Embedded Display Market by Technology (LCD, LED, OLED, and Others), Type, Device, Application (Automobile Displays, Fitness Devices and Wearables, Home Automation and HVAC Systems), Region - Global Forecast to 2025

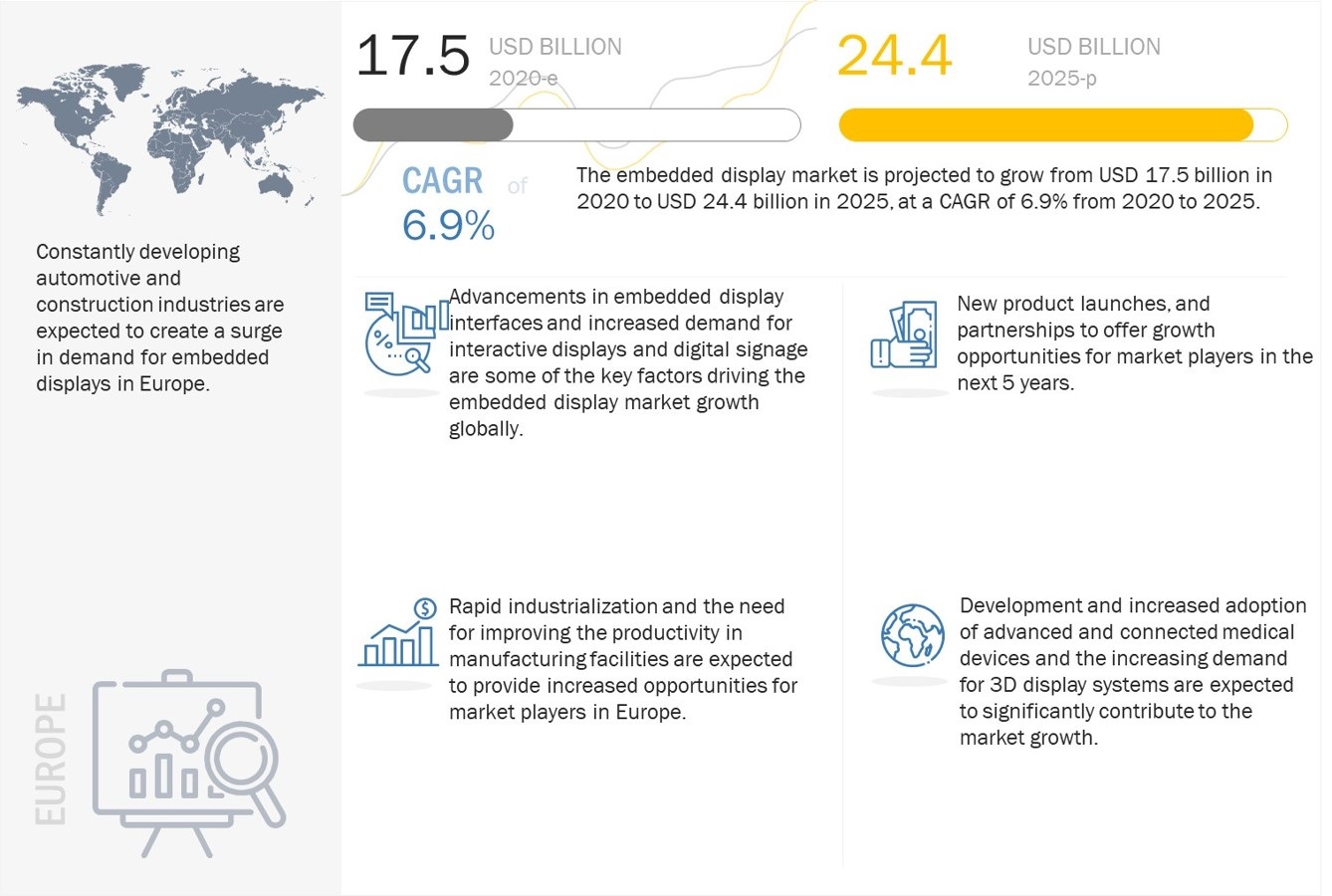

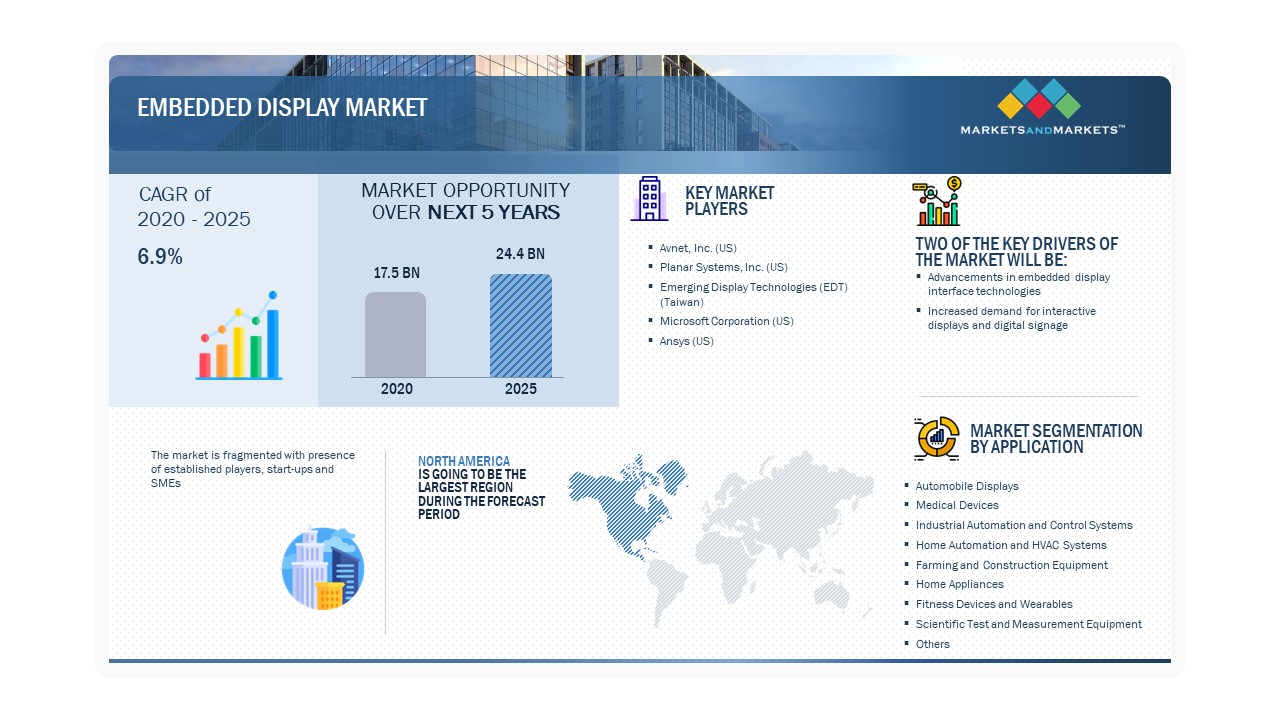

The embedded display market is projected to reach USD 24.4 billion in 2025 from USD 17.5 billion in 2020, growing at a CAGR of 6.9% from 2020 to 2025.

The Embedded Display Market is rapidly growing, driven by increasing demand for advanced displays in consumer electronics, automotive applications, and industrial equipment. Key trends include the integration of touch functionalities, higher resolution displays, and the shift towards energy-efficient technologies. As manufacturers focus on enhancing user experiences through innovative designs and improved performance, the market is witnessing significant advancements. The rise of IoT devices and smart technologies further accelerates the adoption of embedded displays, making it a vital segment in the broader electronics industry.

Embedded display is an emerging technology that enables easy and cost-effective implementation of color display interfaces in touchscreens, embedded systems, and graphic user interfaces (GUI). It offers improved flexibility and saves power with superior display efficiency. A smart embedded display consists of a microcontroller unit (MCU), a thin-film transistor (TFT) display with a capacitive touch panel sensor, a cover lens, and industrial interfaces, to offer a comprehensive solution to designers of embedded systems with displays. These modules offer superior display efficiency and improved interaction between embedded systems/devices and users.

Impact of AI on Embedded Display Market

Artificial Intelligence (AI) is significantly impacting the embedded display market by enhancing user interfaces, enabling smarter interactions, and driving real-time data visualization across various applications. AI-powered embedded displays can adapt content dynamically based on user behavior, environmental conditions, and system performance, offering more intuitive and personalized experiences. In industries such as automotive, healthcare, industrial automation, and consumer electronics, AI integration allows for intelligent touch response, voice recognition, and predictive analytics, transforming displays into interactive control hubs. Moreover, AI enables edge computing capabilities within embedded systems, allowing data processing directly on the device for faster responses and reduced latency. As the demand grows for smarter, more efficient, and context-aware display technologies, AI is playing a pivotal role in advancing embedded display functionality, improving human-machine interaction, and expanding market opportunities across diverse sectors.

Embedded Display Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

Automation and digitalization have transformed businesses globally and have created a surge in demand for advanced devices which are interactive. Embedded displays are essential components of embedded devices as they facilitate interaction between users and devices. The integration of touch interfaces and user interfaces (UI) in display modules increases this interactivity. Embedded displays are used in several industries such as automotive, transportation, agriculture, construction, healthcare, consumer electronics, building automation and control systems, aerospace and defense, retail, energy, advertising and broadcasting, and education.

Embedded displays have witnessed several changes in terms of their design and architecture, along with the incorporation of different types of display interfaces. This, in turn, has led to their increased demand. Advancements in the pixel technology have led to developments in the field of LCD, LED display, and OLED display technologies and in recent years, these display technologies have undergone various transformational changes not only in terms of pixel resolution but also in terms of operating temperature range, design scalability, durability, power consumption, energy efficiency, etc.

The increasing use of portable and touch-enabled embedded devices in various applications is a major factor driving the growth of the embedded display market. Moreover, advancements in display technologies, such as the development of OLED displays, have led to the production of transparent displays that can easily be curved and folded. All these factors have resulted in a positive impact on the growth of the market for embedded displays. Various developments in graphic user interfaces (GUI) and operating systems (OS) of embedded devices have further contributed to the demand for embedded displays that are highly user-friendly and interactive.

Constantly growing automation in industries and the growing demand for smart homes have led to an increased adoption of smart embedded devices, boosting the demand for embedded displays in home and industrial automation systems. The consumer electronics sector has been a major end user of embedded displays. This is due to the integration of embedded displays in wearables and various electronic devices, such as gaming consoles, smart speaker displays, several kitchen appliances, etc. The automotive sector has also witnessed an increased demand for embedded displays in past years for use in infotainment systems, instrument clusters, GPS navigation systems, heads-up displays (HUD), etc.

Embedded Display Market Dynamics:

Driver: Increased demand for interactive displays and digital signage

Rapid urbanization and growing public spending have led to an increased adoption of interactive displays and digital signage globally. Most of the companies operating in retail, education, BFSI, and entertainment sectors need interactive displays and digital signage for several applications such as advertisements, branding, promotions, and entertainment. The growing penetration of active LED video wall displays for outdoor and indoor environments is also driving the demand for interactive displays. Moreover, the technologies used by these interactive displays and digital signage are highly scalable, thereby making them useful and durable in different environments. Advancements in LED and micro-LED video wall displays in the form of pixel-pitch have led to increased adoption of interactive displays globally.

The growing integration of digital signage and digital technologies has made displays highly interactive, thereby enabling them to link with other connected digital devices. The development of advanced configurable digital signage software has also contributed to the overall demand for digital signage across different industries. Moreover, the development of digital signage media players and smart display modules not only leads to their easy deployment but also allows them to store and push content through central content management systems (CMS). All these factors are expected to drive the demand for interactive displays and digital signage for use in different applications, leading to an increased demand for embedded displays.

Restraint: Threat of security breaches in embedded hardware and complexities involved in development of embedded software

Advancements in embedded devices over the past decade have resulted in an increased need for systems, which offer superior functionalities, as well as can be integrated with small devices. However, the increased adoption of these embedded devices has led to many security issues with various vendors developing embedded devices that fail basic security testing. Most miniaturized, connected embedded devices are secured using Secure Shell (SSH) or Secure Sockets Layer (SSL) encryption protocols, which are not effective in preventing possible cyberattacks. These devices fail to receive security updates in time that could make them prone to cyberattacks. The IoT-connected embedded devices used in smart home setups or wearables are vulnerable to frequent attacks. These factors collectively restrict the use of embedded display devices in critical sectors such as aerospace, military, defense, etc.

Embedded software facilitates middleware such as communication protocols, operating systems, and application codes to come together to interact directly with embedded hardware. With growing functionalities offered by various embedded devices, it is important for embedded software to support these devices and be compatible with them. Moreover, the development costs of these embedded software need to be kept in check. Rapid development of embedded software has led to an increase in development costs and the possibility of unprecedented risks associated with them. As the development costs of embedded software are high, it leads to increased costs of embedded display systems. Some other problems associated with the development of embedded software include connectivity issues owing to the presence of multiple connectivity protocols and their separate technology stacks. Moreover, these software require over-the-air (OTA) updates with respect to IoT devices. They also require carrying out debugging owing to the open-source software integration. These factors act as restraints for the growth of the embedded display market.

Opportunity: Growth in demand for 3D display systems used in different applications

3D display-based devices have witnessed an increased demand in the past few years with their growing adoption in medical, automotive, gaming, retail, defense, entertainment, broadcast, and consumer electronics applications. In medical applications, 3D displays, especially volumetric displays, are used in imaging equipment such as X-ray and MRI machines. Similarly, 3D printers using 3D displays are witnessing an increased adoption in several medical applications. 3D displays are also being used extensively in gaming consoles to offer an enhanced gaming experience to users.

The automotive industry is expected to provide opportunities for the adoption of 3D displays in automobiles to facilitate a natural viewing experience to drivers and passengers. These 3D displays can be a part of in-vehicle infotainment systems or instrument clusters used to display important information, including warnings and videos. Companies such as Continental AG (Germany) and Bosch (Germany) offer 3D automotive displays that eliminate the requirement of glasses and display warning signs, pointers, and objects. Such developments are expected to drive the growth of the embedded display market for 3D display solutions, thereby providing growth opportunities for players offering embedded displays.

Challenge: Issues related to design of real-time embedded systems equipped with displays

Real-time embedded systems are used to interact with real-world objects such as automotive central stack display systems for entertainment, as well as for showing information related to navigation on a given input. These interactions can become complex owing to the possible interactions of real-time systems with thousands of such entities simultaneously. These interactions can also involve design-related issues for real-time systems. The real-time systems may sometimes lack real-time responses owing to the unsuitable architecture of embedded devices, inadequate link speed, and incompatible operating system, which may lead to low interrupt latency. These systems need to be reliable to ensure their proper functioning in the event of failures. False handling of software failures during ongoing tasks, delay in handling processor failures, and inconsistencies in recovering context for failed processers can lead to unsuccessful recovering attempts. Moreover, embedded real-time systems need to work with distributed architectures as they usually carry out processing at several nodes. This leads to the requirement for maintaining consistency of data structures, defining, and maintaining message interfaces, distributing loads evenly among multiple processors and links, centralizing the shared pool of resource allocations for achieving full system capacity, etc. Failure in executing these tasks can lead to improper functioning of real-time systems. These factors, therefore, act as challenges for the growth of the market for embedded systems that use embedded displays.

Embedded Display Market Segment Insights:

Based on technology, LCD embedded display segment to dominate the embedded display market from 2020 to 2025

Based on technology, the embedded display market has been segmented into LCD, LED, OLED, and others which include QLED, ELD, and 3D displays. The growth of LCD embedded displays can be attributed to the increasing use of LCD in gaming devices, digital watches, smartwatches, calculators, smart display devices, home appliances, etc. Moreover, LCD offer increased sharpness and enhanced brightness. They are durable and responsive, thereby leading to their increased deployment in automotive, industrial, and retail applications.

Based on device, portable device segment is expected to register highest CAGR during forecast period

Based on device, the embedded displays market has been segmented into fixed and portable devices. The growth of portable devices in the market can be attributed to several benefits offered by them. These devices have multi-touch panel options, thereby making them highly interactive while being easy to handle and use. Portable devices are mainly used in point of sale (POS) machines, wearables, smart display devices, display monitors, HMI, and medical devices, among several other applications. The ongoing commercialization of IoT is expected to fuel the demand for portable devices during the forecast period.

Based on application, automobile displays are expected to account for the largest share of the embedded display market in 2020

Based on application, the embedded display market has been segmented into automobile displays, medical devices, home automation and HVAC systems, industrial automation and control systems, farming and construction equipment, home appliances, fitness devices and wearables, scientific test and measurement instruments, and others which mainly include vending machines, cash registers, digital photo frames, e-readers, and interactive kiosks.

The automobile displays segment is projected to hold the largest size of the embedded displays market in 2020. Growing demand for electric, hybrid, and semi-autonomous vehicles is expected to have a positive impact on the growth of the market for automobile embedded displays. Several automobile manufacturers are offering an enhanced driving experience to users and using digital automotive connectivity capabilities into their vehicles. This is expected to propel the demand for automobile displays used in digital instrument clusters, central stack systems, HUD, navigation systems, and rear-seat entertainment screens.

Based on type, touch display segment to register highest CAGR from 2020 to 2025

Based on type, the embedded display market has been segmented into touch and non-touch displays. Advancements in different films and filters for improving the performance of displays have fueled the demand for embedded displays from various sectors. Additionally, the increasing incorporation of touch-enabled LCD, OLED curved displays, or flexible displays in various embedded applications such as automotive dashboard displays, wearables, and medical monitors is expected to fuel the growth of touch displays.

Regional Insights:

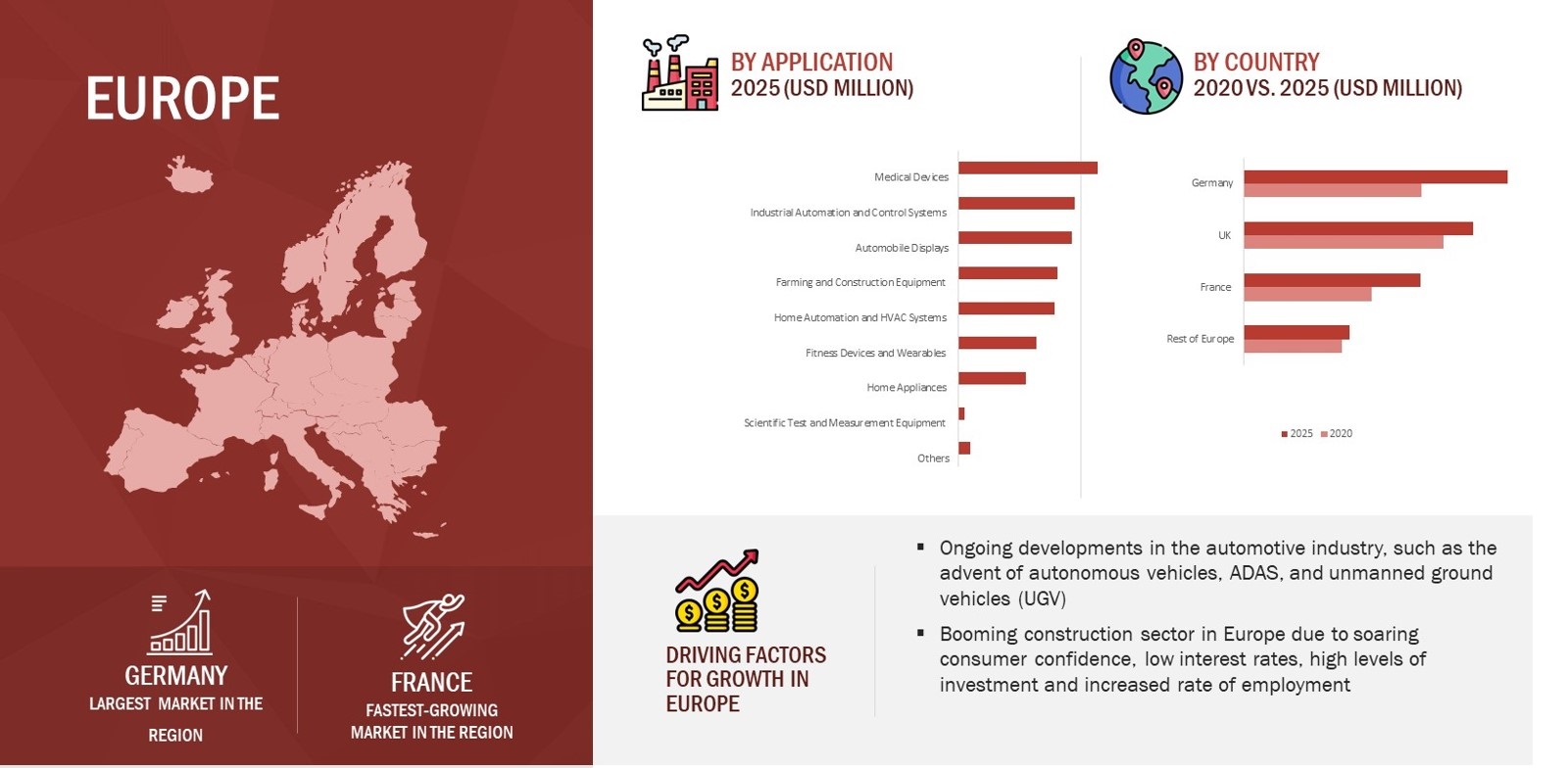

Europe to account for a significant market share during forecast period

Europe has been witnessing rapid industrialization for enhanced efficiency and improved productivity of its manufacturing facilities. Developed economies of the region, including Germany, France, and the UK, are well known business and manufacturing destinations and have witnessed increased factory automation, along with the adoption of smart, IoT-based technologies. This has led to growing penetration of IoT-connected devices and equipment such as smart robots, programmable logic controllers (PLC), HMI, and other industrial automation and control systems throughout Europe in automotive, electronics, aerospace and defense, and semiconductors industries.

The region is home to several leading automobile companies working on the development of advanced technologies such as autonomous driving vehicles, electric vehicles, and ADAS that are integrated with embedded processors for several applications. Europe also consists of well-known solution providers for the aerospace and defense verticals that develop aerospace and military equipment and devices for the government and the private sectors. These devices employ embedded displays for several applications based on their requirements and functionalities. Moreover, the construction sector in Europe is flourishing due to low-interest rates, high levels of investments, and increased employment rate. This is expected to fuel the demand for embedded displays used in various construction equipment for different applications.

Embedded Display Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The North America held the major share of the embedded display market in 2020

According to the United Nations, North America is the most urbanized region in the world with ~82% of its population living in urban areas. North America has also been at the forefront of technological innovations in the past few decades due to the presence of several global technological and digital firms and businesses in the region. The growing demand for automation of manufacturing and assembling, as well as supply chain operations in various industries, is expected to fuel the adoption of smart systems equipped with embedded displays in different applications.

The growth of the embedded display market in North America can also be attributed to the growing demand for smart homes and smart buildings leading to the development of smart cities in the region. Various initiatives undertaken by governments of different countries of the region have further fueled the development of smart cities in North America. Based on R&D activities and product innovation, the US can be regarded as a global leader in the embedded displays market. Growing research and development activities at the industry-level have increased the use of embedded display-equipped devices in healthcare, aerospace and defense, automotive, and industrial sectors of the country.

Key Market Players:

The key players in the embedded displays market include Avnet, Inc. (US), Planar Systems, Inc. (US), Emerging Display Technologies (EDT) (Taiwan), Microsoft Corporation (US), and Ansys (US). The key players have mainly used organic growth strategies such as product launches to strengthen their position in the embedded display market.

Avnet, Inc. is a global leader in technology solutions, with a strong global presence. The company manufactures and supplies LED displays, LCDs, OLED displays, Thin-Film-Transistor (TFT) modules, super-twisted nematic (STN) graphic modules, touchscreen displays, etc. The display solutions offered by Avnet, Inc. cater to the requirements of medical, transportation, retail, gaming, building automation, and industrial sectors. The company extensively focuses on product launches and developments to meet the demands of its broad customer base.

EDT is a leading manufacturer of visual display solutions and integrated touchscreen-based products. It provides solutions for medical, retail, industrial, building automation, and consumer-based applications. EDT has focused on organic growth strategies such as product launches and developments and inorganic growth strategies such as partnerships to increase its share in the embedded display market. The company has launched various display panels and modules for smart devices, medical devices, and industrial applications.

Scope of the Report

This report categorizes the embedded display market based on technology, type, device, and application at the regional and global level

- By Technology

- LCD

- LED

- OLED

- Others

- By Type

- Touch

- Non-touch

- By Device

- Portable Devices

- Fixed Devices

- By Application

- Automobile Displays

- Home Appliances

- Medical Devices

- Fitness Devices and Wearables

- Industrial Automation and Control Systems

- Home Automation and HVAC Systems

- Farming and Construction Equipment

- Scientific Test and Measurement Equipment

- Others

- By Region

- APAC

- North America

- Europe

- Middle East and Africa and South America

Embedded Display Market Highlights:

What’s new?

- Major developments that can change the business landscape as well as market forecasts

Some of the major developments significantly impacting the embedded display market include:

- The advancement of OLED technology

- Increased development and adoption of embedded and connected medical devices

- Growing demand for automation across various industries

- Addition/refinement in segmentation—Increase in depth or width of segmentation of the market

-

Embedded Display Market, by Technology

- LCD

- LED

- OLED

- Others

-

Embedded Displays Market, By Type

- Touch

- Non-touch

-

Embedded Display Market, by Device

- Portable Devices

- Fixed Devices

-

Embedded Displays Market, by Application

- Automobile Displays

- Medical Devices

- Farming and Construction Equipment

- Fitness Devices and Wearables

- Home Appliances

- Home Automation and HVAC Systems

- Industrial Automation and Control Systems

- Scientific Test and Measurement Systems

- Others

- Coverage of market players and providing ranking analysis of players of the embedded display market.

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the report, we have total 21 players (10 major, 11 Startups/SMEs). Moreover, ranking analysis of top 5 companies offering embedded display software has also been provided in the report.

- Financial information and product portfolios of players operating in the embedded display market.

Newer and improved representation of financial information: The report provides updated financial information for the embedded display market players till 2019 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment and investment on research and development activities.

- Market developments of the profiled players.

Recent Developments: Market developments such as partnerships, agreements, acquisitions, collaborations, expansions, and new product launches have been mapped for the years 2017 to 2020.

- Any new data points/analysis (frameworks) which was not present in the previous version of the report.

- The new study includes updated financial information for each listed company till 2019 in graphical representation, as well as information about their product portfolios. This is expected to help in the easy analysis of the present status of the profiled companies in terms of their financial strength, key revenue-generating regions/countries, and business segments.

- The new version of the report includes profiles of 16 additional companies.

- The new study includes updated market developments of the profiled players from January 2017 to June 2020 pertaining to the market.

- The new version includes the addition of 2 new market segments, namely, device and type. These segments have been analyzed in various regions and applications.

- The updated version of the report includes the increased number of data tables analyzed from the perspective of different segments, subsegments, and countries.

- The updated version of the report offers ecosystem mapping, technology analysis, average selling price trends, and case studies.

- The report includes a competitive analysis of 25 key players in the embedded display market. Vendors are placed into 4 categories, namely, visionary leaders, dynamic differentiators, innovators, and emerging companies based on their performance in various parameters.

Recent Developments

- In June 2020, Planar Systems announced updates for its TVF series LED video wall displays. The new 0.9-millimeter pixel-pitch model comes with improved power design and supports high-resolution video walls. The updated model delivers exceptional visual performance and has a simple installation and maintenance procedure.

- In June 2020, EDT announced a partnership with STMicroelectronics, a Switzerland-based semiconductor manufacturer. By becoming a new member of the ST Partner Program, the company aims to strengthen its global presence and develop agile solutions.

- In March 2020, Ansys partnered with Physical Optics Corporation (POC) for the development of avionics for military aircraft of the US. The SCADE simulation software solutions offered by the company are expected to enable POC to accelerate their product certification and development time at a low cost with reduced time-to-market.

- In April 2019, Microsoft announced the acquisition of Express Logic, a leader in RTOS for IoT and edge devices. This acquisition enabled Microsoft to increase its footprint to billions of connected endpoints and broaden the portfolio of devices that can connect to Azure, thereby enabling new intelligent capabilities. The ThreadX of Express Logic is complementary to Azure Sphere, thereby making it available as an option on Azure Sphere devices for real-time processing.

-

In December 2018, Avnet, Inc. launched SimplePlus display solution. It is a new customized touch development platform, which helps simplify the process of LCD touch display customization by shortening the product development cycles. This platform is configurable and is used for medical, automation, and transportation applications.

Key Benefits of the Report/Reason to Buy

- This report includes the market statistics pertaining to technology, type, device, application, and region segments of the embedded display market

- An in-depth value chain analysis has been done to provide deep insight into the embedded display market.

- Major market drivers, restraints, opportunities, and challenges have been detailed in this report.

- The report includes an in-depth analysis and ranking analysis of key players.

Target Audience

- Display module suppliers

- Display panel manufacturers

- System-on-a-chip (SoC) manufacturers

- Display component providers

- Embedded software providers

- System integrators

- Distributors and traders

- Suppliers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Frequently Asked Questions (FAQ):

What is the current size of the embedded display market?

The embedded display market is projected to grow from USD 17.5 billion in 2020 to USD 24.4 billion by 2025, at a CAGR of 6.9% from 2020 to 2025.

Who are the key players in the embedded display market?

Avnet, Inc. (US), Planar Systems, Inc. (US), Emerging Display Technologies (EDT) (Taiwan), Microsoft Corporation (US), and Ansys (US) are the key players in the embedded display market.

What are the factors driving the growth of the market?

Some of the major factors driving the market growth are:

- Advancements in embedded display interface technologies

- Accelerated adoption of automation in various industries

- Increased demand for interactive displays and digital signage

What are the factors impeding the growth of the market?

Some of the major challenges and restraints impeding the embedded display market growth include:

- Threat of security breaches in embedded hardware and complexities involved in the development of embedded software

- Deployment of widescreen displays

- Issues related to design of real-time embedded systems equipped with displays

What are the strategies adopted by market players to strengthen their position in the market?

Organic growth strategies such as product launches/developments, expansions, and inorganic growth strategies such as partnerships, acquisitions, collaborations, and agreements are the major strategies adopted by market players to strengthen their position in the market.

What are the major applications that are expected to provide opportunities for the adoption of embedded displays?

Automobile displays, medical devices, industrial automation and control systems, and farming and construction equipment are some of the major applications that are expected to provide ample growth opportunities for market players offering embedded display solutions.

Which technology is expected to dominate the embedded display market?

LCD is a widely used technology for developing embedded display-based devices. Currently, many end use industries mainly use LCD-based products. The reduction in manufacturing costs of LCDs is one of the major factors driving the extensive adoption of LCDs for developing embedded display-based solutions.

What are the major factors driving the embedded display market growth in Europe?

Some of the major factors driving the market growth for embedded displays in Europe include:

- Ongoing developments in the automotive industry, such as the advent of autonomous vehicles, ADAS, and unmanned ground vehicles (UGV)

- Booming construction sector in Europe due to soaring consumer confidence, low interest rates, high levels of investment and increased rate of employment

Embedded displays of what type are expected to be in demand in the next 5 years?

Touch displays are expected to witness an increased demand in the next 5 years. The increasing incorporation of touch-enabled LCD, OLED curved displays, or flexible displays in various embedded applications such as automotive dashboard displays, wearables, and medical monitors is expected to fuel the growth of touch displays.

Which country is expected to dominate the embedded display market in Europe?

Germany is expected to account for the largest share of the embedded display market in Europe from 2020 to 2025 and France is expected to register the highest CAGR in the European market from 2020 to 2025.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 GENERAL INCLUSIONS AND EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

1.2.3 EMBEDDED DISPLAY MARKET, BY TECHNOLOGY: INCLUSIONS AND EXCLUSIONS

1.2.4 EMBEDDED DISPLAYS MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGING SIZE

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

2.1.1 EMBEDDED DISPLAY MARKET: RESEARCH DESIGN

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primary interviews

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)—REVENUE GENERATED FROM SALES OF EMBEDDED DISPLAYS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION OF COMPANIES FROM SALES OF EMBEDDED DISPLAYS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4—BOTTOM-UP ESTIMATION OF SIZE OF EMBEDDED DISPLAYS MARKET, BY APPLICATION (AUTOMOBILE DISPLAYS)

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating market size using bottom-up approach (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size using top-down approach (supply side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3.1 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 8 COMPARISON OF SCENARIOS FOR EMBEDDED DISPLAY MARKET WITH RESPECT TO IMPACT OF COVID-19

3.1 PRE-COVID-19 SCENARIO

3.2 PESSIMISTIC SCENARIO (POST-COVID-19)

3.3 OPTIMISTIC SCENARIO (POST-COVID-19)

3.4 REALISTIC SCENARIO (POST-COVID-19)

FIGURE 9 OLED SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025 IN TERMS OF VALUE

FIGURE 10 PORTABLE DEVICES SEGMENT OF MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025 IN TERMS OF VALUE

FIGURE 11 AUTOMOBILE DISPLAYS SEGMENT TO ACCOUNT LARGEST SIZE OF MARKET IN 2025 IN TERMS OF VALUE

FIGURE 12 MARKET IN APAC TO GROW AT HIGHEST CAGR IN TERMS OF VALUE FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN EMBEDDED DISPLAY MARKET

FIGURE 13 INCREASING DEMAND FOR INTERACTIVE DISPLAYS OFFERING VISUALLY APPEALING EXPERIENCE TO USERS TO DRIVE MARKET GROWTH

4.2 MARKET, BY GEOGRAPHY

FIGURE 14 MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR IN TERMS OF VALUE FROM 2020 TO 2025

4.3 EMBEDDED DISPLAYS MARKET, BY TYPE

FIGURE 15 NON-TOUCH SEGMENT TO ACCOUNT FOR LARGE SHARE OF MARKET IN TERMS OF VALUE IN 2025

4.4 MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

FIGURE 16 AUTOMOBILE DISPLAYS AND US TO ACCOUNT FOR LARGEST SHARES OF MARKET IN NORTH AMERICA IN 2025 IN TERMS OF VALUE

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 EMBEDDED DISPLAY MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Advancements in embedded display interface technologies

5.2.1.2 Accelerated adoption of automation in different industries owing to COVID-19

FIGURE 18 COMPARISON OF ANNUAL GROWTH RATE AND BASELINE GROWTH TO PROJECT ABSORPTION OF ARTIFICIAL INTELLIGENCE IN ECONOMIC GROWTH OF DIFFERENT COUNTRIES BY 2035

FIGURE 19 M2M CONNECTIONS, 2018–2023 (IN BILLION)

5.2.1.3 Increased demand for interactive displays and digital signage

FIGURE 20 EMBEDDED DISPLAYS MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Threat of security breaches in embedded hardware and complexities involved in development of embedded software

5.2.2.2 Deployment of widescreen displays

FIGURE 21 MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increased adoption of gaming consoles owing to COVID-19

FIGURE 22 PROJECTED GROWTH OF GLOBAL ESPORTS CONSUMERS BY 2023

5.2.3.2 Surged adoption of smart wearables and personal home fitness equipment as result of COVID-19

5.2.3.3 Growth in demand for 3D display systems used in different applications

5.2.3.4 Increased adoption of embedded connected medical devices in wake of COVID-19

FIGURE 23 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Slow growth of global automotive industry resulting from spread of COVID-19

5.2.4.2 Issues related to design of real-time embedded systems equipped with displays

FIGURE 24 EMBEDDED DISPLAY CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS OF EMBEDDED DISPLAYS MARKET

5.4 ECOSYSTEM

FIGURE 26 ECOSYSTEM VIEW

5.5 AVERAGE SELLING PRICE TRENDS

FIGURE 27 AVERAGE SELLING PRICE TRENDS FOR VARIOUS DISPLAY TECHNOLOGIES FROM 2016 TO 2025

5.6 TECHNOLOGY ANALYSIS

5.6.1 OLED TECHNOLOGY

TABLE 1 COMPARISON OF OLED TECHNOLOGY WITH OTHER TECHNOLOGIES

5.7 CASE STUDIES

5.7.1 DEPLOYMENT OF DISPLAY TECHNOLOGY AT OHSU KNIGHT CANCER RESEARCH BUILDING

5.7.2 ADVANCED DATA VISUALIZATION AT TORONTO RAPTORS BIOSTEEL CENTER

6 EMBEDDED DISPLAY MARKET, BY TECHNOLOGY (Page No. - 75)

6.1 INTRODUCTION

FIGURE 28 OLED SEGMENT OF EMBEDDED DISPLAYS MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 2 MARKET, BY TECHNOLOGY, 2016–2019 (USD BILLION)

TABLE 3 MARKET, BY TECHNOLOGY, 2020–2025 (USD BILLION)

TABLE 4 MARKET, BY TECHNOLOGY, 2016–2019 (MILLION UNITS)

TABLE 5 MARKET, BY TECHNOLOGY, 2020–2025 (MILLION UNITS)

6.2 LCD

6.2.1 LOW COST, LIGHTWEIGHT, HIGH SCALABILITY, AND LOW POWER CONSUMPTION LEAD TO INCREASED GLOBAL DEMAND FOR LCD

6.3 LED

6.3.1 PREFERENCE OF LED DISPLAYS FOR OUTDOOR APPLICATIONS OWING TO THEIR BRIGHTNESS

6.4 OLED

6.4.1 OLED DISPLAYS ARE THIN, TRANSPARENT, AND DURABLE WITH LOW POWER CONSUMPTION

6.5 OTHERS

7 EMBEDDED DISPLAY MARKET, BY TYPE (Page No. - 81)

7.1 INTRODUCTION

FIGURE 29 TOUCH SEGMENT OF EMBEDDED DISPLAYS MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

TABLE 6 MARKET, BY TYPE, 2016–2019 (USD BILLION)

TABLE 7 MARKET, BY TYPE, 2020–2025 (USD BILLION)

TABLE 8 MARKET, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 9 MARKET, BY TYPE, 2020–2025 (MILLION UNITS)

7.2 TOUCH DISPLAYS

7.2.1 GROWING INTERACTION BETWEEN PEOPLE AND MACHINES EQUIPPED WITH EMBEDDED SYSTEMS LEADING TO RISE IN DEMAND FOR TOUCH DISPLAYS

7.3 NON-TOUCH DISPLAYS

7.3.1 INCREASING DEMAND FOR NON-TOUCH INTERFACES IN LARGE-FORMAT DISPLAYS TO DRIVE THEIR DEMAND GLOBALLY

8 EMBEDDED DISPLAY MARKET, BY DEVICE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 30 PORTABLE DEVICES SEGMENT OF EMBEDDED DISPLAYS MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

TABLE 10 MARKET, BY DEVICE, 2016–2019 (USD BILLION)

TABLE 11 MARKET, BY DEVICE, 2020–2025 (USD BILLION)

TABLE 12 MARKET, BY DEVICE, 2016–2019 (MILLION UNITS)

TABLE 13 MARKET, BY DEVICE, 2020–2025 (MILLION UNITS)

8.2 PORTABLE DEVICES

8.2.1 INCREASING COMMERCIALIZATION OF IOT TO CONTRIBUTE TO DEMAND FOR PORTABLE EMBEDDED DEVICES

TABLE 14 EMBEDDED DISPLAYS MARKET FOR PORTABLE DEVICES, BY TYPE, 2016–2019 (USD BILLION)

TABLE 15 MARKET FOR PORTABLE DEVICES, BY TYPE, 2020–2025 (USD BILLION)

TABLE 16 MARKET FOR PORTABLE DEVICES, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 17 MARKET FOR PORTABLE DEVICES, BY TYPE, 2020–2025 (MILLION UNITS)

8.3 FIXED DEVICES

8.3.1 SURGING USE OF LARGE-SCREEN FIXED DISPLAY SYSTEMS WITH SEVERAL MULTI-TOUCH DISPLAY SCREENS TO FUEL DEMAND FOR FIXED DEVICES

TABLE 18 MARKET FOR FIXED DEVICES, BY TYPE, 2016–2019 (USD BILLION)

TABLE 19 MARKET FOR FIXED DEVICES, BY TYPE, 2020–2025 (USD BILLION)

TABLE 20 MARKET FOR FIXED DEVICES, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 21 MARKET FOR FIXED DEVICES, BY TYPE, 2020–2025 (MILLION UNITS)

9 EMBEDDED DISPLAY MARKET, BY APPLICATION (Page No. - 91)

9.1 INTRODUCTION

FIGURE 31 AUTOMOBILE DISPLAYS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF EMBEDDED DISPLAYS MARKET FROM 2020 TO 2025

TABLE 22 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 23 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 24 MARKET, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 25 MARKET, BY APPLICATION, 2020–2025 (MILLION UNITS)

9.2 AUTOMOBILE DISPLAYS

9.2.1 SURGING DEMAND FOR ADVANCED TECHNOLOGIES FROM CONSUMERS TO ENHANCE THEIR DRIVING EXPERIENCE AND ENSURE THEIR SAFETY

TABLE 26 MARKET FOR AUTOMOBILE DISPLAYS, BY DEVICE, 2016–2019 (USD MILLION)

TABLE 27 EMBEDDED DISPLAYS MARKET FOR AUTOMOBILE DISPLAYS, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 28 MARKET FOR AUTOMOBILE DISPLAYS, BY DEVICE, 2016–2019 (MILLION UNITS)

TABLE 29 MARKET FOR AUTOMOBILE DISPLAYS, BY DEVICE, 2020–2025 (MILLION UNITS)

TABLE 30 MARKET FOR AUTOMOBILE DISPLAYS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 31 MARKET FOR AUTOMOBILE DISPLAYS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 32 EMBEDDED DISPLAY MARKET FOR AUTOMOBILE DISPLAYS, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 33 MARKET FOR AUTOMOBILE DISPLAYS, BY TYPE, 2020–2025 (MILLION UNITS)

TABLE 34 MARKET FOR AUTOMOBILE DISPLAYS, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 MARKET FOR AUTOMOBILE DISPLAYS, BY REGION, 2020–2025 (USD MILLION)

TABLE 36 MARKET FOR AUTOMOBILE DISPLAYS, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 37 MARKET FOR AUTOMOBILE DISPLAYS, BY REGION, 2020–2025 (MILLION UNITS)

9.3 FARMING AND CONSTRUCTION EQUIPMENT

9.3.1 RISING ADOPTION OF IOT-BASED INTELLIGENT FIELD MONITORING SYSTEMS AND AUTONOMOUS FARM EQUIPMENT WITH EMBEDDED DISPLAYS

TABLE 38 MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY DEVICE, 2016–2019 (USD MILLION)

TABLE 39 EMBEDDED DISPLAYS MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 40 MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY DEVICE, 2016–2019 (MILLION UNITS)

TABLE 41 MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY DEVICE, 2020–2025 (MILLION UNITS)

TABLE 42 MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY TYPE, 2016–2019 (USD MILLION)

TABLE 43 MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 44 EMBEDDED DISPLAYS MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 45 MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY TYPE, 2020–2025 (MILLION UNITS)

TABLE 46 MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY REGION, 2020–2025 (USD MILLION)

TABLE 48 MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 49 MARKET FOR FARMING AND CONSTRUCTION EQUIPMENT, BY REGION, 2020–2025 (MILLION UNITS)

9.4 FITNESS DEVICES AND WEARABLES

9.4.1 INCREASING DEMAND FOR WEARABLES EQUIPPED WITH EMBEDDED OLED DISPLAYS IN FORM OF SMARTWATCHES AND FITNESS TRACKERS

TABLE 50 MARKET FOR FITNESS DEVICES AND WEARABLES, BY DEVICE, 2016–2019 (USD MILLION)

TABLE 51 EMBEDDED DISPLAYS MARKET FOR FITNESS DEVICES AND WEARABLES, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 52 MARKET FOR FITNESS DEVICES AND WEARABLES, BY DEVICE, 2016–2019 (MILLION UNITS)

TABLE 53 MARKET FOR FITNESS DEVICES AND WEARABLES, BY DEVICE, 2020–2025 (MILLION UNITS)

TABLE 54 MARKET FOR FITNESS DEVICES AND WEARABLES, BY TYPE, 2016–2019 (USD MILLION)

TABLE 55 MARKET FOR FITNESS DEVICES AND WEARABLES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 56 MARKET FOR FITNESS DEVICES AND WEARABLES, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 57 EMBEDDED DISPLAY MARKET FOR FITNESS DEVICES AND WEARABLES, BY TYPE, 2020–2025 (MILLION UNITS)

TABLE 58 MARKET FOR FITNESS DEVICES AND WEARABLES, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 MARKET FOR FITNESS DEVICES AND WEARABLES, BY REGION, 2020–2025 (USD MILLION)

TABLE 60 MARKET FOR FITNESS DEVICES AND WEARABLES, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 61 MARKET FOR FITNESS DEVICES AND WEARABLES, BY REGION, 2020–2025 (MILLION UNITS)

9.5 HOME APPLIANCES

9.5.1 SURGING DEMAND FOR EMBEDDED DISPLAYS WITH COLORFUL INTERFACE DESIGNS FOR USE IN HOUSEHOLD APPLIANCES

TABLE 62 MARKET FOR HOME APPLIANCES, BY DEVICE, 2016–2019 (USD MILLION)

TABLE 63 EMBEDDED DISPLAYS MARKET FOR HOME APPLIANCES, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 64 MARKET FOR HOME APPLIANCES, BY DEVICE, 2016–2019 (MILLION UNITS)

TABLE 65 MARKET FOR HOME APPLIANCES, BY DEVICE, 2020–2025 (MILLION UNITS)

TABLE 66 MARKET FOR HOME APPLIANCES, BY TYPE, 2016–2019 (USD MILLION)

TABLE 67 MARKET FOR HOME APPLIANCES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 68 MARKET FOR HOME APPLIANCES, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 69 EMBEDDED DISPLAYS MARKET FOR HOME APPLIANCES, BY TYPE, 2020–2025 (MILLION UNITS)

TABLE 70 MARKET FOR HOME APPLIANCES, BY REGION, 2016–2019 (USD MILLION)

TABLE 71 MARKET FOR HOME APPLIANCES, BY REGION, 2020–2025 (USD MILLION)

TABLE 72 MARKET FOR HOME APPLIANCES, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 73 MARKET FOR HOME APPLIANCES, BY REGION, 2020–2025 (MILLION UNITS)

9.6 MEDICAL DEVICES

9.6.1 SURGING ADOPTION OF PORTABLE MEDICAL DEVICES TO CONTRIBUTE TO GROWTH OF MARKET

TABLE 74 EMBEDDED DISPLAYS MARKET FOR MEDICAL DEVICES, BY DEVICE, 2016–2019 (USD MILLION)

TABLE 75 MARKET FOR MEDICAL DEVICES, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 76 MARKET FOR MEDICAL DEVICES, BY DEVICE, 2016–2019 (MILLION UNITS)

TABLE 77 MARKET FOR MEDICAL DEVICES, BY DEVICE, 2020–2025 (MILLION UNITS)

TABLE 78 MARKET FOR MEDICAL DEVICES, BY TYPE, 2016–2019 (USD MILLION)

TABLE 79 MARKET FOR MEDICAL DEVICES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 80 EMBEDDED DISPLAY MARKET FOR MEDICAL DEVICES, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 81 MARKET FOR MEDICAL DEVICES, BY TYPE, 2020–2025 (MILLION UNITS)

TABLE 82 MARKET FOR MEDICAL DEVICES, BY REGION, 2016–2019 (USD MILLION)

TABLE 83 MARKET FOR MEDICAL DEVICES, BY REGION, 2020–2025 (USD MILLION)

TABLE 84 MARKET FOR MEDICAL DEVICES, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 85 MARKET FOR MEDICAL DEVICES, BY REGION, 2020–2025 (MILLION UNITS)

9.7 HOME AUTOMATION AND HVAC SYSTEMS

9.7.1 INCREASING USE OF BUILDING AUTOMATION PRODUCTS TO CONTRIBUTE TO GROWTH OF MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS

TABLE 86 MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY DEVICE, 2016–2019 (USD MILLION)

TABLE 87 EMBEDDED DISPLAYS MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 88 MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY DEVICE, 2016–2019 (MILLION UNITS)

TABLE 89 MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY DEVICE, 2020–2025 (MILLION UNITS)

TABLE 90 MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 91 EMBEDDED DISPLAY MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 92 MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 93 MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY TYPE, 2020–2025 (MILLION UNITS)

TABLE 94 MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY REGION, 2016–2019 (USD MILLION)

TABLE 95 MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY REGION, 2020–2025 (USD MILLION)

TABLE 96 MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 97 MARKET FOR HOME AUTOMATION AND HVAC SYSTEMS, BY REGION, 2020–2025 (MILLION UNITS)

9.8 INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS

9.8.1 INCREASING PENETRATION OF MODULAR AND PORTABLE HMI WITH TOUCH INTERFACES IN DIFFERENT INDUSTRIES FOR THEIR AUTOMATION

TABLE 98 MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY DEVICE, 2016–2019 (USD MILLION)

TABLE 99 EMBEDDED DISPLAYS MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 100 MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY DEVICE, 2016–2019 (MILLION UNITS)

TABLE 101 MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY DEVICE, 2020–2025 (MILLION UNITS)

TABLE 102 MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 103 MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 104 EMBEDDED DISPLAY MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 105 MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY TYPE, 2020–2025 (MILLION UNITS)

TABLE 106 MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY REGION, 2016–2019 (USD MILLION)

TABLE 107 MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY REGION, 2020–2025 (USD MILLION)

TABLE 108 MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 109 MARKET FOR INDUSTRIAL AUTOMATION AND CONTROL SYSTEMS, BY REGION, 2020–2025 (MILLION UNITS)

9.9 SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT

9.9.1 ONGOING PENETRATION OF IOT TECHNOLOGY IN VARIOUS SECTORS TO FUEL GROWTH OF SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT SEGMENT OF MARKET

TABLE 110 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY DEVICE, 2016–2019 (USD MILLION)

TABLE 111 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 112 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY DEVICE, 2016–2019 (MILLION UNITS)

TABLE 113 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY DEVICE, 2020–2025 (MILLION UNITS)

TABLE 114 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY TYPE, 2016–2019 (USD MILLION)

TABLE 115 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 116 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 117 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY TYPE, 2020–2025 (MILLION UNITS)

TABLE 118 EMBEDDED DISPLAY MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY REGION, 2016–2019 (USD MILLION)

TABLE 119 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY REGION, 2020–2025 (USD MILLION)

TABLE 120 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 121 MARKET FOR SCIENTIFIC TEST AND MEASUREMENT EQUIPMENT, BY REGION, 2020–2025 (MILLION UNITS)

9.1 OTHERS

TABLE 122 MARKET FOR OTHER APPLICATIONS, BY DEVICE, 2016–2019 (USD MILLION)

TABLE 123 MARKET FOR OTHER APPLICATIONS, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 124 MARKET FOR OTHER APPLICATIONS, BY DEVICE, 2016–2019 (MILLION UNITS)

TABLE 125 MARKET FOR OTHER APPLICATIONS, BY DEVICE, 2020–2025 (MILLION UNITS)

TABLE 126 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 127 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 128 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 129 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2020–2025 (MILLION UNITS)

TABLE 130 MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 131 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 132 MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 133 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (MILLION UNITS)

9.11 MOST NEGATIVELY IMPACTED APPLICATION SEGMENT OF EMBEDDED DISPLAY MARKET BY COVID-19

9.11.1 AUTOMOBILE DISPLAYS

FIGURE 32 PRE- AND POST-COVID-19 COMPARISON OF MARKET FOR AUTOMOBILE DISPLAYS

TABLE 134 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS OF MARKET FOR AUTOMOBILE DISPLAYS, 2016–2025 (USD MILLION)

9.11.1.1 Impact analysis

9.12 LEAST IMPACTED APPLICATION SEGMENT OF MARKET BY COVID-19

9.12.1 FITNESS DEVICES AND WEARABLES

FIGURE 33 PRE- AND POST-COVID-19 COMPARISON OF MARKET FOR FITNESS DEVICES AND WEARABLES

TABLE 135 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS OF MARKET FOR FITNESS DEVICES AND WEARABLES, 2016–2025 (USD MILLION)

9.12.1.1 Impact analysis

10 GEOGRAPHIC ANALYSIS (Page No. - 133)

10.1 INTRODUCTION

FIGURE 34 MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 136 MARKET, BY REGION, 2016–2019 (USD BILLION)

TABLE 137 EMBEDDED DISPLAY MARKET, BY REGION, 2020–2025 (USD BILLION)

TABLE 138 MARKET, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 139 MARKET, BY REGION, 2020–2025 (MILLION UNITS)

10.2 NORTH AMERICA

FIGURE 35 SNAPSHOT OF MARKET IN NORTH AMERICA

TABLE 140 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 141 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 142 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (MILLION UNITS)

TABLE 143 EMBEDDED DISPLAYS MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (MILLION UNITS)

10.2.1 US

10.2.1.1 Increasing demand for embedded displays used in smart devices required for home automation in US

10.2.2 CANADA

10.2.2.1 Rising adoption of embedded display-equipped medical devices and related technologies in vertically-integrated healthcare industry of Canada

10.2.3 MEXICO

10.2.3.1 Surging adoption of smart farming equipment incorporated with embedded displays in Mexico

10.2.4 IMPACT OF COVID-19 ON NORTH AMERICA

10.2.4.1 Imposing of partial shutdowns in manufacturing facilities and offices in North America owing to COVID-19 impacted growth of several businesses

FIGURE 36 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIOS FOR MARKET IN NORTH AMERICA, 2016–2025 (USD MILLION)

TABLE 144 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIOS FOR EMBEDDED DISPLAY MARKET IN NORTH AMERICA, 2016–2025 (USD MILLION)

10.2.4.2 Impact of COVID-19 on US

10.2.4.3 Impact of COVID-19 on Canada

10.2.4.4 Impact of COVID-19 on Mexico

10.3 EUROPE

FIGURE 37 SNAPSHOT OF EMBEDDED DISPLAYS MARKET IN EUROPE

TABLE 145 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 146 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 147 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (MILLION UNITS)

TABLE 148 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (MILLION UNITS)

10.3.1 GERMANY

10.3.1.1 Growing electric mobility sector in Germany to spur growth of market for embedded displays

10.3.2 FRANCE

10.3.2.1 Surging adoption of smart meters and other energy monitoring systems equipped with embedded displays in France

10.3.3 UK

10.3.3.1 Rising demand for electric and hybrid vehicles equipped with embedded displays in UK

10.3.4 REST OF EUROPE

10.3.5 IMPACT OF COVID-19 ON EUROPE

10.3.5.1 Falling demand for automobiles in Europe owing to COVID-19 impacted growth of market in region

FIGURE 38 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIOS FOR MARKET IN EUROPE, 2016–2025 (USD MILLION)

TABLE 149 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIOS FOR MARKET IN EUROPE, 2016–2025 (USD MILLION)

10.3.5.2 Impact of COVID-19 on Germany

10.3.5.3 Impact of COVID-19 on France

10.3.5.4 Impact of COVID-19 on UK

10.3.5.5 Impact of COVID-19 on Rest of Europe

10.4 APAC

FIGURE 39 SNAPSHOT OF EMBEDDED DISPLAY MARKET IN APAC

TABLE 150 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 151 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 152 MARKET IN APAC, BY COUNTRY, 2016–2019 (MILLION UNITS)

TABLE 153 MARKET IN APAC, BY COUNTRY, 2020–2025 (MILLION UNITS)

10.4.1 CHINA

10.4.1.1 Surging demand for autonomous driving technology in China to fuel growth of market for embedded displays

10.4.2 JAPAN

10.4.2.1 Increasing shipments of white goods from Japan contributing to growth of embedded display market in country

10.4.3 SOUTH KOREA

10.4.3.1 Growing demand for embedded displays owing to presence of various global electronics companies in South Korea

10.4.4 INDIA

10.4.4.1 Increasing number of initiatives being taken in India for digitalization and automation of different industries

10.4.5 REST OF APAC

10.4.6 IMPACT OF COVID-19 ON APAC

10.4.6.1 Declining shipments of consumer electronics, automobiles, and other industrial equipment and devices in APAC

FIGURE 40 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIOS FOR MARKET IN APAC, 2016–2025 (USD MILLION)

TABLE 154 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIOS FOR MARKET IN APAC, 2016–2025 (USD MILLION)

10.4.6.2 Impact of COVID-19 on China

10.4.6.3 Impact of COVID-19 on Japan

10.4.6.4 Impact of COVID-19 on South Korea

10.4.6.5 Impact of COVID-19 on India

10.4.6.6 Impact of COVID-19 on Rest of APAC

10.5 REST OF THE WORLD (R0W)

TABLE 155 EMBEDDED DISPLAY MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 156 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 157 MARKET IN ROW, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 158 MARKET IN ROW, BY REGION, 2020–2025 (MILLION UNITS)

10.5.1 MIDDLE EAST AND AFRICA (MEA)

10.5.1.1 Flourishing retail, corporate, and industrial sectors in Middle East and Africa to drive demand for embedded displays in region

10.5.2 SOUTH AMERICA

10.5.2.1 Surging adoption of smart farming practices and autonomous farming equipment in South America

10.5.3 IMPACT OF COVID-19 ON ROW

10.5.3.1 Tumbling economic growth of RoW owing to COVID-19

FIGURE 41 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIOS FOR MARKET IN ROW, 2016–2025 (USD MILLION)

TABLE 159 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIOS FOR MARKET IN ROW, 2016–2025 (USD MILLION)

10.5.3.2 Impact of COVID-19 on Middle East and Africa

10.5.3.3 Impact of COVID-19 on South America

11 COMPETITIVE LANDSCAPE (Page No. - 165)

11.1 OVERVIEW

FIGURE 42 COMPANIES ADOPTED PRODUCT DEVELOPMENTS AND LAUNCHES AS KEY GROWTH STRATEGIES FROM JANUARY 2017 TO JUNE 2020

11.2 KEY PLAYERS IN EMBEDDED DISPLAY MARKET

FIGURE 43 MARKET: COMPANY SHARE ANALYSIS FOR HARDWARE IN 2019

TABLE 160 MARKET: COMPANY RANKING ANALYSIS FOR EMBEDDED SOFTWARE IN 2019

11.3 COMPETITIVE LEADERSHIP MAPPING (COMPANY EVALUATION MATRIX)

FIGURE 44 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11.3.1 VISIONARY LEADERS

11.3.2 DYNAMIC DIFFERENTIATORS

11.3.3 INNOVATORS

11.3.4 EMERGING COMPANIES

11.4 COMPETITIVE BENCHMARKING

11.4.1 STRENGTH OF PRODUCT PORTFOLIOS (FOR 25 COMPANIES)

11.4.2 BUSINESS STRATEGY EXCELLENCE (FOR 25 COMPANIES)

11.5 COMPETITIVE SCENARIO

11.5.1 PRODUCT DEVELOPMENTS AND LAUNCHES

TABLE 161 TOP 10 PRODUCT DEVELOPMENTS AND LAUNCHES, JANUARY 2017–JUNE 2020

11.5.2 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

TABLE 162 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS, JANUARY 2017–JUNE 2020

11.5.3 ACQUISITIONS AND EXPANSIONS

TABLE 163 ACQUISITIONS AND EXPANSIONS, JANUARY 2017–JUNE 2020

12 COMPANY PROFILES (Page No. - 179)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business overview, Products & solutions offered, Recent Developments, COVID-19 related developments, SWOT Analysis, MNM view)*

12.2.1 AVNET, INC.

FIGURE 45 AVNET, INC.: COMPANY SNAPSHOT

12.2.2 PLANAR SYSTEMS, INC.

12.2.3 EMERGING DISPLAY TECHNOLOGIES

FIGURE 46 EDT: COMPANY SNAPSHOT

12.2.4 MICROSOFT CORPORATION

FIGURE 47 MICROSOFT CORPORATION: COMPANY SNAPSHOT

12.2.5 ANSYS

FIGURE 48 ANSYS: COMPANY SNAPSHOT

12.2.6 ANDERS ELECTRONICS (ANDERDX)

12.2.7 WINSTAR DISPLAY

12.2.8 ALTIA

12.2.9 GREEN HILLS SOFTWARE

12.2.10 INTEL CORPORATION

FIGURE 49 INTEL: COMPANY SNAPSHOT

*Details on Business overview, Products & solutions offered, Recent Developments, COVID-19 related developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

12.3 RIGHT-TO-WIN

12.4 OTHER COMPANIES

12.4.1 DENSITRON TECHNOLOGIES

12.4.2 MULTITACTION

12.4.3 RIGHTWARE

12.4.4 SOCIONEXT INC.

12.4.5 QT GROUP

12.4.6 UNITY TECHNOLOGIES

12.4.7 REACH TECHNOLOGY

12.4.8 NTX EMBEDDED

12.4.9 ADVANTECH

12.4.10 DELTA DISPLAY

12.4.11 VITEK DISPLAY CO. LTD

13 APPENDIX (Page No. - 221)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

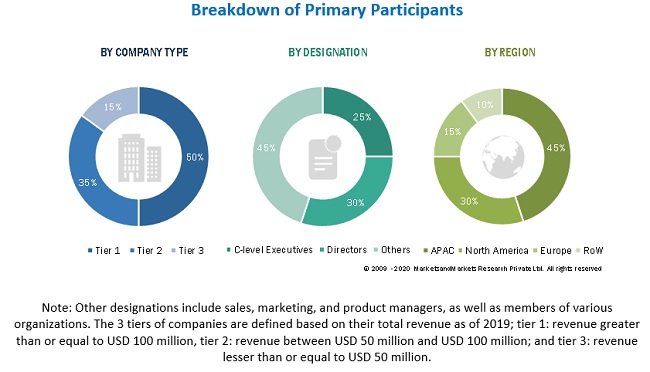

The study involved four major activities for estimating the size of the embedded display market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the embedded display market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the embedded display market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. The secondary research referred to for this research study involve display industry organizations such as OLED Association, Taiwan Display Union Association (TDUA), and European Imaging and Sound Association (EISA). Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the embedded display market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the embedded display market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, APAC, and Middle East and Africa (MEA) and South America. The demand side of this market is characterized by display component companies and manufacturers. The supply side is characterized by OSAT companies, IDM firms, and OEM firms. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of embedded display market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the embedded display market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to embedded display market including key OEMs, IDMs, and Tier I suppliers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the embedded display market.

Report Objectives

- To describe, segment, and forecast the overall size of the embedded display market based on technology, type, device, application, and region

- To describe, analyze, and forecast the market size for various segments with regard to 3 main regions—Asia Pacific (APAC), North America, Europe, and Middle East, and Africa (MEA) and South America

- To analyze and forecast the market size, in terms of volume (000’/million units) and value (USD million/billion), for the embedded display market

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To briefly describe the embedded display value chain

- To segment and forecast the embedded display market size by technology (LCD, LED, OLED)

- To segment and forecast the embedded display market size by type (touch and non-touch)

- To segment and forecast the embedded display market size by device (portable devices and fixed devices)

- To segment and forecast the embedded display market size for key applications (automobile displays, home appliances, medical devices, fitness devices and wearables, industrial automation and control systems, home automation and HVAC systems, farming and construction equipment, scientific test and measurement equipment)

- To forecast the embedded display market size in key regions, namely, North America, Asia Pacific (APAC), Europe, and the Middle East, and Africa (MEA) and South America

- To analyze competitive developments such as product launches and developments, partnerships, collaborations, acquisitions, joint ventures, expansions, and research and development (R&D) activities in the embedded display market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of embedded display market

- Estimation of the market size of the technology segments of the embedded display market based on different subsegments

Growth opportunities and latent adjacency in Embedded Display Market