Food Packaging Films Market by Type (Flexible, Rigid), Material (Polyethylene, Polypropylene, Polyethylene Terephthalate), Application (Meat, Poultry & Seafood, Convenience Food, Bakery & Confectionary) and Region - Global Forecast to 2027

Updated on : June 17, 2024

Food Packaging Films Market

Food Packaging Films Market was valued at USD 49.8 billion in 2021 and is projected to reach USD 72.3 billion by 2027, growing at 6.4% cagr from 2022 to 2027. Food & beverage packaging is one of the largest segments of the packaging industry. Packaging plays a vital role in keeping the product fresh, damage-proof and acts as an efficient marketing tool. The food packaging films market has been growing in tandem with the growth of the food packaging industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Packaging Films Market Dynamics

Driver: Rising demand for oriented films

Biaxially oriented films saw significant growth in demand from 2016 to 2021 and are expected to grow at a steady rate during the forecast period. The rising demand for biaxial oriented films has encouraged a number of packaging film manufacturers to divert their manufacturing efforts and invest in biaxially oriented film packaging. Biaxial films are stretched in both machine direction (MD) and transverse direction (TD) to provide better mechanical, optical, and barrier properties. These films have a large number of applications in food and non-food packaging industries. Biaxially oriented films are made from various materials, including polypropylene (PP), polyethylene terephthalate (PET), polystyrene (ps), polyvinyl chloride (pvc), polyamide (PA), and others.

Restraint: Volatile raw material costs

Most of the costs involved in making food packaging films are attributable to the raw materials. The polymers used in food packaging films are derived from petroleum. Given the volatile trend in crude oil prices and demand for polymers for various applications, the pressure on input costs can be expected to fluctuate. Fluctuation in raw material prices of polymers and monomers used for producing polymers is a major restraint to the growth of the food packaging films market. The prices of raw materials depend mostly on logistics (location of manufacturing), labor cost, trading cost, and tariffs. All these factors affect the growth of the market for polymers, which in turn affect the growth of the food packaging films market.India offers a huge potential for the tile & stone adhesives market. The current 20-25% usage rate of adhesives in the country is expected to reach almost 50% in the forecast period due to the increase in the use of these adhesives in high-end residential projects, commercial projects such as shopping malls, airports & metros, and the constantly upgrading hospitality industry.

Opportunity: Innovations in eco-friendly packaging

Governments across the world are focusing on reducing environmental pollution and encouraging end-use sectors to opt for eco-friendly solutions. There are stringent regulations for plastic landfills in Europe. The European Union intends to achieve ‘zero plastics to landfill’ by 2025. In view of the growing concerns related to environmental pollution, packaging companies are focusing on eco-friendly solutions for environmental sustainability. Green packaging products are designed to adhere to the three ‘R’s of eco-friendly packaging: renew, reuse, and recycle. Governments of developing countries are encouraging packaging solution providers to provide eco-friendly products made of natural biopolymer, which is more flexible than traditional plastic.

Food packaging films can be made using eco-friendly packaging materials, such as bioplastics, recycled papers, forest wood, and palm leaf.

Challenge: Manufacturers concentrating on downsizing packaging

Sustainability is closely associated with the reduction of resources used in the packaging of a particular product, thus reducing the waste generated due to packaging materials. It is related to reducing the volume usage of primary materials in the initial production process by using an ideal combination of primary, secondary, and/or tertiary materials.

Manufacturers have been concentrating on reducing the packaging size and weight by using fewer materials. This trend of downsizing packaging helps reduce waste generated from packaging. The Department of Environmental Conservation of New York City, under its packaging reduction guidelines, recommends the use of a poly wrap or shrink wrap over box packaging to reduce packaging size and bag packaging.

Manufacturers are concentrating on making packaging sizes smaller and lighter, and using fewer materials. Food packaging films play a key role is the downsizing of packaging.

Largest application of food packaging films

Meat products are the largest application of food packaging films. Increasing health concerns and the rising awareness regarding the nutritional values of meat products are boosting the demand for food packaging in this segment. Food packaging prevents contamination caused by bacteria, pathogens, and other microorganisms. The increasing awareness about airborne diseases has also augmented the demand for safely packaged food items.

Extensive use in food packaging solutions

Polypropylene is the fastest-growing segment, both in terms of value and volume. This material is not affected by changes in humidity. It has moderate permeability to gases and odors and a higher barrier to water vapor. These properties enable the use of polypropylene in the production of a wide variety of food & beverage packaging solutions like salad dressing bottles, margarine tubs, and yoghurt containers. Polypropylene is slightly stiff but comparatively less brittle than some other plastics. It is also very lightweight and does not require much storage space, which makes it easy to transport.

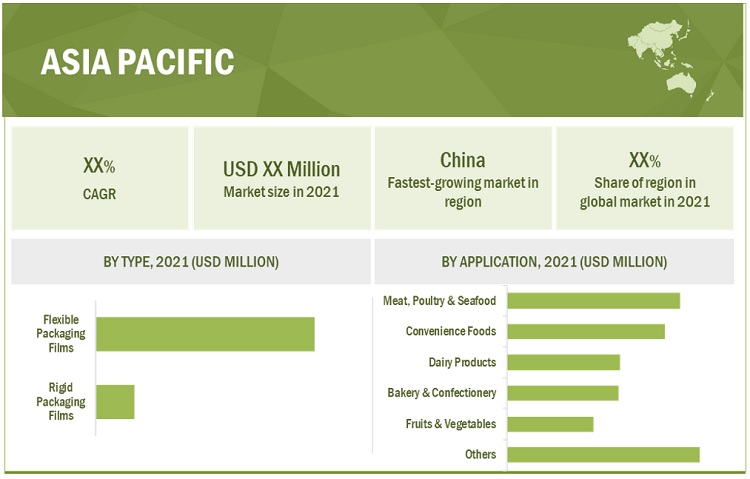

Asia Pacific to be fastest-growing food packaging films market

Asia Pacific is the largest and fastest-growing food packaging films market. Factors such as large population, growing demand for convenience food products, availability of cheap raw materials for packaging, and rising health awareness are driving the market in the region. China is a major manufacturer of food packaging films.

To know about the assumptions considered for the study, download the pdf brochure

Food Packaging Films Market Players

The key players in the food packaging films market are Amcor plc (Australia), Berry Global (US), Coveris (Austria), DS Smith (UK), Sealed Air Corporation (US), Graphic Packaging Holding Company (US), Charter Next Generation (US), Mondi Group (UK), DuPont Teijin Films (Japan), and WestRock (US).

Food Packaging Films Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 49.8 billion |

|

Revenue Forecast in 2027 |

USD 72.3 billion |

|

CAGR |

6.4% |

|

Years considered for the study |

2017–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Billion) and Volume (kiloton) |

|

Segments |

Type, Material, And Application |

|

Regions |

Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

Amcor plc (Australia), Berry Global (US), Coveris (Austria), DS Smith (UK), Sealed Air Corporation (US), Graphic Packaging Holding Company (US), Charter Next Generation (US), Mondi Group (UK), DuPont Teijin Films (Japan), and WestRock (US). |

This research report categorizes the food packaging films market based on chemistry, construction type, end use, and region.

Based on type, the food packaging films market has been segmented as follows:

- Flexible Packaging Films

- Rigid Packaging Films

Based on material, the food packaging films market has been segmented as follows:

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Polyamide

Based on application, the food packaging films market has been segmented as follows:

- Fruits & Vegetables

- Bakery & Confectionery

- Meat, Poultry & Seafood

- Convenience Foods

- Dairy Products

Based on the region, the food packaging films market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In June 2022, Novolex launched RollStar EZ Open Produce Bags. The new bags use a proprietary recipe that makes them easy to open. The bags come in a wide variety of sizes and gauges, including versions certified as compostable by the Biodegradable Products Institute (BPI).

- In May 2022, Berry Global collaborated with Poly-Ag Recycling and Clean Farms to launch Canada-based recycling initiative to recover used agricultural films, process recovered grain bag material, and produce new products with recycled content.

- In August 2021, Sika acquired Bexel International S.A. de C.V., a leading manufacturer of tile adhesives and stuccos in Mexico. The acquisition strengthened Sika’s position in the large, fast-growing Mexican construction market and significantly extended its manufacturing footprint.

- In May 2022, Innovia announced the opening of a new 6.2 meter multi-layer co-extrusion line at its site in P³ock, Poland. The state-of-the-art line will manufacture low-density polyolefin shrink film for shrink sleeve labels and tamper evident applications.

- In January 2019, The company acquired Europac, a large paper and packaging business listed on the Spanish stock exchange and operating, in Iberia and France.

Frequently Asked Questions (FAQ):

Does this report covers the new applications of food packaging films?

Yes the report covers the new applications of food packaging films.

Does this report cover the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value

What is the current competitive landscape in the food packaging films market in terms of new applications, production, and sales?

The market has various large, medium, and small scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, China, Japan, Germany, UK and France are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 FOOD PACKAGING FILMS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.3.1 Market inclusions

TABLE 1 FOOD PACKAGING FILMS MARKET: MARKET INCLUSIONS

1.3.3.2 Market exclusions

1.3.4 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 FOOD PACKAGING FILMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 3 FOOD PACKAGING FILMS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 4 FOOD PACKAGING FILMS MARKET SIZE ESTIMATION, BY VOLUME

FIGURE 5 FOOD PACKAGING FILMS MARKET SIZE ESTIMATION, BY REGION

FIGURE 6 FOOD PACKAGING FILMS MARKET, BY APPLICATION

FIGURE 7 FOOD PACKAGING FILMS MARKET, BY TYPE

2.2.2 BOTTOM-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY SIDE FORECAST

2.3.2 DEMAND-SIDE FORECAST PROJECTION

2.4 FACTOR ANALYSIS

FIGURE 9 FACTOR ANALYSIS OF FOOD PACKAGING FILMS MARKET

2.5 DATA TRIANGULATION

FIGURE 10 FOOD PACKAGING FILMS MARKET: DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 RISK ANALYSIS ASSESSMENT

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

TABLE 2 FOOD PACKAGING FILMS MARKET, 2022 VS. 2027

FIGURE 11 FLEXIBLE PACKAGING FILMS TO BE LARGER SEGMENT IN FOOD PACKAGING FILMS MARKET

FIGURE 12 POLYETHYLENE TO BE LARGEST SEGMENT IN FOOD PACKAGING FILMS MARKET

FIGURE 13 CONVENIENCE FOODS SEGMENT TO RECORD HIGHER CAGR

FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING FOOD PACKAGING FILMS MARKET

TABLE 3 KEY MARKET PLAYERS

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN FOOD PACKAGING FILMS MARKET

FIGURE 15 FOOD PACKAGING FILMS MARKET TO REGISTER ROBUST GROWTH BETWEEN 2022 AND 2027

4.2 FOOD PACKAGING FILMS MARKET, BY MATERIAL

FIGURE 16 POLYETHYLENE SEGMENT TO LEAD MARKET GROWTH

4.3 FOOD PACKAGING FILMS MARKET, BY APPLICATION

FIGURE 17 MEAT, POULTRY & SEAFOOD SEGMENT TO LEAD MARKET GROWTH

4.4 FOOD PACKAGING FILMS MARKET, BY TYPE

FIGURE 18 FLEXIBLE PACKAGING FILMS SEGMENT TO LEAD FOOD PACKAGING FILMS MARKET

4.5 FOOD PACKAGING FILMS MARKET, DEVELOPED VS. EMERGING COUNTRIES

FIGURE 19 MARKET TO GROW FASTER IN EMERGING COUNTRIES THAN IN DEVELOPED COUNTRIES

4.6 ASIA PACIFIC FOOD PACKAGING FILMS MARKET, BY APPLICATION AND COUNTRY

FIGURE 20 MEAT, POULTRY & SEAFOOD SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES IN 2021

4.7 ASIA PACIFIC FOOD PACKAGING FILMS MARKET, BY COUNTRY

FIGURE 21 MARKET IN CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FOOD PACKAGING FILMS MARKET

5.2.1 DRIVERS

5.2.1.1 Rising global population and improving economic conditions of emerging countries

5.2.1.2 Growing demand for convenience food items

5.2.1.3 Innovative packaging solutions for extended shelf life of fresh food items

5.2.1.4 Rising demand for oriented films

5.2.2 RESTRAINTS

5.2.2.1 Volatile raw material costs

5.2.2.2 Stringent government rules and regulations regarding raw materials

5.2.3 OPPORTUNITIES

5.2.3.1 Innovations in eco-friendly packaging

5.2.4 CHALLENGES

5.2.4.1 Manufacturers concentrating on downsizing packaging

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 23 PORTER'S FIVE FORCES ANALYSIS: FOOD PACKAGING FILMS MARKET

TABLE 4 FOOD PACKAGING FILMS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 DEGREE OF COMPETITION

5.4 MACROECONOMIC INDICATORS

5.4.1 INTRODUCTION

5.4.2 RISING POPULATION

5.4.3 INCREASING MIDDLE-CLASS POPULATION, 2009–2030

5.4.4 GDP TRENDS AND FORECAST

TABLE 5 GROWTH TREND IN WORLD GDP PER CAPITA, 2016–2022 (USD BILLION)

5.5 ECOSYSTEM

FIGURE 24 FOOD PACKAGING FILMS ECOSYSTEM

5.5.1 YC AND YCC SHIFT

FIGURE 25 FOOD PACKAGING FILMS FUTURE REVENUE MIX

5.6 AVERAGE SELLING PRICE ANALYSIS

FIGURE 26 PRICING ANALYSIS OF FOOD PACKAGING FILMS, BY REGION, 2021

5.7 PATENT ANALYSIS

5.7.1 INTRODUCTION

5.7.2 METHODOLOGY

5.7.3 DOCUMENT TYPE

FIGURE 27 NUMBER OF PATENTS IN LAST 10 YEARS

FIGURE 28 PUBLICATION TRENDS, 2017–2022

5.7.4 INSIGHTS

FIGURE 29 LEGAL STATUS OF PATENTS

5.7.5 JURISDICTION ANALYSIS

FIGURE 30 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2011–2021

5.7.6 TOP APPLICANTS

FIGURE 31 TOP 10 APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 6 LIST OF PATENTS BY KUHNE ANLAGENBAU GMBH

TABLE 7 LIST OF PATENTS BY TETRA LAVAL HOLDINGS & FINANCE SA

TABLE 8 LIST OF PATENTS OF CRYOVAC INC

TABLE 9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.8 TECHNOLOGY ANALYSIS

5.8.1 TECHNOLOGIES FOR FOOD PACKAGING FILM STRUCTURES

5.9 TRADE ANALYSIS

TABLE 10 MAJOR IMPORT PARTNERS – FOOD PACKAGING FILMS

5.10 VALUE CHAIN ANALYSIS

FIGURE 32 VALUE CHAIN ANALYSIS OF FOOD PACKAGING FILMS MARKET

TABLE 11 FOOD PACKAGING FILMS MARKET: SUPPLY CHAIN ECOSYSTEM

5.10.1 PROMINENT COMPANIES

5.10.2 SMALL & MEDIUM-SIZED ENTERPRISES

5.11 CASE STUDY ANALYSIS

5.12 REGULATIONS

6 FOOD PACKAGING FILMS MARKET, BY TYPE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 33 FLEXIBLE PACKAGING FILMS SEGMENT TO DOMINATE MARKET BETWEEN 2022 AND 2027

TABLE 12 FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 13 FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (KILOTONS)

6.2 FLEXIBLE PACKAGING FILMS

6.2.1 CHANGING LIFESTYLES TO INCREASE DEMAND FOR FLEXIBLE PACKAGING FILMS

TABLE 14 FLEXIBLE PACKAGING FILMS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 15 FLEXIBLE PACKAGING FILMS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

6.3 RIGID PACKAGING FILMS

6.3.1 PREFERENCE FOR CONVENIENCE FOODS TO DRIVE DEMAND FOR RIGID PACKAGING FILMS

TABLE 16 RIGID PACKAGING FILMS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 17 RIGID PACKAGING FILMS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

7 FOOD PACKAGING FILMS MARKET, BY MATERIAL (Page No. - 75)

7.1 INTRODUCTION

FIGURE 34 POLYETHYLENE SEGMENT DOMINATES OVERALL FOOD PACKAGING FILMS MARKET

TABLE 18 FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 19 FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (KILOTONS)

7.2 POLYETHYLENE (PE)

7.2.1 HIGH DEMAND FOR FOOD PACKAGING FILMS DUE TO FAVORABLE PROPERTIES

TABLE 20 POLYETHYLENE: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 21 POLYETHYLENE: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

7.3 POLYPROPYLENE (PP)

7.3.1 EXTENSIVE USE IN FOOD PACKAGING SOLUTIONS

TABLE 22 POLYPROPYLENE: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 23 POLYPROPYLENE: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

7.4 POLYETHYLENE TEREPHTHALATE (PET)

7.4.1 OFFERS RESISTANCE TO HEAT, OILS, SOLVENTS, AND ACIDS

TABLE 24 POLYETHYLENE TEREPHTHALATE: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 25 POLYETHYLENE TEREPHTHALATE: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

7.5 POLYAMIDE (PA)

7.5.1 PROVIDES PROTECTION FROM SCRATCHES, PUNCTURES, AND FLEX-CRACKS

TABLE 26 POLYAMIDE: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 POLYAMIDE: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

7.6 OTHERS

TABLE 28 OTHERS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 29 OTHERS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

8 FOOD PACKAGING FILMS MARKET, BY APPLICATION (Page No. - 83)

8.1 INTRODUCTION

FIGURE 35 MEAT, POULTRY & SEAFOOD TO BE LARGEST SEGMENT BETWEEN 2022 AND 2027

TABLE 30 FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 31 FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (KILOTONS)

8.2 MEAT, POULTRY & SEAFOOD PRODUCTS

8.2.1 LARGEST APPLICATION OF FOOD PACKAGING FILMS

TABLE 32 MEAT, POULTRY & SEAFOOD: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 33 MEAT, POULTRY & SEAFOOD: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

8.3 CONVENIENCE FOODS

8.3.1 HIGH DEMAND FOR FOOD PACKAGING FILMS DUE TO CHANGING CONSUMPTION PATTERNS

TABLE 34 CONVENIENCE FOODS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 35 CONVENIENCE FOODS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTON)

8.4 BAKERY & CONFECTIONERY

8.4.1 PUNCTURE-RESISTANT PACKAGING FILMS PROVIDE ENHANCED PROTECTION

TABLE 36 BAKERY & CONFECTIONERY: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 37 BAKERY & CONFECTIONERY: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

8.5 FRUITS & VEGETABLES

8.5.1 PACKAGING FILMS ENSURE FRESHNESS OF FRUITS & VEGETABLES

TABLE 38 FRUITS & VEGETABLES: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 39 FRUITS & VEGETABLES: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

8.6 DAIRY PRODUCTS

8.6.1 TREND FOR PRE-PACKAGED CHEESE TO DRIVE FOOD PACKAGING FILMS MARKET

TABLE 40 DAIRY PRODUCTS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 41 DAIRY PRODUCTS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

8.7 OTHERS

TABLE 42 OTHERS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 43 OTHERS: FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

9 FOOD PACKAGING FILMS MARKET, BY REGION (Page No. - 92)

9.1 INTRODUCTION

FIGURE 36 ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING FOOD PACKAGING FILMS MARKET DURING FORECAST PERIOD

TABLE 44 FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 45 FOOD PACKAGING FILMS MARKET, BY REGION, 2020–2027 (KILOTONS)

9.2 EUROPE

FIGURE 37 EUROPE: FOOD PACKAGING FILMS MARKET SNAPSHOT

TABLE 46 EUROPE: FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 47 EUROPE: FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (KILOTONS)

TABLE 48 EUROPE: FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 49 EUROPE: FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (KILOTONS)

TABLE 50 EUROPE: FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 51 EUROPE: FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (KILOTONS)

TABLE 52 EUROPE: FOOD PACKAGING FILMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 EUROPE: FOOD PACKAGING FILMS MARKET, BY COUNTRY, 2020–2027 (KILOTONS)

9.2.1 UK

9.2.1.1 Increasing demand for convenience foods to drive market

9.2.2 GERMANY

9.2.2.1 High exports of fruits and vegetables to boost market

9.2.3 FRANCE

9.2.3.1 Growing demand from food and wine sectors

9.2.4 SPAIN

9.2.4.1 Innovations in packaging techniques to offer huge opportunity

9.2.5 REST OF EUROPE

9.3 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: FOOD PACKAGING FILMS MARKET SNAPSHOT

TABLE 54 ASIA PACIFIC: FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 ASIA PACIFIC: FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (KILOTONS)

TABLE 56 ASIA PACIFIC: FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (KILOTONS)

TABLE 58 ASIA PACIFIC: FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 59 ASIA PACIFIC: FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (KILOTONS)

TABLE 60 ASIA PACIFIC: FOOD PACKAGING FILMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 61 ASIA PACIFIC: FOOD PACKAGING FILMS MARKET, BY COUNTRY, 2020–2027 (KILOTONS)

9.3.1 CHINA

9.3.1.1 Rising demand for fresh and healthy food to drive market

9.3.2 JAPAN

9.3.2.1 Need for innovative packaging techniques for dynamic fresh food industry

9.3.3 INDIA

9.3.3.1 Increasing population and disposable income to boost market

9.3.4 SOUTH KOREA

9.3.4.1 Changing lifestyles expected to drive market

9.3.5 REST OF ASIA PACIFIC

9.4 NORTH AMERICA

FIGURE 39 NORTH AMERICA: FOOD PACKAGING FILMS MARKET SNAPSHOT

TABLE 62 NORTH AMERICA: FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (KILOTONS)

TABLE 64 NORTH AMERICA: FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (KILOTONS)

TABLE 66 NORTH AMERICA: FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (KILOTONS)

TABLE 68 NORTH AMERICA: FOOD PACKAGING FILMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: FOOD PACKAGING FILMS MARKET, BY COUNTRY, 2020–2027 (KILOTONS)

9.4.1 US

9.4.1.1 Extensive use of polypropylene for food packaging films

9.4.2 CANADA

9.4.2.1 Improvements in food processing and packaging technologies

9.4.3 MEXICO

9.4.3.1 Inflow of FDI in manufacturing sector to drive market

9.5 MIDDLE EAST & AFRICA

FIGURE 40 SAUDI ARABIA TO DOMINATE FOOD PACKAGING FILMS MARKET IN MIDDLE EAST & AFRICA

TABLE 70 MIDDLE EAST & AFRICA: FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA: FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (KILOTONS)

TABLE 72 MIDDLE EAST & AFRICA: FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA: FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (KILOTONS)

TABLE 74 MIDDLE EAST & AFRICA: FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA: FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (KILOTONS)

TABLE 76 MIDDLE EAST & AFRICA: FOOD PACKAGING FILMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA: FOOD PACKAGING FILMS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

9.5.1 UAE

9.5.1.1 Growing healthcare and food sectors to fuel market

9.5.2 SAUDI ARABIA

9.5.2.1 Rising demand for convenient packaging to bolster market

9.5.3 SOUTH AFRICA

9.5.3.1 Increasing urbanization to drive demand for food packaging films

9.5.4 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

FIGURE 41 BRAZIL TO BE LARGEST FOOD PACKAGING FILMS MARKET IN SOUTH AMERICA

TABLE 78 SOUTH AMERICA: FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 SOUTH AMERICA: FOOD PACKAGING FILMS MARKET, BY TYPE, 2020–2027 (KILOTONS)

TABLE 80 SOUTH AMERICA: FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 81 SOUTH AMERICA: FOOD PACKAGING FILMS MARKET, BY MATERIAL, 2020–2027 (KILOTONS)

TABLE 82 SOUTH AMERICA: FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 83 SOUTH AMERICA: FOOD PACKAGING FILMS MARKET, BY APPLICATION, 2020–2027 (KILOTONS)

TABLE 84 SOUTH AMERICA: FOOD PACKAGING FILMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 85 SOUTH AMERICA: FOOD PACKAGING FILMS MARKET, BY COUNTRY, 2020–2027 (KILOTON)S

9.6.1 BRAZIL

9.6.1.1 High demand from fruits & vegetables industry to drive market

9.6.2 ARGENTINA

9.6.2.1 Growing meat products industry to boost market

9.6.3 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 120)

10.1 OVERVIEW

TABLE 86 OVERVIEW OF STRATEGIES ADOPTED BY KEY FOOD PACKAGING FILMS PLAYERS

10.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

10.2.1 STAR

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE PLAYERS

10.2.4 PARTICIPANTS

FIGURE 42 FOOD PACKAGING FILMS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

10.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 43 STRENGTH OF PRODUCT PORTFOLIO OF TOP PLAYERS IN FOOD PACKAGING FILMS MARKET

10.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 44 BUSINESS STRATEGY ANALYSIS OF TOP PLAYERS IN FOOD PACKAGING FILMS MARKET

10.5 REVENUE ANALYSIS

10.5.1 AMCOR PLC

10.5.2 COVERIS

10.5.3 DS SMITH PLC

10.5.4 BERRY GLOBAL

10.5.5 CHARTER NEXT GENERATION

FIGURE 45 REVENUE ANALYSIS, 2017-2021

10.6 COMPETITIVE BENCHMARKING

10.6.1 MARKET EVALUATION MATRIX

TABLE 87 OVERALL FOOTPRINTS OF COMPANIES

TABLE 88 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 89 REGIONAL FOOTPRINT OF COMPANIES

10.7 MARKET RANKING ANALYSIS

TABLE 90 MARKET RANKING ANALYSIS 2021

10.8 STRATEGIC DEVELOPMENTS

10.8.1 NEW PRODUCT LAUNCHES

TABLE 91 FOOD PACKAGING FILMS MARKET: NEW PRODUCT LAUNCHES, 2017-2022

10.8.2 DEALS

TABLE 92 FOOD PACKAGING FILMS MARKET: DEALS, 2017–2021

10.8.3 OTHER DEVELOPMENTS

TABLE 93 FOOD PACKAGING FILMS MARKET: OTHERS, 2017–2022

11 COMPANY PROFILES (Page No. - 133)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 BERRY GLOBAL

TABLE 94 BERRY GLOBAL: COMPANY OVERVIEW

FIGURE 46 BERRY GLOBAL: COMPANY SNAPSHOT

TABLE 95 BERRY GLOBAL: DEALS

11.1.2 INNOVIA FILMS LTD

TABLE 96 INNOVIA FILMS LTD: COMPANY OVERVIEW

TABLE 97 INNOVIA FILMS LTD: NEW PRODUCT LAUNCHES

TABLE 98 INNOVIA FILMS LTD: DEALS

11.1.3 NOVOLEX

TABLE 99 NOVOLEX: COMPANY OVERVIEW

TABLE 100 NOVOLEX: NEW PRODUCT LAUNCH

TABLE 101 NOVOLEX: DEALS

11.1.4 DUPONT TEIJIN FILMS

TABLE 102 DUPONT TEIJIN FILMS: COMPANY OVERVIEW

11.1.5 MONDI GROUP

TABLE 103 MONDI GROUP: COMPANY OVERVIEW

FIGURE 47 MONDI GROUP: COMPANY SNAPSHOT

TABLE 104 MONDI GROUP: DEALS

11.1.6 DS SMITH PLC

TABLE 105 DS SMITH PLC: COMPANY OVERVIEW

FIGURE 48 DS SMITH PLC: COMPANY SNAPSHOT

TABLE 106 DS SMITH PLC: DEALS

11.1.7 GRAPHIC PACKAGING HOLDING COMPANY

TABLE 107 GRAPHIC PACKAGING HOLDING COMPANY: COMPANY OVERVIEW

FIGURE 49 GRAPHIC PACKAGING HOLDING COMPANY: COMPANY SNAPSHOT

TABLE 108 GRAPHIC PACKAGING INTERNATIONAL: PRODUCT LAUNCHES

TABLE 109 GRAPHIC PACKAGING HOLDING COMPANY: DEALS

11.1.8 COVERIS

TABLE 110 COVERIS: COMPANY OVERVIEW

11.1.9 GEORGIA PACIFIC

TABLE 111 GEORGIA PACIFIC: COMPANY OVERVIEW

FIGURE 50 GEORGIA PACIFIC: COMPANY SNAPSHOT

11.1.10 CHARTER NEXT GENERATION

TABLE 112 CHARTER NEXT GENERATION: COMPANY OVERVIEW

11.1.11 AMCOR PLC

TABLE 113 AMCOR PLC: COMPANY OVERVIEW

FIGURE 51 AMCOR PLC: COMPANY SNAPSHOT

TABLE 114 AMCOR PLC: PRODUCT LAUNCHES

TABLE 115 AMCOR PLC: DEALS

11.1.12 WESTROCK COMPANY

TABLE 116 WESTROCK COMPANY: COMPANY OVERVIEW

FIGURE 52 WESTROCK COMPANY: COMPANY SNAPSHOT

11.1.13 SEALED AIR CORPORATION

TABLE 117 SEALED AIR CORPORATION: COMPANY OVERVIEW

FIGURE 53 SEALED AIR CORPORATION: COMPANY SNAPSHOT

11.2 OTHER KEY PLAYERS

11.2.1 JINDAL POLY FILMS

TABLE 118 JINDAL POLY FILMS: COMPANY OVERVIEW

11.2.2 RKW SE

TABLE 119 RKW SE: COMPANY OVERVIEW

11.2.3 TAGHLEEF INDUSTRIES

TABLE 120 TAGHLEEF INDUSTRIES: COMPANY OVERVIEW

11.2.4 WIPAK GROUP

TABLE 121 WIPAK GROUP: COMPANY OVERVIEW

11.2.5 CLEARWATER PAPER CORP

TABLE 122 CLEARWATER PAPER CORP: COMPANY OVERVIEW

11.2.6 NOVAMONT

TABLE 123 NOVAMONT: COMPANY OVERVIEW

11.2.7 CONSTANTIA FLEXIBLES

TABLE 124 CONSTANTIA FLEXIBLES: COMPANY OVERVIEW

11.2.8 PLASTIPAK

TABLE 125 PLASTIPAK: COMPANY OVERVIEW

11.2.9 TETRA PAK

TABLE 126 TETRA PAK: COMPANY OVERVIEW

11.2.10 PRINTPACK INC.

TABLE 127 PRINTPACK INC.: COMPANY OVERVIEW

11.2.11 HUHTAMÄKI OYJ

TABLE 128 HUHTAMÄKI OYJ: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 176)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This technical and market-oriented study of the food packaging films market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva, to identify and collect relevant information. The primary sources include several industry experts from core and related industries ,and suppliers, manufacturers, distributors, technologists, and organizations related to all segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These include annual reports, press releases and investor presentations of companies, white papers, certified publications, articles, regulatory bodies, trade directories, and databases.

Secondary research has been mainly used to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and geographical markets. It has also been used to obtain information about the key developments from a market-oriented perspective.

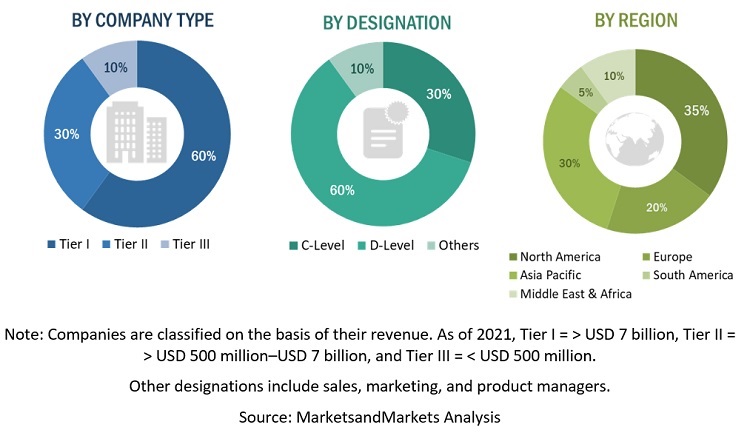

Primary Research

The supply chain of the food packaging films market comprises several stakeholders, including suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of both markets have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of players in the food packaging films industry. The primary sources from the supply side include associations and institutions involved in the food packaging films industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

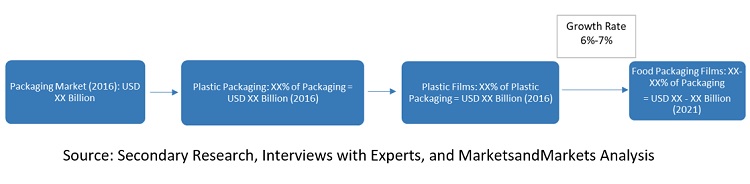

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the global market.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as directors and marketing executives.

Global Food Packaging Films Market: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both top-down and bottom-up approaches.

Report Objectives

- To analyze and forecast the global food packaging films market size in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To define, describe, and forecast the market by type, material, and application

- To forecast the market size with respect to five main regions: Asia Pacific (APAC), the Middle East & Africa, Europe, North America, and South America

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments in the market, such as investments & expansions, new product developments, partnerships & collaborations, and mergers & acquisitions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Packaging Films Market