distance range than ICE Counterparts

Prospective buyers of electric utility vehicles are concerned about the range of distance covered in one charge. The driving range of electric utility vehicles is shorter than that of ICE vehicles. Users prefer covering long distances without interruptions. Electric utility vehicles are arduous to use due to the need for frequent charging, especially in rural areas, where supply may vary. These factors could inhibit the growth of the electric utility vehicle market. R&D efforts are focused on improving batteries' efficiency and increasing the distance range covered by electric utility vehicles. Most electric utility vehicle manufacturers are trying to shift to lithium-ion batteries instead of lead-acid batteries. Lithium-ion batteries offer higher energy density; around 95% of their energy can be utilized efficiently. They also offer a longer range than lead-acid batteries. However, lead-acid batteries are cheaper than lithium-ion batteries, and low-priced electric utility vehicles still use lead-acid batteries due to their easy availability.

Opportunity: Use of battery swapping for electric utility vehicles

Battery swapping at the electric vehicle (EV) charging stations is a new trend that eliminates the time for charging batteries for electric utility vehicle users. Although level 3 EV charging can charge an electric vehicle in 30–60 minutes and ultra-fast charging can charge in 15–30 minutes, they are not compatible with electric utility vehicles. Therefore, battery swapping is a great alternative for electric utility vehicles. Companies such as NIO have installed over 300 battery swapping stations by July 2021 and plan to install around 4,000 more by 2025 in China. Its swapping stations have been used about 2.9 million times globally, with approximately 1,000 battery swapping stations designed outside China. Shell signed an agreement with NIO in November 2021 to develop such battery-swapping EV charging stations jointly. This has created a new opportunity for battery-as-a-service in EV charging. The battery swapping stations are expected to attract more electric utility vehicle customers as they will not have to wait for more charging time. The swap stations will also reduce the upfront cost of the electric utility vehicles as the battery ownership will be replaced by battery leasing.

Challenge: Higher cost than their ICE counterparts

Utility vehicle users find it difficult to switch to advanced electric versions of existing models because of the added high cost. Recent developments in the electric utility vehicle market have pressed OEMs to invest more money in developing such products, which will drive up the cost of these vehicles as they would want to recuperate their investments. The price of the Polaris Ranger EV is USD 13,999, and the Ranger XP Kinetic Premium is USD 24,999. ATV model prices vary depending on feature requirements. A higher number of features would further add up the cost to the manufacturer, resulting in a higher selling price to the customers. Most consumers cannot afford brand-new, expensive models and opt for second-hand ones. Therefore, the cost factor poses a challenge for OEMs.

Commercial transport to grow at the fastest pace during forecast period

Commercial transport is one of the largest applications of electric utility vehicles, with a high demand for electric shuttle carts for passenger carriage in urban areas and utility carts for short-distance last-mile delivery in rural and urban areas. Companies such as Garia (Subsidiary of Club Car (US)), Taylor Dunn (Subsidiary of WAEV (US)), Smart Cart (US), Goupil (Subsidiary of Polaris (US)), Columbia Vehicle (US), and Ari Motors (Germany) produce electric utility carts for commercial transport. These companies have a wide range of product offerings for the market. For instance, in January 2021, Club Car revealed its electric utility cart/vehicle, available in three configurations: pickup, flatbed, and van box. This vehicle is ideal for low-speed logistics and cargo services. Similarly, Ari Motors launched its new solar-enabled electric utility cart, the 458 of series L7e in collaboration with Sono Motors, a German electric vehicle solution startup, in October 2021. In June 2020, Addax Motors launched a new variant of Addax MT series vehicles. This electric utility cart offers a range of up to 132 km on a single charge, following the WLTP standard. It is powered by an electric motor of 12 kW, generating maximum power of 16 hp and 120 N m torque.

Meanwhile, Club Car (US), Columbia Vehicle (US), Textron (US), Pilot Cars (US), Smart Cart (US), and GEM (Subsidiary of WAEV (US)), among others, provide electric shuttle carts for commercial transport. These companies have launched multiple electric shuttle cart offerings over the years. E-Z-GO (a subsidiary of Textron), in June 2021, revealed its new vehicle, the E-Z-GO Liberty. It is the industry’s first compact golf-car-sized vehicle with four front-facing seats. It runs on a 56.7V DC power source, which generates a power of 11.7 hp, and is equipped with Samsung SDI lithium-ion battery system.

Pure-electric segment to lead market during the forecast period

The pure-electric utility vehicle segment will lead the market, with top electric utility vehicle manufacturers providing pure-electric utility vehicles as part of their product portfolio. North America will exceed the demand for electric ATVs and UTVs, while Asia Pacific will have the highest demand for other electric utility vehicles, including material handling equipment, shuttle carts, and utility carts. Companies such as BYD (China), Club Car (US), WAEV (US), Polaris (US), Toyota Industries (Japan), Ari Motors (Germany), John Deere (US), and Alke (Italy) provide pure-electric utility vehicles. BYD, for instance, offers pure-electric industrial utility vehicles, including forklifts and pallet trucks. Similarly, Club Car provides electric utility and shuttle carts. Polaris delivers electric UTVs and utility carts. New generation ATVs and UTVs are comparable to their ICE counterparts. The EZ Raider HD4, for instance, has powerful batteries that enable riders to travel as far as a gas-powered ATV would. On the other hand, hybrid-electric utility vehicles have much lower demand than pure-electric utility vehicles as these vehicles require dual drivetrains in the limited space that utility vehicles have. This reduces the utility vehicle performance and increases vehicle weight compared to the pure-electric or ICE counterparts.

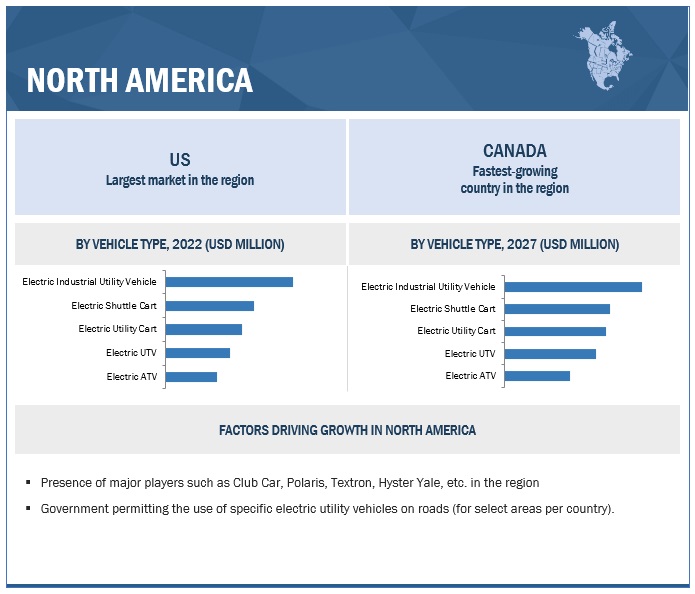

North America to be the largest market by value during the forecast period

The North American ATV/UTV industry is one of the most advanced ATV/UTV industries globally, contributing more than 50% of the global demand. The demand for electric ATVs/UTVs has surged significantly, owing to the rising recreational activities such as camping, hunting, forest rides, etc., during the pandemic. The region’s electric ATV/UTV sales are dominated by key players such as Polaris, Textron, and John Deere. These vehicles also have witnessed considerable growth in demand in agriculture, with the US government pushing farmers to shift to electric utility vehicles. For Instance, John Deere is working with the government to encourage the use of electric utility vehicles on farms in the US.

Factors such as a large e-commerce industry and an established ecosystem for industrial and manufacturing companies with their warehousing capabilities make North America an attractive market for industrial vehicle manufacturers. Moreover, an extensive 3PL network has led to the growth of the warehousing sector in North America. Exhibitions and trade shows such as ProMat and MODEX, held annually, also help material handling equipment manufacturers to look for prospective customers in the region, propelling the electric industrial utility vehicles market. Companies such as Hyster Yale (US), Caterpillar (US), Clark Material Handling Company (US), Crown Equipment Corporation (US), Noblelift (Canada), and Vallee (Canada), among others, develop electric industrial utility vehicles in this region.

North America also has a sizeable market for shuttle carts, with the US acquiring 90% of the regional demand. A significant portion of the shuttle cart sales is electric, leading to the region's strong demand for electric shuttle carts (including golf carts). The US also has a high demand for electric utility carts, making it the largest country-level market in the region. The US accounts for more than two-thirds of the overall utility and shuttle cart demand, followed by Canada and Mexico. Mexico's demand for electric utility vehicles is also growing due to low manufacturing and manpower costs and favorable government policies. This compels top manufacturers such as Polaris to open manufacturing plants in the country.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The electric utility vehicle market is dominated by established players such as Polaris (US), Club Car (US), Toyota Industries Corporation (Japan), John Deere (US), and Textron (US), among others. These players have worked on providing offerings for the electric utility vehicle ecosystem. They have initiated partnerships to develop their electric utility vehicle technology and offer best-in-class products to their customers.

Scope of the Report

|

Report Attributes |

Details |

|

Market size value in 2022: |

USD 18.9 Billion |

|

Projected to reach 2027: |

USD 23.9 Billion |

|

CAGR: |

4.8% |

|

Base Year Considered: |

2021 |

|

Forecast Period: |

2022-2027 |

|

Largest Market: |

North America |

|

Region Covered: |

Asia Pacific, North America, Europe, and RoW |

|

Segments Covered: |

Vehicle Type, Battery Type, Drive Type, Propulsion, Seating Capacity, Application, and Region |

|

Companies Covered: |

Polaris (US), Club Car (US), Toyota Industries Corporation (Japan), John Deere (US), and Textron (US), among others A total of 40 major company profiles were covered and provided. |

This research report categorizes the electric utility vehicle market based on vehicle type, battery type, drive type, propulsion, seating capacity, application, and region.

Based on Vehicle Type:

- Electric ATVs

- Electric UTVs

- Electric Utility Carts

- Electric Shuttle Carts

- Industrial Electric Utility Vehicles

Based on Battery Type:

- Lead Acid

- Lithium-Ion

- Others

Based on Drive Type:

- 2WD

- 4WD

- AWD

Based on Application:

- Commercial Transport

- Recreation

- Agriculture

- Industrial

- Others

Based on Seating Capacity:

- 1-Seater

- 2-Seater

- >2-Seater

Based on Propulsion:

- Pure Electric

- Hybrid Electric

Based on Region:

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- India

-

North America (NA)

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Spain

- UK

- Rest of Europe

-

Rest of the World

- South Africa

- Brazil

Recent Developments

- In June 2022, John Deere announced its AutoTrac assisted steering system for Gator Utility Vehicles such as TE 4x2 Electric. It will make precision agriculture more accessible and work on smaller fields easier.

- In June 2022, John Deere announced its five series utility tractors updates. This series of tractors come with various models for multiple applications. Models such as 5E Tractors and 5M Tractors are included in this series. The 5E models offer 50 to 128 hp, and the 5M models come with 73–128 hp.

- In May 2022, BYD revealed its all-new forklift, the ECB 70/80. It is equipped with an advanced charging system, which provides an operational time of up to 9 hours on a single charge.

- In May 2022, BYD revealed its all-new three-wheel counterbalance forklift, the ECB 20S. It comes with a capacity of up to 2 ton.

- In January 2022, Toyota Material Handling announced to launch 22 new electric industrial utility vehicles across all applications and environments. Out of these, 12 new reach truck models are launched with 24V, 36V, and 48V power options.

- In October 2021, Taylor-Dunn, a subsidiary of WAEV (Back then of Polaris), showcased its tow tractor in collaboration with A&V and LevCon. It is the first ever tiger tow tractor with Li-Ion electric batteries.

- In July 2021, Polaris introduced its first electric drive train lineup, which comes in two models: Ultimate and Premium. The ultimate and premium deliver 190 N m torque and 110 hp power. These vehicles can tow up to 1134 kg and can carry a load of 567 kg. The primary difference between the two models is that Premium comes with a 14.9 kWh battery, which delivers a range of 72 km, whereas ultimate comes with a 29.8 kWh lithium-ion battery, which delivers a range of 129 km.

Frequently Asked Questions (FAQ):

What is the current size of the electric utility vehicle market?

The current size of the electric utility vehicle market is estimated at USD 18.9 billion in 2022.

Who are the winners in the electric utility vehicle market?

The electric utility vehicle market is dominated by Polaris (US), Club Car (US), Toyota Industries Corporation (Japan), John Deere (US), and Textron (US), among others. They have worked on providing offerings for the electric utility vehicle ecosystem. They have initiated partnerships to develop their EUV technology and offer best-in-class products to their customers.

Which region will have the fastest-growing market for electric utility vehicles?

North America will be the fastest-growing region in the electric utility vehicle market due to the huge volume of investments in the region and the high demand for Powersports and commercial transport using utility vehicles.

What are the key technologies affecting the electric utility vehicle market?

The key technologies affecting the electric utility vehicle market are the 5G network, the internet of things (IoT), 3D modeling, artificial intelligence, connected vehicles, and new battery technologies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 ELECTRIC UTILITY VEHICLE MARKET DEFINITION, BY VEHICLE TYPE

TABLE 2 MARKET DEFINITION, BY BATTERY TYPE

TABLE 3 MARKET DEFINITION, BY DRIVE TYPE

TABLE 4 MARKET DEFINITION, BY PROPULSION

TABLE 5 MARKET DEFINITION, BY SEATING CAPACITY

TABLE 6 MARKET DEFINITION, BY APPLICATION

1.2.1 INCLUSIONS AND EXCLUSIONS

TABLE 7 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MARKETS COVERED

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 8 CURRENCY EXCHANGE RATES

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 2 ELECTRIC UTILITY VEHICLE MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights and breakdown of primary interviews

FIGURE 4 KEY INDUSTRY INSIGHTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.3 List of primary participants

2.2 MARKET SIZE ESTIMATION

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 7 BOTTOM-UP APPROACH: MARKET

2.2.2 TOP-DOWN APPROACH

FIGURE 8 TOP-DOWN APPROACH: MARKET

FIGURE 9 MARKET: MARKET ESTIMATION NOTES

FIGURE 10 MARKET: RESEARCH DESIGN AND METHODOLOGY – DEMAND SIDE

2.3 DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION METHODOLOGY

FIGURE 12 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.4 FACTOR ANALYSIS

2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDE

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 60)

FIGURE 13 MARKET: MARKET OVERVIEW

FIGURE 14 MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 15 MARKET: ONGOING MARKET TRENDS

FIGURE 16 ELECTRIC INDUSTRIAL VEHICLE SEGMENT TO BE LARGEST MARKET (2022–2027)

4 PREMIUM INSIGHTS (Page No. - 65)

4.1 ATTRACTIVE OPPORTUNITIES IN ELECTRIC UTILITY VEHICLE MARKET

FIGURE 17 GROWING DEMAND FOR ELECTRIC UTILITY AND SHUTTLE CARTS TO DRIVE MARKET

4.2 MARKET, BY REGION

FIGURE 18 NORTH AMERICA PROJECTED TO BE LARGEST MARKET DURING FORECAST PERIOD

4.3 MARKET, BY VEHICLE TYPE

FIGURE 19 ELECTRIC INDUSTRIAL VEHICLE TO BE DOMINANT SEGMENT (2022–2027)

4.4 MARKET, BY BATTERY TYPE

FIGURE 20 UTILITY VEHICLES USING LITHIUM-ION BATTERIES TO LEAD MARKET (2022–2027)

4.5 MARKET, BY DRIVE TYPE

FIGURE 21 2WD ELECTRIC UTILITY VEHICLES TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.6 MARKET, BY SEATING CAPACITY

FIGURE 22 2 SEATER ELECTRIC UTILITY VEHICLES TO ACQUIRE LARGEST MARKET SHARE (2022–2027)

4.7 MARKET, BY APPLICATION

FIGURE 23 COMMERCIAL TRANSPORT EXPECTED TO BE FASTEST-GROWING MARKET (2022–2027)

4.8 MARKET, BY PROPULSION

FIGURE 24 PURE ELECTRIC SEGMENT EXPECTED TO LEAD MARKET (2022–2027)

4.9 MARKET, BY REGION

FIGURE 25 NORTH AMERICA TO LEAD MARKET, BY VALUE

5 MARKET OVERVIEW (Page No. - 70)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 26 ELECTRIC UTILITY VEHICLE MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Reduced prices of EV batteries

FIGURE 27 EV PRICES FALLING WITH BATTERY PRICES

5.2.1.2 Growing e-commerce and warehousing sectors

FIGURE 28 TOTAL US E-COMMERCE RETAIL SALES, 2017−2021

FIGURE 29 QUARTERLY US E-COMMERCE RETAIL SALES FOR 2020−2021

5.2.1.3 Rapid setup of charging infrastructure

FIGURE 30 NUMBER OF FAST CHARGERS AVAILABLE PUBLICLY

FIGURE 31 NUMBER OF SLOW CHARGERS AVAILABLE PUBLICLY

5.2.1.4 Rising prices of petroleum

FIGURE 32 PRICE OF OIL IN LAST 3 DECADES

5.2.1.5 Increased use of electric utility carts and shuttle carts

5.2.2 RESTRAINTS

5.2.2.1 Lower range compared to ICE counterparts

5.2.2.2 Longer charging time than other fuels

FIGURE 33 CHARGING TIME REQUIRED TO CHARGE USING DIFFERENT CHARGING POINT TYPES

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand in automotive and transportation sectors

5.2.3.2 Battery swapping for electric utility vehicles

FIGURE 34 BATTERY SWAPPING SYSTEM

5.2.4 CHALLENGES

5.2.4.1 Higher cost of electric utility vehicles

5.2.4.2 Insufficient grid infrastructure globally

FIGURE 35 GRID REQUIREMENT FOR EVS IN GERMANY BY 2030

TABLE 9 MARKET: IMPACT OF MARKET DYNAMICS

5.3 PORTER’S FIVE FORCES

FIGURE 36 PORTER’S FIVE FORCES: MARKET

TABLE 10 MARKET: IMPACT OF PORTER’S FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MARKET ECOSYSTEM

FIGURE 37 MARKET: ECOSYSTEM ANALYSIS

5.4.1 EV CHARGING PROVIDERS

5.4.2 ELECTRIC ATV/UTV MANUFACTURERS

5.4.3 ELECTRIC MATERIAL HANDLING VEHICLE MANUFACTURERS

5.4.4 ELECTRIC UTILITY CART MANUFACTURERS

5.4.5 BATTERY PROVIDERS

5.4.6 EUV COMPONENT MANUFACTURERS

5.4.7 END USERS

TABLE 11 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 38 SUPPLY CHAIN ANALYSIS OF MARKET

5.6 ELECTRIC UTILITY VEHICLE PRICING ANALYSIS

TABLE 12 MARKET: ELECTRIC INDUSTRIAL/ MATERIAL HANDLING VEHICLES, 2021

TABLE 13 MARKET: ELECTRIC UTV, 2021

TABLE 14 MARKET: ELECTRIC ATV, 2021

TABLE 15 MARKET: REGIONAL PRICING ANALYSIS, 2021

TABLE 16 MARKET: REGIONAL PRICING ANALYSIS, 2027

5.7 TECHNOLOGY ANALYSIS

5.7.1 IOT FOR AUTOMATED MATERIAL HANDLING

FIGURE 39 IOT FOR AUTOMATED MATERIAL HANDLING IN WAREHOUSES

5.7.2 5G CONNECTIVITY FOR AUTOMATED WAREHOUSES

5.7.3 AI FOR MATERIAL HANDLING

5.7.4 SMART CHARGING SYSTEM

FIGURE 40 SMART EV CHARGING SYSTEM

5.7.5 SOLID STATE BATTERY (SSB)

5.7.6 INTELLIGENT EUVS

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

FIGURE 41 PUBLICATION TRENDS (2010−2022)

5.8.2 PATENTS PUBLISHED BY MAJOR COMPANIES IN EV ECOSYSTEM

FIGURE 42 ELECTRIC VEHICLE PATENTS, TREND ANALYSIS (2010−2022)

TABLE 17 IMPORTANT PATENT REGISTRATIONS RELATED TO ELECTRIC UTILITY VEHICLE MARKET

5.9 TRADE ANALYSIS

TABLE 18 TRADE ANALYSIS: SPECIALLY DESIGNED FOR TRAVELLING ON SNOW, GOLF CARS, AND SIMILAR VEHICLES (870310)

5.10 REGULATORY LANDSCAPE

5.10.1 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS FOR MATERIAL HANDLING VEHICLES: MARKET

5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS: BY COUNTRY

TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 23 US: UTILITY VEHICLE REGULATIONS

TABLE 24 CANADA: UTILITY VEHICLE REGULATIONS

TABLE 25 SAFETY STANDARDS FOR MATERIAL HANDLING VEHICLES

5.11 KEY CONFERENCES AND EVENTS IN 2022 AND 2023

TABLE 26 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.12 CASE STUDIES

5.12.1 THYSSENKRUPP DECIDED ON FLEXIBLE AUTOMATION

5.12.2 TOYOTA’S AUTOMATED FORKLIFTS SUPPORTED ELM.LEBLANC’S 4.0 JOURNEY

5.12.3 INDUCTIVE CHARGING SYSTEM FOR INDUSTRIAL/MATERIAL HANDLING VEHICLES

5.12.4 CLUB CAR’S TEMPO 2+2 FOR KETTERING GENERAL HOSPITAL

5.12.5 CUTR CASE FOR USE OF SMALL NEVS FOR AGED POPULATION

5.13 TRENDS AND DISRUPTIONS

FIGURE 43 MARKET: TRENDS AND DISRUPTIONS

5.14 MARKET SCENARIOS (2022–2027)

5.14.1 MOST LIKELY SCENARIO

FIGURE 44 MARKET – FUTURE TRENDS AND SCENARIOS, 2022–2027 (USD MILLION)

TABLE 27 MARKET (MOST LIKELY), BY REGION, 2022–2027 (USD MILLION)

5.14.2 OPTIMISTIC SCENARIO

TABLE 28 MARKET (OPTIMISTIC), BY REGION, 2022–2027 (USD MILLION)

5.14.3 PESSIMISTIC SCENARIO

TABLE 29 MARKET (PESSIMISTIC), BY REGION, 2022–2027 (USD MILLION)

6 ELECTRIC UTILITY VEHICLE MARKET, BY APPLICATION (Page No. - 114)

6.1 INTRODUCTION

FIGURE 45 INDUSTRIAL SEGMENT TO BE LARGEST SEGMENT DURING FORECAST PERIOD

TABLE 30 MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 31 MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

TABLE 32 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 33 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.1.1 OPERATIONAL DATA

TABLE 34 POPULAR AND UPCOMING EVS WORLDWIDE

6.1.2 ASSUMPTIONS

TABLE 35 ASSUMPTIONS: BY APPLICATION

6.1.3 RESEARCH METHODOLOGY

6.2 COMMERCIAL TRANSPORT

6.2.1 GROWING DEMAND FOR ELECTRIC MOBILITY IN LOW-SPEED VEHICLES

TABLE 36 MARKET FOR COMMERCIAL TRANSPORT, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 37 MARKET FOR COMMERCIAL TRANSPORT, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 38 MARKET FOR COMMERCIAL TRANSPORT, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 MARKET FOR COMMERCIAL TRANSPORT, BY REGION, 2022–2027 (USD MILLION)

6.3 RECREATIONAL

6.3.1 GROWING DEMAND FOR OUTDOOR LEISURE AND RECREATIONAL ACTIVITIES

TABLE 40 MARKET FOR RECREATIONAL, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 41 MARKET FOR RECREATIONAL, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 42 MARKET FOR RECREATIONAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 MARKET FOR RECREATIONAL, BY REGION, 2022–2027 (USD MILLION)

6.4 AGRICULTURE

6.4.1 GOVERNMENT PUSH FOR USE OF ELECTRIC VEHICLES FOR AGRICULTURAL ACTIVITIES

TABLE 44 MARKET FOR AGRICULTURE, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 45 MARKET FOR AGRICULTURE, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 46 MARKET FOR AGRICULTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR AGRICULTURE, BY REGION, 2022–2027 (USD MILLION)

6.5 INDUSTRIAL

6.5.1 HIGH DEMAND FOR INDUSTRIAL AND MATERIAL HANDLING ELECTRIC VEHICLES

TABLE 48 MARKET FOR INDUSTRIAL, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 49 MARKET FOR INDUSTRIAL, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 50 MARKET FOR INDUSTRIAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MARKET FOR INDUSTRIAL, BY REGION, 2022–2027 (USD MILLION)

6.6 OTHERS

6.6.1 GROWING USE OF ELECTRIC ATVS/UTVS IN DEFENSE, FORESTRY, HUNTING

TABLE 52 MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 53 MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 54 MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

6.7 KEY PRIMARY INSIGHTS

7 ELECTRIC UTILITY VEHICLE MARKET, BY VEHICLE TYPE (Page No. - 129)

7.1 INTRODUCTION

FIGURE 46 ELECTRIC UTILITY CART SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD (2022–2027)

TABLE 56 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 57 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 58 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 59 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

7.1.1 OPERATIONAL DATA

TABLE 60 POPULAR EUVS BY VEHICLE TYPE

7.1.2 ASSUMPTIONS

TABLE 61 ASSUMPTIONS: BY VEHICLE TYPE

7.1.3 RESEARCH METHODOLOGY

7.2 ELECTRIC ATV

7.2.1 INCREASED RECREATIONAL AND AGRICULTURAL ACTIVITIES TO DRIVE MARKET

TABLE 62 ELECTRIC ATV MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 63 ELECTRIC ATV MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 64 ELECTRIC ATV MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 ELECTRIC ATV MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ELECTRIC UTV

7.3.1 INCREASED HUNTING, AGRICULTURE, RECREATION, AND FORESTRY ACTIVITIES

TABLE 66 ELECTRIC UTV MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 67 ELECTRIC UTV MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 68 ELECTRIC UTV MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 ELECTRIC UTV MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 ELECTRIC INDUSTRIAL VEHICLE

7.4.1 CONSISTENT GROWTH IN WAREHOUSING AND E-COMMERCE

TABLE 70 ELECTRIC INDUSTRIAL VEHICLE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 71 ELECTRIC INDUSTRIAL VEHICLE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 72 ELECTRIC INDUSTRIAL VEHICLE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 ELECTRIC INDUSTRIAL VEHICLE MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 ELECTRIC UTILITY CART

7.5.1 GROWTH IN DEMAND FOR LOW-EMISSION TRANSPORT

TABLE 74 ELECTRIC UTILITY CART MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 75 ELECTRIC UTILITY CART MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 76 ELECTRIC UTILITY CART MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 ELECTRIC UTILITY CART MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 ELECTRIC SHUTTLE CART

7.6.1 DEMAND FOR LOW-EMISSION PASSENGER TRANSPORT FOR RECREATIONAL ACTIVITIES AND TOURISM

TABLE 78 ELECTRIC SHUTTLE CART MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 79 ELECTRIC SHUTTLE CART MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 80 ELECTRIC SHUTTLE CART MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 ELECTRIC SHUTTLE CART MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 KEY PRIMARY INSIGHTS

8 ELECTRIC UTILITY VEHICLE MARKET, BY BATTERY TYPE (Page No. - 144)

8.1 INTRODUCTION

FIGURE 47 EV BATTERY TYPE COMPARISON

FIGURE 48 LITHIUM-ION BATTERIES SEGMENT TO REGISTER LARGEST MARKET SIZE DURING FORECAST PERIOD (2022–2027)

TABLE 82 MARKET, BY BATTERY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 83 MARKET, BY BATTERY TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 84 MARKET, BY BATTERY TYPE, 2018–2021 (USD MILLION)

TABLE 85 MARKET, BY BATTERY TYPE, 2022–2027 (USD MILLION)

8.1.1 OPERATIONAL DATA

TABLE 86 POPULAR ELECTRIC UTILITY VEHICLES AND THEIR BATTERIES

8.1.2 ASSUMPTIONS

TABLE 87 ASSUMPTIONS: BY BATTERY TYPE

8.1.3 RESEARCH METHODOLOGY

8.2 LEAD-ACID

8.2.1 LOW COST AND EASY AVAILABILITY

TABLE 88 LEAD-ACID BATTERY SPECIFICATIONS

TABLE 89 LEAD-ACID BATTERY MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

TABLE 90 LEAD-ACID BATTERY MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 91 LEAD ACID BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 LEAD ACID BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LITHIUM-ION

8.3.1 HIGHER RANGE AND LOWER WEIGHT

TABLE 93 LITHIUM-ION BATTERY SPECIFICATIONS

TABLE 94 LITHIUM-ION BATTERY MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 95 LITHIUM-ION BATTERY MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 96 LITHIUM-ION BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 97 LITHIUM-ION BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 OTHERS

8.4.1 DEVELOPMENT IN NEW BATTERY TECHNOLOGIES TO DRIVE DEMAND

TABLE 98 HYBRID NICKEL-METAL (NIMH) BATTERY SPECIFICATIONS

TABLE 99 OTHER BATTERY MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 100 OTHER BATTERY MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 101 OTHER BATTERY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 OTHER BATTERY MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 KEY PRIMARY INSIGHTS

9 ELECTRIC UTILITY VEHICLE MARKET, BY DRIVE TYPE (Page No. - 157)

9.1 INTRODUCTION

FIGURE 49 4WD SEGMENT TO REGISTER HIGHER CAGR FROM 2022 TO 2027

TABLE 103 MARKET, BY DRIVE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 104 MARKET, BY DRIVE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 105 MARKET, BY DRIVE TYPE, 2018–2021 (USD MILLION)

TABLE 106 MARKET, BY DRIVE TYPE, 2022–2027 (USD MILLION)

9.1.1 OPERATIONAL DATA

TABLE 107 EUVS AND THEIR DRIVE TYPE COMPARISON

9.1.2 ASSUMPTIONS

TABLE 108 ASSUMPTIONS: BY DRIVE TYPE

9.1.3 RESEARCH METHODOLOGY

9.2 2WD

9.2.1 CONVENIENT OPERATION AND LOWER PRICES

TABLE 109 2WD ELECTRIC UTILITY VEHICLE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 110 2WD MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 111 2WD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 112 2WD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 4WD

9.3.1 BETTER TRACTION AND ABILITY TO SWITCH TO 2WD

TABLE 113 4WD MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 114 4WD MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 115 4WD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 116 4WD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 AWD

9.4.1 DEMAND FOR HIGHER CARRYING AND TOWING CAPACITY FOR OFF-ROADS

TABLE 117 AWD MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 118 AWD MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 119 AWD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 120 AWD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 KEY PRIMARY INSIGHTS

10 ELECTRIC UTILITY VEHICLE MARKET, BY SEATING CAPACITY (Page No. - 167)

10.1 INTRODUCTION

FIGURE 50 >2 SEATER SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD (2022–2027)

TABLE 121 MARKET, BY SEATING CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 122 MARKET, BY SEATING CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 123 MARKET, BY SEATING CAPACITY, 2018–2021 (USD MILLION)

TABLE 124 MARKET, BY SEATING CAPACITY, 2022–2027 (USD MILLION)

10.1.1 OPERATIONAL DATA

TABLE 125 EUVS AND THEIR SEATING CAPACITY

10.1.2 ASSUMPTIONS

TABLE 126 ASSUMPTIONS: BY SEATING CAPACITY

10.1.3 RESEARCH METHODOLOGY

10.2 1 SEATER

10.2.1 DEMAND FOR ELECTRIC INDUSTRIAL VEHICLES AND ATVS TO BOOST DEMAND

TABLE 127 1 SEATER ELECTRIC UTILITY VEHICLE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 128 1 SEATER MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 129 1 SEATER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 130 1 SEATER MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 2 SEATER

10.3.1 INCREASED USE OF ELECTRIC UTVS AND CARTS TO FUEL GROWTH

TABLE 131 2 SEATER MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 132 2 SEATER MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 133 2 SEATER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 134 2 SEATER MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 >2 SEATER

10.4.1 INCREASED DEMAND DUE TO COMMERCIAL AND PASSENGER-CARRYING ELECTRIC VEHICLES

TABLE 135 >2 SEATER ELECTRIC UTILITY VEHICLE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 136 >2 SEATER MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 137 >2 SEATER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 138 >2 SEATER MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 KEY PRIMARY INSIGHTS

11 ELECTRIC UTILITY VEHICLE MARKET, BY PROPULSION (Page No. - 178)

11.1 INTRODUCTION

FIGURE 51 HYBRID ELECTRIC SEGMENT PROJECTED TO GROW AT HIGHER CAGR (2022–2027)

TABLE 139 MARKET, BY PROPULSION, 2018–2021 (THOUSAND UNITS)

TABLE 140 MARKET, BY PROPULSION, 2022–2027 (THOUSAND UNITS)

TABLE 141 MARKET, BY PROPULSION, 2018–2021 (USD MILLION)

TABLE 142 MARKET, BY PROPULSION, 2022–2027 (USD MILLION)

11.1.1 OPERATIONAL DATA

TABLE 143 POPULAR EUVS COMPARISON BY PROPULSION TYPE

11.1.2 ASSUMPTIONS

TABLE 144 ASSUMPTIONS: BY PROPULSION

11.1.3 RESEARCH METHODOLOGY

11.2 PURE ELECTRIC

11.2.1 DECREASE IN EV BATTERY PRICE TO REDUCE COST AND INCREASE DEMAND

TABLE 145 PURE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 146 PURE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 147 PURE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 148 PURE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 HYBRID ELECTRIC

11.3.1 DEMAND FOR MULTIPLE FUEL SOURCES FOR ENHANCED PERFORMANCE

TABLE 149 HYBRID ELECTRIC UTILITY VEHICLE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 150 HYBRID MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 151 HYBRID MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 152 HYBRID MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 KEY PRIMARY INSIGHTS

12 ELECTRIC UTILITY VEHICLE MARKET, BY REGION (Page No. - 187)

12.1 INTRODUCTION

FIGURE 52 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 153 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 154 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 155 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 156 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 ASIA PACIFIC

FIGURE 53 ASIA PACIFIC: ELECTRIC UTILITY VEHICLE MARKET SNAPSHOT

TABLE 157 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 158 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 159 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.1 CHINA

12.2.1.1 High demand for electric industrial vehicles

TABLE 161 CHINA: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 162 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 163 CHINA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 164 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2.2 JAPAN

12.2.2.1 Growing popularity of electric utility and shuttle carts

TABLE 165 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 166 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 167 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 168 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2.3 INDIA

12.2.3.1 Rapid industrialization and growth in recreational activities

TABLE 169 INDIA: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 170 INDIA: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 171 INDIA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 172 INDIA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2.4 SOUTH KOREA

12.2.4.1 Growth of e-commerce and tourism industries to increase demand for electric utility vehicles

TABLE 173 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 174 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 175 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 176 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3 EUROPE

FIGURE 54 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 177 EUROPE: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 178 EUROPE: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 179 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 180 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.1 FRANCE

12.3.1.1 Growing e-commerce and logistics sectors to increase demand for electric utility vehicles

TABLE 181 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 182 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 183 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 184 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Hike in petroleum prices to drive demand for electric utility vehicles

TABLE 185 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 186 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 187 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 188 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.3 SPAIN

12.3.3.1 Growth of warehouse and e-commerce industries to drive demand for electric utility vehicles

TABLE 189 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 190 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 191 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 192 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.4 UK

12.3.4.1 Demand for eco-friendly passenger and commercial transport to drive market

TABLE 193 UK: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 194 UK: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 195 UK: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 196 UK: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.5 REST OF EUROPE

12.3.5.1 Rise in manufacturing facilities and tourism

TABLE 197 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 198 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 199 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 200 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.4 NORTH AMERICA

FIGURE 55 NORTH AMERICA: MARKET, SNAPSHOT

TABLE 201 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 202 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 203 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 204 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.1 US

12.4.1.1 High demand for recreational activities and government push for electric propulsion

TABLE 205 US: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 206 US: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 207 US: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 208 US: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.4.2 CANADA

12.4.2.1 Growing popularity of off-road racing events and export infrastructure

TABLE 209 CANADA: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 210 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 211 CANADA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 212 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.4.3 MEXICO

12.4.3.1 Strategic hub for electric utility vehicle manufacturers

TABLE 213 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 214 MEXICO: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 215 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 216 MEXICO: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5 REST OF THE WORLD (ROW)

FIGURE 56 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 217 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 218 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 219 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 220 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Increasing penetration of utility vehicles in forest departments and shift to electric industrial vehicles

TABLE 221 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 222 BRAZIL: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 223 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 224 BRAZIL: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5.2 SOUTH AFRICA

12.5.2.1 Difficult terrain and expansion of warehouses

TABLE 225 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 226 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 227 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 228 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 226)

13.1 OVERVIEW

13.2 MARKET RANKING ANALYSIS

FIGURE 57 MARKET RANKING OF MAJOR PLAYERS IN ELECTRIC UTILITY VEHICLE MARKET, 2021

13.3 COMPETITIVE SCENARIO

13.3.1 DEALS, 2019–2022

TABLE 229 DEALS, 2019–2022

13.3.2 NEW PRODUCT LAUNCHES, 2019–2022

TABLE 230 NEW PRODUCT LAUNCHES, 2019–2022

13.4 COMPANY EVALUATION QUADRANT: KEY PLAYERS

13.4.1 STARS

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE PLAYERS

13.4.4 PARTICIPANTS

FIGURE 58 MARKET: COMPANY EVALUATION QUADRANT, 2021

TABLE 231 MARKET: COMPANY FOOTPRINT, 2021

TABLE 232 MARKET: APPLICATION FOOTPRINT, 2021

TABLE 233 MARKET: REGIONAL FOOTPRINT, 2021

13.5 COMPETITIVE EVALUATION QUADRANT: OTHER KEY PLAYERS AND STARTUPS

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 DYNAMIC COMPANIES

13.5.4 STARTING BLOCKS

FIGURE 59 MARKET: COMPETITIVE LEADERSHIP MAPPING OTHER KEY PLAYERS, 2021

FIGURE 60 MARKET: COMPETITIVE LEADERSHIP MAPPING KEY STARTUPS, 2021

TABLE 234 MARKET: DETAILED LIST OF KEY STARTUPS

14 COMPANY PROFILES (Page No. - 238)

14.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

14.1.1 POLARIS

TABLE 235 POLARIS: BUSINESS OVERVIEW

FIGURE 61 POLARIS: COMPANY SNAPSHOT

FIGURE 62 POLARIS: MARKET OPPORTUNITY

FIGURE 63 POLARIS: OFF-ROAD SEGMENT GROWTH RESULTS

TABLE 236 POLARIS: PRODUCTS OFFERED

TABLE 237 POLARIS: NEW PRODUCT DEVELOPMENTS

TABLE 238 POLARIS: DEALS

14.1.2 CLUB CAR

TABLE 239 CLUB CAR: BUSINESS OVERVIEW

TABLE 240 CLUB CAR: PRODUCTS OFFERED

TABLE 241 CLUB CAR: NEW PRODUCT DEVELOPMENTS

TABLE 242 CLUB CAR: DEALS

14.1.3 TOYOTA INDUSTRIES CORPORATION

TABLE 243 TOYOTA INDUSTRIES CORPORATION: BUSINESS OVERVIEW

FIGURE 64 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

FIGURE 65 TOYOTA INDUSTRIES CORPORATION: SEGMENT-WISE GROWTH

TABLE 244 TOYOTA INDUSTRIES CORPORATION: PRODUCTS OFFERED

TABLE 245 TOYOTA INDUSTRIES CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 246 TOYOTA INDUSTRIES CORPORATION: DEALS

14.1.4 JOHN DEERE

TABLE 247 JOHN DEERE: BUSINESS OVERVIEW

FIGURE 66 JOHN DEERE: COMPANY SNAPSHOT

TABLE 248 JOHN DEERE: PRODUCTS OFFERED

TABLE 249 JOHN DEERE: NEW PRODUCT DEVELOPMENTS

TABLE 250 JOHN DEERE: DEALS

TABLE 251 JOHN DEERE: OTHERS

14.1.5 TEXTRON

TABLE 252 TEXTRON: BUSINESS OVERVIEW

FIGURE 67 TEXTRON: COMPANY SNAPSHOT

FIGURE 68 TEXTRON: COMPARISON OF E-Z-GO WITH OTHER ELECTRIC GOLF CARTS

TABLE 253 TEXTRON: PRODUCTS OFFERED

TABLE 254 TEXTRON: NEW PRODUCT DEVELOPMENTS

TABLE 255 TEXTRON: OTHERS

14.1.6 KION GROUP

TABLE 256 KION GROUP: BUSINESS OVERVIEW

FIGURE 69 KION GROUP: COMPANY SNAPSHOT

FIGURE 70 KION GROUP: INDUSTRY PERFORMANCE, 2021

TABLE 257 KION GROUP: PRODUCTS OFFERED

TABLE 258 KION GROUP: NEW PRODUCT DEVELOPMENTS

TABLE 259 KION GROUP: DEALS

14.1.7 BYD

TABLE 260 BYD: BUSINESS OVERVIEW

FIGURE 71 BYD: COMPANY SNAPSHOT

FIGURE 72 BYD: RANGE OF ELECTRIC FORKLIFTS

TABLE 261 BYD: PRODUCTS OFFERED

TABLE 262 BYD: NEW PRODUCT DEVELOPMENTS

TABLE 263 BYD: DEALS

14.1.8 ARI MOTORS

TABLE 264 ARI MOTORS: BUSINESS OVERVIEW

TABLE 265 ARI MOTORS: PRODUCTS OFFERED

TABLE 266 ARI MOTORS: NEW PRODUCT DEVELOPMENTS

TABLE 267 ARI MOTORS: DEALS

14.1.9 WAEV

TABLE 268 WAEV: BUSINESS OVERVIEW

TABLE 269 WAEV: PRODUCTS OFFERED

TABLE 270 WAEV: NEW PRODUCT DEVELOPMENTS

TABLE 271 WAEV: DEALS

14.1.10 COLUMBIA VEHICLE GROUP

TABLE 272 COLUMBIA VEHICLE GROUP: BUSINESS OVERVIEW

TABLE 273 COLUMBIA VEHICLE GROUP: PRODUCTS OFFERED

TABLE 274 COLUMBIA VEHICLE GROUP: NEW PRODUCT DEVELOPMENTS

TABLE 275 COLUMBIA VEHICLE GROUP: DEALS

14.1.11 YAMAHA MOTOR COMPANY

TABLE 276 YAMAHA MOTOR COMPANY: BUSINESS OVERVIEW

FIGURE 73 YAMAHA MOTOR COMPANY: COMPANY SNAPSHOT

TABLE 277 YAMAHA MOTOR COMPANY: PRODUCTS OFFERED

TABLE 278 YAMAHA MOTOR COMPANY: NEW PRODUCT DEVELOPMENTS

14.1.12 GODREJ MATERIAL HANDLING

TABLE 279 GODREJ MATERIAL HANDLING: BUSINESS OVERVIEW

TABLE 280 GODREJ MATERIAL HANDLING: PRODUCTS OFFERED

TABLE 281 GODREJ MATERIAL HANDLING: NEW PRODUCT DEVELOPMENTS

TABLE 282 GODREJ MATERIAL HANDLING: DEALS

14.1.13 ADDAX MOTORS

TABLE 283 ADDAX MOTORS: BUSINESS OVERVIEW

TABLE 284 ADDAX MOTORS: PRODUCTS OFFERED

TABLE 285 ADDAX MOTORS: NEW PRODUCT DEVELOPMENTS

TABLE 286 ADDAX MOTORS: DEALS

14.1.14 MARSHELL

TABLE 287 MARSHELL: BUSINESS OVERVIEW

TABLE 288 MARSHELL: PRODUCTS OFFERED

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14.2 OTHER KEY PLAYERS

14.2.1 HISUN MOTORS

14.2.2 EVUM MOTORS

14.2.3 ALKE

14.2.4 CFMOTO

14.2.5 PILOTCARS ELECTRIC VEHICLES

14.2.6 BALKANCAR RECORD

14.2.7 DRR USA

14.2.8 LINHAI

14.2.9 NEBULA AUTOMOTIVE

14.2.10 AMERICAN LANDMASTER

14.2.11 ECO CHARGER

14.2.12 EXCAR

14.2.13 SUZHOU EAGLE ELECTRIC VEHICLE

14.2.14 POWERLAND AGRO TRACTOR VEHICLES

14.2.15 CROSSFIRE MOTORCYCLES

14.2.16 VOLCON

14.2.17 TESLA

14.2.18 AUTO RENNEN INDIA

14.2.19 SMARTCART

14.2.20 EDGO CARTS

15 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 289)

15.1 ELECTRIC UTILITY VEHICLES TO HAVE GREAT GROWTH POTENTIAL IN COMMERCIAL TRANSPORT SEGMENT

15.2 NORTH AMERICA TO BE KEY FOCUS AREA FOR ELECTRIC UTILITY VEHICLE MARKET

15.3 CONCLUSION

16 APPENDIX (Page No. - 291)

16.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 CUSTOMIZATION OPTIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

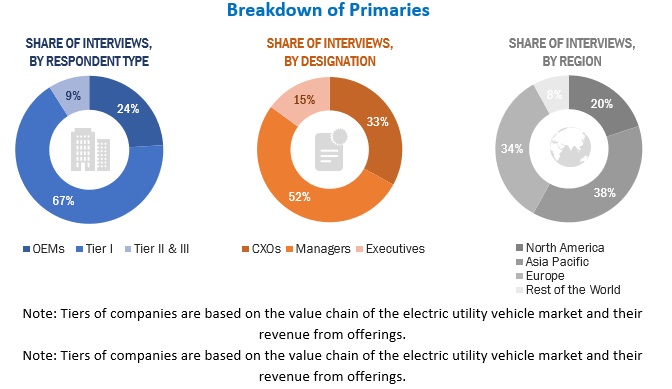

The study involved four major activities in estimating the current size of the electric utility vehicle market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications (for example, publications of automobile OEMs), automotive component associations, American Automobile Association (AAA), European Alternative Fuels Observatory (EAFO), International Energy Agency (IEA), country-level automotive associations, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) were used to identify and collect information for an extensive commercial study of the electric utility vehicle market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the electric utility vehicle market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, trade associations, institutes, R&D centers, OEMs/vehicle manufacturers) and supply (component manufacturers, software providers) sides across four major regions, namely North America, Europe, Asia Pacific, and the Rest of the World. 21% of the experts involved in primary interviews were from the demand side, while the remaining 79% were from the supply side.

Primary data was collected through questionnaires, emails, and telephonic interviews. Primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint of the report. After interacting with industry participants, brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the total size of the electric utility vehicle market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the supply side.

Report Objectives

- To segment and forecast the electric utility vehicle market size in terms of volume (Thousand Units) and value (USD Million/Billion)

- To define, describe, and forecast the electric utility vehicle market based on vehicle type, battery type, drive type, propulsion, seating capacity, application, and region

- To segment the market and forecast its size, by volume and value, based on region (North America, Europe, Asia Pacific, Rest of the World)

- To segment and forecast the market based on vehicle type (electric UTVs, electric ATVs, electric utility carts, electric shuttle carts, electric industrial utility vehicles)

- To segment and forecast the market based on battery type (lead acid, lithium-ion, others)

- To segment and forecast the market based on drive type (2WD, 4WD, AWD)

- To segment and forecast the market based on propulsion (pure electric, hybrid electric)

- To segment and forecast the market based on seating capacity (1-seater, 2-seater, >2-seater)

- To segment and forecast the market based on application (commercial transport, recreation, agriculture, industrial, others)

- To analyze the technological developments impacting the electric utility vehicle market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, challenges, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Value Chain Analysis

- Ecosystem

- Porter’s Five Forces Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Average Selling Price Analysis

- Buying Criteria

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product development, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Additional country-level breakdown for the electric utility vehicle market by propulsion

- Additional country-level breakdown for the electric utility vehicle market by battery type

Company Information

- Profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Utility Vehicle Market