Electronic Logging Device Market by Component (Display, Telematics unit), Form factor (Embedded, Integrated), New & Aftermarket Service (Entry Level, Intermediate, High-End), Vehicle Type (Truck, Bus, LCV), and Region - Global Forecast to 2025

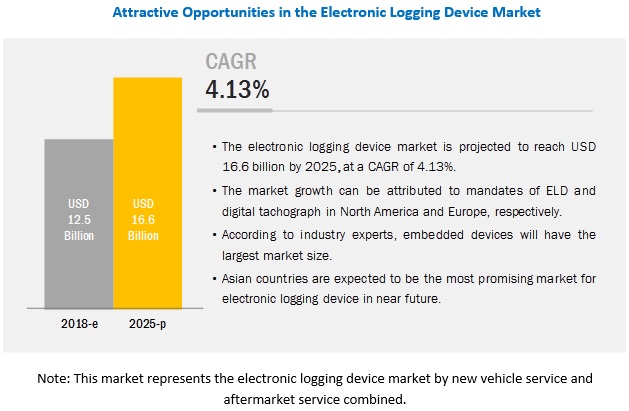

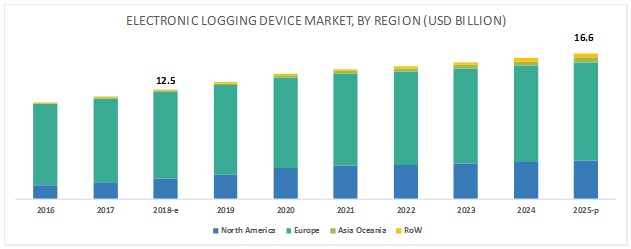

The global electronic logging device market is expected to be USD 12.5 billion in 2018 and is projected to reach USD 16.6 billion by 2025, growing at a CAGR of 4.13%. Major driving factors of the market is ELD mandate for fleet management in North America and in some of the Asian countries like Japan and South Korea. In Addition to that, the growing need for operational efficiency in fleet-owning organizations will also play a crucial role in market. Europe is expected to be the largest market for electronic logging device during the forecasted period because of the strictly implemented regulations related to electronic logging device.

“Embedded electronic logging device is expected to be the largest segment of the electronic logging device market”

Embedded electronic logging device is expected to be the largest segment because of the rapid adoption of electronic logging device in developed regions, particularly in North America and Europe. Embedded electronic logging devices offer more features and are secure and reliable. However, the high cost of these systems is a limitation for many fleet owners. Integrated systems, on the other hand, are cheaper and do not require a high installation cost. Due to the increasing government regulations regarding the safety of drivers and vehicles, regulations related to ELD are expected to be implemented in the coming years in countries such as Russia, Brazil, and China. All such factors are driving the embedded electronic logging device market.

“Telematics unit is expected to hold the largest market share over the forecast period”

By component, telematics unit is estimated to be the largest segment of the electronic logging device market. Telematics unit is the standard fitment in electronic logging device and is the only core component for any electronic logging device. Telematics unit is a system mounted in a vehicle, which measures the performance of the driver as well as the vehicle. It facilitates services like calculating the driver’s hours of service; monitoring the vehicle’s condition, fuel efficiency, and tax report; and transmitting data through a GSM module. Telematics unit of an electronic logging device includes electronic logs, CO2 emission, vehicle inspection, fuel tracking, temperature monitoring, and more. It also includes a Global System for Mobile Communication (GSM), which enables communication between the driver and the fleet owner at any place and time. It also offers other features, including e-call, breakdown assistance, vehicle theft tracking, driver monitoring, and e-toll.

Europe is expected to lead the electronic logging device market for new vehicle service as well as aftermarket service due to high vehicle sales

The European electronic logging device market is estimated to hold the largest market share in 2018. In 2006, digital tachographs were mandated in 27 European countries for commercial vehicles. Europe is expected to witness the shift of OEMs from not only manufacturing but also offering in-built electronic logging device for commercial vehicles. The ongoing and upcoming organic and inorganic growth strategies devised by players in the market would lead to a significant upsurge in the market in Europe. However, players in the region are focusing on R&D and innovations to maximize ROIs. The ongoing and upcoming organic and inorganic growth strategies devised by players in the market would lead to a significant upsurge in the market in Europe.

Key Market Players

The electronic logging device market is dominated by the global players and includes several regional players. Some of the key players in the market are Omnitracs (US), Trimble (US), Geotab (Canada), Donlen (US), and Teletrac Navaman (US). The study includes an in-depth competitive analysis of these key players in the market, with their company profiles, SWOT analysis of the top 5 companies, recent developments, and key market strategies. Omnitracs is anticipated to be a dominant player in the market. Omnitracs adopted the strategies of expansion, new product development, partnership, and mergers & acquisitions to retain its leading position in the market. Omnitracs has a presence in emerging markets such as India also. Strengthening of the product portfolio and global presence by building customer relationships is the strategy that Omnitracs is following to maintain its leadership in the market.

Scope of The Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2025 |

|

Base Year Considered |

2016 |

|

Forecast Period |

2018–2025 |

|

Forecast Units |

Value (USD million/billion) |

|

Segments Covered |

Component type, Vehicle Type, Form Factor Type, Service type, Aftermarket, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

Omnitracs (US), Teletrac Navaman (US), Geotab (Canada), Trimble (US), and Donlen (US) |

Electronic Logging Device Market, By Vehicle Type

- LCV

- Truck

- Bus

Electronic Logging Device Market, By Component

- Display

- Telematics Unit

- Other (Cable, Connectors, Mounting)

Electronic Logging Device Market, By Form Factor

- Embedded

- Integrated

Electronic Logging Device Market, By Service Type

- Entry Level

- Intermediate

- High-End

Electronic Logging Device Market, By Region

- North America

- Europe

- Asia Pacific

- RoW

Key Questions addressed by the report

- Which type of form factor is going to dominate in electronic logging device market in the future?

- How are the industry players addressing the challenge of maintaining a balance between performance and low-cost electronic logging device?

- Which type of service package is expected to dominate the service market?

- What could be the market size of electronic logging device for new vehicle service?

- What could be the market size of electronic logging device for aftermarket service?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Electronic Logging Device Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.3 Sampling Techniques & Data Collection Methods

2.1.4 Primary Participants

2.2 Electronic Logging Device Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Electronic Logging Device Market

4.2 Europe Electronic Logging Device Amrket

4.3 Market, By Region

4.4 Market By Country

4.5 Market, By Component

4.6 Market, By Service

4.7 Electronic Logging Device Amrket, By Aftermarket Service

4.8 Market, By Vehicle Type

4.9 Market, By Form Factor

5 Electronic Logging Device Market Overview (Page No. - 42)

5.1 Introduction

5.2 Electronic Logging Device Market Dynamics

5.2.1 Drivers

5.2.1.1 Eld and Digital Tachograph Mandate to Drive Revenue Streams for Vendors

5.2.1.2 Growing Need for Operational Efficiency in Fleet Owning Organizations

5.2.2 Restraints

5.2.2.1 Cost Sensitivity of Fleet Owners is A Major Hurdle in the Deployment of Advanced Fleet Management Technologies

5.2.2.2 Lack of Awareness Among Drivers and Fleet Owners in Emerging Countries

5.2.3 Opportunities

5.2.3.1 Data Can Be Harnessed to Make Informed Business Decisions

5.2.3.2 Future Potential for 5G Technology Providers

5.2.4 Challenges

5.2.4.1 Data Management and Data Security are Complex Processes for Vendors

6 Electronic Logging Device Market, By Vehicle Type (Page No. - 49)

6.1 Introduction

6.1.1 Research Methodology

6.1.2 Industry Insight

6.1.3 Assumption/Limitation

6.2 Light Commercial Vehicle

6.2.1 Europe is Estimated to Be the Largest Market

6.3 Truck

6.3.1 Asia Pacific is Expected to Be the Fastest Growing Market

6.4 Bus

6.4.1 North America is Estimated to Be the Largest Market

7 Electronic Logging Device Market, By Component (Page No. - 55)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Industry Insight

7.1.3 Assumption/Limitation

7.2 External Display

7.2.1 Europe is Expected to Be the Largest Market

7.3 Telematics Unit

7.3.1 Asia Pacific is Expected to Be the Fastest Growing Market

7.4 Others

7.4.1 Europe is Expected to Be the Largest Market

8 Electronic Logging Device Market, By Form Factor (Page No. - 61)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

8.1 Introduction

8.1.1 Research Methodology

8.1.2 Industry Insight

8.1.3 Assumption/Limitation

8.2 Embedded

8.2.1 Asia Pacific is Expected to Be the Fastest Growing Market

8.3 Integrated

8.3.1 Asia Pacific is Expected to Be the Fastest Growing Market

9 Electronic Logging Device Market, By Service (Page No. - 67)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

9.1 Introduction

9.1.1 Research Methodology

9.1.2 Industry Insight

9.1.3 Assumption/Limitation

9.2 Entry-Level Services

9.2.1 North America is Expected to Be the Second Largest Market for Aftermarket Service

9.3 Intermediate Services

9.3.1 Asia Pacific is Expected to Grow at A Fastest Rate for New Vehicle Service

9.4 High-End Services

9.4.1 Europe is Expected to Be the Largest Market for New Vehicle Service

10 Electronic Logging Device Market, By Region (Page No. - 76)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

10.1 Introduction

10.1.1 Research Methodology

10.1.2 Industry Insight

10.2 North America

10.2.1 US

10.2.1.1 Intermediate Service is Expected to Be the Largest Market for New Vehicle Service

10.2.2 Canada

10.2.2.1 Intermediate Service is Expected to Be the Largest Market for New Vehicle Service

10.2.3 Mexico

10.2.3.1 Intermediate Service is Expected to Be the Largest Market for New Vehicle Service

10.3 Europe

10.3.1 Germany

10.3.1.1 Intermediate Service is Expected to Be the Largest Market for New Vehicle Service

10.3.2 France

10.3.2.1 Entry-Level Service is Expected to Be the Second Largest Market for New Vehicle Service

10.3.3 UK

10.3.3.1 High-End Service is Expected to Be the Fastest Growing Market for Aftermarket Service

10.3.4 Spain

10.3.4.1 Entry-Level Service is Expected to Be the Second Largest Market for New Vehicle Service

10.3.5 Russia

10.3.5.1 High-End Service is Expected to Be the Fastest Growing Market for New Vehicle Service

10.3.6 Rest of Europe

10.3.6.1 Intermediate Service is Expected to Be the Largest Market for New Vehicle Service

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Intermediate Service is Expected to Be the Largest Market for New Vehicle Service

10.4.2 India

10.4.2.1 Intermediate Service is Expected to Be the Largest Market for New Vehicle Service

10.4.3 Japan

10.4.3.1 Intermediate Service is Expected to Be the Largest Market for New Vehicle Service

10.4.4 South Korea

10.4.4.1 Intermediate Service is Expected to Be the Largest Market for New Vehicle Service

10.5 RoW

10.5.1 Brazil

10.5.1.1 High-End Service is Expected to Be the Fastest Growing Market for New Vehicle Service

10.5.2 South Africa

10.5.2.1 High-End Service is Expected to Be the Fastest Growing Market for New Vehicle Service

11 Competitive Landscape (Page No. - 106)

Note - The Chapter is Further Segmented at Regional and Country Level By Service Type and Considered Services are New Vehicle Service (Entry-Level, Intermediate, High-End) and Aftermarket Service (Entry-Level, Intermediate, High-End)

11.1 Overview

11.2 Competitive Leadership Mapping

11.2.1 Introduction

11.2.2 Dynamic Differentiators

11.2.3 Innovators

11.2.4 Visionary Leaders

11.2.5 Emerging Companies

11.2.6 Competitive Benchmarking

11.2.6.1 Company-Wise Business Strategy Analysis

11.2.6.2 Company-Wise Product Offerings Analysis

11.3 Electronic Logging Device: Market Ranking Analysis

11.4 Competitive Scenario

11.4.1 Partnerships/Joint Ventures/Acquisitions

11.4.2 New Product Launches/Developments

11.4.3 Supply Contracts/Agreements/Collaborations

12 Company Profiles (Page No. - 116)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis)*

12.1 Trimble

12.2 Omnitracs

12.3 Teletrac Navman

12.4 Geotab

12.5 Donlen

12.6 Garmin

12.7 Verizon

12.8 AT&T

12.9 WorkWave

12.10 Merchants Fleet Management

12.11 Additional Companies

12.11.1 Leaseplan USA

12.11.2 Masternaut

12.11.3 Tomtom Telematics

12.11.4 Wheels

12.11.5 Vector Informatik

12.11.6 Racelogic

12.11.7 Intrepid Control Systems

12.11.8 HEM Data Corporation

12.11.9 Danlaw Technologies

12.11.10 Influx Technology

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 141)

13.1 Insights of Industry Experts

13.2 Electronic Logging Device Market Definition

13.3 Market Scope

13.4 Market Overview

13.5 Marketes and Markets Analysis

13.6 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.7 Available Customizations

13.7.1 Electric Logging Device Market, By Vehicle Type,

13.7.1.1 Truck

13.7.1.2 Bus

13.7.1.3 LCV

13.7.2 Market for Component, By Region, Volume (000’ Units)

13.7.2.1 Display

13.7.2.1.1 North America

13.7.2.1.2 Europe

13.7.2.1.3 Asia Pacific

13.7.2.1.4 RoW

13.7.2.2 Telematics Unit

13.7.2.2.1 North America

13.7.2.2.2 Europe

13.7.2.2.3 Asia Pacific

13.7.2.2.4 RoW

13.7.3 Market, By Form Factor, By Country

13.7.3.1 Embedded

13.7.3.2 Integrated

13.8 Related Report

13.9 Author Details

List of Tables (70 Tables)

Table 1 Electronic Logging Device Market Definitions - Components and Form Factor

Table 2 Currency Exchange Rates (Per USD)

Table 3 List of Assumptions Considered

Table 4 EU Drivers’ Hours Rules

Table 5 Recent Developments on 5G Technology

Table 6 Market, By Vehicle Type, 2016–2025 (USD Million)

Table 7 Light Commercial Vehicle: Market, By Region, 2016–2025 (USD Million)

Table 8 Truck: Market, By Region, 2016–2025 (USD Million)

Table 9 Bus: Market, By Region, 2016–2025 (USD Million)

Table 10 Installation Rate of Electronic Logging Device Components

Table 11 Market, By Component, 2016–2025 (USD Million)

Table 12 Display Unit: Electronic Logging Device, By Region, 2016–2025 (USD Million)

Table 13 Telematics Unit: Electronic Logging Device, By Region, 2016–2025 (USD Million)

Table 14 Others: Electronic Logging Device, By Region, 2016–2025 (USD Million)

Table 15 Market: Form Factor Definition

Table 16 Telematics Form Factors: Differentiating Factors

Table 17 Elecronic Logging Device Market, By Form Factor, 2016 vs 2025 (USD Million)

Table 18 Embedded: Market, By Region, 2016–2025 (USD Million)

Table 19 Integrated: Market, By Region, 2016–2025 (USD Million)

Table 20 New Vehicle: Market, By Service, 2016–2025 (USD Million)

Table 21 Aftermarket: Market, By Service, 2016–2025 (USD Million)

Table 22 Entry-Level Service: Market, By Region, 2016–2025 (USD Million)

Table 23 Entry-Level Service: Market, By Region, 2016–2025 (USD Million)

Table 24 Intermediate Service: Market, By Region, 2016–2025 (USD Million)

Table 25 Intermediate Service: Market, By Region, 2016–2025 (USD Million)

Table 26 High-End Service: Market, By Region, 2016–2025 (USD Million)

Table 27 High-End Service: Electronic Logging Device Aftermarket, By Region, 2016–2025 (USD Million)

Table 28 New Vehicle Service: Market, By Region, 2016–2025 (USD Million)

Table 29 Aftermarket Service: Market, By Region, 2016–2025 (USD Million)

Table 30 New Vehicle Service: Market, 2016–2025 (USD Million)

Table 31 Aftermarket Service: Market, 2016–2025 (USD Million)

Table 32 US: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 33 US: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 34 Canada: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 35 Canada: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 36 Mexico: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 37 Mexico: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 38 Europe: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 39 Europe: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 40 Germany: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 41 Germany: Market, By Afteramrket Service, 2016–2025 (USD Million)

Table 42 France: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 43 France: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 44 UK: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 45 UK: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 46 Spain: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 47 Spain: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 48 Russia: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 49 Russia: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 50 Rest of Europe: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 51 Rest of Europe: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 52 Asia Pacific: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 53 Asia Pacific: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 54 China: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 55 China: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 56 India: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 57 India: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 58 Japan: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 59 Japan: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 60 South Korea: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 61 South Korea: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 62 RoW: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 63 RoW: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 64 Brazil: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 65 Brazil: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 66 South Africa: Market, By New Vehicle Service, 2016–2025 (USD Million)

Table 67 South Africa: Market, By Aftermarket Service, 2016–2025 (USD Million)

Table 68 Partnerships/Joint Ventures, 2016–2017

Table 69 New Product Launches/Developments, 2016–2017

Table 70 Collaborations, 2015

List of Figures (45 Figures)

Figure 1 Market Segmentation: Electronic Logging Device Market

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Service: Market Size Estimation Methodology, Bottom-Up Approach

Figure 8 Aftermarket: Market Size Estimation Methodology, Bottom-Up Approach

Figure 9 Market: Market Outlook

Figure 10 Electronic Logging Market, By Region, 2018 vs 2025 (USD Billion)

Figure 11 Attractive Opportunities in the Market

Figure 12 Intermediate Services are Expected to Hold the Largest Market

Figure 13 Europe to Have the Largest Market Share

Figure 14 Asian Countries are Expected to Grow With the Fastest Rate

Figure 15 Display is Expected to Be the Fastest Growing Market

Figure 16 Intermediate Services to Hold the Largest Market Share

Figure 17 Intermediate Services to Hold the Largest Market Share

Figure 18 LCV to Hold the Largest Market Share for Hardware

Figure 19 Trucks are Expected to Hold the Largest Market Share for Services

Figure 20 Embedded Electronic Logging Devices to Hold A Larger Market Share

Figure 21 Market Dynamics: Market

Figure 22 Timeline for Electronic Logging Device Mandate

Figure 23 Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 24 Market, By Component, 2018 vs 2025 (USD Million)

Figure 25 Market, By Form Factor, 2018 vs 2025 (USD Million)

Figure 26 Global Market, By Service, 2018 vs 2025 (USD Million)

Figure 27 Market, By Region, 2018 vs 2025 (USD Million)

Figure 28 North America: Market Snapshot

Figure 29 North America: Electeronic Logging Device Market, By Region, 2018 vs 2025 (USD Million)

Figure 30 Europe: Market Snapshot

Figure 31 Europe: Market, By Region, 2016–2025 (USD Million)

Figure 32 Asia Pacific: Market, By Region, 2016–2025 (USD Million)

Figure 33 RoW: Market, By Region, 2016–2025 (USD Million)

Figure 34 Market: Key Developments By Leading Players

Figure 35 Competitive Leadership Mapping: Electronic Logging Device and Its Service Providers, 2018

Figure 36 Market Ranking Analysis, 2018

Figure 37 Trimble: Company Snapshot

Figure 38 SWOT Analysis: Trimble

Figure 39 SWOT Analysis: Omnitracs

Figure 40 SWOT Analysis: Teletrac Navman

Figure 41 SWOT Analysis: Geotab

Figure 42 SWOT Analysis: Donlen

Figure 43 Garmin: Company Snapshot

Figure 44 Verizon: Company Snapshot

Figure 45 AT&T: Company Snapshot

The study involves four main activities to estimate the current size of the electronic logging device market. Exhaustive secondary research was done to collect information on the market, such as form factor type and usage of different service packages for electronic logging device. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered under this study.

Secondary Research

The secondary sources referred for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); Department of Transportation (DOT); Federal Motor Carrier Safety Administration (FMCSA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated by multiple industry experts.

Primary Research

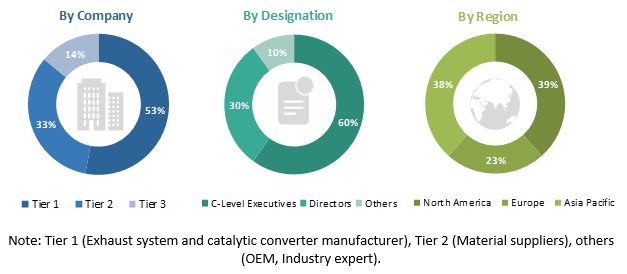

Extensive primary research has been conducted after acquiring an understanding of the electronic logging device market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (electronic logging device & digital tachograph manufacturer) across major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the electronic logging device market and estimate the size of various other dependent submarkets, in the overall market.

The bottom-up approach was employed to arrive at the overall size of the electronic logging device market, by considering vehicle sales, regional electronic logging device adoption rate, and electronic logging device pricing models. All these were triangulated to determine the overall market size. These market numbers were triangulated with the existing MarketsandMarkets’ repository for validation. This overall market size was used to estimate the size of individual markets (mentioned in market segmentation) through percentage splits from secondary and primary research. Further, the percentage splits of each subsegment for hardware and services were determined and verified through primary research.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends from both the demand and the supply sides in the electronic logging device market.

Report Objectives

- To analyze and forecast the electronic logging device market, in terms of value (USD million) and volume (’000 Units) during 2018–2025

- To define, describe, and project the market based on vehicle type (LCV, truck, and bus)

- To segment and forecast market, in terms of value and volume, based on component (display, telematics unit, and others)

- To define, describe, and forecast the market, by value, based on service packages (entry-level, intermediate, and high-end)

- To define, describe, and forecast the market, by value, based on form factor (embedded and integrated)

- To define, describe, and forecast the market, by value, based on aftermarket service

- To analyze and forecast the market across the 4 key regions, namely, Asia Pacific, Europe, North America, and the Rest of the World (RoW)

- To strategically profile key players in the market and comprehensively analyze their respective market share and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other industry activities carried out by the key industry participants

- To analyze the opportunities offered by various segments of the market for the stakeholders

- To identify the market dynamics (drivers, restraints, opportunities, and challenges) for the global market

- To analyze the competitive leadership mapping matrix for the key players based on their product offerings and business strategies

- To analyze the revenue impact of market on industry stakeholders

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Electric logging device market, by vehicle type, By country

- Truck

- Bus

- LCV

Electronic logging device market for component, by region, volume (000’ units)

-

Display

- North America

- Europe

- Asia Pacific

- RoW

-

Telematics unit

- North America

- Europe

- Asia Pacific

- RoW

-

Others

- North America

- Europe

- Asia Pacific

- RoW

Electronic logging device market, by form factor, by country

- Embedded

- Integrated

Growth opportunities and latent adjacency in Electronic Logging Device Market