The research report includes four major activities, estimating the size of the display market. Secondary research has been done to gather important information about the market and peer markets. To validate the findings, assumptions, and sizing with the primary research with industry experts across the supply chain is the next step. Both bottom-up and top-down approaches have been used to estimate the market size. After this, the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments

Secondary Research

In the secondary analysis, several secondary variables were examined to collect relevant data for this study. This source also included company filings such as annual reports, investor presentations, press releases and financial statements, marketing, management and professional association data in addition to trade journals based on area of ??application, white papers, accredited publications, articles by accredited experts, references and databases.

The primary objective of the secondary research is to gain critical insights into the supply chain, market capitalization and the broad geography of the key industry players. It also facilitated the segmentation of the market according to prevailing industry trends, reaching down to granular levels. Moreover, it involved the analysis of geographic markets and significant developments from both market and technology perspectives. The secondary data underwent meticulous collection and analysis to ascertain the overall market size, which was subsequently validated through primary research.

Primary Research

During the primary research analysis, numerous primary sources were used to gather qualitative and quantitative insights for this record, encompassing each of the supply and demand sides. On the supply side, primary source include industry experts along with chief executive officers (CEOs), vice presidents, advertising administrators, technology and innovation directors, subject matter experts (SMEs), consultants, and different key executives from distinguished groups and organizations operating inside the show market.

Following a rigorous market engineering system, which entailed calculations for marketplace records, breakdowns, size estimations, forecasting, and facts triangulation, big primary studies became conducted to collect, verify, and validate critical numerical records.

This primary research aimed to identify segmentation types, industry trends, key players, competitive landscapes, and key market dynamics such as drivers, restraints, opportunities, and challenges. Additionally, it pursued understanding the key strategies adopted by market players.

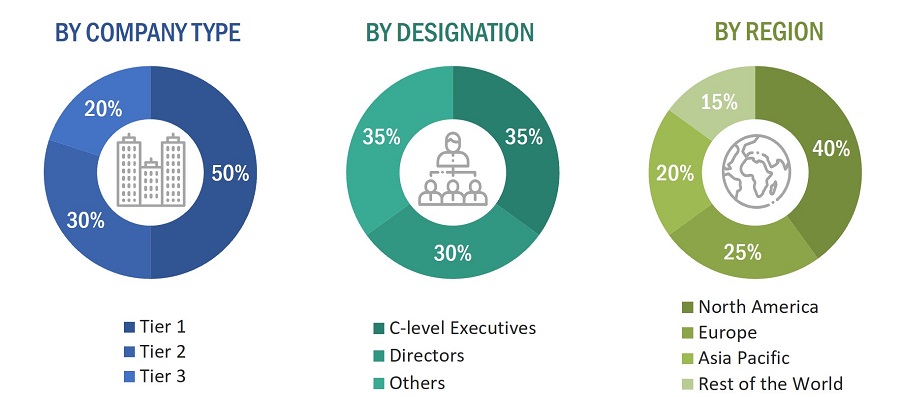

Drawing upon insights garnered from secondary research on the display market, a thorough primary research effort was undertaken. Multiple primary interviews were conducted with experts from both the demand and supply sides across four key regions: North America, Europe, Asia Pacific, and ROW (Middle East, South America, and Africa). Approximately 25% of the primary interviews were conducted with representatives from the demand side, while 75% was with those from the supply side. Primary data collection was executed through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report employed both top-down and bottom-up methodologies to evaluate and validate the size of the display market and its related submarkets. Key players in the display sector were identified through secondary research, while their market share in specific regions was determined through a blend of primary and secondary research. A comprehensive research approach includes reviewing annual financial reports by business leaders and interviewing key stakeholders, such as the CEO, VPS. directors, and marketing managers, to gather both quantitative and qualitative insights. Percentage shares, differences, and divergences were taken from secondary reference data and cross-checked with the primary reference data.

All potential market influencers were examined through primary research and analyzed to compile the final quantitative and qualitative dataset. This data was consolidated and enriched with extensive analysis from MarketsandMarkets. The following figures illustrate the methodology utilized to estimate the overall market size for this study.

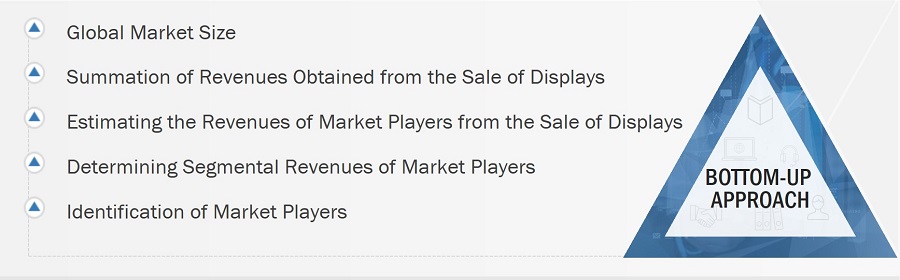

Market Size Estimation Methodology-Bottom-up Approach

The overall size of the display market was obtained using a bottom-up approach, which includes calculation of the market size on the basis of revenue generated by different companies and their market share. A thorough examination of key players in the display market was observed, and market size estimations were considered by the size of their display offerings.

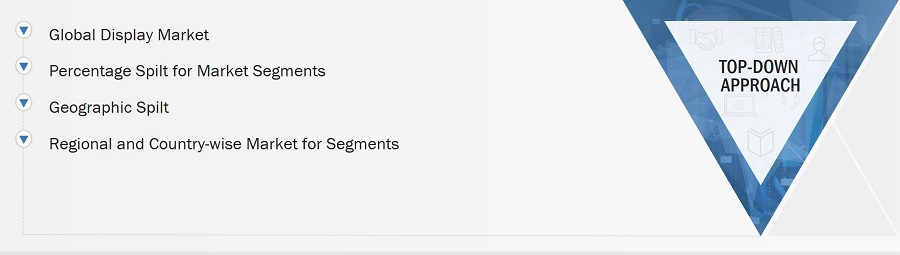

Market Size Estimation Methodology-Top-Down Approach

The top-down methodology utilized the overall market size as the foundation for determining individual market sizes, following the market segmentation with percentage allocations derived from primary and secondary research. To calculate specific market segment sizes, the immediate parent market size was utilized in applying the top-down approach. furthermore, the bottom-up approach was conducted to validate segment sizes using data obtained from secondary research sources. Company market share estimates were utilized to confirm revenue distributions previously used in the bottom-up approach. Through a data triangulation process and validation via primary research sources, this study conclusively determined and confirmed both the overall parent market size and the size of each individual market segment.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation was employed to complete the market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using the top-down and bottom-up approaches.

Market Definition

A display is an output device that provides pictorial, textual, or graphical information. Display panels are used in devices such as digital signage, televisions (TVs), smartphones, personal computers (PCs), and wearables like smartwatches, AR HMDs, VR HMDs and others. Fixed and flexible panels are the major types of panels which utilize different technologies, such as LCDs, OLED, micro-LED, direct-view LED, quantum dot display and others

Key Stakeholders

-

Display Panel Manufacturers

-

Semiconductor Component Suppliers/Foundries

-

Display Material and Component Suppliers

-

Manufacturing Equipment Suppliers

-

System Integrators/OSAT

-

Technology/IP Developers

-

Consulting and Market Research Service Providers

-

Display and Material-related Associations, Organizations, Forums, and Alliances

-

Venture Capitalists and Startups

-

Research and Educational Institutes

-

Distributors and Resellers

-

End Users

The main objectives of this study are as follows:

-

To define, analyze, and forecast the display market size, by display technology, panel size, panel type, dimension, product, and vertical, in terms of value

-

To define, analyze, and forecast the display market size, by panel size, in terms of volume

-

To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World

-

To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the display market

-

To study the complete value chain and related industry segments for the display market

-

To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze trends and disruptions; pricing trends; patents and innovations; trade data (export and import data); regulatory environment; Porter’s five forces analysis; case studies; key stakeholders & buying criteria; technology trends; the market ecosystem; and key conferences and events related to the display market

-

To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

-

To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

-

To analyze competitive developments such as product launches/developments, expansions, acquisitions, partnerships, collaborations, agreements, and research and development (R&D) activities carried out by players in the display market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Country-wise Information for Asia Pacific

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Display Market