Epoxy Resin Market

Epoxy Resin Market by Physical Form (Liquids, Solids, Solutions), Raw Material (Badge, BFDGE, Novolac, Aliphatic, Glycidyl Amine), Application (Paints & Coatings, Adhesives & Sealants, Composites), End-use Industry, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The market for epoxy resin is predicted to rise from USD 14.77 billion in 2025 to USD 20.31 billion in 2030, with a CAGR of 6.6% during the period 2025-2030. Epoxy resins can be classified according to their form as liquid, solid, and solution types. Each variant is designed with the necessary processing and performance requirements fixed with the end-use industries in mind.

KEY TAKEAWAYS

-

By Physical FormBased on physical form, the epoxy resin market has been segmented into Liquid, Solid and Solution. Solid form is the second largest market for epoxy resin. When the liquid epoxy resin and hardener are mixed together and allowed to cure, the epoxy resin transforms from a liquid to a solid state. The solid epoxy resin market is driven by its wide use in applications such as composites, electrical laminates, powder coatings, and adhesives. Growing demand for lightweight materials, high-performance composites, and electrical insulation materials helps the growth of solid epoxy resin

-

By ApplicationBased on applications, the epoxy resin market is segmented in paints & coatings, composites, adhesives & sealants and other applications. Adhesives & Sealants is the third largest segment in applications. Epoxy-based adhesives and sealants are widely used for bonding and sealing various materials, providing strong and durable connections. These are typically applied in automotive assembly, metal bonding, composite component bonding, and windshield bonding. They have applications in multiple industries for structural bonding applications, metal fabrications, and electronic assembly. Epoxy adhesives are critical for bonding advanced composite structures and components in aerospace manufacturing.

-

By End-Use IndustryBased on end-use industry, the epoxy resin market has been segmented into building & construction, automotive, general industrial, consumer goods, wind energy, aerospace/aircraft, marine, and other industries. The general industrial segment is the third largest in these end use industries. The general industrial sector includes a variety of sub segments such as electrical & electronics, tooling, packaging, textiles, and machinery that utilize epoxy resins in many different ways. Epoxy resins provide electrical insulation, chemical resistance and strength properties that are essential for various industrial uses. The general industrial sector is being propelled by advancements in technology, industrial automation, and demand for high-performance materials.

-

BY REGIONBased on Region, North America’s epoxy resin market is witnessing steady growth, holding the third-largest market share in 2024. Europe has strong foundation in pharmaceutical innovation, specialty chemicals, and sustainable chemical manufacturing practices. The region is home to several leading chemical companies based in countries like US, Canada, and Mexico. The construction industry frequently utilizes these resins in epoxy-based coatings as floorings systems to protect surfaces and provide increased performance.

-

COMPETITIVE LANDSCAPEMajor market players are pursuing both organic and inorganic growth strategies, including partnerships, collaborations, and investments, to strengthen their market presence. For instance, ASinopec Corporation (China), 3M (US), Westlake Epoxy (US), DIC Corporation (Japan) and Olin Corporation (US) have engaged in multiple agreements and strategic initiatives to address the rising demand for surface treatment chemicals across automotive, construction, and electronics applications.

The epoxy resin market has been witnessing steady growth driven by its expanding applications across high-performance industries such as construction, automotive, aerospace, electronics, and wind energy. Rapid infrastructure development and industrialization, especially in emerging economies, are increasing the demand for epoxy-based coatings, adhesives, and composites due to their superior mechanical strength, corrosion resistance, and durability.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global epoxy resin market is expected to grow significantly in the coming years, driven by increasing demand from various end-use industries such as automotive, electronics, construction, and aerospace. The market is highly competitive and fragmented, with many players operating in the market. The major players in the market are focused on research and development activities to improve the performance and properties of epoxy resin products.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Technological advancements in epoxy resin

-

•Increasing applications of epoxy resin in wind turbines

Level

-

•Volatility in raw material prices

-

•Workplace safety concerns during resin processing

Level

-

•Growing demand from emerging economies

-

•Increasing applications in electrical & electronics

Level

-

•Availability of competitive substitute materials

-

•Strong market competition and pricing pressure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing applications of epoxy resin in wind turbines

Epoxy resin plays a crucial role in the construction and maintenance of wind turbines. Its versatile properties make it well-suited for various applications in this renewable energy sector. Epoxy resin is a commonly used material in the manufacturing of wind turbine blades. Composite materials, such as fiberglass or carbon fiber-reinforced composites, are used in wind turbines. The epoxy resin acts as a binding agent between composite materials, providing structural integrity and strength to the composite blades. Wind turbine blades are subject to wear and tear over time due to environmental factors, such as weather conditions and bird strikes.

Restraint: Workplace safety concerns during resin processing

Epoxy resins are derived from petroleum-based raw materials, which raises environmental concerns related to carbon emissions and non-renewable resource consumption. Some curing agents and additives used in epoxy resin formulations may contain hazardous substances. Increasing environmental regulations and sustainability initiatives require manufacturers to comply with stricter standards, which can result in additional costs for compliance and impact product development. Epoxy resins and their curing agents may contain chemicals that can pose health and safety risks to workers during manufacturing, handling, and application processes.

Opportunity:Increasing applications in electrical & electronics

The electrical & electronics industry is witnessing a significant surge in the adoption of epoxy resins. They are extensively used as insulating materials due to their exceptional dielectric properties. They act as reliable electrical insulators, protecting electrical circuits and components from moisture, dust, and other contaminants. Epoxy-based insulating materials find applications in power transformers, capacitors, and high-voltage electrical equipment. Epoxy resins are widely employed in the manufacturing of printed circuit boards, serving as the substrate and providing mechanical support for electronic components. They are preferred for potting and encapsulating electronic components, protecting them from environmental influences, vibrations, and shock. Epoxy-based materials are utilized for semiconductors and electronic packaging due to their high adhesion properties and ability to form hermetic seals.

Challenge: Availability of competitive substitute materials

Epoxy resins face competition from alternative materials, including polyurethane, polyester, vinyl ester, and phenolic resins. These materials may offer similar or specific advantages for certain applications, such as better flexibility, lower cost, or higher temperature resistance. The availability and cost-effectiveness of substitute materials can impact the demand for epoxy resins, requiring manufacturers to differentiate their products and demonstrate unique advantages. The increasing use of bio-based resins, seen as more environmentally friendly, challenges epoxy resins, especially in industries focused on sustainability. Advances in alternative materials, such as faster curing and better durability in polyurethanes, can lead customers to choose them over epoxy resins for applications like coatings and adhesives.

Epoxy Resin Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizes epoxy resins in lightweight composites, coatings, and adhesives for vehicle body structures, electronic components, and corrosion protection. | Enhanced structural integrity and crash resistance Improved fuel efficiency through lightweight materials |

|

Applies epoxy resin systems for electrical insulation, switchgear encapsulation, and circuit protection components to ensure high-performance and safety in power systems. | Extended service life of electrical components Reduced failure rates and enhanced operational reliability |

|

Employs epoxy-based solutions in flooring, structural strengthening, waterproofing, and protective coatings across infrastructure and industrial projects. | Increased structural durability and load-bearing capacity Excellent chemical and abrasion resistance in harsh conditions |

|

Uses epoxy resin systems in wind turbine blades and structural composites to enhance strength, durability, and weather resistance. | Reduced production downtime through robust bonding systems Enhanced sustainability through extended component lifespan |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The epoxy resin ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, contractors, and end users. Raw material suppliers provide magnesium and organic halides for synthesis to epoxy resin manufacturers. Manufacturers use these raw materials to produce epoxy resin via controlled reactions. The distributors and suppliers are the ones who establish contact between the manufacturing companies and end users to concentrate on the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Epoxy Resin Market, By Physical Form

By Physical Form, the solid form will dominate the epoxy resin market during the forecast period. Solid epoxy resin is a kind of thermosetting material which comes in the form of flakes, pellets, or powder. It possesses a high weight of molecules and is most common type of epoxy resin. It shows good mechanical strength, heat resistance, chemical resistance, and adhesion when cured. It finds wide application in the form of composites, electrical laminates, powder coatings, adhesives, and sealants. It is applied in solid form in applications that require high mechanical performance as well as dimensional stability. Its broad application in applications such as composites, electrical laminates, powder coatings, and adhesives is the prime factor for the market of solid epoxy resin.

Epoxy Resin Market, By Application

By application, paints & coatings will register the highest market share during the forecast period. Epoxy resins are used in the paints & coatings industry as binders or film formers to provide protective coatings on substrates. Epoxy coatings are used in flooring, walls, and structural members due to their chemical resistance, abrasion resistance, and ease of maintenance. They are used in car refinishing and as protective coatings on automotive components for appearance enhancement and corrosion protection. They protect equipment, machinery, and storage tanks from extreme environments and chemical exposure. They are applied on appliances, electronics, and household goods for providing a smooth gloss and wearing resistant finish.

Epoxy Resin Market, By End Use Industry

By end-use industry, the building & construction end use industry will register the highest market share during the forecast period. Epoxy-based floor coatings and floor systems are extensively used in the construction industry to safeguard surfaces and ensure superior performance. Epoxy floor coatings exhibit extraordinary chemical, abrasion, impact, and moisture resistance, which makes them an ideal choice for industrial buildings, warehouses, commercial establishments, and even domestic properties. These coatings not only enhance the ambiance of the area but also guarantee a safe and sustainable atmosphere. Epoxy resins are widely used in concrete repair and rehabilitation works. Epoxy-based repair mortars, when blended with aggregate materials, are utilized for filling and repairing cracks, spalls, and other surface imperfections in concrete members.

REGION

Asia Pacific to be fastest-growing region in global epoxy resin market during forecast period

Asia Pacific to register the highest market share in the epoxy resin market during the forecast period. The Asia Pacific demonstrates growth for the epoxy resin market, fueled by industrialization, infrastructure development, and the growth of manufacturing industries in large economies. Economic development with foreign investment support, urbanization, and massive industrial and infrastructure projects in China contributes notably to rising demand for epoxy resins, especially in construction and automotive. India is also a prominent growth center, as the government continues to work towards bolstering home-based manufacturing, combined with increasing building activity and an expanding auto industry. The country's policy-friendly business climate and cost-saving labor pool are driving epoxy resin use in a variety of industries.

Epoxy Resin Market: COMPANY EVALUATION MATRIX

In the Epoxy Resin Market Matrix, 3M (Star) holds a strong market position with its extensive portfolio of epoxy resin systems and advanced adhesive technologies, catering to a broad range of industries including automotive, electronics, construction, and aerospace. The company’s focus on high-performance, durable, and lightweight material solutions has enabled it to maintain leadership through innovation, reliability, and global reach. Huntsman Corporation (Emerging Leader) is rapidly strengthening its market footprint with specialized epoxy formulations designed for high-strength composites, coatings, and industrial applications. Through its focus on customized resin systems, sustainable chemistry, and strong partnerships with OEMs, Huntsman is steadily enhancing its presence in niche and value-added epoxy segments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 13.87 Billion |

| Market Forecast in 2030 (value) | USD 20.30 Billion |

| Growth Rate | CAGR of 6.6% from 2025-2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Epoxy Resin Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based Automotive & Aerospace OEM | Competitive profiling of epoxy resin suppliers (commodity, high-performance, bio-based) Mapping customer landscape by EV, aerospace, and automotive sectors Assessment of composite and adhesive partnerships | Identify cost optimization and high-performance resin opportunities Detect adoption trends across high-value applications Highlight untapped customer clusters for advanced epoxy integration |

| Industrial Composite Manufacturers | Segmentation of epoxy resin demand across automotive, aerospace, wind energy, and electronics Benchmarking adoption vs. alternative thermosets (polyesters, vinyl esters) Switching barrier analysis (strength, curing, processability) | Insights on revenue migration from conventional to advanced epoxy systems Pinpoint substitution risks & opportunities in performance-sensitive industries Enable targeting of high-strength, lightweight composites |

| Electronics & Electrical Component OEMs | Technical & economic evaluation of epoxy resins in electronics and electrical applications Lifecycle & sustainability benefits modeling Forecast of epoxy resin demand by 2035 across electronics, wind, and automotive sectors | Support entry into high-value, innovation-driven manufacturing sectors Uncover long-term sustainability-driven cost savings Strengthen ESG and regulatory compliance positioning with advanced epoxy formulations |

| European Epoxy Resin Supplier | Global & regional capacity benchmarking of epoxy resin production & distribution Pipeline of new entrants & technology innovations (bio-based, solvent-free, high-temperature systems) Customer profiling across automotive & wind energy | Strengthen supply chain integration strategy Identify high-demand sectors for long-term supply contracts Assess regional supply-demand imbalances for competitive edge |

| Composite & Industrial OEMs | IP landscape & patent mapping in epoxy resin formulations and composite technologies Competitive analysis of lightweighting, durability, and cost reduction strategies Adoption roadmaps for epoxy in multi-site production platforms | Support backward integration into epoxy resin partnerships Identify high-value applications in automotive, wind, and aerospace Secure early-mover advantage in patent-backed high-performance epoxy solutions |

RECENT DEVELOPMENTS

- March 2025 : Westlake Epoxy has launched its new EpoVIVE product portfolio, focused on delivering sustainable epoxy solutions. Key features include a lower carbon footprint through bio-circular and mass-balanced raw materials, energy-efficient production, and the use of safer materials free from SVHC and CMR substances.

- February 2023 : Huntsman introduced a new product called JEFFAMINE M-3085 amine, which is a mono-polyether amine with a higher molecular weight compared to commonly used amine variants such as JEFFAMINE M-2070 amine and JEFFAMINE M-1000 amine.

- March 2023 : Westlake Corporation announced the upcoming launch of its new product range, AZURES, by Westlake Epoxy. The official debut of AZURES will take place at the highly anticipated European Coatings Show 2023. This innovative range of products promises to deliver exceptional performance and advanced solutions for various coating applications.

- July 2022 : DIC Corporation completed the acquisition of Guangdong TOD New Materials Co., Ltd., a prominent manufacturer of coating resins based in China. This strategic acquisition is part of DIC's ongoing efforts to strengthen its position in the coatings industry and expand its presence in the Chinese market

- February 2022 : Westlake Chemical Corporation announced the successful completion of its acquisition of Hexion Inc.'s global epoxy business. With this strategic acquisition, Westlake Chemical further strengthens its position in the industry and expands its capabilities in the manufacture and development of specialty resins, coatings, and composites.

Table of Contents

Methodology

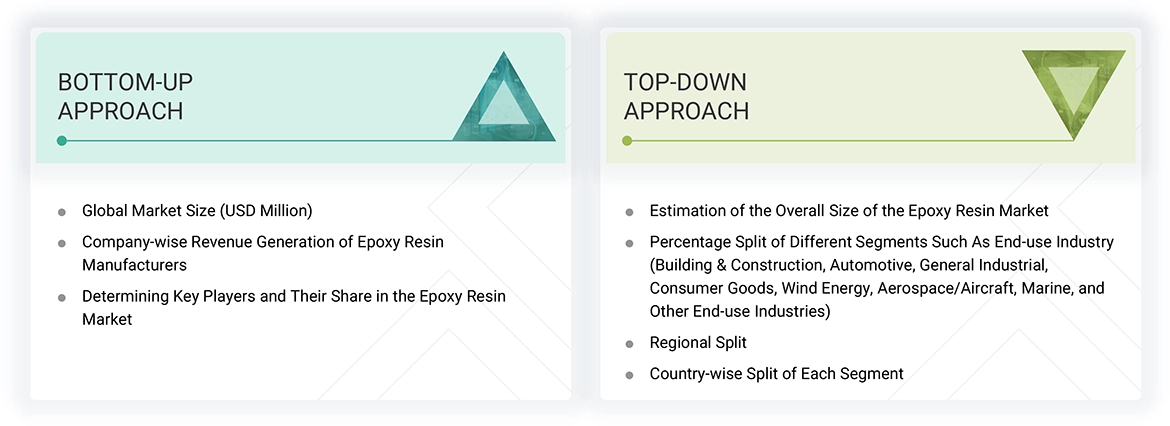

The study involves two major activities in estimating the current market size for the epoxy resin market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering epoxy resin and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the epoxy resin market, which was validated by primary respondents.

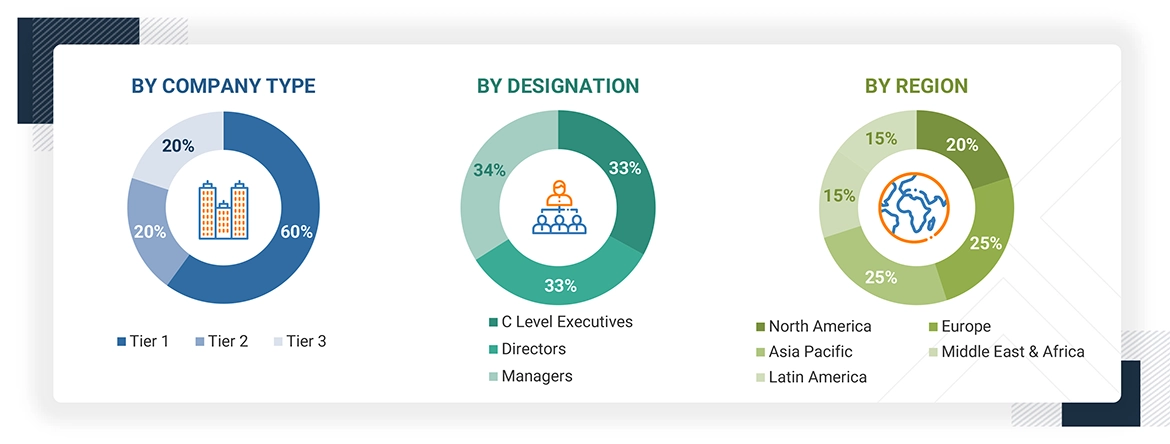

Primary Research

Extensive primary research was conducted after obtaining information regarding the epoxy resin market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief executive officers (CXOs), vice presidents (VPs), directors from business development, marketing, product development/innovation teams, and related key executives from epoxy resin industry vendors, material providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to product type, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking epoxy resin services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of epoxy resin and future outlook of their business which will affect the overall market.

The Breakup of Primary Research

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the epoxy resin market includes the following details. The market sizing was undertaken from the demand side. The market was upsized based on the demand for epoxy resin in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the epoxy resin industry for each application. For each end-use, all possible segments of the epoxy resin market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Epoxy resins are thermosetting resins created by the chemical reaction of an epoxy resin and a hardening agent or curing agent. They possess outstanding mechanical, electrical, and high heat-resistance characteristics, and you can choose many curing-agent variations. They have a vast range of diverse uses in many different systems and are popular in paints & coatings, composites, and adhesives & sealants, to name just a few. Epoxy resin coatings provide a durable and glossy finish and have many uses for flooring, countertops, and many other surfaces. Epoxy resins are also used as a sealant with applications to protect against moisture and corrosion. Epoxy resins exhibit strong adhesion properties and chemical resistance for industrial and chemical-processing applications, as well as for more neutral environments. Their ability to bond to metals, concrete, wood, and a variety of plastics has made them the material of choice for a range of sectors. Epoxy resins also showcase remarkable low shrinkage during the curing process of the resin system, provide dimensional stability, and offer excellent resistance to wear and environmental factors degradation. For these reasons, epoxy resins are used throughout structural applications, electronics encapsulation, wind turbine blades, marine coating, automotive parts, and many others. Epoxy resins come in many different physical forms, including liquids, solids, and solutions. Each end-use is tailored to the best requirements of each application.

Stakeholders

- Epoxy Resin Manufacturers

- Epoxy Resin Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the epoxy resin market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and project the global epoxy resin market, by form, application, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major companies in the epoxy resin market? What key strategies have market players adopted to strengthen their market presence?

The key players in this market are Sinopec Corporation (China), 3M (US), Westlake Epoxy (US), DIC Corporation (Japan), Olin Corporation (US), Huntsman Corporation (US), Nan Ya Plastics Corporation (Taiwan), Kukdo Chemical Co., Ltd. (South Korea), Aditya Birla Chemicals (India), Mitsubishi Chemical Group Corporation (Japan), and BASF SE (Germany). Continuous developments in the market, including new product launches, mergers & acquisitions, agreements, and expansions, are expected to help the market grow.

What are the drivers and opportunities for the epoxy resin market?

Technological advancements in epoxy resin, rising demand from the building & construction industry, increasing applications in electrical & electronics, and increasing market demand from the Asia Pacific region are driving the market and creating lucrative opportunities for market players.

Which region is expected to hold the largest market share?

Asia Pacific is expected to be the largest market for epoxy resin due to its strong industrial base, regulatory stringency, and technological leadership in big sectors.

What is the projected growth rate of the epoxy resin market over the next five years?

The epoxy resin market is projected to register a CAGR of 6.6% during the forecast period.

How is the epoxy resin market aligned for future growth?

The market is growing at a considerable pace. Epoxy resin is a consolidated market due to the large number of regional players planning business strategies to expand their existing epoxy resin production capacities.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Epoxy Resin Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Epoxy Resin Market