Focused Ion Beam Market by Ion Source (Ga+ Liquid Metal, Plasma, Gas Field), Application (Failure Analysis, Nanofabrication, Device Modification, Circuit Edit, Counterfeit Detection), Vertical and Region - Global Forecast to 2028

Updated on : Oct 22, 2024

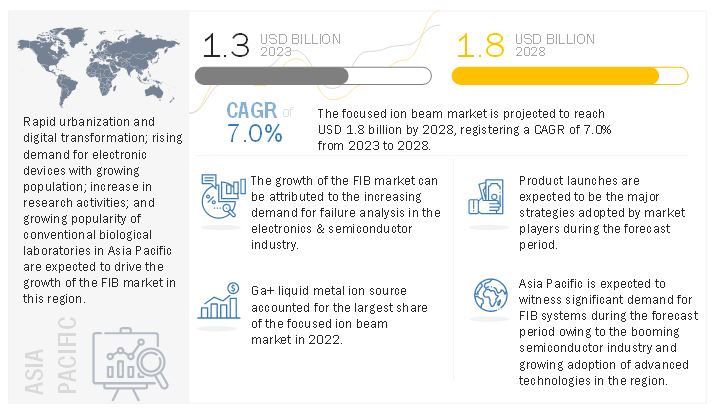

The global focused ion beam market is projected to reach USD 1.8 billion by 2028 from an estimated USD 1.3 billion in 2023, growing at a CAGR of 7.0% during the forecast period from 2023 to 2028.

The growth of the focused ion beam market can be attributed to initiatives of US government to strengthen semiconductor manufacturing, adoption of FIB systems by research laboratories and manufacturing firms worldwide, and deployment of focused ion beam industry for applications in material science industry.

Focused Ion Beam Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics of Focused Ion Beam Market

Drivers: Deployment of focused ion beam systems for applications in material science industry

Characterization and testing of materials are important prior to their use on a large scale. Appropriate testing of materials increases their flexibility and durability. Material science deals with discovering and developing new materials and methods for their study. It is a multidisciplinary science that involves different fields, such as physics, chemistry, and engineering. It focuses on analyzing materials' chemical, electrical, mechanical, magnetic, optical, and thermal characteristics. The field can be divided into biomaterials, electronic and photonic materials, nanomaterials, organic materials, structural and composite materials, and smart materials. Exponential growth has been observed in research activities related to material science across the globe. Research activities require sophisticated analytical tools to analyze and understand new materials with prominent physical properties. This leads to an increased demand for FIB systems that offer analytical and patterning capabilities in a single instrument.

FIB systems can prepare site-specific cross-sections stress-freely, irrespective of the materials used. Ga+ ion beam source is used for imaging conductive and other raw materials in the material science vertical. Sections of material samples prepared by FIB systems are remarkable as they help identify and determine defects. They are also used to cut various materials, including silicon, indium phosphide, gallium arsenide, and metal, without distorting them. These systems are used for sectioning materials in sizes ranging from a few tens of atoms to a few tens of microns. FIB systems are used for the preparation of TEM cross-section lamellae and the production of solid-state nanopores. These systems are also used in thin films and devices for 3D visualization. They also find applications in next-generation memory solutions and processors. These systems are to carry out the microanalysis of cell morphology and biotechnology, nanoscale machining, and metallurgy. FIB systems can remove or add atoms to raw materials with submicron precision. As a result, it is hard to replace FIB systems in failure analysis and masking and (IC) repairing applications.

Material science researchers are making efforts to develop new and strong materials based on the materials that occur naturally. For instance, Nacre, the iridescent and super-strong material, also known as the mother-of-pearl, is sectioned using FIB systems to study it through SEM to develop strong materials based on its properties for the Institute of Soldier Nanotechnologies.

Restraints: Requirement for highly skilled workforce to operate advanced FIB systems

Analysis of devices and recommendations for improving them involves using multiple techniques, equipment, and technical expertise. For instance, skilled engineers must perform the failure analysis of faulty chips by decapsulating and analyzing them to segregate and identify the reason for their fault. Moreover, they should be capable of encapsulating chips into their package for smooth functioning. Different companies are developing new technologies to gain an edge over their competitors and strengthen their market position. For instance, in 2014, US-based IONpath, Inc. developed multiplexed ion beam imaging (MIBI) technology for FIB systems to examine small cellular structures and intact tissue tumor microenvironments and carry out different biological analyses simultaneously to use a single slide.

Moreover, zerok NanoTech developed low-temperature ion source (LoTIS) technology for FIB-based circuit edit applications. As FIB technology is evolving day by day, there is a requirement for a highly skilled workforce to adapt to these latest advancements in this technology. The highly skilled workforce is essential to operate new and advanced FIB systems and gathering accurate data by analyzing samples. Moreover, it should also be able to handle the operational complexity of FIB systems that requires technical expertise and knowledge.

Opportunities: Rising use of FIB systems to study biological samples and biomaterials

Initially, FIB systems were restricted to the electronics & semiconductor and the material sciences verticals. Presently, they are evolving as powerful tools for the ultrastructural and nanoscale cellular imaging of biological samples and biomaterials (materials that associate immediately with the living tissues without causing any adverse immune rejection reaction). Earlier, confocal light microscopy, in combination with the traditional fluorescent labeling technique, was used by biologists and life scientists for a detailed study of the biological structures of tissues and cells. However, with the advent of FIB systems, they are being preferred over traditional techniques as it is easy to obtain information from these systems at small scales. FIB systems can be coupled with complementary cryogenic, dual-beam SEM, environmental SEM, and energy-dispersive X-ray spectroscopy (EDX) tools to analyze biomaterials and cells and their interfaces for TEM sample preparation by imaging them.

Moreover, FIB systems are used as sculpting tools, such as lamellae and needles, to create specimen shapes that can be analyzed further by TEM. The FIB cross-sectioning technique helps extract damageable biological specimens of human hair and housefly eyes. Thus, the increasing use of FIB systems to study and analyze biological samples and biomaterials is expected to act as a growth opportunity for the focused ion beam market during the forecast period.

Challenges: 3D reconstruction of porous materials

Data processing for the 3D reconstruction of porous materials is the most challenging aspect of FIB-SEM tomography. FIB-SEM tomography generates 3D images of materials by acquiring and visualizing their different sections. The serial sectioning tomography technique of FIB-SEM systems creates 3D data with nanoscale resolution. 3D acquisitions of porous materials are necessary to determine the mesopores (pores smaller than 2nm in diameter) and macropores (pores larger than 50nm in diameter) and distinguish interactions between them. This information is necessary to know the transport properties and formation mechanisms of materials, which are subject to textural analysis. For instance, in the oil & gas industry, the analysis of the transport properties of fine-grained sediments is essential to enable the recovery of reservoir rocks.

Treating or processing data related to porous materials is difficult due to their unknown porosity and pore size distribution. As a result, it is difficult for FIB systems to evaluate the accuracy of the segmentation procedure of the internal microstructure of porous materials. As there is no fixed segmentation procedure, the effect of different segmentation procedures is expected to impact the ?nal results directly. Moreover, the final result is dependent on the operators of FIB systems.

Focused Ion Beam Ecosystem

The Ga+ liquid metal ion source is projected to register the highest CAGR 2023 to 2028

The Ga+ liquid metal ion source is projected to register the highest CAGR 2023 to 2028. The growth can be attributed to rising use of Ga+ liquid metal FIB systems in the electronics & semiconductor vertical for failure analysis, TEM sample preparation, IC repair and modification, nanofabrication, and ion microscopy applications. In addition, most of the commercial FIB systems used globally are designed using Ga+ liquid metal as an ion source, owing to the small emission area requirements, which enable the use of small-diameter beams that offer brightness as high as 106 A/cm-sr (square radian) and current density ranging between 2 and 10 A/cm2.

Failure analysis segment is projected to register the highest CAGR during the forecast period

The failure analysis segment is projected to grow at the highest CAGR during the forecast period. The growth of the segment can be attributed to an increase in the adoption of FIB systems to perform failure analysis for submicron level etching, site-specific cross sections, advanced microscopy, circuit rewiring and debugging, and vapor deposition processes.

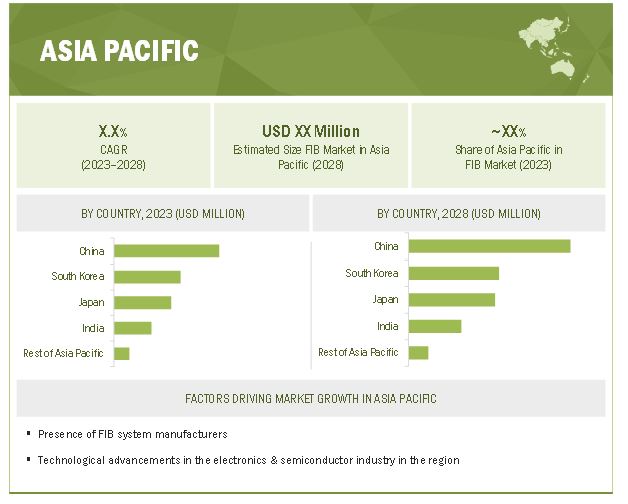

Asia Pacific is expected to register the highest growth in the focused ion beam market during the forecast period

The market in Asia Pacific is expected to grow significantly during the forecast period. The major factor contributing to the growth of the focused ion beam market in APAC can be attributed to the increasing adoption of robotics and automation in the electronics & semiconductor manufacturing industry. With the rising adoption of robots, the demand for ICs and other electronic devices is also increasing. Thus, companies manufacturing electronic devices and ICs require FIB systems for material and failure analyses. This, in turn, is spurring the growth of the electronics & semiconductor segment of the focused ion beam market. In addition, countries such as China and Japan also have huge growth potential for the focused ion beam market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Thermo Fisher Scientific Inc. (US); ZEISS International (Germany); Hitachi, Ltd. (Japan); JEOL Ltd. (Japan); TESCAN ORSAY HOLDING, a.s. (Czech Republic); Eurofins Scientific (Luxembourg); A&D Company, Limited (Japan); Veeco Instruments Inc. (US); Raith GmbH (Germany); and FOCUS GmbH (Germany); are some of the key players in the focused ion beam companies.

Scope of the Report

|

Report Metric |

Details |

| Estimated Market Size | USD 1.3 billion in 2023 |

| Projected Market Size | USD 1.8 billion by 2028 |

| Growth Rate | CAGR of 7.0% |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast unit |

Value (USD Million/Thousand) |

|

Segments Covered |

By Ion Source, By Application, By Vertical, and By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Thermo Fisher Scientific Inc. (US); ZEISS International (Germany); Hitachi, Ltd. (Japan); JEOL Ltd. (Japan); TESCAN ORSAY HOLDING, a.s. (Czech Republic); Eurofins Scientific (Luxembourg); A&D Company, Limited (Japan); Veeco Instruments Inc. (US); Raith GmbH (Germany); and FOCUS GmbH (Germany); are some of the key players in the focused ion beam market. |

Focused Ion Beam Market Highlights

This research report categorizes the focused ion beam market based ion source, application, vertical, and region.

|

Aspect |

Details |

|

Based on Ion Source |

|

|

Based on Application |

|

|

Based on Vertical |

|

|

Based on Region |

|

Recent Developments

- In August 2022, Thermo Fisher Scientific Inc. launched the Thermo Scientific Arctis Cryo-Plasma Focused Ion Beam (Cryo-PFIB), a new connected and automated microscope designed to advance the pace of cryo-electron tomography (cryo-ET) research.

- In July 2022, TESCAN ORSAY HOLDING a.s. supplied the AMBER X focused ion beam-scanning electron microscope (FIB-SEM) to the Institute for Factory Automation and Production Systems (FAPS) in Germany. FAPS will use the FIB-SEM for silver printing and copper coating analysis to improve mechatronic systems, battery components, and additive manufacturing.

- In June 2021, MIT.nano acquired a Raith VELION focused ion beam scanning electron microscope (FIB-SEM) as a demonstration unit in its characterization facility. The VELION will augment the MIT.nano fabrication and characterization tool sets and enable next-generation nanofabrication by allowing users to fabricate two- and three-dimensional nanostructures with high resolution over large areas.

- In May 2021, Thermo Fisher Scientific Inc. launched the Thermo Scientific iFLM Correlative System, the integrated fluorescence light microscope and a value-added component for the Thermo Scientific Aquilos 2 Cryo-FIB. This enhancement enables cell biologists to streamline their sample preparation process for cellular cryo-ET.

- In February 2021, TESCAN ORSAY HOLDING a.s. launched a nanomanipulator for TESCAN SEM and FIB-SEM instruments. TESCAN Nanomanipulator supports TEM sample lift-out and micro- and nanoscale manipulation under room temperature and cryo conditions.

Frequently Asked Questions (FAQ):

Which is the potential market for focused ion beam in terms of the region?

North America is expected to dominate the focused ion beam market due to the presence of numerous consumers and suppliers of FIB solutions.

Which are the major companies in the global focused ion beam market? What are their major strategies to strengthen their market presence?

Thermo Fisher Scientific Inc. (US); ZEISS International (Germany); Hitachi, Ltd. (Japan); JEOL Ltd. (Japan); TESCAN ORSAY HOLDING, a.s. (Czech Republic), are some of the key players in the focused ion beammarket. These players have adopted product launches and contracts, to expand their global presence and increase their share in the global focused ion beammarket.

What are the major opportunities for the focused ion beam market?

Ongoing research activities related to Ga+-free FIB system and increasing adoption of automation and robotics in electronics and semiconductor device manufacturing are among the key opportunities that are expected to support market growth in future.

What are the growing applications in the focused ion beam market?

The focused ion beam market is led by failure analysis segment. Besides, the demand from electronics and semiconductor segments is expected to generate huge demand for FIB systems for these applicationsin future.

Which is the majorly used ion source in the focused ion beam market?

Ga+ liquid metal ion source is the widely used ion source in almost all end-user industries.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size of the focused ion beam market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly conducted to obtain key information about the industry's supply chain, value chain of the market, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

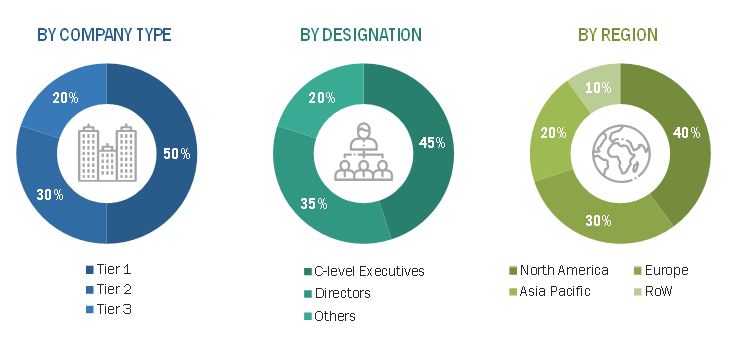

Primary Research

Extensive primary research has been conducted after understanding and analyzing the focused ion beam market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and Rest of the World (South America, the Middle East, and Africa). Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. This primary data has been collected mainly through telephonic interviews, which consists 80% of total primary interviews; however, questionnaires and e-mails have also been used to collect the data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been implemented to arrive at the overall size of the focused ion beam market from the revenues of the key players in the market. Calculations based on the revenue of the key players identified in the market led to the overall market size.

- Identifying various key players offering FIB systems and ion sources

- Analyzing the global penetration of different ion source-based FIB systems in various applications and verticals

- Estimating the market for FIB systems by ion source

- Tracking the ongoing and upcoming developments in FIB applications and forecasting the market based on these developments and other critical parameters

- Undertaking multiple discussions with key opinion leaders to understand the working principle of FIB systems and their applications, which helped analyze the impact of developments undertaken by each major company to increase their share in the focused ion beam market

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEOs), directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases for the company- and region-specific developments undertaken in the focused ion beam market

Focused Ion Beam Market: Bottom-Up Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from the secondary and primary research processes.

- Focusing initially on investments and expenditures undertaken in the ecosystem of FIB; further splitting them into the ion source, application, vertical, and region and listing key developments in major market areas

- Identifying key players in the focused ion beam market based on application and vertical and verifying the findings through secondary research and brief discussions with industry experts

- Analyzing revenues, product mix, geographic presence, and key end-use applications of FIB to estimate and arrive at the percentage splits

- Discussing these splits with industry experts to validate the information and identify key growth pockets across all major segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Focused Ion Beam Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedure has been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe, segment, and forecast the overall size of the focused ion beam (FIB) market based on ion source, application, and vertical, in terms of value

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To forecast the global market size in terms of volume

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the focused ion beam market

- To provide a detailed overview of the FIB value chain

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches and contracts in the focused ion beam market

- To strategically profile the key players in the focused ion beam market and comprehensively analyze their market ranking and core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Focused Ion Beam Market