Electric Vehicle Market Size, Share & Analysis

Electric Vehicle Market by Vehicle Type, Propulsion, Vehicle Connectivity, Component, End Use, P-EV market by EV Architecture, Top Speed, Drive Type, Body Type, H-EV market by Configuration, MHEV market by Topology, and Region - Global Forecast 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

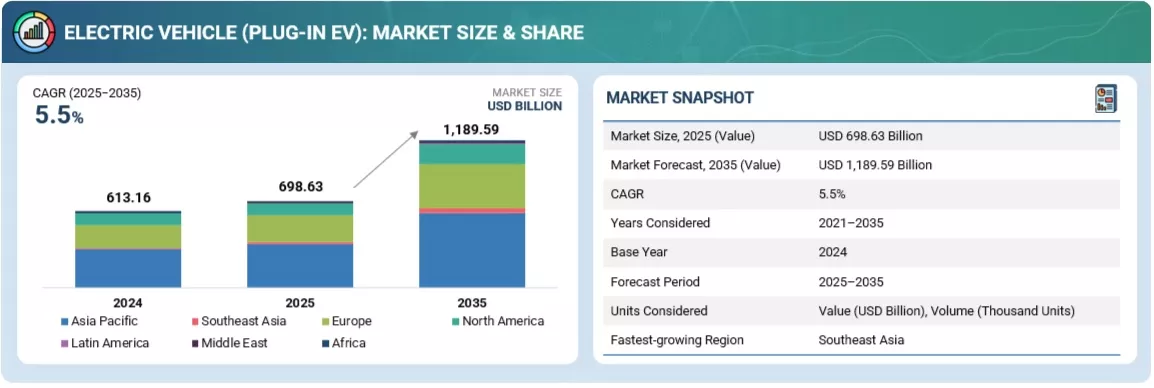

The global electric vehicle market size is forecasted to grow from USD 1,145.51 billion in 2024 to USD 1,857.33 billion by 2035, with a CAGR of 5.0%. As part of this, BEVs are predicted to grow from USD 482.13 billion in 2025 to USD 849.70 billion by 2035, at a CAGR of 5.8%. The market growth is driven by regulatory emission targets that are steering OEM investment toward dedicated electric platforms, rapid declines in lithium ion battery pack costs enabled by higher energy density chemistries and large scale cell manufacturing, expansion of charging infrastructure with faster power electronics and improved grid integration, and increased fleet electrification driven by favorable total cost of ownership models supported by high utilization cycles. Product availability is improving through purpose built architectures that optimize thermal management, powertrain efficiency, and software integration, while advances in materials engineering, battery management algorithms, and regenerative energy systems raise system level performance. .

KEY TAKEAWAYS

-

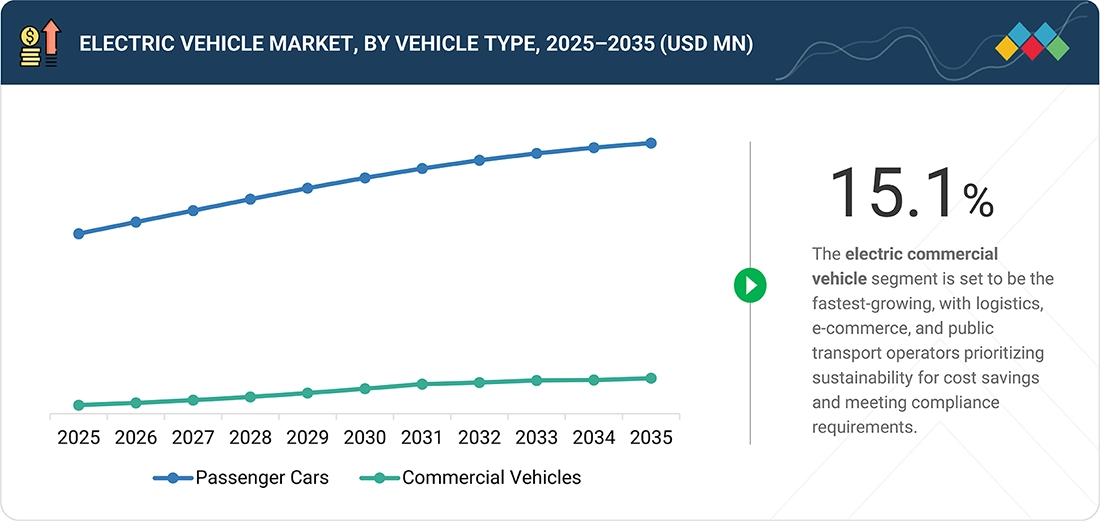

BY VEHICLE TYPEPassenger cars are estimated to account for the largest market share 95.5%, driven by strong demand for personal mobility and premium EV offerings. Commercial vehicles also show steady growth due to the electrification of last-mile delivery and fleet operations.

-

BY PROPULSIONBattery electric vehicles (BEVs) are set to dominate the market by 39.2%, accounting for the largest share, supported by improving battery technologies, lower operational costs, and supportive government policies. Plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs) are growing steadily but remain secondary.

-

BY ELECTRIC ARCHITECTURE400V architectures are pegged to form the largest segment due to established infrastructure and lower vehicle costs. However, 800V architectures are growing rapidly, enabling faster charging, improved efficiency, and higher performance in premium EVs.

-

BY VEHICLE BODY TYPESUVs and MPVs are projected to be the fastest-growing segments by 54.7%, driven by consumer preference for larger, versatile vehicles offering higher ground clearance, cabin space, and safety features. Sedans and hatchbacks remain significant but grow at a slower pace. SUV/MPV projected CAGR 8.1% (Fastest Growing).

-

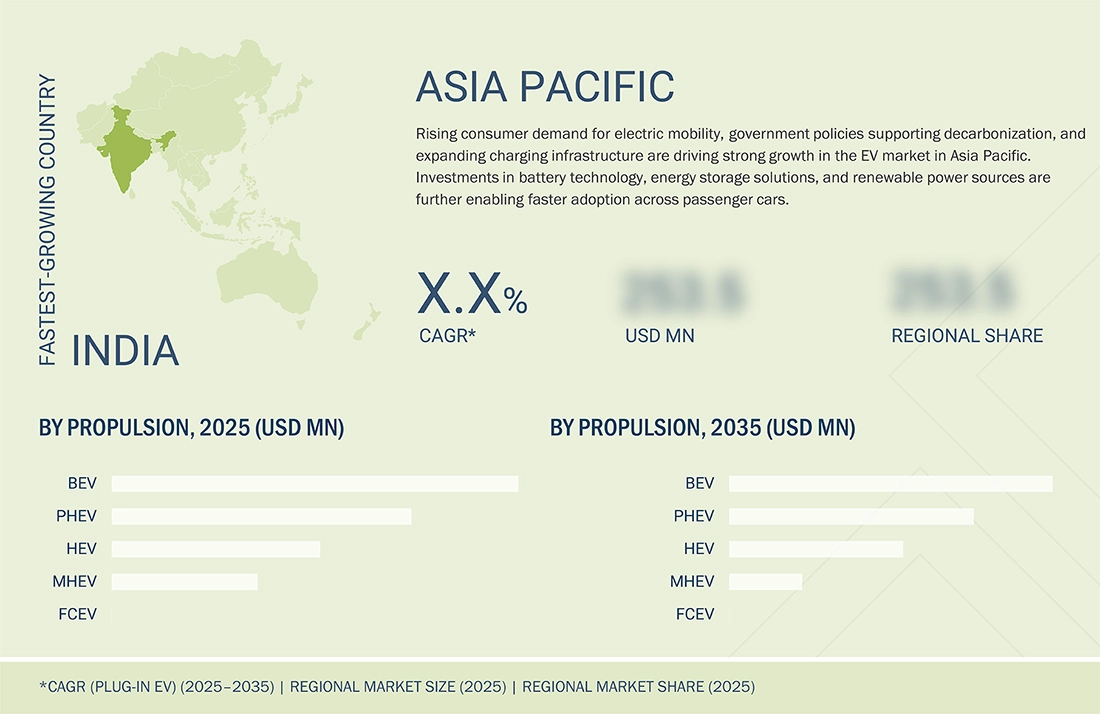

BY REGIONAsia Pacific is estimated to lead the market with more than 40% share, supported by a strong manufacturing base, early adoption in China, Japan, and South Korea, and favorable government incentives. North America and Europe show steady growth driven by policy mandates and consumer interest in EVs. Faster growth is anticipated in emerging markets such as Latin America, the Middle East, and Southeast Asia.

-

COMPETITIVE LANDSCAPEBYD leads the global EV market, followed by Tesla. Key players, such as BYD, Tesla, Geely, Volkswagen, and GM, are launching new models, entering different regional markets, forming partnerships, and collaborating with battery manufacturers to secure supply chains and strengthen technological capabilities. Other companies focus on expanding production, improving vehicle range, and enhancing charging infrastructure.

The electric vehicle market is projected to grow rapidly over the next decade, supported by advancements in battery technologies and power electronics. Automakers are increasingly adopting EVs for their low-emission, energy-efficient, and high-performance motors and battery packs, making them valuable in passenger cars and commercial vehicles. Growing emphasis on sustainable mobility, stricter emission regulations, and supportive government policies further strengthen EV adoption, setting the foundation for widespread market growth across global automotive sectors.

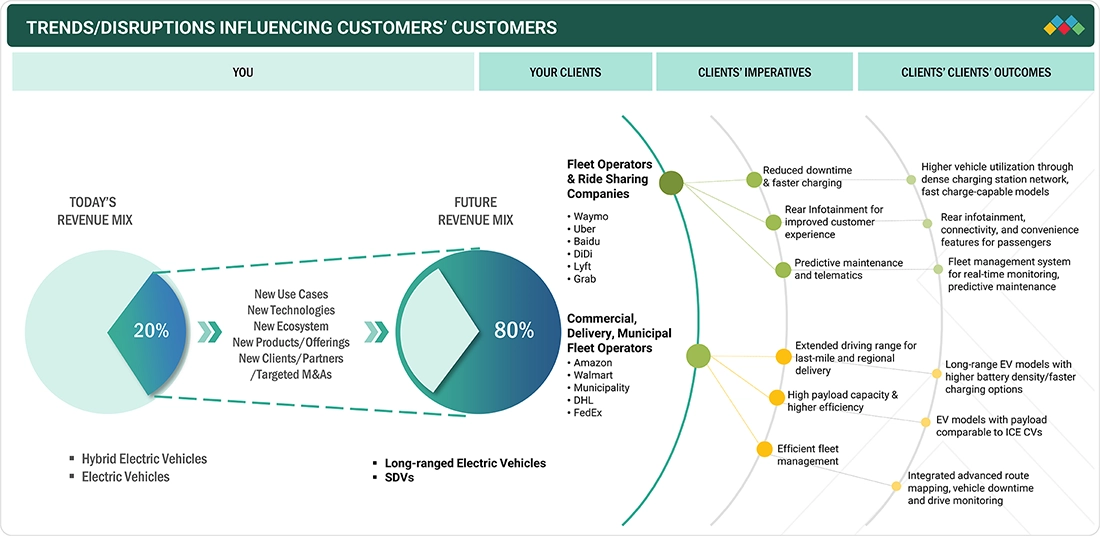

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The past revenue mix was dominated by ICE vehicles, with EVs contributing only a small portion, indicating emerging opportunities. The future mix shows a major shift toward EVs, with ICE share significantly reduced. Advancements in battery efficiency, power electronics, and autonomous driving are driving EV growth, enabling new products and services such as battery swapping and ultra-fast charging. Improved infrastructure and battery technology increase charging speed and vehicle range.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Policy support for EV adoption

-

Zero tailpipe and vehicle lifecycle emissions

Level

-

High initial purchase price

-

Capital-intensive charging infrastructure deployment

Level

-

Fleet electrification and commercial deployment

-

Expansion of Charging-as-a-Service (CaaS) business model

Level

-

Extended charging duration constraints

-

Fragmented charging standards and infrastructure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Policy support for EV adoption

Governments worldwide are promoting EVs to meet 2035 emission targets through subsidies, tax exemptions, and fast-charging networks. Europe, the US, China, and Canada are driving sales with incentives and infrastructure, while strict CO2 norms and ongoing support are expected to sustain market growth.

Restraint: High initial purchase price

High upfront EV costs, driven by expensive batteries, remain a barrier for many consumers despite lower operational costs. Incentives help, but often cannot match ICE affordability. Financing challenges and uncertain resale values keep EVs concentrated among wealthier and early adopter segments.

Opportunity: Fleet electrification and commercial deployment

Fleet and commercial EV adoption is rising, with companies like Lyft, MG, and Mullen Automotive scaling deployments. Government targets and initiatives like EV100 are encouraging fleet electrification, boosting demand for electric commercial vehicles and supporting infrastructure development.

Challenge: Fragmented charging standards and infrastructure

Varying AC/DC voltages and multiple standards (CHAdeMO, CCS, GB/T, Tesla) increase installation costs and limit interoperability. The lack of global standardization increases installation costs and limits interoperability for consumers. Governments are working on standardization, but differing standards continue to hinder broader EV adoption.

Electric Vehicle Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Blade battery technology in passenger cars and electric buses | Enhanced safety, longer battery life, improved energy density, reduced thermal management issues |

|

Electrified pickup trucks and SUVs for fleet and consumer use | High torque for off-road performance, extended driving range, fast charging capability |

|

Electric commercial trucks with integrated telematics and battery management systems | Optimized energy use, reduced operational costs, improved route planning and fleet efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis highlights various players in the electric vehicle market ecosystem, which is primarily represented by OEMs, Tier 1 integrators/suppliers, and EV charging providers. Some of the major EV manufacturers include Tesla, Volkswagen AG, SAIC Motor, BYD, and Geely-Volvo. Top EV charging providers include companies such as ABB, Shell, and ChargePoint, among others. Tier I suppliers include companies such as Denso, Magna, ZF, Delphi, Bosch, and Continental AG, among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electric Vehicle Market, by Vehicle Type

Passenger cars are estimated to account for the largest EV market share, driven by strong consumer demand, diverse models, charging availability, high production volumes, and advances in batteries and powertrains. Growth is further supported by government incentives and expanding urban EV adoption.

Electric Vehicle Market, by Propulsion

HEVs are set to be th fastest growin markt, as they lower fuel use and emissions without relying on charging networks. Their smaller batteries keep costs in check and enable faster scaling through existing production lines. For consumers, they offer better efficiency while retaining the ease of ICE ownership.

Plug-In Electric Vehicle Market, by Electric Architecture

The 400V architecture is projected to dominate, favored for compatibility with existing charging networks, lower costs, and proven reliability in mass-market cars and commercial vehicles. Its wide adoption ensures steady production scaling and supplier alignment.

Hybrid-Electric Vehicle Market, by Configuration Type

Parallel hybrid configurations are estimated to lead, valued for cost-effectiveness, efficiency, simple integration, and balanced performance for passenger cars and commercial vehicles. Their flexibility makes them suitable for both mid-range and premium models globally.

REGION

Asia Pacific to be the largest region in global electric vehicle market during forecast period

The Asia Pacific region is projected to be the largest market for EVs over the forecast period. Strong government support, extensive manufacturing capabilities, and high consumer adoption in countries such as China, Japan, and South Korea are driving market growth. Expanding charging infrastructure, favorable policies, and increasing investments in battery technologies further reinforce the region’s leading position in the global EV market.

Electric Vehicle Market: COMPANY EVALUATION MATRIX

In the electric vehicle market matrix, BYD Company Ltd. (Star) leads with a strong market presence and diverse product lineup, driving large-scale adoption in passenger cars and commercial vehicles. Changan Automobile (Emerging Leader) is gaining momentum with new EV models and strategic partnerships in urban mobility and fleet solutions. While BYD dominates with scale and infrastructure, Changan shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2025 (Value) | USD 698.63 Billion (Plug-In) |

| Market Forecast, 2035 (Value) | USD 1,189.59 Billion (Plug-In) |

| Growth Rate | CAGR of 5.5% from 2025 to 2035 (Plug-In) |

| Years Considered | 2021–2035 |

| Base Year | 2024 |

| Forecast Period | 2025–2035 |

| Units Considered | Volume (Thousand Units), Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Southeast Asia, Europe, North America, Latin America, Middle East, Africa |

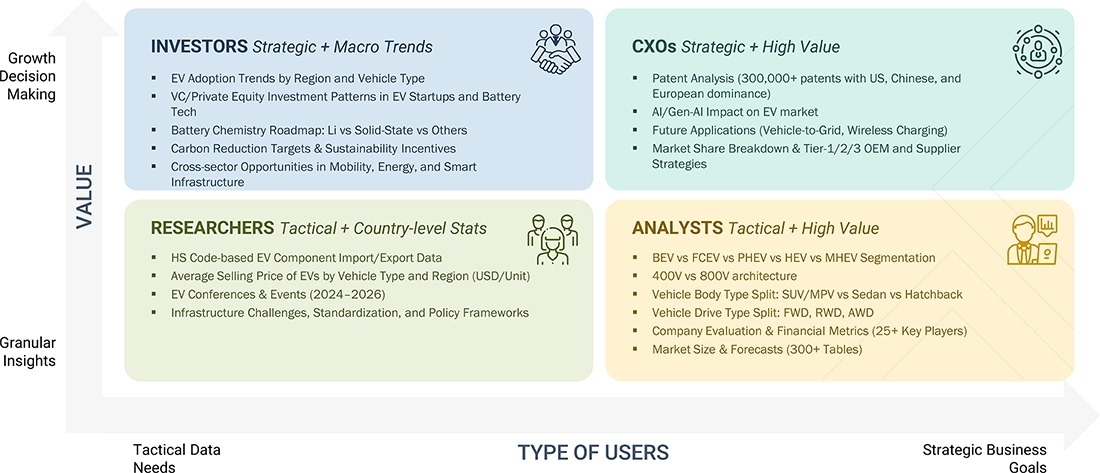

WHAT IS IN IT FOR YOU: Electric Vehicle Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| EV Manufacturer expanding in Latin America |

|

|

| EV Manufacturer in Indonesia gauging SEA market potential |

|

|

| Tier-1 Auto Component Provider planning for EV shift |

|

|

| OEM planning GTM strategy for new EV market |

|

|

| Tier-1 Auto Component Provider assessing North American EV demand |

|

|

| Battery Supplier entering the EV market |

|

|

| Fleet Operator planning EV transition |

|

|

RECENT DEVELOPMENTS

- August 2025 : Volkswagen introduced a subscription-based power upgrade for UK customers of its ID.3 electric vehicle range. This feature allowed drivers to unlock the full engine output at around USD 22 per month, USD 220 annually, or USD 860 for a lifetime activation linked to the vehicle.

- August 2025 : General Motors announced that it will temporarily import electric vehicle batteries from Chinese supplier CATL to support production of its affordable EV models, including the upcoming Chevrolet Bolt with LFP chemistry. GM sells various EVs in the US with locally produced cells and plans to localize LFP battery production in 2027.

- July 2025 : Tesla signed a USD 4.3 billion deal with LG Energy Solution to supply lithium iron phosphate (LFP) batteries from August 2027 to July 2030 for its energy storage systems, including Megapack, avoiding reliance on Chinese suppliers by utilizing LG’s Michigan factory.

- July 2025 : Geely launched the updated Galaxy E5 on July 24, 2025, with price dropped to RMB 109,800 (~USD 15,340), enhanced CLTC range up to 610 km (from 530 km), available in five trims with 60.22 kWh (530 km) and 68.39 kWh (610 km) battery options.

- June 2025 : BYD signed a strategic agreement with Austrian steelmaker voestalpine to supply high-quality sheet steel for its new passenger car factory in Szeged, Hungary. The facility is set to begin vehicle manufacturing by the end of 2025.

Table of Contents

Methodology

The research study involves extensive use of secondary sources such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases to identify and collect information on the electric vehicle market. In-depth interviews have been conducted with various primary sources, experts from related industries, auto component and service providers, to obtain and verify critical information, as well as assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and electric vehicle-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

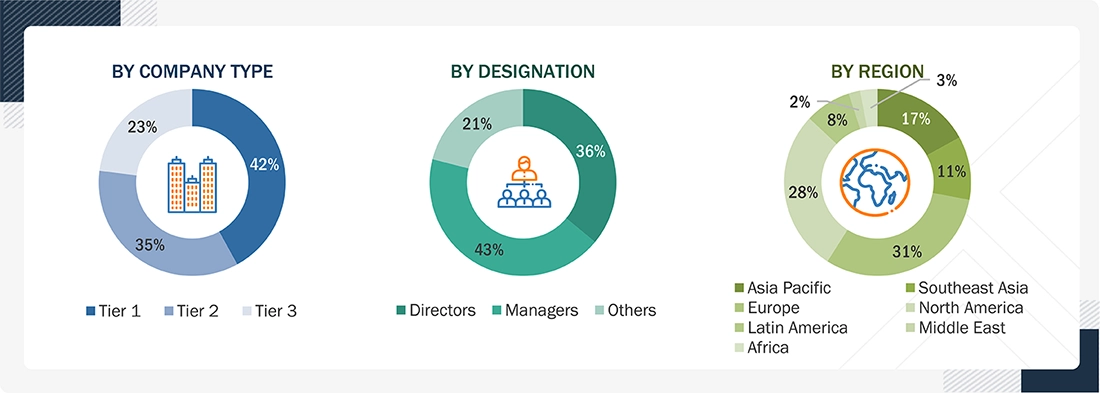

Primary Research

Extensive primary research has been conducted after understanding the electric vehicle market scenario through secondary research. Several primary interviews have been conducted with market experts from demand (fleet operators, consumers) and supply (OEMs, EV battery manufacturers, country-level government associations, and trade associations) sides. The regions considered for the research include North America, Europe, Asia Pacific, Southeast Asia, Latin America, the Middle East, and Africa. Approximately 32% and 68% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, have been covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions have been conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings described in this report.

Note: Others include sales, managers, and product managers.

Company tiers are based on the value chain; the company’s revenue is not considered.

To know about the assumptions considered for the study, download the pdf brochure

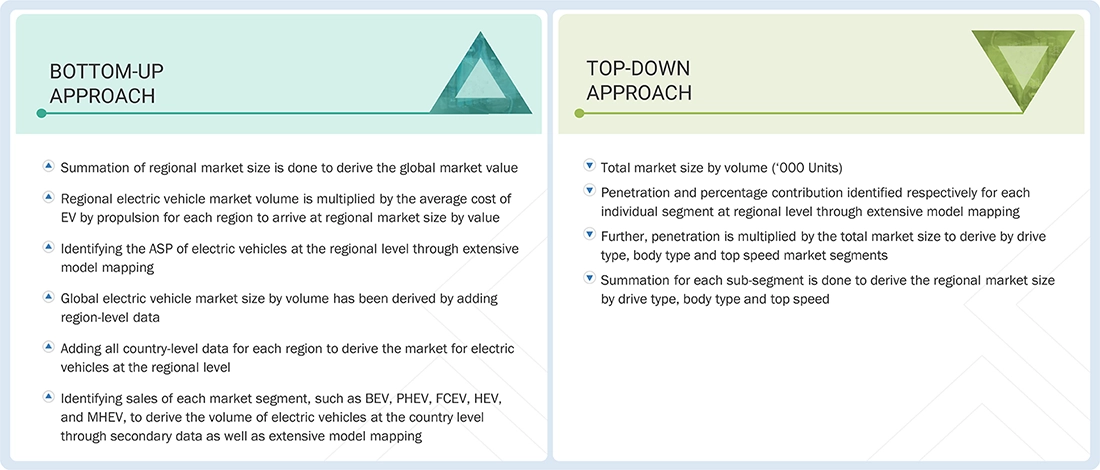

Market Size Estimation

As mentioned below, a detailed market estimation approach has been followed to estimate and validate the volume and value of the electric vehicle market and other submarkets.

- The market size has been derived by using parameters such as sales of EVs.

- Segment split has been identified through primary and secondary research.

- Key players in the global electric vehicle market have been identified through secondary research, and their global market ranking has been determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the global electric vehicle market have been determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data has been consolidated and added with detailed inputs, analyzed, and presented in this report.

Electric Vehicle Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the aforementioned methodology, the electric vehicle market has been split into several segments and subsegments. The data triangulation procedure has been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value for key segments and subsegments. The extrapolated market data has been triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

An electric vehicle (EV) is an automobile propelled by one or more electric motors. An EV uses energy stored in rechargeable batteries, which can be charged using private or public charging infrastructure. There are five major types of EVs, namely, battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), hybrid electric vehicles (HEVs), mild hybrid electric vehicles (MHEVs), and fuel cell electric vehicles (FCEVs).

Stakeholders

- Associations, forums, and alliances related to EVs

- Automobile manufacturers

- Battery distributors

- Battery manufacturers

- Charging infrastructure providers

- Charging service providers

- EV charging station service providers

- EV component manufacturers

- EV distributors and retailers

- EV manufacturers

- Government agencies and policymakers

Report Objectives

- To analyze and forecast the electric vehicle market in terms of volume (thousand units) and value (USD million) from 2025 to 2035

-

To segment the market by Vehicle Type, Propulsion, by EV Architecture, Vehicle Top Speed, Vehicle Drive Type, Vehicle Body Type, Configuration Type, Topology, Vehicle Connectivity, Propulsion & Component, End Use, and Region

- To segment and forecast the market size by vehicle type (passenger cars and commercial vehicles)

- To segment and forecast the market by propulsion (battery electric vehicle, fuel cell electric vehicle, plug-in hybrid electric vehicle, hybrid electric vehicle, and mild hybrid electric vehicle)

- To segment and forecast the market by EV architecture (400V and 800V)

- To segment and forecast the market by vehicle top speed (<125 mph and >125 mph)

- To segment and forecast the market by vehicle drive type (front-wheel drive, rear-wheel drive, and all wheel drive)

- To segment and forecast the market by vehicle body type (SUV/MPV, sedan, and hatchback)

- To segment and forecast the market by configuration type (series, parallel, and series-parallel)

- To segment and forecast the market by topology (P0, P1, P2, P3, and P4)

- To segment and forecast the market by vehicle connectivity (V2B or V2I, V2G, and V2V)

- To segment and forecast the market by propulsion & component (BEV components, PHEV components, FCEV components, HEV components, and MHEV components)

- To segment and forecast the market by end use (private and commercial fleets)

- To segment and forecast the market by Region [Asia Pacific, Southeast Asia, Europe, North America, and Rest of the World (RoW)]

- To identify and analyze key drivers, challenges, restraints, and opportunities influencing the market growth

- To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Supply chain analysis

- Ecosystem analysis

- Technology analysis

- Trade analysis

- Case study analysis

- Patent analysis

- Regulatory landscape

- Average selling price analysis

- Trends/Disruptions impacting customers’ business

- Impact of AI/Gen AI

- Key stakeholders and buying criteria

- Key conferences and events

- MNM insights on the electric vehicle market trends

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments and launches, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- Electric vehicle market, by commercial vehicle type, at the regional level (for regions covered in the report)

- Electric vehicle market, by propulsion, for additional countries (for countries not covered in the report)

- Additional company profiles (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electric Vehicle Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Electric Vehicle Market

Mathew

May, 2022

We want to know the competitive scenario for Electric Vehicle Market? and the Top vendors in the EV Market for the Forecast period 2022 to 2030. .

Jhon

Dec, 2022

For the Asia market, we have provided the latest industry trends from both supply-side and demand-side, market insights for ASIA at the total and country-level (China, India, Japan and South Korea), and quantified the market size in units and revenues and growth forecast to 2030..

Wills

Dec, 2022

Electric Vehicle Market report also includes the latest industry trends from both supply-side and demand-side, market insights for ASIA market at the total and country-level (China, India, Japan and South Korea) data as well, and quantified the market size in units and revenues and growth forecast to 2030..