Food Disinfection Market Size, Share & Trends Analysis Report by Chemical Type (Chlorine, Hydrogen Peroxide & Peracetic Acid, and Quaternary Ammonium Compounds), End Use (Food Processing and Beverage Processing), Application Area, and Region - Global Industry Forecast to 2025

Food Disinfection Market Overview

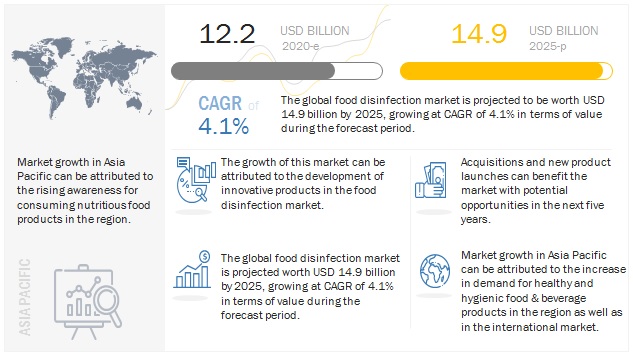

Food disinfection market size was valued at USD 12.2 billion in 2020. Food disinfection industry is projected to reach USD 14.9 billion by 2025, growing at a CAGR of 4.1% during the forecast period 2020-2025. Due to increase in cases of foodborne diseases, growing awareness about food safety among people.

The growth of the industry is primarily augmented by the growing need for food safety, focusing on the reduction of food waste, and avoiding foodborne disease outbreaks. The industry is dominated by hydrogen peroxide & peracetic acid, as they can be directly used on food surfaces for killing microorganisms. North America accounted for the largest share, driven by factors like well-established food processing industry with strict regulations, food disinfecting equipment suppliers, innovation in food science and high food consumption. The highest growth is estimated in the Asia Pacific region with a CAGR of 5.3% between 2020 and 2025. However, the restriction on the usage of chemicals for disinfection is expected to restrict the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Disinfection Market Growth Insights

Driver: Increase in instances of foodborne diseases and outbreaks

Foodborne diseases are one of the major concerns across the globe. Rapid urbanization and changing lifestyles have increased the number of people eating food prepared in public places. There are several known ways in which foodborne illnesses can occur. For instance, in the food industry, food ingredients such as herbs and spices often carry pathogenic microbes, which can cause food spoilage and foodborne illnesses. Also, the consumption of contaminated or improperly sterilized food products can expose people to harmful microbes such as bacteria, parasites, and viruses, which can result in severe illnesses.

According to the Centers for Disease Control and Prevention (CDC) estimates, 48 million people get sick because of foodborne illnesses, while 128,000 people are hospitalized due to foodborne illnesses every year in the US. According to WHO estimates, globally, Africa has the highest burden of foodborne diseases per person. The WHO has estimated that in Europe, approximately 5,000 people die due to foodborne diseases each year. Also, African and Southeast regions have the highest incidences of deaths caused due to foodborne diseases.

Restraint : Rise in demand for minimally processed food products

In developed countries such as the US, Germany, the UK, and France, the demand for new organic foods among consumers, changes in eating habits, and food safety risks are restraining the prepared food industry and, in turn, the food disinfection market size . Several food safety issues have been debated in the past in the global market, such as issues associated with food allergens, irradiation, and chemical preservatives. These have been and currently are the crucial factors that are of major concern to the consumers. The rise in the aging population in developed countries has led to an increase in health concerns, owing to which there is a high preference for fresh and minimally processed food products processed without using synthetic chemical preservatives, heat, or radiation. Hence, the chemical disinfection of organic and natural food & beverages is avoided by manufacturers, leading to slower growth of disinfection chemicals.

Opportunity: Packaging and shelf-life enhancement for processed food

Food products such as vegetables and meat products require proper packaging to maintain longer shelf life. Manufacturers are shifting to various disinfection technologies to packaging food products as food surface disinfection is not preferred by end consumers. Upcoming disinfection technologies such as steam-ultrasound and ozonation are used by several food & beverage manufacturers since disinfection can be accomplished faster and result in better food quality. This saves energy and reduces the deformation of packaged food products. Food manufacturers in developing countries such as India and China are implementing various disinfection processes to meet the growing demand for packaged and processed food in the country. According to Agriculture and Agri-Food Canada (AAFC), China is one of the largest and fastest-growing packaged food products markets. It grew at a CAGR of 11.5% between 2017 and 2018, to reach USD 347 billion. According to the World Packaging Organization (WPO), the packaging industry will reach a value of close to USD 1 trillion by 2020, indicating significant potential and opportunity for the growth of the market size in the packaging industry.

Challenges : Maintaining proper process control

During food processing, it is crucial to maintain control over the process, especially while disinfection due to the direct application of chemicals such as quaternary ammonium compounds and hypochlorous acid on the food surface. Similarly, while using irradiation or pulse-electric during food processing, one has to take care as it can have an adverse effect on the operator. Shortage of skilled labor could delay the processing and affect results, which could increase the wastage of raw materials. This would subsequently result in a decrease in productivity and efficiency of the company.

Food Disinfection Market Segment Insights

The quaternary ammonium compounds segment of the market is projected to have highest CAGR during the forecast period, by chemical type

By chemical type, the quaternary ammonium compounds segment is projected to have highest CAGR during the forecast period in the food disinfection market. Quaternary ammonium compounds, also known as Quats or QACs, are positively charged ions that are naturally attracted to negatively charged molecules such as bacterial proteins. They are effective against bacteria, yeasts, mold, and viruses. Quats are surfactants and possess some detergency, so they are less affected by light soil than other disinfectants. They are non-corrosive, do not act as a skin irritant and are also very stable. Quaternary ammonium compounds are widely used disinfectants in the food industry and are effective against a wide range of microorganisms such as L. monocytogenes and vegetative bacteria, but not against spores. Quaternary ammonium compounds have higher efficacy in alkaline environments and warm temperatures as disinfectants.

The market for food processing segment is projected to account for the largest share during the forecast period

By end use, the food processing segment accounted for the highest share in the food disinfection market. Disinfection during food processing & manufacturing is required in food plant operations, where wet surfaces provide favorable conditions for the growth of microbes. The efficacy of disinfectants is usually determined in suspensions, which do not mimic the growth conditions on surfaces where the agents are required to inactivate the microbes. In the food processing industry, chemicals are generally routinely used to sanitize and disinfect product contact surfaces. These chemicals provide a necessary and required step to ensure that the foods produced and consumed are as free as possible from microorganisms that can cause foodborne illness. Processed food products require utmost quality maintenance, which is facilitated by routine disinfection of food contact surfaces and packaging materials. Disinfection of the production line is a crucial step in achieving quality standards.

Fish & seafood by food processing drives the market during the forecast period

By food processing, the fish & seafood segment is projected to have the highest CAGR during the forecast period. Disinfection chemicals and technology form an integral part of the fish & seafood processing industries as these products are susceptible to bacterial contamination, high perishability, and decomposition and require care during processing. Countries that are heavily focused on the production and export of seafood, such as India and China, exhibit a positive outlook for the growth of disinfection chemicals and technology. Compared to chlorine and other disinfectants, lower concentrations and shorter contact times are sufficient in controlling or reducing microbial populations. According to the FAO, the standards of hygiene required to avoid such problems are variable. In a plant, packaging products processed for safety requirements (such as by heat treatment) will be very strict, whereas handling fresh, chilled fish with a short shelf life and cooked before consumption will be less demanding.

The non-alcoholic subsegment of beverage processing by end use, of the food disinfection market is projected to account for the largest share

By beverage processing, the non-alcoholic subsegmentaccounted for the largest share in 2019. Non-alcoholic beverages include bottled water, tea, coffee, fruit juices, and carbonated drinks. The presence of a high amount of sugar due to the incorporation of sugar syrups in carbonated drinks and fruit juices has prompted non-alcoholic beverage manufacturers to incorporate green and eco-friendly chemicals that are specially manufactured for sugar syrup disinfection, which is expected to result in high demand for beverage disinfection chemicals.

Food Disinfection Market Regional Insight

Asia Pacific is the fastest-growing market during the forecast period in the global market

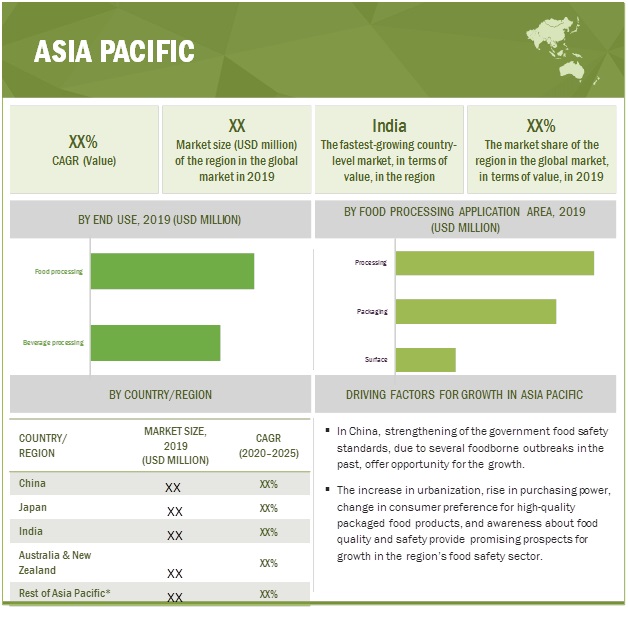

The growth in population, rise in disposable incomes, rapid urbanization in the Asia Pacific region, and an increase in demand for high-quality meat products are the key factors that have encouraged the demand for feed additives. Substantial growth is witnessed in countries, such as China, India, and Japan, due to the increase in the purchasing power of the population and demand for protein-rich meat diets. Pork and poultry are widely consumed in the Asia Pacific region. Moreover, consumers prefer opting for products that have high nutritional content and offer health benefits and exotic taste. Thus, fish and other seafood products are also a preferred option for consumers, which is also a growing industry in this region.

To know about the assumptions considered for the study, download the pdf brochure

Food Disinfection Market Report Scope

|

Report Metric |

Details |

| Market valuation in 2020 | USD 12.2 Billion |

| Revenue prediction in 2025 | USD 14.9 Billion |

| Forecast period | 2020 to 2025 |

| Progress rate | CAGR of 4.1% |

|

Companies studied |

Solvay (Belgium), Neogen Corporation (US), Evonik Industries (Germany), Ecolab (US), BASF SE (Germany), Aqua Bond Inc. (US), Diversey, Inc (US), Kersia Group (France), Thatcher Company (US),) CCL Pentasol (UK), Rentokil (US), Entaco N.V. (Belgium), Sanosil Ltd. (Switzerland), Stepan Company (US), Acuro Organics Limited (India), Deluxe Chemicals (US), Finktech GmbH (Germany), Pilot Chemical Corp (US), and Spartan Chemical Company (US) |

Food Disinfection Market Report Segmentation

This research report categorizes the Food disinfection market based on chemical type, application area, end use, and region

|

Aspect |

Details |

|

Market By Chemical Type |

|

|

Market By Application Area |

|

|

Market By End Use |

|

|

Market By Region |

|

Recent Developments

- In May 2020, Ecolab acquired CID Lines N.V (Belgium), a global livestock biosecurity and hygiene solutions provider, to form a new animal health division. The objective of the acquisition is to develop and expand the hygiene solutions for the food industry. This acquisition would help the company to expand its operations and consumer base in Europe.

- In May 2020, Kersia Group acquired Manchester-based Holchem, a leading provider of hygiene and food safety solutions and technology in the UK. Through this acquisition, Kersia would become a leader in the UK food hygiene sector and the second-largest player in Europe.

- In January 2021, Neogen Corporation acquired Megazyme, Ltd. (Ireland), a major supplier of analytical solutions for the food & beverage industries. This acquisition would help the company to widen its geographic reach and offer its various products to its customers across Ireland.

- In November 2020, Ecolab launched a new product named Exelerate TUFSOIL, an innovative ready-to-use gel cleaner and degreaser for food and protein manufacturers. This product would help in enabling more effective cleaning within a short span of time by removing tough, burnt-on soils in fryers, ovens, smokehouses, dryers, racks, catwalks, and environmental areas. This new product launch would help the company to strengthen its product portfolio for the food & beverage industry.

- In February 2018, Evonik entered into a joint venture with AkzoNobel Specialty Chemicals to focus on the production of chlorine and potassium hydroxide at their joint production facility in Germany. The facility was designed to produce nearly 120,000 tonnes (~132,277 tons) of potassium hydroxide, 75,000 tonnes (~82,673 tons) of chlorine, and hydrogen per year.

Frequently Asked Questions (FAQ):

What is food disinfection?

Food disinfection refers to the process of eliminating or reducing harmful microorganisms, such as bacteria, viruses, fungi, and parasites, from food products to ensure they are safe for consumption. This process is crucial in preventing foodborne illnesses and maintaining food safety standards.

How big is the food disinfection market?

The global food disinfection market is predicted to develop at an 4.1% compound annual growth rate (CAGR) to $14.9 billion by 2025. In 2020, the global market size was valued $12.2 billion.

Which players are involved in the manufacturing of food disinfection market?

Key players in this market include Solvay (Belgium), Neogen Corporation (US), Evonik Industries (Germany), Ecolab (US), BASF SE (Germany), Diversey, Inc (US), and Kersia Group (France), Thatcher Company (US),) CCL Pentasol (UK), Rentokil (US), and Entaco N.V. (Belgium), Sanosil Ltd. (Switzerland), Stepan Company (US), Acuro Organics Limited (India), Deluxe Chemicals (US), and Finktech GmbH (Germany).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for the food disinfection market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of the food disinfection market?

With growing concerns about foodborne illnesses and contamination, there is a heightened emphasis on food safety measures. This drives the demand for effective disinfection solutions in the food industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 FOOD DISINFECTION MARKET SIZE SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2015–2019

1.6 STAKEHOLDERS

1.7 INCLUSIONS & EXCLUSIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 3 FOOD DISINFECTION FOOD DISINFECTION: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights for region

2.1.2.2 Key industry insights for chemical type

2.1.2.3 Key industry insights for end use

2.1.2.4 Key industry insights for applications area

2.1.2.5 Breakdown of primary interviews

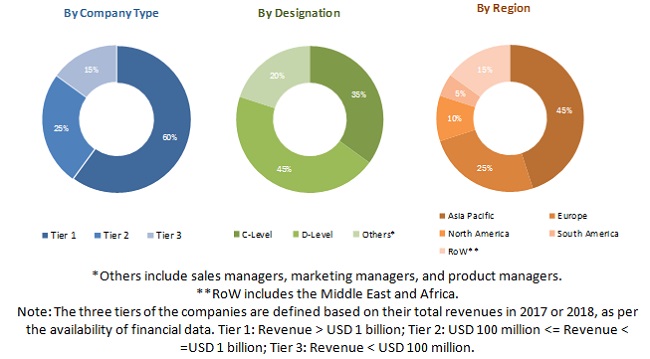

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BASE NUMBER CALCULATION

2.2.2 FORECAST NUMBER CALCULATION

2.3 MARKET ENGINEERING PROCESS

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 FOOD DISINFECTION MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET: TOP-DOWN APPROACH

FIGURE 7 MARKET: COMPANY REVENUE ANALYSIS (TOP-DOWN APPROACH)

2.4 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTION

2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 9 MARKET SIZE, BY REGION, 2020 VS. 2025 (USD MILLION)

FIGURE 10 MARKET SHARE (VALUE), BY APPLICATIONS AREA, 2020 VS. 2025

FIGURE 11 HYDROGEN PEROXIDE & PERACETIC ACID TO BE THE MOST DOMINANT CHEMICAL TYPE IN FOOD & BEVERAGE DISINFECTION, 2020 VS. 2025

FIGURE 12 NORTH AMERICA IS PROJECTED TO DOMINATE THE MARKET SIZE

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET SIZE

FIGURE 13 GROWTH IN NEED FOR FOOD SAFETY TO DRIVE THE MARKET SIZE

4.2 FOOD DISINFECTION MARKET SIZE, BY REGION

FIGURE 14 ASIA PACIFIC TO DOMINATE THE MARKET SIZE

4.3 MARKET SIZE, BY CHEMICAL TYPE & REGION

FIGURE 15 HYDROGEN PEROXIDE & PERACETIC ACID ARE ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE IN THE MARKET SIZE IN 2020

4.4 NORTH AMERICA: MARKET SIZE, BY APPLICATIONS AREA & COUNTRY

FIGURE 16 FOOD PROCESSING SEGMENT TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET SIZE IN 2019

4.5 FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS (USD MILLION), 2020 VS 2025

FIGURE 17 DAIRY TO ACCOUNT FOR THE LARGEST SHARE OF THE FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE (USD MILLION)

4.6 MARKET SIZE, BY COUNTRY/REGION

FIGURE 18 INDIA IS ESTIMATED TO BE THE FASTEST-GROWING MARKET FOR FOOD DISINFECTION

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 RISE IN GLOBAL POPULATION

FIGURE 19 GLOBAL POPULATION PROJECTED TO REACH ~9.7 BILLION BY 2050

5.2.2 GDP GROWTH RATE FORECAST OF MAJOR ECONOMIES

TABLE 2 TRENDS AND FORECAST OF GDP GROWTH RATE, BY KEY COUNTRY, 2016–2020

5.3 MARKET DYNAMICS

FIGURE 20 MARKET DYNAMICS: MARKET SIZE

5.3.1 DRIVERS

5.3.1.1 Increase in instances of foodborne diseases and outbreaks

FIGURE 21 US: FOODS CAUSING OUTBREAK-ASSOCIATED ILLNESSES, 2015

5.3.1.2 Increase in demand for environment-friendly solutions

5.3.1.3 Rise in awareness about food safety among consumers

FIGURE 22 SOUTH AFRICA: NUMBER OF FOODBORNE DISEASE OUTBREAKS REPORTED TO ORU/NICD, 2013–2017

5.3.1.4 Increase in demand for non-thermal process in disinfection

FIGURE 23 REASONS FOR COMPANY PREFERENCES FOR NON-THERMAL PROCESSING, 2018

5.3.2 RESTRAINTS

5.3.2.1 Rise in demand for minimally processed food products

FIGURE 24 US: ORGANIC FOOD RETAIL SALES, 2013–2016

5.3.2.2 Maintaining proper process control

5.3.2.3 Exposure of the eyes to concentrations of 5% or more of hydrogen peroxide could result in permanent loss of vision

5.3.3 OPPORTUNITIES

5.3.3.1 Packaging and shelf-life enhancement for processed food

5.3.4 CHALLENGES

5.3.4.1 Stringent government regulations

5.3.4.2 Increase in raw material prices and operating cost

5.4 COVID-19 IMPACT ON THE FOOD DISINFECTION MARKET SIZE

6 REGULATORY FRAMEWORK (Page No. - 59)

6.1 INTRODUCTION

6.2 NORTH AMERICA

6.2.1 US

6.3 EUROPE

6.4 ASIA PACIFIC

6.4.1 CHINA

6.5 PATENT ANALYSIS

FIGURE 25 NUMBER OF PATENTS GRANTED FOR OZONE IN THE FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, 2015–2020

FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED FOR OZONE IN FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, 2020

TABLE 3 LIST OF A FEW PATENTS IN THE MARKET SIZE , BY OZONE IN WATER TREATMENT, 2020

6.6 VALUE CHAIN

FIGURE 27 VALUE CHAIN ANALYSIS

6.7 TRADE ANALYSIS

FIGURE 28 EXPORT OF VEGETABLES, 2015–2018 (USD MILLION)

6.8 TECHNOLOGY ANALYSIS

6.9 MARKET ECOSYSTEM

6.9.1 MARKET: MARKET MAP

6.9.1.1 Upstream

6.9.1.1.1 Chemical provider

6.9.1.1.2 Ingredient and raw material providers

6.9.1.2 Downstream

6.9.1.2.1 Regulatory bodies & certification providers

6.10 CASE STUDY ANALYSIS

6.10.1 SAFETY ASSESSMENT DEMAND BY INDUSTRY PLAYERS TO ENSURE TRANSPARENCY

6.10.1.1 Problem statement

6.10.1.2 Solution offered

6.10.1.3 Outcome

6.10.2 DIVERSEY STARTED OFFERING EASY-TO-USE AND EFFICIENT-IN-CLEAN DISINFECTION SOLUTIONS FOR ITS CUSTOMERS

6.10.2.1 Problem statement

6.10.2.2 Solution offered

6.10.2.3 Outcome

6.11 YC–YCC SHIFTS IN THE MARKET SIZE

FIGURE 29 DEMAND FOR INNOVATIVE CHEMICALS IN FOOD DISINFECTION FOR IMPROVING PRODUCT QUALITY IS THE NEW HOT BET IN THE MARKET

6.12 PORTER’S FIVE FORCES ANALYSIS

6.12.1 THREAT OF NEW ENTRANTS

6.12.2 THREAT OF SUBSTITUTES

6.12.3 BARGAINING POWER OF SUPPLIERS

6.12.4 BARGAINING POWER OF BUYERS

6.12.5 INTENSITY OF COMPETITIVE RIVALRY

7 MARKET, BY CHEMICAL TYPE (Page No. - 72)

7.1 INTRODUCTION

FIGURE 30 FOOD DISINFECTION MARKET SIZE, BY CHEMICAL TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 4 MARKET SIZE, BY CHEMICAL TYPE, 2018–2025 (USD MILLION)

TABLE 5 FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY CHEMICAL TYPE, 2018–2025 (USD MILLION)

TABLE 6 FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY CHEMICAL TYPE, 2018–2025 (USD MILLION)

7.1.1 HYDROGEN PEROXIDE & PERACETIC ACID

7.1.1.1 Hydrogen peroxide is effective mostly against fungi and bacteria, thus majorly used in food & beverage disinfection processing

TABLE 7 HYDROGEN PEROXIDE & PERACETIC ACID MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.1.2 CHLORINE COMPOUNDS

7.1.2.1 Due to low cost and ease of availability, chlorine compounds are widely used as food disinfectants

TABLE 8 CHLORINE COMPOUNDS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.1.3 QUATERNARY AMMONIUM COMPOUNDS

7.1.3.1 Quaternary ammonium compounds have higher efficacy in alkaline environments and warm temperatures as disinfectants

TABLE 9 QUATERNARY AMMONIUM COMPOUNDS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.1.4 CARBOXYLIC ACID

7.1.4.1 Carboxylic acids offer broad-spectrum antimicrobial activity against gram-positive and gram-negative bacteria in food processing

TABLE 10 CARBOXYLIC ACID MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.1.5 ALCOHOLS

7.1.5.1 Ethyl alcohol is commonly used alcohol in the food industry disinfection due to its Generally Recognized As Safe status

TABLE 11 ALCOHOLS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.1.6 OTHER CHEMICAL TYPES

7.1.6.1 Iodophors are environmental-friendly chemicals, non-corrosive, and usually find applications in alcoholic beverages bottling

TABLE 12 OTHER CHEMICALS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8 FOOD DISINFECTION MARKET, BY END USE (Page No. - 81)

8.1 INTRODUCTION

FIGURE 31 MARKET SIZE, BY END USE, 2020 VS. 2025 (USD MILLION)

TABLE 13 MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

8.2 FOOD PROCESSING

8.2.1 CHEMICALS ARE USED TO SANITIZE AND DISINFECT FOOD PRODUCT CONTACT SURFACES THAT KEEP FOOD SAFE FOR CONSUMPTION

TABLE 14 FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

8.2.2 DAIRY

8.2.2.1 Due to reduce operational cost & high-water efficiency, the dairy industry is focusing on usage of ozone systems on a higher scale

TABLE 16 FOOD DISINFECTION FOR DAIRY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.2.3 MEAT & POULTRY

8.2.3.1 Meat processors are preferring proper cleaning & sanitation to keep meat products perishable for a longer period of time

TABLE 17 FOOD DISINFECTION FOR MEAT & POULTRY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.2.4 FISH & SEAFOOD

8.2.4.1 Ozonation as an effective disinfection treatment finds wide applications in the fish & seafood processing industry

TABLE 18 FOOD DISINFECTION FOR FISH & SEAFOOD MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.2.5 FRUITS & VEGETABLES

8.2.5.1 UV radiation treatment is preferred for disinfecting fruits & vegetables as it leaves no residue on them

TABLE 19 FOOD DISINFECTION FOR FRUIT & VEGETABLE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.2.6 OTHER FOODS

8.2.6.1 Rise in trend of high-quality food consumption contributes to an increase in the significance of disinfection processes in the food industry

TABLE 20 FOOD DISINFECTION FOR OTHER FOODS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3 BEVERAGE PROCESSING

8.3.1 UV RADIATION TECHNOLOGY IS HIGHLY PREFERRED IN THE BEVERAGE INDUSTRY AS IT IS COST-EFFECTIVE AND ECO-FRIENDLY

TABLE 21 FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

8.3.2 BREWING

8.3.2.1 High growth opportunities in the alcoholic beverage industry, as disinfection of equipment is important for the brewing industry

TABLE 23 FOOD DISINFECTION FOR BREWING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3.3 NON-ALCOHOLIC BEVERAGES

8.3.3.1 Eco-friendly chemicals is mostly preferred over chlorine, as it sterilizes beverage products without altering the taste

TABLE 24 FOOD DISINFECTION FOR NON-ALCOHOLIC BEVERAGES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 FOOD DISINFECTION MARKET, BY APPLICATIONS AREA (Page No. - 91)

9.1 INTRODUCTION

FIGURE 32 MARKET SIZE, BY APPLICATIONS AREA, 2020 & 2025 (USD MILLION)

TABLE 25 MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 26 FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 27 FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

9.1.1 PACKAGING

9.1.1.1 Packaging is one of the critical steps of manufacturing, which is mostly done by the hydrogen peroxide due to its cost-efficient nature

TABLE 28 FOOD DISINFECTION FOR FOOD & BEVERAGE PACKAGING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.1.2 PROCESSING

9.1.2.1 The disinfectants to be used on food contact surfaces during processing are highly regulated by government agencies to ensure food security

TABLE 29 FOOD DISINFECTION FOR FOOD & BEVERAGE PROCESSING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.1.3 SURFACE

9.1.3.1 Surface disinfection involves the use of hypochlorous acid and ozonation

TABLE 30 FOOD DISINFECTION FOR FOOD & BEVERAGE SURFACES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 FOOD DISINFECTION MARKET SIZE, BY REGION (Page No. - 96)

10.1 INTRODUCTION

FIGURE 33 GEOGRAPHIC SNAPSHOT OF THE MARKET SHARE, 2019

TABLE 31 MARKET SIZE, BY REGION, 2018–2025, (USD MILLION)

10.2 NORTH AMERICA

FIGURE 34 THE US DOMINATES THE NORTH AMERICAN MARKET

TABLE 32 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY CHEMICAL TYPE, 2018–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 38 NORTH AMERICA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

10.2.1 US

10.2.1.1 The well-established food & beverage sector finds applications for disinfectants owing to consumer safety and health

TABLE 40 US: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 41 US: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 42 US: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rise of the food processing industry in Canada has supported the growth of the food disinfection market size

TABLE 43 CANADA: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 44 CANADA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 45 CANADA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Strong focus on maintenance of international food safety standards drive the growth of the market in Mexico

TABLE 46 MEXICO: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 47 MEXICO: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 48 MEXICO: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.3 EUROPE

TABLE 49 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 EUROPE: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY CHEMICAL TYPE, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 53 EUROPE: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 54 EUROPE: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 55 EUROPE: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 56 EUROPE: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 The popularity of eco-friendly alternative disinfection methods is increasing in the country

TABLE 57 GERMANY: FOOD DISINFECTION MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 58 GERMANY: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 59 GERMANY: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 The use of irradiation technologies for decontamination or sterilization of food products is largely adopted by the French government

TABLE 60 FRANCE: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 61 FRANCE: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 62 FRANCE: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.3.3 ITALY

10.3.3.1 Ozone and UV radiation are commonly used technologies for disinfection in the Italian food & beverage industry

TABLE 63 ITALY: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 64 ITALY: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 65 ITALY: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 The Spanish F&B industry are adopting energy-efficient UV radiation and ozonation treatment in place of conventional disinfection methods

TABLE 66 SPAIN: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 67 SPAIN: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 68 SPAIN: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.3.5 UK

10.3.5.1 With the increased concerns for food safety, the market for disinfectants used in the F&B industry in the UK is projected to grow at a faster pace

TABLE 69 UK: FOOD DISINFECTION MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 70 UK: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 71 UK: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.3.6 RUSSIA

10.3.6.1 Russia’s disinfection chemical providers are increasing their production capacities for disinfectants used in the F&B industry

TABLE 72 RUSSIA: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 73 RUSSIA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 74 RUSSIA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 75 REST OF EUROPE: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 76 REST OF EUROPE: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 77 REST OF EUROPE: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE SNAPSHOT

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 79 ASIA PACIFIC: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY CHEMICAL TYPE, 2018–2025 (USD MILLION)

TABLE 80 ASIA PACIFIC: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 82 ASIA PACIFIC: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 84 ASIA PACIFIC: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 85 ASIA PACIFIC: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China faces stringent regulations and guidelines to be followed for cold chain and supply chain distribution

TABLE 86 CHINA: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 87 CHINA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 88 CHINA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Japanese food & beverage industry adopted ozone as the most widely used disinfectant

TABLE 89 JAPAN: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 90 JAPAN: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 91 JAPAN: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Meat and dairy form one of the largest food & beverage processing sectors in India

TABLE 92 INDIA: FOOD DISINFECTION MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 93 INDIA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 94 INDIA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.4.1 Rise in demand for meat & seafood products in Australia leads to disinfection technologies to extend the shelf life of products

TABLE 95 AUSTRALIA & NEW ZEALAND: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 97 AUSTRALIA & NEW ZEALAND: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 98 REST OF ASIA PACIFIC: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 99 REST OF ASIA PACIFIC: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 100 REST OF ASIA PACIFIC: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 101 SOUTH AMERICA: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 102 SOUTH AMERICA: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY CHEMICAL TYPE, 2018–2025 (USD MILLION)

TABLE 103 SOUTH AMERICA: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 104 SOUTH AMERICA: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 105 SOUTH AMERICA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 106 SOUTH AMERICA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 107 SOUTH AMERICA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 108 SOUTH AMERICA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 There is a growing demand for chlorine and peracetic acid for food safety and quality food products in the country

TABLE 109 BRAZIL: FOOD DISINFECTION MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 110 BRAZIL: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 111 BRAZIL: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Hydrogen peroxide is expected to witness high usage due to the demand for regulation on food & beverage disinfectants

TABLE 112 ARGENTINA: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 113 ARGENTINA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 114 ARGENTINA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

TABLE 115 REST OF SOUTH AMERICA: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 116 REST OF SOUTH AMERICA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 117 REST OF SOUTH AMERICA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.6 REST OF THE WORLD

TABLE 118 ROW: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 119 ROW: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY CHEMICAL TYPE, 2018–2025 (USD MILLION)

TABLE 120 ROW: FOOD DISINFECTION MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 121 ROW: FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 122 ROW: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 123 ROW: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

TABLE 124 ROW: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 125 ROW: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY APPLICATIONS AREA, 2018–2025 (USD MILLION)

10.6.1 MIDDLE EAST

10.6.1.1 F&B disinfection equipment manufacturers are launching energy-efficient systems in the region for small and medium-sized beverage manufacturers

TABLE 126 MIDDLE EAST: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 127 MIDDLE EAST: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 128 MIDDLE EAST: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

10.6.2 AFRICA

10.6.2.1 Africa is one of the largest potential markets for food & beverage disinfection chemicals and technology

TABLE 129 AFRICA: MARKET SIZE, BY END USE, 2018–2025 (USD MILLION)

TABLE 130 AFRICA: FOOD DISINFECTION FOR FOOD PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

TABLE 131 AFRICA: FOOD DISINFECTION FOR BEVERAGE PROCESSING MARKET SIZE, BY SUBAPPLICATIONS, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 143)

11.1 OVERVIEW

FIGURE 36 MARKET EVALUATION FRAMEWORK

11.2 RANKINGS OF KEY PLAYERS

FIGURE 37 ECOLAB DOMINATED THE FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE IN 2019

11.3 OVERVIEW

11.4 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 38 FOOD DISINFECTION MARKET SIZE EVALUATION QUADRANT, 2019

11.5 MARKET SHARE ANALYSIS

FIGURE 39 MARKET SHARE ANALYSIS, 2019

11.6 COMPETITIVE SCENARIO

FIGURE 40 KEY DEVELOPMENTS IN THE FOOD DISINFECTION FOR FOOD & BEVERAGE APPLICATIONS MARKET SIZE (2018—2020)

11.6.1 ACQUISITIONS

TABLE 132 ACQUISITIONS, 2018–2021

11.6.2 NEW PRODUCT LAUNCHES

TABLE 133 NEW PRODUCT LAUNCHES, 2018–2020

11.6.3 JOINT VENTURES

TABLE 134 JOINT VENTURES, 2018

12 COMPANY PROFILES (Page No. - 151)

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

12.1 EVONIK INDUSTRIES

FIGURE 41 EVONIK INDUSTRIES: COMPANY SNAPSHOT

12.2 NEOGEN CORPORATION

FIGURE 42 NEOGEN CORPORATION: COMPANY SNAPSHOT

12.3 BASF SE

FIGURE 43 BASF SE: COMPANY SNAPSHOT

12.4 SOLVAY

FIGURE 44 SOLVAY: COMPANY SNAPSHOT

12.5 DIVERSEY, INC.

12.6 ECOLAB

FIGURE 45 ECOLAB: COMPANY SNAPSHOT

12.7 STEPAN COMPANY

FIGURE 46 STEPAN COMPANY: COMPANY SNAPSHOT

12.8 KERSIA GROUP

12.9 SPARTAN CHEMICAL COMPANY, INC.

12.10 PILOT CHEMICAL CORP

12.11 ENTACO NV (NERTA)

12.12 FINKTECH GMBH

12.13 CCL PENTASOL

12.14 SANOSIL LTD.

12.15 DELUXE CHEMICALS

12.16 ACURO ORGANICS LIMITED

12.17 AQUA BOND INC.

12.18 THATCHER COMPANY

12.19 RENTOKIL

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 181)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

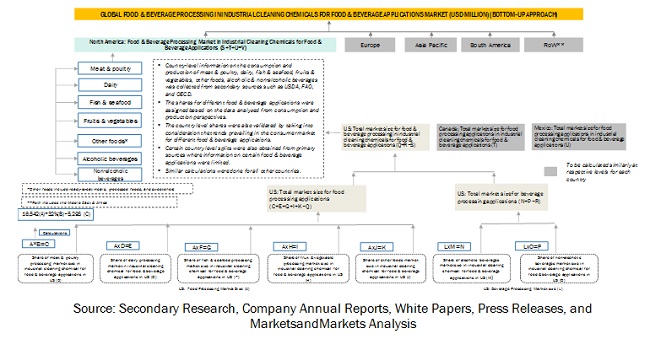

The study involves four major activities to estimate the current market size of the food disinfection market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of various segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Commission, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, and trade directories.

Primary Research

The food disinfection market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations, in the supply chain. The interviews were conducted with market experts from the demand-side (feed manufacturers, commercial research institutions, agencies, and laboratories) and supply-side (manufacturers of cleaning chemicals such as hydrogen peroxide, chlorine compounds, quaternary ammonium compounds, carboxylic acids, and alcohols) across countries in the studied regions. This primary data was collected through questionnaires, e-mails, and telephonic interviews.

Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of food antioxidant producers and end-use industries.

The primary sources from the supply side included executives from research institutions involved in R&D to introduce technology, key opinion leaders, distributors, and food disinfection product manufacturers.

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food disinfection market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size include the following:

- Key players were identified through extensive secondary research.

- The industry’s value chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources and extensive product mapping.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- Data from the parent market, which include food processing & beverage processing markets, has also been taken into consideration to arrive at the estimated market size.

Food disinfection market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food disinfection market.

Report Objectives

- To define, segment, and estimate the size of the market with respect to its end use, application area, chemical type, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, joint ventures, in the food disinfection market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

Geographic Analysis

- Further breakdown of the Rest of Europe market for food disinfection which includes countries such as Poland, Ukraine, Denmark, and Hungary

- Further breakdown of the Rest of Asia Pacific market for food disinfection, which includes countries such as Philippines, Vietnam, Malaysia, and Indonesia.

- Further breakdown of the Rest of South America market for food disinfection which includes countries such as Peru, Chile, and Venezuela

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Disinfection Market