The study involved four major activities to estimate the current size of the industrial vehicles market. Exhaustive secondary research collected information on the market, the peer market, and model mapping. The next step was to validate these findings and assumptions and size them with industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to determine the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information on the industrial vehicles market for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles from recognized authors; directories; databases; and articles from recognized associations and government publishing sources. Secondary research has been used to obtain key information about the industry's value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

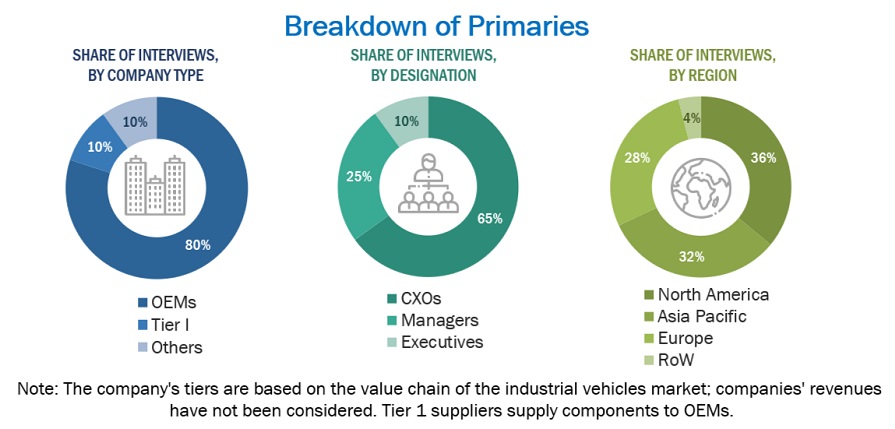

Extensive primary research has been conducted after understanding the industrial vehicles market scenario through secondary research. Several primary interviews have been conducted with market experts from demand-side industrial vehicle product providers and supply-side OEMs across four major regions: North America, Europe, and Asia Pacific. Approximately 21% and 79% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert opinions, led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

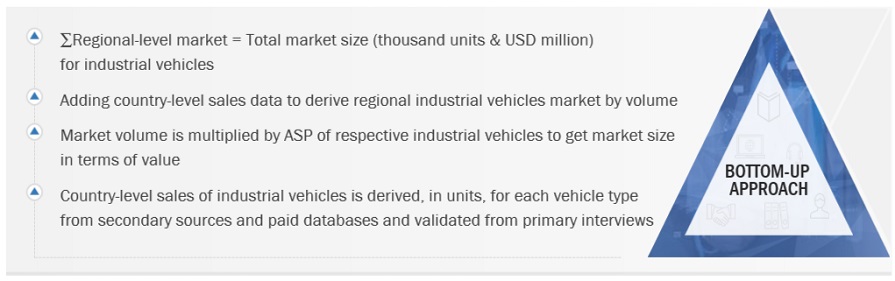

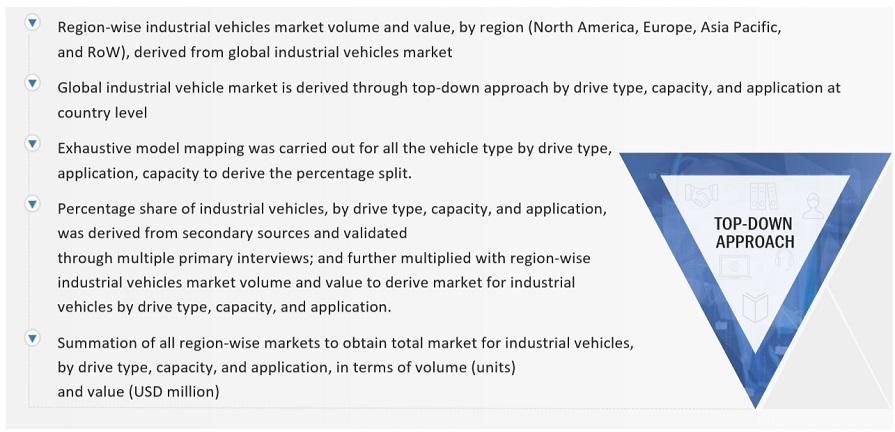

A detailed market estimation approach was followed to estimate and validate the value of the industrial vehicles market. Key industrial vehicle market players were identified through secondary research, and their global market shares were determined through primary and secondary research. The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights. All major penetration rates, percentage shares, splits, and breakdowns for the industrial vehicles market were determined using secondary sources model mapping and verified through primary sources. All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data. The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Global Industrial Vehicles Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Industrial Vehicles Market Size: Top-Down Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Market Definition

Industrial vehicles: The industrial vehicles market encompasses the production, distribution, and utilization of specialized vehicles tailored for material handling, transportation, and logistical operations within industrial environments like warehouses, manufacturing facilities, distribution centers, and ports. These vehicles, including forklifts, aisle trucks, tow tractors, and container handlers, are crucial for optimizing operational productivity, safety, and efficiency. Key stakeholders involved in this market include industrial vehicle manufacturers, component manufacturers, industrial vehicle rental/leasing companies, and end-users.

Key Stakeholders

-

Associations, forums, and alliances related to industrial vehicles

-

Raw material suppliers

-

Industrial vehicle distributors and dealers

-

Manufacturers of industrial vehicles

-

Manufacturers of industrial vehicle components

-

Autonomous vehicle solution providers

-

Technology vendors

-

Industrial vehicle rental/leasing companies

-

Material handling associations

-

Standards organizations and regulatory authorities related to the material handling industry

Report Objectives

-

To segment and forecast the size of the global industrial vehicles market, by value & volume, based on vehicle type & capacity (Forklifts (<5ton, 5-10 ton, 11-36 ton, >36 ton), Aisle trucks (<1ton, 1-2 ton, >2 ton), Tow tractors (<5ton, 5-10 ton, 11-30 ton, >30 ton), Container handlers (<30ton, 30-40 ton, >40 ton), Automated Guided Vehicles, and Personnel Carriers)

-

To segment and forecast the size of the global industrial vehicles market by value & volume based on drive type (Internal Combustion Engine Industrial Vehicles, Battery-operated Industrial Vehicles, and Gas-powered Industrial Vehicles)

-

To segment and forecast the size of the global industrial vehicles market by value & volume based on application (Manufacturing (Chemical, Food & Beverages, Mining, Automotive, Metals & Heavy Machinery, and Others), Warehousing, Freight & Logistics, and Others)

-

To segment and forecast the size of the global industrial vehicles market by value, based on level of autonomy (Non/Semi-autonomous and Autonomous)

-

To segment and forecast the size of the global aerial work platforms market, by value & volume, based on Type (Scissor Lifts (Scissor Lifts by Drive Type), Boom Lifts (Articulating AWP, Telescopic AWP), and Boom Lifts by Drive Type)

-

To segment and forecast the size of the industrial vehicles market, by value & volume, based on region (Asia Pacific, Europe, North America, and Rest of the World)

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs.

-

By capacity at the regional level for each vehicle type

-

By drive type at the regional level for each vehicle type

-

By application at the global level for each vehicle type

Company Information

-

Profiling of additional market players (up to five)

Roma

Jun, 2022

Which geography is expected to grow at the highest rate among others in the global Industrial Vehicles Market from 2022 to 2030?.