Exosome Research Market: Growth, Size, Share, and Trends

Exosome Research Market by Offering (Kits, Reagents (Antibodies, Isolation, Purification), Instruments, Services), Indication (Cancer, Infectious Diseases), Application (Biomarkers, Vaccines), Manufacturing Services (Stem Cell) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The exosome research market is expected to reach USD 480.6 million by 2030 from USD 214.4 million in 2025, at a CAGR of 17.5% during the forecast period. The growing interest in exosome-based therapies and the rising prevalence of chronic diseases such as cancer have attracted substantial funding and investment from public and private sources, which is crucial for exosome R&D.

KEY TAKEAWAYS

-

By RegionThe North America exosome research market dominated, with a share of 45.9% in 2024. the large share of the market is mainly due to increasign research and development activities for the development of exosome based therapeutics.

-

By OfferingBy offering, kits and reagents segment is expected to register the highest CAGR of 18.7%, owing to increasing usase of kits and reagent for the developent of exosome based biomarkers.

-

By IndicationBy indication, the cancer segment is projected to grow at the fastest rate from 2025 to 2030, owing increasing prevalence of cancer has driven continuous R&D to enable the early diagnosis and treatment of cancer using exosome based biomarkers.

-

By ApplicationBy application, the biomarkers segment is expected to dominate the market. This is mainly attributed to the increasing research and development activities for developing new disease biomarkers.

-

By Manufacturing ServiceBy manufacturing service, the dendritic cell-derived exosome manufacturing services segment is projected to grow at the fastest rate over the forecast peirod, owing to developent of dendritic cell-based exosome immunotherapies which can restore and facilitate anticancer immune responses.

-

By End UserBy end user, academic and research institutes segment growing at fastest rate during the forecast period. Growth of the segment is mainly driven by increasing research and development activities for exosome in academic and research institutes.

-

COMPETITIVE LANDSCAPECompany Thermo Fisher Scientific, Inc., QIAGEN, and Lonza were identified as some of the star players in the gene therapy market (global), given their strong market share and product footprint.

The exosome research market is witnessing steady growth, driven by the increasing funding for life sciences research, the increasing global prevalence of cancer, and the increasing interest in exosome-based procedures. However, the technical complexity of exosome isolation and technological limitations are expected to restrain the growth of this market to a certain extent.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The exosome research market is experiencing significant disruptions that impact customer businesses. Rapid technological advancements in isolation and analysis techniques are reshaping research approaches, necessitating businesses to stay technologically current. The expanding clinical applications of exosomes in diagnostics, therapeutics, and drug delivery demand adaptability from companies, fostering potential collaborations across sectors. However, challenges arise due to the lack of standardized procedures for exosome research, requiring concerted efforts to establish industry-wide standards for consistency and reproducibility. Ethical considerations regarding biosafety and sourcing practices are gaining prominence, urging businesses to address these concerns. The integration of big data and bioinformatics further complicates the landscape, prompting businesses to invest in advanced data management tools. Additionally, increased competition, strategic collaborations, and a globalized market necessitate businesses to navigate a dynamic landscape while evolving regulatory frameworks underscore the importance of compliance for sustained success in exosome research.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing investment in pharmaceutical and life sciences R&D

-

Rising focus on development of cancer therapeutics and diagnostics

Level

-

Technical complexity of exosome isolation and characterization

-

Regulatory complications and uncertainty in exosome research

Level

-

High investments in emerging economies

-

Growing interest in exosome-based therapeutics

Level

-

Lack of standard protocols for exosome manufacturing and development

-

Limited understanding of cargo loading capacity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing investment in pharmaceutical and life sciences R&D.

Most pharmaceutical, biopharmaceutical, and medical device companies continue to invest heavily in developing novel drugs and devices. The pharmaceutical industry, in particular, is R&D-intensive. Pharmaceutical companies invest in R&D to deliver high-quality and innovative products. Trends suggest that the top pharma companies are increasing their R&D efficiencies through heavy R&D investments to see returns in the longer term and through collaborative R&D efforts. For instance, Thermo Fisher Scientific invested USD 1.39 billion in R&D in 2024. Similarly, QIAGEN invested approximately USD 193 million in R&D in 2024. Moreover, advancements in biotechnology have resulted in a sharp increase in the number of drug candidates under development. According to Pharma R&D Annual Review 2022, the number of drugs in the R&D pipeline grew from 17,737 in 2020 to 22,825 in 2024. As per the ClinicalTrials.gov website, the total number of clinical registered studies went up to 538,875 as of May 2025; this has provided lucrative opportunities for emerging drug candidates, such as exosome-based therapeutics, driving market growth.

Restraint: Technical complexity of exosome isolation and characterization.

The complexities associated with isolating and characterizing exosomes, along with existing technological limitations, are significant impediments to the progress of exosome research. These challenges hinder the development of robust methodologies and impact the overall advancement of the field. The complications involved in working with exosomes, which are small extracellular vesicles, pose difficulties in their isolation and thorough characterization. Current technological limitations further exacerbate these challenges, creating obstacles to achieving precise and consistent results. The isolation of exosomes from biological samples, such as blood or cell cultures, involves intricate processes that require addressing issues like heterogeneity, purity, and yield. Additionally, accurately characterizing exosomes, including their size, surface markers, and cargo, demands sophisticated technologies that may have limitations in terms of sensitivity and specificity. As a result, the pace of research progress is affected, and the development of robust methodologies for exosome isolation and characterization is constrained. Moreover, the lack of uniformity and precision in isolation techniques raises concerns about data reliability, limiting the confidence of stakeholders, researchers, and investors in the exosome market's potential. Thus, addressing these limitations through advancements in isolation methodologies is crucial for fostering the sustained growth and broader acceptance of exosome-related applications in diagnostics, therapeutics, and beyond.

Opportunity: High investments in emerging economies.

Emerging countries such as China, India, Brazil, and Mexico are expected to offer significant growth opportunities to market players in the coming years. These high growth opportunities can be attributed to the growing biopharmaceutical and biotechnology sectors and the development of bioclusters in these countries. The developing healthcare infrastructure and increasing healthcare expenditure, the presence of large patient populations and the increasing need for affordable care, and the growing focus of major pharmaceutical and biotechnology companies on increasing their presence in these countries (to leverage the low manufacturing cost advantage) are the other major factors supporting market growth in these countries. For instance, Researchers in China have developed novel exosome-based therapies for various diseases, including cancer, cardiovascular diseases, and neurodegenerative diseases. One notable example is the development of exosomes derived from mesenchymal stem cells (MSCs) to treat patients with acute ischemic stroke. This therapy has shown promising results in clinical trials, with patients experiencing improved neurological function.

Challenge: Lack of standard protocols for exosome manufacturing and development.

The exosome field is still nascent, and no gold standards have been developed so far. The diversity of exosome isolation techniques, including ultracentrifugation, precipitation, and chromatography, lacks a universally agreed-upon methodology, resulting in variations in purity, yield, and contamination levels. Standardizing parameters for exosome characterization, such as size distribution, surface markers, and cargo content, is complicated by the inherent heterogeneity within exosome populations. The prevalent method, differential centrifugation, often relies on factors such as sample viscosity, resulting in inconsistent exosome capture. Alternative approaches, including size-exclusion chromatography and immunoaffinity capture, though presenting certain benefits, encounter limitations in accuracy and specificity.

exosome-research-product-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Thermo Fisher partnered with RoosterBio to provide an integrated pathway for cell- and exosome-therapy manufacturing. This collaboration targets accelerating timelines from process/analytical development to clinical material supply. | Faster time-to-clinic, standardized upstream/downstream workflows, reproducible analytical quality, and access to global GMP capacity. |

|

FUJIFILM Diosynth and RoosterBio established an end-to-end collaboration enabling tech-transfer from RoosterBio’s process and analytical development into FUJIFILM’s advanced-therapies GMP manufacturing. The scope covers process development, analytics, scale-up and GMP clinical supply for MSC- and exosome-based therapeutics. | Seamless scale-up into cGMP, regulatory readiness, reduced transfer risk, and a single CDMO path from process development to clinical supply. |

|

Lonza entered into collaborative agreement with Exogenus Therapeutics (Exo-101) to develop a GMP-compliant manufacturing process for Exogenus’ Exo-101, leveraging Lonza’s cell culture, characterization and clinical-supply capabilities (Siena, Italy site referenced for scale-up). Lonza offers process definition, analytics, and clinical-supply manufacturing for exosome modalities. | Robust GMP process development, reduced time and risk to IND/CTA, clinical supply reliability and access to established analytical platforms. |

|

Exopharm’s LEAP purification platform (patented) is being trialed/licensed with industrial partners (e.g., Showa Denko) to validate large-scale, high-purity exosome isolation and integration into partner manufacturing workflows. Agreements typically begin with feasibility studies to evaluate LEAP at partner sites and progress to licensing/scale-up terms. | Improved purity and yield at scale, enabling commercial-scale manufacturing pathways and reduced downstream impurity burden for therapeutic exosome products. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The exosome research market operates within a complex and dynamic ecosystem comprising raw material and reagent suppliers, technology providers, instrument manufacturers, CMOs, biotech & pharmaceutical innovators, academic & research institutions, clinical laboratories, regulatory bodies, and funding agencies. This ecosystem collectively supports the development, standardization, and commercialization of exosome- based applications in diagnostics, therapeutics, and drug delivery. Key interactions between these stakeholders, such as academic-industry partnerships, growing investment in R&D, and regulatory guidance, are accelerating innovation and enabling the transition of exosome technologies from research settings to clinical and commercial use, particularly in areas such as cancer, neurology, and cardiovascular diseases.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Exosome Research Market, By Offerings

In 2024, the most significant market share was held by the reagents and kits segment in the exosome research market. This category encompasses a variety of products, including antibodies, isolation kits, purification kits, quantitation kits, and other associated reagents. Reagents have emerged as the preferred option in exosome research workflows, owing to their enhanced efficiency and user-friendliness across various phases of project execution. Engineered for scalability, these reagents accommodate a wide spectrum of research conditions and sample volumes, rendering them indispensable in both academic settings and high-throughput industrial laboratories. Ongoing advancements in the sensitivity, specificity, and reproducibility of these reagents have facilitated their increased utilization. Furthermore, their compatibility with diverse instruments and workflows reinforces their critical role as essential consumables, substantially contributing to the evolution of exosome-based diagnostics and therapeutic applications.

Exosome Research Market, By Indication

In 2024, cancer segment dominated the exosome research market. The increasing prevalence of cancer has driven continuous R&D to enable the early diagnosis and treatment of cancer. Liquid biopsy is one of the many emerging technologies developed to address the growing cancer prevalence. Cancer research has found a novel foothold in studying exosomes. If compared, cancer cells release more exosomes than normal cells. The exosomes secreted by tumor cells promote tumor progression, survival, invasion, and angiogenesis. Hence, the analysis of exosomes isolated from the blood or other body fluids of cancer patients could provide insights into cancer cell biology and serve as non-invasive predictive biomarkers for early detection, progression, and metastasis. However, the clinical use of exosomes and other EVs is restricted by the lack of robust and reproducible methods for isolating pure exosomes.

Exosome Research Market, By Application

The biomarkers segment is expected to dominate the exosome research market. Biomarkers are essential for early disease detection and effective therapy, and it is vital that these biomarkers are non-invasive, specific, and have high stability. The present lack of such biomarkers has directed researchers to the attention of exosomes and their content as promising biomarkers. Exosomes are easily accessible for diagnosis and studying complex diseases as these can be sampled from various body fluids, such as blood plasma and urine. They also act as a fingerprint of parental cells and reflect their pathological status, which makes them potent biomarkers. The most adoption of exosomes as biomarkers has been observed in diagnosing cancer, cardiovascular diseases, central nervous system disorders, and infectious diseases. Different research studies have shown the diagnostic potential of exosomes as biomarkers for Alzheimer's disease and amnestic mild cognitive impairment. In addition, a combination of exosomal synaptic proteins can predict Alzheimer's disease ~5-7 years before cognitive impairment.

Exosome Research Market, By Manufacturing Service

In 2024, Stem Cell-Derived Exosome Manufacturing Services segment dominated the exosome research market. Stem cell-derived exosome manufacturing involves cultivating stem cells, collecting their secreted exosomes, and isolating these nanosized vesicles through purification and concentration techniques. Characterization and quality control measures ensure consistency and purity, with subsequent storage and stability testing. The scalable process, tailored for therapeutic or research purposes, adheres to regulatory guidelines for applications such as regenerative medicine or drug delivery systems.

Exosome Research Market, By End user

The academic & research institutes segment is expected to dominate the exosome research market by end user. The academic & research institutes segment mainly comprises university laboratories and private and government research institutions that use exosomes to conduct research activities. Exosomes are used in cancer research, stem cell research, and studies of immunological disorders. They are also used in biomedical and life science research activities for cancer diagnostics and therapeutics, with several applications in drug delivery, tumor immunotherapy, and diagnostic biomarkers. In November 2023, The Paul G. Allen Family Foundation allocated over USD 10 million in funding to support new cohorts of Allen Distinguished Investigators in the exploration of extracellular vesicles, elucidating their crucial role in cellular communication, and delving into the influence of sex hormones on behavior and development. This substantial funding will empower 18 researchers to pioneer innovative technologies, devise novel methodologies, and unravel profound insights into the fundamental aspects of exosome research, contributing significantly to our understanding of human biology.

REGION

North America to be fastest-growing region in global exosome research market during forecast period

The North America exosome research market is expected to register the highest CAGR during the forecast period, driven by increasing R&D activities, the growing focus on cell-based research, favorable government support for the development of targeted therapies, and the rising prevalence of diseases are driving the market growth. Furthermore, the region is witnessing increasing investments in developing drugs and advanced dosage forms, with the impending patent expiration of several blockbuster drugs (implying a rise in patent applications). These factors are expected to drive the exosome research market in North America during the forecast period.

exosome-research-product-market: COMPANY EVALUATION MATRIX

In the exosome research market matrix, Thermo Fisher Scientific (Star Player) leads with a strong market presence and a comprehensive product portfolio, driven by its advanced exosome isolation, characterization, and analytical platforms that support both research and clinical applications. Miltenyi Biotec (Emerging Leader) is rapidly gaining momentum through continuous innovation in exosome isolation kits, magnetic bead–based separation technologies, and scalable workflow solutions for translational and clinical research. While Thermo Fisher dominates through its global reach, integrated product ecosystem, and established collaborations with leading biotech and academic centers, Miltenyi Biotec shows significant potential to advance into the leaders’ quadrant, supported by its expanding customer base, technological advancements, and growing role in standardizing exosome manufacturing and purification workflows.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific Inc. (US)

- Lonza (Switzerland)

- QIAGEN (Germany)

- Bio-Techne (US)

- Danaher (US)

- Miltenyi Biotech (Germany)

- Izon Science Limited (New Zealand)

- Capricor Therapeutics, Inc. (US)

- InnovaPrep (US)

- NX Pharmagen (US)

- Aethlon Medical, Inc. (US)

- Spectris (UK)

- AMSBio (UK)

- System Biosciences, LLC (US)

- Norgen Biotek Corp. (Canada)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 189.4 Million |

| Market Forecast in 2030 (Value) | USD 480.6 Million |

| Growth Rate | CAGR of 17.5% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: exosome-research-product-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Application Specific |

|

|

| Indication-specific |

|

|

| Geographic (market entry & access) |

|

|

| Company profiles |

|

|

RECENT DEVELOPMENTS

- January 2025 : MLTENYI BIOTEC launched the MACSPlex EV Kit MSC (for Mesenchymal stem cells) that detects 37 EV (extracellular vesicle) surface epitopes plus two isotype controls. The MACSPlex EV Kit MSC comprises a cocktail of various fluorescently labeled bead populations, each coated with a specific antibody binding the respective surface epitopes.

- July 2024 : Malvern Panalytical provided advanced analytical solutions for the characterization of nanoparticles, including exosomes. The company has acquired Micromeritics to broaden the physical characterization of particles, powders, and porous material portfolio in the market.

- December 2023 : MLTENYI BIOTEC launched the MACSPlex EV Kit Neuro (for neurobiology) for the detection and characterization of extracellular vesicles (EVs), such as exosomes, using 37 different surface epitopes and two isotype controls.

- October 2022 : Lonza expanded its cell and gene therapies (CGT) process and analytical development laboratories at its locations in Houston (US) and Geleen (NL). This further strengthened Lonza’s global process development service offering by adding capabilities and capacity to its existing laboratories

- February 2022 : Bio-Techne entered an exclusive agreement with Thermo Fisher Scientific to develop and commercialize the ExoTRU kidney transplant rejection test designed by Bio-Techne. This liquid biopsy test offers allograft health information suitable for clinical and research applications

Table of Contents

Methodology

This research study extensively used secondary sources, directories, and databases to identify and collect valuable information to analyze the global exosome research market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the exosome research market. The secondary sources used for this study include the International Chromosome and Genome Society (ICGS), the National Human Genome Research Institute (NHGRI), the Asia Pacific Society of Human Genetics (APSHG), Genetics Society of America (GSA), the European Society of Human Genetics (ESHG), Centers for Common Disease Genomics (CDDG), Center for Cellular and Molecular Biology (CCMB) (India), the Department of Biotechnology (DBT) (India), World Health Organization (WHO), United States Food & Drug Administration (US FDA). Scientist Magazine, ScienceDirect, research journals, corporate filings such as annual reports, SEC filings, investor presentations, financial statements, press releases, trade, business, professional associations, and others are also pivotal sources. These sources also obtained key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

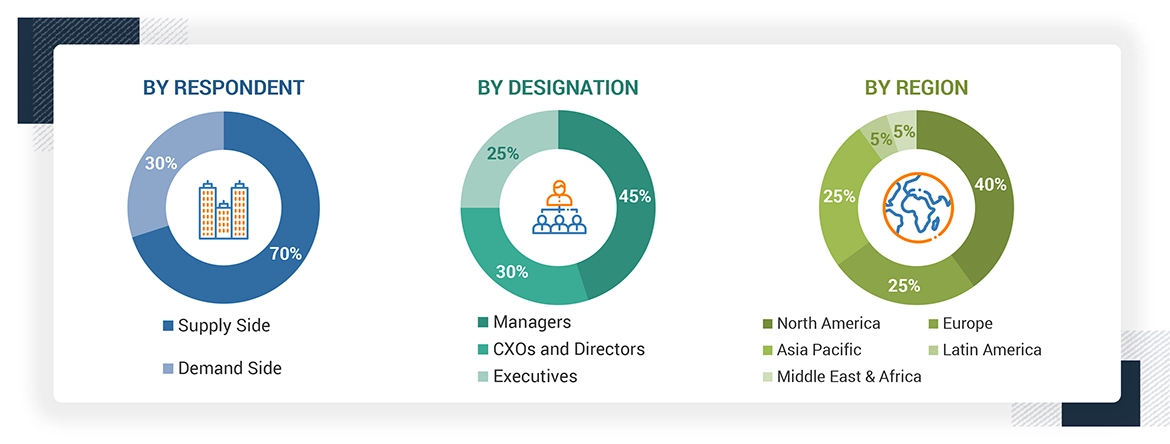

Comprehensive primary research was undertaken following an initial assessment of the global exosome research market landscape through secondary research. This involved conducting in-depth interviews with market experts from the demand side, including stakeholders from pharmaceutical & biotechnology firms, CROs, CMOs, and academic and research institutions. Additionally, interviews were held with key supply-side participants, such as C-suite and senior executives, product managers, and marketing and sales leaders from prominent manufacturers, distributors, and channel partners. The research covered six major geographical regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Approximately 70% of the primary interviews were conducted with supply-side participants, while 30% involved demand-side experts. Data collection methods included structured questionnaires, email correspondence, online surveys, personal interviews, and telephonic discussions to understand the market dynamics comprehensively.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

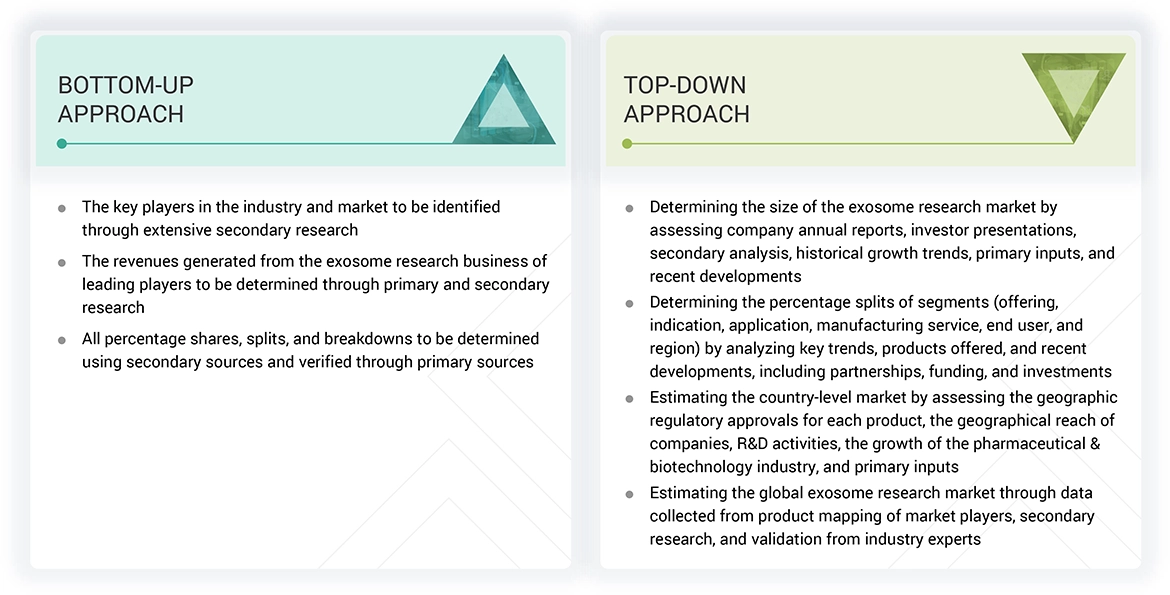

Both bottom-up and top-down approaches were used to estimate and validate the total size of the exosome research market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- A list of the major global players operating in the exosome research market was generated.

- The revenues generated from their exosome research product have been determined through annual reports and secondary sources (including paid databases)

- The products were mapped according to the segments of the market. Percentage shares and splits were determined based on the revenue contributed to each segment; this was verified using secondary sources and by industry experts.

- All assumptions, approaches, and individual shares/revenue estimates were validated through expert interviews.

Global Exosome Research Market Size: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the market size from the estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Exosomes are biomembrane-like vesicles containing protein, miRNA, and lipids that can be delivered to the extracellular milieu (ECM). Exosomes are naturally produced within the body and could be utilized in cell-to-cell communication, molecular therapy for cancer treatment, and the diagnosis of skeletal disorders. They have several advantages in cell-based treatment, which has brought attention to R&D in this field.

Stakeholders

- Manufacturers and distributors of exosome research products

- Pharmaceutical and biotechnology companies

- Contract research organizations (CROs)

- Contract development & manufacturing organizations (CDMOs)

- Market research and consulting firms

- R&D centers

- Academic & research institutes

- Regulatory agencies

- Health insurers and payers

- Venture capitalists

- Government organizations

- Industry associations & professional societies

- Private & government funding organizations

Report Objectives

- To define, describe, and forecast the exosome research market based on offering, indication, application, manufacturing service, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the exosome research market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments concerning five main regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the global exosome research market and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as product approvals and launches, expansions, agreements, and collaborations in the exosome research market

- To benchmark players within the exosome research market using the company evaluation matrix framework, which analyzes market players based on various parameters within the broad categories of business and service strategy

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Exosome Research Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Exosome Research Market