The study involved four major activities in estimating the current size of the ethylene carbonate market: comprehensive secondary research gathered information on the market, related markets, and parent markets. The next step was to validate these findings, assumptions, and measurements with industry experts across the ethylene carbonate value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Then, market segmentation and data triangulation helped estimate the size of segments and subsegments.

Secondary Research

Secondary sources for this research include annual reports, press releases, investor presentations, white papers, certified publications, articles by recognized authors, reputable websites, Ethylene carbonate manufacturing companies, regulatory agencies, trade directories, and databases. The secondary research was mainly used to gather key information about the industry’s supply chain, major players, market classification, and segmentation based on industry trends, down to the regional level. It also provided insights into key developments from a market-focused perspective.

Primary Research

The ethylene carbonate market includes various stakeholders such as raw material suppliers, technology support providers, ethylene carbonate manufacturers, and regulatory organizations involved in the supply chain. To gather both qualitative and quantitative data, interviews were conducted with primary sources from both the supply and demand sides of the market. On the supply side, these sources included industry experts like chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and other key executives from different companies and organizations operating within the ethylene carbonate market. On the demand side, primary sources included directors, marketing heads, and purchase managers from various sourcing industries.

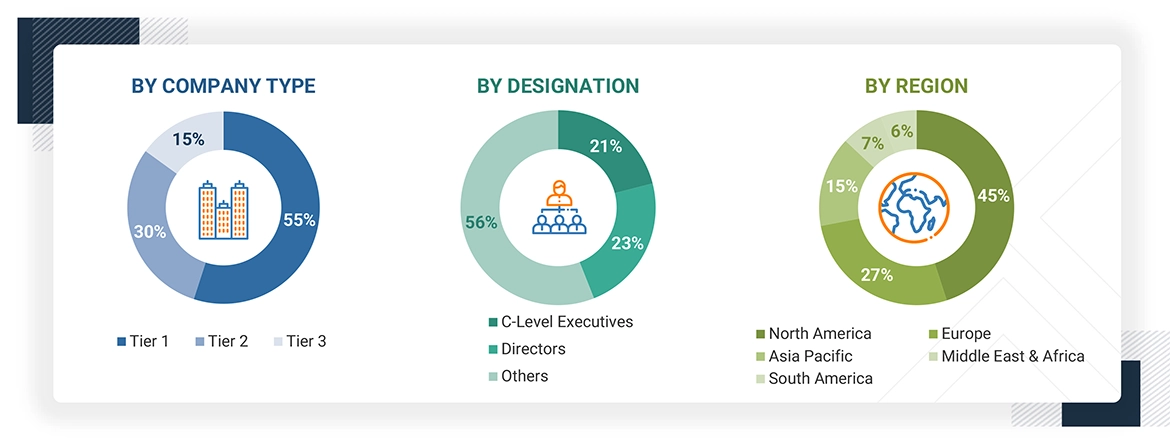

The following is a breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of the ethylene carbonate market. These methods have also been widely used to determine the size of various related market subsegments. The research methodology employed to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study:

-

The key players in the market were identified through secondary research.

-

The market share in the respective regions was identified through primary and secondary research.

-

Primary and secondary research determined the ethylene carbonate market's value chain and market size in terms of value and volume.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research included studying the annual and financial reports of the top market players and interviewing industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key quantitative and qualitative insights.

Global Ethylene Carbonate Market Size: Bottom-up Approach and Top-down Approach

Data Triangulation

After estimating the overall market size using the methods described above, the market was divided into several segments and sub-segments. To complete the market engineering process and determine the precise statistics for each segment and subsegment, data triangulation and market breakdown procedures were used where applicable. The data was triangulated by examining various factors and trends from both the demand and supply sides in the oil & gas sector.

Market Definition

Ethylene carbonate is an organic compound with the formula (CH2O)2CO. It is classified as the carbonate ester of ethylene glycol and carbonic acid. In the market, ethylene carbonate is available in both liquid and solid forms. It primarily serves as a raw material for producing lubricants and polycarbonates and as an electrolyte in lithium-ion batteries. Additionally, ethylene carbonate is used as a solvent in various polymer resins, plasticizers, adhesives, sealants, and other chemical applications. Key factors affecting the ethylene carbonate market include supply and demand dynamics, pricing trends, regulatory frameworks, technological advancements, and global trade flows.

Stakeholders

-

Manufacturers of ethylene carbonate

-

Traders, distributors, and suppliers of ethylene carbonate

-

Government and research organizations

-

Associations and industrial bodies

-

Research and consulting firms

-

R&D institutions

-

Environment support agencies

-

Investment banks and private equity firms

Report Objectives

-

To analyze and forecast the market size of the ethylene carbonate market in terms of value and volume

-

To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

-

To analyze and forecast the global ethylene carbonate market based on form, application, end-use industry, and region

-

To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

-

To forecast the size of various market segments based on five major regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their respective key countries

-

To analyze the competitive developments, such as partnerships and expansions, in the market

-

To strategically profile the key players and comprehensively analyze their market share and core competencies

Growth opportunities and latent adjacency in Ethylene Carbonate Market