Field Service Management Market by Offering (Solutions, Services), Deployment Mode (On-premises, Cloud), Organization Size, Vertical (Manufacturing, Transportation & Logistics, Construction & Real Estate) and Region - Global Forecast to 2028

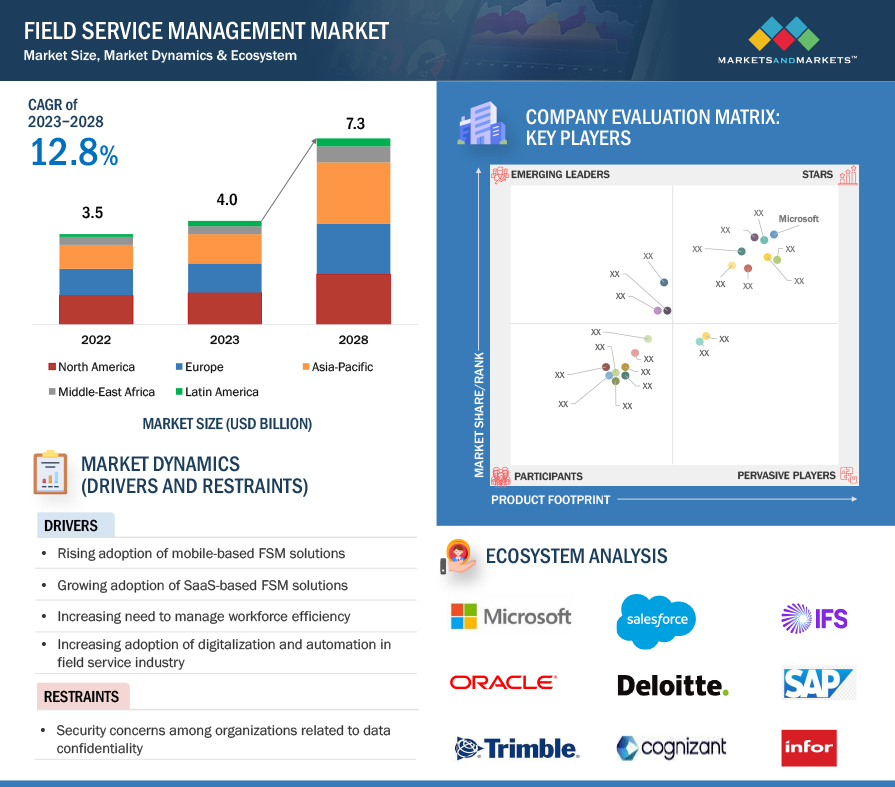

[283 Pages Report] The global Field Service Management Market size is expected to grow from USD 4.0 billion in 2023 to USD 7.3 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 12.8% during the forecast period. The field service management (FSM) market is experiencing dynamic growth, primarily driven by technological advancements, evolving customer expectations, and the increasing need for efficient service delivery across industries. FSM solutions have become essential for organizations seeking to optimize their field operations, enhance workforce productivity, and deliver superior customer experiences. The key trends that are supporting the growth of the FSM market include the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) to enable predictive maintenance, remote diagnostics, and intelligent scheduling. Cloud-based FSM platforms are gaining traction due to their scalability, flexibility, and cost-effectiveness, offering access to critical data anytime, anywhere, and facilitating seamless integration with other enterprise systems.

Moreover, there is a growing emphasis on delivering exceptional customer experiences, driving the adoption of FSM solutions that empower field technicians with real-time access to customer data, service history, and collaboration tools on mobile devices. This trend is further fueled by the proliferation of mobile devices and connectivity, enabling organizations to empower their mobile workforce and improve communication between field staff and the back office. While the FSM market presents significant opportunities for organizations to enhance operational efficiency and drive revenue growth, it poses challenges such as integration complexity, talent shortage, and intense market competition. However, by embracing digital transformation, investing in advanced FSM solutions, and prioritizing customer-centric service delivery, organizations can capitalize on the opportunities and overcome the challenges to succeed in the dynamic and competitive FSM market landscape.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Field Service Management Market

The global FSM market has a medium impact on the current recession. Organizations may seek cost-effective alternatives to traditional FSM software, such as cloud-based or subscription-based offerings that offer lower upfront costs and flexible pricing models. Vendors providing Software-as-a-Service (SaaS) or pay-per-use FSM solutions may benefit from increased demand during a recession as organizations look to minimize capital expenditures and align costs with usage. Recession may accelerate the adoption of FSM solutions that enable remote workforce management and collaboration, particularly in industries where field service technicians need to work remotely or in dispersed locations. Solutions that offer mobile capabilities, real-time communication, and remote diagnostics may become increasingly valuable in maintaining service continuity and efficiency during economic uncertainty.

Field Service Management Market Dynamics

Driver: Rising adoption of mobile-based FSM solutions

Mobile FSM solutions empower technicians to manage schedules, access work orders, and document service activities directly from their smartphones or tablets. This accessibility reduces administrative overhead and enables technicians to focus more on servicing customers, improving productivity and faster job completion times. A study by the Service Council in 2021 found that approximately 99% of survey respondents use mobile devices in the fields. Mobile FSM solutions facilitate real-time communication and collaboration between field technicians, dispatchers, and back-office staff. Technicians can receive updates on job assignments, share information with colleagues, and seek assistance when encountering complex issues, leading to faster problem resolution and enhanced customer satisfaction. Mobile FSM solutions provide technicians access to customer history, equipment manuals, and troubleshooting guides on their mobile devices, enabling them to diagnose and resolve issues more effectively on the first visit. Companies can increase their first-time fix rates and reduce the need for costly return visits by arming technicians with the information they require to succeed. With the proliferation of smartphones and tablets and advancements in mobile technology, mobile FSM solutions will continue to play a crucial role in shaping the future of FSM.

Restraint: Security concerns of organizations related to data confidentiality

Organizations handling sensitive customer information, operational data, and intellectual property are rightfully concerned about data breaches and unauthorized access. FSM software collects, stores, and transmits valuable data, including customer details, service histories, and financial records. Any compromise in data security could lead to severe consequences, including economic loss, damage to reputation, and legal liabilities. Compliance with data protection regulations, such as GDPR or HIPAA, adds a layer of complexity and scrutiny. Organizations may only adopt FSM software with assurances of robust security measures, encryption protocols, and compliance controls in place. As a result, addressing these security concerns and ensuring data confidentiality are essential prerequisites for the widespread adoption of FSM software across industries.

Opportunity: Remote AR assistance for on-site support

Remote Augmented Reality (AR) assistance will revolutionize on-site support for field technicians, providing real-time guidance and expertise from remote specialists. AR technology offers step-by-step instructions and visual cues, enhancing problem-solving capabilities by overlaying digital information onto the technician's view of the physical world. For instance, Xerox implemented AR technology to link field engineers with experts, replacing traditional service manuals and telephone support. As a result, first-time fix rates surged by 67%, and the engineers' productivity notably increased by 20%. This real-time support empowers technicians to address complex issues efficiently, minimizing downtime and optimizing service delivery. Remote AR assistance improves field technicians' effectiveness and demonstrates innovative technology's potential to enhance operational efficiency and customer satisfaction in FSM.

Challenge: Need for resource management

Integrating FSM software with existing resource management systems and processes can be complex and time-consuming. Organizations often have diverse resources to manage, including equipment, vehicles, and personnel, each with its own scheduling and allocation requirements. Ensuring seamless integration of FSM software with these systems requires careful planning and customization to accommodate various resource types and workflows. Further, optimizing resource allocation and scheduling within FSM software can be challenging, especially in dynamic field service environments. Balancing workload distribution, skill matching, and travel time optimization requires real-time visibility into resource availability and capabilities and sophisticated scheduling algorithms. However, unexpected delays, last-minute changes, and competing priorities can disrupt scheduling efforts and impact service delivery efficiency. Thus, ensuring accurate and up-to-date resource data within FSM software is essential for effective resource management. Only accurate or complete resource information can lead to scheduling conflicts, efficient resource utilization, and delays in service delivery. Therefore, organizations must invest in data quality assurance processes and ongoing maintenance efforts to ensure the reliability of resource data within FSM software.

Field Service Management Market Ecosystem

Based on solutions, the work order management segment will grow at a higher CAGR during the forecast period.

Work order creation involves systematic documentation of service requests, detailing customer requirements, job specifications, and relevant information essential for task execution. Once created, work orders are assigned to field technicians based on skill set, availability, and proximity to the job site, ensuring optimal resource allocation and timely service delivery. Throughout the service lifecycle, work order tracking enables real-time visibility into task progress, technician location, and job completion status, facilitating proactive intervention and resolution of potential issues or delays. Job status updates give stakeholders timely insights into service activities, enabling informed decision-making and transparent communication regarding service timelines and expectations with customers.

Based on vertical, transportation & logistics segment to grow at a higher CAGR during the forecast period.

The transportation & logistics vertical within the field service management market focuses on optimizing the movement of goods and resources throughout the supply chain. It involves managing various aspects such as fleet operations, route optimization, vehicle maintenance, and driver scheduling to ensure efficient and timely delivery of products. Key priorities include minimizing transportation costs, improving delivery accuracy, enhancing fleet safety, and maximizing asset utilization. By leveraging field service management solutions tailored to the transportation and logistics sector, companies can streamline operations, improve customer service, and gain a competitive edge in the dynamic and fast-paced logistics industry. Collaboration with industry partners and stakeholders aims to enhance interoperability and data exchange between different systems and platforms used in transportation and logistics operations.

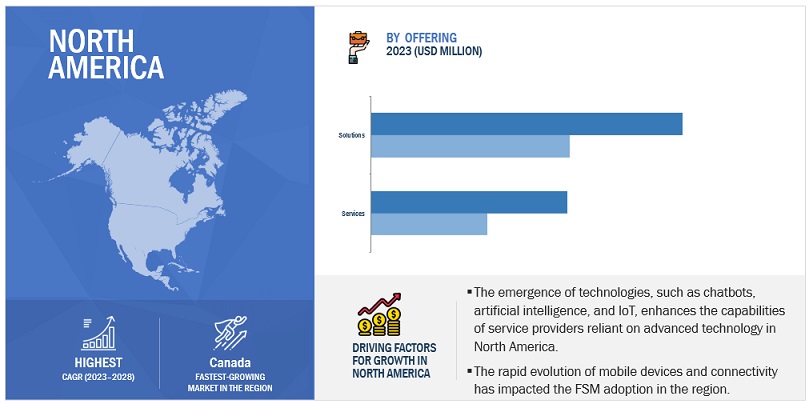

Based on region, North America holds the largest market share during the forecast period.

North America is characterized by innovation, extensive infrastructure, and widespread adoption of digital technologies across various sectors. The region boasts a robust telecommunications network, including high-speed internet connectivity and widespread mobile coverage, facilitating seamless communication and data exchange. Cloud computing has seen widespread adoption, with businesses leveraging platforms like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud for scalable and cost-effective storage and computing resources. In North America, the proliferation of smartphones and tablets has contributed significantly to the widespread embrace of mobile FSM solutions. Per the ServiceCouncil Voice of The Field Service Engineer Survey 2021, 99.5% of field service engineers use mobile devices for fieldwork. FSM vendors in the region cater to the diverse applications and functionalities available within the FSM ecosystem. For instance, Salesforce's Field Service Lightning empowers organizations to deliver exceptional on-site service experiences by leveraging AI-driven scheduling, predictive maintenance, and IoT integration. Similarly, ServiceNow's Field Service Management solution enables companies to streamline field operations, automate service workflows, and improve customer satisfaction through personalized interactions. These technological advancements create a dynamic ecosystem that empowers organizations in North America to transform their field service operations, delivering superior customer experiences and driving competitive advantage.

Key Market Players

The FSM market is dominated by a few globally established players such as Oracle (US), Microsoft (US), SAP (US), IFS (Sweden), ServiceMax (US), Salesforce (US), Infor (US), Trimble (US), Comarch (Poland), ServicePower (US), ServiceNow (US), OverIT (Italy), FieldAware (US), Zinier (US), Accruent (US), Praxedo (France), FieldEZ (India), FieldEdge (US), Jobber (Canada), ServiceTitian (US), Kickserv (US), mHelpDpesk (US), Skedulo (US), Service Fusion (US), Husky Intelligence (UK), Field Pulse (US), Workiz (US), and Nomadia(France). among others, are the key vendors that secured FSM contracts in last few years. These vendors have both global and local presence in the FSM market. The FSM market is witnessing significant growth, driven by evolving learning needs, technological advancements, and the increasing adoption of digital learning solutions across various industries. Vendors are focusing on continuous product innovation to differentiate themselves in the market; this includes developing user-friendly interfaces and incorporating advanced features such as AI-driven work order management solutions and mobile-based FSM solutions to offer enhanced customer service.

Scope of Report

|

Report Metrics |

Details |

|

Market Size Available For Years |

2018–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Deployment Mode, Organization Size, and Vertical |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Oracle (US), Microsoft (US), SAP (US), IFS (Sweden), ServiceMax (US), Salesforce (US), Infor (US), Trimble (US), Comarch (Poland), ServicePower (US), ServiceNow (US), OverIT (Italy), FieldAware (US), Zinier (US), Accruent (US), Praxedo (France), FieldEZ (India), FieldEdge (US), Jobber (Canada), ServiceTitian (US), Kickserv (US), MHelpesk (US), Skedulo (US), Service Fusion (US), Husky Intelligence (UK), Field Pulse (US), Workiz (US), and Nomadia(France). |

This research report categorizes the Learning management system market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

- Solutions

- Scheduling, Dispatch, & Route Optimization

- Customer Management

- Work Order Management

- Inventory Management

- Service Contract Management

- Reporting and Analytics

- Other Solutions

- Services

- Consulting

- Integration & Implementation

- Training & Support

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large Enterprises

- SMEs

By Vertical:

- Telecom

- IT & ITeS

- Healthcare & Life Sciences

- Manufacturing

- Transportation & Logistics

- Construction & Real Estate

- Energy & Utilities

- Oil & Gas

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

-

Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In January 2024, ServicePower partnered with Encompass Simply Parts, an OEM supplier, to offer simplified and streamlined capabilities for parts ordering to all service providers utilizing the ServicePower platform and ServicePower HUB.

- In December 2023, Future Connections, a managed telco service provider, integrated the Comarch FSM tool to serve its customers in B2B and B2C domains by helping resolve client inquiries, schedule meetings, and dispatch engineers to the field.

- In June 2023, Microsoft announced that the release of field service software would enhance field service operations for service managers. Dispatchers can streamline the triage and assignment of work orders by prioritizing those in proximity. The updated schedule board experience is accessible to all users, and improvements for frontline workers for their mobile applications.

- In August 2023, IFS acquired Falkonry. This AI-based software company provides automated, high-speed data analysis to the manufacturing and defense industries to monitor large volumes of data for assets, machines, systems, and industrial processes to discover and analyze unusual behavior and causes of failures.

- In October 2022, Salesforce introduced additional functionalities for Salesforce Field Service, enabling companies to expand their field operations, customize services, and foster connectivity among their frontline teams. The functionalities include proactive maintenance, offline mobile UI extensibility, and AI-guided visual assistance.

- In August 2022, ServiceMax introduced new functionalities for the ServiceMax core, including mobile, communication, and data capture features. These enhancements benefit dispatchers, field technicians, planners, and administrators and a widening range of positions linked with boosting revenues, enhancing customer value, and refining operating margins.

Frequently Asked Questions (FAQ):

What is a Field Service Management?

Field Service Management (FSM) refers to the comprehensive set of activities in managing a company's resources and operations in the field, typically involving mobile workers or technicians providing on-site services to customers. FSM aims to streamline and optimize field operations, ensuring efficiency, productivity, and customer satisfaction. Critical components of FSM include work-order management, customer management, inventory management, service contract management, reports & analytics, and schedule & dispatch.

Which country was the early adopter of FSM solutions?

The US was at the initial stage of the adoption of FSM solutions.

Which are the key vendors exploring FSM Solutions?

Some of the significant vendors offering FSM solutions across the globe include Oracle (US), Microsoft (US), SAP (US), IFS (Sweden), ServiceMax (US), Salesforce (US), Infor (US), Trimble (US), Comarch (Poland), ServicePower (US), ServiceNow (US), OverIT (Italy), FieldAware (US), Zinier (US), Accruent (US), Praxedo (France), FieldEZ (India), FieldEdge (US), Jobber (Canada), ServiceTitian (US), Kickserv (US), MHelpesk (US), Skedulo (US), Service Fusion (US), Husky Intelligence (UK), Field Pulse (US), Workiz (US), and Nomadia(France).

What is the total CAGR recorded for the FSM market from 2023 to 2028?

The FSM market will record a CAGR of 12.8% from 2023-2028

What is the projected market value of the FSM market?

The FSM market will grow from USD 4.0 billion in 2023 to USD 7.3 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 12.8% during the forecast period.

What are the significant trends in the FSM market?

Organizations are increasingly adopting cloud-based FSM solutions over traditional on-premises systems. Cloud-based FSM offers scalability, accessibility, and cost-effectiveness. FSM providers prioritize user-friendly interfaces and intuitive designs to enhance the user experience. Improved UX contributes to higher engagement and better adoption rates among learners. FSM platforms are integrating personalization features, leveraging data analytics and AI to tailor learning paths based on individual preferences, skills, and performance. Adaptive learning enhances engagement and relevance. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

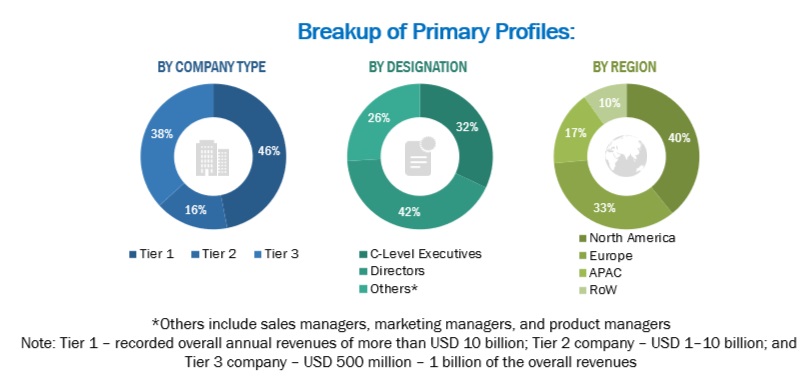

The study involved four major activities in estimating the field service management market. We performed extensive secondary research to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, we used the market breakup and data triangulation procedures to estimate the market size of the various segments in the FSM market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. We used these sources to identify and collect valuable information for this technical, market-oriented, and commercial FSM market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market's prospects.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); the installation teams of governments/end users using FSM solutions & services; and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall FSM market.

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the FSM and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the FSM market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research. We then determined their revenue contributions in the respective countries through primary and secondary research.

- This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Learning management system market: Top-down and Bottom-up approaches

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the FSM market's demand and supply sides.

Market Definition

Field Service Management (FSM) refers to the comprehensive set of activities in managing a company's resources and operations in the field, typically involving mobile workers or technicians providing on-site services to customers. FSM aims to streamline and optimize field operations, ensuring efficiency, productivity, and customer satisfaction. Critical components of FSM include work-order management, customer management, inventory management, service contract management, reports & analytics, and schedule & dispatch.

Source: Secondary Research and MarketsandMarkets Analysis

Key Stakeholders

- IT Service Providers

- Field Service Management Vendors

- Software Providers

- System Integrators

- System Administrators

- Internet Service Providers (ISPs)

- Compliance Regulatory Authorities

- Cloud Service Providers (CSPs)

- Government Authorities

- Sales and Marketing Teams

- Regulatory Authorities

Report Objectives

- To define, describe, and forecast the FSM market based on offerings, organization sizes, deployment modes, verticals, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the macro and micromarkets1 concerning growth trends, prospects, and their contributions to the overall market

- To analyze the industry trends, patents and innovations, and pricing data related to the FSM market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies across segments and subsegments.

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, and partnerships and collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Field Service Management Market

Interested to learn more about Field Service Management Market report. When was the latest version updated, data available? Also, looking for breakouts by region, industry verticals served, use cases. Does this report covers the COVID-19 impact analysis as well? In addion, looking for projections by Use Case (e.g. scheduling, inventory management, etc) and GEO (US, Europe, APAC)

We would like to learn more about the Field Service Management Market study. We are looking for breakouts in the following categories - region, industry vertical, and use case. Does the report cover Covid impact analysis along with updated market numbers and competitive landscape? We are also interested in By Use Case (e.g. scheduling, inventory management, etc) and By Geo (US, Europe, APAC) market projections.

Interested in identifying field service company