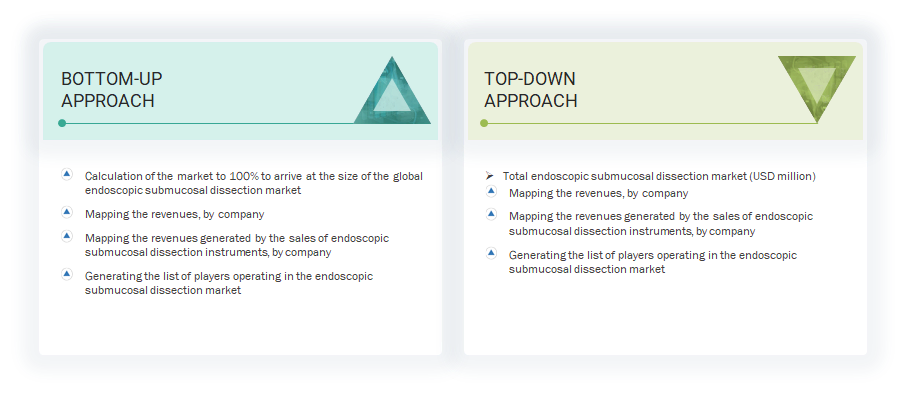

The study focused on estimating the current size of the endoscopic submucosal dissection (ESD) market. We conducted thorough secondary research to gather information about the market. The next step involved validating our findings, assumptions, and estimates through primary research by consulting industry experts throughout the value chain. We used various approaches, including top-down and bottom-up methods, to calculate the total market size. Subsequently, we applied market breakdown and data triangulation techniques to estimate the sizes of different segments and subsegments within the ESD market.

Secondary Research

This research study heavily utilized secondary sources, including directories and databases such as Dun & Bradstreet, Bloomberg Businessweek, Factiva, whitepapers, and company documents. The purpose of the secondary research was to identify and gather information for a comprehensive, technical, market-oriented, and commercial analysis of the endoscopic submucosal dissection (ESD) market. It also aimed to collect vital information about leading industry players, market classification, and segmentation according to industry trends, down to the most granular levels, as well as geographic markets and key developments related to the market. Additionally, a database of key industry leaders was created based on the findings from the secondary research.

Primary Research

During the primary research process, a variety of supply-side and demand-side sources were interviewed to gather both qualitative and quantitative information for this report. On the supply side, primary sources included industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, engineers, and other key executives from various companies and organizations operating in the ESD market. On the demand side, primary sources encompassed hospitals, clinics, researchers, lab technicians, purchasing managers, and stakeholders from corporate and government bodies.

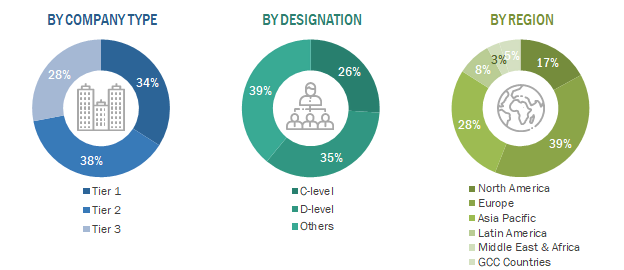

Breakdown of Primary Interviews

Note 1: C-level executives include CEOs, COOs, and CTOs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ESD market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The entire market was split into three segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of ESD. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Endoscopic submucosal dissection (ESD) is an advanced therapeutic endoscopy technique for superficial gastrointestinal neoplasms. In endoscopic submucosal dissection, the equipment includes different types of knives, forceps, snares, and a few other products that support the procedure, as well as accessories used to ease the handling of instruments during surgeries.

Stakeholders

-

Manufacturers of endoscopes and related devices

-

Suppliers and distributors of endoscopy devices

-

Hospitals, diagnostic centers, and medical colleges

-

Independent surgeons and private offices of physicians

-

Ambulatory surgery centers (ASCs)

-

Teaching hospitals and academic medical centers

-

Government bodies/municipal corporations

-

Business research and consulting service providers

-

Venture capitalists

-

US Food and Drug Administration (US FDA)

-

European Union (EU)

Report Objectives

-

To define, describe, and forecast the endoscopic submucosal dissection market by product, indication, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

-

To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall endoscopic submucosal dissection market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To forecast the size of the endoscopic submucosal dissection market in six regions: North America (US and Canada), Europe (Germany, the UK, France, Spain, Italy, and the Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and the Rest of Latin America), the Middle East & Africa, and the GCC Countries

-

To strategically profile the key players in the global market and comprehensively analyze their core competencies

-

To track and analyze competitive developments, such as product launches, expansions, agreements, and acquisitions, of the leading players in the market

Kahlill

Feb, 2023

what are the top 3 use cases of endoscopic submucosal dissection market in near future?.