Breast Cancer Liquid Biopsy Market by Circulating Biomarkers, Region, End User, Investments, Market Dynamics, Platform Comparison (NGS, PCR), Competitive Landscape (Acquisition, Mergers, Collaboration, Competitive technology) & Geography

The global breast cancer liquid biopsy market is expected to grow at a CAGR of 23.1%. Factors such as increasing prevalence of breast cancer, increasing preference for noninvasive procedures, initiatives undertaken by government and global health organizations, technological advancements to augment market revenues, rising emphasis on personalized medicine in clinical practice, and increased funding for liquid biopsy R&D are driving the growth of the market.

Objectives of the Study

- To define, describe, and forecast the breast liquid biopsy market on the basis of circulating biomarkers, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive technology, investments, funding for the breast cancer liquid biopsy market

- To track and analyze competitive developments such as acquisitions, product developments, partnerships, agreements, expansions, and collaborations in the liquid biopsy market

Research Methodology

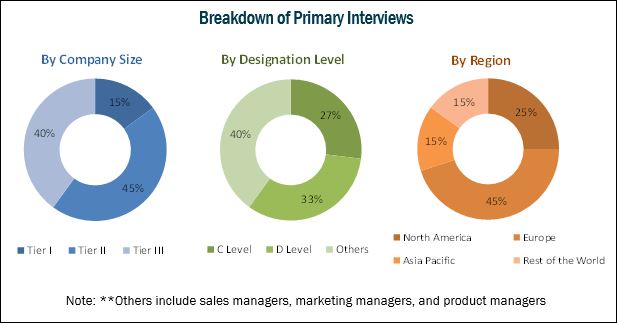

Top-down and bottom-up approaches were used to validate the size of overall breast cancer liquid biopsy industry and estimate the size of other dependent submarkets. Various secondary sources such as World Health Organization (WHO), Food and Drug Administration (FDA), National Institutes of Health (NIH), American Cancer Society, Inc. (ACS), National Cancer Institute (NCI), National Health Service (NHS), British In Vitro Diagnostics Association (BIVDA), Cancer Aid Society (CAS), National Breast Cancer Foundation (NBCF), International Journal of Molecular Sciences, European Association for Cancer Research, Journal of Medical Screening, Japan Cancer Society, Cancer Council Australia, Annual Reports, Press Releases, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis have been used to identify and collect information useful for the study of this market. Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to the assess dynamics of this market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The major players in the global breast cancer liquid biopsy market are QIAGEN N.V. (Netherlands), Roche Diagnostics (US), Bio-Rad Laboratories (US), Myriad Genetics (US), Menarini Silicon Biosystems (Italy), Illumina (US), Cynvenio Biosystems, Inc. (US) Genomic Health, Inc. (US), Thermo Fisher Scientific Inc. (US), Fluxion Biosciences, Inc. (US), Biodesix, Inc. (US), Guardant Health, Inc. (US), and Isogen Life Science B.V. (Netherlands).

Target Audience:

- Liquid biopsy system manufacturers, suppliers, and distributors

- Research institutes

- Physicians and surgeons

- Healthcare service providers and clinical research organizations

- Market research and consulting firms

Breast Cancer Liquid Biopsy Market Scope

The research report categorizes the market into the following segments and subsegments:

By Circulating Biomarker

- Circulating Tumor Cells (CTCs)

- Cell-free DNA (cfDNA)

- Extracellular Vesicles (EVs)

- Other Circulating Biomarkers*

*Other circulating biomarkers include circulating RNA (ctRNA and cfRNA) and cell-free protein biomarkers.

By End User

- Reference Laboratories

- Hospitals and Physician Laboratories

- Other End Users

By Region

- North America

- Europe

- Asia Pacific

- RoW

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

- Country-wise market information for North America (US, Canada), and Europe (Germany, UK, France, Rest of Europe)

The report analyzes the market by circulating biomarker, end user, and region. On the basis of circulating biomarkers, the market is segmented into circulating tumor cells (CTCs), cell-free DNA (cfDNA), extracellular vesicles (EVs), and other circulating biomarkers. The cfDNA segment is the largest and fastest-growing segment in the circulating biomarkers market during the forecast period. The growing research on cfDNA owing to its occurrence in other body fluids along with the blood of cancer patients and the real-time results obtained by the analysis of cfDNA are the major factors contributing to the growth of cfDNA in the market.

Based on end user, the breast cancer liquid biopsy market is segmented into reference laboratories, hospitals and physician laboratories, and other end users (research institutes, public health laboratories, pathology laboratories, and small molecular laboratories). In 2017, the reference laboratories segment accounted for the largest share of the market. The large share is attributed to the availability of advanced genetic testing equipment leading to an increased volume of liquid biopsy test samples outsourced to reference laboratories.

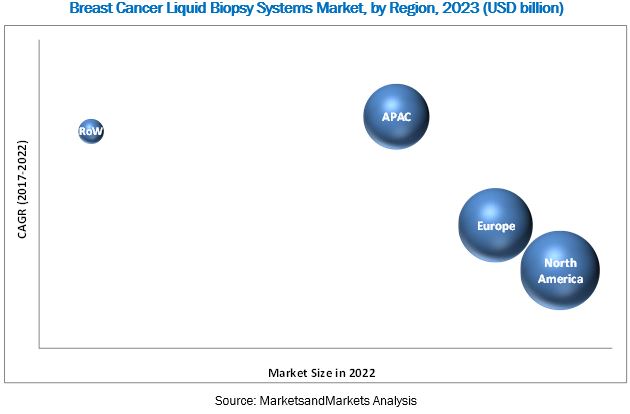

Geographically, the global breast cancer liquid biopsy market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. In 2022, North America is expected to dominate the market which can be attributed to the ease of accessibility and high adoption of advanced diagnostic technologies (such as PCR and NGS) among healthcare professionals. The APAC region is expected to register the highest CAGR during the forecast period. Growth in this market can be attributed to a number of factors such as rising disposable incomes in the middle-class population, infrastructural developments, rising penetration of cutting-edge diagnostic technologies, the growing focus of global life science companies in this region, government initiatives to increase awareness about genome-based diagnostic procedures, and the increasing incidence of breast cancer. However, low awareness on molecular testing, and lack of skilled Molecular Diagnostics technicians restraints the market growth in APAC.

In 2016, QIAGEN N.V. (Netherlands), Roche Diagnostics (US), and Illumina, Inc. (US) dominated the global breast cancer liquid biopsy market. Some of the other players competing in this market are Bio-Rad Laboratories (US), Myriad Genetics (US), Menarini Silicon Biosystems (Italy), Cynvenio Biosystems, Inc. (US) Genomic Health, Inc. (US), Thermo Fisher Scientific Inc. (US), Fluxion Biosciences, Inc. (US), Biodesix, Inc. (US), Guardant Health, Inc. (US), and Isogen Life Science B.V. (Netherlands).

Frequently Asked Questions (FAQs):

What is the size of Breast Cancer Liquid Biopsy Market?

The global breast cancer liquid biopsy market is expected to grow at a CAGR of 23.1%.

What are the major growth factors of Breast Cancer Liquid Biopsy Market?

Factors such as increasing prevalence of breast cancer, increasing preference for noninvasive procedures, initiatives undertaken by government and global health organizations, technological advancements to augment market revenues, rising emphasis on personalized medicine in clinical practice, and increased funding for liquid biopsy R&D are driving the growth of the market.

Who all are the prominent players of Breast Cancer Liquid Biopsy Market?

The major players in the global breast cancer liquid biopsy market are QIAGEN N.V. (Netherlands), Roche Diagnostics (US), Bio-Rad Laboratories (US), Myriad Genetics (US), Menarini Silicon Biosystems (Italy), Illumina (US), Cynvenio Biosystems, Inc. (US) Genomic Health, Inc. (US), Thermo Fisher Scientific Inc. (US), Fluxion Biosciences, Inc. (US), Biodesix, Inc. (US), Guardant Health, Inc. (US), and Isogen Life Science B.V. (Netherlands).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Liquid Biopsy: Market at A Glance

1.1 Introduction

1.2 Issues Addressed By Liquid Biopsy & Biomarkers Detected

1.3 Milestones in Liquid Biopsy

2 Liquid Biopsy: Circulating Biomarkers

2.1 Liquid Biopsy Market for Circulating Tumor DNA (CTDNA)

2.2 CTDNA Approaches: Applications and Limitations

2.3 Methods for CTC Isolation

3 Liquid Biopsy: Market Overview

3.1 Introduction

3.1.1 Drivers

3.1.2.1 High Burden of Cancer

3.1.2.2 Increasing Preference for Noninvasive Procedures

3.1.2.3 Initiatives Undertaken By Governments and Global Health Organizations

3.1.2.4 Technological Advancements

3.1.2.5 Rising Emphasis on Personalized Medicine

3.1.2.6 Availability of Funding for Liquid Biopsy R&D

3.1.2 Restraints

3.1.2.1 Low Sensitivity and Specificity

3.1.3 Opportunities

3.1.3.1 Growing Interest in Liquid Biopsy

3.1.4 Challenges

3.1.4.1 Unclear Regulatory and Reimbursement Scenario

4 Major Investments & Initiatives

4.1 Government Funding & Initiatives

4.2 Industry Investments and Initiatives

5 Breast Cancer Liquid Biopsy Market

5.1 Breast Cancer Liquid Biopsy Market: Global Scenario

5.2 Potential of Liquid Biopsy and CTC in Breast Cancer Diagnosis

6 Liquid Biopsy Market: Competitive Landscape

6.1 Introduction

6.2 Key Strategies

6.2.1 Acquisitions and Mergers

6.2.2 Product Launches

6.2.3 Agreements, Partnerships, and Collaborations

6.3 Liquid Biopsy Market: Competitive Technology Portfolio

7 Appendix

7.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

7.2 Introducing RT: Real-Time Market Intelligence

7.3 Available Customizations

7.4 Related Reports

7.5 Author Details

List of Tables (15 Tables)

Table 1 CTDNA Approaches: Applications and Limitations

Table 2 Methods for CTC Isolation-1

Table 3 Methods for CTC Isolation -2

Table 4 Conferences & Awareness Programs on Liquid Biopsy

Table 5 Upcoming Conferences & Awareness Programs on Liquid Biopsy

Table 6 Government Funding & Initiatives – North America

Table 7 Government Funding & Initiatives – Europe

Table 8 Government Funding & Initiatives – Asia Pacific

Table 9 Government Funding & Initiatives – Rest of the World

Table 10 Major Investments in the Liquid Biopsy Market (2010–2017) -1,2,3,4,5,6

Table 11 Breast Cancer Liquid Biopsy Market, By Circulating Biomarker, 2015-2022 (USD Million)

Table 12 Global Market, By Region, 2015-2022 (USD Million)

Table 13 Global Market, By End User, 2015-2022 (USD Million)

Table 14 Breast Cancer CTDNA Market, By Region, 2015-2022 (USD Million)

Table 15 Major Players and Competitive Technology Portfolio – 1,2,3,4,5,6,7

List of Figures (11 Figures)

Figure 1 Issues Addressed By Liquid Biopsy

Figure 2 Liquid Biopsy: Detection of Cancer Biomarkers

Figure 3 Milestones in Liquid Biopsy

Figure 4 Liquid Biopsy Market: Drivers, Restraints, Opportunities, and Challenges

Figure 5 Global Cancer Mortality Statistics (2012)

Figure 6 Biomarkers Used in Current Liquid Biopsy Tests

Figure 7 Pubmed Publications on Liquid Biopsy

Figure 8 Investments in Liquid Biopsy: 2016 & 2017 (Used Million)

Figure 9 NGS Fund-Raising in 2017 (USD Million)

Figure 10 Breast Cancer Liquid Biopsy: Market Overview

Figure 11 Liquid Biopsy Market By Circulating Biomarkers (CAGR 2017 – 2022)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Breast Cancer Liquid Biopsy Market