ERCP Market by Product (Upper GI endoscopes, Stent, Balloons, Catheters, Baskets), Procedure (Biliary Sphincterotomy & Stenting, Pancreatic Sphincterotomy), End User (Hospitals) - Global Forecast to 2026

Updated on : February 15, 2023

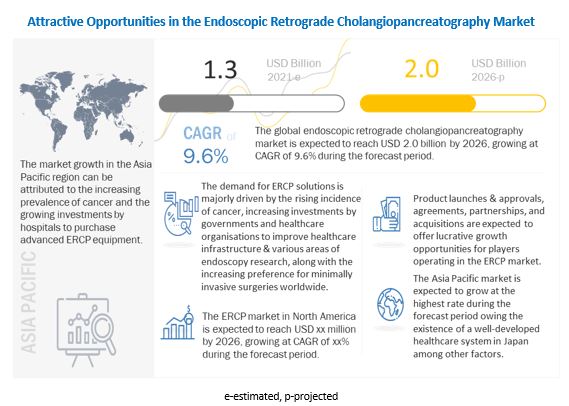

The global ERCP market in terms of revenue was estimated to be worth $1.3 billion in 2021 and is poised to reach $2.0 billion by 2026, growing at a CAGR of 9.6% from 2021 to 2026. The drivers of the market include the rising incidence of cancer, increasing investments by governments and healthcare organizations to improve endoscopy research, growing focus on investments by hospitals for advanced endoscopy instruments, and the increasing preference for minimally invasive surgeries.

To know about the assumptions considered for the study, Request for Free Sample Report

ERCP Market Dynamics

Driver: rising incidence of cancer

Nowadays, the global incidence of cancer is increasing. According to the WHO, cancer is the second-leading cause of death globally and was responsible for 9.6 million deaths in 2018. According to the American Cancer Society's estimates, about 41,260 new cases of liver cancer and intrahepatic bile duct cancer will be diagnosed in the US in 2022. Liver cancer incidence rates have more than tripled since 1980, while death rates have more than doubled during this time. In 2021, around 60,430 new pancreatic cancer cases will be diagnosed in the US. Every year in the United Kingdom (2016–2018), approximately 10,500 new pancreatic cancer cases and 6,200 new liver cancer cases were diagnosed. Globally, 458,918 new cases of pancreatic cancer were reported in 2018, and 355,317 new cases are estimated to occur until 2040 (GLOBOCAN 2018 estimates). Since ERCP is often used as a diagnostic tool in hepatic, biliary, and pancreatic cancers, the rising incidence of these cancers is directly related to the impact on the ERCP market.

Restraint: high costs of endoscopic retrograde cholangiopancreatography devices

One of the most pertinent restraints on the market is the high cost of ERCP equipment and procedures. The average selling price of a duodenoscope is around USD 31,500 (non-HD) to USD 37,000 (HD). This high price, combined with the long procedure time, makes this unfavorable. Furthermore, according to an expert in the ERCP market, cost is one of the primary reasons why the procedure is not easily accessible and affordable to many small-scale end users who serve a large population, particularly in developing countries.

Opportunity: The growing healthcare sector in emerging economies

Brazil, Russia, India, China, and South Africa (BRICS) are among the fastest-growing economies globally. According to the World Economic Forum, the emerging economies will account for around one-third of global healthcare expenditure in 2021. More than half of the world's population resides in India and China, owing to which these countries are home to the highest number of patients.

The increasing burden of cancer, rapid improvements in healthcare infrastructure, the rapid growth of medical tourism, and the presence of flexible regulation in these countries encourage players in the endoscopy equipment market to expand their presence in emerging countries.

Several endoscopy equipment manufacturers are currently setting up their facilities in Asia, the Middle East, and Latin America. Karlstrom, for example, has already established manufacturing and R&D facilities in these countries. In addition, market saturation in developed regions, such as North America and Europe, will force manufacturers to focus on emerging markets in the coming years.

By product type segment, the largest share of the ERCP market was occupied by the endotherapy devices segment during the forecast period.

This is due to driving factors such as the growth of minimally invasive surgeries and the increasing prevalence of gastrointestinal conditions.

Under endotherapy devices, sphincterotomes accounted for the largest share of the ERCP market during the forecast period.

the increasing incidence of pancreatic duct and bile duct stones and the increase in the geriatric population (and therefore, an increase in biliary disorders).

To know about the assumptions considered for the study, download the pdf brochure

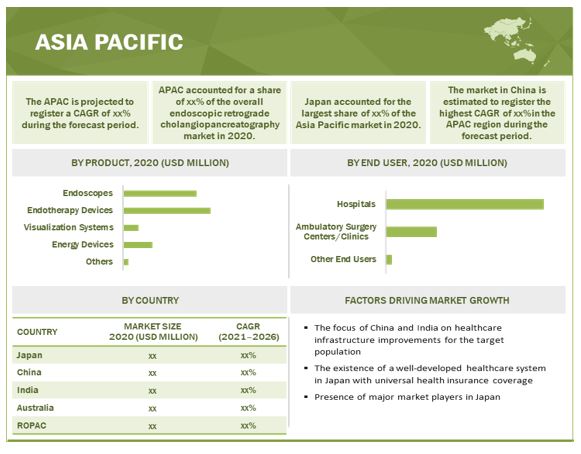

Asia-Pacific and Latin America are the fastest-growing markets for the ERCP market during the forecast period.

Governments in several Latin American countries focus on improving their respective healthcare systems, and the healthcare sector in Brazil has undergone significant changes, making the country one of the world's most promising and attractive markets. Along with this, Japan's well-developed healthcare system with universal health insurance coverage and the focus of countries such as China and India on healthcare infrastructure improvements to serve large populations of patients with critical illnesses, including cancer and tumors, are driving the market in these regions forward at a rapid pace.

The major players in the global ERCP market include Olympus Corporation (Japan), CONMED Corporation (US), Fujifilm Holdings Corporation (Japan), HOYA Corporation (Japan), KARL STORZ SE & Co. KG (Germany), Ambu A/S (Denmark), Boston Scientific Corporation (US), Johnson & Johnson (US), Medtronic, PLC (Ireland), Cook Medical (US), and B. Braun Melsungen AG (Germany).

Other players in the ERCP market include Hobbs Medical, Inc. (US), STERIS PLC (US), Merit Medical Systems, Inc. (US), TeleMed Systems, Inc. (US), Changzhou Health Microport Medical Device Co., LTD. (China), Medi-Globe GmbH (Germany), Taewoong Medical Co., Ltd. (South Korea), Huger Medical Instrument Co., Ltd. (China), IntroMedic Co., Ltd. (Republic of Korea), SonoScape Medical Corporation (China), Shanghai AOHUA Photoelectricity Endoscope Co., Ltd. (China), Ottomed (India), Kimberly-Clark Corporation (US), and Shaili Endoscopy (India)

ERCP Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$1.3 billion |

|

Estimated Value by 2026 |

$2.0 billion |

|

Growth Rate |

Poised to grow at a CAGR of 9.6% |

|

Segments covered |

Product, procedure, end-user, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

The research report categorizes the ERCP Market into the following segments and subsegments:

By Product

- Endoscopes

-

Endotherapy Devices

- Sphincterotomes

- Lithotripter

- Stents

- Cannulas

- Forceps

- Snares

- Catheters

- Guiding Wires

- Balloons

- Baskets

- Visualization Systems

- Energy Devices

- Others

By Procedure

- Biliary Sphincterotomy

- Biliary Stenting

- Biliary Dialtation

- Pancreatic Sphincterotomy

- Pancreatic Duct Stenting

- Pancreatic Duct Dilatation

End User

- Hospitals

- Ambulatory Surgery Centers & Clinics

- Other End Users

Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

- Latin America

- Middle East

- Africa

Recent Developments

- In January 2022, Cook Medical (US) launched an endoscopic clipping device, namely Instinct Plus, which is compatible through a duodenoscope, has applications for defect closure, anchoring procedures and prophylactic clipping in the gastrointestinal (GI) tract.

- In May 2021, STERIS PLC (US) acquired Cantel Medical (US) which enabled STERIS Healthcare to expand its product portfolio and cater to customers worldwide.

- In March 2021, Fujifilm Holdings Corporation (Japan) acquired Hitachi, Ltd.’s Diagnostic Imaging-related Business (Japan), adding to the former’s stronghold in the healthcare business.

- In October 2020, Olympus Corporation (Japan) launched two endotherapy devices, StoneMasterV and VorticCatchV, to increase the efficiency in bile duct stone management and retrieval for ERCP announced a partnership with Holberg to develop and distribute the Autoscore algorithm.

Frequently Asked Questions (FAQ):

What is the projected market value of the global ERCP market?

The global market of ERCP is projected to reach USD 2.0 billion.

What is the estimated growth rate (CAGR) of the global ERCP market for the next five years?

The global ERCP market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.6% from 2021 to 2026.

What are the major revenue pockets in the ERCP market currently?

The global ERCP market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. North America accounted for the largest share of the ERCP market in 2020. Factors such the increasing prevalence of cancer, high investments by hospitals to purchase new ERCP equipment, and a strong focus on research activities to improve endoscopy techniques.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 ERCP MARKET

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

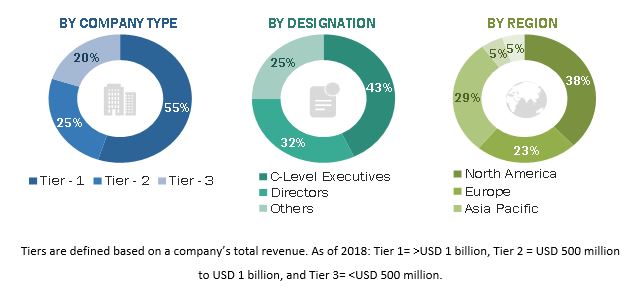

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS (ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET)

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION: OLYMPUS CORPORATION

FIGURE 8 SUPPLY-SIDE MARKET SIZE ESTIMATION (2020)

FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR THE MARKET (2021–2026)

FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 11 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 12 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 STUDY ASSUMPTIONS

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

2.8 ASSESSMENT OF IMPACT OF COVID-19 ON ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 13 ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 14 MARKET, BY PROCEDURE, 2021 VS. 2026 (USD MILLION)

FIGURE 15 MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 16 GEOGRAPHICAL SNAPSHOT OF THE ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET OVERVIEW

FIGURE 17 INCREASING INCIDENCE OF CANCER AND THE GROWING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES ARE THE KEY FACTORS DRIVING MARKET GROWTH

4.2 GEOGRAPHICAL GROWTH OPPORTUNITIES

FIGURE 18 CHINA TO WITNESS THE HIGHEST GROWTH IN THE ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY INDUSTRY DURING THE FORECAST PERIOD

4.3 NORTH AMERICA: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY INDUSTRY, BY PRODUCT AND COUNTRY (2020)

FIGURE 19 THE ENDOSCOPES SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE ERCP MARKET IN NORTH AMERICA FOR 2020

4.4 REGIONAL MIX: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET (2021–2026)

FIGURE 20 THE ASIA PACIFIC AND LATIN AMERICA REGIONS ARE EXPECTED TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD (2021–2026)

4.5 ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY INDUSTRY: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 21 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MARKET DYNAMICS: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET

5.2.1 MARKET DRIVERS

5.2.1.1 Rising incidence of cancer

FIGURE 23 GLOBAL AGE-STANDARDIZED INCIDENCE RATES OF PANCREATIC CANCER, 2020

5.2.1.2 Increasing investments, funds, and grants by governments and healthcare organizations to improve endoscopy research

TABLE 1 MAJOR DEVELOPMENTS

5.2.1.3 Growing focus on investments by hospitals for advanced endoscopy instruments

TABLE 2 SOME EXAMPLES OF INVESTMENTS BY HOSPITALS FOR ENDOSCOPY INSTRUMENTS

5.2.1.4 Increasing preference for minimally invasive surgeries

FIGURE 24 ENDOSCOPIC GLOBAL MINIMALLY INVASIVE MARKET SIZE (2019-2030)

5.2.2 MARKET RESTRAINTS

5.2.2.1 High costs of endoscopic retrograde cholangiopancreatography devices

5.2.2.2 Development of other procedures like EUS and MRCP

5.2.2.3 Shortage of trained physicians and endoscopists

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 The growing healthcare sector in emerging economies

5.2.3.2 Increasing adoption of single-use endoscopy instruments

5.2.4 MARKET CHALLENGES

5.2.4.1 Product recalls witnessed by major market players

TABLE 3 LIST OF PRODUCT RECALLS

5.2.4.2 Side-effects and infections (like post-ERCP pancreatitis) caused by duodenoscopy products

6 INDUSTRY INSIGHTS (Page No. - 63)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 ARTIFICIAL INTELLIGENCE IN GI ENDOSCOPY

TABLE 4 AI SYSTEMS AND OTHER RELATED FUNCTIONS

6.2.2 SINGLE-USE ENDOSCOPES

TABLE 5 ADVANTAGES OF DISPOSABLE OR SINGLE-USE ENDOSCOPES OVER REUSABLE ENDOSCOPES

6.2.3 ROBOT-ASSISTED ENDOSCOPES

TABLE 6 ROBOT-ASSISTED ENDOSCOPY PRODUCTS

6.3 INDUSTRY TRENDS

6.3.1 FAVOURABLE REIMBURSEMENT SCENARIO FOR SINGLE-USE DEVICES

6.4 PRICING ANALYSIS

TABLE 7 AVERAGE SELLING PRICE OF FLEXIBLE HD AND NON-HD DUODENOSCOPE (USD)

TABLE 8 US: AVERAGE COST OF ERCP PROCEDURES, 2020 (USD)

6.5 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING THE MANUFACTURING PHASE

6.6 ECOSYSTEM MAPPING

FIGURE 26 ECOSYSTEM ANALYSIS

6.7 SUPPLY CHAIN ANALYSIS

FIGURE 27 STAKEHOLDERS IN SUPPLY CHAIN

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY INDUSTRY: PORTER’S FIVE FORCES ANALYSIS

6.8.1 THREAT OF NEW ENTRANTS

6.8.1.1 High capital requirement

6.8.1.2 High preference for products from well-established brands

6.8.2 THREAT OF SUBSTITUTES

6.8.2.1 Substitute therapies for ERCP procedures

6.8.3 BARGAINING POWER OF SUPPLIERS

6.8.3.1 Presence of several raw material suppliers

6.8.3.2 Supplier switching costs

6.8.4 BARGAINING POWER OF BUYERS

6.8.4.1 Few companies offer premium products at the global level

6.8.5 INTENSITY OF COMPETITIVE RIVALRY

6.8.5.1 Increasing demand for high-quality and innovative products

6.8.5.2 Lucrative growth potential in emerging markets

6.9 REGULATORY ANALYSIS

6.10 PATENT ANALYSIS

6.10.1 PATENT PUBLICATION TRENDS FOR ERCP

FIGURE 28 GLOBAL PATENT PUBLICATION TRENDS IN ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, 2017–2021

6.10.2 TOP APPLICANTS (COMPANIES) OF ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY PATENTS

FIGURE 29 TOP COMPANIES THAT APPLIED FOR ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY PATENTS, 2017–2021

6.10.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY INDUSTRY

FIGURE 30 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY PATENTS, 2017–2021

6.11 TRADE ANALYSIS

TABLE 10 NUMBER OF EXPORTS AND IMPORTS RELATED TO ERCP EQUIPMENT

6.12 IMPACT OF COVID-19 ON THE ENDOSCOPY EQUIPMENT MARKET

7 ERCP MARKET, BY PRODUCT (Page No. - 78)

7.1 INTRODUCTION

TABLE 11 ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

7.2 ENDOSCOPES

7.2.1 THE RISING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES IS EXPECTED TO DRIVE THE ENDOSCOPES MARKET

TABLE 12 ENDOSCOPES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 ENDOTHERAPY DEVICES

7.3.1 THESE ARE MINIMALLY INVASIVE DEVICES USED TO TREAT OR DIAGNOSE GI CONDITIONS

TABLE 13 ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 14 ENDOTHERAPY DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.2 SPHINCTEROTOME

7.3.2.1 The risk of bleeding post-sphincterotomy is 2%, with 0.1% mortality

TABLE 15 SPHINCTEROTOME MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.3 LITHOTRIPTER

7.3.3.1 Lithotripters are used to pulverize stones into smaller pieces so that they can pass out of a body naturally

TABLE 16 LITHOTRIPTER MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.4 STENTS

7.3.4.1 Metal stents have higher patency rates and are less expensive than plastic stents

TABLE 17 STENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.5 CANNULAS

7.3.5.1 The success rate of ERCP procedures is directly proportional to cannulation

TABLE 18 CANNULAS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.6 FORCEPS

7.3.6.1 The prevalence of cancer leads to significant demand for biopsy forceps for the collection of tissue samples

TABLE 19 FORCEPS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.7 SNARES

7.3.7.1 Snares are commonly used for cold or hot polypectomy

TABLE 20 SNARES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.8 CATHETERS

7.3.8.1 Catheters inject a contrast medium for the visualization of internal tissues

TABLE 21 CATHETERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.9 GUIDING WIRES

7.3.9.1 The most used guidewires in ERCP come in three different diameters: 0.018, 0.025, and 0.035 inches

TABLE 22 GUIDING WIRES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.10 BALLOONS

7.3.10.1 Balloon endoscopy involves balloons that inflate and deflate to pinch together the walls of the GI tract

TABLE 23 BALLOONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.11 BASKETS

7.3.11.1 Baskets are commonly used instruments for the removal of bile duct stones in ERCP

TABLE 24 BASKETS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 VISUALIZATION SYSTEMS

7.4.1 VISUALIZATIONS SYSTEMS HAVE APPLICATIONS ACROSS ALL ERCP PROCEDURES

TABLE 25 VISUALIZATION SYSTEMS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 ENERGY DEVICES

7.5.1 ENERGY DEVICES CAN BE MONOPOLAR OR BIPOLAR

TABLE 26 ENERGY DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6 OTHERS

TABLE 27 ERCP ACCESSORIES AND DESCRIPTIONS

TABLE 28 OTHERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 ERCP MARKET, BY PROCEDURE (Page No. - 96)

8.1 INTRODUCTION

TABLE 29 MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

8.2 BILIARY SPHINCTEROTOMY

8.2.1 INCREASING INCIDENCE RATES OF SOD TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 30 MARKET FOR BILIARY SPHINCTEROTOMY, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 BILIARY DILATATION

8.3.1 HIGH-CHOLESTEROL DIETS AND OBESITY ARE THE KEY CAUSES OF GALLSTONES, THUS DRIVING THE UPTAKE OF BILIARY DILATATION PROCEDURES

TABLE 31 MARKET FOR BILIARY DILATATION, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 BILIARY STENTING

8.4.1 THE RISING PREVALENCE OF GALLBLADDER DISEASES IN THE GROWING GERIATRIC POPULATION IS EXPECTED TO PROPEL THE DEMAND FOR BILIARY STENTS

TABLE 32 MARKET FOR BILIARY STENTING, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 PANCREATIC SPHINCTEROTOMY

8.5.1 THE RISING INCIDENCE OF PANCREATIC CANCER IS EXPECTED TO DRIVE THE DEMAND FOR THIS PROCEDURE

TABLE 33 MARKET FOR PANCREATIC SPHINCTEROTOMY, BY COUNTRY, 2019–2026 (USD MILLION)

8.6 PANCREATIC DUCT DILATATION

8.6.1 BALLOON DILATION ALONG WITH ENDOSCOPIC SPHINCTEROTOMY IS THE PREFERRED PROCEDURE FOR STONE REMOVAL

TABLE 34 MARKET FOR PANCREATIC DUCT DILATATION, BY COUNTRY, 2019–2026 (USD MILLION)

8.7 PANCREATIC DUCT STENTING

8.7.1 PANCREATIC DUCT STENTING IS THE TREATMENT OF CHOICE FOR CHRONIC PANCREATIC DISORDERS

TABLE 35 MARKET FOR PANCREATIC DUCT STENTING, BY COUNTRY, 2019–2026 (USD MILLION)

9 ERCP MARKET, BY END USER (Page No. - 104)

9.1 INTRODUCTION

TABLE 36 MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 HOSPITALS

9.2.1 INCREASING INVESTMENTS BY GOVERNMENT ORGANISATIONS BOOST THE ADOPTION OF ERCP BY THIS END-USER SEGMENT

TABLE 37 MARKET FOR HOSPITALS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 AMBULATORY SURGERY CENTERS/CLINICS

9.3.1 AMBULATORY SURGERY CENTERS PROVIDE OUTPATIENT ECRP PROCEDURES THROUGH EFFICIENT OPERATIONS

TABLE 38 MARKET FOR AMBULATORY SURGERY CENTERS/CLINICS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 OTHER END USERS

TABLE 39 MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

10 ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY REGION (Page No. - 109)

10.1 INTRODUCTION

FIGURE 31 ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

TABLE 40 ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 41 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 The large market in the US is mainly driven by high healthcare spending in the country and the increasing incidence of cancer

TABLE 46 MEDICARE NATIONAL AVERAGE COVERAGE FOR OUTPATIENT PROCEDURES, 2020

TABLE 47 LIST OF DEVICES THAT RECEIVED FDA APPROVALS BETWEEN 2018 AND 2021

TABLE 48 US: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 49 US: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 50 US: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 51 US: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 High costs of endoscopic retrograde cholangiopancreatography to restrain the market growth in Canada

TABLE 52 INCIDENCE ESTIMATES BY CANCER TYPE (CANADA)

TABLE 53 CANADA: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 54 CANADA: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 CANADA: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 56 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 57 EUROPE: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 59 EUROPE: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany’s rising geriatric population is one of the key drivers for the ERCP market

TABLE 62 GERMANY: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 63 GERMANY: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 GERMANY: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 65 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Investments by hospitals to purchase new & advanced ERCP equipment is expected to propel market growth in the UK

TABLE 66 UK: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 67 UK: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 68 UK: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 69 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 High healthcare expenditure is expected to support the growth of the ERCP market in France

TABLE 70 FRANCE: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 71 FRANCE: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 FRANCE: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 73 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Increasing prevalence of cardiovascular diseases in Spain to stimulate the market growth for endoscopes

TABLE 74 SPAIN: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 75 SPAIN: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 SPAIN: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 77 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Rising government initiatives for the adoption of advanced medical equipment to drive the market growth for ERCP equipment & procedures in Italy

TABLE 78 ITALY: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 79 ITALY: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 ITALY: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 81 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE (ROE)

TABLE 82 ROE: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 83 ROE: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 ROE: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 85 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET SNAPSHOT

TABLE 86 ASIA PACIFIC: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 88 ASIA PACIFIC: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Supportive medical device reimbursement policies to drive the market growth for ERCP in Japan

TABLE 91 JAPAN ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 92 JAPAN: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 JAPAN: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 94 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Large patient population and the strong need for healthcare infrastructure improvements to drive the market growth in China

TABLE 95 CHINA: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 96 CHINA: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 CHINA: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 98 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Favorable government initiatives for improvements in healthcare infrastructure to support the market growth for ERCP in India

TABLE 99 INDIA: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 100 INDIA: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 INDIA: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 102 INDIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 The high number of cancer rates in Australia is expected to drive the demand for endoscopy instruments

TABLE 103 AUSTRALIA: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 104 AUSTRALIA: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 105 AUSTRALIA: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 106 AUSTRALIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC (ROAPAC)

TABLE 107 ROAPAC: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 108 ROAPAC: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 ROAPAC: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 110 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 THE GOVERNMENTS IN MANY LATIN AMERICAN COUNTRIES ARE FOCUSED ON IMPROVING HEALTHCARE INFRASTRUCTURE, AND IN TURN, THE ADOPTION OF ERCP IS EXPECTED TO RISE

TABLE 111 LATIN AMERICA: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 112 LATIN AMERICA: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 LATIN AMERICA: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 114 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5.2 MIDDLE EAST

10.5.2.1 Healthcare infrastructural advancements are expected to create the requirement for advanced hospital equipment such as ERCP in the region

TABLE 115 MIDDLE EAST: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 116 MIDDLE EAST: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 MIDDLE EAST: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 118 MIDDLE EAST: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5.3 AFRICA

10.5.3.1 High prevalence of target diseases and initiatives to strengthen endoscopic services in healthcare organizations to propel market growth

TABLE 119 AFRICA: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 120 AFRICA: ENDOTHERAPY DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 AFRICA: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 122 AFRICA: ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 158)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT-TO-WIN

11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN THE ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET

11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS IN ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET

11.4 COMPETITIVE BENCHMARKING

TABLE 123 FOOTPRINT OF COMPANIES IN ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET

TABLE 124 PRODUCT AND SERVICE: COMPANY FOOTPRINT (25 COMPANIES)

TABLE 125 END USER: COMPANY FOOTPRINT (25 COMPANIES)

TABLE 126 REGION: COMPANY FOOTPRINT (26 COMPANIES)

11.5 COMPETITIVE LEADERSHIP MAPPING

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE PLAYER

11.5.4 PARTICIPANT

FIGURE 35 ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

11.6 COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES

11.6.1 PROGRESSIVE COMPANY

11.6.2 DYNAMIC COMPANY

11.6.3 STARTING BLOCK

11.6.4 RESPONSIVE COMPANY

FIGURE 36 ENDOSCOPIC RETROGRADE CHOLANGIOPANCREATOGRAPHY MARKET: COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES (2020)

11.7 MARKET RANKING ANALYSIS

FIGURE 37 ERCP MARKET RANKING ANALYSIS, BY PLAYER, 2020

FIGURE 38 ENDOTHERAPY DEVICES MARKET RANKING ANALYSIS, BY PLAYER, 2020

11.8 COMPETITIVE SCENARIO

TABLE 127 PRODUCT LAUNCHES & APPROVALS, 2019–2021

TABLE 128 DEALS, 2019–2021

12 COMPANY PROFILES (Page No. - 173)

(Business overview, Products offered, Recent developments, MnM view, Right to win, Weakness and competitive threats, and Strategic choices made)*

12.1 KEY PLAYERS

12.1.1 OLYMPUS CORPORATION

TABLE 129 OLYMPUS CORPORATION: BUSINESS OVERVIEW

FIGURE 39 COMPANY SNAPSHOT: OLYMPUS CORPORATION (2020)

12.1.2 CONMED CORPORATION

TABLE 130 CONMED CORPORATION: BUSINESS OVERVIEW

FIGURE 40 COMPANY SNAPSHOT: CONMED CORPORATION (2020)

12.1.3 AMBU A/S

TABLE 131 AMBU A/S: BUSINESS OVERVIEW

FIGURE 41 COMPANY SNAPSHOT: AMBU A/S (2020)

12.1.4 BOSTON SCIENTIFIC CORPORATION

TABLE 132 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 42 COMPANY SNAPSHOT: BOSTON SCIENTIFIC CORPORATION (2020)

12.1.5 JOHNSON & JOHNSON

TABLE 133 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 43 COMPANY SNAPSHOT: JOHNSON & JOHNSON (2020)

12.1.6 FUJIFILM HOLDINGS CORPORATION

TABLE 134 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 44 COMPANY SNAPSHOT: FUJIFILM HOLDINGS CORPORATION (2020)

12.1.7 MEDTRONIC, PLC

TABLE 135 MEDTRONIC, PLC: BUSINESS OVERVIEW

FIGURE 45 COMPANY SNAPSHOT: MEDTRONIC, PLC (2020)

12.1.8 KARL STORZ SE & CO. KG

TABLE 136 KARL STORZ SE & CO. KG.: BUSINESS OVERVIEW

12.1.9 COOK MEDICAL

TABLE 137 COOK MEDICAL: BUSINESS OVERVIEW

12.1.10 HOYA CORPORATION

TABLE 138 HOYA CORPORATION: BUSINESS OVERVIEW

FIGURE 46 COMPANY SNAPSHOT: HOYA CORPORATION (2020)

12.1.11 B. BRAUN MELSUNGEN AG

TABLE 139 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

FIGURE 47 COMPANY SNAPSHOT: B. BRAUN MELSUNGEN AG (2020)

12.1.12 HOBBS MEDICAL, INC.

TABLE 140 HOBBS MEDICAL, INC.: BUSINESS OVERVIEW

12.1.13 STERIS PLC

FIGURE 48 COMPANY SNAPSHOT: STERIS PLC (2020)

TABLE 141 STERIS PLC: BUSINESS OVERVIEW

12.1.14 MERIT MEDICAL SYSTEMS, INC.

TABLE 142 MERIT MEDICAL SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 49 COMPANY SNAPSHOT: MERIT MEDICAL SYSTEMS, INC. (2020)

12.1.15 TELEMED SYSTEMS, INC.

TABLE 143 TELEMED SYSTEMS, INC.: BUSINESS OVERVIEW

12.1.16 CHANGZHOU HEALTH MICROPORT MEDICAL DEVICE CO., LTD.

TABLE 144 CHANGZHOU HEALTH MICROPORT MEDICAL DEVICE CO., LTD.: BUSINESS OVERVIEW

12.1.17 MEDI-GLOBE GMBH

TABLE 145 MEDI-GLOBE GMBH: BUSINESS OVERVIEW

12.1.18 TAEWOONG MEDICAL CO., LTD.

TABLE 146 TAEWOONG MEDICAL CO., LTD.: BUSINESS OVERVIEW

12.1.19 HUGER MEDICAL INSTRUMENT CO., LTD.

TABLE 147 HUGER MEDICAL INSTRUMENT CO., LTD..: BUSINESS OVERVIEW

12.1.20 INTROMEDIC CO., LTD.

TABLE 148 INTROMEDIC CO., LTD.: BUSINESS OVERVIEW

FIGURE 50 COMPANY SNAPSHOT: INTROMEDIC CO., LTD. (2020)

12.1.21 SONOSCAPE MEDICAL CORP.

TABLE 149 SONOSCAPE MEDICAL CORP.: BUSINESS OVERVIEW

FIGURE 51 COMPANY SNAPSHOT: SONOSCAPE MEDICAL CORP (2020)

12.2 OTHER PLAYERS

*Details on Business overview, Products offered, Recent developments, MnM view, Right to win, Weakness and competitive threats, and Strategic choices made might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 230)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the endoscopic retrograde cholangiopancreatography market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the endoscopic retrograde cholangiopancreatography market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the endoscopic retrograde cholangiopancreatography market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the endoscopic retrograde cholangiopancreatography market

The size of the global endoscopic retrograde cholangiopancreatography market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global endoscopic retrograde cholangiopancreatography market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the endoscopic retrograde cholangiopancreatography market based on product, procedure, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall endoscopic retrograde cholangiopancreatography market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in the market and comprehensively analyze their market shares and core competencies

- To forecast the size of the market segments with respect to six main regions, namely, North America, Asia Pacific, Europe, Latin America, Middle East, and Africa.

- To track and analyze competitive developments such as new product launches, agreements, collaborations, and expansions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific endoscopic retrograde cholangiopancreatography market into South Korea, New Zealand, and other countries

- Further breakdown of the Rest of Europe endoscopic retrograde cholangiopancreatography market into Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the Latin America endoscopic retrograde cholangiopancreatography market into the Brazil, Mexico, Argentina, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ERCP Market

What are the challenges in Endoscopic Retrograde Cholangiopancreatography Market?

What are the key trends impacting the Endoscopic Retrograde Cholangiopancreatography Market?

What will be the future perspectives in Endoscopic Retrograde Cholangiopancreatography Market?

What will be the key challenges for business in ERCP industry in the future?