Fluid Management Systems Market by Product (Standalone (Dialyzers, Insufflators, Suction) Integrated Systems, Disposables, Accessories), Application (Urology, Nephrology, Laparoscopy) End User (Hospitals, Dialysis Centers) & Region - Global Forecast to 2025

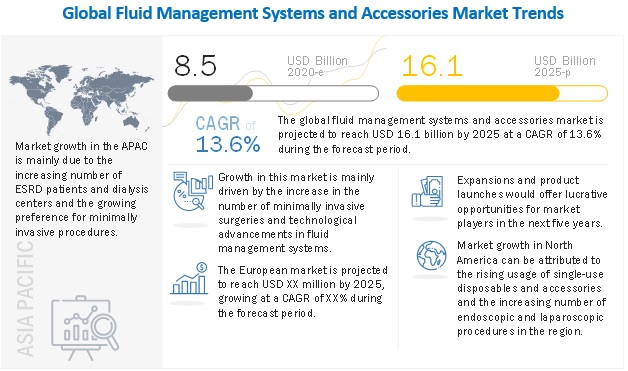

The global Fluid Management Systems Market in terms of revenue was estimated to be worth $8.5 billion in 2020 and is poised to reach $16.1 billion by 2025, growing at a CAGR of 13.6% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth of this market is majorly driven by the increasing number of minimally invasive surgeries, technological advancements in fluid management systems, an increase in government funds and grants worldwide for endosurgical procedures, increasing ESRD patient base, and rising number of hospitals and investments in endoscopy and laparoscopy facilities. Emerging markets and single-use disposable devices and accessoires are expected to provide significant opportunities for providers of fluid management systems and accessories. On the other hand, the high cost of endosurgical procedures, a lack of awareness, and the dearth of sufficient surgeons may affect market growth negatively during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Fluid Management Systems Market Growth Dynamics

Drivers: Rising number of minimally invasive surgeries

Compared to open surgeries, minimally invasive surgeries are associated with a wide range of advantages—fewer postoperative complications, shorter recovery periods (shorter hospital stay), and lower risks of surgical site infections. Many minimally invasive surgeries are considered outpatient surgeries in which the patient does not need to stay overnight in a medical facility. According to a blog published in Surgical Solutions, hospitals in the US could collectively prevent thousands of post-surgical complications and save around USD 280–340 million every year by opting for minimally invasive surgeries instead of open surgery for routine operations of the appendix, colon, and lungs.

Minimally invasive surgeries are also increasingly being covered by health insurance providers in various countries across the globe. Due to their advantages, many patients and physicians opt for minimally invasive surgeries over other surgical procedures. More than 7.5 million surgical and minimally invasive cosmetic procedures were performed in the US as of 2017; this is projected to rise by 2% per year (Source: American Association of Pharmaceutical Scientists).

The growing number of minimally invasive cancer treatment procedures can also be expected to contribute to the demand for fluid management systems and accessories.

Restraints: High cost of endosurgical procedures

The cost of minimally invasive surgeries is higher than that of open surgeries due to the extensive use of specialized equipment and increased surgical time. The investment costs for endoscopic equipment are extremely high for most hospitals in developing countries. An HD colonoscopy system’s average price ranges between USD 100,000 and USD 120,000—an exceptionally high investment for healthcare providers in developing nations such as India, Brazil, and Mexico, who have lower financial resources to invest in sophisticated technologies. Also, personnel must be trained to handle and maintain endoscopy systems and equipment, adding to the operational cost for any endoscopy system acquired by the healthcare provider.

Owing to the high capital, training, and maintenance costs, endoscopy procedures are generally expensive. For instance, the average cost of a colonoscopy procedure ranges from USD 2,000–3,000 in many developing countries. Also, in most Asian countries, there is limited or no reimbursement for endoscopy procedures. The higher costs of endoscopic procedures typically prompt physicians and patients to opt for alternative, lower-priced methods, thereby limiting the adoption of endoscopic procedures across the world and affecting the growth of dependent industries such as fluid management systems and accessories.

Opportunities: Untapped potential in emerging markets

Emerging countries (such as China, India, South Korea, Brazil, and Mexico) offer significant growth opportunities to players operating in the global fluid management systems and accessories market. This can be attributed to the increasing public and private initiatives undertaken by market stakeholders across these countries, low regulatory barriers for trade, continuous improvements in healthcare infrastructure, growing patient population, rising healthcare expenditure, strengthening distribution networks of market leaders in these regions, and the rising medical tourism in these countries. The availability of high-quality surgical treatments at lower costs than developed markets has attracted many medical tourists.

Furthermore, the APAC accounts for the major portion of the global population; of 7.79 billion people (as of 2020-end), 4.66 billion live in the APAC. China and India contribute 30.9% and 29.6% of the APAC population, respectively. These countries are also home to a larger patient base for renal, respiratory, gastroenterological, and gynecological diseases.

Furthermore, the increase in disposable incomes and healthcare expenses in developing markets across the APAC and Latin America has made it easier for patients to access advanced treatments. These emerging markets are underpenetrated by major players, which indicates huge untapped market potential. Successful entry in these growing markets with suitable investment plans can ensure high growth for any global fluid management system provider.

The fluid management systems segment accounts for the largest share of the market, by product, in 2019

By product, the fluid management systems and accessories fluid management systems market is segmented into systems and disposables and accessories. The systems segment accounted for the largest market share in 2019. The dominant share this segment can be attributed to the high cost of fluid management systems compared to accessories & consumables.

The laparoscopy application segment is expected to grow at the highest CAGR during the forecast period

Based on application, the fluid management systems market is categorized into urology and nephrology, gastroenterology, gynecology/obstetrics, laparoscopy, bronchoscopy, cardiology, arthroscopy, otoscopy, dentistry, neurology, and other applications. The laparoscopy application segment is expected to grow at the highest CAGR during the forecast period. Growth in this application segment is mainly due to the growing shift towards minimally invasive procedures, which, in turn, boosts the number of laparoscopic surgeries performed worldwide.

Hospitals end-user segment is expected to grow at the highest CAGR in the fluid management systems and accessories market during the forecast period

Based on end user, the global fluid management systems market is broadly segmented into hospitals, dialysis centers, ambulatory surgical centers, and other end users. The hospitals segment accounted for the largest market share in 2019 and is projected to register the highest CAGR during the forecast period.

The large share and high growth rate of this end-user segment can mainly be attributed to the large number of surgical procedures performed in these facilities.

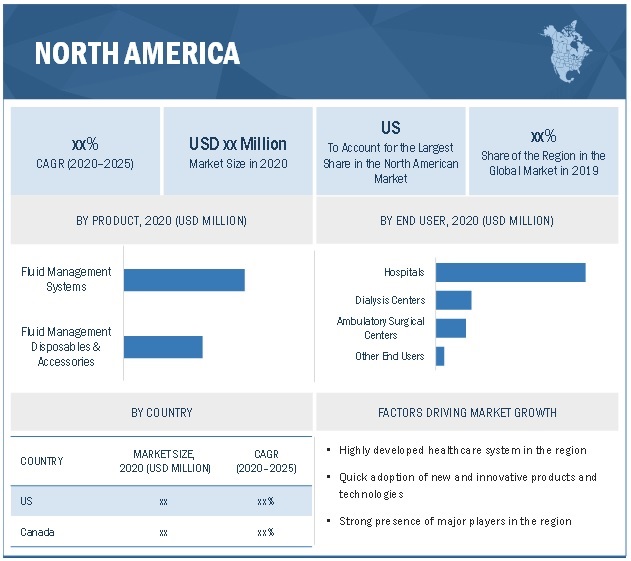

North America is expected to account for the largest share of the fluid management systems and accessories market in 2019

In 2019, North America accounted for the largest share of the fluid management systems market, followed by Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America is a lucrative and well-established market for fluid management systems and accessories. The growth in this market is majorly attributed to technological advancements, the presence of a favorable reimbursement scenario, rising incidence of diseases such as ESRD, cancer, and the greater adoption of advanced technologies in North America are the key factors driving the growth of the fluid management systems and accessories market in North America. The presence of a large number of global players in this region is another key factor contributing to the large share of this market segment.

To know about the assumptions considered for the study, download the pdf brochure

Fluid Management Systems Market Key Players

The prominent players in fluid management systems market are Fresenius Medical Care AG & Co. KGaA (Germany), Baxter International Inc. (US), Cardinal Health, Inc. (US), Stryker Corporation (US), Olympus Corporation (Japan), B. Braun Melsungen AG (Germany), Medline Industries, Inc. (US), KARL STORZ GmbH & Co. KG (Germany), Ecolab Inc. (US), Smiths Medical (UK), Zimmer Biomet Holdings Inc. (US), Medtronic plc (Ireland), FUJIFILM Holdings Corporation (Japan), CONMED Corporation (US), Hologic, Inc. (US), Arthrex, Inc. (US), Thermedx, LLC. (US), COMEG Medical Technologies (Germany), and EndoMed Systems GmbH (Germany).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Product, Application, End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa |

|

Companies covered |

Fresenius Medical Care AG & Co. KGaA (Germany), Baxter International Inc. (US), Cardinal Health, Inc. (US), B. Braun Melsungen AG (Germany), Stryker Corporation (US), Olympus Corporation (Japan), Medline Industries, Inc. (US), KARL STORZ GmbH & Co. KG (Germany), Ecolab Inc. (US), Smiths Medical (UK), Zimmer Biomet Holdings Inc. (US), Medtronic plc (Ireland), FUJIFILM Holdings Corporation (Japan), CONMED Corporation (US), Hologic, Inc. (US), Arthrex, Inc. (US), Thermedx, LLC. (US), COMEG Medical Technologies (Germany), and EndoMed Systems GmbH (Germany). |

The study categorizes the fluid management systems market based on product, application, end user, and regional and global level.

By Product

-

Fluid Management Systems

-

Standalone Fluid Management Systems

- Dialyzers

- Insufflators

- Suction/Evacuation and Irrigation Systems

- Fluid Warming Systems

- Fluid Waste Management Systems

- Others

- Integrated Fluid Management Systems

-

Standalone Fluid Management Systems

-

Fluid Management Disposables & Accessories

- Catheters

- Blood Lines

- Tubing Sets

- Pressure Monitoring Lines

- Pressure Transducers

- Valves, Connectors, and Fittings

- Suction Canisters

- Cannulas

- Other Fluid Management Disposables & Accessories

By Application

- Urology and Nephrology

- Laparoscopy

- Gastroenterology

- Gynecology / Obstetrics

- Bronchoscopy

- Arthroscopy

- Cardiology

- Neurology

- Otoscopy

- Dentistry

- Other Applications

By End User

- Hospitals

- Dialysis Centers

- Ambulatory Surgical Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments

- In December 2020, Medtronic (Ireland) launched the Carpediem System, a pediatric and neonatal acute dialysis machine (including dialyzer) in the US.

- In June 2020, Fresenius Medical Care (Germany) is planning to open more than 100 new transitional care units (TCU) centers in the US. These units will help people recently diagnosed with kidney failure to learn about the treatment options available to them (including home dialysis) and become more empowered in managing their own care.

- In February 2019, Fresenius Medical Care (Germany) acquired NxStage Medical, Inc. (a US-based home dialysis leader). With this acquisition, the company aims to expand its presence in the dialysis market.

- In February 2019, Fresenius Medical Care (Germany) launched the 2008T BlueStar hemodialysis machine in the US.

Frequently Asked Questions (FAQ):

Which are the top industry players in the global fluid management systems market?

The top market players in the global fluid management systems market include Fresenius Medical Care AG & Co. KGaA (Germany), Baxter International Inc. (US), Cardinal Health, Inc. (US), Stryker Corporation (US), Olympus Corporation (Japan), B. Braun Melsungen AG (Germany), Medline Industries, Inc. (US), KARL STORZ GmbH & Co. KG (Germany), Ecolab Inc. (US), Smiths Medical (UK), Zimmer Biomet Holdings Inc. (US), Medtronic plc (Ireland), FUJIFILM Holdings Corporation (Japan), CONMED Corporation (US), Hologic, Inc. (US), Arthrex, Inc. (US), Thermedx, LLC. (US), COMEG Medical Technologies (Germany), and EndoMed Systems GmbH (Germany).

Which fluid management systems and accessories products have been included in this report?

This report contains the following main segments:

- Systems- This segment majorly includes standalone fluid management systems (dialyzers, insufflators, suction/evacuation and irrigation systems, fluid warming systems, fluid waste management systems, and others) and integrated fluid management systems

- Disposables and Accessories- Fluid management disposables & accessories are vital elements required for the normal functioning of fluid management systems during surgeries and dialysis. Various accessories and disposables used in fluid management include tubing sets, pressure monitoring lines, suction canisters, catheters, cannulas, bloodlines, pressure transducers, valves, connectors, and fittings.

Which geographical region is dominating in the global fluid management systems market?

The global fluid management systems and accessories market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East and Africa. North America is the largest regional market for fluid management systems and accessories. The large share of this region can be attributed to the growth in the aging and chronically ill population, increasing number of minimally invasive surgeries, growth in the number of dialysis centers, rising usage of single-use disposable accessories, and advancements in technologies. Moreover, considering the increasing prevalence of cancer, the demand and adoption of endoscopic, diagnostic, and surgical procedures are expected to increase in North America in the coming years.

The Asia Pacific market is estimated to grow at the highest CAGR during the forecast period, primarily due to the rising geriatric population, increased patient awareness of minimally invasive endosurgery, the rapid rise in the number of people suffering from kidney disorders, growth in per capita income, increasing investments in the healthcare industry by key market players, rising demand for cutting-edge technologies in endosurgery, and the expansion of private-sector hospitals in rural areas are expected to drive the growth of the Asia Pacific market during the forecast period.

Which is the leading application segment for fluid management systems market ?

The urology and nephrology segment accounted for the largest share of the global fluid management systems and accessories market in 2019. The large share of this application segment can mainly be attributed to the increasing incidence of end-stage renal disease and the growing number of dialysis procedures performed worldwide.

Which is the major end user segment for fluid management systems market ?

The hospitals segment accounted for the largest market share in 2019 and is projected to register the highest CAGR during the forecast period. The large share and high growth rate of this segment can mainly be attributed to the large number of surgical procedures performed in these facilities and the increasing government & private funding for hospitals. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVE OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.4.1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH APPROACH

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2019)

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION: FRESENIUS MEDICAL CARE

FIGURE 7 SUPPLY-SIDE ANALYSIS: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET (2019)

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS OF THE FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET (2019)

FIGURE 9 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET (2020–2025)

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 HEALTH ASSESSMENT

2.7 COVID-19 ECONOMIC ASSESSMENT

2.8 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 11 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 12 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

2.9 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO IN THE FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 13 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 14 FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 15 STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 16 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 17 GEOGRAPHIC SNAPSHOT: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES: MARKET OVERVIEW

FIGURE 18 INCREASING NUMBER OF MINIMALLY INVASIVE SURGERIES IS PROPELLING THE FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET

4.2 ASIA PACIFIC: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER

FIGURE 19 HOSPITALS WILL CONTINUE TO DOMINATE THE ASIA PACIFIC FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET BY 2025

4.3 GEOGRAPHIC SNAPSHOT: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET

FIGURE 20 CHINA TO REGISTER THE HIGHEST CAGR OF 17.2% DURING THE FORECAST PERIOD

4.4 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 21 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING THE FORECAST PERIOD

4.5 REGIONAL MIX: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET

FIGURE 22 APAC TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DYNAMICS: IMPACT ANALYSIS

5.2.2 DRIVERS

5.2.2.1 Rising number of minimally invasive surgeries

TABLE 1 MINIMALLY INVASIVE SURGICAL PROCEDURES, BY COUNTRY, 2014 VS 2016

5.2.2.2 Increasing ESRD patient base

FIGURE 24 NUMBER OF PATIENTS WITH RENAL DISORDERS, BY TREATMENT TYPE

5.2.2.3 Technological advancements in fluid management systems

TABLE 2 PRODUCT LAUNCHES, BY COMPANY, 2016–2020

5.2.2.4 Government funds and grants for endosurgical procedures

5.2.2.5 Rising number of hospitals and investments in endoscopy and laparoscopy facilities

5.2.3 RESTRAINTS

5.2.3.1 High cost of endosurgical procedures

5.2.3.2 Lack of consumer awareness

5.2.4 OPPORTUNITIES

5.2.4.1 Untapped potential in emerging markets

5.2.4.2 Single-use disposable devices and accessories

5.2.5 CHALLENGES

5.2.5.1 Dearth of surgeons worldwide

TABLE 3 US: TOTAL NUMBER OF SURGEONS (2010-2017)

5.3 INDUSTRY TRENDS

5.3.1 SHIFT TOWARD INTEGRATED FLUID MANAGEMENT SYSTEMS

5.3.2 ADVANCEMENTS IN DIALYZERS

FIGURE 25 TECHNOLOGICAL ADVANCEMENTS, 2005–2020

5.4 PRODUCT PORTFOLIO ANALYSIS

TABLE 4 PRODUCT PORTFOLIO ANALYSIS: FLUID MANAGEMENT SYSTEMS MARKET

5.5 COVID-19 IMPACT ON THE FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET: PORTER’S FIVE FORCES ANALYSIS (2019)

TABLE 5 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET: PORTER’S FIVE FORCES ANALYSIS (2019)

5.6.1 THREAT FROM NEW ENTRANTS

5.6.2 THREAT FROM SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 VALUE CHAIN ANALYSIS

FIGURE 27 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET: VALUE CHAIN ANALYSIS (2019)

5.8 ECOSYSTEM ANALYSIS

FIGURE 28 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET: ECOSYSTEM ANALYSIS (2019)

5.9 REGULATORY ANALYSIS

FIGURE 29 KEY REGULATORY BODIES INVOLVED IN THE APPROVAL OF NEW DIALYSIS PRODUCTS

5.9.1 NORTH AMERICA

5.9.1.1 US

5.9.1.2 Canada

5.9.2 EUROPE

5.9.3 ASIA PACIFIC

5.9.3.1 India

5.9.3.2 China

5.9.3.3 Japan

5.9.4 LATIN AMERICA

5.9.4.1 Brazil

5.9.4.2 Mexico

5.9.5 MIDDLE EAST AND AFRICA

5.9.5.1 Middle East

5.9.5.2 Africa

5.10 AVERAGE SELLING PRICE OF FLUID MANAGEMENT SYSTEMS

TABLE 6 AVERAGE SELLING PRICE OF FLUID MANAGEMENT SYSTEMS, BY REGION (2019)

6 FLUID MANAGEMENT SYSTEMS MARKET, BY PRODUCT (Page No. - 86)

6.1 INTRODUCTION

TABLE 7 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 8 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.2 IMPACT OF COVID-19 ON THE FLUID MANAGEMENT SYSTEMS MARKET, BY PRODUCT

6.3 FLUID MANAGEMENT SYSTEMS

TABLE 9 FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 10 FLUID MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.1 STANDALONE FLUID MANAGEMENT SYSTEMS

TABLE 11 STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 12 STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.1.1 Dialyzers

6.3.1.1.1 Increasing prevalence of chronic kidney disease and ESRD drives growth in the dialyzers market

TABLE 13 DIALYZERS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 DIALYZERS MARKET, BY REGION, 2018–2025 (MILLION UNITS)

6.3.1.2 Insufflators

6.3.1.2.1 Increasing volume of laparoscopic procedures to boost the demand for insufflators

TABLE 15 INSUFFLATORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 16 INSUFFLATORS MARKET, BY REGION, 2018–2025 (UNITS)

6.3.1.3 Suction/evacuation and irrigation systems

6.3.1.3.1 Rising volume of endoscopic and laparoscopic procedures to drive growth in this segment

TABLE 17 SUCTION/EVACUATION AND IRRIGATION SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.1.4 Fluid waste management systems

6.3.1.4.1 Growing risk of exposure to infectious agents and toxic substances during surgery to drive the demand for these devices

TABLE 18 FLUID WASTE MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.1.5 Fluid warming systems

6.3.1.5.1 Fluid warming systems are used for the administration of normothermic fluids to reduce the occurrence of hypothermia

TABLE 19 FLUID WARMING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.1.6 Other standalone fluid management systems

TABLE 20 OTHER STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.2 INTEGRATED FLUID MANAGEMENT SYSTEMS

6.3.2.1 Increasing number of endoscopic and laparoscopic surgical procedures worldwide to drive the growth of this segment

TABLE 21 INTEGRATED FLUID MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4 FLUID MANAGEMENT DISPOSABLES & ACCESSORIES

TABLE 22 FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 23 FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

6.4.1 CATHETERS

6.4.1.1 Rising popularity of interventional and minimally invasive procedures to drive market growth

TABLE 24 CATHETERS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4.2 BLOODLINES

6.4.2.1 Increasing number of ESRD patients and rising hemodialysis procedures drive demand for bloodlines

TABLE 25 BLOODLINES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4.3 TUBING SETS

6.4.3.1 Disposable tubing sets are widely adopted to avoid the risk of contamination in surgical procedures

TABLE 26 TUBING SETS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4.4 PRESSURE MONITORING LINES

6.4.4.1 Pressure monitoring lines are used for the measurement and control of pressure of several body fluids, including blood and CSF

TABLE 27 PRESSURE MONITORING LINES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4.5 PRESSURE TRANSDUCERS

6.4.5.1 Increase in the usage of disposable pressure transducers to reduce contamination is a key driving factor

TABLE 28 PRESSURE TRANSDUCERS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4.6 VALVES, CONNECTORS, AND FITTINGS

6.4.6.1 Increasing demand for disposable valves, connectors, and fittings to prevent the risks associated with infectious fluid waste is a major market driver

TABLE 29 VALVES, CONNECTORS, AND FITTINGS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4.7 SUCTION CANISTERS

6.4.7.1 Suction canisters are used for the collection, retention, and disposal of irrigation fluids

TABLE 30 SUCTION CANISTERS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4.8 CANNULAS

6.4.8.1 Growing demand for minimally invasive procedures and the increasing number of surgeries worldwide drive growth in this segment

TABLE 31 CANNULAS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4.9 OTHER FLUID MANAGEMENT DISPOSABLES & ACCESSORIES

TABLE 32 OTHER FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7 FLUID MANAGEMENT SYSTEMS MARKET, BY APPLICATION (Page No. - 113)

7.1 INTRODUCTION

TABLE 33 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

7.2 IMPACT OF COVID-19 ON THE FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION

7.3 UROLOGY AND NEPHROLOGY

7.3.1 GROWING NUMBER OF DIALYSIS PROCEDURES TO DRIVE THE MARKET FOR UROLOGY AND NEPHROLOGY APPLICATIONS

TABLE 34 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR UROLOGY AND NEPHROLOGY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

7.4 LAPAROSCOPY

7.4.1 GRADUAL SHIFT TOWARDS MINIMALLY INVASIVE PROCEDURES TO BOOST GROWTH IN THIS APPLICATION SEGMENT

TABLE 35 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR LAPAROSCOPY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

7.5 GASTROENTEROLOGY

7.5.1 INCREASING INCIDENCE OF GASTROENTEROLOGICAL CANCER TO DRIVE THE MARKET FOR GASTROENTEROLOGY APPLICATIONS

TABLE 36 ESTIMATED NEW CANCER CASES AND DEATHS IN THE US, 2015 VS. 2020

TABLE 37 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR GASTROENTEROLOGY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

7.6 GYNECOLOGY/OBSTETRICS

7.6.1 GROWING INCIDENCE OF FIBROIDS AND POLYPS IN WOMEN TO DRIVE GROWTH IN THIS APPLICATION SEGMENT

TABLE 38 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR GYNECOLOGY/ OBSTETRICS APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

7.7 BRONCHOSCOPY

7.7.1 RISING CASES OF LUNG CANCER TO PROPEL THE MARKET FOR BRONCHOSCOPY APPLICATIONS

TABLE 39 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR BRONCHOSCOPY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

7.8 ARTHROSCOPY

7.8.1 RISING SEDENTARY LIFESTYLES AND GROWING INCIDENCE OF JOINT DAMAGE TO DRIVES THE GROWTH OF THIS APPLICATION SEGMENT

TABLE 40 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR ARTHROSCOPY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

7.9 CARDIOLOGY

7.9.1 RISING PREVALENCE OF CVD COUPLED WITH THE INCREASING NUMBER OF CARDIOVASCULAR SURGERIES—KEY GROWTH DRIVERS FOR THIS APPLICATION SEGMENT

TABLE 41 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR CARDIOLOGY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

7.10 NEUROLOGY

7.10.1 INCREASING NUMBER OF NEUROENDOSCOPY PROCEDURES TO DRIVE GROWTH IN THE NEUROLOGY APPLICATION SEGMENT

TABLE 42 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR NEUROLOGY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

7.11 OTOSCOPY

7.11.1 RISING INCIDENCE OF ENT-RELATED DISEASES BOOSTING THE DEMAND FOR OTOSCOPY APPLICATIONS

TABLE 43 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR OTOSCOPY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

7.12 DENTISTRY

7.12.1 INCREASING NUMBER OF DENTAL SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

TABLE 44 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR DENTISTRY APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

7.13 OTHER APPLICATIONS

TABLE 45 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

8 FLUID MANAGEMENT SYSTEMS MARKET, BY END USER (Page No. - 133)

8.1 INTRODUCTION

TABLE 46 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

8.2 IMPACT OF COVID-19 ON THE FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER

8.3 HOSPITALS

8.3.1 HOSPITALS ARE THE LARGEST END USERS OF FLUID MANAGEMENT SYSTEMS AND ACCESSORIES

TABLE 47 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

8.4 DIALYSIS CENTERS

8.4.1 RISING PREVALENCE OF ESRD AND INCREASING NUMBER OF DIALYSIS CENTERS TO DRIVE MARKET GROWTH

TABLE 48 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR DIALYSIS CENTERS, BY COUNTRY, 2018–2025 (USD MILLION)

8.5 AMBULATORY SURGICAL CENTERS

8.5.1 INCREASING NUMBER OF AMBULATORY SURGICAL CENTERS TO DRIVE THE DEMAND FOR FLUID MANAGEMENT SYSTEMS AND ACCESSORIES

TABLE 49 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2018–2025 (USD MILLION)

8.6 OTHER END USERS

TABLE 50 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2025 (USD MILLION)

9 FLUID MANAGEMENT SYSTEMS MARKET, BY REGION (Page No. - 140)

9.1 INTRODUCTION

TABLE 51 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY REGION, 2018–2025 (USD MILLION)

FIGURE 30 GEOGRAPHIC SNAPSHOT—EMERGING COUNTRIES EXPECTED TO GROW AT THE HIGHEST RATE IN THE FORECAST PERIOD

9.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET SNAPSHOT

TABLE 52 NORTH AMERICA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 55 NORTH AMERICA: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 NORTH AMERICA: FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 NORTH AMERICA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 NORTH AMERICA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.1 NORTH AMERICA: IMPACT OF COVID-19 ON THE FLUID MANAGEMENT SYSTEMS MARKET

9.2.2 US

9.2.2.1 The US holds a major share in the fluid management systems and accessories market

TABLE 59 US: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 60 US: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 US: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 US: FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 US: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 64 US: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.3 CANADA

9.2.3.1 Growing incidence of chronic diseases such as ESRD and cancer to support market growth in Canada

TABLE 65 CANADA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 CANADA: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 67 CANADA: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 68 CANADA: FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 CANADA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 CANADA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3 EUROPE

TABLE 71 EUROPE: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 EUROPE: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 EUROPE: FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 EUROPE: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 EUROPE: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.1 EUROPE: IMPACT OF COVID-19 ON THE FLUID MANAGEMENT SYSTEMS MARKET

9.3.2 GERMANY

9.3.2.1 Germany to dominate the European market for fluid management systems during the forecast period

TABLE 78 GERMANY: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 79 GERMANY: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 GERMANY: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 81 GERMANY: FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 GERMANY: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 83 GERMANY: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Favorable health insurance system to drive the market for fluid management systems in the coming years

TABLE 84 FRANCE: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 FRANCE: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 FRANCE: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 87 FRANCE: FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 88 FRANCE: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 89 FRANCE: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.4 UK

9.3.4.1 Increasing prevalence of CKD to drive the market for fluid management systems in the UK

TABLE 90 UK: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 UK: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 UK: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 UK: FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 UK: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 95 UK: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.5 ITALY

9.3.5.1 Growing cancer incidence and the number of related diagnostic and therapeutic surgical procedures to drive market growth

TABLE 96 ITALY: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 ITALY: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 ITALY: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 99 ITALY: FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 100 ITALY: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 101 ITALY: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.6 SPAIN

9.3.6.1 Increasing geriatric population coupled with the increasing number of surgical procedures to drive market growth

TABLE 102 SPAIN: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 SPAIN: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 SPAIN: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 SPAIN: FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 SPAIN: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 107 SPAIN: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.7 REST OF EUROPE

TABLE 108 ROE: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 ROE: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 110 ROE: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 111 ROE: FLUID MANAGEMENT DISPOSABLES & ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 ROE: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 113 ROE: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 32 APAC: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET SNAPSHOT

TABLE 114 APAC: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 115 APAC: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 116 APAC: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 APAC: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 APAC: FLUID MANAGEMENT DISPOSABLES AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 119 APAC: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 120 APAC: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.1 ASIA PACIFIC: IMPACT OF COVID-19 ON THE FLUID MANAGEMENT SYSTEMS MARKET

9.4.2 CHINA

9.4.2.1 Large patient population and healthcare infrastructure improvements to drive the market growth in China

TABLE 121 CHINA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 122 CHINA: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 123 CHINA: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 124 CHINA: FLUID MANAGEMENT DISPOSABLES AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 125 CHINA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 126 CHINA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.3 JAPAN

9.4.3.1 High prevalence of ESRD to support market growth in Japan

TABLE 127 JAPAN: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 128 JAPAN: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 129 JAPAN: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 130 JAPAN: FLUID MANAGEMENT DISPOSABLES AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 131 JAPAN: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 132 JAPAN: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.4 INDIA

9.4.4.1 Healthcare infrastructural improvements and implementation of favorable government initiatives support the market in India

TABLE 133 INDIA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 134 INDIA: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 135 INDIA: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 136 INDIA: FLUID MANAGEMENT DISPOSABLES AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 137 INDIA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 138 INDIA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.5 REST OF APAC

TABLE 139 ROAPAC: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 140 ROAPAC: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 141 ROAPAC: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 142 ROAPAC: FLUID MANAGEMENT DISPOSABLES AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 143 ROAPAC: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 144 ROAPAC: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5 LATIN AMERICA

TABLE 145 LATIN AMERICA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 146 LATIN AMERICA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 147 LATIN AMERICA: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 148 LATIN AMERICA: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 149 LATIN AMERICA: FLUID MANAGEMENT DISPOSABLES AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 150 LATIN AMERICA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 151 LATIN AMERICA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Brazil dominates the fluid management systems and accessories market in Latin America

TABLE 152 BRAZIL: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 153 BRAZIL: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 154 BRAZIL: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 155 BRAZIL: FLUID MANAGEMENT DISPOSABLES AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 156 BRAZIL: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 157 BRAZIL: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Growing patient pool and increasing awareness about fluid management systems drives market growth in Mexico

TABLE 158 MEXICO: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 159 MEXICO: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 160 MEXICO: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 161 MEXICO: FLUID MANAGEMENT DISPOSABLES AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 162 MEXICO: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 163 MEXICO: FLUID MANAGEMENT SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 164 ROLA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 165 ROLA: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 166 ROLA: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 167 ROLA: FLUID MANAGEMENT DISPOSABLES AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 168 ROLA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 169 ROLA: FLUID MANAGEMENT SYSTEMS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.6 MIDDLE EAST AND AFRICA

9.6.1 INITIATIVES TO ENHANCE HEALTHCARE ACCESSIBILITY MAY SUPPORT MARKET GROWTH

TABLE 170 MEA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 171 MEA: FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 172 MEA: STANDALONE FLUID MANAGEMENT SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 173 MEA: FLUID MANAGEMENT DISPOSABLES AND ACCESSORIES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 174 MEA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 175 MEA: FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, BY END USER, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 213)

10.1 OVERVIEW

FIGURE 33 KEY DEVELOPMENTS IN THE FLUID MANAGEMENT SYSTEMS MARKET, 2017–2020

FIGURE 34 MARKET EVALUATION FRAMEWORK: MARKET WITNESSED MORE THAN 10 PRODUCT LAUNCHES BETWEEN 2017 AND 2020

10.2 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 35 REVENUE SHARE ANALYSIS OF TOP 5 PLAYERS, 2016–2019

10.3 GEOGRAPHICAL ASSESSMENT OF MAJOR PLAYERS IN THE FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET

FIGURE 36 GEOGRAPHIC REVENUE MIX: FLUID MANAGEMENT SYSTEMS MARKET (2019)

10.4 COMPETITIVE ASSESSMENT OF THE R&D EXPENDITURE

FIGURE 37 R&D EXPENDITURE OF THE MAJOR PLAYERS IN THE FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET, 2017–2019

10.5 COMPETITIVE SITUATION AND TRENDS

10.5.1 PRODUCT LAUNCHES

TABLE 176 RECENT PRODUCT LAUNCHES, 2019–2020

10.5.2 PRODUCT APPROVALS

TABLE 177 RECENT PRODUCT APPROVALS, 2019–2020

10.5.3 EXPANSIONS

TABLE 178 RECENT EXPANSIONS, 2018–2020

10.5.4 ACQUISITIONS

TABLE 179 RECENT ACQUISITIONS, 2018–2019

10.5.5 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS

TABLE 180 RECENT AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS, 2019–2020

11 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 220)

11.1 MARKET SHARE ANALYSIS

FIGURE 38 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET SHARE, BY KEY PLAYER (2019)

11.2 COMPANY EVALUATION MATRIX: DEFINITIONS AND METHODOLOGY

11.2.1 COMPETITIVE LEADERSHIP MAPPING

11.2.1.1 Stars

11.2.1.2 Emerging leaders

11.2.1.3 Pervasive players

11.2.1.4 Participants

FIGURE 39 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET: COMPANY EVALUATION MATRIX, 2019

11.2.2 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2019)

11.2.2.1 Progressive companies

11.2.2.2 Dynamic companies

11.2.2.3 Starting blocks

11.2.2.4 Responsive companies

FIGURE 40 FLUID MANAGEMENT SYSTEMS AND ACCESSORIES MARKET: START-UP COMPANY EVALUATION MATRIX, 2019

11.3 COMPANY PROFILES

(Business overview, Products offered, Recent developments, MNM view)*

11.3.1 FRESENIUS MEDICAL CARE AG & CO. KGAA

FIGURE 41 COMPANY SNAPSHOT: FRESENIUS MEDICAL CARE AG & CO. KGAA

11.3.2 BAXTER INTERNATIONAL INC.

FIGURE 42 COMPANY SNAPSHOT: BAXTER INTERNATIONAL INC.

11.3.3 B. BRAUN MELSUNGEN AG

FIGURE 43 COMPANY SNAPSHOT: B. BRAUN MELSUNGEN AG

11.3.4 STRYKER CORPORATION

FIGURE 44 COMPANY SNAPSHOT: STRYKER CORPORATION

11.3.5 ECOLAB INC.

FIGURE 45 COMPANY SNAPSHOT: ECOLAB INC.

11.3.6 CARDINAL HEALTH, INC.

FIGURE 46 COMPANY SNAPSHOT: CARDINAL HEALTH

11.3.7 OLYMPUS CORPORATION

FIGURE 47 COMPANY SNAPSHOT: OLYMPUS CORPORATION

11.3.8 SMITHS MEDICAL (A DIVISION OF SMITHS GROUP PLC)

FIGURE 48 COMPANY SNAPSHOT: SMITHS GROUP PLC

11.3.9 ZIMMER BIOMET HOLDINGS, INC.

FIGURE 49 COMPANY SNAPSHOT: ZIMMER BIOMET HOLDINGS, INC.

11.3.10 MEDTRONIC PLC

FIGURE 50 COMPANY SNAPSHOT: MEDTRONIC PLC

11.3.11 FUJIFILM HOLDINGS CORPORATION

FIGURE 51 COMPANY SNAPSHOT: FUJIFILM HOLDINGS CORPORATION

11.3.12 CONMED CORPORATION

FIGURE 52 COMPANY SNAPSHOT: CONMED CORPORATION

11.3.13 HOLOGIC, INC.

FIGURE 53 COMPANY SNAPSHOT: HOLOGIC, INC.

11.3.14 SMITH & NEPHEW PLC

FIGURE 54 COMPANY SNAPSHOT: SMITH & NEPHEW PLC

11.3.15 KARL STORZ GMBH & CO. KG

11.3.16 ARTHREX, INC.

11.3.17 THERMEDX, LLC

11.3.18 ENDOMED SYSTEMS GMBH

11.3.19 COMEG MEDICAL TECHNOLOGIES

11.3.20 MEDLINE INDUSTRIES, INC.

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 274)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

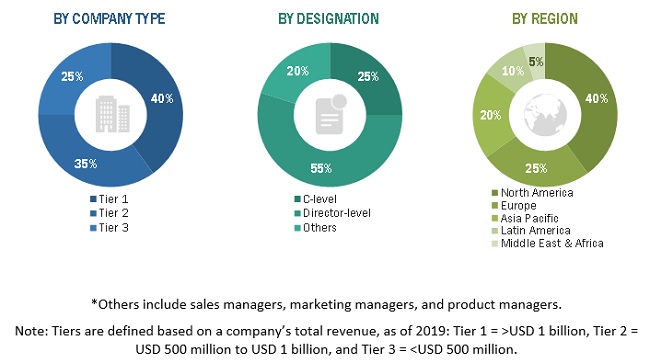

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories, and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global fluid management systems and accessories market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, manufacturing managers, and related key executives from various key companies and organizations operating in the global fluid management systems and accessories market. The primary sources from the demand side include purchase managers, surgeons from hospitals, ambulatory surgical centers, and dialysis centers.

Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, application, end-user, and region).

Data Triangulation

After arriving at the market size, the total fluid management systems and accessories market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the fluid management systems and accessories market by product, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, and opportunities)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall fluid management systems and accessories market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the fluid management systems and accessories market in five main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the fluid management systems and accessories and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as acquisitions; new product launches and upgrades; expansions; collaborations, agreements, and partnerships; and acquisitions of the leading players in the fluid management systems and accessories market

- To benchmark players within the fluid management systems and accessories market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific fluid management systems and accessories market into Australia, New Zealand, and others.

- Further breakdown of the Rest of Latin America fluid management systems and accessories market into Argentina, Columbia, Chile, Ecuador, and others.

- Further breakdown of the Rest of Europe fluid management systems and accessories market into Belgium, Russia, Netherlands, Switzerland, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fluid Management Systems Market

What are the growth estimates for the Fluid Management Systems Market by the year 2028?

I want more detailed information on the geographical segmentation of the Fluid Management Systems Market

Which of the segment holds the major share of the Fluid Management Systems Market?