Fleet Management Market

Fleet Management Market by Solutions (Operation Management, Vehicle Maintenance & Diagnostics, Performance Management, Fleet Analytics & Reporting), Fleet Type (Passenger Cabs, Commercial Vehicles, Public Transport) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global fleet management market size is estimated to reach USD 37.71 billion in 2025 and is projected to grow to USD 70.26 billion by 2030, with a CAGR of 13.3% over the forecast period. Market growth is supported by the expanding scale of commercial vehicle operations across logistics, construction, utilities, and field services. Fleet operators face growing pressure to improve cost control, maintain regulatory compliance, and ensure consistent service delivery across increasingly distributed operations.

KEY TAKEAWAYS

-

By RegionAsia Pacific will be the fastest-growing region in the global fleet management market during the forecast period, driven by the rapid expansion of commercial vehicle fleets and the increasing adoption of digital fleet technologies across emerging economies.

-

By ComponentBy component, the services segment is expected to register the highest CAGR of 15.3%.

-

By Fleet TypeBy fleet type, the commercial vehicles segment is projected to grow at the fastest rate from 2025 to 2030.

-

By PowertrainBy powertrain, the internal combustion engine (ICE) segment is expected to dominate the market.

-

By VerticalBy vertical, the law enforcement & emergency services segment will grow the fastest during the forecast period.

-

Competitive Landscape - Key PlayersVerizon Connect, Trimble, Geotab, Wheels, were identified as some of the star players in the fleet management market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsGurtam, GPS Insight, FleetComplete, Freeway Fleet have distinguished themselves among startups and SMEs in the fleet management market. Their emphasis on quick deployment, broad hardware compatibility, and configurable features makes them practical alternatives to complex enterprise fleet systems.

-

Europe Fleet Management MarketThe Europe Fleet Management market size is projected to grow from USD 11.82 billion in 2025 to USD 21.90 billion by 2030, with a compound annual growth rate (CAGR) of 13.1%

-

US Fleet Management MarketThe US Fleet Management market size is projected to grow from USD 11.34 billion in 2025 to USD 17.63 billion by 2030, with a compound annual growth rate (CAGR) of 9.2%

-

ANZ Fleet Management MarketThe ANZ Fleet Management market is projected to grow from USD 0.76 billion in 2025 to USD 1.76 billion by 2030, with a compound annual growth rate (CAGR) of 18.3%

-

Saudi Arabia Fleet Management MarketThe Saudi Arabia Fleet Management marketis projected to grow from USD 0.30 billion in 2025 to USD 0.49 billion by 2030, with a compound annual growth rate (CAGR) of 10.2%

-

APAC Fleet Management MarketThe APAC Fleet Management Marketis projected to grow from USD 7.57 billion in 2025 to USD 17.36 billion by 2030, with a compound annual growth rate (CAGR) of 18.1%

Fleet management adoption continues to gain momentum as fleet operations grow more complex and cost-sensitive. Many organizations now rely on digital systems to track vehicle movements, monitor fuel use, plan maintenance, and oversee driver activity. This approach helps limit unexpected disruptions and makes better use of available vehicles. As fleets operate across wider geographies, delivery timelines are tightening and becoming harder to manage with manual processes. Under these conditions, greater visibility into daily operations is essential. Centralized platforms enable fleet managers to respond more quickly to operational issues and make informed planning decisions. This shift toward data-driven operations is strengthening the role of fleet management systems as a core part of modern fleet operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The fleet management market increasingly shapes customers’ business outcomes amid evolving operational requirements, emerging technologies, and stricter regulatory standards. Key users include logistics operators, construction and heavy equipment fleets, public transportation providers, cold chain distributors, and government emergency services. These integrated fleet management solutions are relied on to improve service reliability, safety performance, and regulatory compliance. Rising pressure to cut costs, prevent asset misuse, improve driver behavior, and protect cargo is driving adoption of telematics and data-driven platforms. Provider revenue is shifting from software subscriptions and hardware fees toward automotive data monetization, advanced safety and video telematics, and EV and sustainability services. Demand for next-generation systems and value-added services is expected to strengthen market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid Expansion of Connected Telematics and IoT Integration in Fleet Operations

-

Growing demand for real-time fleet visibility and performance monitoring

Level

-

Fragmented fleet systems limit integrated adoption

-

Limited digital infrastructure slows fleet technology adoption in some regions

Level

-

Increasing Demand for Predictive Maintenance and Data-Driven Fleet Decisions

-

Regulatory Incentives & Clean Energy Credits for Early Adopters

Level

-

Fuel costs and logistics volatility increase pressure on fleet operations

-

Managing data security and compliance across connected fleets

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid Expansion of Connected Telematics and IoT Integration in Fleet Operations

The global fleet management market is being propelled by the growing integration of connected telematics and Internet of Things (IoT) technologies that improve operational visibility and decision-making across vehicle networks. As more operators adopt real-time tracking devices and on-board sensors, fleets can monitor vehicle status, driver behavior, and fuel consumption in far greater detail than before. This technological shift supports efforts to lower operating costs and enhance service reliability across complex routes and delivery networks. In particular, fleet telematics control units and integrated tracking modules are becoming standard across logistics, transportation, and delivery fleets, delivering actionable data that enhances routing, safety monitoring, and asset utilization. The enhanced focus on connected platforms reflects broader digitization trends that tie operational data to predictive maintenance, fuel-efficiency programs, and compliance reporting, strengthening the case for continued fleet management adoption across both developed and emerging markets.

Restraint: Fragmented fleet systems limit integrated adoption

Although digital tools are increasingly available, many fleet operators still struggle with fragmented, isolated systems, such as separate platforms for tracking, maintenance, compliance, and fuel analytics. These silos create integration roadblocks that limit data flow, increase complexity, and reduce the overall effectiveness of fleet solutions. Integrating these systems across technologies and regions requires investment in infrastructure, skilled personnel, and standardized data interfaces. As long as operators continue to rely on legacy systems or nonstandardized data architectures, scalability and real-time insight remain constrained.

Opportunity: Increasing Demand for Predictive Maintenance and Data-driven Fleet Decisions

The growing volume of data generated by vehicles and sensors is driving demand for predictive maintenance and advanced analytics platforms. Instead of reacting to breakdowns, operators are now seeking tools that can forecast component failures, optimize service schedules, and reduce unplanned downtime. These predictive tools leverage vehicle usage data, engine health indicators, and historical patterns to enable smarter service planning. As fleets aim to reduce total cost of ownership and improve uptime, analytics-driven fleet applications present a major opportunity for solution providers.

Challenge: Fuel costs and logistics volatility increase pressure on fleet operations

Global fuel price volatility and fluctuating logistics demand in the global market are putting more strain on fleet managers' bottom lines. Rising fuel prices and slowdowns in supply chain activity not only demand greater attention and efficiency in managing costs but also require more sophisticated solutions in fleet and transportation management. However, the cost of implementation, training, and ongoing management can be a barrier for smaller operators or those in emerging markets. This limits fleet modernization and slows broader market adoption.

FLEET MANAGEMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The City of Opelousas Police Department (US) implemented Verizon Connect to track patrol vehicles, monitor driver behavior, and manage fleet utilization in real time. The system was used to improve visibility across vehicles and optimize daily operations for public safety services. | 40% reduction in fleet operating costs | Improved vehicle utilization | Better response time and centralized fleet oversight |

|

DB Schenker (global logistics provider) deployed Geotab telematics across its vehicle fleet to monitor fuel usage, vehicle health, and driver performance as part of its efficiency and sustainability initiatives. | Improved fuel efficiency | Reduced emissions | Data-driven maintenance planning | Enhanced fleet visibility |

|

Cardinal Plumbing (US) adopted Samsara’s fleet management platform to track service vehicles, monitor driver activity, and improve dispatch coordination for field technicians. | Faster dispatch decisions | Improved driver accountability | Reduced idle time | Better service reliability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The fleet management ecosystem is an interconnected network that enables end-to-end visibility, regulatory compliance, and operational optimization across the region. Fleet management platforms bring vehicle, driver, and operational data into one system for real-time monitoring, data-driven decisions, and improved efficiency. Hardware manufacturers supply telematics devices that capture location, performance, and safety data across diverse vehicle types. Implementation, integration, maintenance, and localized expertise are provided by service providers to adapt solutions to regional regulatory and operational requirements. Regulatory bodies set emissions standards, safety mandates, and cross-border transport rules that drive the adoption of advanced telematics and digital compliance tools. Together, these components help fleets improve productivity, lower operating costs, support electrification, and maintain compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fleet Management Market, By Component

Fleet management solutions account for a significant share of overall market adoption because they form the operational backbone of day-to-day fleet activities. These platforms integrate vehicle tracking, route planning, maintenance scheduling, and driver monitoring into a single operational view. As fleet operations grow larger and more distributed, relying on manual reporting or disconnected tools makes it difficult to maintain consistency and control. Real-time access to vehicle and driver data enables fleet managers to respond more quickly to delays, breakdowns, or route deviations. This improves service reliability while reducing unnecessary fuel use and downtime. Over time, the ability to standardize processes and reduce manual oversight has made solution-based platforms central to fleet operations, particularly for organizations managing vehicles across multiple locations or regions.

Fleet Management Market, By Fleet Type

The commercial vehicles segment is seeing steady growth as industries such as logistics, construction, utilities, and field services continue to expand their vehicle fleets. Higher delivery volumes, ongoing infrastructure work, and expanding service networks are increasing the number of vans and trucks in use. As vehicles are deployed more frequently, operators need closer oversight of fuel use, maintenance cycles, and overall utilization. Fleet management systems help identify where time, fuel, or maintenance resources are overused, allowing operators to control costs more effectively. With larger fleets, even modest improvements in routing or service planning can deliver noticeable savings, supporting broader adoption of digital fleet management tools among commercial operators.

Fleet Managmeent Market, By Powertrain

Electric vehicle (EV) fleets are gaining traction globally as organizations respond to sustainability goals and evolving transportation policies. Compared with conventional vehicles, EVs introduce additional operational needs tied to battery condition, charging access, and route planning. Fleet operators need systems that can align charging with daily delivery schedules, particularly when routes and time windows are fixed. Fleet management platforms are increasingly being adapted to support these needs by providing visibility into energy use and vehicle readiness. As EVs are added alongside traditional vehicles, managing mixed-powertrain fleets is becoming a practical requirement. This shift is driving steady demand for EV-focused fleet management capabilities, especially in regions moving more quickly toward electrification.

Fleet Management Market, By Vertical

The transportation and logistics vertical holds a major share of the global fleet management market due to the scale and complexity of its operations. Logistics providers often operate fleets with heavy daily use and limited flexibility in delivery timelines. Operating costs are closely tied to fuel spending, driver availability, and route efficiency, underscoring the need for clear operational oversight. Fleet management platforms help address these needs by supporting route planning, monitoring delivery status, and highlighting areas where time or fuel is being lost. As delivery networks grow and service reliability is increasingly monitored, logistics operators are placing greater weight on systems that help maintain predictable execution. This practical requirement continues to drive adoption across the transportation and logistics sector.

REGION

Asia Pacific to be fastest-growing region in global fleet management market during forecast period

Asia Pacific is seeing faster adoption of fleet management as commercial vehicle fleets expand across both emerging and established markets. Rapid urbanization, infrastructure development, and growth in logistics and delivery services are increasing the need for structured fleet oversight. Many organizations are moving from informal or manual fleet management practices to standardized digital systems as fleet sizes grow. Managing fuel costs, vehicle availability, and service reliability across dense urban areas and long-distance routes is becoming more challenging. Fleet management platforms support these needs by providing clearer operational visibility and helping operators maintain control as fleet activity increases. Together, these conditions are supporting steady growth across the region.

FLEET MANAGEMENT MARKET: COMPANY EVALUATION MATRIX

In the fleet management market matrix, Verizon Connect (Star) holds a leading position, supported by a strong combination of market share and a broad product footprint, as well as its comprehensive telematics platform and deep expertise in commercial logistics and service fleets. Zebra Technologies (Emerging Leader) is gaining momentum by leveraging its asset visibility, rugged mobility solutions, and integrated tracking capabilities to strengthen its role in modern fleet operations. While Verizon Connect maintains its lead through scale, feature depth, and widespread adoption, Zebra Technologies shows considerable potential to advance toward the leaders’ quadrant as demand for unified device ecosystems, real-time operational intelligence, and connected asset management accelerates across industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Verizon Connect (US)

- Trimble (US)

- Geotab (Canada)

- Wheels (US)

- Samsara (US)

- Bridgestone Group (Japan)

- Inseego (US)

- Solera Group (US)

- Verra Mobility (US)

- Teletrac Navman (US)

- Holman (US)

- Orbcomm (US)

- Mix Telematics (South Africa)

- Zebra Technologies (US)

- Motive (US)

- Chevin (UK)

- GPS Insight (US)

- Michelin (France)

- ClearpathGPS (US)

- Fleetcomplete (Canada)

- Gurtam (Belarus)

- Automile (US)

- VIA (Israel)

- Fleetroot (UAE)

- Ruptela (Lithuania)

- Freeway Fleet (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 32.76 Billion |

| Market Forecast in 2030 (Value) | USD 70.26 Billion |

| Growth Rate | CAGR of 13.3% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: FLEET MANAGEMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| EV Fleet Operator |

|

|

| Construction & Mining Operator |

|

|

| Commercial Logistics / Freight Carrier |

|

|

| Public Transport Authority |

|

|

| Ride-hailing/Passenger Cabs |

|

|

RECENT DEVELOPMENTS

- October 2025 : Geotab acquired the commercial operations of Verizon Connect in Australia. The acquisition brought more than 400 local sales staff and customer relationships into Geotab’s business. This move strengthens Geotab’s regional presence and expands its ability to serve small and mid-sized fleets across Australia and New Zealand.

- September 2025 : Zonar Systems acquired ez enRoute and then launched the "Zonar Bus Suite" to modernize student transportation logistics and improve routing efficiency.

- July 2025 : Teletrac Navman debuted its "Multi IQ Camera," a cloud-based AI dashcam solution that delivers 360-degree visibility and real-time safety insights for large commercial vehicles.

- April 2025 : Solera launched the "Solera Fleet Platform," a unified solution that integrates vehicle claims, repairs, and fleet management data into a single AI-driven ecosystem.

- September 2024 : Azuga introduced its next-generation Bluetooth Low Energy (BLE) Asset Tracking solution, enabling fleets to monitor tools and small equipment alongside their vehicles to prevent theft.

- April 2024 : Powerfleet and MiX Telematics completed a business combination to form a larger global software provider. The deal brings together MiX Telematics’ Asia Pacific customer base and Powerfleet’s North American footprint. The combined company expands product depth and partner reach across Australia and other Asia Pacific markets.

- February 2024 : Queclink launched QTrack Protocol Pro as a new device integration standard. The protocol improves device to cloud connectivity through stronger security and lower data usage. It supports MQTT and simplifies large scale deployments. This benefits system integrators and partners deploying Queclink devices across Asia Pacific fleets.

Table of Contents

Methodology

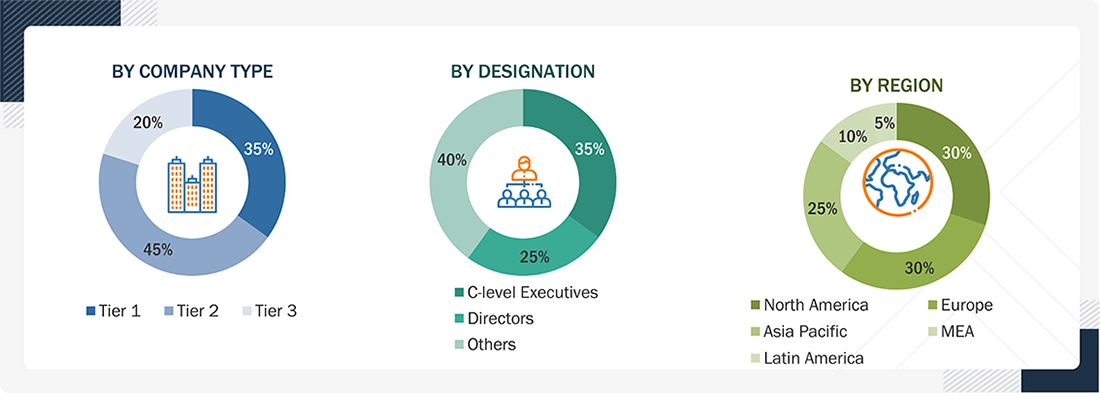

This research study relied on extensive secondary sources, including directories and databases such as Dun & Bradstreet (D&B), Hoovers, and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the fleet management market. The primary sources were mainly industry experts from core and related industries, as well as preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations across all segments of the value chain of this market. In-depth interviews were conducted with primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering fleet management solutions and services across different verticals has been estimated and projected using secondary data from paid and unpaid sources, along with analysis of their product portfolios within the fleet management ecosystem. The process also involved rating company products based on performance and quality. In the secondary research process, various sources such as the International Journal of Advanced Research (IJAR), EA Journals, and the International Journal of Technology, Innovation, and Management (IJTIM) were referred to for identifying and collecting information for this study of the fleet management market. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, articles by recognized authors, directories, and databases. Secondary research was mainly used to obtain critical information about the market's supply chain, the total pool of key players, market classification, segmentation according to industry trends down to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives, which primary sources have further validated.

Primary Research

In the primary research process, interviews were conducted with various primary sources from both the supply and demand sides to gather qualitative and quantitative information on the market. The supply-side sources included industry experts such as Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; critical executives from fleet management solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, revenue data from solutions and services, market breakdowns, market size estimates, market forecasts, and triangulated data. Primary research also helped understand trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users of fleet management solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of fleet management solutions, which would impact the overall fleet management market.

Note: Others include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

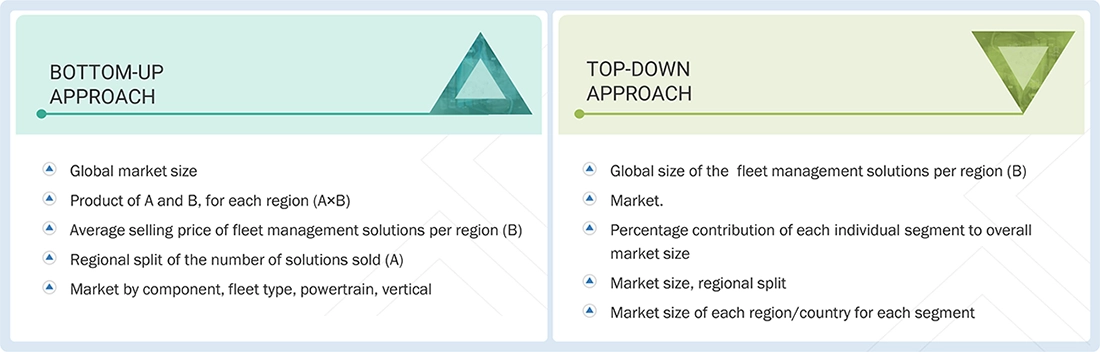

Multiple approaches were used to estimate and forecast the size of the fleet management market. The first approach estimates market size by summing the revenue generated by companies from the sale of fleet management offerings.

The top-down and bottom-up approaches were used to estimate and validate the total size of the fleet management market. These methods were also used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- Regarding value, the industry’s supply chain and market size have been determined through primary and secondary research processes

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources

Fleet Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the fleet management market was segmented into several categories and subcategories. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by analyzing various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated using the top-down and bottom-up approaches.

Market Definition

Fleet management encompasses the activities necessary to maintain a fleet's optimal efficiency, punctuality, and financial adherence. It is the systematic approach fleet managers use to oversee fleet operations, involving continuous monitoring of activities and strategic decision-making in areas such as asset management, dispatch, and routing, as well as the acquisition and disposal of vehicles.

Key Stakeholders

- Fleet Managers

- IT Departments

- Drivers

- Digital Map Providers

- Automotive Suppliers

- Government Agencies

- Investment Firms

- Fleet Management Alliances/Groups

Report Objectives

- To determine, segment, and forecast the fleet management market by component, fleet type, powertrain, vertical, and region in terms of value

- To forecast the size of the market segments in 5 main regions: North America, Europe, Asia Pacific, Middle East Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise Information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fleet Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Fleet Management Market