Industrial Enzymes Market

Industrial Enzymes Market by Type (Carbohydrases, Proteases, Lipases, Polymerases, and Nucleases), Application (Food & Beverages, Bioethanol, Feed, Detergents, Wastewater, Soil, and Oil Treatment), Source, Formulation, and Region - Global Forecast to 2030

OVERVIEW

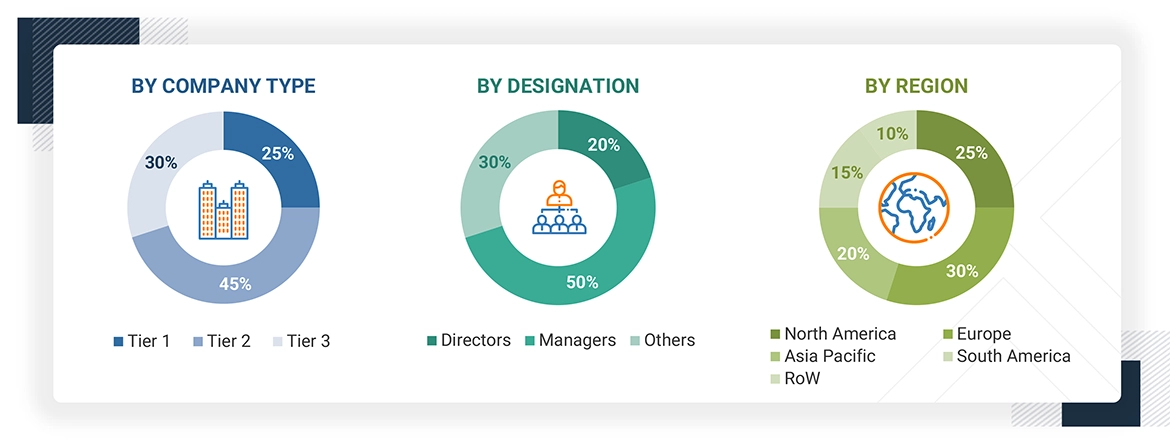

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The industrial enzymes market is estimated at USD 8.42 billion in 2025 and is projected to reach USD 12.01 billion by 2030, growing at a CAGR of 7.3%. The market includes a wide range of enzymes, technologies, and applications that enhance efficiency, reduce chemical usage, and improve yield across various industries, including food and beverages, detergents, textiles, biofuels, animal feed, and pulp and paper. These enzymes help optimize industrial processes, reduce environmental impact, and support sustainable manufacturing practices across the supply chain.

KEY TAKEAWAYS

- North America dominated the market with a 32% share in 2024.

- Carbohydrases remain the leading enzyme type, accounting for a 52.6% share in 2024.

- Wastewater treatment is the fastest-growing application, with a CAGR of 9.31% during the forecast period.

- Microorganism-derived enzymes dominate the market due to their broad activity range, versatility, and cost-effective scalability.

- Key players in the industrial enzymes market include Novonesis, BASF SE, and International Flavors & Fragrances, each holding strong positions with diversified enzyme applications.

- Emerging players, such as Tex Biosciences, Biocatalysts, and Kexing Biotechnology, are expanding their market reach through specialization in industrial, wastewater, and bio-processing enzyme solutions.

The global industrial enzymes market is set for fast growth due to the rising need for sustainable and efficient production processes in most industries. Enzymes, being biological catalysts, provide environmentally friendly substitutes for conventional chemical processes, which help industries decrease energy usage, lower waste generation, and improve product quality. This change is especially seen in industries such as food & beverage, biofuels, textiles, and wastewater treatment, wherein enzymes are responsible for maximizing operations and complying with strict environmental laws. Biotechnology and enzyme engineering have further extended the scope of industrial enzymes. New technologies like protein engineering and metagenomics have facilitated the creation of more stable, specific, and efficient enzymes in response to the unique requirements of various industrial applications. In addition, the application of machine learning and artificial intelligence in bioprocess design is accelerating enzyme production and process optimization and driving the growth curve of the market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The industrial enzymes market is experiencing significant trends and disruptions driven by evolving customer demands, technological innovation, and sustainability imperatives. Traditional applications, such as detergents, textiles, food & beverage, and pulp & paper, continue to generate the majority of revenue; however, emerging applications in bioplastics, carbon capture, enzyme recycling, and sustainable chemical processes are rapidly gaining prominence. Advanced enzyme engineering techniques, including CRISPR, directed evolution, and AI-enabled enzyme discovery, are enabling tailored solutions for niche industries, improving efficiency, and reducing environmental impact. Circular economy models and ESG mandates are further reshaping market dynamics, encouraging the adoption of low-waste and sustainable industrial processes. These shifts are creating new revenue pockets for enzyme manufacturers, solution providers, and biotech firms while enabling their clients’ clients, such as biodegradable packaging producers, biofuel companies, and wastewater treatment operators, to achieve regulatory compliance, optimize costs, and enhance sustainability. As the market transitions, emerging applications are expected to surpass traditional segments, positioning innovation, sustainability, and strategic partnerships as critical drivers of future growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Shift toward sustainable and regulatory-compliant manufacturing

-

Advancement in enzymes engineering & green chemistry

Level

-

High production costs and technical barriers in scale-up

-

Stringent regulatory guidelines for manufacturers

Level

-

Growth in wastewater treatment and environmental remediation

-

Demand for natural substitutes of synthetic chemicals

Level

-

Ensuring enzyme stability in harsh industrial environments

-

Concerns over enzymes quality used in food & beverages and feed industries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Shift toward sustainable and regulatory-compliant manufacturing

One of the key propellants in the market for industrial enzymes is the increasing need for ecologically friendly and regulation-acceptable processes of production. Conventional chemical processing in textiles, pulp & paper, and detergents industries tends to use high energy, toxic effluents, and poses occupational risk. Enzymes provide a bio-alternative that minimizes water consumption, energy inputs, and chemical residues. An example is the textile sector, where cellulases and amylases are used to displace bleaching chemicals and alkali scouring agents, lowering the effluent load as well as enhancing the quality of fabrics. In detergent formulations, too, enzymes enable effective removal of stains at lower temperatures, resulting in considerable savings on energy. Rules by the European Chemicals Agency (ECHA) and India's National Green Tribunal (NGT) are supporting the move toward greener inputs. With carbon neutrality and ESG reporting becoming business necessities, industrial enzymes present a make-or-break pathway for sustainable transformation.

Restraint: High production costs and technical barriers in scale-up

The high cost of producing and scaling up the manufacture of enzymes is a major constraint in the industrial enzymes market. It takes investment in controlled fermentation systems, purification facilities, and cold-chain logistics to ensure the stability of enzymes when manufactured at an industrial scale. The cost of inputs like fermentation substrates and microbial strain development also contributes to the cost of production. Proteases and lipases employed in detergent or food processing must be active over temperature and pH fluctuations, requiring sophisticated formulation, which increases expense. Additionally, SMEs in developing countries generally have no access to capital and technical know-how to embrace enzyme-based technologies. The cost-consciousness of industries such as textiles and wastewater treatment further limits adoption. Although innovations like solid-state fermentation (SSF) and recombinant DNA technology are helping reduce costs, the price-performance ratio remains a constraint, particularly in low-margin industries.

Opportunity: Growth in wastewater treatment and environmental remediation

The increasing need for environmentally friendly wastewater treatment solutions presents a significant opportunity for industrial enzyme producers. With fast industrialization, urbanization, and tighter discharge controls, particularly in Asia Pacific and Europe, enzymes are becoming highly regarded as powerful instruments for biological treatment. Enzymes like proteases, lipases, and cellulases are capable of degrading organic material, fats, oils, and fibers effectively, and lowering Chemical Oxygen Demand (COD) and Biological Oxygen Demand (BOD). One of the prime examples is the application of multi-enzyme mixes in food processing and textile industries to dispose of high-strength effluents. In May 2025, scientists at the National Institute of Technology (NIT) Rourkela invented an economical enzymatic wastewater treatment system that can run in natural sunlight with over 82% COD removal using reusable photocatalytic beads. Such innovations are a sign of increasing institutional and industrial desire for enzymes for environmental usage, presenting new markets for enzyme suppliers.

Challenge: Ensuring enzyme stability in harsh industrial environments

Maintaining the stability and activity of the enzyme in extreme operating conditions is the most vital challenge in the industrial deployment of enzymes. Industrial operations in industries such as bioethanol, pulp & paper, and oil treatment involve high temperatures, alkalinity or acidity, and mechanical agitation, conditions that can denature enzymes. For example, enzymes utilized in the production of bioethanol need to withstand heat and shear stress during saccharification. Although thermostable enzymes have been made available (e.g., Novozymes' Termamyl® family for starch liquefaction), they tend to be application-specific and premium-priced. Moreover, the performance of enzymes can vary depending on the source of substrate, water hardness, or contaminant level, resulting in erratic outcomes. Overcoming this will necessitate ongoing investment in protein engineering, immobilization methods, and enzyme formulation to match industrial process variability. Until these innovations are widely accepted and affordable, enzyme stability is a technical obstacle to widespread adoption.

industrial enzymes market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Enzyme solutions for bioethanol and biodiesel production | Increased conversion efficiency, reduced processing costs, and improved energy yield |

|

Enzymes for textile processing and baking applications | Enhanced softness in fabrics, clean-label baking, improved dough handling, and energy savings |

|

Enzymatic solutions for paper and pulp bleaching processes | Reduced use of harsh chemicals, improved fiber quality, and enhanced sustainability |

|

Specialty enzymes for nutraceutical formulations and dietary supplements | Improved bioavailability, natural claim support, and formulation stability in functional products |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

This image illustrates the dynamic ecosystem of the enzyme industry, highlighting key stakeholders across the value chain. Primary enzyme application companies such as Kraft Heinz (US), P&G (US), Pfizer (US), Kellogg’s (US), AB InBev (Belgium), and L'Oréal (France) represent major players leveraging enzymes in food, pharma, and consumer goods. Key enzyme manufacturers like BASF (Germany), IFF (US), DSM-Firmenich (Netherlands/Switzerland), AB Enzymes (Germany), and Kerry (Ireland) drive innovation and supply. Regulatory bodies and associations, including the FDA, ISO, WHO, and USDA, ensure safety and compliance. Startups like Alltech (US) and Brandon Biocatalyst (Canada) are emerging as agile innovators in this fast-growing industry.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Enzymes Market, by Type

Proteases are the most rapidly growing type of industrial enzymes, driven by the broad functionality, scalability, and high demand for them across various industries. These enzymes catalyze protein cleavage into peptides and amino acids, which makes them extremely efficient for use in detergents, the food industry, leather, and feed. Proteases are essential in the detergent industry for cleaning protein-based stains (blood, food, sweat) at low wash temperatures, which promotes energy-saving laundry compositions. In the feed industry, proteases increase nutrient digestibility and lower nitrogen excretion, consistent with sustainable livestock farming. In food processing, they tenderize meat and alter protein-rich ingredients for enhanced texture and digestibility. One of the most significant developments came in January 2024, when Novonesis (formerly known as Novozymes) introduced a next-generation protease enzyme for laundry detergents that delivers performance in cold water and shorter cycle washing. This innovation is backing the growing demand for low-impact cleaning products and demonstrates how proteases are helping industries achieve both performance and sustainability objectives.

Industrial Enzymes Market, by Application

Industrial enzymes play a vital role in the textile and leather industries, facilitating cleaner, more efficient, and sustainable use of resources. Examples of textiles involve bio-scouring using cellulases and amylases, which are environmentally friendly methods to strip natural impurities in cotton (Luthra et al., 2019) from the USDA ARS. Their method requires less water than conventional methods, does away with the use of strong alkali to effect scouring, and reduces environmental effects. Nonconventional enzymes like proteases, lipases, and laccases are employed in leather at different stages of processing (pickling, tanning, degreasing) to substitute conventional chemicals or reduce their consumption. A targeted study by the US EPA demonstrated that enzymatic tanning using transglutaminase and laccase/tyrosinase can effectively process goat hides into leather while reducing toxic effluent burdens on the environment. These and other alternative enzyme-based processes can enhance throughput and quality of products while minimizing water and chemical consumption. Enzymes are thus a solution to meet sustainability targets and regulatory challenges. Enzyme immobilization research provides stability solutions for re-use and has made continued use and adoption possible in these industries.

Industrial Enzymes Market, by Source

Microbial enzymes dominate the industrial enzymes market due to their high stability, cost-effectiveness, and adaptability across a wide range of industrial applications. Microorganisms such as bacteria, fungi, and yeasts serve as reliable and scalable sources for producing carbohydrases, proteases, lipases, polymerases, and nucleases. Their ease of cultivation, rapid growth rates, and capability for genetic modification allow manufacturers to tailor enzyme characteristics for specific applications, including food & beverages, bioethanol, detergents, textiles, pulp & paper, and wastewater treatment. Microbial enzymes also offer consistent performance under varying temperature, pH, and process conditions, making them suitable for large-scale industrial operations. The dominance of microbial sources is further strengthened by ongoing R&D, which focuses on improving yield, specificity, and environmental sustainability, as well as the ability to produce enzymes at lower costs compared to plant- or animal-derived alternatives.

REGION

Asia Pacific to be fastest-growing region in global industrial enzymes market during forecast period

Asia Pacific is the leading region of the industrial enzymes market, fueled by industrialization, population growth, and growing manufacturing industries. Regions like China, India, Japan, and Southeast Asian countries are experiencing robust growth in enzyme-consuming industries like food and beverages, textiles, feed, bioethanol, and water treatment. Increasing consumer demand for processed foods, dairy products, and drinks is driving enzyme use in food applications, while increasing environmental concerns are promoting the use of enzyme-based solutions in wastewater and effluent treatment. Regional governments in Asia Pacific are promoting biotechnology and clean manufacturing, significantly enhancing local enzyme production and R&D capabilities, particularly through India's BioE3 policy initiated in August 2024 and China's industrial biotechnology plans. The region's cost-effective labor, abundant raw materials, and increasing foreign investment bolster its position as a key player in the global industrial enzymes market. Notable examples include Novus International's March 2024 acquisition of BioResource International to develop enzyme-based feed solutions. Key market players such as Novozymes A/S, Amano Enzyme Inc., and Advanced Enzyme Technologies Ltd. are leveraging regional strengths in biotechnology and manufacturing to meet growing demand in food processing, biofuels, and more, thereby driving the advancement of the industrial enzymes sector across Asia Pacific.

industrial enzymes market: COMPANY EVALUATION MATRIX

In the industrial enzymes market matrix, Novonesis (Denmark), positioned as a Star, leads the market with its advanced, technology-driven enzyme solutions, including carbohydrases, proteases, lipases, and polymerases for diverse industrial applications such as food & beverages, bioethanol, detergents, textiles, and wastewater treatment. Associated British Foods (UK), recognized as a Leader, maintains a strong global presence by offering a wide portfolio of enzyme products, coupled with innovation in enzyme engineering, formulation, and application-specific solutions. While Novozymes dominates through its extensive R&D capabilities, cutting-edge technologies, and strong market penetration, Associated British Foods continues to expand its production capacities, strategic partnerships, and application reach, demonstrating strong potential to further strengthen its position in the industrial enzymes market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 7.88 BN |

| Market Forecast, 2030 (Value) | USD 12.01 BN |

| Growth Rate | CAGR of 7.3% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN), Volume (Million Tons) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: industrial enzymes market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Food & Beverage Producer | Detailed enzyme application forecast by type (carbohydrases, proteases, lipases, polymerases, nucleases) | Actionable insights on process optimization, yield enhancement, and cost savings |

| Biofuel & Ethanol Manufacturer | Analysis of enzyme efficiency in biomass conversion and fermentation across feedstocks | Recommendations for enzyme selection, dosage optimization, and energy reduction |

| Detergent & Textile Companies | Mapping of enzyme adoption in detergents, textile finishing, and leather processing | Enabled product positioning, investment prioritization, and differentiation in enzyme solutions |

| Pharmaceutical & Biotechnology Firms | Enzyme usage analysis for polymerases and nucleases in diagnostics, molecular biology, and therapeutics | Strategic insights for R&D prioritization, regulatory compliance, and innovation opportunities |

| Feed & Animal Nutrition Companies | Enzyme performance assessment in feed digestibility and nutrient absorption | Optimization strategies for cost-effective formulations, productivity improvements, and sustainability benefits |

RECENT DEVELOPMENTS

- June 2025 : Novonesis acquired DSM-Firmenich’s stake in the Feed Enzymes Alliance for EUR 1.5 billion, strengthening its position in enzyme-based animal nutrition. This strategic acquisition expanded Novonesis’s enzyme portfolio and enhanced its control over product innovation, distribution, and global market access in the industrial feed enzyme space.

- May 2025 : Novozymes launched a next-generation enzyme range for cold-water detergent formulations, enabling effective stain removal at lower temperatures. These enzymes would help reduce energy usage in laundry applications, supporting sustainability goals and consumer demand for eco-efficient cleaning products in both developed and emerging markets.

- May 2025 : BASF’s enzyme research team in San Diego, led by Dr. Melissa Scranton, announced new R&D focus areas, including high-performance enzymes for cleaning products and animal nutrition. This initiative aims to deliver more sustainable enzyme-based formulations aligned with industrial decarbonization trends.

- July 2024 : BASF, in collaboration with the University of Graz and the Austrian Research Centre of Industrial Biotechnology, developed a computer-assisted enzyme optimization model, accelerating the design of enzymes with improved performance and stability. This innovation supported scalable, resource-efficient biocatalytic production in industrial settings.

Table of Contents

Methodology

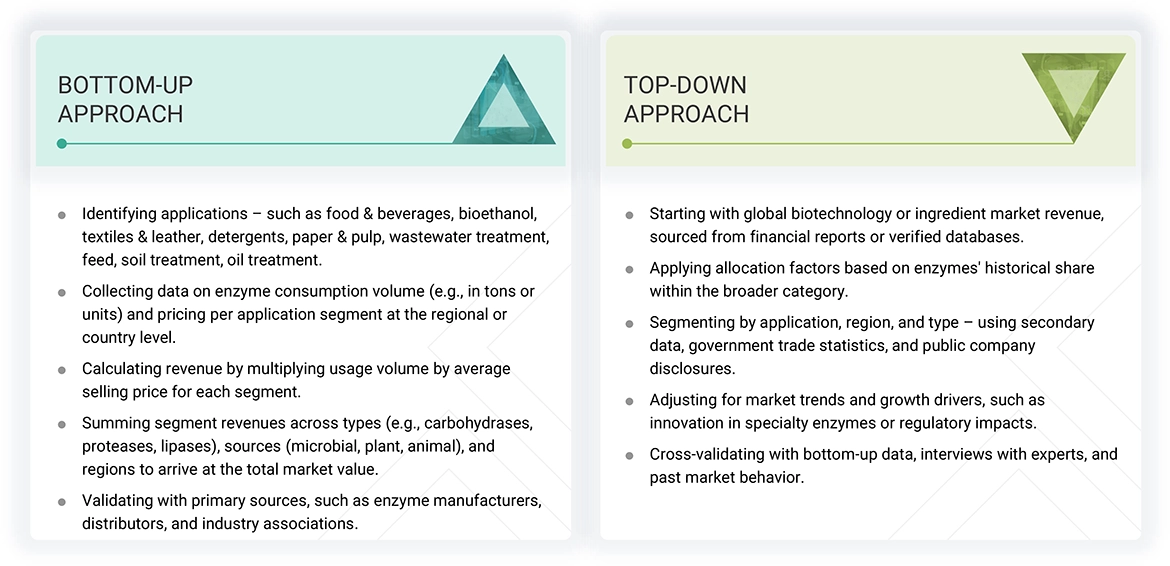

The study involved two major approaches in estimating the current size of the Industrial enzymes market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources, such as company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were used to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Industrial enzymes market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, research, and development teams, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research provided valuable insights into various trends related to enzyme types, sources, applications, formulations, and regions. Stakeholders from the demand side, including representatives from research institutions, universities, and third-party vendors, were interviewed to gain a better understanding of the buyers' perspectives on these services. This included their current usage of enzymes and their business outlook, which will ultimately impact the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per

the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue = USD

1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Novozymes A/S (Denmark) |

R&D Expert |

|

Kerry Group plc. (Ireland) |

Sales Manager |

|

Dyadic International Inc (US) |

Manager |

|

Advanced Enzyme Technologies (India) |

Sales Manager |

|

Aumgene Biosciences (India) |

Marketing Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Industrial enzymes market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Industrial Enzymes Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall industrial enzymes market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

The industrial enzymes market comprises industrial enzymes and specialty enzymes.

Enzymes are proteins composed of amino acids and can convert a compound (substrate) into another product by catalytic reaction. These catalytic proteins assist in the performance of biochemical reactions. They lower the activation energy of the reaction and then induce it.

Enzymes used for industrial applications such as food & beverage processing, feed, bioethanol, textile & leather, detergent, paper & pulp, wastewater treatment, and other industrial applications are termed as industrial enzymes.

Stakeholders

- Enzyme raw material suppliers

- Industrial enzyme manufacturers

- Specialty enzyme manufacturers

- Intermediate suppliers such as traders and distributors of enzymes

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- European communities

- World Health Organization (WHO)

- Association of Manufacturers & Formulators of Enzyme Products (AMFEP)

- Enzyme Technical Association (ETA)

- OECD-FAO Agricultural Outlook

- United States Department of Agriculture (USDA)

Report Objectives

- To define and measure the global Industrial enzymes market with respect to type, source, formulation, application, and geography

- Determining and projecting the size of the Industrial enzymes market, with respect to product type, source, type, application, and regional markets, over a five-year period, ranging from 2025 to 2030

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro markets, with respect to individual growth trends, prospects, and their contribution to the total market

- To strategically profile key players of the global Industrial enzymes market and comprehensively analyze their core competencies in each segment

- To track and analyze competitive developments, such as alliances, joint ventures, product developments, mergers, and acquisitions in the global industrial enzymes market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Service Analysis

- Service Matrix, which gives a detailed comparison of the service portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of European industrial enzymes market into key countries

- Further breakdown of the Rest of Asia Pacific industrial enzymes market into key countries

- Further breakdown of the Rest of South American industrial enzymes market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the size of the industrial enzymes market in 2030?

The industrial enzymes market is estimated to be USD 12.01 billion by 2030. This is driven by the growing adoption of enzymes in industries such as food processing, detergents, bioethanol, and wastewater treatment, helped by the growing need for sustainable and cost-effective industrial processes that substitute traditional chemical processes.

What is the anticipated CAGR during 2025-2030 for the industrial enzymes market?

The industrial enzymes market is anticipated to grow at a CAGR of 7.3% from 2025 to 2030. This growth is fueled by the worldwide trend toward environmentally friendly production, backed by innovation in stability, efficiency, and increased usage across emerging markets and regulated industrial applications.

What type of enzyme is developing the fastest in industrial use?

Proteases are developing the fastest, experiencing heightened demand for use in detergents, feed, and food processing. Their capacity to effectively degrade proteins under different conditions, combined with advancements in enzyme engineering, renders them extremely desirable for both energy reduction and increased product performance in industry.

Why is Asia Pacific the fastest-growing region in the industrial enzymes market?

Asia Pacific takes the lead with its growing food, textile, and biofuel industries, combined with favorable government initiatives and growing environmental concerns. China and India are investing in domestic enzyme manufacturing and R&D, and the low cost of manufacturing and growing demand for sustainable methods drive growth in the region.

What application makes the biggest contribution to the market for industrial enzymes?

The largest contribution comes from the food & beverage sector, which applies enzymes to baking, brewing, dairy processing, and juice clarification. Enzymes enable consistency of product, shelf life extension, and facilitation of clean-label manufacturing to respond to increasing consumer demands for natural, high-quality, and process-effective foods.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Enzymes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Enzymes Market