Feed Preservatives Market by Type (Feed Acidifiers, Mold Inhibitors, Feed Antioxidants, Anticaking Agents), Livestock (Poultry, Cattle, Swine, Aquaculture), Feed Type (Compound Feed, Feed Premix, Feed Meal, Silage), and Region - Global Forecast to 2027

Feed Preservatives Market Insights

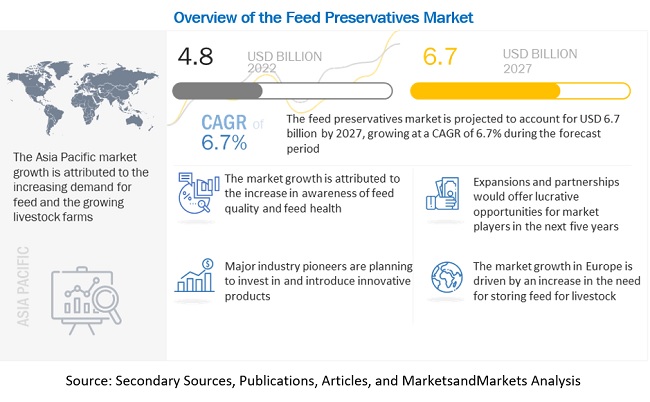

The global feed preservatives market is estimated to reach $6.7 billion by 2027, growing at a 6.7% compound annual growth rate (CAGR). The global market size was valued $4.8 billion in 2022. Feed preservatives are added to enhance animal nutrition and prevent it from any sort of microbial contamination, thus enhancing the shelf-life of the product. Increasing hygiene concerns regarding food safety and increased meat consumption globally, are factors promoting the demand for feed preservatives.

To know about the assumptions considered for the study, Request for Free Sample Report

Feed Preservatives Market Dynamics

Drivers: Growing applications of livestock in the food industry to fuel its production

The large-scale surging demand for livestock production on the global level has impacted the livestock industry. Drastic meat consumption, a rise in the need for meat and dairy products, and increased demand for eggs are some of the factors driving the market. The increasing demand in the food industry for livestock has significantly increased the demand for feed preservatives.

Restraints: Low-profit margin and lesser availability of end products

In the animal nutrition industry, it is difficult to achieve high margin. In the last few decades, high-margin products are sold at a lesser volume, which has shrunk the sales volume. Principles of oversupply, over-promising, and under delivering has diminished the available margins and shrunk the sales volume. Under-delivering principles have diminished the available profit and eventually lowered the demand for feed preservatives market.

Opportunities: Surge in demand for natural preservatives

Feed preservatives are used to improve the efficacy of the feed and enhance its shelf-life. However, the extensive use of antibiotics has led to antibiotic-resistant pathogens and their residue in animal products because of which they can no longer to used to preserve the feeds. EU has imposed a ban on using antibiotics as a growth promoter. The ban of antibiotics has emerged as a growth opportunity for natural feed preservatives. The players operating in market have huge growth prospects and are investing in developing newer and natural feed preservatives.

Challenges: Market capitalization is restricted by a strong pool of cooperative societies

There is a good network of farm operators in the cooperative societies, who source raw materials within the community and this becomes a barrier for manufacturers of feed preservatives. As these societies are the largest buyer in the area or region, they even procure commercial feed and possess a competitive advantage over feed manufacturers.

By type, the anticaking agents segment is expected to grow with the highest CAGR in the feed preservatives market during the forecast period

Based on type, the anticaking agents segment is projected to grow at the highest CAGR in the market during the forecast period. Anticaking agents absorbs excess moisture or repelling water and oil, thus keeping the feed dry for a long time. These are added to the feed to avoid lumps and ease the transportation of the product.

By livestock, the poultry segment accounts for the largest market share in the market

Based on livestock, the poultry segment is estimated to hold the highest market share during the forecast period. The increasing demand for eggs for appropriate vitamins and protein is expected to increase the demand for poultry. Additionally, the rise in awareness regarding optimum nutrition and care would boost the demand for feed preservatives in the poultry sector.

By feed type, the compound feed segment is estimated to account for the largest market share during the forecast period

By feed type, the compound feed segment is projected to account for the largest market share. Compound feed refers to the feed that produced on the basis of animals’ different growth stages, different physiological requirements, and different production uses.

To know about the assumptions considered for the study, download the pdf brochure

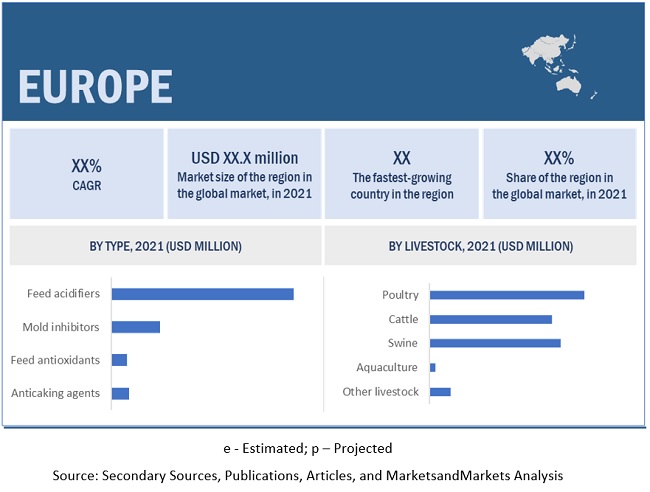

Europe is the second-largest region in the feed preservatives market. The feed preservative market in Europe has been in the growth stage due to the increased focus on feed cost reduction by the regulatory authority. Some of the factors because the region is experiencing growth are a ban on antibiotics by the regulatory authority, investment in R&D by leading companies for technology innovation, increased meat consumption, and feed quality.

Key Players in Feed Preservatives Market

Key players in this market include BASF SE (Germany), Cargill (US), Nutreco NV (Netherlands), Alltech Inc. (US), Perstorp Holding AB (Sweden), Novus International Inc. (US), DSM (Netherlands), Kemin Industries (US), Impextraco NV (Belgium), Eastman Chemical Company (US).

Scope of the report

|

Report Metric |

Details |

|

Market valuation in 2022 |

USD 4.8 Billion |

|

Revenue prediction in 2027 |

USD 6.7 Billion |

|

Forecast Period |

2022 to 2027 |

|

Progress rate |

CAGR of 6.7% |

|

Companies studied |

|

Target Audience:

- Feed preservatives manufacturers and distributors

- Marketing directors

- Research officers and quality control officers

- Government and Non-Government Research Institutes and Institutional Laboratories

- Animal husbandry companies and large-scale ranches and poultries

- Key executives from various key companies and organizations in feed preservatives market.

Report Scope

- This research report categorizes feed preservatives market based on type, livestock, feed type, and region.

By type

- Feed acidifiers

- Mold inhibitors

- Feed antioxidants

- Anticaking agents

By livestock

- Cattle

- Poultry

- Swine

- Aquaculture

- Other livestock

By feed type

- Compound feed

- Feed premix

- Feed meal

- Silage

- Other feed types

By Region

- North America

- Europe

- Asia Pacific

- South America

-

Rest of the World (RoW)

- Middle East

- Africa

Recent Developments

- BASF SE expanded its feed enzymes production plant in Ludwigshafen, Germany in February 2022. This expansion will help in increasing the production capacity and meet the rising demand from customers.

- In January 2022, Cargill is assembling a portfolio of AI-driven innovations such as Galleon Microbiome Analysis and Birdoo to assess broiler health and weight performance. The company is developing these technologies through proprietary developments and strategic partnerships to provide customers with actionable insights so that they can optimize their operations.

- In December 2021, BASF SE launched Natupulse TS to improve nutrient digestion in a more cost-effective and sustainable manner. With this product launch, the company intends to reach a larger customer base looking for solutions to make the feed more cost-effective and support the sustainable production of animal protein.

Frequently Asked Questions (FAQ):

Which are the major feed preservatives market types considered in this study and which segments are projected to have promising growth rates in the future?

All the major feed preservatives market types such as feed acidifiers, mold inhibitors, feed antioxidants, and anticaking agents are considered in the scope of the study. Feed acidifiers is currently accounting for a dominant share in the feed preservatives market and segment is projected to experience the highest growth rate in the next five years, due to its application as feed preservatives and increased need for quality meat and animal products.

I am interested in the Asia Pacific market for feed acidifiers and mold inhibitors segment. Is the customization available for the same? What all information would be included in the same?

Yes, customization for the Asia Pacific market for various segments can be provided on various aspects including market size, forecast, top companies etc. Exclusive insights on below Asia Pacific countries will be provided:

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific (Australia, Thailand, Indonesia, and Vietnam)

Also, you can let us know if there are any other countries of your interest

What are some of the drivers fuelling the growth of the feed preservatives market?

Global feed preservatives market is characterized by the following drivers:

Drivers: Growing applications of livestock in the food industry to fuel its production

The large-scale surging demand for livestock production on the global level has impacted the production of livestock. Drastic meat consumption, a rise in the need for meat and dairy products, and increased demand for eggs are some of the factors driving the market. The increasing demand in the food industry for livestock has significantly increased the demand for feed preservatives.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of the research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Bottom-up approach

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst view on the company. Some of the key players in the market include BASF SE (Germany), Cargill, Inc. (US), Nutreco NV (Netherlands), DSM (Netherlands), Kemin Industries (US), Impextraco NV (Belgium), Eastman Chemical Company (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE FEED PRESERVATIVES MARKET STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 FEED PRESERVATIVE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP (BASED ON TYPE, BY REGION)

2.2.2 APPROACH TWO – TOP-DOWN (BASED ON GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 2 FEED PRESERVATIVES MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 4 MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 5 MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022 VS. 2027 (USD MILLION)

FIGURE 6 MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 7 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 BRIEF OVERVIEW OF THE MARKET

FIGURE 8 THE RISING DEMAND FOR ANIMAL PRODUCTS AND INCREASING ANIMAL COUNT TO FUEL THE DEMAND FOR FEED PRESERVATIVES

4.2 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY TYPE AND COUNTRY

FIGURE 9 CHINA AND FEED ACIDIFIERS TO ACCOUNT FOR THE LARGEST SHARES IN 2022

4.3 MARKET FOR FEED PRESERVATIVES, BY TYPE

FIGURE 10 FEED ACIDIFIERS TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 MARKET, BY LIVESTOCK

FIGURE 11 POULTRY SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 MARKET FOR FEED PRESERVATIVES, BY FEED TYPE AND REGION

FIGURE 12 ASIA PACIFIC AND COMPOUND FEED SEGMENTS TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: FEED PRESERVATIVES MARKET

5.2.1 DRIVERS

5.2.1.1 Growing applications of livestock in the food industry to fuel its production

FIGURE 14 GLOBAL MEAT PRODUCTION, 2010-2018

5.2.1.2 Unpredictable crop harvest patterns, leading to the need for feed storage

5.2.2 RESTRAINTS

5.2.2.1 Low profit margin and lesser availability of end products

5.2.3 OPPORTUNITIES

5.2.3.1 Surge in demand for natural preservatives

5.2.3.2 Mold inhibitors preserve the feed’s value

5.2.3.3 Strong growth opportunities in poultry and aquafeed sectors

5.2.4 CHALLENGES

5.2.4.1 Market capitalization is restricted by a strong pool of cooperative societies

6 INDUSTRY TRENDS (Page No. - 58)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING AND MANUFACTURING

6.2.3 ASSEMBLY

6.2.4 DISTRIBUTION

6.2.5 MARKETING & SALES

FIGURE 15 VALUE CHAIN ANALYSIS OF THE MARKET

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 16 MARKET FOR FEED PRESERVATIVES: SUPPLY CHAIN

6.4 TECHNOLOGY ANALYSIS

6.5 PRICING ANALYSIS: FEED PRESERVATIVES MARKET

TABLE 3 GLOBAL FEED PRESERVATIVES’ AVERAGE SELLING PRICE (ASP), BY TYPE, 2020-2022 (USD/TONS)

TABLE 4 GLOBAL FEED PRESERVATIVES’ AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TONS)

6.6 MARKET MAPPING AND ECOSYSTEM OF FEED PRESERVATIVES

6.6.1 DEMAND SIDE

6.6.2 SUPPLY SIDE

FIGURE 17 FEED PRESERVATIVES: MARKET MAP

FIGURE 18 FEED PRESERVATIVES: ECOSYSTEM MAPPING

6.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 19 REVENUE SHIFT FOR THE MARKET

6.8 MARKET FOR FEED PRESERVATIVES: PATENT ANALYSIS

FIGURE 20 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

FIGURE 21 TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 22 TOP 10 APPLICANTS WITH THE HIGHEST NO. OF PATENT DOCUMENTS

TABLE 5 PATENTS PERTAINING TO FEED PRESERVATIVES, 2018–2022

6.9 CASE STUDIES

6.9.1 CARGILL INC: OTHER LIVESTOCK FEED

6.9.2 BASF SE: OTHER LIVESTOCK FEED

6.10 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 6 KEY CONFERENCES & EVENTS IN THE MARKET

6.11 TARIFF & REGULATORY LANDSCAPE

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.11.1 NORTH AMERICA

6.11.1.1 UNITED STATES (US)

6.11.1.2 CANADA

6.11.2 EUROPEAN UNION (EU)

6.11.3 SOUTH AMERICA

6.11.3.1 BRAZIL

6.11.4 ASIA PACIFIC

6.11.4.1 JAPAN

6.11.4.2 CHINA

6.11.5 THE INTERNATIONAL FEED INDUSTRY FEDERATION (IFIF)

6.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 FEED PRESERVATIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

6.12.1 DEGREE OF COMPETITION

6.12.2 BARGAINING POWER OF SUPPLIERS

6.12.3 BARGAINING POWER OF BUYERS

6.12.4 THREAT OF SUBSTITUTES

6.12.5 THREAT OF NEW ENTRANTS

6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

6.13.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS FOR THE TOP THREE APPLICATIONS

TABLE 11 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS FOR THE TOP THREE APPLICATIONS (%)

6.13.2 BUYING CRITERIA

TABLE 12 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 MARKET, BY TYPE (Page No. - 75)

7.1 INTRODUCTION

FIGURE 24 FEED PRESERVATIVES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 13 MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 14 MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 15 MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (KT)

TABLE 16 MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (KT)

7.2 FEED ACIDIFIERS

7.2.1 PROPIONIC ACID

7.2.2 FORMIC ACID

7.2.3 CITRIC ACID

7.2.4 LACTIC ACID

7.2.5 SORBIC ACID

7.2.6 BENZOIC ACID

7.2.7 OTHER ACIDIFIERS

TABLE 17 FEED ACIDIFIERS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

TABLE 18 FEED ACIDIFIERS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 19 FEED ACIDIFIERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 FEED ACIDIFIERS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 21 FEED ACIDIFIERS MARKET, BY REGION, 2018–2021 (KT)

TABLE 22 FEED ACIDIFIERS MARKET, BY REGION, 2022–2027 (KT)

7.3 MOLD INHIBITORS

7.3.1 PROPIONATES

7.3.2 FORMATES

7.3.3 BENZOATES

7.3.4 NATAMYCIN

7.3.5 OTHER TYPES

TABLE 23 MOLD INHIBITORS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

TABLE 24 MOLD INHIBITORS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 25 MOLD INHIBITORS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 MOLD INHIBITORS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 27 MOLD INHIBITORS MARKET, BY REGION, 2018–2021 (KT)

TABLE 28 MOLD INHIBITORS MARKET, BY REGION, 2022–2027 (KT)

7.4 FEED ANTIOXIDANTS

7.4.1 BHA

7.4.2 BHT

7.4.3 ETHOXYQUIN

TABLE 29 FEED ANTIOXIDANTS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

TABLE 30 FEED ANTIOXIDANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 31 FEED ANTIOXIDANTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 FEED ANTIOXIDANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 FEED ANTIOXIDANTS MARKET, BY REGION, 2018–2021 (KT)

TABLE 34 FEED ANTIOXIDANTS MARKET, BY REGION, 2022–2027 (KT)

7.5 ANTICAKING AGENTS

TABLE 35 ANTICAKING AGENTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 ANTICAKING AGENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 ANTICAKING AGENTS MARKET, BY REGION, 2018–2021 (KT)

TABLE 38 ANTICAKING AGENTS MARKET, BY REGION, 2022–2027 (KT)

8 FEED PRESERVATIVES MARKET, BY LIVESTOCK (Page No. - 90)

8.1 INTRODUCTION

FIGURE 25 MARKET, BY LIVESTOCK, 2022 VS. 2027 (USD MILLION)

TABLE 39 MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 40 MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

8.2 CATTLE

TABLE 41 CATTLE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 CATTLE: MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

8.3 POULTRY

TABLE 43 POULTRY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 POULTRY: MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

8.4 SWINE

TABLE 45 SWINE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 SWINE: MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

8.5 AQUACULTURE

TABLE 47 AQUACULTURE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 AQUACULTURE: MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHER LIVESTOCK

TABLE 49 OTHER LIVESTOCK: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 OTHER LIVESTOCK: MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

9 MARKET, BY FEED TYPE (Page No. - 98)

9.1 INTRODUCTION

FIGURE 26 MARKET, BY FEED TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 51 MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2018–2021 (USD MILLION)

TABLE 52 MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2022–2027 (USD MILLION)

9.2 COMPOUND FEED

9.2.1 RISING POPULARITY FOR COMPOUND FEED TO DRIVE GROWTH

TABLE 53 COMPOUND FEED: FEED PRESERVATIVES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 COMPOUND FEED: MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

9.3 FEED PREMIX

9.3.1 GROWING AWARENESS REGARDING HEALTH AND HYGIENE IS A SIGNIFICANT DRIVING FORCE FOR FEED PREMIXES AFTER THE PANDEMIC AND RECENT FLU OUTBREAKS

TABLE 55 FEED PREMIX: ARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 FEED PREMIX: MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

9.4 FEED MEAL

9.4.1 RISING ANIMAL DISEASES TO DRIVE THE GROWTH OF FEED MEAL AS A RICH SOURCE OF ANIMAL PROTEINS AND VITAMINS FOR LIVESTOCK SPECIES

TABLE 57 FEED MEAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 FEED MEAL: MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

9.5 SILAGE

9.5.1 INNOVATIVE PRODUCT LAUNCHES AND RISING DEMAND FOR SILAGE ADDITIVES FOR BETTER YIELD IN DAIRY PRODUCTS TO DRIVE THE DEMAND FOR SILAGE

TABLE 59 SILAGE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 SILAGE: MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

9.6 OTHER FEED TYPES

TABLE 61 OTHER FEED TYPES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 OTHER FEED TYPES: MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

10 MARKET, BY REGION (Page No. - 106)

10.1 INTRODUCTION

FIGURE 27 CHINA TO RECORD THE FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 63 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 MARKET FOR FEED PRESERVATIVES, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

TABLE 65 NORTH AMERICA: FEED PRESERVATIVES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (KT)

TABLE 70 NORTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (KT)

TABLE 71 NORTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2018–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Rising awareness toward hygiene and health in dairy and meat consumption to drive the growth of feed preservatives

TABLE 75 US: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 76 US: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 77 US: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 78 US: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rising meat consumption coupled with the growing poultry industry to present growth opportunities for feed preservatives

TABLE 79 CANADA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 80 CANADA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 81 CANADA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 82 CANADA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 New product launches coupled with the rising demand for commercialized feed likely to drive the growth of the feed preservatives industry

TABLE 83 MEXICO: FEED PRESERVATIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 84 MEXICO: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 85 MEXICO: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 86 MEXICO: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 28 EUROPE: MARKET SNAPSHOT

TABLE 87 EUROPE: MARKET FOR FEED PRESERVATIVES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 EUROPE: MARKET FOR FEED PRESERVATIVES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 89 EUROPE: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 90 EUROPE: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 91 EUROPE: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (KT)

TABLE 92 EUROPE: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (KT)

TABLE 93 EUROPE: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 94 EUROPE: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 95 EUROPE: MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2018–2021 (USD MILLION)

TABLE 96 EUROPE: MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Rising meat consumption and growing concerns over feed hygiene likely to contribute to the demand for feed preservatives

TABLE 97 GERMANY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 98 GERMANY: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 99 GERMANY: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 100 GERMANY: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Rising awareness about feed hygiene solutions likely to drive the market growth

TABLE 101 UK: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 102 UK: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 103 UK: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 104 UK: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.3.3 RUSSIA

10.3.3.1 Recent flu outbreaks and significant growth in the domestic livestock sector to provide good business opportunities for the feed preservative industry

TABLE 105 RUSSIA: FEED PRESERVATIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 106 RUSSIA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 107 RUSSIA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 108 RUSSIA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Highly regulated environment regarding feed hygiene in the country to drive the demand for feed preservatives

TABLE 109 FRANCE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 110 FRANCE: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 111 FRANCE: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 112 FRANCE: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Large compound feed industry is likely to drive the growth of the market

TABLE 113 SPAIN: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 114 SPAIN:MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 115 SPAIN: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 116 SPAIN: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 117 REST OF EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 120 REST OF EUROPE: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: FEED PRESERVATIVES MARKET SNAPSHOT

TABLE 121 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (KT)

TABLE 126 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (KT)

TABLE 127 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2018–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Rising meat consumption coupled with a large domestic livestock production likely to provide business opportunities for the market

TABLE 131 CHINA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 132 CHINA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 133 CHINA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 134 CHINA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Increased imports of feed raw materials to fuel the demand for feed preservatives in Japan

TABLE 135 JAPAN: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 136 JAPAN: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 137 JAPAN: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 138 JAPAN: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Rising economic growth coupled with the growing demand for meat consumption likely to drive the growth of the feed preservatives industry

TABLE 139 INDIA: FEED PRESERVATIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 140 INDIA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 141 INDIA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 142 INDIA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 Increasing domestic livestock sectors for poultry, cattle, swine, and aquaculture present attractive business opportunities for the feed preservatives industry

TABLE 143 SOUTH KOREA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 144 SOUTH KOREA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 145 SOUTH KOREA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 146 SOUTH KOREA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 147 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 148 REST OF ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 151 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 152 SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 153 SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 154 SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 155 SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (KT)

TABLE 156 SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (KT)

TABLE 157 SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 158 SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 159 SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2018–2021 (USD MILLION)

TABLE 160 SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2022–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Rising pet and companion feed industry and opportunities due to increasing commercial feed production likely to drive the growth of the feed preservatives industry

TABLE 161 BRAZIL: FEED PRESERVATIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 162 BRAZIL: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 163 BRAZIL: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 164 BRAZIL: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Rising pork consumption likely to offer significant business opportunities for the feed preservative industry

TABLE 165 ARGENTINA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 166 ARGENTINA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 167 ARGENTINA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 168 ARGENTINA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

TABLE 169 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 170 REST OF SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 171 REST OF SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 172 REST OF SOUTH AMERICA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.6 REST OF THE WORLD

TABLE 173 REST OF THE WORLD: FEED PRESERVATIVES, BY REGION, 2018–2021 (USD MILLION)

TABLE 174 REST OF THE WORLD: FEED PRESERVATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 175 REST OF THE WORLD: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 176 REST OF THE WORLD: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 177 REST OF THE WORLD: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2018–2021 (KT)

TABLE 178 REST OF THE WORLD: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (KT)

TABLE 179 REST OF THE WORLD: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 180 REST OF THE WORLD: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

TABLE 181 REST OF THE WORLD: MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2018–2021 (USD MILLION)

TABLE 182 REST OF THE WORLD: MARKET FOR FEED PRESERVATIVES, BY FEED TYPE, 2022–2027 (USD MILLION)

10.6.1 MIDDLE EAST

10.6.1.1 Rising demand for poultry products is expected to drive the demand for feed preservatives

TABLE 183 MIDDLE EAST: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 184 MIDDLE EAST: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 185 MIDDLE EAST: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 186 MIDDLE EAST: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

10.6.2 AFRICA

10.6.2.1 Increase in livestock farms and demand for meat and meat products to increase the demand for feed preservatives

TABLE 187 AFRICA: FEED PRESERVATIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 188 AFRICA: MARKET FOR FEED PRESERVATIVES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 189 AFRICA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

TABLE 190 AFRICA: MARKET FOR FEED PRESERVATIVES, BY LIVESTOCK, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 161)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS, 2021

TABLE 191 MARKET SHARE ANALYSIS, 2021

11.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 30 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2019–2021 (USD BILLION)

11.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.4.1 STARS

11.4.2 PERVASIVE PLAYERS

11.4.3 EMERGING LEADERS

11.4.4 PARTICIPANTS

FIGURE 31 MARKET FOR FEED PRESERVATIVES: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

11.4.5 FEED PRESERVATIVES PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 192 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

TABLE 193 COMPANY FOOTPRINT, BY LIVESTOCK (KEY PLAYERS)

TABLE 194 COMPANY FOOTPRINT, BY FEED TYPE (KEY PLAYERS)

TABLE 195 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

TABLE 196 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

11.5 MARKET FOR FEED PRESERVATIVES: OTHER PLAYERS’ EVALUATION QUADRANT, 2021

11.5.1 PROGRESSIVE COMPANIES

11.5.2 STARTING BLOCKS

11.5.3 RESPONSIVE COMPANIES

11.5.4 DYNAMIC COMPANIES

FIGURE 32 FEED PRESERVATIVES MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

TABLE 197 FEED PRESERVATIVES: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

11.6 COMPETITIVE SCENARIO

11.6.1 NEW PRODUCT LAUNCHES

TABLE 198 MARKET FOR FEED PRESERVATIVES: NEW PRODUCT LAUNCHES, 2019-2022

11.6.2 DEALS

TABLE 199 MARKET FOR FEED PRESERVATIVES: OTHERS, 2019-2022

TABLE 200 MARKET FOR FEED PRESERVATIVES: DEALS, 2018-2022

12 COMPANY PROFILES (Page No. - 172)

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)*

12.1 KEY PLAYERS

12.1.1 BASF SE

TABLE 201 BASF SE: BUSINESS OVERVIEW

FIGURE 33 BASF SE: COMPANY SNAPSHOT

TABLE 202 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 203 BASF SE: DEALS

TABLE 204 BASF SE: NEW PRODUCT LAUNCHES

TABLE 205 BASF SE: OTHERS

12.1.2 CARGILL, INC

TABLE 206 CARGILL, INC: BUSINESS OVERVIEW

FIGURE 34 CARGILL, INC.: COMPANY SNAPSHOT

TABLE 207 CARGILL, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 208 CARGILL, INC: DEALS

TABLE 209 CARGILL, INC: OTHERS

12.1.3 NUTRECO N.V.

TABLE 210 NUTRECO N.V.: BUSINESS OVERVIEW

TABLE 211 NUTRECO N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 212 NUTRECO N.V.: DEALS

TABLE 213 NUTRECO N.V.: OTHERS

12.1.4 ALLTECH, INC.

TABLE 214 ALLTECH, INC.: FEED PRESERVATIVES MARKET BUSINESS OVERVIEW

TABLE 215 ALLTECH, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 216 ALLTECH, INC.: DEALS

TABLE 217 ALLTECH, INC.: OTHERS

12.1.5 PERSTORP HOLDING AB

TABLE 218 PERSTORP HOLDING AB: BUSINESS OVERVIEW

TABLE 219 PERSTORP HOLDING AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.6 NOVUS INTERNATIONAL, INC.

TABLE 220 NOVUS INTERNATIONAL, INC: BUSINESS OVERVIEW

TABLE 221 NOVUS INTERNATIONAL, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 222 NOVUS INTERNATIONAL, INC: DEALS

12.1.7 DSM N.V.

TABLE 223 DSM N.V.: BUSINESS OVERVIEW

FIGURE 35 DSM N.V.: COMPANY SNAPSHOT

TABLE 224 DSM N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 225 DSM N.V.: DEALS

TABLE 226 DSM N.V.: OTHERS

12.1.8 KEMIN INDUSTRIES

TABLE 227 KEMIN INDUSTRIES: BUSINESS OVERVIEW

TABLE 228 KEMIN INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 229 KEMIN INDUSTRIES: NEW PRODUCT LAUNCHES

TABLE 230 KEMIN INDUSTRIES: DEALS

12.1.9 IMPEXTRACO NV

TABLE 231 IMPEXTRACO NV: BUSINESS OVERVIEW

TABLE 232 IMPEXTRACO NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.10 EASTMAN CHEMICAL COMPANY

TABLE 233 EASTMAN CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 36 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 234 EASTMAN CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 235 EASTMAN CHEMICAL COMPANY: DEALS

12.2 OTHER PLAYERS

12.2.1 BLUESTAR ADISSEO NUTRITION GROUP LTD.

TABLE 236 BLUESTAR ADISSEO NUTRITION GROUP LTD.: BUSINESS OVERVIEW

TABLE 237 BLUESTAR ADISSEO NUTRITION GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 238 BLUESTAR ADISSEO NUTRITION GROUP LTD.: DEALS

TABLE 239 BLUESTAR ADISSEO NUTRITION GROUP LTD.: OTHERS

12.2.2 PESTELL NUTRITION, INC.

TABLE 240 PESTELL NUTRITION, INC: BUSINESS OVERVIEW

TABLE 241 PESTELL NUTRITION, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 242 PESTELL NUTRITION, INC: DEALS

12.2.3 ARCHER-DANIELS-MIDLAND COMPANY (ADM)

TABLE 243 ARCHER-DANIELS-MIDLAND COMPANY: BUSINESS OVERVIEW

FIGURE 37 ARCHER-DANIELS-MIDLAND COMPANY: COMPANY SNAPSHOT

TABLE 244 ARCHER-DANIELS-MIDLAND COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 245 ARCHER-DANIELS-MIDLAND COMPANY: DEALS

TABLE 246 ARCHER-DANIELS-MIDLAND COMPANY: OTHERS

12.2.4 JUNGBUNZLAUER SUISSE AG

TABLE 247 JUNGBUNZLAUER SUISSE AG: FEED PRESERVATIVES MARKET BUSINESS OVERVIEW

TABLE 248 JUNGBUNZLAUER SUISSE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 249 JUNGBUNZLAUER SUISSE AG: OTHERS

12.2.5 NIACET CORPORATION

TABLE 250 NIACET CORPORATION: BUSINESS OVERVIEW

TABLE 251 NIACET CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 252 NIACET CORPORATION: DEALS

12.2.6 VINAYAK INGREDIENTS

12.2.7 SAIDEEP EXPORTS PRIVATE LIMITED

12.2.8 AVON ANIMAL HEALTH

12.2.9 VEE EXCEL DRUGS AND PHARMACEUTICALS PRIVATE LIMITED

12.2.10 NOR-FEED

13 ADJACENT AND RELATED MARKETS (Page No. - 215)

13.1 INTRODUCTION

TABLE 253 ADJACENT MARKETS

13.2 LIMITATIONS

13.3 LACTIC ACID MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 254 LACTIC ACID MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

13.4 FEED ADDITIVES MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

TABLE 255 FEED ADDITIVES MARKET, BY TYPE, 2021–2026 (USD MILLION)

*Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 219)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

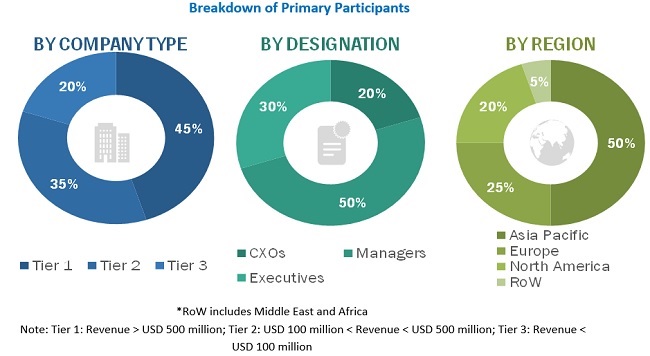

The study involved four major activities in estimating feed preservatives market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders in the supply chain, including feed preservatives manufacturers, distributors & suppliers, importers and exporters, experts in animal nutrition and husbandry, research centers and scientific institutes. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include feed preservatives manufacturers, exporters, and importers. The primary sources from the demand-side include poultry farm owners, dairy farm owners and other end-use sectors.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Feed Preservatives Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of feed preservative market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of feed preservative market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Report Objectives

- To describe and forecast feed preservatives market, in terms of type, livestock, feed type, and region

- To describe and forecast feed preservative market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of feed preservative market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of feed preservative market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in feed preservative market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific feed preservatives market, by key country

- Further breakdown of the Rest of European feed preservative market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Feed Preservatives Market