Fermented Ingredients Market by Type (Amino Acids, Organic Acids, Biogas, Polymers, Vitamins, Industrial Enzymes), Application (Food & Beverages, Feed, Pharmaceuticals, Paper), Form (Dry, and Liquid), and Region - Global Forecast to 2022

[159 Pages Report] The global fermented ingredients market size was valued at USD 23.1 billion in 2017, and is projected to grow at a CAGR of 9.0% from 2017, to reach USD 35.6 billion by 2022. The base year considered for the study is 2016, and the forecast period is from 2017 to 2022. Fermented ingredients are considered as food additives. These are processed or semi-processed forms of diverse materials, which are available in various types such as amino acids, organic acids, polymers, vitamins, antibiotics, industrial enzymes, and biogas. Industrial fermentation is a complex, and multi-step process which converts different materials such as sugar, starches, cellulose materials into food, feed, fuel, or other products. The process involves the conversion of these materials with the help of enzymes or microorganisms such as yeasts and algae, which can be a modified version, and takes place in the fermentor. The objectives of the report include analyzing the opportunities in the market for stakeholders and providing the competitive landscape of market trends, supply chain of this market, and projecting the size of the fermented ingredients market and its submarkets, in terms of value and volume.

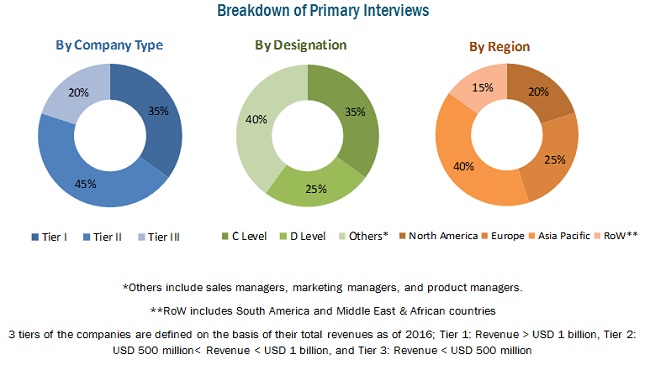

This report includes estimations of the market size in terms of value (USD billion) and volume (KT). Both top-down and bottom-up approaches have been used to estimate and validate the size of the global fermented ingredients market and to estimate the size of various other dependent submarkets in the overall market. The key players in the market have been identified through secondary research, some of the sources are press releases, paid databases such as Factiva and Bloomberg, annual reports, and financial journals; their market share in respective regions have also been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources. The figure below shows the breakdown of profiles of industry experts that participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The leading players in the fermented ingredients market are considered for this study. A brief description of the company and their products are mentioned in the company profiles. Detailed insights about the key strategies and recent developments of the companies in attaining a strong position in the fermented ingredients market provided. The global market for fermented ingredients is dominated by large players of the food industry such as DuPont (US), Ajinomoto (Japan), DSM (Netherlands), Chr. Hansen (Denmark.), BASF (Germany), Lallemand (Canada), Döhler Group (Germany), and Cargill (US).

This report is targeted at the existing players in the industry, which include the following:

- Fermented food manufacturers

- Fermented beverage manufacturers

- Fermented ingredient importers and exporters

- Fermented product importer and exporters

- Associations and industry bodies such as the Food and Agriculture Organization (FAO), and Organization for Economic Co-operation and Development (OECD)

- Raw material producers, suppliers, and distributors

- Research and consulting firms

“The study answers several questions for stakeholders, primarily which market segments to focus on in next two to five years for prioritizing efforts and investments”

Scope of the Report

On the basis of type, the fermented ingredients market has been segmented into:

- Amino acids

- Organic acids

- Industrial enzymes

- Antibiotics

- Polymer

- Vitamins

- Biogas

On the basis of form, the fermented ingredients market has been segmented into:

- Dry form

- Liquid form

On the basis of process, the fermented ingredients market has been segmented into:

- Batch fermentation

- Continuous fermentation

- Aerobic fermentation

- Anaerobic fermentation

On the basis of Application, the fermented ingredients market has been segmented into:

- Food & beverage

- Feed

- Pharmaceuticals

- Personal Care

- Paper

- Biofuel

- Textile & leather

On the basis of region, the fermented ingredients market has been segmented into:

- North America

- Europe

- Asia Pacific

- RoW (South America and Middle East & African countries)

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Segment Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis at volume level can also be provided

Regional Analysis

- Further breakdown of the Rest of Asia Pacific fermented ingredients market, by country

- Further breakdown of the Rest of Europe fermented ingredients market, by country

- Further breakdown of South America, by country

- Further breakdown of the Middle East & Africa, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The overall fermented ingredients market is expected to grow from USD 23.1 billion in 2017 to USD 35.6 billion by 2022 at a CAGR of 9.0%. Fermented ingredients are most widely used in beverages, bakery products, and dairy products. The growth of the fermented ingredients market is driven by the rising demand from a variety of application industries, namely, pharmaceuticals, food, and feed, among others.

Fermented ingredients are processed or semi-processed forms of diverse materials, which are available in various types such as amino acids, organic acids, polymers, vitamins, antibiotics, industrial enzymes, and biogas. Industrial fermentation is a complex, and multi-step process which converts different materials such as sugar, starches, cellulose materials into food, feed, fuel, or other products. The effect of busy lifestyles and evolving eating habits in the developing economies has propelled the market for processed food & beverages; hence, there is a rise in the demand for fermented ingredients. In addition, rising awareness and growing consumer capacity are expected to drive the demand for fermented ingredients in the food and feed industries.

The fermented ingredients market has been segmented, on the basis of type, into amino acids, organic acids, industrial enzymes, antibiotics, polymer, vitamins and biogas. The market for polymers is expected to grow at the highest CAGR between 2017 and 2022. Among all fermented ingredients, amino acids are the most common fermented ingredients. The demand for fermentation ingredients is growing at a considerable growth rate as it is being utilized on a large basis in several applications from tissue engineering to strain removing of fabrics.

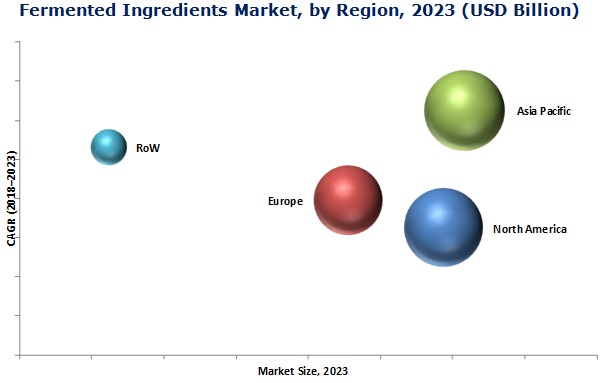

The fermented ingredients market in APAC is expected to grow at the highest CAGR during the forecast period. The improved agricultural growth over the past decade as well as the advancements in the food & beverage industry in this region have resulted in new opportunities for the fermented ingredients market. The rising middle-class population, high disposable incomes of the population, and increased demand for healthy and nutritious food & beverage products with natural ingredients drive the growth of the fermented ingredients market. Another factor contributing to the growth of this market are the untapped regions that are not completely tapped by fermented ingredient manufacturers.

The rapidly growing bioethanol industry is expected to significantly drive the demand for fermented ingredients

Food & beverage

Fermented ingredients are commonly used in food and beverage applications such as beer, bread, yoghurts, and cheese among others. Fermented amino acid is widely used in food products, and different amino acids impart different flavors to the food products they are used in. Increasing application of fermented ingredients in bakery and dairy products is expected to drive the global fermented ingredients market for food & beverages. With the advancement of microbiology and biotechnology, food and beverages has become a major industry for the fermented ingredients market.

Feed

Fermented ingredients in feed products are rising in popularity owing to its beneficial functionalities. For instance, studies show that fermenting chicken feed can increase its eggshell thickness and egg weight, and boost the chickens’ immune system and intestinal health, increasing their resistance to diseases such as E. coli and Salmonella. Some of the well-known fermented feed ingredients of amino acids are ADM L-Lysine HCl, ADM Liquid L-Lysine 50%, and ADM L-Threonine.

Pharmaceuticals

The pharmaceutical industry is focusing on developing new concepts and products of specialty ingredients including fermented ingredients. Amino acids, vitamin and related compounds, and industrial enzymes are commonly used as fermented ingredients in the pharmaceutical industry.

Paper

Fermented ingredients also have a significant demand from the paper industry for reducing pitch deposits on paper machines. Industrial enzymes such as lipases is one of the most popular industrial enzymes that are used in the paper industry. The use of industrial enzymes also varies in the paper industry. For instance, the enzyme laccase produced from different fungi was used to make paper.

Personal Care

Fermentation technology for cosmetic and personal care products helps to generate eco-friendly products. Personal care ingredients manufacturing companies are using fermentation ingredients to develop new products and processes, which include high bioavailability actives, bioconversion of fragrance to water-soluble natural fragrance, bioactive for anti-aging, whitening, and moisturizing, anti-inflammatory, and UV-blocking effect.

Biofuel

Industrial enzymes are one of the popular fermented ingredients owing to its dynamic applications in the biofuel industry. For instance, lipases are widely used in biofuel; cellulases, amylases, protease, catalase, and pectinase are popular fermented ingredients in the biofuel industry.

Textile & leather

The demand for industrial enzymes such as polysaccharides are continuously increasing from the textile & leather industry. Companies from the textile and leather industry are focusing on cost-effective fermented ingredients as a semi-finished product for the manufacturing of their products. Due to the global energy crisis as well as high cost of fuels, the focus on activities to conserve energy to a maximum extent has increased. The textile industry retains a record of the lowest efficiency in energy utilization and as one of the major energy consuming industries.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for fermented ingredients?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The effect of busy lifestyles and evolving eating habits in the developing economies has propelled the market for processed food & beverages; hence, there is a rise in the demand for fermented ingredients. In addition, rising awareness and growing consumer capacity are expected to drive the demand for fermented ingredients in the food and feed industries. Consumers are expected to replace their consumption of industry products with fresh or healthier food products with the intention of improving their diet. This has increased the demand for food products processed with fermented ingredients. A majority of global growth in the demand for processed fermented products is expected to come from Asia, in particular from China and India.

The key players in this market are DuPont (US), Ajinomoto (Japan), DSM (Netherlands), Chr. Hansen (Denmark.), BASF (Germany), Lallemand (Canada), Döhler Group (Germany), Cargill (US), Lonza AngelYeast Co., Ltd (China), International B.V. (Netherlands), Kerry (Ireland), DIANA Group (France), Olam International (Singapore), SensoryEffects Ingredient Solutions (US), and Sensient Technologies Corporation (US). These companies use strategies such as acquisitions, expansions & investments, agreements, joint venture & partnerships, and new product launches/developments to strengthen their position in the market.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization

1.5 Currency

1.6 Units

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Introduction

2.2 Research Data

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primaries

2.3 Macroindicators

2.3.1 Rising Population and Urbanization

2.3.2 Increasing Middle-Class Population, 2009–2030

2.3.3 Developing Economies

2.3.4 Research & Development

2.4 Market Size Estimation

2.5 Market Breakdown & Data Triangulation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in this Market

4.2 Fermented Ingredients Market, By Application

4.3 Asia-Pacific: Fastest-Growing Fermented Ingredients Market

4.4 Fermented Ingredients Market: Developed vs Developing Economies, 2017 vs 2022

4.5 Life Cycle Analysis, By Region

4.6 Year-On-Year Growth Outlook: Major Regions

4.7 Summary Outlook of the Fermented Ingredients Market (Including Alcohol)

4.7.1 Year-On-Year Growth Comparison

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Development of the Global Bioethanol Industry

5.3.1.2 Rising Awareness About Food Preservation

5.3.1.3 Demand for Antibiotics is High

5.3.2 Restraints

5.3.2.1 Inconsistent Availability of Quality Raw Material and High Cost

5.3.2.2 Possibilities of Health Risks Due to Fermentation

5.3.3 Opportunities

5.3.3.1 Emerging Economies With High Growth Potential

5.3.3.2 Technological Innovation and Increase in the Number of Applications

5.3.3.3 New Product Development and Acquisitions By Key Players

5.3.4 Challenges

5.3.4.1 Stringent Regulations

5.3.4.2 Restricted Temperature and Ph Operational Range

6 Regulatory Framework (Page No. - 50)

6.1 Introduction

6.2 Food Act 1985 Malaysia

6.2.1 New Regulation 26b: Microbial Cultures for Food Fermentation

6.3 Food Regulations 1985, Malaysia

6.4 Alcohol and Tobacco Tax and Trade Bureau (TTB) Regulations, U.S.

6.5 Code of Federal Regulations, Part 173 (21 CFR 173), U.S.

6.6 The Foods, Cosmetics, and Disinfectants Act, 1972 (Act No.54 of 1972), U.S.

7 Fermented Ingredients Market, By Type (Page No. - 54)

7.1 Introduction

7.2 Amino Acids

7.3 Organic Acids

7.4 Industrial Enzymes

7.5 Antibiotics

7.6 Polymer (Polysacchrides/Xanthan)

7.7 Vitamins

7.8 Biogas

8 Fermented Ingredients Market, By Application (Page No. - 68)

8.1 Introduction

8.2 Food & Beverages

8.2.1 Bakery

8.2.2 Brewery & Distilling

8.2.3 Dairy Products

8.3 Feed

8.4 Pharmaceuticals

8.5 Personal Care

8.6 Paper

8.7 Biofuel

8.8 Textile & Leather

9 Fermented Ingredients Market, By Form (Page No. - 82)

9.1 Introduction

9.2 Dry Form

9.3 Liquid Form

10 Fermentation Ingredients Market By Process (Page No. - 88)

10.1 Introduction

10.2 Batch Fermentation

10.3 Continuous Fermentation

10.4 Aerobic Fermentation

10.5 Anaerobic Fermentation

11 Fermented Ingredients Market, By Region (Page No. - 92)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 U.K.

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Australia

11.4.4 Japan

11.4.5 Rest of Asia-Pacific

11.5 Rest of the World (RoW)

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Others in RoW

12 Competitive Landscape (Page No. - 120)

12.1 Overview

12.2 Market Players’ Ranking Analysis

12.3 Competitive Situation & Trends

12.3.1 New Product Developments

12.3.2 Acquisitions

12.3.3 Agreements, Collaborations, and Joint Ventures

12.3.4 Expansions & Regulatory Approvals

13 Company Profiles (Page No. - 126)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

13.1 E.I. Dupont De Nemours and Company

13.2 Ajinomoto Corporation Inc.

13.3 Koninklijke DSM N.V.

13.4 CHR. Hansen A/S

13.5 BASF SE

13.6 Lallemand Inc.

13.7 Angelyeast Co., Ltd.

13.8 Döhler Group

13.9 Cargill, Incorporated

13.10 Lonza

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 152)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (106 Tables)

Table 1 Countries and Feedstock Production

Table 2 Difference in Ph Ranges of Some Enzymes

Table 3 Fermented Ingredients Market Size, By Type, 2015–2022 (KT)

Table 4 Market Size, By Type, 2015–2022 (USD Million)

Table 5 Amino Acids: Fermentation Ingredients Market Size, By Region, 2015–2022 (KT)

Table 6 Amino Acids: Market Size, By Region, 2015–2022 (USD Million)

Table 7 Organic Acids and Their Applications

Table 8 Organic Acids: Fermentation Ingredients Market Size, By Region, 2015–2022 (KT)

Table 9 Organic Acids: Market Size, By Region, 2015–2022 (USD Million)

Table 10 Industrial Enzymes and Their Applications

Table 11 Industrial Enzymes: Fermentation Ingredients Market Size, By Region, 2015–2022 (KT)

Table 12 Indusrial Enzymes: Market Size, By Region, 2015–2022 (USD Million)

Table 13 Antibiotics: Fermentation Ingredients Market Size, By Region, 2015–2022 (KT)

Table 14 Antibiotics: Market Size, By Region, 2015–2022 (USD Million)

Table 15 Polymer (Polysachhrides/Xanthan): Fermentation Ingredients Market Size, By Region, 2015–2022 (KT)

Table 16 Polymer (Polysacchrides/Xanthan): Market Size, By Region, 2015–2022 (USD Million)

Table 17 Vitamins: Fermention Ingredients Market Size, By Region, 2015–2022 (KT)

Table 18 Vitamins: Market Size, By Region, 2015–2022 (USD Million)

Table 19 Biogas: Fermentation Ingredients Market Size, By Region, 2015–2022 (KT)

Table 20 Biogas: Market Size, By Region, 2015–2022 (USD Million)

Table 21 Fermented Ingredients Market Size, By Application, 2015–2022 (USD Million)

Table 22 Market Size, By Application, 2015–2022 (KT)

Table 23 Fermented Ingredients Market Size for Food & Beverages, By Region, 2015–2022 (USD Million)

Table 24 Market Size for Food & Beverages, By Region, 2015–2022 (KT)

Table 25 Fermented Ingredients Market Size for Food & Beverages, By Sub-Application, 2015–2022 (USD Million)

Table 26 Market Size for Food & Beverages, By Sub-Application, 2015–2022 (KT)

Table 27 Fermented Ingredients Market Size for Bakery, By Region, 2015–2022 (USD Million)

Table 28 Market Size for Bakery, By Region, 2015–2022 (KT)

Table 29 Fermented Ingredients Market Size for Brewery & Distilling, By Region, 2015–2022 (USD Million)

Table 30 Market Size for Brewery & Distilling, By Region, 2015–2022 (KT)

Table 31 Fermented Ingredients Market Size for Dairy Products, By Region, 2015–2022 (USD Million)

Table 32 Market Size for Dairy Products, By Region, 2015–2022 (KT)

Table 33 Fermented Ingredients Market Size for Feed, By Region, 2015–2022 (USD Million)

Table 34 Market Size for Feed, By Region, 2015–2022 (KT)

Table 35 Fermented Ingredients Market Size for Pharmaceuticals, By Region, 2015–2022 (USD Million)

Table 36 Market Size for Pharmaceuticals, By Region, 2015–2022 (KT)

Table 37 Fermented Ingredients Market Size for Personal Care, By Region, 2015–2022 (USD Million)

Table 38 Market Size for Personal Care, By Region, 2015–2022 (KT)

Table 39 Fermented Ingredients Market Size for Paper, By Region, 2015–2022 (USD Million)

Table 40 Market Size for Paper, By Region, 2015–2022 (KT)

Table 41 Fermented Ingredients Market Size for Biofuel, By Region, 2015–2022 (USD Million)

Table 42 Market Size for Biofuel, By Region, 2015–2022 (KT)

Table 43 Fermented Ingredients Market Size for Textile & Leather, By Region, 2015–2022 (USD Million)

Table 44 Market Size for Textile & Leather, By Region, 2015–2022 (KT)

Table 45 Fermented Ingredients Market Size, By Form, 2015–2022 (USD Million)

Table 46 Market Size, By Form, 2015–2022 (KT)

Table 47 Dry Fermented Ingredients Market Size, By Region, 2015–2022 (USD Million)

Table 48 Dry Fermented Ingredients Market Size, By Region, 2015–2022(KT)

Table 49 Liquid Fermented Ingredients Market Size, By Region, 2015–2022 (USD Million)

Table 50 Liquid Fermented Ingredients Market Size, By Region, 2015–2022 (KT)

Table 51 Fermented Ingredients Market Size, By Region, 2015–2022 (USD Million)

Table 52 Market Size, By Region, 2015–2022 (KT)

Table 53 North America: Fermented Ingredients Market Size, By Country, 2015–2022 (USD Million)

Table 54 North America: Market Size, By Country, 2015–2022 (KT)

Table 55 North America: Fermented Ingredients Market Size, By Type, 2015–2022 (USD Million)

Table 56 North America: Market Size, By Type, 2015–2022 (KT)

Table 57 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 58 North America: Market Size, By Application, 2015–2022 (KT)

Table 59 North America: Market Size, By Food & Beverage Application, 2015–2022 (USD Million)

Table 60 North America: Market Size, By Food & Beverage Application, 2015–2022 (KT)

Table 61 North America: Market Size, By Form, 2015–2022 (USD Million)

Table 62 North America: Market Size, By Form, 2015–2022 (KT)

Table 63 Europe: Fermented Ingredients Market Size, By Country, 2015–2022 (USD Million)

Table 64 Europe: Market Size, By Country, 2015–2022 (KT)

Table 65 Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 66 Europe: Market Size, By Type, 2015–2022 (KT)

Table 67 Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 68 Europe: Market Size, By Application, 2015–2022 (KT)

Table 69 Europe: Market Size for Food & Beverages, By Sub-Application, 2015–2022 (USD Million)

Table 70 Europe: Market Size for Food & Beverages, By Sub-Application, 2015–2022 (KT)

Table 71 Europe: Market Size, By Form, 2015–2022 (USD Million)

Table 72 Europe: Market Size, By Form, 2015–2022 (KT)

Table 73 Asia-Pacific: Fermented Ingredients Market Size, By Country, 2015–2022 (USD Million)

Table 74 Asia-Pacific: Market Size, By Country, 2015–2022 (KT)

Table 75 Asia-Pacific: Market Size, By Type, 2015–2022 (USD Million)

Table 76 Asia-Pacific: Market Size, By Type, 2015–2022 (KT)

Table 77 Asia-Pacific: Market Size, By Application, 2015–2022 (USD Million)

Table 78 Asia-Pacific: Market Size, By Application, 2015–2022 (KT)

Table 79 Asia-Pacific: Market Size, By Food & Beverages Application, 2015–2022 (USD Million)

Table 80 Asia-Pacific: Market Size, By Food & Beverages Application, 2015–2022 (KT)

Table 81 Asia-Pacific: Market Size, By Form, 2015–2022 (USD Million)

Table 82 Asia-Pacific: Market Size, By Form, 2015–2022 (KT)

Table 83 RoW: Fermented Ingredients Market Size, By Country, 2015–2022 (USD Million)

Table 84 RoW: Market Size, By Country, 2015–2022 (KT)

Table 85 RoW: Market Size, By Type, 2015–2022 (USD Million)

Table 86 RoW: Market Size, By Type, 2015–2022 (KT)

Table 87 RoW: Market Size, By Application, 2015–2022 (USD Million)

Table 88 RoW: Market Size, By Application, 2015–2022 (KT)

Table 89 RoW: Market Size in Food & Beverages, By Sub-Application, 2015–2022 (USD Million)

Table 90 RoW: Market Size in Food & Beverages, By Sub-Application, 2015–2022 (KT)

Table 91 RoW: Fermented Ingredients Market Size, By Form, 2015–2022 (USD Million)

Table 92 RoW: Market Size, By Form, 2015–2022 (KT)

Table 93 New Product Developments, 2012–2016

Table 94 Acquisitions, 2012–2016

Table 95 Agreements, Collaborations, and Joint Ventures, 2012- 2016

Table 96 Expansions & Regulatory Approvals, 2012–2016

Table 97 E. I. Du Pont De Nemours and Company: Products Offered

Table 98 Ajinomoto Corporation Inc.: Products Offered

Table 99 Koninklijke DSM N.V.: Products Offered

Table 100 CHR. Hansen A/S: Products Offered

Table 101 BASF SE : Products Offered

Table 102 Lallemand Inc. : Products Offered

Table 103 Angelyeast Co., Ltd. : Products Offered

Table 104 Döhler Group: Products Offered

Table 105 Cargill Corpoeation: Products Offered

Table 106 Lonza: Products Offered

List of Figures (53 Figures)

Figure 1 Market Segmentation

Figure 2 Fermented Ingredients: Research Design

Figure 3 Middle-Class Population in Asia-Pacific is Projected to Grow Rapidly By 2030

Figure 4 Global GDP Growth (%), 2010-2015

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Fermented Ingredients Market Growth Trend, 2017 vs 2022

Figure 9 Amino Acids Segment to Dominate the Global Market, By Type, 2017–2022

Figure 10 Fermented Ingredients Market, By Form, 2017 vs 2022 (USD Million)

Figure 11 Asia-Pacific is Projected to Be the Fastest-Growing Market for Fermented Ingredients From 2017 to 2022

Figure 12 Rising Living Standards and Higher Purchasing Power of Consumers Would Drive the Market Growth During the Forecast Period

Figure 13 Polymers Segment is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 14 Amino Acids Segment Accounted for the Largest Share in the Asia-Pacific Fermented Ingredients Market, 2015 (KT)

Figure 15 Developed Markets to Dominate & Developing Markets Show Strong Growth Opportunities in the Next Five Years

Figure 16 Fermented Ingredients Market is Projected to Experience Strong Growth in the Asia-Pacific Region

Figure 17 North America is Expected to Grow at A Low Rate

Figure 18 Alcohol Remains the Key Segment in the Fermented Ingredients Market

Figure 19 Non-Alcoholic Fermented Ingredients Market is Expected to Grow at A Higher Rate as Compared to the Non-Alcoholic Segment

Figure 20 Fermented Ingredients Market Segmentation, By Application

Figure 21 Market Segmentation, By Type

Figure 22 Market Segmentation, By Form

Figure 23 Market Segmentation, By Process

Figure 24 Market Segmentation, By Region

Figure 25 Fermented Ingredients Market: Drivers, Restraints, Opportunities and Challenges

Figure 26 Bioethanol Production Over the Last Decade

Figure 27 Fermented Ingredients Market, By Type, 2017 vs 2022 (USD Million)

Figure 28 Market, By Type, 2017 vs 2022 (KT)

Figure 29 Fermented Ingredients Market Size, By Application, 2017 vs 2022 (USD Million)

Figure 30 Market, By Form

Figure 31 Dry Form Segment Projected to Account for the Larger Share in Terms of Value, 2017 vs 2022

Figure 32 Dry Confectionery Ingredients Market in Asia-Pacific is Projected to Grow at the Highest Rate From 2017 to 2022 in Terms of Value

Figure 33 North America is Projected to Lead the Liquid Segment of Fermented Ingredients, 2017 and 2022

Figure 34 Batch Fermentation Process

Figure 35 Lactic (Anaerobic Fermentation Type) Fermentation Process

Figure 36 Geographic Snapshot: New Hotspots Emerging in Asia-Pacific, 2017–2022

Figure 37 North America: Fermented Ingredients Market Snapshot

Figure 38 Asia-Pacific: Fermented Ingredients Market Snapshot

Figure 39 New Product Developments: Most Preferred Strategy By Key Companies in the Fermentated Ingredients Market for the Last Five Years

Figure 40 Fermented Ingredients Market : Industry Players’ Ranking Analysis

Figure 41 Strengthening Market Presence Through New Product Developments & Acquisitions in the Fermented Ingredients Market Between 2012 to 2016

Figure 42 New Product Developments and Acquisitions: Key Strategies, 2012-2016

Figure 43 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 44 E. I. Du Pont De Nemours and Company: SWOT Analysis

Figure 45 Ajinimoto Corporation Inc. : Company Snapshot

Figure 46 Ajinomoto Corporation Inc.: SWOT Analysis

Figure 47 Koninklijke DSM N.V.: Company Snapshot

Figure 48 Koninklijke DSM N.V.: SWOT Analysis

Figure 49 CHR. Hansen A/S: Company Snapshot

Figure 50 CHR. Hansen A/S: SWOT Analysis

Figure 51 BASF SE : Company Snapshot

Figure 52 BASF SE : SWOT Analysis

Figure 53 Cargill Corporation: Company Snapshot

Growth opportunities and latent adjacency in Fermented Ingredients Market

I want to know the approximate market size, indicative pricing, and any other relevant information that can help me arrive at an assessment of market attractiveness for the following products. Geographically, the market areas I am interested in are Africa and the Middle East, South East Asia, India, China, Taiwan. Any other relevant information relevant to these markets, such as market growth rates would be appreciated. The products I am interested in selling are as follows: Organic Acids and Amino Acids